Global Carbon Fiber Market

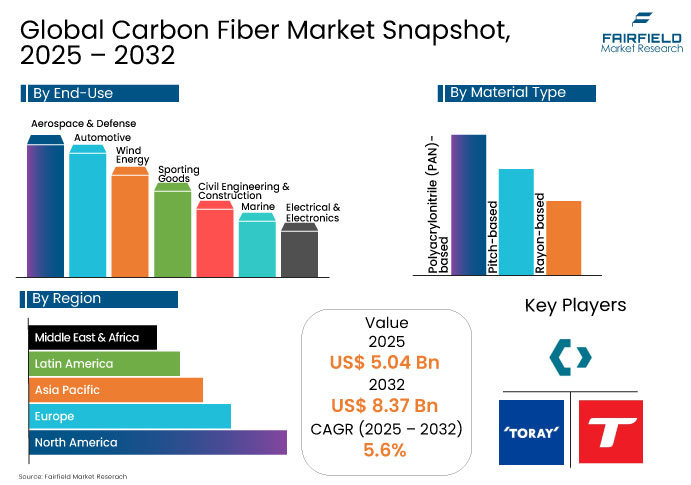

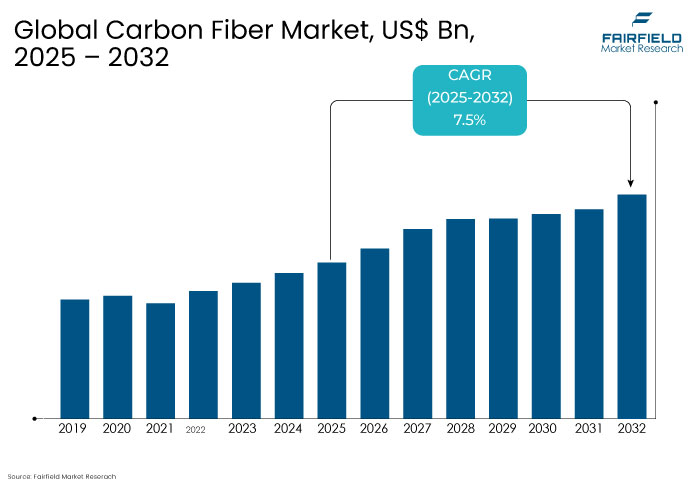

- The Carbon Fiber Market is valued at USD 5.9 Bn in 2026 and is projected to reach USD 13.6 Bn, growing at a CAGR of 13% by 2033.

Carbon Fiber Market Insights

- Aerospace and defense account for 34.5% of the market share, fueled by lightweight engineering needs.

- High-strength fibers are being adopted in electric air mobility and lunar rover missions, driving innovation.

- Wind capacity reached 1,173.6 GW in 2024, creating significant opportunities for high-performance composites.

- EV market growth is boosting demand for lightweight, sustainable carbon fiber solutions. New recycled composite partnerships, like Syensqo and Vartega, meet OEM needs for emissions compliance.

- Companies like HS Hyosung and Mitsubishi Chemical are pioneering bio-based PAN and recycling tech. These advancements aim to reduce emissions by up to 25%, aligning with global net-zero targets.

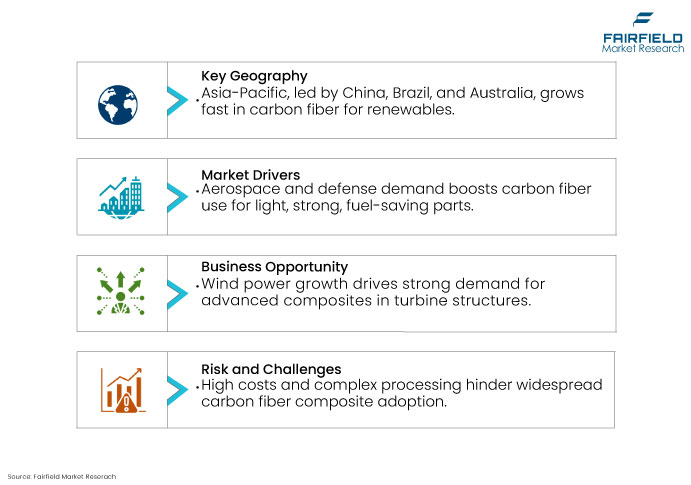

- China, Japan, and South Korea lead due to expanding EV production and wind power projects. China alone produces 70% of global EVs, intensifying regional demand for carbon fiber components.

A Look Back and a Look Forward- Comparative Analysis

Over the past decade, the market has evolved from niche aerospace and defense applications to a broader spectrum including automotive, wind energy, and consumer electronics. This shift has been driven by increasing demands for lightweight, high-strength materials amid rising sustainability concerns. Manufacturers have also invested heavily in production efficiency, automation, and recycling technologies, lowering costs and improving scalability. Collaborations and acquisitions have further enabled global expansion and innovation across the value chain.

Looking ahead, the focus is shifting toward greener production methods, bio-based raw materials, and circular economy integration. Regulatory pressures, such as the EU’s Ecodesign directives, are compelling companies to enhance traceability and environmental compliance. With electric mobility and renewable energy infrastructure gaining momentum, demand is poised to grow rapidly. The next phase will likely prioritize sustainability, regional capacity expansion, and strategic partnerships to secure long-term competitiveness.

Key Growth Determinants

- Soaring Demand from Aerospace and Defense Spurs Composite Advancements

The aerospace and defence industry is experiencing rapid expansion, directly fueling demand for lightweight and high-strength materials like carbon fiber. In 2025, global airline traffic is projected to surpass 5.22 billion passengers, while commercial and defense aerospace sales in the U.S. crossed $955 billion in 2023. With rising aircraft production and the push for fuel efficiency, manufacturers are increasing the use of advanced composites to reduce operating costs and emissions.

To meet growing expectations, key suppliers such as Hexcel and Syensqo have unveiled new high-performance materials that simplify large-scale composite manufacturing. Innovations like HexTow® IM9 24K and HexForce® 1K support faster, automated production for next-gen aircraft, including electric air mobility vehicles. These developments indicate a clear trend that the aerospace sector is not just recovering but scaling, and composite materials are essential to its next phase of growth.

- Innovation and Circularity Transform the Composite Market Landscape

A wave of technological breakthroughs and sustainability-focused partnerships is reshaping the future of advanced composites. Companies such as Toray and Hexcel are investing in nano-engineered materials, like the Torayca M46X, which improves strength by 20% while maintaining a high modulus.

Firms are exploring newer applications in hydrogen production and membrane technologies, enhancing the strategic value of high-performance fibers.

Circularity is gaining traction, with players like Mitsubishi Chemical and Hexcel forming long-term recycling alliances to convert composite waste into reusable materials. Fairmat’s facility near Hexcel’s Salt Lake City site is a prime example of this shift. As regulations tighten and industries move toward net-zero targets, sustainable alternatives and closed-loop production models are positioning advanced composites as the cornerstone of future-ready engineering.

Key Growth Barriers

- High Production Costs Hamper Wider Adoption

Producing advanced composite materials involves energy-intensive processes and expensive raw materials such as PAN (polyacrylonitrile). Manufacturers must maintain strict quality control standards, which further elevate costs. These financial barriers make it difficult for cost-sensitive industries, such as automotive or construction, to integrate these lightweight reinforcements at scale.

Even with growing demand across sectors, affordability remains a key challenge. Suppliers struggle to reduce per-unit costs without compromising performance. Until innovation significantly cuts expenses, widespread usage across mid- and low-tier applications will remain limited.

Market Opportunity

- Surge in Wind Power Expansion Unlocks Material Demand Across Global Turbine Infrastructure

Soaring wind power installations worldwide, led by China’s 86.7 GW and Brazil’s 19% year-over-year growth, are rapidly increasing demand for advanced materials that deliver strength, lightweight performance, and fatigue resistance.

With global wind capacity now at 1,173.6 GW and over 121 GW added in 2024 alone, turbine blade manufacturers are under growing pressure to enhance efficiency and reduce lifecycle costs. This surge presents a major opening for high-performance composites with superior tensile strength and reduced weight to replace conventional materials in nacelles, blades, and other structural components across both onshore and offshore projects.

Emerging wind markets such as Brazil, Australia, and Finland, each reporting annual growth rates above 18%, are scaling up next-generation turbine manufacturing, intensifying the need for resilient and lightweight reinforcements. As countries such as Denmark, Uruguay, and over 30 others derive more than 10% of their electricity from wind, the need for durable, low-maintenance materials is growing. Composites with low density and high stiffness offer a compelling solution to enhance load-bearing structures, reduce installation time, and improve power-to-weight ratios, making them indispensable to meet the structural demands of modern wind farms globally.

Market Trend

- Surge in Demand for Lightweight Recyclables in Automotive Spurs Composite Innovation

The increasing pressure to decarbonize the automotive sector is rapidly accelerating the adoption of lightweight and sustainable materials. In 2024, global car sales climbed to 74.6 million units, up 2.5% from 2023, with particularly strong growth in markets like Brazil (12.5%) and India (4.8%).

As automakers intensify their focus on electrification and emissions targets, the demand for structural components that are both strong and low in weight has surged. This has opened new market opportunities for advanced recycled materials, especially in high-volume segments like dampening rings, transmission systems, and automotive frames. The latest collaboration between Syensqo and Vartega announced in March 2025, capitalizes on this shift by transforming production scrap into performance-ready, post-industrial composite bundles tailored for such applications.

The alliance harnesses Vartega’s EasyFeed Bundles™, derived from Syensqo’s North American manufacturing scrap, and channels them into the ECHO portfolio known for its use in automotive-grade specialty polymers. These materials not only reduce CO₂ emissions but also maintain performance benchmarks essential for demanding automotive functions.

The partnership is strategic amid Europe’s car registration recovery (0.8% rise in 2024) and North America’s 3.8% sales increase, underscoring growing reliance on sustainable materials to meet evolving regulatory and efficiency standards. As regional players face pressures to balance cost, durability, and emissions goals, these next-generation composites are becoming a crucial differentiator for OEMs navigating post-pandemic recovery and electrification trends.

- Circular Manufacturing Gains Ground Amid Green Construction Push

Global building operations and materials production generated nearly 10 gigatonnes of CO₂ in 2022, reinforcing urgent calls for low-impact solutions in construction. As governments and industries strive to meet net-zero targets by 2030 for new buildings, and by 2050 for existing stock, there's a surge in demand for sustainable materials that can lower embodied emissions. Acknowledging this opportunity, Formosa Plastics announced a NT$2 billion investment in March 2025 to expand its annual composite output by 1,600 tons.

In tandem, the company formed a joint venture with Shangwei to deliver thermoplastic composites for sectors like wind energy and eco-conscious mobility, sectors aligned with global decarbonization pathways.

In another notable development, Formosa Plastics collaborated with Taiwan Textile Research Institute to engineer a nonwoven composite integrating recycled fibers with polycarbonate. This material enables reshaping without additional resins, thus reducing CO₂ emissions, cycle times, and production costs. With the construction sector consuming 34% of total energy and contributing over 3.7 gigatonnes of emissions through cement, steel, and glass use alone, such innovations signal a turning point. As building codes tighten and decarbonization investments peaking at US$285 billion in 2022 face budget constraints, these next-gen materials offer a scalable solution for both sustainability and cost-efficiency in global construction projects.

Segments Covered in the Report

- PAN’s Dominance Strengthens with Breakthrough in Sustainable Bio-Based Raw Materials

Polyacrylonitrile (PAN) dominates the raw material landscape with a commanding market share of 94.2%, primarily driven by its superior strength, durability, and versatility across high-performance applications.

On April 21, 2024, HS Hyosung Advanced Materials announced a breakthrough by investing in U.S. startup Trillium, which successfully polymerized bio acrylonitrile (ACN) into 100% bio-based aerospace-grade PAN. This innovation replaces traditional petroleum-based raw materials with renewable bio-based sources, potentially cutting carbon emissions by 15-25%. The development supports HS Hyosung’s sustainability goals and broadens its product offerings across automotive, aerospace, energy, and consumer goods sectors.

- Aerospace and Defense Sector Drives Advanced Composites Growth Through Lightweight Engineering and Sustainable Supply Chain Initiatives

The aerospace and defense industry commands a 34.5% market share, fueled by growing demand for lightweight, high-strength materials in critical applications. Companies continue to invest in cutting-edge composite innovations to meet performance expectations in aviation and space missions. On March 17, 2025, Mitsubishi Chemical Group supported Japan’s first private lunar rover mission, YAOKI, by supplying ultra-light and rigid composites that enabled successful image capture and data transmission from the moon. On March 5, 2024, Hexcel Corporation launched its HexTow® IM9 24K fiber at JEC World, offering a 12% increase in tensile strength over its predecessor for use in aircraft structures.

To meet the rising needs of the U.S. defense sector, Toray Composite Materials America expanded its TORAYCA™ T1100 production line with a $15 million investment in January 2024. This expansion doubled output and enhanced supply chain resilience for defense programs like Future Vertical Lift. Teijin Limited advanced supply chain transparency on April 10, 2025, by collaborating with Circularise B.V. to roll out Digital Product Passport (DPP) technology. Teijin began integrating DPP into its advanced fiber materials, allowing traceability and supporting sustainable procurement in compliance with EU regulations. These efforts reflect the sector's dual focus on innovation and sustainability.

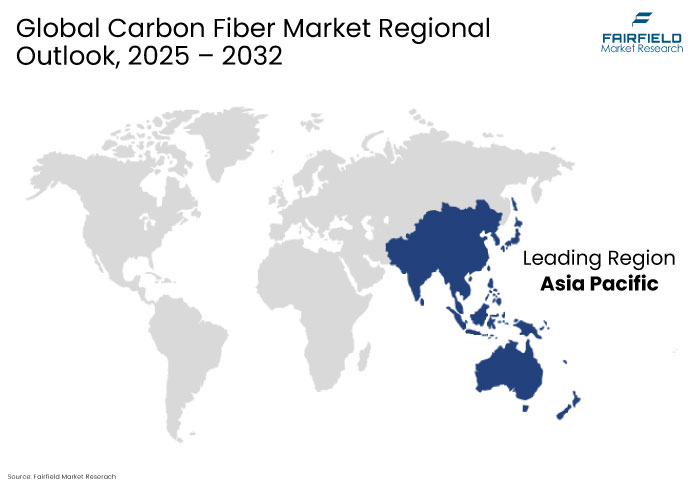

Regional Analysis

- Dominating Carbon Fiber Demand Through Automotive and Wind Energy Expansion

Asia Pacific is expected to account for a market share of 44.3% in 2025, driven by strong momentum in electric vehicles, wind energy, and sporting goods manufacturing.

China accounted for more than 70% of global electric vehicle production in 2024, with domestic players capturing 80% of local sales. Exports surged to 1.25 million units, representing 40% of the global total. Japan and South Korea also expanded output, contributing to a 15% increase in EV manufacturing outside China. Carbon fiber has become essential for vehicle structures such as body panels, enclosures, and chassis as regional OEMs increasingly rely on advanced composites to enhance efficiency and remain competitive.

Wind power installation growth in East Asia, led by China, is significantly bolstering carbon fiber demand.

In wind energy, China added a record 86.9 GW of capacity in 2024, accounting for 72% of global installations and raising its total to 561.5 GW. Japan followed with a 600 MW boost, reaching 5.8 GW overall and securing a top 20 global rank. Lightweight materials with superior strength properties are critical to building efficient and durable turbine blades.

The region’s manufacturing advantage is reinforced by investments like Zhongfu Shenying’s 30,000-ton facility in Jiangsu and innovations such as Teijin’s ISCC PLUS-certified Tenax™ fiber, positioning East Asia at the forefront of sustainable composite production.

- Navigating Carbon Fiber Growth Through Electric Cars and Wind Power Push

Europe holds a market share of 26.7%, driven by sustained demand from the automotive and wind energy sectors.

Electric vehicle (EV) adoption is a major catalyst, with battery-electric models accounting for 13.6% of total EU car sales in 2024, surpassing diesel-powered vehicles. The region saw around 10.6 million new car registrations, led by Spain’s 7.1% increase. Carbon fiber, prized for its lightweight and durable properties, plays a vital role in boosting battery range and energy efficiency in EVs. However, the broader automotive industry faced a 6.2% decline in output to 11.4 million units, reflecting a structural shift that may temper near-term demand.

Wind energy remains a major carbon fiber consumer across Europe, despite recent slowdowns in installations.

In the energy segment, wind power continues to support composite material usage despite a slowdown in new installations. Germany added 3.2 GW of new capacity, maintaining its lead with a total of 72.7 GW. The UK (2.2 GW), Finland (1.4 GW), and Spain (1.2 GW) also contributed to regional growth. Mid-sized markets like France, Italy, and Poland enhanced adoption through increased turbine production. While overall growth moderated, strong EU policies on energy independence and decarbonization are expected to maintain momentum for high-performance materials across the wind energy landscape.

Competitive Landscape

The global carbon fiber market shows a consolidated structure, with a few dominant players like Toray, Teijin, Mitsubishi Chemical, and Hexcel driving technological advancements and strategic capacity expansions. These companies strengthen their positions by focusing on innovation, sustainable production practices, and defense and aerospace applications. Their continuous investment in R&D and collaboration enables rapid adaptation to evolving performance demands across industries. This strategic focus limits room for smaller entrants to significantly influence the market.

Despite increasing sustainability initiatives and recycling collaborations, the overall competitive landscape remains tightly controlled by top-tier manufacturers. Their vertical integration, partnerships, and ability to scale new technologies for both defense and commercial sectors reinforce their leadership. The market's consolidation stems from high entry barriers related to cost, technology, and certifications, making disruption difficult. As a result, most developments funnel through the strategic agendas of a few global companies.

Key Companies

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Group Corporation

- Hexcel Corporation

- SGL Carbon

- Syensqo

- DowAksa

- HS Hyosung Advanced Materials

- Zhongfu Shenying Carbon Fiber Co., Ltd.

- Jiangsu Hengshen Co., Ltd.

- Jilin Chemical Fiber Group Co., Ltd.

- UMATEX

- Kureha Corporation

- Osaka Gas Chemicals Co., Ltd.

- Formosa Plastics Corporation

- Nippon Graphite Fiber Co. Ltd

- Anshan Sinocarb Carbon Fiber Co. Ltd

- China National Bluestar (Group) Co., Ltd.

- A&P Technology Inc.

- DowAksa USA LLC

- Holding company Composite.

Recent Industry Developments

- In April 2025, Zhongfu Shenying started building a high-performance carbon fiber plant in Lianyungang, Jiangsu, with an annual capacity of 30,000 tons. This move aims to boost China’s domestic production and meet rising demand across various industries.

- In March 2025, Formosa Plastics invested NT$2 billion to increase carbon fiber output by 1,600 tons per year at its Renwu plant. The company also partnered with Shangwei to develop thermoplastic carbon fiber composites targeting wind power and lightweight vehicle markets.

Expert Opinion

- Demand for advanced lightweight materials is accelerating, especially in aerospace, automotive, and sports equipment sectors. This shift signals robust long-term growth for high-performance composites.

- Manufacturers continue to invest heavily in production efficiency and recycling technologies, reflecting rising sustainability concerns. This move not only improves margins but also aligns with stricter global regulations.

- Asia-Pacific emerges as a key growth engine, driven by rapid industrialization and government-backed defense and infrastructure projects. Strategic partnerships and capacity expansions further strengthen the region’s lead.

- Wind energy and hydrogen storage applications open new frontiers for these high-strength reinforcements. Market players who diversify across these sectors will gain a competitive edge.

- Innovation remains central, as companies focus on improving thermal resistance, reducing production costs, and enhancing durability. Those leading in R&D are shaping the next era of lightweight engineering

Global Carbon Fiber Market Segmentation

By Material Type

- Polyacrylonitrile (PAN)-based

- Pitch-based

- Rayon-based

By Technology

- Filament Winding

- Pultrusion

- Resin Transfer Molding (RTM)

- Compression Molding

- Lay-up Process

- Injection Molding

- Miscellaneous

By End-Use

- Aerospace & Defense

- Automotive

- Wind Energy

- Sporting Goods

- Civil Engineering & Construction

- Marine

- Electrical & Electronics

- Others (Medical, Oil & Gas)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

- Executive Summary

- Global Carbon Fiber Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Carbon Fiber Market Outlook, 2020 - 2033

- Global Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyacrylonitrile (PAN)-based

- Pitch-based

- Rayon-based

- Global Carbon Fiber Market Outlook, by Technology, Value (US$ Mn), 2020-2033

- Filament Winding

- Pultrusion

- Resin Transfer Molding (RTM)

- Compression Molding

- Lay-up Process

- Injection Molding

- Miscellaneous

- Global Carbon Fiber Market Outlook, by End-Use, Value (US$ Mn), 2020-2033

- Aerospace & Defense

- Automotive

- Wind Energy

- Sporting Goods

- Civil Engineering & Construction

- Marine

- Electrical & Electronics

- Others (Medical, Oil & Gas)

- Global Carbon Fiber Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- North America Carbon Fiber Market Outlook, 2020 - 2033

- North America Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyacrylonitrile (PAN)-based

- Pitch-based

- Rayon-based

- North America Carbon Fiber Market Outlook, by Technology, Value (US$ Mn), 2020-2033

- Filament Winding

- Pultrusion

- Resin Transfer Molding (RTM)

- Compression Molding

- Lay-up Process

- Injection Molding

- Miscellaneous

- North America Carbon Fiber Market Outlook, by End-Use, Value (US$ Mn), 2020-2033

- Aerospace & Defense

- Automotive

- Wind Energy

- Sporting Goods

- Civil Engineering & Construction

- Marine

- Electrical & Electronics

- Others (Medical, Oil & Gas)

- North America Carbon Fiber Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Carbon Fiber Market Outlook, by Material Type, 2020-2033

- S. Carbon Fiber Market Outlook, by Technology, 2020-2033

- S. Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Canada Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Canada Carbon Fiber Market Outlook, by Technology, 2020-2033

- Canada Carbon Fiber Market Outlook, by End-Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Europe Carbon Fiber Market Outlook, 2020 - 2033

- Europe Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyacrylonitrile (PAN)-based

- Pitch-based

- Rayon-based

- Europe Carbon Fiber Market Outlook, by Technology, Value (US$ Mn), 2020-2033

- Filament Winding

- Pultrusion

- Resin Transfer Molding (RTM)

- Compression Molding

- Lay-up Process

- Injection Molding

- Miscellaneous

- Europe Carbon Fiber Market Outlook, by End-Use, Value (US$ Mn), 2020-2033

- Aerospace & Defense

- Automotive

- Wind Energy

- Sporting Goods

- Civil Engineering & Construction

- Marine

- Electrical & Electronics

- Others (Medical, Oil & Gas)

- Europe Carbon Fiber Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Germany Carbon Fiber Market Outlook, by Technology, 2020-2033

- Germany Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Italy Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Italy Carbon Fiber Market Outlook, by Technology, 2020-2033

- Italy Carbon Fiber Market Outlook, by End-Use, 2020-2033

- France Carbon Fiber Market Outlook, by Material Type, 2020-2033

- France Carbon Fiber Market Outlook, by Technology, 2020-2033

- France Carbon Fiber Market Outlook, by End-Use, 2020-2033

- K. Carbon Fiber Market Outlook, by Material Type, 2020-2033

- K. Carbon Fiber Market Outlook, by Technology, 2020-2033

- K. Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Spain Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Spain Carbon Fiber Market Outlook, by Technology, 2020-2033

- Spain Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Russia Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Russia Carbon Fiber Market Outlook, by Technology, 2020-2033

- Russia Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Rest of Europe Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Rest of Europe Carbon Fiber Market Outlook, by Technology, 2020-2033

- Rest of Europe Carbon Fiber Market Outlook, by End-Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Asia Pacific Carbon Fiber Market Outlook, 2020 - 2033

- Asia Pacific Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyacrylonitrile (PAN)-based

- Pitch-based

- Rayon-based

- Asia Pacific Carbon Fiber Market Outlook, by Technology, Value (US$ Mn), 2020-2033

- Filament Winding

- Pultrusion

- Resin Transfer Molding (RTM)

- Compression Molding

- Lay-up Process

- Injection Molding

- Miscellaneous

- Asia Pacific Carbon Fiber Market Outlook, by End-Use, Value (US$ Mn), 2020-2033

- Aerospace & Defense

- Automotive

- Wind Energy

- Sporting Goods

- Civil Engineering & Construction

- Marine

- Electrical & Electronics

- Others (Medical, Oil & Gas)

- Asia Pacific Carbon Fiber Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Carbon Fiber Market Outlook, by Material Type, 2020-2033

- China Carbon Fiber Market Outlook, by Technology, 2020-2033

- China Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Japan Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Japan Carbon Fiber Market Outlook, by Technology, 2020-2033

- Japan Carbon Fiber Market Outlook, by End-Use, 2020-2033

- South Korea Carbon Fiber Market Outlook, by Material Type, 2020-2033

- South Korea Carbon Fiber Market Outlook, by Technology, 2020-2033

- South Korea Carbon Fiber Market Outlook, by End-Use, 2020-2033

- India Carbon Fiber Market Outlook, by Material Type, 2020-2033

- India Carbon Fiber Market Outlook, by Technology, 2020-2033

- India Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Southeast Asia Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Southeast Asia Carbon Fiber Market Outlook, by Technology, 2020-2033

- Southeast Asia Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Rest of SAO Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Rest of SAO Carbon Fiber Market Outlook, by Technology, 2020-2033

- Rest of SAO Carbon Fiber Market Outlook, by End-Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Latin America Carbon Fiber Market Outlook, 2020 - 2033

- Latin America Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyacrylonitrile (PAN)-based

- Pitch-based

- Rayon-based

- Latin America Carbon Fiber Market Outlook, by Technology, Value (US$ Mn), 2020-2033

- Filament Winding

- Pultrusion

- Resin Transfer Molding (RTM)

- Compression Molding

- Lay-up Process

- Injection Molding

- Miscellaneous

- Latin America Carbon Fiber Market Outlook, by End-Use, Value (US$ Mn), 2020-2033

- Aerospace & Defense

- Automotive

- Wind Energy

- Sporting Goods

- Civil Engineering & Construction

- Marine

- Electrical & Electronics

- Others (Medical, Oil & Gas)

- Latin America Carbon Fiber Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Brazil Carbon Fiber Market Outlook, by Technology, 2020-2033

- Brazil Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Mexico Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Mexico Carbon Fiber Market Outlook, by Technology, 2020-2033

- Mexico Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Argentina Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Argentina Carbon Fiber Market Outlook, by Technology, 2020-2033

- Argentina Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Rest of LATAM Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Rest of LATAM Carbon Fiber Market Outlook, by Technology, 2020-2033

- Rest of LATAM Carbon Fiber Market Outlook, by End-Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Middle East & Africa Carbon Fiber Market Outlook, 2020 - 2033

- Middle East & Africa Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Polyacrylonitrile (PAN)-based

- Pitch-based

- Rayon-based

- Middle East & Africa Carbon Fiber Market Outlook, by Technology, Value (US$ Mn), 2020-2033

- Filament Winding

- Pultrusion

- Resin Transfer Molding (RTM)

- Compression Molding

- Lay-up Process

- Injection Molding

- Miscellaneous

- Middle East & Africa Carbon Fiber Market Outlook, by End-Use, Value (US$ Mn), 2020-2033

- Aerospace & Defense

- Automotive

- Wind Energy

- Sporting Goods

- Civil Engineering & Construction

- Marine

- Electrical & Electronics

- Others (Medical, Oil & Gas)

- Middle East & Africa Carbon Fiber Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Carbon Fiber Market Outlook, by Material Type, 2020-2033

- GCC Carbon Fiber Market Outlook, by Technology, 2020-2033

- GCC Carbon Fiber Market Outlook, by End-Use, 2020-2033

- South Africa Carbon Fiber Market Outlook, by Material Type, 2020-2033

- South Africa Carbon Fiber Market Outlook, by Technology, 2020-2033

- South Africa Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Egypt Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Egypt Carbon Fiber Market Outlook, by Technology, 2020-2033

- Egypt Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Nigeria Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Nigeria Carbon Fiber Market Outlook, by Technology, 2020-2033

- Nigeria Carbon Fiber Market Outlook, by End-Use, 2020-2033

- Rest of Middle East Carbon Fiber Market Outlook, by Material Type, 2020-2033

- Rest of Middle East Carbon Fiber Market Outlook, by Technology, 2020-2033

- Rest of Middle East Carbon Fiber Market Outlook, by End-Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Carbon Fiber Market Outlook, by Material Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Toray Industries, Inc.

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Teijin Limited

- Mitsubishi Chemical Group Corporation

- Hexcel Corporation

- SGL Carbon

- Syensqo

- DowAksa

- HS Hyosung Advanced Materials

- Zhongfu Shenying Carbon Fiber Co., Ltd.

- Jiangsu Hengshen Co., Ltd.

- Toray Industries, Inc.

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Material Type Coverage |

|

|

Technology Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |