Bio LPG Market Outlook

Bid to Reduce Dependence on Conventional LPG Stirs Demand for Bio LPG

The exponential rise in the demand for energy continues to be dependent on oil & gas reserves. Forming a large part of the pie, the conventional liquified petroleum gas (LPG) or cooking gas is produced during the petroleum refining process in oil refineries or processed from natural gas streams. Made of 30% butane and 70% propane gas, conventional LPG has been an indispensable part of households and the food and beverage industry. However, changing customer and community expectations towards reducing carbon footprint and cost of living have stirred a demand for bio LPG.

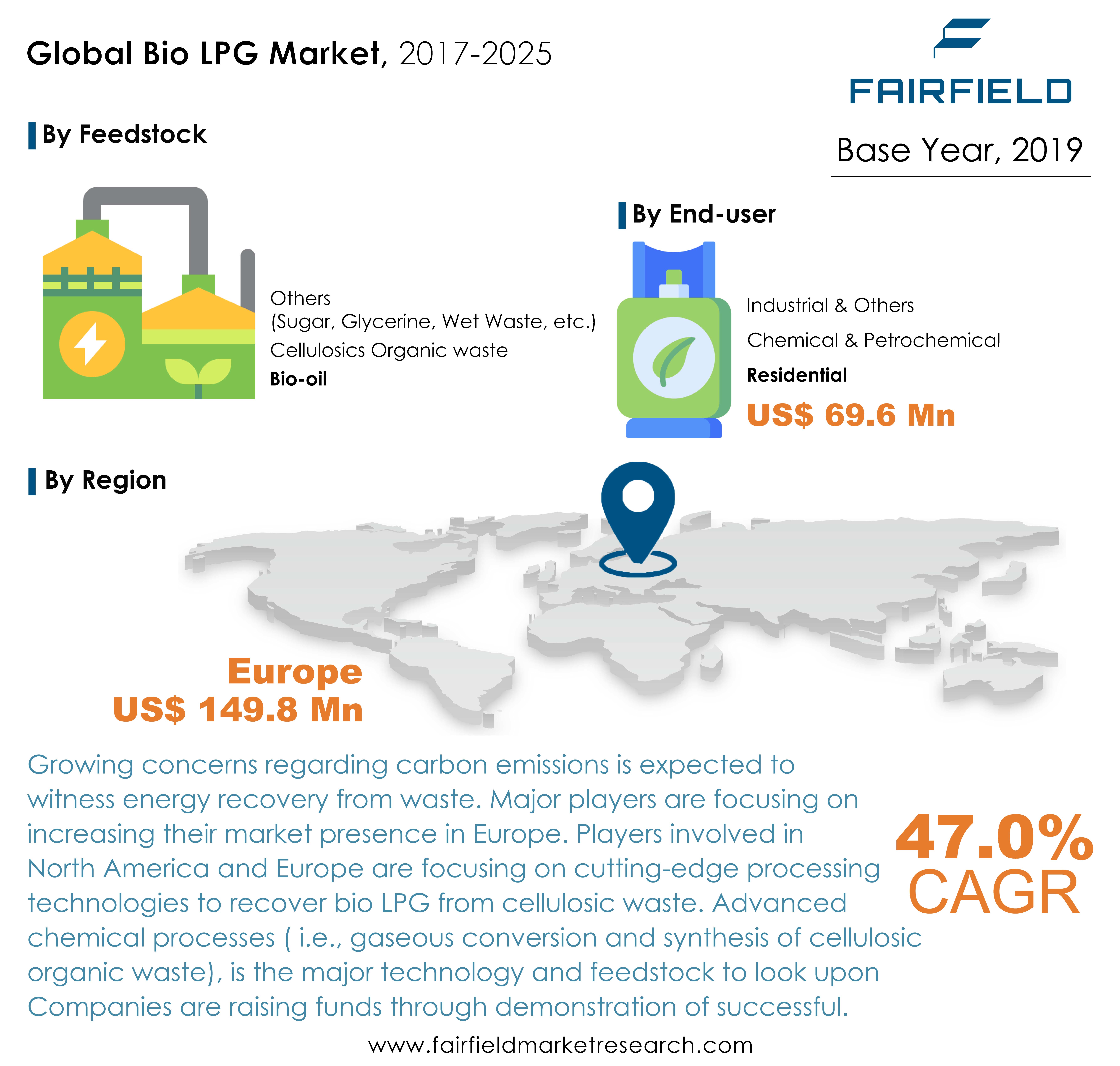

According to the report, the global bio LPG market was worth US$153.71 Mn in 2019 and is expected to reach US$1,020.32 Mn by 2025. The market is expected to register a double-digit CAGR of 47% from 2020-2025, predict analysts.

Bio LPG is propane produced from renewable feedstocks such as plant and vegetable waste material. It is also called renewable propane and bio propane. In most cases, Bio LPG is produced as a by-product. For every ton of biodiesel, 50 kg of bio LPG is generated from the off-gas stream. This co-product is then purified to make it identical to conventional propane or cooking gas. Thus, as prices of conventional gas soar, an alternative such as bio LPG is expected to deliver a solution that is greener, cleaner, and definitely affordable.

Increase in R&D Activities in Advanced Chemical Processes through Demonstration of Pilot Projects to Fuel Growth

Presently, bio LPG production is negligible in terms of percentage terms due to its low recovery rate from the bio-oil feedstock. However, if advanced chemical processes are commercialized to process cellulosic and mixed waste feedstocks and bio-oil hydrotreating is maximized, enough bio LPG could be produced by 2025. This could cover up to one-third of global LPG production.

Cellulosic organic waste, which includes agricultural and forest residues plus energy crops such as switchgrass and poplar, are the key for a higher yield of bio LPG in the near future. These waste products are by far the largest supply of biological hydrocarbons. Mixed waste, mainly municipal waste, is significant as well but its availability remains lesser than cellulosic. Cellulosic organic waste, if exploited to the maximum, could also deliver significant output.

Uncooperative Government Policies and Availability of Substitutes to Dampen Market Spirits

The major restraints for bio LPG are the stringent government regulations and policies related to feedstock used for biodiesel production. Globally, the government policy on biofuels, particularly, have been inconsistent. Only a decade ago, some governments offered direct subsidies and rebates to biofuels. This proved too costly, which translated to a shift to mandates, requiring a certain share of the market to consist of biofuels. Controversies of ‘food vs. fuel’, indirect land-use change, deforestation, and destruction of natural habitat are driving possible restrictions or bans, particularly on palm oil and other vegetable oils as well. This has resulted in lower interest in bio LPG production.

Furthermore, the bio LPG market is widely driven by the price of natural gas and crude oil in the global market. The existing restraints are further complicated as biogas remains the key substitute for bio LPG. Biogas, usually derived from wet organic waste consists of methane, which is environment-friendly and much safer than LPG due to its physical characteristics like low density and pressure. This is likely to hinder the growth of the bio-LPG market.

Bio-oil Feedstock Stands Out; Cellulosic Organic Waste Conversion to Follow Suit

Currently, in terms of feedstock, bio-oil dominates the global bio LPG market and constitutes 100% share of the market. Bio-oil refers to the recovery of bio LPG through the biodiesel route as a by-product. However, the low bio LPG yield through bio-oil route remains the key hurdle. Today, the majority of bio-LPG is recovered as a by-product from a biodiesel plant. Other feedstock include cellulosic organic waste, wet waste, sugar, and glycerine. These are processed using different technologies such as advanced chemical processes, hydrotreating, and fermentation to attain bio-LPG as a final product or by-product.

A higher yield of bio LPG through the processing of cellulosic organic waste remains the key driver for bio LPG market. Investments in pilot/demonstration projects related to cellulosic organic waste to bio LPG recovery is gaining momentum. Furthermore, as prices of oil & gas is declining, major oil & gas players such as Royal Dutch Shell, Total SE, etc. are investing in cellulosic organic waste to bio LPG recovery projects, through demonstrating cutting-edge technologies to maximize the yield of bio LPG.

Europe Leads in Terms of Production and Marketing of Bio-LPG

Globally, more than 90% of bio-LPG is produced and marketed in Europe only. Currently, Europe remains the most lucrative market for bio LPG followed by North America in 2019. Europe holds more than 90% share of the global market both in terms of volume and value. A strong presence of bio-LPG producers is active such as Neste Oil, ENI, Total SE, PREEM Group, Global Bioenergies in Europe has given the region an edge over others. In France, Neste Oil is the key producer of bio-LPG, which is marketed by SHV Energy. The ambition to reduce carbon emissions has led to serious enforcement of decarbonization, which has been the strong undercurrent for the uptake of biofuels across Europe. As governments and activities raise louder voices about the conscious use of fuels and deliberate efforts to reduce pollution, analysts anticipate that bio LPG market will find lucrative opportunities.

North America is following in the footsteps with large number of small and large-scale demonstration or concept projects related to the recovery of bio LPG from different feedstocks. U.S. dominates the North America bio LPG market both in terms of value and volume in 2019.

The goals of the European climate and energy policy of putting in place an energy system that is less dependent on fossil fuels will create a stronger pull for the bio LPG usage across industrial sectors, predict analysts.

Global Bio-LPG Market: Competitive Landscape

Key players operating in the bio LPG market are Neste Oil, Total SE, ENI, SHV Energy, Preem AB, Renewable Energy Group, AvantiGas, Irving Oil, Global Bioenergies, and Diamond Green Diesel.

In 2019, Primagaz signed a contract with the global service station chain Circle K that ensures all cylinder gas sold in 297 stores all over Sweden will be 100% bio-LPG from April 2020.

In 2019, SHV Energy doubled the volume of bio LPG supplied to customers in key European markets and explored new opportunities and projects around the world. Bio LPG market currently represents 4% of volume in European markets and 1% of the global volume.

The Global Bio LPG Market is Segmented as Below:

Feedstock Coverage

- Bio-oil

- Cellulosic Organic waste

- Others (Sugar, Glycerine, Wet Waste, etc.)

End-user Coverage

- Residential

- Chemical & Petrochemical

- Industrial & Others

Geographical Coverage

- North America

- U.S.

- Canada

- Europe

- Italy

- Denmark

- Ireland

- France

- Sweden

- U.K.

- Germany

- Rest of Europe

- Asia Pacific

- India

- Japan

- Rest of Asia Pacific

- Rest of the World

Leading Companies

- Neste Oil

- Total SE

- ENI

- Preem AB

- SHV Energy

- Diamond Green Diesel

- Renewable Energy Group

- Global Bioenergies

- AvantiGas

- Irving Oil

Inside This Report You Will Find:

1. Executive Summary

2. Market Overview

3. Price Trends Analysis and Future Projects, 2017 - 2025

4. Global Bio LPG Market Outlook, 2017 - 2025

5. North America Bio LPG Market Outlook, 2017 - 2025

6. Europe Bio LPG Market Outlook, 2017 - 2025

7. Asia Pacific Bio LPG Market Outlook, 2017 - 2025

8. Rest of the World (RoW) Bio LPG Market Outlook, 2017 - 2025

9. Competitive Landscape

10. Appendix

Post Sale Support, Research Updates & Offerings:

We value the trust shown by our customers in Fairfield Market Research. We support our clients through our post sale support, research updates and offerings.

- The report will be prepared in a PPT format and will be delivered in a PDF format.

- Additionally, Market Estimation and Forecast numbers will be shared in Excel Workbook.

- If a report being sold was published over a year ago, we will offer a complimentary copy of the updated research report along with Market Estimation and Forecast numbers within 2-3 weeks’ time of the sale.

- If we update this research study within the next 2 quarters, post purchase of the report, we will offer a Complimentary copy of the updated Market Estimation and Forecast numbers in Excel Workbook.

- If there is a geopolitical conflict, pandemic, recession, and the like which can impact global economic scenario and business activity, which might entirely alter the market dynamics or future projections in the industry, we will create a Research Update upon your request at a nominal charge.

1. Executive Summary

1.1. Global Bio LPG Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact

2.5.1. Supply Chain

2.5.2. Raw Materials Impact Analysis

3. Price Trends Analysis and Future Projects, 2017 - 2025

3.1. Key Highlights

3.2. by Feedstock/by End-user

3.3. By Region

4. Global Bio LPG Market Outlook, 2017 - 2025

4.1. Global Bio LPG Market Outlook, by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

4.1.1. Key Highlights

4.1.1.1. Bio-oil

4.1.1.2. Cellulosic Organic Waste

4.1.1.3. Others (Sugar, Glycerine, Wet Waste, etc.)

4.1.2. BPS Analysis/Market Attractiveness Analysis, by Feedstock

4.2. Global Bio LPG Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

4.2.1. Key Highlights

4.2.1.1. Residential

4.2.1.2. Chemical & Petrochemical

4.2.1.3. Industrial & Others

4.2.2. BPS Analysis/Market Attractiveness Analysis, by End-user

4.3. Global Bio LPG Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Rest of the World (RoW)

4.3.2. BPS Analysis/Market Attractiveness Analysis, by Region

5. North America Bio LPG Market Outlook, 2017 - 2025

5.1. North America Bio LPG Market Outlook, by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

5.1.1. Key Highlights

5.1.1.1. Bio-oil

5.1.1.2. Cellulosic Organic Waste

5.1.1.3. Others (Sugar, Glycerine, Wet Waste, etc.)

5.2. North America Bio LPG Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

5.2.1. Key Highlights

5.2.1.1. Residential

5.2.1.2. Chemical & Petrochemical

5.2.1.3. Industrial & Others

5.3. North America Bio LPG Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

5.3.1. Key Highlights

5.3.1.1. U.S. Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

5.3.1.2. U.S. Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

5.3.1.3. Canada Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

5.3.1.4. Canada Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6. Europe Bio LPG Market Outlook, 2017 - 2025

6.1. Europe Bio LPG Market Outlook, by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.1.1. Key Highlights

6.1.1.1. Bio-oil

6.1.1.2. Cellulosic Organic Waste

6.1.1.3. Others (Sugar, Glycerine, Wet Waste, etc.)

6.2. Europe Bio LPG Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.2.1. Key Highlights

6.2.1.1. Residential

6.2.1.2. Chemical & Petrochemical

6.2.1.3. Industrial & Others

6.3. Europe Bio LPG Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1. Key Highlights

6.3.1.1. Italy Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.2. Italy Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.3. Denmark Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.4. Denmark Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.5. Ireland Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.6. Ireland Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.7. France Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.8. France Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.9. Sweden Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.10. Sweden Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.11. U.K. Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.12. U.K. Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.13. Germany Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.14. Germany Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.15. Rest of Europe Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.16. Rest of Europe Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

7. Asia Pacific Bio LPG Market Outlook, 2017 - 2025

7.1. Asia Pacific Bio LPG Market Outlook, by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

7.1.1. Key Highlights

7.1.1.1. Bio-oil

7.1.1.2. Cellulosic Organic Waste

7.1.1.3. Others (Sugar, Glycerine, Wet Waste, etc.)

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Asia Pacific Bio LPG Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

7.2.1. Key Highlights

7.2.1.1. Residential

7.2.1.2. Chemical & Petrochemical

7.2.1.3. Industrial & Others

7.3. Asia Pacific Bio LPG Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

7.3.1. Key Highlights

7.3.1.1. Japan Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.2. Japan Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.3. India Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.4. India Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025South Korea

7.3.1.5. Rest of Asia Pacific Bio LPG Market by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.6. Rest of Asia Pacific Bio LPG Market by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

8. Rest of the World (RoW) Bio LPG Market Outlook, 2017 - 2025

8.1. Rest of the World (RoW) Bio LPG Market Outlook, by Feedstock, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

8.1.1. Key Highlights

8.1.1.1. Bio-oil

8.1.1.2. Cellulosic Organic Waste

8.1.1.3. Others (Sugar, Glycerine, Wet Waste, etc.)

8.2. Rest of the World (RoW) Bio LPG Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2017 - 2025

8.2.1. Key Highlights

8.2.1.1. Residential

8.2.1.2. Chemical & Petrochemical

8.2.1.3. Industrial & Others

9. Competitive Landscape

9.1. Company Market Share Analysis, 2019

9.2. Strategic Collaborations

9.3. Company Profiles

9.3.1. SHV Energy

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Neste

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Preem AB

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Renewable Energy Group

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Total SE

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. AvantiGas

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Irving Oil

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Global Bioenergies

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Diamond Green Diesel

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.3. Business Strategies and Development

9.3.10. ENI

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

|

2019 |

|

2017 - 2019 |

|

2020 - 2025 |

Value: US$ Million Volume: Kilo Tons |

|

REPORT FEATURES |

DETAILS |

|

Feedstock Coverage |

|

|

End-user Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2017-2019), Price Trend Analysis- 2019-2025, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |