Global Brain Health Devices Market Forecast

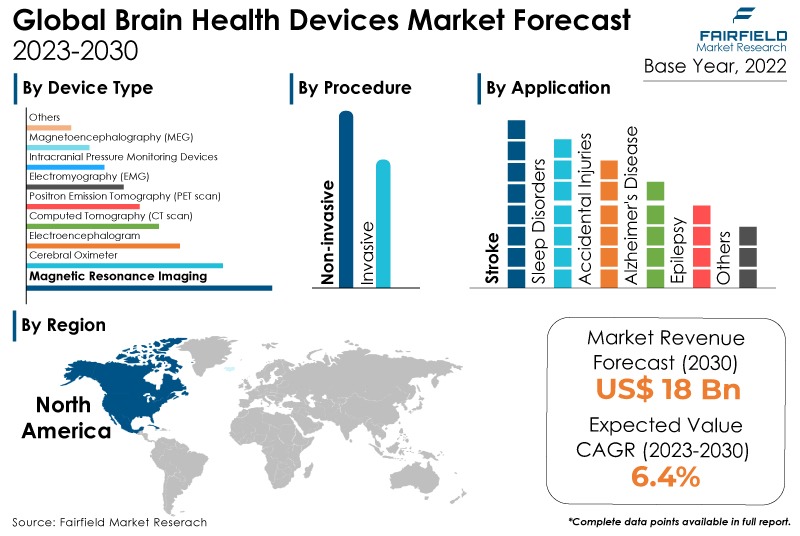

- Global brain health devices market size to witness healthy expansion at a CAGR of 4% during 2023 - 2030

- Market value projected to reach approximately US$18 Bn in 2030, up from US$ 10 Bn recorded in 2022

Market Analysis in Brief

Brain health devices are a diverse range of technological tools and equipment designed to monitor, assess, enhance, and support cognitive well-being and neurological function. These devices cater to various aspects of brain health, including diagnosing neurological disorders, improving cognitive function, managing stress, and promoting overall mental well-being. The brain health devices market has witnessed remarkable expansion and transformation in recent years, spurred by an upsurge in awareness about cognitive well-being, technological breakthroughs, and a growing demand for novel solutions to neurological disorders. This dynamic market encompasses a diverse array of devices designed to monitor, diagnose, treat, and optimise brain function, addressing individuals across various age groups, from young children to the elderly population.

Fairfield Market Research analyses diverse aspects of the global brain health devices market by device type, procedure type, applications, end-users, and regional analysis in detail. Device types comprise cerebral oximeter, EEG, MRI, CT scan, PET Scan, EMG, intracranial pressure monitoring devices, MEG, and other types. Invasive and non-invasive are the procedure types covered in the report. Applications analysed include sleep disorders, accidental injuries, Alzheimer’s disease, epilepsy, stroke, and others. The insights offered in this report are expected to aid in market growth examination over the forecast timeline.

Growth Drivers

Improving Rate of Diagnosis

Developments in neurodiagnostics are contributing to the brain health devices market growth. The increasing emphasis of patients on early disease diagnosis and the growing number of diagnostic centres and hospitals are favouring the overall momentum of the market. Growing patient awareness about neurological diseases, coupled with increasing support from governments, non-government bodies, and healthcare providers regarding awareness, diagnostics, and treatment are bolstering the market growth.

The National Institute of Neurological Disorders and Stroke, an institute founded within the National Institutes of Health (Spain) to carry out research work about the brain and nervous system and to reduce the burden of neurological disease. The market is also expected to be driven by regulatory approval for advanced and innovative devices. In April 2019, GE Healthcare received the clearance for its deep learning apex computed tomography device from the US Food and Drug Administration.

Deep learning image reconstruction (DLIR) is a next-generation alternative that employs a deep neural network (DNN) to generate TrueFidelity CT image. The three most common and frequently used technologies are functional magnetic resonance imaging (fMRI), magnetoencephalography (MEG), and electroencephalography (EEG). The myriad of benefits these technologies offer is bolstering the growth of the brain health devices market worldwide.

COVID-19 Impact

The COVID-19 pandemic has brought about significant effects on the realm of brain health devices, yielding a combination of positive and negative consequences. On the positive side, the pandemic served as a stark reminder of the importance of mental health, resulting in an increased demand for tools that can support and monitor brain health. This surge in interest led to a heightened focus on brain health devices tailored to address issues such as stress, anxiety, and overall cognitive well-being.

The adoption of telehealth and remote patient monitoring experienced rapid acceleration during the pandemic, fostering a greater appreciation for brain health devices that can be effectively utilised from a distance. Furthermore, the urgency prompted by the pandemic expedited the pace of innovation and research, fostering advancements in brain health devices designed for home use or remote settings. Elevated awareness surrounding the psychological toll of isolation and uncertainty further fueled interest in devices that can effectively manage such challenges.

Cancer has been recognised as a risk factor for COVID-19 because some COVID-19 patients have malignancies. It is predicted that additional studies in this area would advance cancer research by helping to better understand infection dynamics. It is also anticipated that this would increase demand for brain health devices products.

Surging Cases of Traumatic Brain Injuries, and Neurological Disorders

The age group most vulnerable to Traumatic Brain Injury is individuals between 15 and 24 years old, while both children under 5 years old and adults aged 75 and above are also at notable risk. Among the elderly population, around 20-30% experience moderate to severe injuries like bruises, fractures, or head trauma. The growing number of elderly individuals in the population has resulted in a steady increase in the occurrence of neurological disorders for both men and women.

The Alzheimer's Association reports that over 6 million Americans, spanning various age groups, are affected by Alzheimer's disease. Specifically, there are an estimated 6.7 million individuals aged 65 and older living with Alzheimer's in 2023. The extension of life expectancy has led to a rise in the prevalence of stroke cases.

Furthermore, the escalating instances of obesity, hypertension, diabetes, and cardiovascular ailments also contribute significantly to the occurrence of strokes. Accidental injuries demonstrate a revenue value of US$1,974.3 Mn in 2022, while sleep disorders are expected to exhibit a strong growth rate during the forecast period (2023-2030) with a CAGR of ~7.2%.

Strong Government Backing

Government initiatives worldwide are playing a pivotal role in shaping the trajectory of the brain health devices market, underpinning the advancement of neurological research, technological innovation, awareness campaigns, and accessibility enhancements. Notable examples span regions and exhibit a strong commitment to fostering progress in brain health technologies.

In July 2023, the World Health Organization (WHO) introduced a comprehensive Intersectoral Global Action Plan (IGAP) dedicated to enhancing the management and accessibility of care for epilepsy and other neurological disorders. This strategic blueprint is designed to elevate policy emphasis and bolster governance structures, offer timely and efficient diagnosis, treatment, and care, execute strategies for promotion and prevention, foster advancements in research and innovation, fortify information systems, and bolster the public health approach.

In parallel, numerous collaborative clinical trials are presently in progress, focusing on non-invasive brain health monitoring. These trials, conducted in conjunction with universities, federal entities, and emerging companies, hold significant potential.

Noteworthy among these trials recent example is, named "Non-invasive Monitoring of Traumatic Brain Injury Progression Using the Infrascanner (MOBI-1)," is sponsored by the University of Alabama at Birmingham and in collaboration with the US Department of Defense (DOD) and InfraScan, Inc. This initiative underscores the concerted efforts in advancing non-invasive methods for tracking brain health, fostering a collaborative environment among various stakeholders for the betterment of neurological well-being.

Growth Challenges

High Costs, and Complexities in Brain Monitoring Procedures

Skilled and experienced therapists are essential for operating complex equipment and analysing the data it produces. Despite showcasing positive results, certain advanced tools like continuous EEG monitoring (cEEG) face limited adoption due to the expenses linked with hardware, software, and the need for proficient personnel to oversee and interpret the generated data. An article featured in Neurology Today in December 2018 highlighted that while cEEG correlates with lower in-hospital mortality for critically ill patients, its utilisation remains restricted due to high equipment costs and a shortage of qualified experts.

The realm of conventional devices is marred by steep pricing and technological obstacles, paving the way for the emergence of innovative platforms that truly disrupt the landscape by being user-friendly and cost-effective. Furthermore, there exists a significant disparity in the projected adoption of brain health devices for both diagnosis and treatment.

Challenges including costs and the intricacies associated with brain monitoring must be effectively addressed within the broader spectrum of comprehensive care. Certain platforms manage to mitigate the overall expenses of brain monitoring by shortening the length of stay in intensive care units, effectively offsetting the financial burden.

Growth Opportunities

North America Surges Ahead

With the presence of key companies engaging in brain health devices-related research and development activities, the North American market is anticipated to have the greatest revenue share among other regional markets during the projected period as the region stands out as a prominent hub for brain health devices market, primarily due to a convergence of factors that foster a robust demand for these technologies.

The increasing number of product approvals from the US Food and Drug Administration (FDA) will also bolster growth in this region. IRRAflow, an integrated closed medical device system by IRRAS AB recently received clearance from the FDA. The system enables cerebrospinal fluid (CSF) management and accurate and continuous monitoring of intracranial pressure (ICP). The wearable brain devices market will continue to expand, led by Google and Microsoft. The technology giants are focusing more on the development of digital brain health tools.

With an advanced and well-established healthcare infrastructure, particularly in the United States, and Canada, the region offers a conducive environment for the integration and adoption of innovative medical technologies, including brain health devices.

Moreover, the region's emphasis on research and technological advancement positions it as a leader in developing cutting-edge solutions for neurological health. Rigorous yet well-defined regulatory frameworks, overseen by entities like the US Food and Drug Administration (FDA), assure the safety and effectiveness of brain health devices, instilling confidence in both healthcare professionals and patients.

Developing Economies Gear up to Enter the Fray

Asia Pacific is predicted to demonstrate significant growth during the forecast period due to increased government initiatives to raise awareness, medical tourism, research activities and growing demand for high-quality healthcare in the region. Market expansion is also anticipated to be supported by strategic approvals and agreements between significant market players to promote brain health devices in this area.

Additionally, the growing use of sophisticated diagnostic procedures in clinics, hospitals, and diagnostic laboratories in this area, as well as greater awareness of mental wellness, is anticipated to promote market revenue growth. the dementia India 2017 report stated that India was recorded as the second largest place with incidence of dementia. The report stated 4.1 million dementia cases in 2017, which alone augments the regional demand.

Brain Health Devices Market: Competitive Landscape Analysis

Currently, there are numerous players extensively engaged in marketing as well as research and development of brain health products and are strongly anticipated to win the war against mental diseases. These include Philips Group, GE HealthCare, Medtronic Plc, Siemens Healthineers, Integra Lifesciences, Bioserenity, Neuroelectrics, Cognionics Inc., Advanced Brain Monitoring, Inc., Edwards Lifesciences Corporation, Neurosoft, Masimo Corporation, and Natus Medical Inc.

Expanding Market Catapulted by Competitors' Accelerated Growth and Strategic Mergers

Parkway Shenton of Singapore achieves a remarkable milestone by becoming the Asia Pacific's pioneer primary healthcare provider to introduce digital brain screening and monitoring through Neurowyzr's exclusive Digital Brain Function Scan. This innovative approach offers the potential for early identification of brain health issues linked to cognitive decline, stroke, the neurological impacts of Long COVID, Parkinson's disease, and dementia.

Neurowyzr, a prominent Singaporean company specialising in neuroscience-driven digital solutions, has entered a strategic collaboration with Parkway Shenton to facilitate the utilisation of digital tools for brain health screening and continuous monitoring. In 2019, Masimo Corporation received CE Mark approval for its SedLine brain function monitor for pediatric patients. This product is known to assess the functioning of the brain when the patient is under anesthesia.

The Global Brain Health Devices Market is Segmented into:

By Device Type

- Cerebral Oximeter

- Electroencephalogram

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT scan)

- Positron Emission Tomography (PET scan)

- Electromyography (EMG)

- Intracranial Pressure Monitoring Devices

- Magnetoencephalography (MEG)

- Others

By Procedure

- Invasive

- Non-invasive

By Application

- Sleep Disorders

- Accidental Injuries

- Alzheimer's Disease

- Epilepsy

- Stroke

- Others

By End User

- Hospitals and Clinics

- Diagnostic Imaging Centres

- Homecare Settings

- Assisted Living Facilities

- Others

1. Executive Summary

1.1. Global Brain Health Devices Market Outlook, 2018 - 2030 (US$ Million)

1.2. Global Brain Health Devices Market Incremental Opportunity, 2023 - 2030 (US$ Million)

1.3. Key Industry Trends

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Market Drivers

2.2.2. Market Threats

2.2.3. Market Opportunities

2.3. Growth Opportunity Matrix

2.4. Regulatory Framework

2.5. COVID-19 Impact Analysis

2.6. Average Cost, by Major Device Type

3. Global Brain Health Devices Market Outlook, 2018 - 2030

3.1. Global Brain Health Devices Market Outlook, By Type, 2018 - 2030

3.1.1. Key Highlights

3.1.2. Global Brain Health Devices Market Outlook, by Type, Value (US$ Million), 2018 - 2030

3.1.2.1. Cerebral Oximeter

3.1.2.2. Electroencephalography (EEG)

3.1.2.3. Magnetic Resonance Imaging (MRI)

3.1.2.4. Computed Tomography (CT Scan)

3.1.2.5. Positron Emission Tomography (PET Scan)

3.1.2.6. Electromyography (EMG)

3.1.2.7. Intracranial Pressure Monitoring Devices

3.1.2.8. Magnetoencephalography (MEG)

3.1.2.9. Others

3.1.3. Market Attractiveness Analysis, by Type

3.2. Global Brain Health Devices Market Outlook, By Procedure, 2018 - 2030

3.2.1. Key Highlights

3.2.2. Global Brain Health Devices Market Outlook, by Procedure Type, Value (US$ Million), 2018 - 2030

3.2.2.1. Invasive

3.2.2.2. Non-invasive

3.2.3. Market Attractiveness Analysis, by Procedure Type

3.3. Global Brain Health Devices Market Outlook, By Application, 2018 - 2030

3.3.1. Key Highlights

3.3.2. Global Brain Health Devices Market Outlook, by Application, Value (US$ Million), 2018 - 2030

3.3.2.1. Sleep Disorders

3.3.2.2. Accidental Injuries

3.3.2.3. Alzheimer’s Disease

3.3.2.4. Epilepsy

3.3.2.5. Stroke

3.3.2.6. Others

3.3.3. Market Attractiveness Analysis, by Application

3.4. Global Brain Health Devices Market Outlook, By End User, 2018 - 2030

3.4.1. Key Highlights

3.4.2. Global Brain Health Devices Market Outlook, by End User, Value (US$ Million), 2018 - 2030

3.4.2.1. Hospitals & Clinics

3.4.2.2. Diagnostic Imaging Centres

3.4.2.3. Homecare Settings

3.4.2.4. Assisted Living Facilities

3.4.2.5. Others

3.4.3. Market Attractiveness Analysis, by End User

3.5. Global Brain Health Devices Market Outlook, By Region, 2018 - 2030

3.5.1. Key Highlights

3.5.2. Global Brain Health Devices Market Outlook, by Region, Value (US$ Million), 2018 - 2030

3.5.2.1. North America

3.5.2.2. Europe

3.5.2.3. Asia Pacific

3.5.2.4. Rest of the World

3.5.3. Market Attractiveness Analysis, by Region

4. North America Brain Health Devices Market Outlook, 2018 - 2030

4.1. North America Brain Health Devices Market Outlook, By Country, 2018 - 2030

4.1.1. Key Highlights

4.1.2. North America Brain Health Devices Market Outlook, by Country, Value (US$ Million), 2018 - 2030

4.1.2.1. U.S.

4.1.2.2. Canada

4.1.3. Market Attractiveness Analysis, by Country

4.2. North America Brain Health Devices Market Outlook, by Type, 2018 - 2030

4.2.1. Key Highlights

4.2.2. North America Brain Health Devices Market Outlook, by Type, Value (US$ Million), 2018 - 2030

4.2.2.1. Cerebral Oximeter

4.2.2.2. EEG

4.2.2.3. MRI

4.2.2.4. CT Scan

4.2.2.5. PET Scan

4.2.2.6. EMG

4.2.2.7. Intracranial Pressure Monitoring Devices

4.2.2.8. MEG

4.2.2.9. Others

4.2.3. Market Attractiveness Analysis, by Type

4.3. North America Brain Health Devices Market Outlook, by Procedure Type, 2018 - 2030

4.3.1. Key Highlights

4.3.2. North America Brain Health Devices Market Outlook, by Procedure Type, Value (US$ Million), 2018 - 2030

4.3.2.1. Invasive

4.3.2.2. Non-invasive

4.3.3. Market Attractiveness Analysis, by Procedure Type

4.4. North America Brain Health Devices Market Outlook, By Application, 2018 - 2030

4.4.1. Key Highlights

4.4.2. North America Brain Health Devices Market Outlook, by Application, Value (US$ Million), 2018 - 2030

4.4.2.1. Sleep Disorders

4.4.2.2. Accidental Injuries

4.4.2.3. Alzheimer’s Disease

4.4.2.4. Epilepsy

4.4.2.5. Stroke

4.4.2.6. Others

4.4.3. Market Attractiveness Analysis, by Application

4.5. North America Brain Health Devices Market Outlook, By End User, 2018 - 2030

4.5.1. Key Highlights

4.5.2. North America Brain Health Devices Market Outlook, by End User, Value (US$ Million), 2018 - 2030

4.5.2.1. Hospitals & Clinics

4.5.2.2. Diagnostic Imaging Centres

4.5.2.3. Homecare Settings

4.5.2.4. Assisted Living Facilities

4.5.3. Market Attractiveness Analysis, by End User

5. Europe Brain Health Devices Market Outlook, 2018 - 2030

5.1. Europe Brain Health Devices Market Outlook, By Country, 2018 - 2030

5.1.1. Key Highlights

5.1.2. Europe Brain Health Devices Market Outlook, by Country, Value (US$ Million), 2018 - 2030

5.1.2.1. U.K.

5.1.2.2. France

5.1.2.3. Germany

5.1.2.4. Italy

5.1.2.5. Spain

5.1.2.6. Rest of Europe

5.1.3. Market Attractiveness Analysis, by Country

5.2. Europe Brain Health Devices Market Outlook, by Type, Value (US$ Million), 2018 - 2030

5.2.1. Key Highlights

5.2.2. Europe Brain Health Devices Market Outlook, by Type, Value (US$ Million), 2018 - 2030

5.2.2.1. Cerebral Oximeter

5.2.2.2. EEG

5.2.2.3. MRI

5.2.2.4. CT Scan

5.2.2.5. PET Scan

5.2.2.6. EMG

5.2.2.7. Intracranial Pressure Monitoring Devices

5.2.2.8. MEG

5.2.2.9. Others

5.2.3. Market Attractiveness Analysis, by Type

5.3. Europe Brain Health Devices Market Outlook, By Procedure Type, 2018 - 2030

5.3.1. Key Highlights

5.3.2. Europe Brain Health Devices Market Outlook, by Procedure Type, Value (US$ Million), 2018 - 2030

5.3.2.1. Invasive

5.3.2.2. Non-invasive

5.3.3. Market Attractiveness Analysis, by Procedure Type

5.4. Europe Brain Health Devices Market Outlook, By Application, 2018 - 2030

5.4.1. Key Highlights

5.4.2. Europe Brain Health Devices Market Outlook, by Application, Value (US$ Million), 2018 - 2030

5.4.2.1. Sleep Disorders

5.4.2.2. Accidental Injuries

5.4.2.3. Alzheimer’s Disease

5.4.2.4. Epilepsy

5.4.2.5. Stroke

5.4.2.6. Others

5.4.3. Market Attractiveness Analysis, by Application

5.5. Europe Brain Health Devices Market Outlook, By End User, 2018 - 2030

5.5.1. Key Highlights

5.5.2. Europe Brain Health Devices Market Outlook, by End User, Value (US$ Million), 2018 - 2030

5.5.2.1. Hospitals & Clinics

5.5.2.2. Diagnostic Imaging Centres

5.5.2.3. Homecare Settings

5.5.2.4. Assisted Living Facilities

5.5.3. Market Attractiveness Analysis, by End User

6. Asia Pacific Brain Health Devices Market Outlook, 2018 - 2030

6.1. Asia Pacific Brain Health Devices Market Outlook, By Country, 2018 - 2030

6.1.1. Key Highlights

6.1.2. Asia Pacific Brain Health Devices Market Outlook, by Country, Value (US$ Million), 2018 - 2030

6.1.2.1. India

6.1.2.2. Japan

6.1.2.3. China

6.1.2.4. Australia

6.1.2.5. Rest of Asia Pacific

6.1.3. Market Attractiveness Analysis, by Country

6.2. Asia Pacific Brain Health Devices Market Outlook, by Type, Value (US$ Million), 2018 - 2030

6.2.1. Key Highlights

6.2.2. Asia Pacific Brain Health Devices Market Outlook, by Type, Value (US$ Million), 2018 - 2030

6.2.2.1. Cerebral Oximeter

6.2.2.2. EEG

6.2.2.3. MRI

6.2.2.4. CT Scan

6.2.2.5. PET Scan

6.2.2.6. EMG

6.2.2.7. Intracranial Pressure Monitoring Devices

6.2.2.8. MEG

6.2.2.9. Others

6.2.3. Market Attractiveness Analysis, by Type

6.3. Asia Pacific Brain Health Devices Market Outlook, By Procedure Type, 2018 - 2030

6.3.1. Key Highlights

6.3.2. Asia Pacific Brain Health Devices Market Outlook, by Procedure Type, Value (US$ Million), 2018 - 2030

6.3.2.1. Invasive

6.3.2.2. Non-invasive

6.3.3. Market Attractiveness Analysis, by Procedure Type

6.4. Asia Pacific Brain Health Devices Market Outlook, By Application, 2018 - 2030

6.4.1. Key Highlights

6.4.2. Asia Pacific Brain Health Devices Market Outlook, by Application, Value (US$ Million), 2018 - 2030

6.4.2.1. Sleep Disorders

6.4.2.2. Accidental Injuries

6.4.2.3. Alzheimer’s Disease

6.4.2.4. Epilepsy

6.4.2.5. Stroke

6.4.2.6. Others

6.4.3. Market Attractiveness Analysis, by Application

6.5. Asia Pacific Brain Health Devices Market Outlook, By End User, 2018 - 2030

6.5.1. Key Highlights

6.5.2. Asia Pacific Brain Health Devices Market Outlook, by End User, Value (US$ Million), 2018 - 2030

6.5.2.1. Hospitals & Clinics

6.5.2.2. Diagnostic Imaging Centres

6.5.2.3. Homecare Settings

6.5.2.4. Assisted Living Facilities

6.5.3. Market Attractiveness Analysis, by End User

7. Rest of the World Brain Health Devices Market Outlook, 2018 - 2030

7.1. Rest of the World Brain Health Devices Market Outlook, By Sub-region, 2018 - 2030

7.1.1. Key Highlights

7.1.2. Rest of the World Brain Health Devices Market Outlook, by Sub-region, Value (US$ Million), 2018 - 2030

7.1.2.1. Latin America

7.1.2.2. Middle East & Africa

7.1.3. Market Attractiveness Analysis, by Sub-region

7.2. Rest of the World Brain Health Devices Market Outlook, by Type, 2018 - 2030

7.2.1. Key Highlights

7.2.2. Rest of the World Brain Health Devices Market Outlook, by Type, Value (US$ Million), 2018 - 2030

7.2.2.1. Cerebral Oximeter

7.2.2.2. EEG

7.2.2.3. MRI

7.2.2.4. CT Scan

7.2.2.5. PET Scan

7.2.2.6. EMG

7.2.2.7. Intracranial Pressure Monitoring Devices

7.2.2.8. MEG

7.2.2.9. Others

7.2.3. Market Attractiveness Analysis, by Type

7.3. Rest of the World Brain Health Devices Market Outlook, By Procedure Type, 2018 - 2030

7.3.1. Key Highlights

7.3.2. Rest of the World Brain Health Devices Market Outlook, by Procedure Type, Value (US$ Million), 2018 - 2030

7.3.2.1. Invasive

7.3.2.2. Non-invasive

7.3.3. Market Attractiveness Analysis, by Procedure Type

7.4. Rest of the World Brain Health Devices Market Outlook, By Application, 2018 - 2030

7.4.1. Key Highlights

7.4.2. Rest of the World Brain Health Devices Market Outlook, by Application, Value (US$ Million), 2018 - 2030

7.4.2.1. Sleep Disorders

7.4.2.2. Accidental Injuries

7.4.2.3. Alzheimer’s Disease

7.4.2.4. Epilepsy

7.4.2.5. Stroke

7.4.2.6. Others

7.4.3. Market Attractiveness Analysis, by Application

7.5. Rest of the World Brain Health Devices Market Outlook, By End User, 2018 - 2030

7.5.1. Key Highlights

7.5.2. Rest of the World Brain Health Devices Market Outlook, by End User, Value (US$ Million), 2018 - 2030

7.5.2.1. Hospitals & Clinics

7.5.2.2. Diagnostic Imaging Centres

7.5.2.3. Homecare Settings

7.5.2.4. Assisted Living Facilities

7.5.3. Market Attractiveness Analysis, by End User

8. Competitive Landscape

8.1. Company Profiles

8.1.1. Philips Group

8.1.1.1. Company Overview

8.1.1.2. Financial Performance

8.1.1.3. Product Portfolio

8.1.1.4. Recent Developments and Strategic Collaborations

Above details will include, but not be limited to below list of companies based on availability

8.1.2. GE HealthCare

8.1.3. Medtronic Plc

8.1.4. Siemens Healthineers

8.1.5. Integra Lifesciences

8.1.6. Bioserenity

8.1.7. Neuroelectrics

8.1.8. Cognionics Inc.

8.1.9. Advanced Brain Monitoring, Inc.

8.1.10. Edwards Lifesciences Corporation

8.1.11. Neurosoft

8.1.12. Masimo Corporation

8.1.13. Natus Medical Inc.

9. Appendix

9.1. Research Methodology

9.2. Report Specific Research Approach

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

By Device Type |

|

|

By Procedure |

|

|

By Application |

|

|

By End User |

|

|

Geographic Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Market Estimates and Forecast (Value), Market Dynamics, Regulatory Guidelines, Technological Advancements, COVID-19 Impact Analysis, Device Type Insights, Procedure Type Insights, Application Insights, End User, Regional and Country Insights, Competitive Landscape, Company Profiles |