Global Branded Food Staple Market Forecast

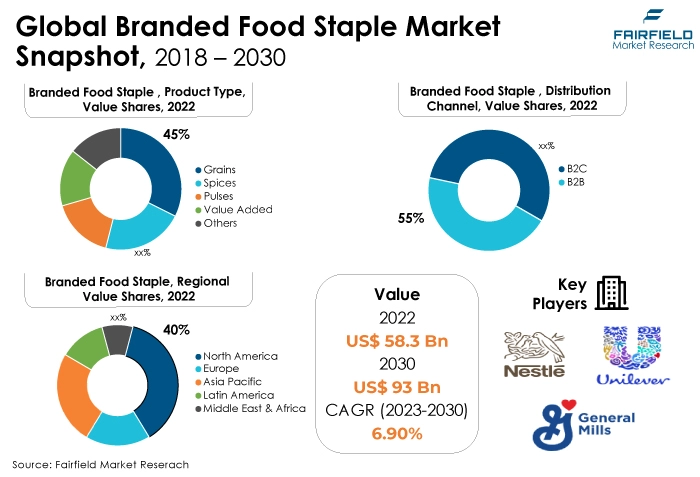

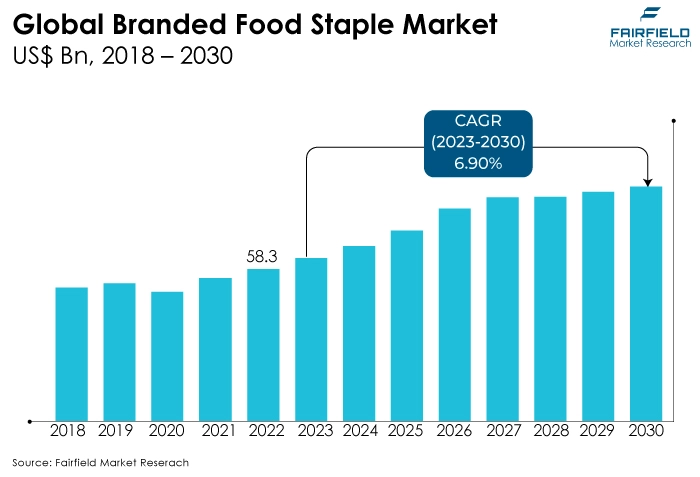

- The approximately US$58.3 Bn market for branded food staples projected to reach US$93 Bn by 2030-end

- Market valuation poised to experience a healthy CAGR of 6.9% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to drive the branded food staple market growth is an increasing demand for ethnic and global flavours. Furthermore, Food businesses have increased the number of international flavours in their product lines. This covers elements from several international cuisines, such as Mexican, Indian, Thai, and Mediterranean, as well as spices, sauces, seasonings, and condiments.

- Another major market trend expected to drive the branded food staple market growth is the rapidly expanding health and wellness trends. The demand for organic and non-GMO food essentials is rising. Customers are willing to pay more for goods that are produced without genetically modified organisms and industrial pesticides. Today, several companies provide organic variations of their standard goods.

- Some branded food staples may be perceived as less healthy by customers who are growing more health conscious due to concerns about additives, preservatives, or high amounts of sugar, salt, or fat. This could lead to decreased sales for some brands.

- In 2022, the grains category dominated the industry. Wheat flour is used to make bread, a common grain product. Sliced bread, baguettes, rolls and specialty bread like whole grain, or artisanal loaves are among the varieties.

- The spices segment is expected to be the fastest-growing of the branded food staple market during the forecast period. Cinnamon is a spice that can be used in both savory and sweet foods. Both ground and stick (cinnamon bark) versions are readily accessible.

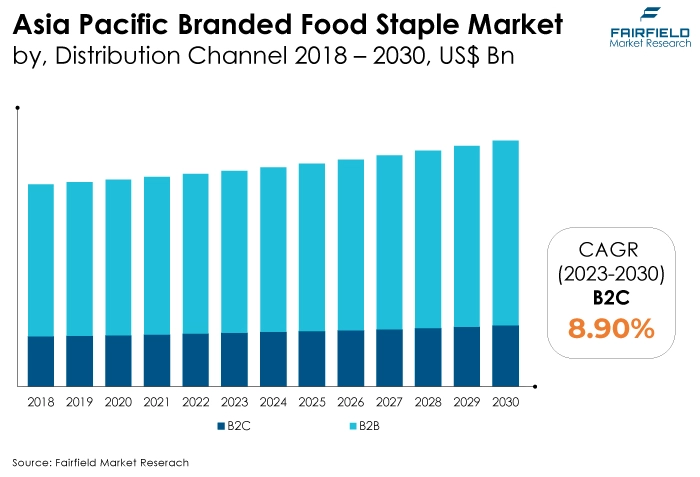

- In 2022, the B2B category dominated the industry. The process begins with manufacturers and producers of branded food staples. These companies are responsible for sourcing raw materials, processing, packaging, and branding their products.

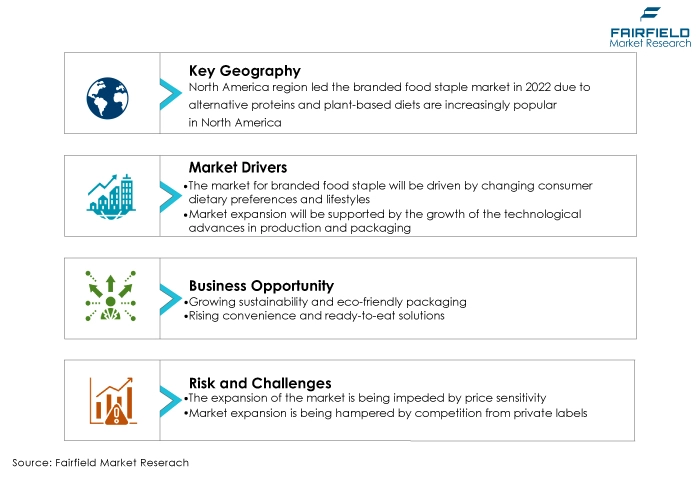

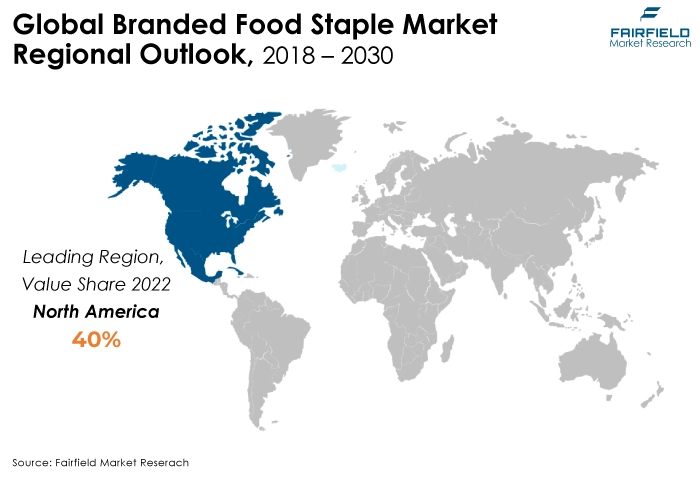

- North America is expected to dominate the branded food staple market during the forecast period. Alternative proteins and plant-based diets are increasingly popular in North America. In this sector, brands that provide dairy-free and animal alternatives, as well as staple plant-based foods are thriving.

- Asia Pacific is expected to be the fastest-growing branded food staple market region. Food staples of the highest quality are increasingly in demand. Brands that can guarantee reliable quality and food safety are in a good position to expand in the area.

A Look Back and a Look Forward - Comparative Analysis

Food staples are becoming more and more popular among consumers. With the help of innovation, businesses can create goods that follow the latest nutritional fads, such as low-sugar, low-sodium, organic, gluten-free, and plant-based options.

Innovative packaging approaches, like resealable pouches, single-serving containers, and vacuum-sealed packaging, can extend the freshness and shelf life of products, lowering food waste while increasing consumer convenience.

The market witnessed staggered growth during the historical period 2018 - 2022. Customers have access to a wide range of branded food staple products via online platforms. Customers could peruse and select from a wide variety of cereals, spices, and packaged food basics from various brands, including ones that may not be readily available in their area.

Consumers can readily browse ingredient lists and nutritional data, compare pricing, and read product reviews thanks to e-commerce. Because of the transparency, customers are now able to choose products that suit their tastes and dietary requirements.

Clear packaging and labeling included comprehensive nutritional data, such as calorie counts, macronutrient breakdowns, and allergen warnings. Customers valued having access to this knowledge so they could choose their diets intelligently in the coming years.

Additionally, By prominently emphasizing common allergens in the ingredient list, clean labeling addressed allergy concerns. For customers who had dietary allergies or sensitivities, this was especially crucial.

Furthermore, Artificial flavours, and colours were avoided in products with clear labeling. To get the required flavours and appearances, natural ingredients and spices are used as substitutes.

Key Growth Determinants

- Evolving Consumer Dietary Preferences, and Lifestyles

Consumers are looking for dietary staples that support their health objectives as knowledge of the value of a healthy diet grows. They are prepared to spend more for goods that are thought to be healthier or provide certain nutritional advantages.

Consumers frequently lead busy lives that leave little time for preparing extravagant meals. The desire for branded foods that are quick and simple to prepare, such as pre-packaged meals or ready-to-eat options, is significant.

More people are embracing special diets like vegetarianism, veganism, gluten-free eating, or keto, and they are searching for branded food staples that meet their dietary requirements. Such items give brands a competitive advantage.

- Technological Advances in Production and Packaging

Modern technology for processing and manufacturing food increases productivity, lowers production costs, and benefits the entire supply chain. This enables businesses to provide consumers with competitive prices. The stability and security of branded food staples are guaranteed by cutting-edge monitoring and quality control systems.

Brands that can ensure high-quality goods are more likely to win the trust and loyalty of their target audience. The shelf life of common foods is extended through advances in packing materials and methods such as vacuum sealing, modified atmosphere packaging (MAP), and antimicrobial coatings. As a result, there is less food waste and more product availability.

- Greater Emphasis on Brand Recognition, and Trust

Customers have faith in brands that have a solid reputation for reliability and quality. People are more likely to select a brand's staple foods over unproven or generic alternatives when they trust it. Trustworthy brands develop loyal customer bases.

Food staples from a particular brand are more likely to attract repeat customers who generate reliable revenue streams. Strongly trusted and well-known brands can successfully introduce new goods or line extensions.

Customers who already trust a brand are more likely to try new products from that brand, increasing the business's product line and market share.

Major Growth Barriers

- Price Sensitivity

Price-conscious consumers are more likely to select less expensive options over branded goods, such as generic or store-brand food staples. This choice may constrain the market share and growth potential of branded pins.

Price-sensitive consumers are less likely to show strong brand loyalty. It is challenging for branded food staples to develop a constant and devoted client base since they may switch between brands in response to price changes or promotions.

To appeal to price-conscious consumers, brands may need to provide price reductions and promotions frequently. Profit margins may be under pressure, and brand value may gradually decline as a result.

- Competition from Private Labels

Prices for private labels are often lower than those for branded alternatives. Consumers who are concerned about cost are frequently drawn to these less expensive alternatives, which puts pressure on branded food staples to maintain a competitive price.

Retailers have made investments to increase the value and selection of their private-label products. As a result, the perceived value of branded products is diminished because private-label products can now match or even outperform the quality of branded food staples.

Key Trends and Opportunities to Look at

- Plant-based and Alternative Proteins

Consumers are increasingly looking for plant-based proteins because they are thought to be healthier and more sustainable than traditional animal-based proteins due to growing awareness of environmental and health issues.

Flexitarians and omnivores who want to cut back on their meat consumption, as well as vegetarians and vegans, are drawn to plant-based proteins. This diverse consumer base provides a considerable business opportunity.

Brands, including plant-based protein powders, dairy substitutes, and meat substitutes, are creating innovative plant-based food staples. These goods are more tempting to customers because they have a similar flavour and texture to their animal-based equivalents.

- Eco-friendly Packaging Formats

A growing number of consumers are actively seeking out products that align with their sustainability values. Branded food staples that prioritise eco-friendly practices and packaging resonate with these consumers.

Brands that adopt sustainable practices, such as responsible sourcing of ingredients and eco-friendly packaging, can reduce their environmental footprint. This appeals to environmentally conscious consumers.

Sustainable practices, such as cutting down on energy use and packaging waste, can eventually save brands money. These savings could improve product quality or be distributed to customers.

- Convenience Foods, and Ready-to-Eat Solutions

Complete meal solutions, which combine the main course, a side dish, and a dessert in one box, are being introduced by brands. These meal kits make it simpler for consumers to prepare balanced meals at home by streamlining purchasing and preparation.

Food staples with a focus on convenience are frequently packaged in portion-controlled ways to assist consumers in controlling their calorie intake and prevent food wastage.

A variety of items are being created by brands that offer ease and versatility in the kitchen by serving as ingredients in different recipes or as parts of meals or snacks.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the branded food staple market has been regulated by a number of legal frameworks intended to guarantee the integrity, safety, and transparency of food items.

The Nutrition Facts panel, ingredient lists, and health claims on branded food staples are all influenced by restrictions imposed by the US FDA. The European Commission and the member states of the European Union (EU) get scientific advice on matters pertaining to food safety from the European Food Safety Authority (EFSA). The evaluations and suggestions made by the EFSA have an impact on the European Union (EU) market's requirements for branded food staples with regard to food safety.

Indian standards and labeling requirements are met by branded food staples thanks to the Food Safety and Standards Authority of India (FSSAI's) regulation of food safety and quality in India. By establishing safety requirements and controlling food imports and exports, it has an impact on the market.

By setting regulations, monitoring compliance, and bolstering consumer trust in the reliability and quality of food items, regulatory bodies play a critical role in defining the market for branded food staples. To operate lawfully and preserve consumer trust, brands in this industry need to abide by these rules.

Fairfield’s Ranking Board

Top Segments

- Grains Win over Spices in Sales

The grains segment dominated the market in 2022. Oatmeal, granola and rolled oats are all made from oats. They are a well-liked grain product for breakfast and are often used in baking.

A grain-based food called pasta is produced from wheat semolina or other grains. It contains pasta in a variety of sizes and forms, such as penne, macaroni, and spaghetti. Corn is used to produce cornmeal, cornflour, cornflour and items like tortillas and cornbread that are corn-based.

Furthermore, the spices category is projected to experience the fastest market growth. Spices are essential for improving the flavour of many different cuisines. Branded spices are well-liked in the market for branded food staples because of their reliable quality and uniform packaging.

The emphasis on sustainable sourcing, the creation of spice blends and spices, and the rising acceptance of ethnic and foreign flavours are among the trends.

- B2B Channels Bring in Noteworthy Revenue

The B2B segment dominated the market in 2022. Manufacturers sell their branded food products to companies, including restaurants, lodging facilities, and food service providers through the B2B. It includes purchasing in bulk and distributing for business purposes.

Adopting cutting-edge inventory management systems and incorporating data analytics to increase productivity and satisfy changing B2B customer demands.

The B2C category on the other hand is anticipated to grow substantially throughout the projected period. This segment involves the direct selling of branded grocery items from producers or merchants to solitary customers. It consists of conventional brick-and-mortar stores, online merchants, food markets, and supermarkets.

Increased customer preference for branded food staples with healthier options and sustainable packaging is influenced by the increased emphasis on health and wellness.

Regional Frontrunners

North America Prime Revenue Generator

Throughout the forecast period, North America is anticipated to dominate the market for branded food staples. A substantial portion of the population in North America has a variety of food preferences.

A significant demand for branded food staples is provided by the region's numerous and varied consumers, enabling brands to innovate and satisfy a wide range of tastes and preferences. Due to their busy lifestyles, North American consumers frequently seek more convenient food options.

The market for branded convenience food staples, such as ready-to-eat meals, meal kits, and on-the-go snacks, is driven by this need. The people of the United States are very diverse, and they have a big desire for many kinds of food. This market is accessible to companies with a wide selection of goods with an international flair.

Sales in Asia Pacific to Soar High

The region with the fastest-growing branded food staple market is expected to be Asia Pacific. The increasing middle class in the region demands higher-quality, branded food staples and more spending income. This group frequently favours branded goods since they are thought to be of higher quality and safety.

The various and extensive culinary traditions of the Asia-Pacific region are well-known. Food staples from brands that use real regional and ethnic flavours can be popular with consumers.

Consumers in India are beginning to place more importance on health and fitness. Brands that sell healthy food staples, such as low-fat, low-sugar, organic, and gluten-free items, are growing in popularity.

Fairfield’s Competitive Landscape Analysis

The market for branded food essentials is consolidating and has fewer well-known companies. In a drive to expand globally, the major corporations are launching new products and modernising their distribution networks. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Branded Food Staple Space?

- Nestlé

- Kraft Heinz Company

- General Mills Inc.

- The Kellogg Company

- Unilever

- Mars Incorporated

- The Coca-Cola Company

- PepsiCo Inc.

- Mondelez International Inc.

- Archer Daniels Midland Company

- Conagra Brands

- The J.M. Smucker Company

- McCormick & Company

- Hormel Foods Corporation

- The Campbell Soup Company

Significant Company Developments

New Product Launches

- March 2022: The latest generation of maize rootworm (CRW) trait technology, Vorceed Enlist maize, has been launched by Corteva Agriscience. More alternatives than any other seed corn product will be available to farmers to manage CRW acres.

- June 2022: 'INH 16019', a hybrid rice seed with built-in resistance to Brown Plant Hopper and bacterial Leaf Blight (BLB), was released by the Bayer firm in Bangladesh.

- October 2021: Tyson Foods, Inc. launched air-fried chicken bits with 35% less calories and 75% less fat. These are Parmesan Chicken Bites, and Spicy Chicken Bites. This allowed the business to increase the number of packaged food products it offers in the U.S. market.

Distribution Agreements

- January 2022: Bunge, and UPL Limited reached an agreement wherein Bunge would collaborate with UPL Limited and purchase a 33% stake from Sinagro in order to enhance its grain direction strategy in Brazil. Sinagro primarily focuses on providing external support to agricultural producers and end users in Brazil's "Cerrado" Savanna regions. This partnership will also broaden both companies' global markets and boost their combined profitability.

- April 2020: The online retailer Flipkart has a partnership with Tata Consumer Products Limited (Tata Sampann). As a result of this relationship, a new method of delivery for necessities like Tata Sampann spices, pulses, and beverages like Tata Tea was established.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, building trust and awareness through consistent branding. Customers are more likely to select goods from well-known, trustworthy brands, which encourages repeat business and market growth.

Furthermore, Advertising, promotions, and social media are just some of the marketing strategies used to spread the word about and spark interest in branded everyday foods. Promotions and discounts can provide purchase incentives and market expansion.

However, the branded food staple market is expected to face considerable challenges because of price sensitivity.

Supply and Demand Side of the Market

According to our analysis, North America is the largest region across the globe for branded food staples, with a supply of more than 150 million tonnes. The primary branded food staples distributed in the area include bread, rice, pasta, and dairy products.

Asia follows the suit, with a supply of more than 2.7 billion tonnes. China, and India are the two main suppliers in the region. The main branded food staples distributed in the area are rice, wheat, rice, and dairy products.

Major multinational corporations like Nestlé, Unilever, and PepsiCo are the primary suppliers in the global market for branded food staples. These businesses offer a wide variety of products and have a global presence. They can also make significant marketing and branding investments.

China is the largest consumer of branded food staples due to the large population growth and improving standard of living in the area.

Global Branded Food Staple Market is Segmented as Below:

By Product Type:

- Grains

- Pulses

- Spices

- Value Added

- Others

By Distribution Channel:

- B2B

- B2C

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Branded Food Staple Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Branded Food Staple Market Outlook, 2018 - 2030

3.1. Global Branded Food Staple Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Grains

3.1.1.2. Pulses

3.1.1.3. Spices

3.1.1.4. Value Added

3.1.1.5. Others

3.2. Global Branded Food Staple Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. B2B

3.2.1.2. B2C

3.3. Global Branded Food Staple Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Branded Food Staple Market Outlook, 2018 - 2030

4.1. North America Branded Food Staple Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Grains

4.1.1.2. Pulses

4.1.1.3. Spices

4.1.1.4. Value Added

4.1.1.5. Others

4.2. North America Branded Food Staple Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. B2B

4.2.1.2. B2C

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Branded Food Staple Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Branded Food Staple Market Outlook, 2018 - 2030

5.1. Europe Branded Food Staple Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Grains

5.1.1.2. Pulses

5.1.1.3. Spices

5.1.1.4. Value Added

5.1.1.5. Others

5.2. Europe Branded Food Staple Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. B2B

5.2.1.2. B2C

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Branded Food Staple Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Branded Food Staple Market Outlook, 2018 - 2030

6.1. Asia Pacific Branded Food Staple Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Grains

6.1.1.2. Pulses

6.1.1.3. Spices

6.1.1.4. Value Added

6.1.1.5. Others

6.2. Asia Pacific Branded Food Staple Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. B2B

6.2.1.2. B2C

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Branded Food Staple Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Branded Food Staple Market Outlook, 2018 - 2030

7.1. Latin America Branded Food Staple Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Grains

7.1.1.2. Pulses

7.1.1.3. Spices

7.1.1.4. Value Added

7.1.1.5. Others

7.2. Latin America Branded Food Staple Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. B2B

7.2.1.2. B2C

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Branded Food Staple Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Branded Food Staple Market Outlook, 2018 - 2030

8.1. Middle East & Africa Branded Food Staple Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Grains

8.1.1.2. Pulses

8.1.1.3. Spices

8.1.1.4. Value Added

8.1.1.5. Others

8.2. Middle East & Africa Branded Food Staple Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. B2B

8.2.1.2. B2C

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Branded Food Staple Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Branded Food Staple Market by Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Branded Food Staple Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Product Type Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Nestlé

9.4.1.1. Company Overview

9.4.1.2. Product Type Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Kraft Heinz Company

9.4.2.1. Company Overview

9.4.2.2. Product Type Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. General Mills Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Type Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. The Kellogg Company

9.4.4.1. Company Overview

9.4.4.2. Product Type Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Unilever

9.4.5.1. Company Overview

9.4.5.2. Product Type Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Mars Incorporated

9.4.6.1. Company Overview

9.4.6.2. Product Type Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. The Coca-Cola Company

9.4.7.1. Company Overview

9.4.7.2. Product Type Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. PepsiCo Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Type Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Mondelez International Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Type Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Archer Daniels Midland Company

9.4.10.1. Company Overview

9.4.10.2. Product Type Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Conagra Brands

9.4.11.1. Company Overview

9.4.11.2. Product Type Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. The J.M. Smucker Company

9.4.12.1. Company Overview

9.4.12.2. Product Type Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. McCormick & Company

9.4.13.1. Company Overview

9.4.13.2. Product Type Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Hormel Foods Corporation

9.4.14.1. Company Overview

9.4.14.2. Product Type Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. The Campbell Soup Company

9.4.15.1. Company Overview

9.4.15.2. Product Type Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |