Global Battery Manufacturing Equipment Market Forecast

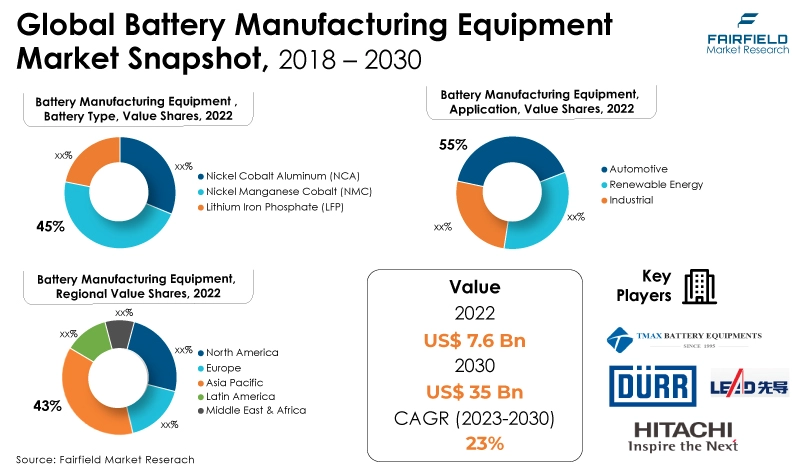

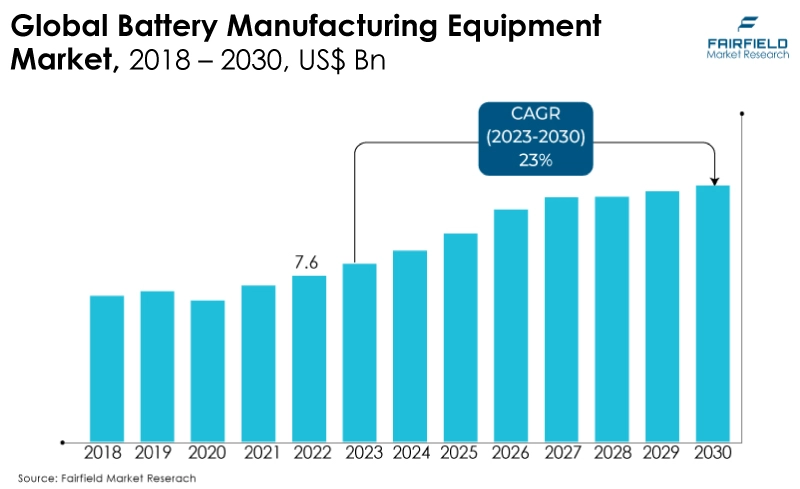

- Global market for battery manufacturing equipment worth US$7.6 Bn in 2022 likely to reach US$35 Bn by 2030-end

- Market valuation poised to exhibit robust expansion at a CAGR of 23% over 2023 - 2030

Quick Report Digest

- The key trend anticipated to drive the battery manufacturing equipment market growth is an increasing demand for energy storage systems (ESS). Furthermore, battery manufacturing facilities must be expanded and scaled up to meet the increasing demand for energy storage. This prompts purchases of advanced manufacturing machinery to boost output.

- Another major market trend expected to drive the battery manufacturing equipment market growth is the rapidly expanding green manufacturing. Greener and more sustainable battery production techniques are becoming increasingly prevalent as a result of environmental concerns. This involves using greener energy sources, promoting recycling, and creating environmentally friendly products and materials.

- In 2022, the mixing machines category dominated the industry. Ribbon mixers move materials in opposing directions using two blades that rotate in a counter-clockwise motion. By generating a fluidising movement, this design encourages quick and effective mixing.

- In 2022, the nickel manganese cobalt (NMC) category dominated the industry. NMC batteries are used in energy storage applications, such as residential and commercial battery systems, to store surplus electricity generated from renewable sources or during off-peak hours.

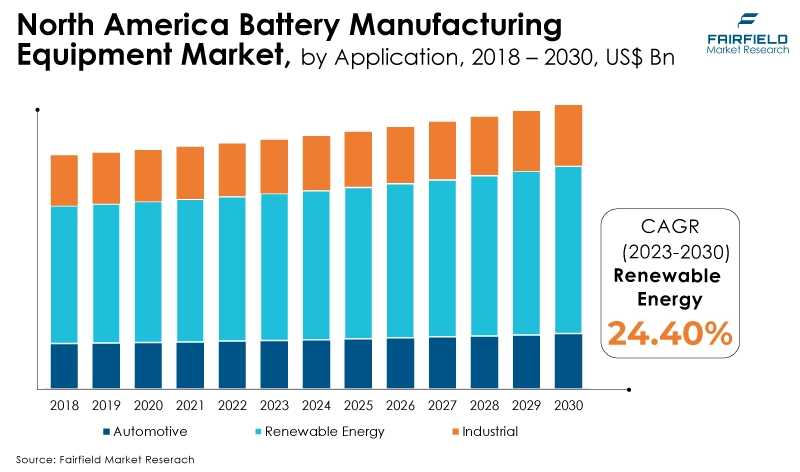

- The renewable energy category is expected to experience the fastest growth within the forecast time frame. Manufacturers are working on improving the energy density and efficiency of batteries used in renewable energy applications.

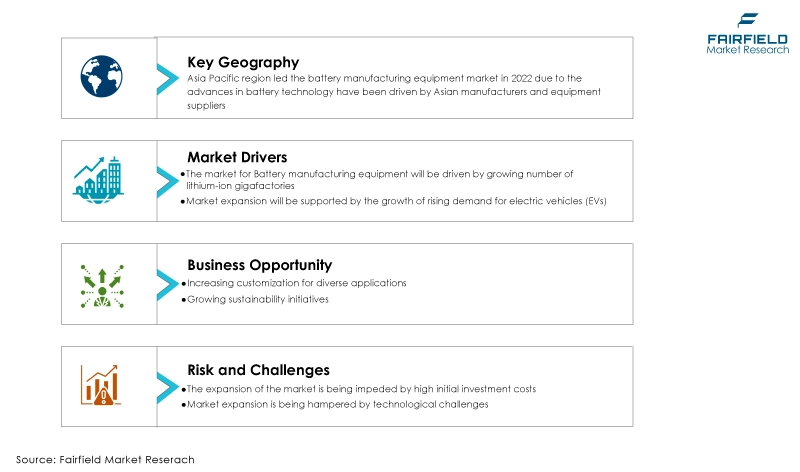

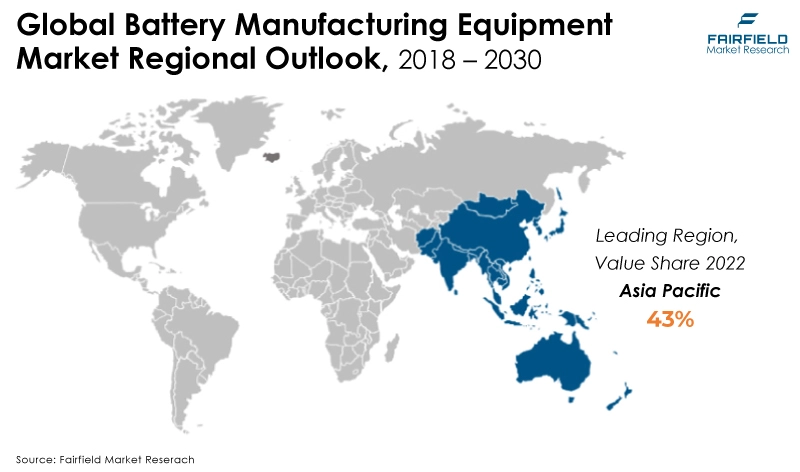

- Asia Pacific is expected to dominate the battery manufacturing equipment market during the forecast period. Asian manufacturers and equipment suppliers have driven advances in battery technology. They are always coming up with new, more productive, and less expensive production technologies.

- North America is expected to be the fastest-growing battery manufacturing equipment market region. Numerous universities, research organisations, and private businesses working on developing battery technology are located throughout North America.

A Look Back and a Look Forward - Comparative Analysis

Higher energy density and better battery performance are made possible by improved coating and drying processes, which also make it possible to apply electrode materials and coatings precisely and uniformly.

Manufacturers can easily scale up or down production, adjust to shifting market demands, and minimise downtime for maintenance and upgrades because of innovative modular equipment designs. Energy-efficient manufacturing machinery lowers energy consumption and operational expenses, improving the sustainability and economic viability of battery manufacture.

The market witnessed staggered growth during the historical period 2018 - 2022. The overall cost of making batteries was reduced as a result of efforts to lower the price of raw materials, including lithium, nickel, cobalt, and other active components. This was accomplished through the invention of substitute materials, improved extraction techniques, and material recycling.

Equipment for making batteries has advanced substantially, with a focus on boosting production effectiveness. This decreased the cost of production per unit and allowed manufacturers to create storms in greater volumes.

The need for manufacturing machinery that can accept multiple materials, processes, and safety precautions is driven by the need for batteries with varied chemistries, including lithium-ion, lithium iron phosphate (LiFePO4), nickel manganese cobalt (NMC), and others in the coming years. Additionally, Manufacturers can adjust their production capacities in accordance with their growth plans because of customisation.

Equipment can be modified to accommodate both the demand for production volume now and in the future. Furthermore, Manufacturers can quickly replace between different battery types or sizes due to the flexibility of customised equipment, which allows for flexible production. Responding to shifting market demands requires a high level of adaptability during the next five years.

Key Growth Determinants

- Growing Number of Lithium-ion Gigafactories

Gigafactories are built to manufacture batteries on a massive scale, frequently in the gigawatt-hour (GWh) range. As additional gigafactories are created, they need a lot of equipment for making batteries in order to reach their output goals.

Gigafactories' huge manufacturing capacities enable economies of scale. As a result, the price of batteries drops per unit, lowering the overall cost of energy storage systems and electric vehicles as a whole and increasing customer access to these products.

Gigafactories often adopt the most recent technological advancements in battery manufacturing. This includes cutting-edge machinery for manufacturing, automation, and robots, which not only boost productivity but also raise the need for specialised equipment.

- Rising EV Boom

Large batteries, typically lithium-ion batteries, power EVs. Battery production has significantly increased as a result of the boom in EV demand, necessitating the expansion and upgrading of manufacturing facilities with cutting-edge machinery.

To fulfill consumer demand, both well-known and up-and-coming manufacturers are increasing the capacity of their EV production. This necessitates the installation of bigger and more effective battery production lines, which fuel the need for battery manufacturing machinery.

Battery technology is constantly improving to satisfy consumer demands for performance and range. In order to create batteries with increased energy density, longer lifespans, and faster charging capabilities, there is a constant need for cutting-edge machinery.

- Increasing Demand for Renewable Energy

Renewable energy sources are intermittent, and factors like sunlight and wind speed influence energy production. Energy storage systems (ESS) are crucial for ensuring a consistent and dependable energy supply. ESS relies heavily on batteries, especially lithium-ion batteries, which makes it necessary to produce more batteries and battery manufacturing machinery.

Supply fluctuations might result from the electrical grid's integration of renewable energy sources. By holding extra energy during times of high production and releasing it when demand is high, energy storage, which is frequently in the form of large-scale batteries, aids with grid stabilisation. Expanding equipment and capacity for battery production is necessary for this.

Major Growth Barriers

- High Initial Investments

The significant investment needed to start a battery manufacturing facility might be a difficult barrier for new competitors. Due to the difficulty smaller businesses may have in obtaining the appropriate financing, this may reduce market competition and innovation.

Potential investors and manufacturers are frequently risk-averse as a result of high initial investment expenses. They might be hesitant to make such substantial financial commitments, especially if they are still determining future technical advancements or market demand.

- Technological Challenges

Technology related to batteries is always changing. Battery performance and efficiency are always being improved through the development of new chemistries, components, and manufacturing techniques.

Manufacturers might struggle to keep up with these innovations and might be reluctant to invest in machinery that might be quickly rendered outdated.

Manufacturers may need specialised equipment for particular battery chemistries or form factors as battery technology evolves to satisfy a variety of applications. It might take a lot of time and be technically difficult to develop and integrate unique solutions.

Key Trends and Opportunities to Look at

- Growing Automation and Robotics Integration

The efficiency and accuracy of battery production processes are improved by automation and robotics. Robots can carry out repetitive activities with great precision and consistency, which lowers the possibility of mistakes and flaws in battery manufacturing.

Because automated systems can work continuously without becoming tired, they can produce more goods in less time. To fulfill the rising demand for batteries, particularly in the EV and renewable energy sectors, this scalability is essential.

- Increasing Customisation for Diverse Applications

Manufacturers may cater to a wide range of applications because of customizable equipment, including consumer electronics, electric vehicles, grid energy storage, and aircraft. Equipment suppliers can meet the varying needs of numerous sectors due to their versatility.

Manufacturers benefit from flexibility in production when using battery manufacturing equipment that is simple to design or adapt for various battery chemistries, sizes, and form factors. Given how quickly battery technology is developing, this flexibility is essential.

- Growing Sustainability Initiatives

Eco-friendly manufacturing techniques are encouraged by sustainability programs. Equipment producers are creating low-emission, energy-efficient equipment, which lowers the environmental impact of battery production.

Using renewable energy sources in production processes, like solar and wind power, is common in sustainable battery manufacturing. This not only cuts running expenses and greenhouse gas emissions but also increases the appeal of environmentally friendly technology.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, to ensure safety, environmental compliance, and high-quality products, the battery manufacturing equipment market has been subject to a number of regulatory frameworks and standards. The Environmental Protection Agency (EPA) is heavily involved in controlling the environmental effects of battery manufacture. For battery production plants, it establishes pollution norms and hazardous waste management guidelines.

Utilising particular tools and technology to reduce ecological consequences is frequently necessary to comply with Environmental Protection Agency (EPA) requirements. Occupational Safety and Health Administration (OSHA) is responsible for setting safety and health requirements for the workplace. To safeguard the security of employees using the equipment, battery production equipment producers must abide by Occupational Safety and Health Administration (OSHA) rules. This affects how equipment is designed and operated to fulfill safety standards.

The National Fire Protection Association (NFPA) provides standards and guidelines for fire safety, including those that apply to facilities that make batteries. National Fire Protection Association (NFPA) requirements must be met by battery manufacturing equipment to reduce fire risks related to battery production. Compliance with safety, environmental, and quality requirements is crucial because of how these regulatory bodies affect the market for battery manufacturing equipment.

Fairfield’s Ranking Board

Top Segments

- Mixing Machines Category Maintains Prominence over Coating and Drying

The mixing machines segment dominated the market in 2022. A revolving blade used in planetary mixers rotates both on its axis and in an orbit around a main axis. This dual rotation action thoroughly ensures material mixing and dispersion.

In the manufacturing of lithium-ion batteries, planetary mixers are frequently used to combine electrode materials, slurries, and pastes.

Furthermore, the coating and drying machines category is projected to experience the fastest market growth. Precision slot dies are used in space die coating equipment to control the coating's thickness and homogeneity precisely.

A precise and even layer is produced by pumping the substance onto the substrate through the slot die. In the manufacture of lithium-ion batteries, slot die coaters are frequently used to apply separator and electrode coatings.

- NMC Leads

The nickel manganese cobalt (NMC) segment dominated the market in 2022. The active components for NMC batteries, such as nickel, manganese, cobalt, and other additives, are mixed into a slurry using mixing equipment. The slurry is applied to electrode substrates using coating machinery.

Battery performance depends on accurate mixing and uniform coating of NMC materials. To manage the unique properties of NMC materials, equipment must be devised.

The nickel cobalt aluminum (NCA) category is anticipated to grow substantially throughout the projected period. Electric vehicles (EVs) and other high-energy-density applications frequently use nickel-cobalt aluminum (NCA) batteries, a form of lithium-ion battery.

The machinery utilised in the production of NCA batteries includes a variety of tools and procedures created for the production of electrodes, cell assembling, and quality control.

- Automotive Industry Heads Demand Game

The automotive category dominated the market in 2022. The most popular technology for automotive applications is still lithium-ion batteries. In order to fulfill the rising production demands of EV manufacturers, battery manufacturing equipment for these batteries has become more sophisticated and effective.

The industry keeps investing in high-throughput, automated manufacturing machinery due to the rising popularity of EVs and the demand for large-scale battery manufacture. For battery assembly to be efficient and precise, automation and robotics are essential.

The renewable energy segment is expected to experience the fastest growth within the forecast time frame. While lithium-ion batteries are frequently used in the storage of renewable energy, other technologies, such as flow batteries, vanadium flow batteries and solid-state batteries, are also being investigated. Depending on the battery chemistry, different manufacturing tools may be used.

Regional Frontrunners

Asia Pacific Remains the Prime Market

Asia Pacific is expected to lead the battery manufacturing equipment market during the forecast period. The Asia Pacific area has driven the electric car revolution. Strong regulations to encourage EV adoption have been implemented in nations like China, which has resulted in a rise in demand for lithium-ion batteries and, subsequently, for machinery used in the production of batteries.

Governments in the Asia Pacific area have supported the increase of the renewable energy and electric vehicle sectors. This includes financial aid, tax breaks, and research and development expenditures, all of which have a direct bearing on the production of batteries. The manufacturing infrastructure in the Asia Pacific region is strong, and they can scale up output swiftly. They are, therefore, excellent locations for battery production plants.

North America Eyes Opportunity in Gigafactories

North America is anticipated to be one of the fastest-growing region in the global battery manufacturing equipment market. Large-scale energy storage initiatives, such as grid-scale battery deployments and home energy storage systems, have become more prevalent in the area. To keep up with demand, these initiatives need cutting-edge battery manufacturing machinery.

Companies such as Tesla, LG Chem, and others have planned or constructed a number of lithium-ion battery "gigafactories" across North America. These gigafactories demand substantial expenditures in machinery for making batteries.

The demand for batteries and related manufacturing machinery has been boosted by growing worries about climate change and environmental sustainability, which have led to a move towards electric vehicles and renewable energy sources.

Fairfield’s Competitive Landscape Analysis

A smaller number of prominent companies operate in the consolidated global market for battery manufacturing equipment. The major firms are upgrading their distribution networks and launching new products in an effort to grow internationally. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Battery Manufacturing Equipment Space?

- Hitachi High-Tech Corporation

- Dürr AG

- Schuler Group

- Shenzhen Yinghe Technology Co. Ltd.

- Wuxi Lead Intelligent Equipment Co Ltd.

- Manz AG

- Xiamen Tmax Battery Equipments Limited

- Bühler Group

- Nordson Corporation

- Xiamen Lith Machine Limited

- Rosendahl Nextrom GmbH

- Guangdong Lyric Robot Automation Co., Ltd.

- Xiamen Acey New Energy Technology Co.,Ltd.

- Charles Ross & Son Company

Significant Company Developments

New Product Launches

- January 2023: Recharge Industries Pty, an Australian startup, revealed intentions to build a USD 210 million factory to manufacture lithium-ion batteries. The business plans to begin building in Geelong, southeast Australia, in the second half of 2023 and to start producing by the end of 2024. The operation will initially have a two gigawatt-hour yearly capacity, with a predicted final output of 30 gigawatt-hours.

- May 2022: A new integrated machine set that enables high speed in operations like cutting and stacking while saving time and money was introduced, according to Shenzhen Yinghe Technology Co., Ltd. The integrated set of machines also increases the manufacturing capacity of battery production lines.

- May 2020: The debut of Manz AG's new production platform for lithium-ion hard case or pouch batteries was announced. These cells are utilised in energy storage batteries or cars.

Distribution Agreements

- May 2022: Xiamen Tmax Equipments developed a positive relationship with clients in the U.S. by helping them with battery production. It provided them with access to the 52-machine pilot line for pouch cells, which ranges from mixing through testing. Xiamen Tmax Equipments offered complete solutions for the manufacturing of coin cells, cylinder cells, prismatic cells, pouch cells, and battery packs on a pilot, lab, and large scale, in accordance with the actual needs of the client.

- June 2022: A deal between Volkswagen and Wuxi Lead Intelligent Equipment Co., Ltd. covers the delivery of equipment for the production of 20GWh lithium batteries. The business would expand its customer base in Europe and enter a new stage in its worldwide expansion.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the widespread use of smartphones, laptops, and other portable electronics necessitates effective battery production, which raises the need for manufacturing machinery.

Furthermore, Beyond EVs, several industries, such as aerospace, marine, and construction equipment, are moving towards electrification, which increases the demand for equipment for making batteries. However, the battery manufacturing equipment market is expected to face considerable challenges because of high initial investment costs.

Supply Side of the Market

The equipment manufacturing companies available in the market develop, manufacture, and create a wide range of tools and machinery made especially for the production of batteries. Equipment for making electrodes, assembling cells, checking for quality, testing, and other things is included in this.

Specialised suppliers that concentrate on particular facets of battery manufacture, like electrode coating machines, slitting equipment, and quality control systems, exist in addition to big, varied businesses. These suppliers meet the specific requirements of battery producers.

To satisfy the unique needs of battery makers, equipment for making batteries is frequently customised. To design and produce equipment specifically suited to their clients' production processes, suppliers may collaborate closely with their customers.

After-sale support and service are also included in the supply side. To maintain the efficient operation of their apparatus, equipment manufacturers frequently offer maintenance, repair, and training services.

Global Battery Manufacturing Equipment Market is Segmented as Below:

By Machine Type:

- Mixing Machines

- Coating and Drying Machines

- Calendaring Machines

- Slitting Machines

- Electrode Stacking Machines

- Assembling and Handling Machines

- Formation and Testing Machines

By Battery Type:

- Nickel Cobalt Aluminum (NCA)

- Nickel Manganese Cobalt (NMC)

- Lithium Iron Phosphate (LFP)

By Application:

- Automotive

- Renewable Energy

- Industrial

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Battery Manufacturing Equipment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Battery Manufacturing Equipment Market Outlook, 2018 - 2030

3.1. Global Battery Manufacturing Equipment Market Outlook, by Machine Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Mixing Machines

3.1.1.2. Coating and Drying Machines

3.1.1.3. Calendaring Machines

3.1.1.4. Slitting Machines

3.1.1.5. Electrode Stacking Machines

3.1.1.6. Assembling and Handling Machines

3.1.1.7. Formation and Testing Machines

3.2. Global Battery Manufacturing Equipment Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Nickel Cobalt Aluminum (NCA)

3.2.1.2. Nickel Manganese Cobalt (NMC)

3.2.1.3. Lithium Iron Phosphate (LFP)

3.3. Global Battery Manufacturing Equipment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Automotive

3.3.1.2. Renewable Energy

3.3.1.3. Industrial

3.4. Global Battery Manufacturing Equipment Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Battery Manufacturing Equipment Market Outlook, 2018 - 2030

4.1. North America Battery Manufacturing Equipment Market Outlook, by Machine Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Mixing Machines

4.1.1.2. Coating and Drying Machines

4.1.1.3. Calendaring Machines

4.1.1.4. Slitting Machines

4.1.1.5. Electrode Stacking Machines

4.1.1.6. Assembling and Handling Machines

4.1.1.7. Formation and Testing Machines

4.2. North America Battery Manufacturing Equipment Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Nickel Cobalt Aluminum (NCA)

4.2.1.2. Nickel Manganese Cobalt (NMC)

4.2.1.3. Lithium Iron Phosphate (LFP)

4.3. North America Battery Manufacturing Equipment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Automotive

4.3.1.2. Renewable Energy

4.3.1.3. Industrial

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Battery Manufacturing Equipment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Battery Manufacturing Equipment Market Outlook, 2018 - 2030

5.1. Europe Battery Manufacturing Equipment Market Outlook, by Machine Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Mixing Machines

5.1.1.2. Coating and Drying Machines

5.1.1.3. Calendaring Machines

5.1.1.4. Slitting Machines

5.1.1.5. Electrode Stacking Machines

5.1.1.6. Assembling and Handling Machines

5.1.1.7. Formation and Testing Machines

5.2. Europe Battery Manufacturing Equipment Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Nickel Cobalt Aluminum (NCA)

5.2.1.2. Nickel Manganese Cobalt (NMC)

5.2.1.3. Lithium Iron Phosphate (LFP)

5.3. Europe Battery Manufacturing Equipment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Automotive

5.3.1.2. Renewable Energy

5.3.1.3. Industrial

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Battery Manufacturing Equipment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.13. Russia Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Russia Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.15. Russia Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.16. Rest of Europe Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Rest of Europe Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.18. Rest of Europe Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Battery Manufacturing Equipment Market Outlook, 2018 - 2030

6.1. Asia Pacific Battery Manufacturing Equipment Market Outlook, by Machine Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Mixing Machines

6.1.1.2. Coating and Drying Machines

6.1.1.3. Calendaring Machines

6.1.1.4. Slitting Machines

6.1.1.5. Electrode Stacking Machines

6.1.1.6. Assembling and Handling Machines

6.1.1.7. Formation and Testing Machines

6.2. Asia Pacific Battery Manufacturing Equipment Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Nickel Cobalt Aluminum (NCA)

6.2.1.2. Nickel Manganese Cobalt (NMC)

6.2.1.3. Lithium Iron Phosphate (LFP)

6.3. Asia Pacific Battery Manufacturing Equipment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Automotive

6.3.1.2. Renewable Energy

6.3.1.3. Industrial

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Battery Manufacturing Equipment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Battery Manufacturing Equipment Market Outlook, 2018 - 2030

7.1. Latin America Battery Manufacturing Equipment Market Outlook, by Machine Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Mixing Machines

7.1.1.2. Coating and Drying Machines

7.1.1.3. Calendaring Machines

7.1.1.4. Slitting Machines

7.1.1.5. Electrode Stacking Machines

7.1.1.6. Assembling and Handling Machines

7.1.1.7. Formation and Testing Machines

7.2. Latin America Battery Manufacturing Equipment Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Nickel Cobalt Aluminum (NCA)

7.2.1.2. Nickel Manganese Cobalt (NMC)

7.2.1.3. Lithium Iron Phosphate (LFP)

7.3. Latin America Battery Manufacturing Equipment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Automotive

7.3.1.2. Renewable Energy

7.3.1.3. Industrial

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Battery Manufacturing Equipment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.7. Rest of Latin America Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Rest of Latin America Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.9. Rest of Latin America Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Battery Manufacturing Equipment Market Outlook, 2018 - 2030

8.1. Middle East & Africa Battery Manufacturing Equipment Market Outlook, by Machine Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Mixing Machines

8.1.1.2. Coating and Drying Machines

8.1.1.3. Calendaring Machines

8.1.1.4. Slitting Machines

8.1.1.5. Electrode Stacking Machines

8.1.1.6. Assembling and Handling Machines

8.1.1.7. Formation and Testing Machines

8.2. Middle East & Africa Battery Manufacturing Equipment Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Nickel Cobalt Aluminum (NCA)

8.2.1.2. Nickel Manganese Cobalt (NMC)

8.2.1.3. Lithium Iron Phosphate (LFP)

8.3. Middle East & Africa Battery Manufacturing Equipment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Automotive

8.3.1.2. Renewable Energy

8.3.1.3. Industrial

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Battery Manufacturing Equipment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.7. Rest of Middle East & Africa Battery Manufacturing Equipment Market by Machine Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Rest of Middle East & Africa Battery Manufacturing Equipment Market Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.9. Rest of Middle East & Africa Battery Manufacturing Equipment Market Application, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Hitachi High-Tech Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Dürr AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Schuler Group

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Shenzhen Yinghe Technology Co. Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Wuxi Lead Intelligent Equipment Co Ltd.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Manz AG

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Xiamen Tmax Battery Equipments Limited

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Bühler Group

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Nordson Corporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Xiamen Lith Machine Limited

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Rosendahl Nextrom GmbH

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Guangdong Lyric Robot Automation Co., Ltd.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Xiamen Acey New Energy Technology Co.,Ltd.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Charles Ross & Son Company

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Machine Type Coverage |

|

|

Battery Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |