Global Base Oil Market Forecast

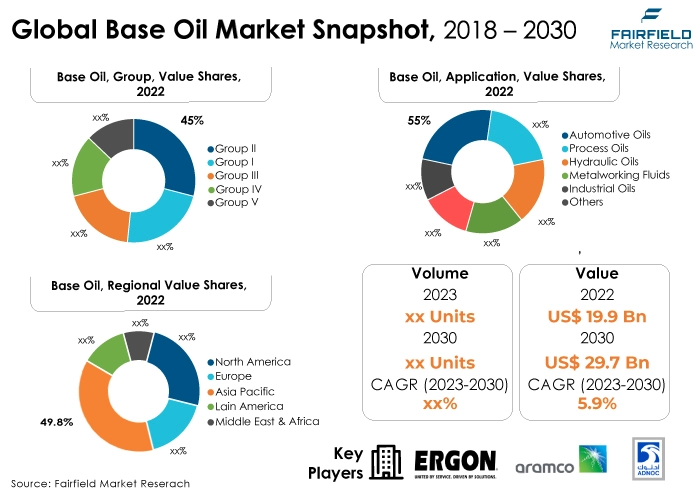

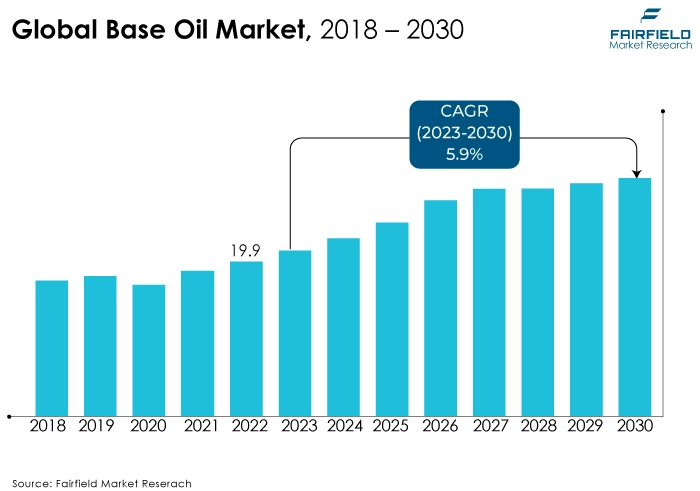

- The approximately US$19.9 Bn market for base oil (2022) poised to touch revenue worth US$29.7 Bn by 2030-end

- Market revenue expected to see a healthy rise at a CAGR of 5.9% during 2023 - 2030

Quick Report Digest

- The key trend anticipated to drive the base oil market growth is an increasing demand for increased focus on energy efficiency. Furthermore, In the automotive sector, the use of high-quality lubricants and base oils can help reduce internal friction within engines. This, in turn, leads to improved fuel efficiency, a key consideration for vehicle owners and manufacturers.

- Another major market trend expected to drive the base oil market growth is the rapidly expanding environmental sustainability. Environmentally friendly lubricants are in greater demand as consumers and industries become more environmentally conscious. More people are looking for lubricants that are made using base oils from renewable sources or that have less of an impact on the environment.

- Synthetic lubricants frequently allow for a longer interval between oil changes due to their improved thermal and oxidative resilience. As a result of the decreased frequency of oil changes, the demand for base oils is influenced.

- In 2022, the Group II category dominated the industry. Group II base oils have undergone a more thorough purifying process, resulting in higher purity and fewer contaminants.

- The Group I segment is expected to be the fastest-growing of the base oil market during the forecast period. Group I base oils are used in a wide range of general-purpose lubricants, such as motor oils for older engines, hydraulic fluids, and industrial gear oils.

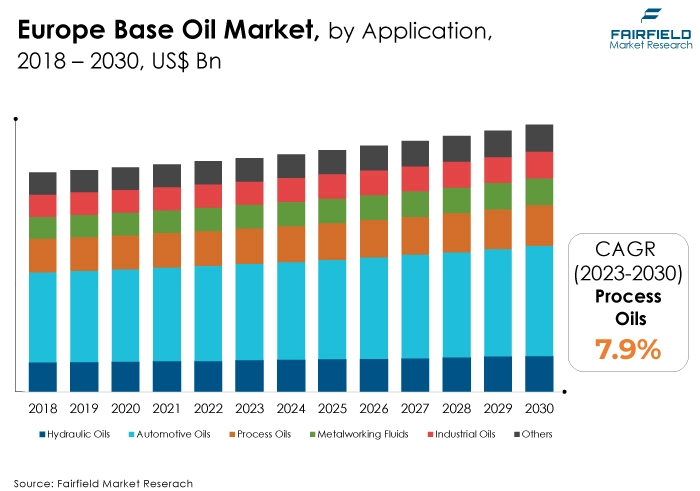

- In 2022, the automotive oils category dominated the industry. Internal combustion engines are lubricated with engine oils to prevent wear and tear, reduce friction, cool components, and clean deposits.

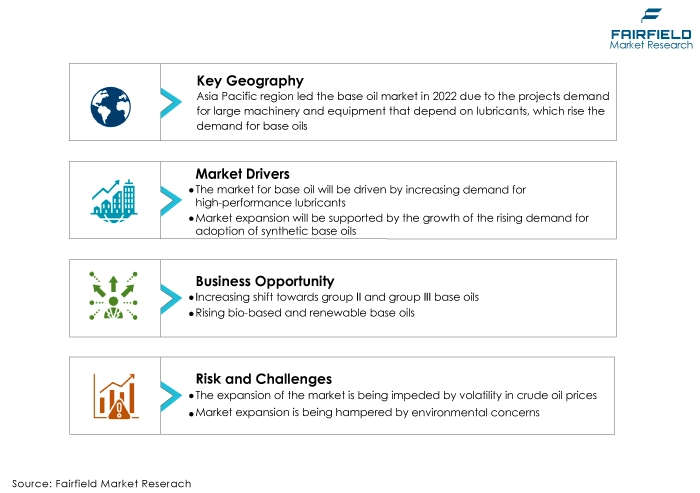

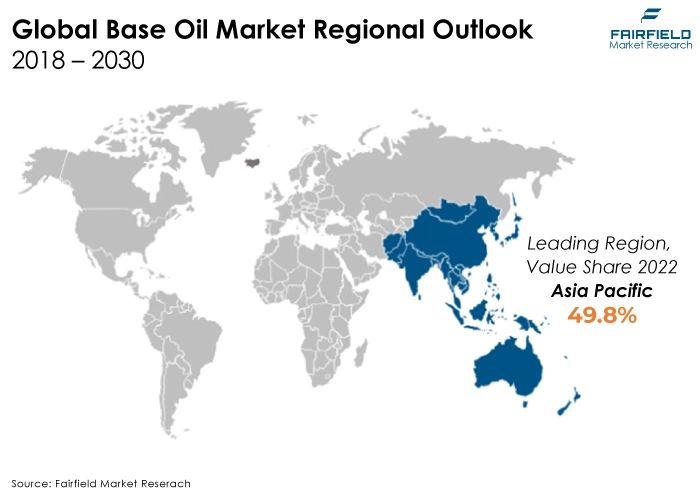

- Asia Pacific is expected to dominate the base oil market during the forecast period. The region is home to numerous building and infrastructure development projects. These projects demand large machinery and equipment that depend on lubricants, which raises the demand for base oils.

- Europe is expected to be the fastest-growing base oil market region. European businesses have access to advanced production and refining technologies, allowing them to manufacture high-quality base oils that comply with exacting standards.

A Look Back and a Look Forward - Comparative Analysis

Many emerging economies' largest industry is agriculture. Lubricants and base oils are necessary for agricultural machinery and equipment, which supports market growth. Investments in base oil manufacturing and production are being drawn to emerging markets from around the world. This assists in meeting local demand and establishes these areas as major players in the world-based oil market.

Growing urbanisation raises the need for transportation and construction services, which in turn raises the demand for lubricants and base oils. The market witnessed staggered growth during the historical period 2018 - 2022. Refining old lubricants aids in the preservation of priceless natural resources like crude oil. This answers worries about the depletion of fossil fuels and is in line with aspirations for resource conservation.

Refined base oils' quality has increased over time due to improvements in re-refining techniques. As a result, base oils were produced that performed as well as or better than virgin base oils. Re-refined base oils frequently offer cost advantages over virgin base oils, making them a desirable choice for companies looking for affordable lubrication solutions.

Digitalisation enables data collection and analysis throughout the base oil production process. This data-driven approach helps manufacturers optimise production, improve product quality, and reduce operational costs in the coming years. Additionally, real-time monitoring of machinery and equipment in base oil production facilities is made possible by Industry 4.0 technologies, including Internet of Things (IoT) sensors and predictive analytics.

Predictive maintenance guarantees consistent product quality and reduces expensive downtime. Furthermore, base oils reliably fulfill industry standards and legal requirements because of automation and data analytics in quality control procedures. This increases customer trust and reduces the possibility of product recalls during the next five years.

Key Growth Determinants

- Increasing Demand for High-performance Lubricants

Engine and machinery efficiency is increased by high-performance lubricants, which are frequently made using premium base oils. They lower wear and friction, improving fuel economy and reducing maintenance costs.

Longer equipment lifespans are produced by these lubricants' improved protection against wear, corrosion, and oxidation. This promotes the use of high-performance lubricants by industries, which in turn raises the demand for premium base oils.

The automotive sector is a key user of high-performance lubricants, particularly for luxury and high-performance automobiles. The need for sophisticated base oils to create premium lubricants rises as vehicle technology develops.

- Rising Demand for Adoption of Synthetic Base Oils

Synthetic base oils have exceptional oxidative and thermal stability as well as high-temperature stability and low-temperature fluidity. They are perfect for demanding applications, including automotive engines, industrial machinery, and aerospace equipment, because of these qualities.

Because of their lower friction and viscosity index, synthetic base oils help increase the fuel efficiency of machinery and automobiles. The demand for synthetic lubricants and, consequently, synthetic base oils increases as fuel economy rules tighten.

Many synthetic base oils are created with strict environmental rules in mind, reducing emissions and lubricant impact on the environment. This is consistent with the increased focus on sustainability and environmentally friendly practices.

- Advent of Technology

Base oils can now be produced with better thermal stability, less volatility, and better viscosity control because of technological improvements. These premium base oils are highly sought-after for use in creating cutting-edge lubricants.

Lower-quality base oils can now be transformed into Group III base oils, which perform better and are frequently utilised in high-performance lubricants because of advancements in hydroprocessing technology.

Modern base oil technology guarantees compatibility with a variety of additives, facilitating the creation of specialised lubricants catered to particular industry requirements.

By precisely formulating lubricants with specialised qualities, advanced technology enables the meeting of unique requirements in a variety of industries, including automotive, industrial, and aerospace.

Major Growth Barriers

- Volatility in Crude Oil Prices

Crude oil is frequently used to make base oils, and the price of crude oil has a significant impact on the cost of production. It becomes difficult for base oil producers to forecast and control their production costs when crude oil prices are wildly unpredictable.

An increase in production costs and a decline in profit margins might result from rapid price changes. Changes in the price of crude oil can cause base oil prices to fluctuate quickly.

In particular, when competing with synthetic or alternative lubricant products with more stable pricing, this might make it challenging for base oil makers to compete effectively in the market.

- Environmental Concerns

Lubricants that are biodegradable and favourable to the environment are in greater demand. As a result, conventional base oils made from crude oil could face a decrease in demand in favour of base oils that are made from bio-based materials or synthetic materials.

Because they are petroleum-based, base oils, and lubricants are produced and used in a way that contributes to greenhouse gas emissions. The industry is looking into lower-emission alternatives because of worries about climate change and carbon footprints, which may reduce the need for conventional base oils.

Key Trends and Opportunities to Look at

- Visible Preferential Shift Toward Group II and Group III Base Oils

Compared to conventional Group I base oils, Group II and Group III base oils offer greater performance characteristics. They are appropriate for a variety of applications, including high-performance engines and industrial machines, since they have superior low-temperature qualities, stronger oxidative stability, and higher viscosity indices.

Longer intervals between oil changes are possible due to the improved qualities of Group II and Group III base oils, which lower maintenance frequency and costs for end users. Industries looking to streamline their processes and reduce downtime may find this to be very enticing.

To fulfill higher fuel efficiency and emissions rules, the automotive industry, a big user of base oils, is moving more and more towards Group II and Group III base oils.

- Bio-based and Renewable Base Oils

Sustainable sources like plant oils, animal fats, and other renewable feedstocks are used to create bio-based and renewable base oils. They are preferred by industries and customers who care about the environment since they are thought to be more environmentally benign than their petroleum-based rivals.

Compared to conventional petroleum-based oils, bio-based and renewable-based oils often have a lower carbon impact. This supports efforts being made around the world to address climate change and cut greenhouse gas emissions.

- Automotive Industry’s Rapid Expansion

More vehicles, including passenger cars, trucks, and commercial vehicles, are being produced as the automotive industry expands internationally. The need for lubricants, which are manufactured with base oils, for each of these vehicles is increasing demand for base oils.

In addition to new vehicle manufacture, base oils and lubricants are also required for the upkeep and repair of existing vehicles. Regular lubrication and oil changes are necessary for the longevity and proper operation of cars, which helps to explain the steady demand.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, various regulatory frameworks and standards that are intended to ensure product quality, environmental sustainability, and safety are applicable to the base oil market. In the US, the American Petroleum Institute (API) develops and maintains industry standards for base oils and lubricants. The performance criteria for lubricants are established by API standards, such as API SN for passenger car motor oils, which in turn affects the base oil formulations used in these lubricants.

Engine oil performance requirements are defined by the European Automobile Manufacturers' Association (ACEA), which is the trade association for European automakers. The base oils and additives used in lubricant formulations to satisfy ACEA criteria are influenced by these parameters.

International standards are developed and published by the American Society for Testing and Materials (ASTM) for a variety of industries, including lubricants. Assuring uniformity and quality, ASTM standards for base oils and lubricants serve as a guide for manufacturers as they create goods that satisfy international standards.

Fairfield’s Ranking Board

Top Segments

- Group II Category Maintains Dominance over Group I

The Group II segment dominated the market in 2022. Group II base oil can be used for a wide range of purposes, including in trunk piston engine oils, marine and gas engine applications and other base oil-related uses. Due to Group II base oil's superior performance and lower price compared to other base oil (Group) categories, this market is expected to develop.

Furthermore, the Group I category is projected to experience the fastest market growth. Due to their accessibility, ease of processing, low volatility, high viscosity index, and lubricating qualities, lubricants are increasingly used in the automotive, marine, and rail industries.

Products that fall into the Group I category have a viscosity between 80 and 120, more sulfur than 0.03%, and less saturated fat than 90%. Low levels of aromatic compounds and paraffinic properties define this Group. 32 to 150 degrees Fahrenheit are the acceptable range.

- Automotive Oils will Retain a Leading Position

The automotive oils segment dominated the market in 2022. The rising need for greases, gear oil, engine oil, and other lubricants for lubricating car parts is responsible for its large share. Around the world, truck engines and cars account for roughly half of all lubricant use, consuming over 20 million tonnes of lubricants annually. Oil firms are expected to generate base oils as vehicle makers strive to meet pollution rules, which will benefit the automotive industry.

The process oils category is anticipated to grow substantially throughout the projected period. Because it is used in a wide range of technical and chemical industries as a raw material or as a processing aid, they are essential to many applications, including the production of polymers, foam control, agricultural products, sealants, leather goods, textiles, and civil explosives, among others.

Regional Frontrunners

Asia Pacific Stands the Strongest

Throughout the forecast period, Asia Pacific is anticipated to dominate the market for base oils. Strong growth in industry is being seen throughout Asia Pacific, especially in countries like China and India. As businesses grow and more machinery is used, the need for lubricants and base oils to maintain and operate machinery smoothly is increasing.

China, India, and Japan are just a few of the Asia Pacific region's major car markets. The automobile industry's continued growth drives the need for base oils used in engine oils and other lubricants. Rising disposable incomes and urbanisation have contributed to an increase in car ownership across Asia Pacific. As a result, there is a rise in demand for basic oils and lubricants used in vehicle maintenance.

China leads the region in manufacturing production, and the manufacturing sector in the Asia Pacific region is growing. For many uses, this industry is significantly dependent on basic oils and lubricants.

Europe Develops an Attractive Market

The region with the fastest-growing base oil market is expected to be Europe. In the lubricants sector, Europe places a high priority on research and development. When it comes to creating cutting-edge lubrication solutions that make use of cutting-edge base oils, European businesses frequently lead the way. Group III base oils are often used in synthetic lubricants, which have found success in the European market.

Manufacturers of basic oils profit from the growing demand for synthetic lubricants. European nations are actively supporting the circular economy concept, including recycling and re-refining spent lubricants. The focus on sustainability influences manufacturers of base oils to create more recyclable products.

Fairfield’s Competitive Landscape Analysis

A smaller number of well-known companies dominate the market for vital base oil products, which is consolidating. The main firms are introducing new items and updating their distribution networks as part of their global growth strategy. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Base Oil Space?

- Aramco Saudi Arabian Oil Co.

- Kuwait Petroleum Corporation (KPC)

- Royal Dutch Shell

- Ergon, Inc.

- China National Petroleum Corporation

- China Petrochemical Corporation

- Exxon Mobil Corporation

- Petróleo Brasileiro S.A.

- HPCL

- Repsol

- bp p.l.c.

- Abu Dhabi National Oil Company

- Nynas AB

- Chevron Corporation

- Petroliam Nasional Berhad (PETRONAS)

Key Company Developments

New Product Launches

- September 2023: The opening of a new sustainable base oil refinery in Rotterdam, Netherlands, was revealed by Neste Corporation. The refinery will be operational in 2026 and have a 400 KTPA production capacity.

- March 2021: Maserati and Shell have expanded their technical and business collaboration to ensure long-lasting performance and the greatest possible protection for car engine lifespan with the launch of new Shell Helix Ultra Hybrid oil for Maserati hybrid engines.

- January 2020: Highly refined process oils Nynas AB launched NYFLEX 201B and NYFLEX 2005 for use in sealant compositions.

Distribution Agreements

- November 2020: Business was grown by PT Pertamina (Persero) into a variety of areas and spheres. In Australia, the MoU and PT Pertamina Lubricants (PTPL) were signed. This agreement is part of PT Pertamina Lubricants' business plan to diversify its international clientele and enter the Australian market for industrial lubricant products.

- August 2019: Synergy Additives Company S.A. de C.V. (Mexico) has been selected by ExxonMobil Chemical Company, a division of Exxon Mobil Corporation, to serve as the distributor of its Group IV/V base stocks (synthetic base stocks) in Mexico, Central America, and the Caribbean. This action has improved the company's regional presence.

An Expert’s Eye

Demand and Future Growth

Regular maintenance such as oil changes, is required for vehicle ownership. For engine lubrication, cooling, and protection, lubricants that comprise base oils are crucial. The need for lubricant and base oil products remains constant as more vehicles are owned and driven.

Furthermore, Increasing vehicle ownership includes a variety of vehicle types, including trucks, construction machinery, and passenger automobiles. Due to the unique lubrication requirements of each type of vehicle, base oils and lubricants are in high demand.

However, the base oil market is expected to face considerable challenges because of volatility in crude oil prices.

Supply Side of the Market

According to our analysis, the world's largest producer and user of base oils is Asia Pacific. Over 10 million metric tonnes can be produced in the region annually, but over 9 million metric tonnes are needed. There are many major and small competitors competing for market share in the fragmented Asia Pacific base oil market.

Sinopec, PetroChina, ExxonMobil, and Shell are a few of the prominent companies in the Asia Pacific base oil industry. With a capacity of more than 5 million metric tonnes annually, North America is the second-largest producer of base oils. With a need for base oils of over 4 million metric tonnes annually, the region is also a significant base oil consumer. ExxonMobil, Chevron, and Group I Petroleum Products are among the market leaders in North America for base oil.

The third-largest producer and consumer of base oils is Europe. The region has a yearly demand of more than 3 million metric tonnes and a production capability of over 4 million metric tonnes. Major businesses, including Shell, BP, and Neste, are present in the European base oil market.

Global Base Oil Market is Segmented as Below:

By Group:

- Group I

- Group II

- Group III

- Group IV

- Group V

By Application:

- Automotive Oils

- Process Oils

- Hydraulic Oils

- Metalworking Fluids

- Industrial Oils

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Base Oil Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Base Oil Market Outlook, 2018 - 2030

3.1. Global Base Oil Market Outlook, by Group, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Group I

3.1.1.2. Group II

3.1.1.3. Group III

3.1.1.4. Group IV

3.1.1.5. Group V

3.2. Global Base Oil Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Automotive Oils

3.2.1.2. Process Oils

3.2.1.3. Hydraulic Oils

3.2.1.4. Metalworking Fluids

3.2.1.5. Industrial Oils

3.2.1.6. Others

3.3. Global Base Oil Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Base Oil Market Outlook, 2018 - 2030

4.1. North America Base Oil Market Outlook, by Group, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Group I

4.1.1.2. Group II

4.1.1.3. Group III

4.1.1.4. Group IV

4.1.1.5. Group V

4.2. North America Base Oil Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Automotive Oils

4.2.1.2. Process Oils

4.2.1.3. Hydraulic Oils

4.2.1.4. Metalworking Fluids

4.2.1.5. Industrial Oils

4.2.1.6. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Base Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Base Oil Market Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Base Oil Market Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Base Oil Market Outlook, 2018 - 2030

5.1. Europe Base Oil Market Outlook, by Group, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Group I

5.1.1.2. Group II

5.1.1.3. Group III

5.1.1.4. Group IV

5.1.1.5. Group V

5.2. Europe Base Oil Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Automotive Oils

5.2.1.2. Process Oils

5.2.1.3. Hydraulic Oils

5.2.1.4. Metalworking Fluids

5.2.1.5. Industrial Oils

5.2.1.6. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Base Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Base Oil Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Base Oil Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Base Oil Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Base Oil Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Base Oil Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Base Oil Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Base Oil Market Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Base Oil Market Outlook, 2018 - 2030

6.1. Asia Pacific Base Oil Market Outlook, by Group, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Group I

6.1.1.2. Group II

6.1.1.3. Group III

6.1.1.4. Group IV

6.1.1.5. Group V

6.2. Asia Pacific Base Oil Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Automotive Oils

6.2.1.2. Process Oils

6.2.1.3. Hydraulic Oils

6.2.1.4. Metalworking Fluids

6.2.1.5. Industrial Oils

6.2.1.6. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Base Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Base Oil Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Base Oil Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Base Oil Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Base Oil Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Base Oil Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Base Oil Market Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Base Oil Market Outlook, 2018 - 2030

7.1. Latin America Base Oil Market Outlook, by Group, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Group I

7.1.1.2. Group II

7.1.1.3. Group III

7.1.1.4. Group IV

7.1.1.5. Group V

7.2. Latin America Base Oil Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Automotive Oils

7.2.1.2. Process Oils

7.2.1.3. Hydraulic Oils

7.2.1.4. Metalworking Fluids

7.2.1.5. Industrial Oils

7.2.1.6. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Base Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Base Oil Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Base Oil Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Base Oil Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Base Oil Market Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Base Oil Market Outlook, 2018 - 2030

8.1. Middle East & Africa Base Oil Market Outlook, by Group, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Group I

8.1.1.2. Group II

8.1.1.3. Group III

8.1.1.4. Group IV

8.1.1.5. Group V

8.2. Middle East & Africa Base Oil Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Automotive Oils

8.2.1.2. Process Oils

8.2.1.3. Hydraulic Oils

8.2.1.4. Metalworking Fluids

8.2.1.5. Industrial Oils

8.2.1.6. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Base Oil Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Base Oil Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Base Oil Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Base Oil Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Base Oil Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Base Oil Market by Group, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Base Oil Market Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Saudi Arabian Oil Co.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Kuwait Petroleum Corporation (KPC)

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Royal Ducth Shell

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Ergon, Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. China National Petroleum Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. China Petrochemical Corporation

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Exxon Mobil Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Petróleo Brasileiro S.A.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. HPCL

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Repsol

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. bp p.l.c.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Abu Dhabi National Oil Company

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Nynas AB

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Chevron Corporation

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Petroliam Nasional Berhad (PETRONAS)

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Group Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |