Global Biochar Market Forecast

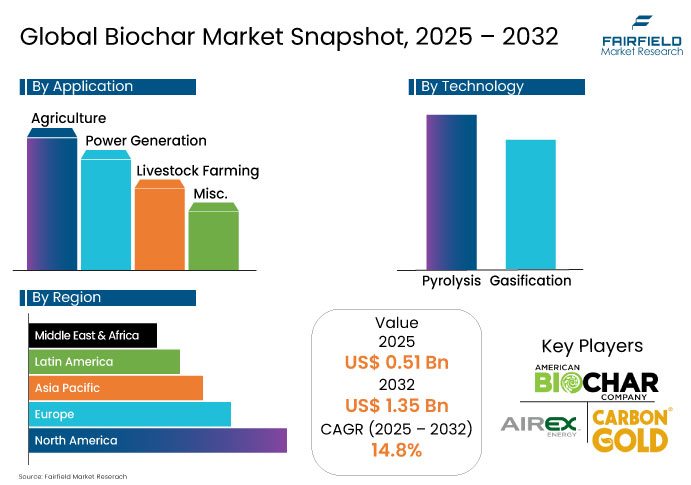

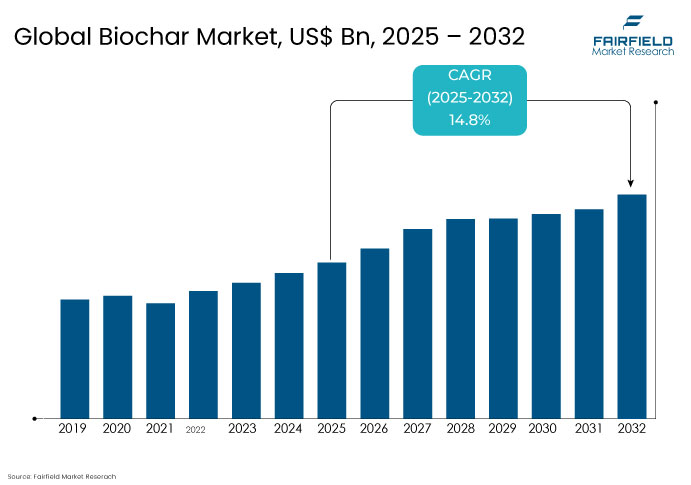

- The global Biochar Market is projected to grow significantly from a market size of US$ 0.51 Bn in 2025 to reach approximately US$ 1.35 Bn by 2032, registering a robust CAGR of 14.8% during this period.

- This substantial growth is fuelled by the rising demand for biochar in agriculture, power generation, environmental remediation, and carbon sequestration projects.

Biochar Market Insights

- Increasing usage of biochar in agriculture, animal feed, and waste management applications to stimulate the demand for biochar.

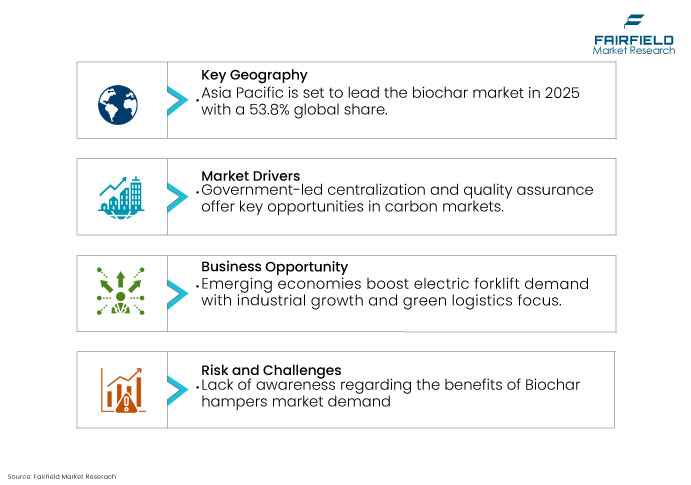

- Lack of awareness regarding the benefits of Biochar hampers market demand.

- Government-led centralization and quality assurance present a significant opportunity in voluntary carbon markets.

- Integration of biochar into carbon offset programs and voluntary carbon markets is emerging as a key market trend.

- Pyrolysis technology holds a commanding share of 87.9% in 2025, establishing it as the dominant method for biochar production.

- Agriculture is the largest application area for biochar, accounting for 69.2% of the global market in 2025.

- North America to generate highest absolute dollar opportunity of US$ 181.8 million

- Europe is expected to experience the fastest CAGR of 18.3% from 2025 to 2032

- Asia Pacific is projected to lead the global biochar market, accounting for a substantial 53.8% market share in 2025.

A Look Back and a Look Forward- Comparative Analysis

The global biochar market has witnessed substantial expansion, fueled by growing awareness of sustainable agriculture, carbon sequestration, and waste management solutions. In 2019, the market was valued at approximately USD 274.4 million, and it is projected to reach around USD 1,355.7 million by 2032, growing at a strong compound annual growth rate (CAGR) of 14.8%. This notable growth trajectory reflects rising interest in climate-smart agricultural practices and the increasing incorporation of biochar into soil health programs, composting processes, and carbon offset projects.

Key drivers of this growth include the adoption of regenerative farming techniques, government incentives for carbon sequestration, and the role of biochar in voluntary carbon markets. Advancements in pyrolysis technology and the utilization of diverse feedstock, especially livestock-manure-derived biochar, have improved both the scalability and effectiveness of biochar products.

Collaborations between agricultural enterprises, clean energy developers, and carbon credit buyers are expected to accelerate, with a strong push from policies promoting carbon removal technologies. As global focus sharpens on climate mitigation, the market will likely shift toward standardization, high-quality biochar production, and integration with environmental certification systems, thereby driving further adoption across agriculture, power generation, and environmental remediation sectors.

Key Growth Determinants

Increasing usage of biochar in agriculture, animal feed, and waste management applications to stimulate the demand for biochar

The global biochar market is witnessing robust growth, driven by the increasing adoption of livestock-manure-derived biochar across multiple sectors, including agriculture, animal husbandry, and waste management. Biochar-based fertilizers, which integrate traditional nutrients with biochar as a carrier, are gaining traction for their ability to improve soil fertility, retain nutrients, and enhance crop productivity.

Additionally, biochar is increasingly being used as a feed additive in animal nutrition due to its positive impact on livestock performance. It has been shown to improve gut microbiota, reduce enteric methane emissions, enhance egg yield, and mitigate endo-toxicants, contributing to improved animal health and lower environmental impacts.

Biochar also plays a vital role in anaerobic digestion systems by boosting biogas generation, mitigating the impact of inhibitory compounds, and improving the overall efficiency and sustainability of the process. In composting applications, biochar controls greenhouse gas emissions and stimulates microbial activity, further enriching compost quality. Co-composted biochar is particularly effective in improving soil texture, nutrient availability, and long-term agricultural productivity.

The increasing use of pyrolysis and other advanced treatment methods, such as composting, calcination, and gasification, to convert livestock manure into value-added biochar is expected to remain a major driver for the global biochar market in the coming years.

Key Growth Barriers

Lack of awareness regarding the benefits of Biochar hampers market demand

One of the primary restraints hindering the growth of the global biochar market is the limited awareness and understanding of its benefits, particularly in emerging and developing economies. Despite its well-documented environmental and agricultural advantages, including enhanced soil fertility, improved crop yields, carbon sequestration, and sustainable waste management, biochar remains underutilized due to a lack of widespread information dissemination.

Many farmers and agricultural stakeholders are unaware of how integrating biochar into their practices can lead to better soil health and increased productivity. This lack of awareness is further compounded by the technical complexity associated with biochar production and application, which may deter potential users from adopting the technology.

Moreover, the absence of coordinated outreach efforts by governments, NGOs, and private industry to educate the public on biochar’s environmental and economic value limits its acceptance and scalability. Without structured training programs, demonstrations, and policy-level support, the perception of biochar as a viable agricultural input remains low.

Biochar Market Opportunities and Trends

- Government-led centralization and quality assurance present a significant opportunity in voluntary carbon markets

A key opportunity in the voluntary carbon market lies in greater government involvement to centralize trading platforms, enhance credit quality, and direct capital toward impactful carbon reduction and removal projects. The current landscape of the voluntary carbon market is highly fragmented, characterized by numerous standards, rating agencies, project types, and brokers. This fragmentation complicates efforts to assess credit quality and limits the efficiency of transactions, particularly in over-the-counter trades that are often time-consuming and opaque.

Governments, leveraging their regulatory authority and institutional legitimacy, are uniquely positioned to address this challenge by centralizing market infrastructure within their jurisdictions. Initiatives such as Australia’s carbon exchange and Japan’s voluntary carbon market demonstrate how government intervention can promote unified systems around government-issued credits like the Australian Carbon Credit Units (ACCU) and J-Credits. These centralized systems reduce heterogeneity in credit supply, making it easier for buyers to assess credit quality and track supply trends, thereby improving transparency and market participation.

Additionally, governments can strategically guide capital allocation within voluntary markets by narrowing credit eligibility to favor specific technologies, geographies, or project models. For instance, frameworks such as the proposed Energy Transition Accelerator (ETA) aim to drive investments in renewable energy transitions across developing nations. Likewise, the EU certification framework seeks to promote innovative carbon removal technologies in sectors such as industrial manufacturing and sustainable agriculture.

- Integration of biochar into carbon offset programs and voluntary carbon markets is emerging as a key market trend

A significant trend shaping the global biochar market is its growing integration into carbon offset programs and voluntary carbon markets, driven by increasing global emphasis on climate change mitigation. Biochar’s unique ability to sequester carbon in soils for centuries positions it as a highly effective tool for long-term carbon capture. As a result, biochar projects are increasingly being recognized within carbon credit frameworks, allowing companies and industries to invest in biochar production to offset their greenhouse gas emissions.

The biochar production process is frequently associated with bioenergy generation, where biomass is pyrolyzed to produce both renewable energy and biochar as a byproduct. This synergy enables biochar projects to qualify for carbon credits not only from the carbon stored in the soil but also from the renewable energy produced, creating dual revenue streams and enhancing project viability.

Governments across various regions are reinforcing this trend by introducing financial incentives, regulatory support, and recognition of biochar as a carbon-negative solution. In jurisdictions where biochar is acknowledged as a legitimate carbon sequestration technology, producers benefit from programs that reward sustainable practices through tax credits, subsidies, or tradable credits.

Additionally, the rapid development of voluntary carbon markets presents new opportunities for biochar producers. These markets allow environmentally conscious corporations and individuals to purchase carbon credits voluntarily, driving investment into biochar-based carbon removal projects. As the demand for verifiable, nature-based solutions grows, biochar is increasingly viewed as a credible and marketable environmental asset within these evolving carbon ecosystems.

Leading Segment Overview

- Pyrolysis Technology Dominates the Market with a Leading Share in 2025

Pyrolysis technology holds a commanding share of 87.9% in 2025, establishing it as the dominant method for biochar production. Pyrolysis, which involves thermally decomposing biomass in the absence of oxygen, is widely adopted due to its efficiency, scalability, and ability to produce high-quality biochar with consistent carbon content. This method is particularly effective in converting various biomass sources, including agricultural waste and forestry residues, into both biochar and bioenergy.

While other methods like gasification and hydrothermal carbonization are also in use, they occupy a significantly smaller share of the biochar market. The dominance of pyrolysis is expected to continue as technological refinements and increasing demand for carbon-rich soil amendments and carbon credits drive further investments in this production technique.

- Agriculture Application Leads with a Positive Market Share in 2025

Agriculture is the largest application area for biochar market, accounting for 69.2% of the global market in 2025. Biochar is extensively used to enhance soil fertility, increase water retention, reduce nutrient leaching, and sequester carbon. Its compatibility with organic and regenerative farming practices further fuels its adoption.

However, the power generation segment is emerging as the fastest-growing application, expected to expand at a CAGR of 10.4% between 2025 and 2032. Biochar production integrated with bioenergy systems allows for dual benefits renewable energy generation and carbon credit revenue making it an increasingly attractive solution for sustainable power infrastructure. This dual utility is driving biochar’s integration in decentralized energy systems, especially in rural and off-grid settings.

Regional Analysis

- North America to generate highest absolute dollar opportunity of US$ 181.8 million

North America is anticipated to generate the highest absolute dollar opportunity, with an estimated incremental revenue of US$ 181.87 million between 2025 and 2032. This growth is propelled by increasing adoption in agriculture, expansion of voluntary carbon markets, and robust R&D activity in biochar-enhanced climate technologies. The U.S. and Canada are investing in scalable pyrolysis infrastructure and integrating biochar into climate-smart agricultural programs, setting the stage for significant market expansion.

- Europe to Witness Fastest Growth at 18.3% CAGR through 2032

Europe is expected to experience the fastest CAGR of 18.3% from 2025 to 2032, driven by stringent environmental regulations, the European Union’s climate neutrality goals, and increasing investments in sustainable agricultural technologies. The region's emphasis on carbon removal certifications and incentives for biochar inclusion in circular economy frameworks makes it a key growth frontier. European nations are actively funding biochar research and incentivizing its use in regenerative agriculture and industrial carbon capture applications.

- Asia Pacific to Maintain Market Leadership with 53.8% Share in 2025

Asia Pacific region is projected to lead the global biochar market, accounting for a substantial 53.8% market share in 2025. Countries such as China, India, and Australia are at the forefront of biochar adoption due to the availability of agricultural biomass, supportive government initiatives, and increasing awareness of sustainable farming practices. This regional dominance is reinforced by the region’s large agrarian economies and commitment to soil health and carbon sequestration.

Competitive Landscape

The global biochar market has witnessed a rising competitiveness, driven by increasing demand across agriculture, packaging, textiles, automotive, electronics, and carbon removal sectors. Key manufacturers are prioritizing capacity expansion, technological innovation, and strategic partnerships to secure market leadership and align with global sustainability goals.

- In 2024, Swedish metal powder manufacturer Höganäs AB announced plans to invest in a new biochar receiving facility and supporting infrastructure at its site. Construction is set to begin in Q2 2025. Additionally, the company has launched two R&D projects aimed at maximizing the use of biochar in reduction processes and exploring fossil-free reduction technologies.

- In 2024, Shopify invested $36.3 million in carbon removal, supporting biochar companies such as BIOSORRA, Applied Carbon, MASH Makes, and Planboo. These projects aim to enhance carbon sequestration and soil health while scaling sustainable technologies.

Key Market Companies

- American BioChar Company

- Carbonis GmbH & Co. KG

- Airex Energy

- Carbon Gold

- Swiss Biochar

- Wakefield Biochar

- Carbo Culture

- VGrid Energy

- SOLER Group/Carbon Centric

- Onnu Ltd.

Expert Opinion

- Over 1.4 billion tonnes of agricultural waste is generated globally each year, much of which remains underutilized or improperly disposed of. Biochar production offers a sustainable pathway to convert this biomass into a valuable soil amendment and carbon sink.

- Biochar is gaining recognition for its ability to improve soil fertility, retain moisture, enhance microbial activity, and permanently sequester carbon, making it a crucial tool in climate change mitigation and sustainable agriculture.

- Carbon markets and net-zero commitments from governments and corporations drive investments in biochar projects, which can earn carbon credits through verified carbon sequestration. This is turning biochar into a commercially viable climate solution.

- Major agriculture, energy, and sustainability players incorporate biochar into their environmental strategies. For instance, partnerships and pilot projects involving Shell, Microsoft, Stripe, and Shopify are actively testing biochar for carbon removal at scale.

- Countries like Australia, Japan, and the U.S. are investing in biochar research, certification standards, and voluntary carbon markets, aiming to scale up biochar use across farming, waste management, and industrial sectors by 2030.

Global Biochar Market Segmentation-

By Technology

- Pyrolysis

- Gasification

By Application

- Agriculture

- Power Generation

- Livestock Farming

- Misc.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Biochar Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Biochar Market Outlook, 2019 - 2032

3.1. Global Biochar Market Outlook, by Technology, Value (US$ Bn) & Volume (Tons), 2019-2032

3.1.1. Pyrolysis

3.1.2. Gasification

3.1.3. Hydrothermal Carbonization

3.1.4. Misc.

3.2. Global Biochar Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

3.2.1. Agriculture

3.2.2. Power Generation

3.2.3. Livestock Farming

3.2.4. Misc.

3.3. Global Biochar Market Outlook, by Region, Value (US$ Bn) & Volume (Tons), 2019-2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Biochar Market Outlook, 2019 - 2032

4.1. North America Biochar Market Outlook, by Technology, Value (US$ Bn) & Volume (Tons), 2019-2032

4.1.1. Pyrolysis

4.1.2. Gasification

4.1.3. Hydrothermal Carbonization

4.1.4. Misc.

4.2. North America Biochar Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

4.2.1. Agriculture

4.2.2. Power Generation

4.2.3. Livestock Farming

4.2.4. Misc.

4.3. North America Biochar Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

4.3.1. U.S. Biochar Market Outlook, by Technology, 2019-2032

4.3.2. U.S. Biochar Market Outlook, by Application, 2019-2032

4.3.3. Canada Biochar Market Outlook, by Technology, 2019-2032

4.3.4. Canada Biochar Market Outlook, by Application, 2019-2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Biochar Market Outlook, 2019 - 2032

5.1. Europe Biochar Market Outlook, by Technology, Value (US$ Bn) & Volume (Tons), 2019-2032

5.1.1. Pyrolysis

5.1.2. Gasification

5.1.3. Hydrothermal Carbonization

5.1.4. Misc.

5.2. Europe Biochar Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

5.2.1. Agriculture

5.2.2. Power Generation

5.2.3. Livestock Farming

5.2.4. Misc.

5.3. Europe Biochar Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

5.3.1. Germany Biochar Market Outlook, by Technology, 2019-2032

5.3.2. Germany Biochar Market Outlook, by Application, 2019-2032

5.3.3. Italy Biochar Market Outlook, by Technology, 2019-2032

5.3.4. Italy Biochar Market Outlook, by Application, 2019-2032

5.3.5. France Biochar Market Outlook, by Technology, 2019-2032

5.3.6. France Biochar Market Outlook, by Application, 2019-2032

5.3.7. U.K. Biochar Market Outlook, by Technology, 2019-2032

5.3.8. U.K. Biochar Market Outlook, by Application, 2019-2032

5.3.9. Spain Biochar Market Outlook, by Technology, 2019-2032

5.3.10. Spain Biochar Market Outlook, by Application, 2019-2032

5.3.11. Russia Biochar Market Outlook, by Technology, 2019-2032

5.3.12. Russia Biochar Market Outlook, by Application, 2019-2032

5.3.13. Rest of Europe Biochar Market Outlook, by Technology, 2019-2032

5.3.14. Rest of Europe Biochar Market Outlook, by Application, 2019-2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Biochar Market Outlook, 2019 - 2032

6.1. Asia Pacific Biochar Market Outlook, by Technology, Value (US$ Bn) & Volume (Tons), 2019-2032

6.1.1. Pyrolysis

6.1.2. Gasification

6.1.3. Hydrothermal Carbonization

6.1.4. Misc.

6.2. Asia Pacific Biochar Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

6.2.1. Agriculture

6.2.2. Power Generation

6.2.3. Livestock Farming

6.2.4. Misc.

6.3. Asia Pacific Biochar Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

6.3.1. China Biochar Market Outlook, by Technology, 2019-2032

6.3.2. China Biochar Market Outlook, by Application, 2019-2032

6.3.3. Japan Biochar Market Outlook, by Technology, 2019-2032

6.3.4. Japan Biochar Market Outlook, by Application, 2019-2032

6.3.5. South Korea Biochar Market Outlook, by Technology, 2019-2032

6.3.6. South Korea Biochar Market Outlook, by Application, 2019-2032

6.3.7. India Biochar Market Outlook, by Technology, 2019-2032

6.3.8. India Biochar Market Outlook, by Application, 2019-2032

6.3.9. Southeast Asia Biochar Market Outlook, by Technology, 2019-2032

6.3.10. Southeast Asia Biochar Market Outlook, by Application, 2019-2032

6.3.11. Rest of SAO Biochar Market Outlook, by Technology, 2019-2032

6.3.12. Rest of SAO Biochar Market Outlook, by Application, 2019-2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America Biochar Market Outlook, 2019 - 2032

7.1. Latin America Biochar Market Outlook, by Technology, Value (US$ Bn) & Volume (Tons), 2019-2032

7.1.1. Pyrolysis

7.1.2. Gasification

7.1.3. Hydrothermal Carbonization

7.1.4. Misc.

7.2. Latin America Biochar Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

7.2.1. Agriculture

7.2.2. Power Generation

7.2.3. Livestock Farming

7.2.4. Misc.

7.3. Latin America Biochar Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

7.3.1. Brazil Biochar Market Outlook, by Technology, 2019-2032

7.3.2. Brazil Biochar Market Outlook, by Application, 2019-2032

7.3.3. Mexico Biochar Market Outlook, by Technology, 2019-2032

7.3.4. Mexico Biochar Market Outlook, by Application, 2019-2032

7.3.5. Argentina Biochar Market Outlook, by Technology, 2019-2032

7.3.6. Argentina Biochar Market Outlook, by Application, 2019-2032

7.3.7. Rest of LATAM Biochar Market Outlook, by Technology, 2019-2032

7.3.8. Rest of LATAM Biochar Market Outlook, by Application, 2019-2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Biochar Market Outlook, 2019 - 2032

8.1. Middle East & Africa Biochar Market Outlook, by Technology, Value (US$ Bn) & Volume (Tons), 2019-2032

8.1.1. Pyrolysis

8.1.2. Gasification

8.1.3. Hydrothermal Carbonization

8.1.4. Misc.

8.2. Middle East & Africa Biochar Market Outlook, by Application, Value (US$ Bn) & Volume (Tons), 2019-2032

8.2.1. Agriculture

8.2.2. Power Generation

8.2.3. Livestock Farming

8.2.4. Misc.

8.3. Middle East & Africa Biochar Market Outlook, by Country, Value (US$ Bn) & Volume (Tons), 2019-2032

8.3.1. GCC Biochar Market Outlook, by Technology, 2019-2032

8.3.2. GCC Biochar Market Outlook, by Application, 2019-2032

8.3.3. South Africa Biochar Market Outlook, by Technology, 2019-2032

8.3.4. South Africa Biochar Market Outlook, by Application, 2019-2032

8.3.5. Egypt Biochar Market Outlook, by Technology, 2019-2032

8.3.6. Egypt Biochar Market Outlook, by Application, 2019-2032

8.3.7. Nigeria Biochar Market Outlook, by Technology, 2019-2032

8.3.8. Nigeria Biochar Market Outlook, by Application, 2019-2032

8.3.9. Rest of Middle East Biochar Market Outlook, by Technology, 2019-2032

8.3.10. Rest of Middle East Biochar Market Outlook, by Application, 2019-2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. American BioChar Company

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Carbonis GmbH & Co. KG

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Airex Energy

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Carbon Gold

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Swiss Biochar

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Wakefield Biochar

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Carbo Culture

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. VGrid Energy

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. SOLER Group/Carbon Centric

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Onnu Ltd

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Bn |

||

|

REPORT FEATURES |

DETAILS |

|

Technology Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |