Global Biodegradable Packaging Material Market Forecast

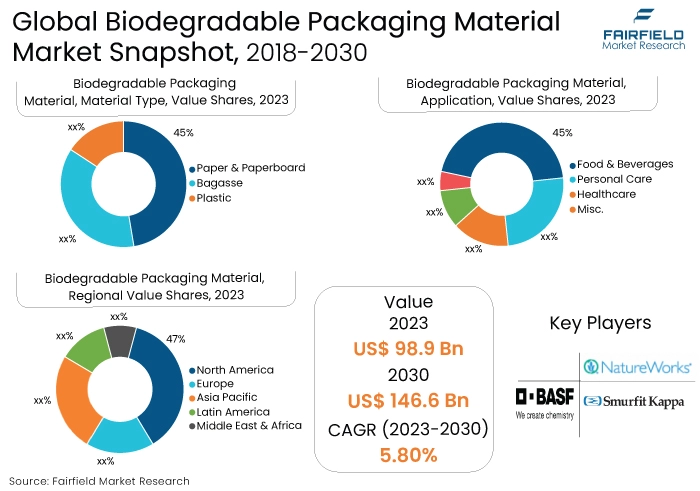

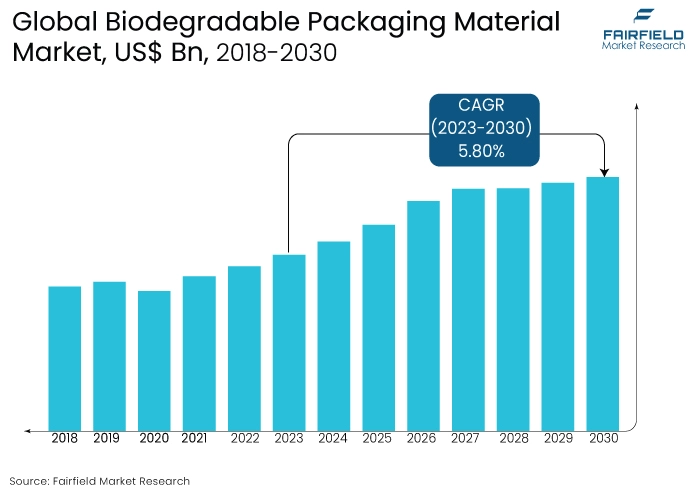

- Global biodegradable packaging material market size to reach US$146.6 Bn in 2030 from US$98.9 Bn in 2023

- Market for biodegradable packaging materials poised to experience a promising CAGR of 5.8% between 2023 and 2030

Quick Report Digest

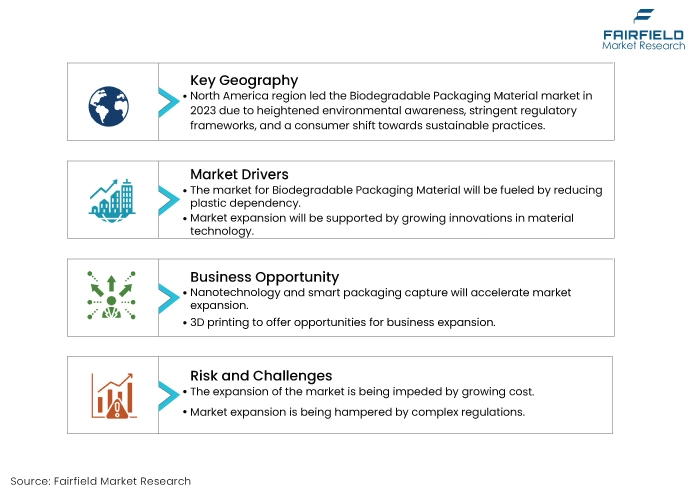

- The biodegradable packaging material market is growing due to heightened environmental awareness and a global shift towards sustainable practices. Increasing consumer demand for eco-friendly packaging solutions, coupled with regulatory support for reducing single-use plastics, drives the market's expansion. As businesses prioritise sustainability, the adoption of biodegradable materials continues to rise, fostering market growth.

- Another major market trend expected to fuel the growth of the biodegradable packaging material market is the rapidly expanding Food and beverage industry. The market is also predicted to profit from the expanding worldwide pharmaceutical industries.

- Paper and paperboard material types are growing in the biodegradable packaging material market due to their eco-friendly nature, renewability, and recyclability. The emphasis on reducing plastic waste and increasing sustainability in packaging solutions has propelled the demand for paper-based biodegradable materials, making them a preferred choice in the market.

- The packaging format for boxes and cartons is growing in the biodegradable packaging material market due to its versatility, recyclability, and eco-friendly attributes. As consumers and businesses prioritise sustainable packaging solutions, the demand for biodegradable boxes and cartons increases, contributing to the format's growth in the market.

- The food and beverages application is growing in the biodegradable packaging material market due to increased consumer awareness, regulatory pressures, and the perishable nature of food products. The industry's commitment to sustainable practices drives the adoption of biodegradable packaging materials, meeting the rising demand for eco-friendly solutions in food packaging.

- The growing environmental concerns are driving the biodegradable packaging material market as consumers and industries seek eco-friendly alternatives to conventional packaging. The detrimental impact of non-biodegradable materials on the environment, coupled with increased awareness, fuels the demand for sustainable solutions, pushing the market's growth.

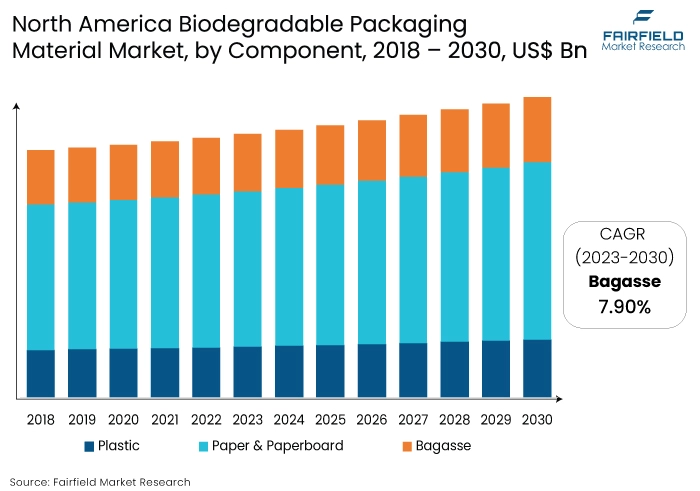

- North America is growing in the biodegradable packaging material market due to heightened environmental awareness, stringent regulatory frameworks, and a consumer shift towards sustainable practices. The region's emphasis on reducing single-use plastics and promoting eco-friendly alternatives positions it as a key player in driving the market's expansion.

- The Asia Pacific region is growing in the biodegradable packaging material market due to increasing awareness of environmental issues, government initiatives promoting sustainable practices, and a rising demand for eco-friendly packaging solutions. The region's dynamic economies and evolving consumer preferences contribute to its significant growth in the market.

A Look Back and Look Forward - Comparative Analysis

The biodegradable packaging material market is growing due to increasing environmental concerns and a shift toward sustainable practices. Consumers and businesses are seeking eco-friendly alternatives to conventional packaging materials. Biodegradable packaging offers a solution by reducing environmental impact, minimising waste, and meeting regulatory requirements. As awareness of environmental issues rises and demand for green packaging solutions increases, the market experiences growth, driven by a collective commitment to a more sustainable and eco-conscious approach to packaging.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of major applications such as Food & Beverages, Personal Care, and Pharmaceuticals. However, in some applications, the demand for biodegradable packaging materials has increased, including in healthcare and other areas.

The future of the biodegradable packaging material market looks promising as sustainability gains prominence. Growing awareness of environmental issues, stringent regulations, and consumer preferences for eco-friendly options will drive demand. Innovations in biodegradable materials, increased adoption by industries, and heightened focus on circular economies will contribute to the market's expansion. As businesses prioritise environmental responsibility, the biodegradable packaging material market is poised to play a pivotal role in shaping the future of sustainable packaging solutions.

Key Growth Determinants

- Growing Environmental Concerns

Growing environmental concerns are propelling the biodegradable packaging material market as the global community seeks sustainable alternatives to traditional packaging. Rising awareness of plastic pollution, non-biodegradable waste, and their adverse effects on ecosystems and wildlife drives consumers, businesses, and governments toward eco-friendly solutions.

Biodegradable packaging materials, designed to break down naturally, offer a promising solution to mitigate environmental impact. Regulations aimed at reducing single-use plastics further accelerate the market's growth. As environmental consciousness becomes integral to consumer choices, the biodegradable packaging material market responds to the urgent need for sustainable packaging, fostering a paradigm shift towards eco-conscious practices in the packaging industry.

- Critically Growing Need to Reduce Plastic Dependency

The drive to reduce plastic dependency is a key driver for the biodegradable packaging material market . The detrimental environmental impact of traditional plastics, including pollution and long decomposition periods, has led to a global push for alternatives. Biodegradable packaging materials offer a sustainable solution, breaking down naturally and minimising the reliance on non-degradable plastics.

Businesses and consumers seeking to reduce their carbon footprint and address plastic pollution concerns are embracing these materials. Regulatory measures and corporate sustainability goals further propel the shift away from conventional plastics, driving the biodegradable packaging material market toward increased adoption and market growth.

- Growing Innovation in Material Technology

Innovations in material technology are propelling the biodegradable packaging material market by continuously improving the performance and versatility of biodegradable materials. Ongoing research and development efforts focus on creating novel and eco-friendly alternatives to traditional packaging. Innovations enhance the strength, flexibility, and barrier properties of biodegradable materials, expanding their applicability across various industries.

These advancements address performance concerns and broaden the range of applications, driving increased adoption. As technology evolves, offering more sustainable and efficient solutions, businesses are increasingly incorporating innovative biodegradable materials, thus shaping the market's trajectory and contributing to the global shift toward environmentally friendly packaging practices.

Major Growth Barriers

- Increasing Material Costs

The biodegradable packaging material market faces challenges from increasing costs associated with production. Biodegradable materials often involve higher manufacturing expenses than conventional alternatives. This cost disparity poses a challenge as businesses strive to balance sustainability with economic considerations. The affordability of biodegradable packaging is crucial for widespread adoption.

To overcome this challenge, ongoing research and development are essential to find cost-effective production methods, and increased demand and economies of scale may contribute to cost reductions, making biodegradable packaging more competitive in the market.

- Complex Regulations

Complex regulations pose a challenge to the biodegradable packaging material market . Varying standards and definitions of what qualifies as biodegradable create compliance complexities for manufacturers. The absence of consistent global regulations and the evolving nature of standards across regions make it challenging for businesses to navigate and adapt.

Regulatory uncertainties can hinder market growth, as companies must invest in understanding and complying with diverse requirements. Harmonization of regulations and increased clarity would facilitate the seamless adoption of biodegradable packaging materials, fostering a more conducive environment for sustainable packaging solutions.

Key Trends and Opportunities to Look at

- Nanotechnology

Integration of nanomaterials enhances the properties of biodegradable packaging, improving strength, barrier capabilities, and overall performance.

- Smart Packaging

Incorporation of smart technologies like sensors and indicators to monitor freshness and quality, enhancing the functionality of biodegradable packaging.

- 3D Printing

Advancements in 3D Printing allow for the creation of intricate and customised biodegradable packaging designs, optimising material use and reducing waste.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape for biodegradable packaging materials varies globally, with several entities and guidelines influencing the market. Notable regulations include the European Union's Single-Use Plastics Directive, which emphasizes reduction and sustainability. In the US, the Federal Trade Commission (FTC) Green Guides provide guidance on environmental marketing claims. In India, the Plastic Waste Management Rules regulate biodegradability claims. China's ban on certain single-use plastics aligns with environmental goals.

Additionally, regional standards like EN 13432 in Europe outline criteria for compostability. Compliance with these regulations impacts market entry, product labeling, and consumer trust. As sustainability becomes paramount, evolving regulatory frameworks shape the biodegradable packaging material market , reflecting a global effort to mitigate environmental impacts and promote eco-friendly practices.

Fairfield’s Ranking Board

Top Segments

- Paper & Paperboard to be the Material of Choice

Paper & Paperboard material types are known to capture a significant market share in the biodegradable packaging material market. This dominance is attributed to several factors, including the widespread acceptance of paper as a renewable resource, its recyclability, and its natural biodegradability. The demand for sustainable packaging solutions has propelled paper and paperboard to the forefront, driven by consumer preferences for eco-friendly options.

Additionally, regulatory initiatives favouring the reduction of single-use plastics have further boosted the adoption of paper-based biodegradable packaging materials, contributing to their largest market share in the biodegradable packaging segment.

Bagasse material, on the other side, is likely to experience the highest CAGR in the biodegradable packaging material market by 2030, due to several key factors. Bagasse, a byproduct of sugarcane processing, is abundant and sustainable, making it an eco-friendly choice. Its popularity is driven by its versatility, offering excellent strength and barrier properties.

The increasing emphasis on circular economies and waste reduction further propels the growth of bagasse-based packaging. With consumers and industries seeking alternatives to traditional plastics, bagasse emerges as a preferred material, contributing to its rapid market expansion and positioning it as a leading player in the biodegradable packaging sector.

- Bottles & Jars Represent the Preferred Packaging Format

Bottles & jars captured the largest market share in the biodegradable packaging material market . Beverages, condiments, and personal care products dominate the market, often requiring liquid-specific formats like bottles and jars. Biodegradable bottles and jars can achieve excellent barrier properties against factors like moisture, oxygen, and light, crucial for preserving product quality and extending shelf life.

Bottles and jars come in diverse shapes, sizes, and dispensing mechanisms, catering to various product viscosities and functionalities. Consumers are well-accustomed to bottles and jars, making them a convenient and readily accepted format for eco-conscious choices. Bottles and jars often enable convenient single-serve packaging or controlled dispensing, reducing waste and enhancing user experience.

The biodegradable packaging market is witnessing exciting growth, and one segment leading the charge is labels & tapes. Consumers and businesses are increasingly prioritising eco-friendly practices, and biodegradable labels & tapes offer a sustainable alternative to traditional plastic options. This aligns with growing regulations and environmental awareness, propelling market demand.

Labels & tapes play a crucial role in branding, product information, and tamper-evident sealing. The segment will thus demonstrate a significantly high CAGR during the years of projection. Biodegradable options provide these functionalities while minimising environmental impact. They can be used on various packaging materials, making them a versatile solution. As production scales up and technology matures, biodegradable labels & tapes are becoming more cost-competitive. This is making them an increasingly viable option for manufacturers and brands seeking sustainable packaging solutions without compromising affordability.

- Food & Beverages Industry Presents the Most Lucrative Application Segment

Food & beverage applications have captured the largest market share in the biodegradable packaging material market . Food and beverages are among the most consumed product categories globally, necessitating extensive packaging. Regulatory pressure on plastic use in food packaging drives demand for alternatives, making biodegradables a viable option.

Biodegradable materials can now achieve adequate shelf-life requirements for various food & beverage products. Growing environmental consciousness among consumers makes them increasingly receptive to biodegradable packaging in F&B. Biodegradables can be used for diverse F&B packaging formats, from trays and wraps to bottles and caps.

The pharmaceutical industry faces growing pressure to adopt sustainable practices. Biodegradable packaging offers a guilt-free option for medication delivery. Some regions incentivise eco-friendly practices in pharmaceuticals, boosting the adoption of biodegradable packaging solutions.

Biodegradable materials are evolving to offer enhanced barrier properties, crucial for protecting sensitive drugs from moisture, light, and oxygen. With rising awareness, patients are increasingly seeking environmentally friendly pharmaceutical options, influencing packaging choices.

Regional Frontrunners

North America Retains the Top Spot

North America has captured the largest market share in the biodegradable packaging material market. North America, particularly the US, embraced environmental consciousness early, fostering a market receptive to eco-friendly alternatives like biodegradable packaging. Stringent regulations like plastic bans in some US states, and cities incentivise businesses to switch to biodegradable packaging options.

Strong consumer spending in North America allows for higher penetration of premium eco-friendly products, including biodegradable packaging. Investments in composting facilities and recycling infrastructure create a supportive ecosystem for the adoption and disposal of biodegradable packaging—leading research and development in biodegradable materials, and production processes in North America fuel market growth.

Asia Pacific Likely to Witness the Significant Growth in Sales During

A booming population with rising disposable incomes creates a surge in demand for packaged goods, driving the need for sustainable packaging solutions across Asia Pacific. Growing environmental awareness, and stricter regulations in some of the Asian countries like China, and India push manufacturers towards biodegradable alternatives.

Rising production capacity and technological advancements in Asia Pacific make biodegradable packaging materials more cost-competitive, expanding market reach. Rising production capacity and technological advancements in Asia Pacific make biodegradable packaging materials more cost-competitive, expanding market reach.

Leading countries in the Asian subcontinent like Japan, and South Korea invest heavily in research and development of next-generation biodegradable materials, solidifying their growth potential.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the biodegradable packaging material market is dynamic, with key players such as NatureWorks LLC, BASF SE, Mondi Group, Tetra Pak International, and Amcor Limited. Intense competition is driven by innovations in material technology, eco-friendly initiatives, and strategic collaborations.

New entrants and evolving consumer preferences contribute to market evolution. Companies focus on sustainable practices, product diversification, and global expansion to maintain and enhance their market positions in this rapidly growing sector.

Who are the Leaders in the Global Biodegradable Packaging Material Space?

- NatureWorks LLC

- BASF SE

- Smurfit Kappa Group

- Mondi Group

- Novamont S.p.A

- Arkema S.A.

- Biomass Packaging

- Eco-Products, Inc.

- Green Packaging, Inc.

- Huhtamaki Group

- Novamont S.p.A.

- Be Green Packaging

- Vegware Ltd.

- Green Packaging Material (Jiangyin) Co., Ltd.

- Eco-Products, Inc.

Significant Company Developments

New Product Launch

- May 2022: Amcor Rigid Packaging (ARP) has unveiled PowerPostTM, an innovative technology designed for the production of bottles that are approximately one-third lighter. This breakthrough technology results in bottles that require 30% less energy and generate 30% less carbon emissions compared to most 20 oz. bottles. The innovation lies in PowerPost's ability to actively dislodge the vacuum within the container after filling. This marks a significant advancement in sustainable packaging, contributing to reduced environmental impact and increased efficiency in bottle manufacturing.

- January 2022: Amcor PLC has introduced AmFiberTM, a pioneering platform for paper-based packaging solutions. This innovative platform seeks to revolutionise the capabilities of conventional paper packaging, delivering an expanded array of functional advantages to align with evolving consumer preferences. Specifically designed to cater to European customers, AmFiberTM presents an inventive solution for snacks and confectionery products. The packaging is recyclable and incorporates a high barrier to both oxygen and moisture, addressing sustainability concerns while maintaining the integrity of the packaged items.

An Expert’s Eye

Demand and Future Growth

An increase in consumer demand for Food & beverage is driving the market. The biodegradable packaging material market is experiencing substantial demand driven by increasing environmental awareness and a shift towards sustainable practices. As consumers and industries prioritise eco-friendly alternatives, the market is witnessing robust growth.

Future prospects remain optimistic, with a projected upward trajectory fuelled by stringent regulations, heightened focus on circular economies, and continuous innovations in biodegradable materials. The demand for packaging solutions that reduce environmental impact and support a more sustainable future positions the biodegradable packaging material market for continued expansion in response to evolving consumer expectations and global sustainability initiatives.

Supply Side of the Market

A surge in consumer and industry preference for sustainable solutions drives the demand for biodegradable packaging materials. Supply needs to work on meeting this demand due to the complexity of sourcing biodegradable materials. Production costs, technological advancements, and regulatory compliance influence current pricing structures. Long-term growth is contingent on pricing competitiveness achieved through economies of scale and efficient supply chain management.

Major trends shaping competition include innovations in material technology, increased adoption in various industries, and a focus on circular economy principles. Supply chain analysis involves raw material sourcing, manufacturing processes, and global logistics, with an emphasis on sustainability and environmental impact throughout the supply chain.

Global Biodegradable Packaging Material Market is Segmented as Below:

By Material Type:

- Plastic

- Paper & Paperboard

- Bagasse

By Packaging Format:

- Bottles & Jars

- Boxes & Cartons

- Cans

- Trays & Clamshells

- Cups & Bowls

- Pouches & Bags

- Films & Wraps

- Labels & Tapes

- Misc (Stick pack, Sachets, etc.)

By Application:

- Food & Beverages

- Personal Care

- Pharmaceuticals

- Healthcare

- Misc

By Geographic Coverage:

- North America

- The U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Biodegradable Packaging Material Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Biodegradable Packaging Material Market Outlook, 2018 – 2030

3.1. Global Biodegradable Packaging Material Market Outlook, by Material Type, Value (US$ Mn), 2018 – 2030

3.1.1. Key Highlights

3.1.1.1. Plastic

3.1.1.2. Paper & Paperboard

3.1.1.3. Bagasse

3.2. Global Biodegradable Packaging Material Market Outlook, by Packaging Format, Value (US$ Mn), 2018 – 2030

3.2.1. Key Highlights

3.2.1.1. Bottles & Jars

3.2.1.2. Boxes & Cartons

3.2.1.3. Cans

3.2.1.4. Trays & Clamshells

3.2.1.5. Cups & Bowls

3.2.1.6. Pouches & Bags

3.2.1.7. Films & Wraps

3.2.1.8. Labels & Tapes

3.2.1.9. Misc (Stick pack, Sachets, etc.)

3.3. Global Biodegradable Packaging Material Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

3.3.1. Key Highlights

3.3.1.1. Food & Beverages

3.3.1.2. Personal Care

3.3.1.3. Pharmaceuticals

3.3.1.4. Healthcare

3.3.1.5. Misc

3.4. Global Biodegradable Packaging Material Market Outlook, by Region, Value (US$ Mn), 2018 – 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Biodegradable Packaging Material Market Outlook, 2018 – 2030

4.1. North America Biodegradable Packaging Material Market Outlook, by Material Type, Value (US$ Mn), 2018 – 2030

4.1.1. Key Highlights

4.1.1.1. Plastic

4.1.1.2. Paper & Paperboard

4.1.1.3. Bagasse

4.2. North America Biodegradable Packaging Material Market Outlook, by Packaging Format, Value (US$ Mn), 2018 – 2030

4.2.1. Key Highlights

4.2.1.1. Bottles & Jars

4.2.1.2. Boxes & Cartons

4.2.1.3. Cans

4.2.1.4. Trays & Clamshells

4.2.1.5. Cups & Bowls

4.2.1.6. Pouches & Bags

4.2.1.7. Films & Wraps

4.2.1.8. Labels & Tapes

4.2.1.9. Misc (Stick pack, Sachets, etc.)

4.3. North America Biodegradable Packaging Material Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

4.3.1. Key Highlights

4.3.1.1. Food & Beverages

4.3.1.2. Personal Care

4.3.1.3. Pharmaceuticals

4.3.1.4. Healthcare

4.3.1.5. Misc

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Biodegradable Packaging Material Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

4.4.1.2. U.S. Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

4.4.1.3. U.S. Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

4.4.1.4. Canada Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

4.4.1.5. Canada Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

4.4.1.6. Canada Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Biodegradable Packaging Material Market Outlook, 2018 – 2030

5.1. Europe Biodegradable Packaging Material Market Outlook, by Material Type, Value (US$ Mn), 2018 – 2030

5.1.1. Key Highlights

5.1.1.1. Plastic

5.1.1.2. Paper & Paperboard

5.1.1.3. Bagasse

5.2. Europe Biodegradable Packaging Material Market Outlook, by Packaging Format, Value (US$ Mn), 2018 – 2030

5.2.1. Key Highlights

5.2.1.1. Bottles & Jars

5.2.1.2. Boxes & Cartons

5.2.1.3. Cans

5.2.1.4. Trays & Clamshells

5.2.1.5. Cups & Bowls

5.2.1.6. Pouches & Bags

5.2.1.7. Films & Wraps

5.2.1.8. Labels & Tapes

5.2.1.9. Misc (Stick pack, Sachets, etc.)

5.3. Europe Biodegradable Packaging Material Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

5.3.1. Key Highlights

5.3.1.1. Food & Beverages

5.3.1.2. Personal Care

5.3.1.3. Pharmaceuticals

5.3.1.4. Healthcare

5.3.1.5. Misc

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Biodegradable Packaging Material Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

5.4.1. Key Highlights

5.4.1.1. Germany Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

5.4.1.2. Germany Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

5.4.1.3. Germany Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.4. U.K. Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

5.4.1.5. U.K. Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

5.4.1.6. U.K. Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.7. France Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

5.4.1.8. France Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

5.4.1.9. France Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.10. Italy Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

5.4.1.11. Italy Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

5.4.1.12. Italy Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.13. Turkey Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

5.4.1.14. Turkey Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

5.4.1.15. Turkey Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.16. Russia Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

5.4.1.17. Russia Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

5.4.1.18. Russia Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.19. Rest of Europe Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

5.4.1.20. Rest of Europe Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

5.4.1.21. Rest of Europe Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Biodegradable Packaging Material Market Outlook, 2018 – 2030

6.1. Asia Pacific Biodegradable Packaging Material Market Outlook, by Material Type, Value (US$ Mn), 2018 – 2030

6.1.1. Key Highlights

6.1.1.1. Plastic

6.1.1.2. Paper & Paperboard

6.1.1.3. Bagasse

6.2. Asia Pacific Biodegradable Packaging Material Market Outlook, by Packaging Format, Value (US$ Mn), 2018 – 2030

6.2.1. Key Highlights

6.2.1.1. Bottles & Jars

6.2.1.2. Boxes & Cartons

6.2.1.3. Cans

6.2.1.4. Trays & Clamshells

6.2.1.5. Cups & Bowls

6.2.1.6. Pouches & Bags

6.2.1.7. Films & Wraps

6.2.1.8. Labels & Tapes

6.2.1.9. Misc (Stick pack, Sachets, etc.)

6.3. Asia Pacific Biodegradable Packaging Material Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

6.3.1. Key Highlights

6.3.1.1. Food & Beverages

6.3.1.2. Personal Care

6.3.1.3. Pharmaceuticals

6.3.1.4. Healthcare

6.3.1.5. Misc

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Biodegradable Packaging Material Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

6.4.1. Key Highlights

6.4.1.1. China Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

6.4.1.2. China Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

6.4.1.3. China Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.4. Japan Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

6.4.1.5. Japan Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

6.4.1.6. Japan Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.7. South Korea Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

6.4.1.8. South Korea Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

6.4.1.9. South Korea Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.10. India Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

6.4.1.11. India Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

6.4.1.12. India Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.13. Southeast Asia Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

6.4.1.14. Southeast Asia Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

6.4.1.15. Southeast Asia Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.16. Rest of Asia Pacific Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

6.4.1.17. Rest of Asia Pacific Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

6.4.1.18. Rest of Asia Pacific Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Biodegradable Packaging Material Market Outlook, 2018 – 2030

7.1. Latin America Biodegradable Packaging Material Market Outlook, by Material Type, Value (US$ Mn), 2018 – 2030

7.1.1. Key Highlights

7.1.1.1. Plastic

7.1.1.2. Paper & Paperboard

7.1.1.3. Bagasse

7.2. Latin America Biodegradable Packaging Material Market Outlook, by Packaging Format, Value (US$ Mn), 2018 – 2030

7.2.1. Key Highlights

7.2.1.1. Bottles & Jars

7.2.1.2. Boxes & Cartons

7.2.1.3. Cans

7.2.1.4. Trays & Clamshells

7.2.1.5. Cups & Bowls

7.2.1.6. Pouches & Bags

7.2.1.7. Films & Wraps

7.2.1.8. Labels & Tapes

7.2.1.9. Misc (Stick pack, Sachets, etc.)

7.3. Latin America Biodegradable Packaging Material Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

7.3.1. Key Highlights

7.3.1.1. Food & Beverages

7.3.1.2. Personal Care

7.3.1.3. Pharmaceuticals

7.3.1.4. Healthcare

7.3.1.5. Misc

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Biodegradable Packaging Material Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

7.4.1.2. Brazil Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

7.4.1.3. Brazil Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.4. Mexico Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

7.4.1.5. Mexico Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

7.4.1.6. Mexico Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.7. Argentina Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

7.4.1.8. Argentina Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

7.4.1.9. Argentina Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.10. Rest of Latin America Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

7.4.1.11. Rest of Latin America Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

7.4.1.12. Rest of Latin America Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Biodegradable Packaging Material Market Outlook, 2018 – 2030

8.1. Middle East & Africa Biodegradable Packaging Material Market Outlook, by Material Type, Value (US$ Mn), 2018 – 2030

8.1.1. Key Highlights

8.1.1.1. Plastic

8.1.1.2. Paper & Paperboard

8.1.1.3. Bagasse

8.2. Middle East & Africa Biodegradable Packaging Material Market Outlook, by Packaging Format, Value (US$ Mn), 2018 – 2030

8.2.1. Key Highlights

8.2.1.1. Bottles & Jars

8.2.1.2. Boxes & Cartons

8.2.1.3. Cans

8.2.1.4. Trays & Clamshells

8.2.1.5. Cups & Bowls

8.2.1.6. Pouches & Bags

8.2.1.7. Films & Wraps

8.2.1.8. Labels & Tapes

8.2.1.9. Misc (Stick pack, Sachets, etc.)

8.3. Middle East & Africa Biodegradable Packaging Material Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

8.3.1. Key Highlights

8.3.1.1. Food & Beverages

8.3.1.2. Personal Care

8.3.1.3. Pharmaceuticals

8.3.1.4. Healthcare

8.3.1.5. Misc

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Biodegradable Packaging Material Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

8.4.1. Key Highlights

8.4.1.1. GCC Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

8.4.1.2. GCC Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

8.4.1.3. GCC Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.4. South Africa Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

8.4.1.5. South Africa Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

8.4.1.6. South Africa Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.7. Egypt Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

8.4.1.8. Egypt Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

8.4.1.9. Egypt Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.10. Nigeria Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

8.4.1.11. Nigeria Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

8.4.1.12. Nigeria Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.13. Rest of Middle East & Africa Biodegradable Packaging Material Market by Material Type, Value (US$ Mn), 2018 – 2030

8.4.1.14. Rest of Middle East & Africa Biodegradable Packaging Material Market Packaging Format, Value (US$ Mn), 2018 – 2030

8.4.1.15. Rest of Middle East & Africa Biodegradable Packaging Material Market Application, Value (US$ Mn), 2018 – 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. NatureWorks LLC

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. BASF SE

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Smurfit Kappa Group

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Mondi Group

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Novamont S.p.A

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Arkema S.A.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Biomass Packaging

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Eco-Products, Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Tracklab

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Green Packaging, Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Huhtamaki Group

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Novamont S.p.A.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Be Green Packaging

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Vegware Ltd.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Green Packaging Material (Jiangyin) Co., Ltd.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Material Type Coverage |

|

|

Packaging Format Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |