Carbon Dioxide Utilization Market Growth and Industry Forecast

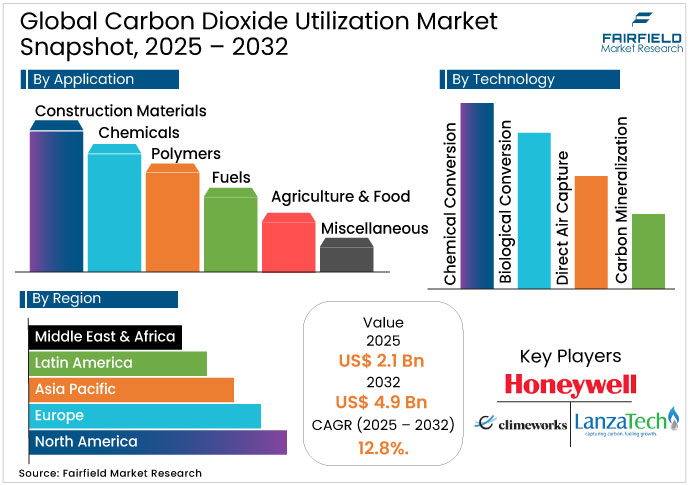

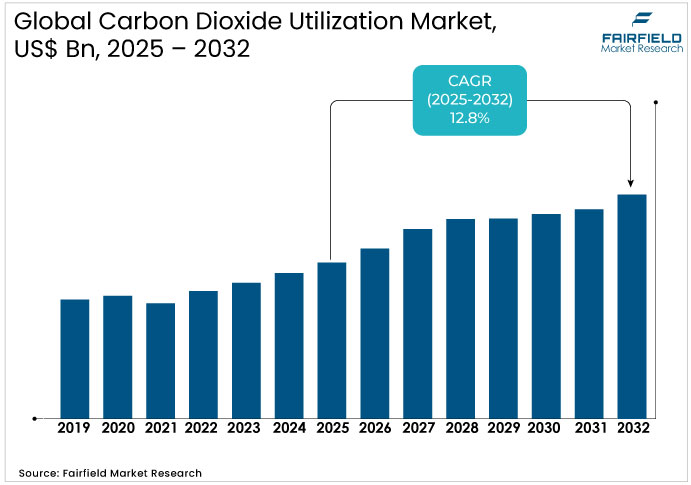

The Carbon Dioxide Utilization Market is valued at USD 2.1 billion in 2025 and is projected to reach USD 4.9 billion by 2032, growing at a CAGR of 12.8%.

Carbon Dioxide Utilization Market Summary: Key Insights & Trends

- Chemical Conversion leads the market with about 75% share, driven by mature CO₂ hydrogenation processes for methanol and syngas production.

- Direct Air Capture is the fastest-growing technology, leveraging modular sorbents and corporate net-zero pledges for scalable carbon removal.

- Chemicals dominate with roughly 60% share, as CO₂-derived methanol and urea gain adoption across fertilizers and plastics manufacturing.

- Fuels emerge as the fastest-growing application, supported by rising use of CO₂-based sustainable aviation fuel and e-diesel.

- Global climate policies such as the EU ETS and U.S. 45Q tax credit continue to accelerate industrial CO₂ utilization adoption.

- Integration of CO₂ utilization with green hydrogen presents a major opportunity for carbon-neutral fuel and chemical production.

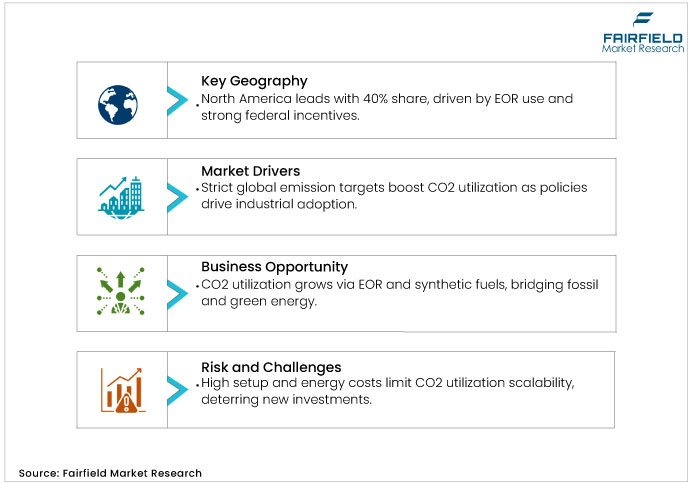

- North America holds the largest regional share (~40%) through robust EOR activity and strong federal support for carbon capture projects.

- Asia Pacific is the fastest-growing regional market, driven by industrial CO₂ reuse in China, biofuel initiatives in India, and polymer innovations in Japan.

Key Growth Drivers

- Global Climate Policies Accelerate CO₂ Utilization Adoption Across Industrial Sectors

Governments worldwide enforce rigorous emission reduction targets, compelling industries to adopt CO2 utilization technologies to comply with frameworks such as the Paris Agreement. For instance, the European Union's Emissions Trading System imposes carbon pricing that incentivizes CO2 reuse, while the U.S. Inflation Reduction Act extends tax credits under Section 45Q for utilization projects, potentially unlocking billions in investments. These policies drive adoption by making non-compliance cost-prohibitive, as evidenced by a 2023 report from the International Energy Agency (IEA) indicating that regulatory compliance accounts for over 40% of CCUS project initiations globally. This translates to accelerated deployment, particularly in energy-intensive sectors, where firms leverage utilization to offset penalties and enhance corporate sustainability profiles. The causal link between policy enforcement and market entry is clear: without such mandates, utilization pathways would lag behind traditional disposal methods.

- Growing Need for Low-Carbon Materials Drives Expansion of CO₂-Derived Products

Industries such as chemicals and construction increasingly seek low-carbon alternatives, fueling the Carbon Dioxide Utilization Market through demand for CO2-derived products such as methanol and carbonated aggregates. The global chemicals sector, responsible for 5-7% of total emissions, turns to utilization to meet net-zero pledges, with projections showing a 25% rise in sustainable feedstock demand by 2030 from the World Economic Forum. This driver stems from supply chain pressures, where consumer-facing brands prioritize eco-friendly sourcing, directly boosting utilization economics. For example, polymer manufacturers integrate CO2 to reduce fossil input dependency, yielding cost savings of up to 15% in raw materials over time. Theoretically, this shift embodies circular economy principles, where waste becomes input, fostering resilience against volatile fossil prices and embedding long-term value.

Key Restraints

- Rising Setup and Energy Costs Limit Scalability of CO₂ Utilization Projects

Initial setup costs for CO2 utilization facilities, including capture infrastructure, deter widespread adoption with projects often exceeding USD 500 million per site according to DOE estimates. Operational hurdles, such as energy-intensive conversion steps, add 20-30% to ongoing expenses, straining smaller enterprises. This restraint hampers scalability, particularly in developing economies, where financing gaps widen the adoption divide.

- CO₂ Purity Issues and Catalyst Shortages Hinder Utilization Process Efficiency

Inconsistent CO2 purity from diverse sources complicates conversion processes in the Carbon Dioxide Utilization Market, requiring additional purification that inflates costs by 10-15% as noted in IEA analyses. Supply chain bottlenecks for catalysts and hydrogen co-reactants further impede progress, fostering dependency on volatile global markets and slowing deployment timelines.

Carbon Dioxide Utilization Market Trends and Opportunities

- EOR and CO₂-Based Synthetic Fuels Create Billion-Dollar Market Potential

The Carbon Dioxide Utilization Market stands to benefit from heightened EOR applications, where injected CO2 boosts oil yields by 10-20% in mature fields, per U.S. Geological Survey data. With global oil demand persisting amid energy transitions, this opportunity arises from policy incentives such as the 45Q credit, valued at USD 50 per ton, potentially injecting USD 1-2 billion into projects by 2030. Theoretically, EOR bridges fossil and renewable paradigms, utilizing CO2 to extend hydrocarbon life while funding low-carbon tech. In the carbon dioxide utilization industry, synthetic fuel production from CO2 and green hydrogen could displace 5% of diesel imports in aviation, as projected by the IEA, creating a USD 50 billion sub-market by 2032 through decarbonized supply chains.

- CO₂ Utilization Coupled with Green Hydrogen Accelerates Carbon-Neutral Fuel Growth

Pairing CO2 utilization with electrolyzer-based hydrogen production unlocks opportunities in the market by enabling carbon-neutral fuels and chemicals. As solar and wind costs fall 85% since 2010, excess renewables power electrolysis affordably, reducing synthesis costs by 40%. This synergy, evidenced by DOE pilots yielding 90% efficiency, theoretically amplifies circularity, turning intermittent energy into storable products. For the market, it implies a 15-20% CAGR in fuel applications, driven by mandates such as the EU's Renewable Energy Directive, fostering investments exceeding USD 200 billion globally and positioning utilization as a linchpin in energy system resilience.

Segment-wise Trends & Analysis

- Chemical Conversion Dominates as Direct Air Capture Gains Rapid Global Momentum

Chemical Conversion commands approximately 75% market share in 2025, valued at US$ 1.575 billion, dominating due to its maturity in producing syngas and acids from CO2 hydrogenation. This segment's leadership stems from established catalytic processes, widely adopted in petrochemical hubs for their high throughput and compatibility with existing refineries. Competitive positioning favors incumbents such as ExxonMobil, which leverage integrated assets to minimize logistics costs, outpacing newcomers in volume efficiency.

Direct Air Capture emerges as the fast-growing segment, projected to surge at over 20% CAGR through 2032, driven by atmospheric sourcing for premium, verifiable credits. Innovations in modular sorbents lower energy needs, enabling deployment in remote sites and aligning with corporate net-zero pledges. Underpinning this trajectory are falling costs—from $600 to under $200 per ton by 2030—and policy tailwinds such as EU ETS expansions.

- Chemicals Lead Utilization Market While CO₂-Based Fuels Show Accelerated Growth

Chemicals lead with ~60% share in 2025, equating to US$1.26 billion, anchored by CO2-derived methanol and urea essential for fertilizers and resins. This dominance arises from volume-driven economics in agriculture, where utilization substitutes fossil carbon, stabilizing supply amid volatility. Key players such as Linde secure positioning through global supply networks, ensuring just-in-time delivery and cost leadership over fragmented rivals.

Fuels represent the emerging powerhouse, forecasted for an 18% CAGR to 2032, propelled by e-diesel and sustainable aviation fuels meeting ICAO mandates. Drivers include oil majors' pivot to low-carbon blends, with CO2-to-jet pathways reducing lifecycle emissions by 80%. TotalEnergies exemplifies a competitive edge via refinery retrofits, blending utilization with refining expertise to undercut grey fuel prices. This segment's ascent reshapes energy markets, favoring agile innovators over traditional drillers.

Regional Trends & Analysis

North America Leads Global CO₂ Utilization with Strong EOR and Policy Support

North America leads the Carbon Dioxide Utilization Market, capturing ~40% global share in 2025, bolstered by robust EOR applications and federal incentives that subsidize capture costs by up to 30%. Trends emphasize shale gas pairing, where CO2 utilization enhances recovery rates amid a 15% domestic production rise, as reported by the U.S. Energy Information Administration. This region's maturity fosters innovation hubs, though supply chain localization pressures could accelerate domestic tech adoption.

U.S. Carbon Dioxide Utilization Market – 2025 Snapshot & Outlook

The U.S. market thrives on EOR dominance, accounting for 75% of global capacity, with Permian Basin projects injecting 18 million tons annually to boost oil yields by 12%. Government policies such as the 45Q tax credit, extended via the Inflation Reduction Act, deliver $85 per ton incentives, improving project IRRs by 20% and spurring 50 new facilities by 2030. A key consumer trend reveals 68% of energy executives prioritizing CCUS for compliance, based on a 2024 Deloitte survey. Margin advantages accrue from low-cost CO2 sources in Midwest hubs, enabling 15% cost edges over imports.

This outlook projects a sustainable CAGR through 2032, as hydrogen blending emerges, supported by DOE's $8 billion hydrogen hubs initiative that integrates utilization for net-zero aviation fuels. Retail shifts toward blended synthetics in trucking further demand, with EPA regulations mandating 10% low-carbon fuels by 2028, per regulatory filings.

Asia Pacific Emerges as Fastest-Growing Region in CO₂ Utilization Market

Asia Pacific accelerates in the Carbon Dioxide Utilization Market as the fastest-growing region, with industrial output up 3.6% in 2022, channelling CO2-to-chemicals amid urbanization. Japan and South Korea pioneer tech exports, while India's biofuel mandates drive agricultural uses; China's shale ambitions amplify EOR opportunities.

Japan Carbon Dioxide Utilization Market – 2025 Snapshot & Outlook

Japan's market focuses on polymer enhancements, where CO2-infused materials cut emissions by 25%, aligning with the nation's 46% reduction target by 2030 under METI guidelines. Supportive policies include JPY 100 billion in R&D grants, yielding 18% ROI for conversion projects and fostering alliances such as Mitsubishi's syngas pilots. A survey by the Japan Carbon Capture Association indicates 72% industry adoption intent for utilization in electronics. Tax incentives on green imports provide 10% margin boost.

India Carbon Dioxide Utilization Market – 2025 Snapshot & Outlook

India's market leverages agriculture, with CO2-derived fertilizers boosting crop yields by 20% in pilot farms, supporting the National Biofuel Policy's 20% blending goal. GST exemptions on CCUS equipment slash costs by 12%, enhancing viability in fertilizer hubs such as Uttar Pradesh. Consumer trends show 65% farmers favoring sustainable inputs. Government subsidies via the PLI scheme inject US$2.4 billion, improving margins amid rising urea imports.

Europe Strengthens CO₂ Utilization Through Green Deal and Cross-Border Collaboration

Europe advances the Carbon Dioxide Utilization Market through the Green Deal, investing €1 trillion to decarbonize chemicals, with trends toward cross-border pipelines linking emitters to utilization sites. Germany's industrial clusters lead, while the U.K. emphasizes fuels post-Brexit.

Germany Carbon Dioxide Utilization Market – 2025 Snapshot & Outlook

Germany's market centers on chemical recycling, where CO2-to-methanol plants offset 5 million tons yearly, aiding the 65% emission cut by 2030. EEG levies provide €200 per ton credits, lifting project economics by 22% and spurring BASF-led hubs. A 2024 Eurostat survey notes 70% manufacturers shifting to circular feedstocks. Policy-driven R&D grants ensure 12% cost advantages in polymer production.

U.K. Carbon Dioxide Utilization Market – 2025 Snapshot & Outlook

The U.K.'s market prioritizes EOR in the North Sea, recovering 10% additional reserves via CO2 injection, aligning with net-zero by 2050. Contracts for Difference offer £100 per ton, boosting IRRs by 15% for offshore projects. UK Energy Research Centre surveys reveal 62% oil firms committing to CCUS. Tax relief on capex yields 8% margin gains.

Competitive Landscape Analysis

The players in the Carbon Dioxide Utilization Market are focusing on strategic partnerships to accelerate technology commercialization. This approach mitigates R&D risks while pooling resources for scale-up, as seen in 40 new CCUS alliances by mid-2025. Such collaborations enable shared infrastructure, reducing individual capex by 25%, and align with global standards for verifiable credits. Venture financing hit record highs in H1 2025, underscoring investor bets on integrated solutions.

Rising raw material costs and evolving regulations will reshape capacities, with M&A activity consolidating supply chains. New EU mandates for 20% utilization in chemicals by 2030 demand agile adaptations, potentially hiking compliance expenses by 10-15%. Early movers will benefit from locked-in subsidies and market premiums, while latecomers may face saturated niches and higher entry barriers.

Key Companies

- Honeywell International Inc

- LanzaTech Inc.

- Climeworks AG

- TotalEnergies SE

- Hitachi, Ltd.

- ExxonMobil Corporation

- Linde plc

- Carbon Recycling International

- Carbon Engineering

- Royal Dutch Shell Plc

- Mitsubishi Heavy Industries, Ltd

- JGC Holdings Corporation

- General Electric

- CarbonCure Technologiesḍ

Recent Developments:

- February 2025: Honeywell and AM Green signed an MoU at India Energy Week 2025 to assess producing sustainable aviation fuel (SAF) from ethanol, green methanol from CO₂ emissions, and green hydrogen. The study is expected to conclude by mid-2025, aligning with India’s energy-security and SAF-blending goals.

- August 2025: LanzaTech Global reported Q2 2025 revenue of USD 9.1 million (down from US$ 17.4 million in Q2 2024) and a net loss of US$ 32.5 million. The company received a £6.4 million UK government grant for its Project DRAGON SAF plants and is restructuring to improve efficiency and focus on SAF growth.

- June/July 2025: Climeworks secured US$ 162 million in equity funding, the largest carbon-removal investment globally in 2025 to date, bringing its total funding to over US$ 1 billion. The financing, led by BigPoint Holding and Partners Group, will accelerate the scaling of its direct-air-capture (DAC) technology and expand its carbon-removal portfolio.

Global Carbon Dioxide Utilization Market Segmentation-

By Technology

- Chemical Conversion

- Biological Conversion

- Direct Air Capture

- Carbon Mineralization

By Application

- Construction Materials

- Chemicals

- Polymers

- Fuels

- Agriculture & Food

- Miscellaneous

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Carbon dioxide utilization Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics (If Applicable)

3.1. Global Carbon dioxide utilization Production, 2019 - 2025

4. Price Trends Analysis and Future Projects, 2019 - 2032 (If Applicable)

4.1. Global Average Price Analysis, by Technology, US$ per Kg

4.2. Prominent Factors Affecting Carbon dioxide utilization Prices

4.3. Global Average Price Analysis, by Region, US$ per Kg

5. Global Carbon dioxide utilization Market Outlook, 2019 - 2032

5.1. Global Carbon Dioxide Utilization Market Outlook, by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Chemical Conversion

5.1.1.2. Biological Conversion

5.1.1.3. Direct Air Capture

5.1.1.4. Carbon mineralization

5.2. Global Carbon Dioxide Utilization Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Construction Materials

5.2.1.2. Chemicals

5.2.1.3. Polymers

5.2.1.4. Fuels

5.2.1.5. Agriculture & Food

5.2.1.6. Misc.

5.3. Global Carbon Dioxide Utilization Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Carbon Dioxide Utilization Market Outlook, 2019 - 2032

6.1. North America Carbon Dioxide Utilization Market Outlook, by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Chemical Conversion

6.1.1.2. Biological Conversion

6.1.1.3. Direct Air Capture

6.1.1.4. Carbon mineralization

6.2. North America Carbon Dioxide Utilization Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Construction Materials

6.2.1.2. Chemicals

6.2.1.3. Polymers

6.2.1.4. Fuels

6.2.1.5. Agriculture & Food

6.2.1.6. Misc.

6.2.2. Market Attractiveness Analysis

6.3. North America Carbon Dioxide Utilization Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. U.S. Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.1.2. U.S. Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.1.3. Canada Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.1.4. Canada Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Carbon Dioxide Utilization Market Outlook, 2019 - 2032

7.1. Europe Carbon Dioxide Utilization Market Outlook, by Service, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.2. Europe Carbon Dioxide Utilization Market Outlook, by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Chemical Conversion

7.2.1.2. Biological Conversion

7.2.1.3. Direct Air Capture

7.2.1.4. Carbon mineralization

7.3. Europe Carbon Dioxide Utilization Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Construction Materials

7.3.1.2. Chemicals

7.3.1.3. Polymers

7.3.1.4. Fuels

7.3.1.5. Agriculture & Food

7.3.1.6. Misc.

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Carbon Dioxide Utilization Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Germany Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.2. Germany Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.3. U.K. Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.4. U.K. Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.5. France Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.6. France Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.7. Italy Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.8. Italy Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.9. Turkey Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.10. Turkey Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.11. Russia Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.12. Russia Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.13. Rest of Europe Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.1.14. Rest of Europe Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Carbon Dioxide Utilization Market Outlook, 2019 - 2032

8.1. Asia Pacific Carbon Dioxide Utilization Market Outlook, by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Chemical Conversion

8.1.1.2. Biological Conversion

8.1.1.3. Direct Air Capture

8.1.1.4. Carbon mineralization

8.2. Asia Pacific Carbon Dioxide Utilization Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Construction Materials

8.2.1.2. Chemicals

8.2.1.3. Polymers

8.2.1.4. Fuels

8.2.1.5. Agriculture & Food

8.2.1.6. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Carbon Dioxide Utilization Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. China Carbon Dioxide Utilization Market Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.2. China Carbon Dioxide Utilization Market Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.3. Japan Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.4. Japan Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.5. South Korea Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.6. South Korea Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.7. India Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.8. India Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.9. Southeast Asia Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.10. Southeast Asia Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.11. Rest of Asia Pacific Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.1.12. Rest of Asia Pacific Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Carbon Dioxide Utilization Market Outlook, 2019 - 2032

9.1. Latin America Carbon Dioxide Utilization Market Outlook, by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Chemical Conversion

9.1.1.2. Biological Conversion

9.1.1.3. Direct Air Capture

9.1.1.4. Carbon mineralization

9.2. Latin America Carbon Dioxide Utilization Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Construction Materials

9.2.1.2. Chemicals

9.2.1.3. Polymers

9.2.1.4. Fuels

9.2.1.5. Agriculture & Food

9.2.1.6. Misc.

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Carbon Dioxide Utilization Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Brazil Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.2. Brazil Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.3. Mexico Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.4. Mexico Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.5. Rest of Latin America Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.1.6. Rest of Latin America Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Carbon Dioxide Utilization Market Outlook, 2019 - 2032

10.1. Middle East & Africa Carbon Dioxide Utilization Market Outlook, by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.1.1. Key Highlights

10.1.1.1. Chemical Conversion

10.1.1.2. Biological Conversion

10.1.1.3. Direct Air Capture

10.1.1.4. Carbon mineralization

10.2. Middle East & Africa Carbon Dioxide Utilization Market Outlook, by Application, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.2.1. Key Highlights

10.2.1.1. Construction Materials

10.2.1.2. Chemicals

10.2.1.3. Polymers

10.2.1.4. Fuels

10.2.1.5. Agriculture & Food

10.2.1.6. Misc.

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Carbon Dioxide Utilization Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1. Key Highlights

10.3.1.1. GCC Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.2. GCC Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.3. South Africa Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.4. South Africa Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.5. Rest of Middle East & Africa Carbon Dioxide Utilization Market by Technology, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.1.6. Rest of Middle East & Africa Carbon Dioxide Utilization Market End-user, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2032

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2025

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Honeywell International Inc.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. LanzaTech Inc.

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. TotalEnergies SE

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Hitachi Ltd.

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. ExxonMobil Corporation

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Linde Plc

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Climeworks AG

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Carbon Recycling International

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Carbon Engineering

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Royal Dutch Shell Plc

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Mitsubishi Heavy Industries, Ltd.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. JGC Holdings Corporation

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. General Electric

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. CarbonCure Technologies

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Bn |

||

|

REPORT FEATURES |

DETAILS |

|

Technology Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Production Output, Trade Statistics, Price Trend Analysis, Competition Landscape, Grade-, Application-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply), Key Market Trends |