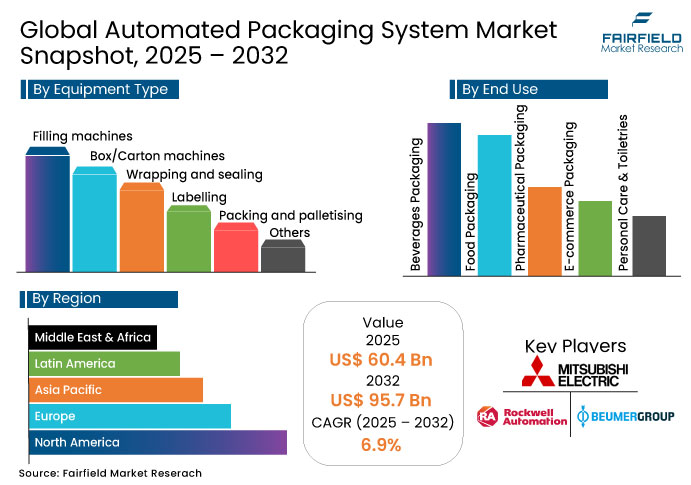

Global Automated Packaging System Market Forecast

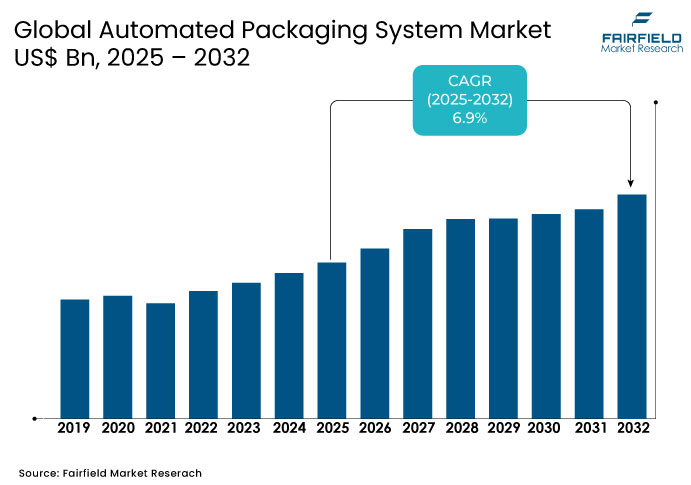

- The global automated packaging system market size is projected to grow from US$60.4 Bn in 2025 to US$95.7 Bn by 2032. The market will witness a CAGR of 6.9% during this period.

- Growing demand for operational efficiency and cost reduction across manufacturing industries is expected to significantly drive automated packaging system demand due to its critical role in speeding up production, minimizing errors, and reducing dependency on manual labour.

Automated Packaging System Insights

- Box/carton machines are witnessing strong demand in food packaging due to the rise in ready-to-eat and processed food products, which require fast, hygienic, and efficient secondary packaging solutions.

- Filling machines are gaining popularity in beverage packaging as manufacturers seek high-speed, multi-product compatible systems that reduce downtime and improve production line efficiency.

- Wrapping and sealing systems are rapidly adopted in pharmaceutical packaging to comply with stringent regulations for tamper-evidence and ensure product safety during transportation and storage.

- Labelling systems are in high demand in e-commerce packaging as online retailers require fast, automated labelling solutions for real-time tracking, error reduction, and faster order fulfilment.

- Packing and palletising systems are being embraced in personal care and toiletries packaging to handle increasing product variety with flexible automation that reduces manual labor and improves throughput.

A Look Back and a Look Forward - Comparative Analysis

From 2019 to 2024, the global automated packaging system market grew steadily, driven by rising e-commerce, labor shortages, and demand for operational efficiency. Sectors like food, pharmaceuticals, and consumer goods led adoption. COVID-19 accelerated automation as companies sought contactless operations, while investments focused on speed, accuracy, and reducing workforce dependency in warehousing and manufacturing.

Between 2025 and 2032, automation in packaging is expected to expand further due to sustainability regulations, digital transformation, and AI integration. Demand will rise for smart systems with real-time data tracking, predictive maintenance, and eco-friendly packaging capabilities. Customization, robotics, and flexible machinery will shape future growth, especially in fast-moving consumer goods and pharmaceutical applications.

Key Growth Determinants

The growing demand for precision and high-speed filling machines in the beverage packaging sector is accelerating global packaging automation adoption

Automation in beverage filling is accelerating global packaging systems demand. The beverage packaging machine market is experiencing strong growth, with filling and capping machines leading the way. High-speed filling machines are widely adopted to improve production speed and consistency. These machines help manufacturers meet rising demand while reducing errors and minimizing product loss in bottling operations.

Manufacturers are focusing on precision and efficiency to meet growing consumer expectations. In 2023, filling machines accounted for nearly 30% of all packaging machinery demand, making it the largest equipment segment. Companies such as Accutek and Cozzoli have seen strong orders for automated liquid filling systems, especially in the beverage industry. The trend is supported by growing needs for hygienic, reliable, and high-throughput packaging processes.

Key Growth Barriers

High initial investment and integration complexity of palletising automation systems restrict adoption, particularly among small and medium enterprises

High initial investment for palletising automation is a major barrier. A standard industrial robotic palletising system can start at around €70,000, not including integration and customization costs. Many small and medium enterprises find this upfront expense too high. As a result, even when automation offers long-term savings, many smaller businesses delay or avoid adoption.

Integration of palletising systems into existing production lines adds more complexity. Companies often need extra hardware, software, and sometimes have to modify their facilities. Industry reviews have shown that high capital expenditure and system integration challenges are key reasons many businesses hesitate to invest. These issues make it difficult for small manufacturers to justify the cost and effort of full-scale automation.

Automated Packaging System Market Opportunities

Rising e-commerce penetration offers packaging automation companies opportunities to deploy compact, high-throughput labelling systems for rapid fulfilment

Rising e-commerce demand is boosting the need for packaging automation. Global e-commerce sales reached US$6 trillion in 2023 and are expected to keep growing as more consumers shop online. This surge is creating pressure on fulfilment centres to process and dispatch orders faster. As a result, businesses are adopting compact, high-speed labelling systems to keep up with daily order volumes and reduce human error.

As warehouses get busier, third-party logistics providers and online brands need compact, high-throughput labelling systems. For instance, some systems now fit in just 10 square metres but still support fast order flow in limited space. Advanced solutions are also reducing labour needs by 50% and lowering package volume by 30%, helping fulfilment centres cut costs and speed up delivery to meet growing customer expectations.

Segment-wise Overview

- Pharmaceutical packaging is witnessing rapid automation due to stringent regulatory demands for tamper-evident and traceable packaging solutions

Pharmaceutical packaging is leading automation growth due to high safety and compliance demands. Nearly 45% of pharmaceutical packaging processes are now automated, reflecting rapid adoption of labeling, sealing, and serialization systems to meet strict drug-traceability rules. Companies like Systech and Praxis are rolling out cloud-based track-and-trace platforms to support global regulations such as the Drug Supply Chain Security Act and the Falsified Medicines Directive.

Demand is also growing for tamper-evident and smart packaging. The global tamper-proof packaging market reached USD 13.4 billion in 2024, driven by rising needs for drug integrity during transit. New solutions, like SCHOTT’s polymer syringe with RFID chips and first-opening indicators, enable automation-ready packaging lines. These innovations highlight why pharmaceutical packaging is the leading equipment type in the automated packaging system market.

- Filling machines remain dominant as manufacturers upgrade to multi-product compatible systems with automated cleaning and reduced downtime

Filling machines remain the top equipment type in automated packaging as industries demand faster, cleaner, and more flexible systems. A recent industry report noted that over 65% of packaging lines in food and beverage sectors now use automated filling machines. Companies are also shifting to clean-in-place systems that reduce manual intervention, cut cleaning time by up to 40%, and improve production uptime.

New product developments support this trend. For example, SIG launched a high-speed aseptic filler capable of handling multiple product types with minimal changeover, reducing downtime by nearly 30%. Similarly, Bosch introduced a modular filling line with automated adjustment features, allowing manufacturers to switch between product formats quickly. These innovations show why filling machines continue to lead in the automated packaging system market.

Regional Analysis

- Increased labor cost and workforce shortages in the U.S. are pushing companies to adopt automated packing and palletising solutions

In North America, high labor costs and workforce shortages are pushing automation. U.S. manufacturing job openings are now double the pre-pandemic levels, with employee turnover reaching 36.6% in 2023. About 65% of packaging operations leaders have stated their intention to adopt automation and robotics, with labor shortages being the top reason behind this shift toward automated systems.

These pressures are driving strong investment in automated packing and palletising solutions. A recent study found that labor issues are the main factor behind the growing use of robotics in warehouses. In 2024, the U.S. saw a sharp rise in demand for robotic palletizers, particularly due to their flexibility, safety, and speed. Automation has become necessary for companies to maintain output despite rising wages and limited worker availability.

- Sustainability regulations in Europe are encouraging adoption of automated carton machines that minimize packaging waste and energy use

In Europe, strict sustainability regulations are pushing companies to adopt automated carton machines that cut packaging waste and reduce energy use. The EU Packaging and Packaging Waste Regulation (PPWR) is encouraging businesses to shift to more efficient packaging methods. Many European manufacturers now use automated systems that right-size each package, helping reduce space and save material with every order.

Leading companies are investing in eco-friendly automation. For example, several logistics centers in Germany and France have installed carton machines that use 20% less energy and reduce cardboard waste by nearly 30%. These systems also help businesses meet carbon reduction goals. As regulations tighten, more European firms are adopting automated packaging solutions that align with sustainability targets and improve operational efficiency.

- Rapid industrialisation and food processing expansion in China and India are fueling demand for advanced wrapping and sealing machines

In Asia Pacific, rapid industrialisation and strong growth in food processing especially in China and India are increasing demand for advanced wrapping and sealing machines. In 2024, China held over 29% share of the global wrapping machine market, showing the country’s growing shift toward automation. In India, rising demand for frozen and ready-to-eat foods is driving the adoption of modern food packaging systems.

Manufacturers across the region are investing in smart and efficient packaging technologies. In India, companies expect packaging automation to grow by more than 10% annually due to the increasing use of smart factories. Throughout Asia Pacific, wrapping machines generated significant revenue in 2024, as businesses focus on reducing manual labor and improving packaging speed and hygiene. These trends highlight the region's leading role in automated packaging system growth.

Competitive Landscape

Competition is intense, with market leaders forming partnerships and acquiring firms to strengthen their product range. Sealed Air’s acquisition of Automated Packaging Systems helped expand its automated bagging solutions. Packsize is acquiring Sparck Technologies to add automated lidding and height-reduction features. These strategic moves show how companies are investing in technology and integration to stay ahead in the market.

Innovation, service, and sustainability are key strategies among leading players. Mondi partnered with CMC to offer automated solutions using sustainable kraft paper for e-commerce packaging. Domino chose Viking Masek’s servo-driven machines to ensure high speed and low maintenance. Domino Printing Sciences also launched automated label printing and inspection systems to reduce human error. These actions show how firms are competing through smart technology, green solutions, and customer-centric services.

Key Companies

- Mitsubishi Electric Corp.

- Rockwell Automation

- BEUMER Group GmbH & Co.

- Automated Packaging Systems Inc.

- Siemens AG

- Linkx Packaging

- Emerson Electric Co.

- SATO Holdings

- Swisslog Holding AG

- ABB Ltd

- Schneider Electric SE

- Kollmorgen Corporation

- Bosch Packaging Technology

- Krones AG

- Pro Mach, Inc.

- Omron Corporation

- Sealed Air Corporation

Expert Opinion

- Rising labor shortages and increased wage pressures are pushing manufacturers to adopt automated packaging systems, which offer consistent output, reduced human error, and higher operational efficiency across industries.

- The growing e-commerce and food delivery sectors demand faster, flexible packaging lines, leading to investment in compact, high-throughput machines with real-time monitoring and minimal downtime capabilities.

- Regulatory focus on traceability, especially in pharmaceuticals and food, is accelerating adoption of automated labelling and serialization systems to ensure compliance, product integrity, and supply chain transparency.

- Sustainability is becoming a major driver, with industries seeking automation solutions that support material reduction, energy efficiency, and compatibility with recyclable or biodegradable packaging formats.

Global Automated Packaging System Market Segmentation

By Equipment Type

- Box/Carton machines

- Filling machines

- Wrapping and sealing

- Labelling

- Packing and palletising

- Others

By End Use

- Food Packaging

- Beverages Packaging

- Pharmaceutical Packaging

- E-commerce Packaging

- Personal Care & Toiletries

- Other Industrial (including Electronics Automotive, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Automated Packaging Systems Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Automated Packaging Systems Market Outlook, 2019 - 2032

3.1. Global Automated Packaging Systems Market Outlook, by Equipment Type, Value (US$ Bn), 2019 - 2032

3.1.1. Box/Carton machines

3.1.2. Filling machines

3.1.3. Wrapping and sealing

3.1.4. Labelling

3.1.5. Packing and palletising

3.1.6. Others

3.2. Global Automated Packaging Systems Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

3.2.1. Food Packaging

3.2.2. Beverages Packaging

3.2.3. Pharmaceutical Packaging

3.2.4. E-commerce Packaging

3.2.5. Personal Care & Toiletries

3.2.6. Other Industrial (including Electronics Automotive, etc.)

3.3. Global Automated Packaging Systems Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Automated Packaging Systems Market Outlook, 2019 - 2032

4.1. North America Automated Packaging Systems Market Outlook, by Equipment Type, Value (US$ Bn), 2019 - 2032

4.1.1. Box/Carton machines

4.1.2. Filling machines

4.1.3. Wrapping and sealing

4.1.4. Labelling

4.1.5. Packing and palletising

4.1.6. Others

4.2. North America Automated Packaging Systems Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

4.2.1. Food Packaging

4.2.2. Beverages Packaging

4.2.3. Pharmaceutical Packaging

4.2.4. E-commerce Packaging

4.2.5. Personal Care & Toiletries

4.2.6. Other Industrial (including Electronics Automotive, etc.)

4.3. North America Automated Packaging Systems Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.3.1. U.S. Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

4.3.2. U.S. Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

4.3.3. Canada Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

4.3.4. Canada Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Automated Packaging Systems Market Outlook, 2019 - 2032

5.1. Europe Automated Packaging Systems Market Outlook, by Equipment Type, Value (US$ Bn), 2019 - 2032

5.1.1. Box/Carton machines

5.1.2. Filling machines

5.1.3. Wrapping and sealing

5.1.4. Labelling

5.1.5. Packing and palletising

5.1.6. Others

5.2. Europe Automated Packaging Systems Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

5.2.1. Food Packaging

5.2.2. Beverages Packaging

5.2.3. Pharmaceutical Packaging

5.2.4. E-commerce Packaging

5.2.5. Personal Care & Toiletries

5.2.6. Other Industrial (including Electronics Automotive, etc.)

5.3. Europe Automated Packaging Systems Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Germany Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

5.3.2. Germany Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

5.3.3. Italy Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

5.3.4. Italy Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

5.3.5. France Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

5.3.6. France Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

5.3.7. U.K. Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

5.3.8. U.K. Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

5.3.9. Spain Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

5.3.10. Spain Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

5.3.11. Russia Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

5.3.12. Russia Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

5.3.13. Rest of Europe Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

5.3.14. Rest of Europe Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Automated Packaging Systems Market Outlook, 2019 - 2032

6.1. Asia Pacific Automated Packaging Systems Market Outlook, by Equipment Type, Value (US$ Bn), 2019 - 2032

6.1.1. Box/Carton machines

6.1.2. Filling machines

6.1.3. Wrapping and sealing

6.1.4. Labelling

6.1.5. Packing and palletising

6.1.6. Others

6.2. Asia Pacific Automated Packaging Systems Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

6.2.1. Food Packaging

6.2.2. Beverages Packaging

6.2.3. Pharmaceutical Packaging

6.2.4. E-commerce Packaging

6.2.5. Personal Care & Toiletries

6.2.6. Other Industrial (including Electronics Automotive, etc.)

6.3. Asia Pacific Automated Packaging Systems Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. China Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

6.3.2. China Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

6.3.3. Japan Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

6.3.4. Japan Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

6.3.5. South Korea Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

6.3.6. South Korea Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

6.3.7. India Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

6.3.8. India Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

6.3.9. Southeast Asia Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

6.3.10. Southeast Asia Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

6.3.11. Rest of SAO Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

6.3.12. Rest of SAO Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America Automated Packaging Systems Market Outlook, 2019 - 2032

7.1. Latin America Automated Packaging Systems Market Outlook, by Equipment Type, Value (US$ Bn), 2019 - 2032

7.1.1. Box/Carton machines

7.1.2. Filling machines

7.1.3. Wrapping and sealing

7.1.4. Labelling

7.1.5. Packing and palletising

7.1.6. Others

7.2. Latin America Automated Packaging Systems Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

7.2.1. Food Packaging

7.2.2. Beverages Packaging

7.2.3. Pharmaceutical Packaging

7.2.4. E-commerce Packaging

7.2.5. Personal Care & Toiletries

7.2.6. Other Industrial (including Electronics Automotive, etc.)

7.3. Latin America Automated Packaging Systems Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Brazil Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

7.3.2. Brazil Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

7.3.3. Mexico Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

7.3.4. Mexico Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

7.3.5. Argentina Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

7.3.6. Argentina Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

7.3.7. Rest of LATAM Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

7.3.8. Rest of LATAM Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Automated Packaging Systems Market Outlook, 2019 - 2032

8.1. Middle East & Africa Automated Packaging Systems Market Outlook, by Equipment Type, Value (US$ Bn), 2019 - 2032

8.1.1. Box/Carton machines

8.1.2. Filling machines

8.1.3. Wrapping and sealing

8.1.4. Labelling

8.1.5. Packing and palletising

8.1.6. Others

8.2. Middle East & Africa Automated Packaging Systems Market Outlook, by End Use, Value (US$ Bn), 2019 - 2032

8.2.1. Food Packaging

8.2.2. Beverages Packaging

8.2.3. Pharmaceutical Packaging

8.2.4. E-commerce Packaging

8.2.5. Personal Care & Toiletries

8.2.6. Other Industrial (including Electronics Automotive, etc.)

8.3. Middle East & Africa Automated Packaging Systems Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. GCC Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

8.3.2. GCC Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

8.3.3. South Africa Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

8.3.4. South Africa Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

8.3.5. Egypt Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

8.3.6. Egypt Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

8.3.7. Nigeria Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

8.3.8. Nigeria Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

8.3.9. Rest of Middle East Automated Packaging Systems Market Outlook, by Equipment Type, 2019 - 2032

8.3.10. Rest of Middle East Automated Packaging Systems Market Outlook, by End Use, 2019 - 2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Mitsubishi Electric Corp.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Rockwell Automation

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. BEUMER Group GmbH & Co.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Automated Packaging Systems Inc.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Siemens AG

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Linkx Packaging

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Emerson Electric Co.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. SATO Holdings

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Swisslog Holding AG

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. ABB Ltd

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

9.4.11. Schneider Electric SE

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Developments

9.4.12. Kollmorgen Corporation

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Developments

9.4.13. Bosch Packaging Technology

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Developments

9.4.14. Krones AG

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Developments

9.4.15. Pro Mach, Inc.

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Developments

9.4.16. Omron Corporation

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Developments

9.4.17. Sealed Air Corporation

9.4.17.1. Company Overview

9.4.17.2. Product Portfolio

9.4.17.3. Financial Overview

9.4.17.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Equipment Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |