Global Aloe Vera Gel Market Forecast

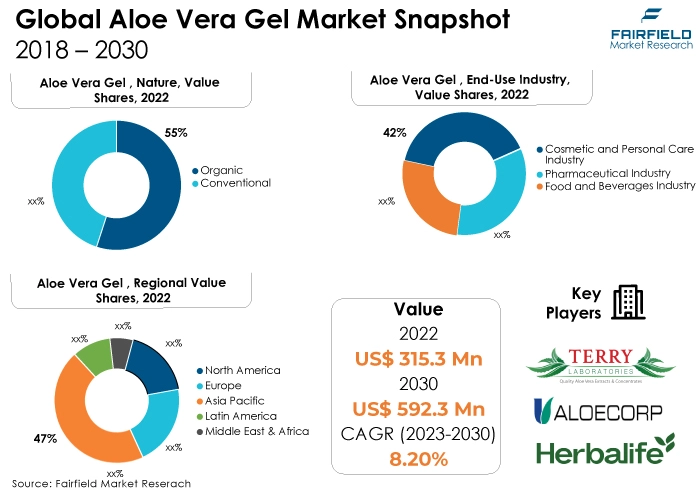

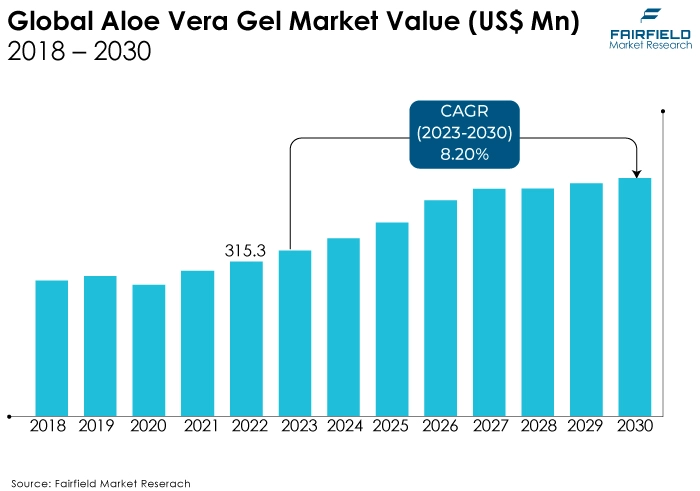

- The approximately US$315.3 Bn aloe vera gel market (2022) expected to reach around US$592.3 Bn

- Aloe vera gel market size likely to witness a robust rise at a CAGR of 8.2% during 2023 - 2030

Quick Report Digest

- The growing awareness of consumer health around the globe is the main factor driving the aloe vera gel market. Obesity, cardiovascular disease, diabetes, and other skin-related illnesses are all very common, which is increasing demand for the products.

- The demand for the product is also being fueled by the growing use of aloe vera gel in a variety of personal grooming products, including face washes, sunscreens, moisturizers, anti-ageing treatments, and facial creams.

- Aloe vera gel, which is made from the inner leaf of the plant and mostly contains water, vitamins, minerals, hormones, enzymes, amino acids, and carbohydrates in trace amounts, is rapidly gaining popularity because of its therapeutic, herbal, and medical characteristics.

- It is anticipated that the organic segment will dominate the worldwide market. In contrast to conventional aloe vera gel, which may contain pesticides and other dangerous chemicals, organic goods offer health benefits, which might be related to the increase in demand for them.

- In 2022, the market was dominated by the cosmetic and personal care industry category. The demand for herbal components in cosmetics such as hair care, skincare, and body care products is rising, which is fueling the segment's expansion.

- The market is anticipated to be dominated by the online distribution channel segment over the length of the projection. The segment is growing as a result of the internet's expanding use. Aloe vera sales are rising quickly through online merchants like Amazon and Flipkart, contributing to the segment's expansion.

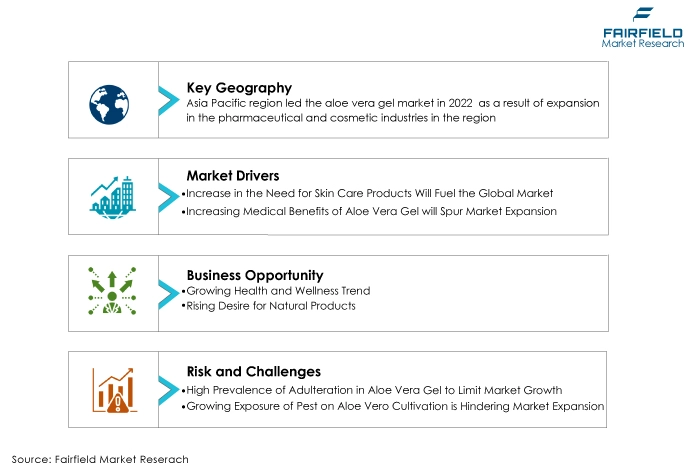

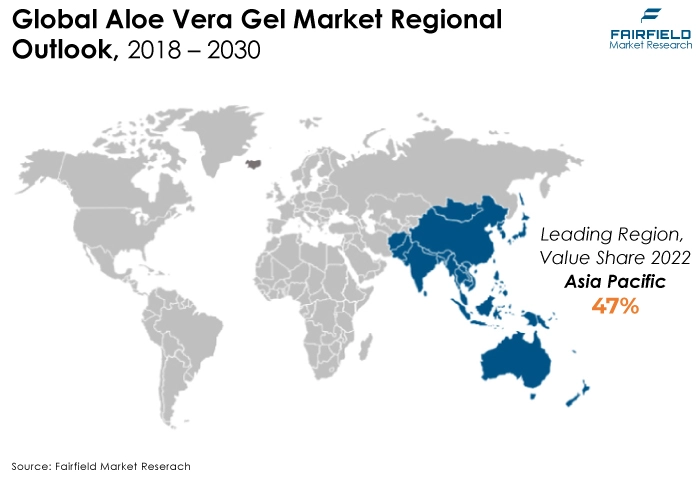

- The Asia Pacific region is anticipated to account for the highest share of the global aloe vera gel market. The Asia Pacific market is expanding as a result of expansion in the pharmaceutical and cosmetic industries in the region. The cosmetics industry in India is expanding at the quickest rate in the world, driving the market's expansion.

- North America will have the significant rate of growth in the market during the forecast period because there are many significant goods producers, especially in the US. Both the raw ingredients and finished aloe vera gel have historically come from the US.

A Look Back and a Look Forward - Comparative Analysis

The main driver of the demand for aloe vera gel is ascribed to elements like the rising level of health consciousness among consumers. Additionally, the industry is expanding as customers increasingly turn away from products with chemical bases in favour of those with herbal or organic ingredients.

The market is expanding further due to the growing acceptance of aloe vera gel in the healthcare industry for the treatment of minor injuries and the reduction of skin inflammations.

Throughout the historical period of 2018-2022, the market had staggered growth. Aloe vera gel's advantages for skincare, wellbeing, and health continue to be better known to consumers. Aloe vera gel-based products were in high demand as a result of this awareness. This is projected to accelerate market expansion.

Aloe vera gel continued to be a well-liked ingredient in skincare and hair care products, which helped the market for personal care and beauty goods flourish. Additionally, the development of online retail and e-commerce platforms gave customers easy access to items made with aloe vera gel, which helped the market grow.

The market will expand as consumer awareness of aloe vera gel's advantages for skin and hair care grows. Additionally, producers are creating brand-new, cutting-edge goods like body washes, shampoos, and facial masks that contain aloe vera gel. In subsequent years, this will encourage marker expansion.

Moreover, growing consumer desire for natural and organic goods is a major factor driving market expansion. Due to its natural ingredients and extensive list of advantages, aloe vera gel is a popular option for consumers who are wanting more organic and natural products.

Key Growth Determinants

- Growing Boom Around Skin Care Products

The market for aloe vera gel is being driven by an increase in the demand for skin care products. Additionally, the anti-inflammatory, acne-curing, anti-oxidant, herbal, and other health characteristics of aloe vera gel serve to expand the market for the product. Aloe vera gel is conveniently available at malls, pharmacies, and other places.

Like most people have started using natural ingredient-based cosmetics in recent years, most people are swiftly shifting their preferences toward a healthy lifestyle.

The market is driven by the gel's features, such as mannose polymers with different sugars, including glucose, vitamin, minerals, enzymes, proteins, and phytosterols.

- Medical Benefits of Aloe Vera Gel

According to a study by Herbal Medicines, aloe vera gel has 200 active ingredients, mostly vitamins, minerals, enzymes, and polysaccharides. Together, the elements above provide the intended outcome. A potent anti-inflammatory, aloe vera gel can be used to treat a variety of health concerns, such as constipation, colitis, and high blood pressure.

About half of all adults in the US have hypertension, yet only one-third of them take medication to manage it. According to a report from the National Center for Complementary & Integrative Health, aloe vera gel can also be used to treat fevers, gastrointestinal disorders, and cases of osteoarthritis. Because of these medical benefits, the market has the potential to expand dramatically.

- E-commerce Expansion

The dynamics and growth of the aloe vera gel industry are greatly influenced by the expansion of e-commerce and online retail platforms in the market. Global distribution of aloe vera gel goods is made possible through e-commerce platforms and online shopping. Due to the ease with which consumers from many locations may access and buy these products online, the market has become more global.

In addition, shoppers enjoy convenience when shopping online. The purchasing procedure is made more convenient because customers may browse and buy aloe vera gel goods using their smartphones while at home or on the road.

Online retail websites also include comprehensive product information and user testimonials. Customers who want to make educated buying selections can read about the advantages, components, and usage guidelines for aloe vera gel products.

Major Growth Barriers

- High Prevalence of Adulteration

There are more and more items on the market that are contaminated and lack the genuine qualities of pure aloe vera gel. Globally, there are many synthetic extracts made of hazardous substances that producers add for the aroma.

The main cause of this is the relatively reduced supply of pure aloe vera gels and, as a result, the high cost of these products due to increased demand. Thus, the high prevalence of adulteration in these items is the key growth inhibitor for the market's development.

- Growing Exposure of Pests on Aloe Vero Cultivation

Pests are one of the things that restrict aloe vera's growth. Mealybugs are one of the most prevalent mites that harm aloe-vera plants because they can pierce right through the tissues of the plant and suck up all the sap.

Furthermore, because it is a desert plant, the entire plot may get ruined by a brief period of high water. These factors have the potential to impede the market's growth.

Key Trends and Opportunities to Look at

- Rising Desire for Natural Products

Since a few years ago, particularly after the release of Covid-19, there has been an increase in interest among individuals of all ages in natural goods, such as aloe vera extracts. The main factor influencing this trend is customers' growing knowledge of these plant extracts' numerous health advantages.

As a result, more people are using aloe vera gels, whole leaf extracts, etc. for health reasons such as improving the texture of their skin and hair and preventing weight loss, which is driving the global aloe vera gel market.

- Growing Health and Wellness Trend

The increasing health and wellness trend is a major force in the aloe vera gel market, affecting consumer preferences and reshaping the sector in numerous ways. Customers are actively looking for products that improve their general wellbeing as they become more health conscious.

Because of its possible health advantages, aloe vera gel is seen as a natural and advantageous substance that matches this trend. Additionally, a lot of consumers favour natural and plant-based remedies for their skincare and health problems.

- Rising International Trade

International trade is an important market force in the aloe vera gel sector, influencing the development, dynamics, and accessibility of aloe vera gel products globally. Moving aloe vera gel items across borders is made easier by international trade.

As a result, suppliers and producers have easier access to a wider variety of resources such as aloe vera processing centres and distribution networks. Aloe vera is mostly farmed in a few places with adequate weather, like India, Mexico, and some areas of Africa.

How Does the Regulatory Scenario Shape this Industry?

Standards for aloe vera gel and related goods' quality and safety are established by regulations. By doing this, it is made sure that the products people obtain fulfill strict standards for purity, potency, and contamination-freeness. Market access and customer confidence depend heavily on compliance with these restrictions.

Additionally, regulatory bodies frequently regulate the statements that may be made in advertising and on product labels. Health, therapeutic, and cosmetic claims fall under this category. These rules must be followed by businesses to prevent consumer misinformation.

Furthermore, the rules might outline the permitted components and their corresponding concentrations in aloe vera gel products. This may affect the way manufacturers formulate their goods and choose where to get their ingredients.

Fairfield’s Ranking Board

Top Segments

- Organic Aloe Vera Bestseller

The organic segment dominated the market in 2022. Aloe vera plants that have been grown without the use of artificial pesticides, herbicides, or genetically modified organisms (GMOs) produce organic aloe vera gel. Natural and environmentally friendly farming methods are used during the cultivation process.

Additionally, consumers who value goods that are seen as more natural, ecologically friendly, and devoid of synthetic additives favour organic aloe vera gel. Some people may view it as a healthier option.

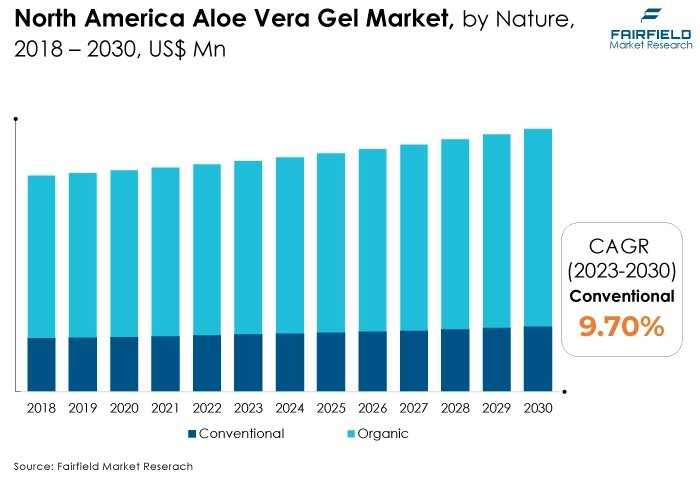

The conventional category is expected to grow significantly over the forecast period. Traditional agricultural methods, which may include the use of artificial pesticides, herbicides, and fertilizers, are commonly used to manufacture conventional aloe vera gel. It does not follow the guidelines for organic production.

However, due to the utilisation of traditional farming practices and perhaps larger-scale production, the conventional aloe vera gel products are frequently more economically produced.

- Cosmetic and Personal Care Industry Records Maximum Uptake

In 2022, the cosmetic and personal care industry dominated the market, and it is predicted to grow significantly over the course of the forecast period. This is due to the widespread use of aloe vera gel for many purposes, particularly those relating to the skin.

Aloe vera gel has been proven to be a fantastic skin healer and offers burn prevention. Aloe vera serves as a barrier for the skin and restores moisture to it. Australia and other places receive 15% more UV than Europeans while also receiving an additional 7% more UV intensity from the sun.

Furthermore, the pharmaceutical industry category is expected to expand significantly. The general nutritional properties are what enable a multifaceted use. The demand for items in the sector is being driven by an increase in the usage of herbal remedies for the treatment of various illnesses, including diabetes.

Furthermore, type II diabetes can be controlled by continuing to use such products. Around 490 million people worldwide have diabetes, according to the WHO.

- Online Sales Continue to Flourish

The online category held the majority of the market share. It is because of steep discounts and more recent digital sales tactics that confidence is boosted and discounts are implemented at numerous checkpoints.

Additionally, celebrity codes and sponsorships help with positioning. Last but not least, because customers in different economies are often price-sensitive, online selling platforms can offer further options.

During the forecasted years, the supermarket & hypermarket category is growing at a substantial rate. The preferred selling strategies used to promote new products through supermarkets and hypermarkets are to blame.

Additionally, these goods have a longer shelf life, increasing the likelihood that the consumer will use them. By offering bulk discounts of up to 10-12%, offline merchants are attempting to correct old practices and boost sales of the newest products.

Regional Frontrunners

Asia Pacific Holds the Lion’s Share

The region with the biggest market share for aloe vera gel is expected to be Asia Pacific during that forecast period. The two main countries for aloe vera gel are China, and India, and both offer great profit margins for distributors and merchants. A 2,000-acre aloe vera farm might make a profit of about INR 4,72,000 due to increased product demand, according to a farmer's analysis.

Moreover, due to the expansion of the cosmetic and healthcare industries in the region, the rising population, and the growing purchasing power of consumers, emerging nations like China and India are also anticipated to be significant players in the regional market.

North America All Set for Significant Growth

The market for aloe vera gel is expanding at the fastest rate in North America, which presents a significant opportunity for the industry. It is because there is such a huge demand in the green beauty industry.

Additionally, consumers polled stated in a data report that they would be more eager to buy food or cosmetic products that were obtained responsibly, from nearby farms, and were organic in nature.

Furthermore, most of the leading market players for aloe vera gel are situated in North America, particularly in the US. Aloe vera gel sales are anticipated to increase over the next five years due to the high concentration of industry competitors in the area.

Fairfield’s Competitive Landscape Analysis

As per the Fairfields analysis, the leading players in the global market put a lot of effort into crucial market tactics like mergers, acquisitions, collaborations, and partnerships to grow their markets and hold onto their positions in an extremely competitive marketplace.

Additionally, since some players in the aloe vera gel market charge excessive costs for their products, competitors in the sector must provide products that are affordable in order to grow and survive in a market that is becoming more and more competitive.

Who are the Leaders in Global Aloe Vera Gel Space?

- Aloe Farms Inc.

- Aloe Vera Australia

- Pharmachem Laboratories Inc.

- Foodchem International Cooperation

- Terry Laboratories Inc.

- Patanjali Ayurved Ltd.

- Aloecorp Inc

- Aloe Laboratories Inc. (Harmony Green Co. Ltd.)

- Forever Living Products Inc.

- Herbalife International Inc.

- Lily of the Desert

- Natural Aloe Costa Rica S.A.

- NOW Health Group, Inc.

- Real Aloe Solutions, Inc.

- Lakewood Inc.

Key Company Developments

New Product Launches

- August 2022: Aloe Vera gel and the CHI Naturals with Hyaluronic Acid Collection were introduced by CHI Haircare. The hydration and nourishment provided by CHI Naturals with aloe vera, and hyaluronic acid helps to lock in moisture, boost shine, and soften both the skin and hair.

- July 2022: A brand-new line of organic aloe vera gel was introduced by organic cosmetics and personal care company Organic Harvest. There are four different versions of the product available.

- August 2021: The Ceremonia oil mist with aloe vera product was introduced as a combination of potent components from Latin America packaged in a micro-mist solution that enables the hair to maintain hydration and shine without the weight of oil. Aloe vera, and Mexican chia seed oil are among the reviving, nutrient-rich elements in this ultra-fine mist that work to strengthen hair, condition it, and increase shine. For a quick boost of nutrition for hair that will benefit all hair types.

An Expert’s Eye

Demand and Future Growth

Skin care businesses have made significant investments to support market expansion. Aloe vera gell has miraculous skin advantages, including the ability to hydrate the skin and alleviate irritation.

Additionally, raising public awareness of the medical properties of aloe vera gel will accelerate market expansion. Furthermore, aloe vera gel use, whether through functional foods or supplements, has proven effective as a detoxifier, immune system booster, and promoter of healthy skin and hair.

Supply Side of the Market

According to our analysis, due to its ideal climate for the production of aloe vera, India has been a prominent producer and exporter of aloe vera gel and associated goods.

India has also adapted contemporary agricultural techniques and technology to effectively cultivate aloe vera. Aloe vera is a growing part of farmers' crop portfolios, which helps to explain why it is such a key provider.

Additionally, India has a thriving processing and production sector for aloe vera goods. These include cosmetics, juice, extracts, and gel from aloe vera. Aloe vera is extracted from plants, processed, and sold to a variety of foreign markets by numerous Indian businesses.

Global Aloe Vera Gel Market is Segmented as Below:

By Nature

- Conventional

- Organic

By End-use Industry

- Cosmetic and Personal Care Industry

- Food and Beverages Industry

- Pharmaceutical Industry

By Distribution Channel

- Institutional Sales

- Supermarkets and Hypermarkets

- Speciality Stores

- Online

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Aloe Vera Gel Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Aloe Vera Gel Market Outlook, 2018 - 2030

3.1. Global Aloe Vera Gel Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Conventional

3.1.1.2. Organic

3.2. Global Aloe Vera Gel Market Outlook, by End-Use Industry, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Cosmetic and Personal Care Industry

3.2.1.2. Food and Beverages Industry

3.2.1.3. Pharmaceutical Industry

3.3. Global Aloe Vera Gel Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Supermarket & Hypermarket

3.3.1.2. Institutional Sales

3.3.1.3. Speciality Stores

3.3.1.4. Online

3.3.1.5. Others

3.4. Global Aloe Vera Gel Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Aloe Vera Gel Market Outlook, 2018 - 2030

4.1. North America Aloe Vera Gel Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Conventional

4.1.1.2. Organic

4.2. North America Aloe Vera Gel Market Outlook, by End-Use Industry, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Cosmetic and Personal Care Industry

4.2.1.2. Food and Beverages Industry

4.2.1.3. Pharmaceutical Industry

4.3. North America Aloe Vera Gel Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Supermarket & Hypermarket

4.3.1.2. Institutional Sales

4.3.1.3. Speciality Stores

4.3.1.4. Online

4.3.1.5. Others

4.3.2. Market Attractiveness Analysis

4.4. North America Aloe Vera Gel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Aloe Vera Gel Market Outlook, 2018 - 2030

5.1. Europe Aloe Vera Gel Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Conventional

5.1.1.2. Organic

5.2. Europe Aloe Vera Gel Market Outlook, by End-Use Industry, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Cosmetic and Personal Care Industry

5.2.1.2. Food and Beverages Industry

5.2.1.3. Pharmaceutical Industry

5.3. Europe Aloe Vera Gel Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Supermarket & Hypermarket

5.3.1.2. Institutional Sales

5.3.1.3. Speciality Stores

5.3.1.4. Online

5.3.1.5. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Aloe Vera Gel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Aloe Vera Gel Market Outlook, 2018 - 2030

6.1. Asia Pacific Aloe Vera Gel Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Conventional

6.1.1.2. Organic

6.2. Asia Pacific Aloe Vera Gel Market Outlook, by End-Use Industry, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Cosmetic and Personal Care Industry

6.2.1.2. Food and Beverages Industry

6.2.1.3. Pharmaceutical Industry

6.3. Asia Pacific Aloe Vera Gel Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Supermarket & Hypermarket

6.3.1.2. Institutional Sales

6.3.1.3. Speciality Stores

6.3.1.4. Online

6.3.1.5. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Aloe Vera Gel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Aloe Vera Gel Market End-Use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Aloe Vera Gel Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Aloe Vera Gel Market Outlook, 2018 - 2030

7.1. Latin America Aloe Vera Gel Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Conventional

7.1.1.2. Organic

7.2. Latin America Aloe Vera Gel Market Outlook, by End-Use Industry, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Cosmetic and Personal Care Industry

7.2.1.2. Food and Beverages Industry

7.2.1.3. Pharmaceutical Industry

7.3. Latin America Aloe Vera Gel Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Supermarket & Hypermarket

7.3.1.2. Institutional Sales

7.3.1.3. Speciality Stores

7.3.1.4. Online

7.3.1.5. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Aloe Vera Gel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Aloe Vera Gel Market Outlook, 2018 - 2030

8.1. Middle East & Africa Aloe Vera Gel Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Conventional

8.1.1.2. Organic

8.2. Middle East & Africa Aloe Vera Gel Market Outlook, by End-Use Industry, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Cosmetic and Personal Care Industry

8.2.1.2. Food and Beverages Industry

8.2.1.3. Pharmaceutical Industry

8.3. Middle East & Africa Aloe Vera Gel Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Supermarket & Hypermarket

8.3.1.2. Institutional Sales

8.3.1.3. Speciality Stores

8.3.1.4. Online

8.3.1.5. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Aloe Vera Gel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Aloe Vera Gel Market by Nature, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Aloe Vera Gel Market by End-Use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Aloe Vera Gel Market by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Aloe Farms Inc.

9.5.1.1. Company Overview

9.5.1.2. Products Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Aloe Vera Australia

9.5.2.1. Company Overview

9.5.2.2. Products Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Pharmachem Laboratories Inc

9.5.3.1. Company Overview

9.5.3.2. Products Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Foodchem International Cooperation

9.5.4.1. Company Overview

9.5.4.2. Products Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Terry Laboratories Inc.

9.5.5.1. Company Overview

9.5.5.2. Products Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Patanjali Ayurved Ltd.

9.5.6.1. Company Overview

9.5.6.2. Products Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Aloecorp Inc.

9.5.7.1. Company Overview

9.5.7.2. Products Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Aloe Laboratories Inc. (Harmony Green Co. Ltd.)

9.5.8.1. Company Overview

9.5.8.2. Products Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Forever Living Products Inc.

9.5.9.1. Company Overview

9.5.9.2. Products Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Herbalife International Inc

9.5.10.1. Company Overview

9.5.10.2. Products Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Lily of the Desert

9.5.11.1. Company Overview

9.5.11.2. Products Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Natural Aloe Costa Rica S.A.

9.5.12.1. Company Overview

9.5.12.2. Products Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. NOW Health Group, Inc.

9.5.13.1. Company Overview

9.5.13.2. Products Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Real Aloe Solutions, Inc.

9.5.14.1. Company Overview

9.5.14.2. Products Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Lakewood Inc

9.5.15.1. Company Overview

9.5.15.2. Products Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

End-use Industry Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver,Restraints, and Future Opportunities & Revenue Pockets,Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category,Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |