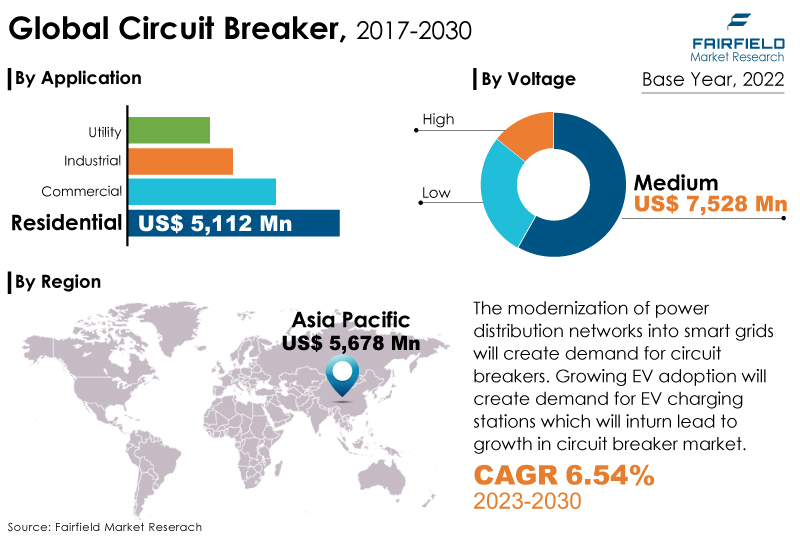

The global circuit breakers market size is forecast to reach US$21.5 Bn by 2030, exhibiting an estimated CAGR of more than 6.5% during 2023 - 2030.

Market Analysis in Brief

The global circuit breakers market has witnessed significant growth in recent years on account of the increasing demand for electrical distribution and power transmission systems. Circuit breakers are essential components that play a crucial role in protecting electrical circuits from overloads and short circuits, ensuring safety, and preventing potential damage to electrical equipment. The ongoing transition towards sustainable and eco-friendly technologies presents a significant opportunity for circuit breaker manufacturers to innovate environmentally responsible solutions. As governments worldwide continue to prioritize energy efficiency and environmental protection, circuit breaker manufacturers are likely to align their product portfolios with these objectives to see sustained growth. Overall, the future of the global circuit breakers market looks promising, driven by technological advancements, increasing investments in infrastructure, and the shift towards renewable energy and smart grid initiatives.

Key Report Findings

- The market for circuit breakers is projected to display a strong, healthy CAGR of 6.5% between 2023 and 2030.

- Governments and regulatory bodies across the globe have implemented strict guidelines for electrical installations to prevent accidents, fires, and electrical hazards. This lays a strong foundation for the establishment and expansion of market.

- Residential sector takes up the largest revenue share of the market.

- Demand for medium voltage circuit breakers will continue to be dominant.

- The Asia Pacific market for circuit breakers spearheads and will continue to lead throughout the period of assessment.

Market Drivers

Escalating Global Demand for Electricity

The global demand for electricity has been steadily rising due to population growth, urbanisation, and industrialisation. Developing countries, in particular, have witnessed a surge in energy consumption as they strive to meet the needs of their expanding economies. This trend has driven the need for efficient electrical distribution systems, where circuit breakers play a vital role in maintaining a stable power supply and preventing power outages. Governments and utilities worldwide are investing heavily in upgrading their electrical infrastructure, thereby fueling the demand for circuit breakers.

Brisk Infrastructural Developments

The ongoing infrastructure development projects in both developed and emerging economies have significantly contributed to the growth of the circuit breakers market. The construction of new buildings, commercial complexes, industrial facilities, and transportation networks has increased the demand for circuit breakers to ensure safe and reliable electrical systems. As more cities and regions experience urbanisation, the need for efficient electrical distribution will continue to grow, providing a boost to the circuit breakers market.

Advent of Circuit Breaker Technology

Advancements in circuit breaker technology have been a major driving force in the market's growth. Manufacturers have introduced innovative products with enhanced features, such as increased breaking capacity, reduced size, improved protection mechanisms, and remote monitoring capabilities. Smart circuit breakers, equipped with advanced sensors and communication capabilities, enable real-time diagnostics and predictive maintenance, enhancing system reliability and efficiency. These technological advancements have led to increased adoption across various industries, further propelling market growth.

Safety and Regulatory Compliance

Stringent safety regulations and government initiatives aimed at ensuring electrical safety have played a significant role in driving the adoption of circuit breakers. Governments and regulatory bodies across the globe have implemented strict guidelines for electrical installations to prevent accidents, fires, and electrical hazards. As a result, end users are increasingly investing in modern and reliable circuit breakers to comply with safety standards and avoid penalties. This growing emphasis on safety and compliance is expected to continue driving market growth.

Market Challenges

High Initial Costs

The demand for circuit breakers is set to witness substantial growth in the coming years with increasing electricity demand, rapid infrastructural developments, and technological advancements. Detailed market examination shows market players must leverage opportunities presented by renewable energy integration, smart grid infrastructure, and vehicle electrification in transportation to stay ahead of the curve. However, challenges related to high initial costs, lack of awareness, and environmental concerns must be addressed by manufacturers to unlock the market's full potential.

One of the primary challenges faced by the circuit breakers market is the high initial investment required for purchasing and installing these devices. The cost of circuit breakers varies based on their type, voltage rating, and additional features. Advanced circuit breakers with smart capabilities may come with a higher price tag, which can deter small-scale industries and consumers with budget constraints. Manufacturers and industry stakeholders need to address this challenge by offering cost-effective solutions and exploring financing options to make circuit breakers more accessible.

Lack of Awareness

In some regions, there is still a lack of awareness regarding the benefits and importance of circuit breakers. Many end-users, especially in rural and underdeveloped areas, may not fully understand the role of circuit breakers in electrical safety and protection. Educating consumers and businesses about the advantages of using circuit breakers and their impact on preventing electrical accidents is crucial to expanding market penetration.

Environmental Concerns

Traditional circuit breakers may contain harmful materials, such as sulfur hexafluoride (SF6), which has a high global warming potential. SF6 is used in gas-insulated circuit breakers to improve their performance, but its environmental impact has raised concerns. As environmental regulations become more stringent, there is a growing demand for eco-friendly alternatives that do not contribute to greenhouse gas emissions. Manufacturers are investing in research and development to develop sustainable and environmentally friendly circuit breakers, addressing this challenge.

Market Opportunity

Renewable Energy Integration

The transition towards renewable energy sources, such as solar and wind power, presents a significant market opportunity for circuit breaker manufacturers. Renewable energy generation is inherently intermittent, and integrating these sources into the grid requires advanced circuit breakers capable of handling fluctuations in power output.

Grid stability, fault management, and protection against voltage surges are critical aspects that need to be addressed through specialised circuit breakers tailored for renewable energy applications.

Smart Grid Infrastructure

The development of smart grid infrastructure provides ample opportunities for advanced circuit breakers equipped with smart features. Smart grids enable bidirectional communication between utilities and consumers, enabling real-time monitoring and control of electricity flow.

Circuit breakers integrated into smart grids can provide valuable data on system performance, load patterns, and fault occurrences. By responding to grid conditions intelligently, these smart circuit breakers can optimize power distribution, reduce losses, and enable demand-side management.

Increasing Electrification in Transportation

The growing trend towards electric vehicles (EVs), and along with vehicle electrification, the electrification of public transportation systems is poised to create new prospects for circuit breaker manufacturers. EV charging infrastructure requires circuit breakers with specific characteristics to handle high currents and ensure safe charging processes. Additionally, circuit breakers are essential components in electric mobility systems, such as trams and trains, where electrical safety is paramount.

Key Segments Overview

Medium Voltage Segment Takes the Lead

Based on the voltage, the medium voltage segment has been the dominant category in 2022. These circuit breakers, leading with around 58% share of the market value pie, are typically deployed in industrial settings, power distribution networks, and infrastructure projects where voltage levels range from 1000V to 38kV. On the other hand, the low voltage circuit breakers that are installed in residential, commercial, and small-scale industrial applications where voltage levels typically range from 100V to 1000V, will experience growing demand in the upcoming years.

Residential Sector Creates Maximum Demand

With more than 39% share of the overall market revenue, the residential sector leads the pack in the circuit breakers market, in terms of application. The residential sector widely employs circuit breakers as a majority of residential buildings have these instruments installed for safeguarding of the associated electrical appliances and occupants. The growing trend of smart homes, and home automation is also influencing the demand for advanced circuit breakers with smart capabilities.

The commercial category follows, further trailed by the industrial segment. Both the segments of the market are expected to represent a collective revenue share of more than 45% through the end of the forecast period. Demand from the commercial sector will be prominently accounted for by offices, shopping malls, hotels, and other commercial spaces that utilise circuit breakers for assured safety of electrical operations. The commercial sector's growing emphasis on energy efficiency, and sustainable practices is driving the adoption of eco-friendly circuit breakers.

Outdoor Installations in Demand

The preferential inclination of end users indicates dominance of outdoor installations of circuit breakers rather than the indoor counterpart. The former makes up for over 58% of the total installations recorded in the global circuit breakers market space.

Growth Opportunities Across Regions

Asia Pacific at the Forefront

With approximately 44% share of the overall market valuation pie, Asia Pacific's circuit breakers industry maintains dominance in the global industry. The region currently contributes more than US$5 Bn revenue to the market. The rapidly surging demand for electricity within the region will remain the strongest driving force for the market expansion here. Besides highly populous nations like China, India, and Japan, the Asian market is expected to be dominated by South Korea, and some of the southeast Asian nations.

The Asia Pacific circuit breakers market will gain from the booming construction industry, significant investments in power infrastructure, and rapid infrastructural developments. An increasing number of government initiatives to enhance grid stability, emphasis on improved energy efficiency, and paced promotion of renewable energy integration will further propel installations of circuit breakers across the region that has been poised for a solid CAGR of more than 7% through 2030-end.

On the other side, developed western markets of North America, and Europe collectively hold over 40% share of the total market pie. North America has a well-established power sector and infrastructure that remains the mainstay for incessant opportunity generation for manufacturers of circuit breakers. Grid modernisation, and the growing smart technology integration will push the market here, to a large extent.

Competition Landscape Analysis - Circuit Breakers Industry

Some of the major competitors in the worldwide circuit breakers landscape that have been covered in the report’s strategic competitive analysis section, include Siemens AG, Schneider Electric SE, ABB Ltd., Mitsubishi Electric Corporation, Eaton Corporation plc, GE’s Alstom, Fuji Electric Co., Ltd., Toshiba Corporation, Rockwell Automation, Inc., Hitachi Industrial Equipment Systems Co., Ltd., Powell industries, Havells, Kirloskar Electric, Hyundai Electric, and Furukawa Electric.

Global Multifunctional Composites Market is Segmented as Below:

By Voltage

- Low

- Medium

- High

By Application

- Residential

- Commercial

- Industrial

- Utility

By Installation

- Outdoor

- Indoor

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of EU

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of APAC

- RoW

- Brazil

- Mexico

- GCC

- Iran

- Rest of Latin America, Middle East& Africa

Leading Companies

- ABB

- Schneider Electric

- Mitsubishi Electric

- Eaton

- Siemens

- Toshiba

- Powell industries

- GE’s Alstom

- Havells

- Furukawa Electric

- Kirloskar Electric

- Hyundai Electric

- Others

1. Executive Summary

1.1. Global Circuit Breaker Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.2.4. Economic Trends

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact

2.6. End-user Industry Customer Impact Analysis

3. Global Circuit Breaker Outlook, 2019 - 2030

3.1. Global Circuit Breaker Outlook, by Voltage, Value (US$ Mn), 2019 - 2030

3.1.1. Key Highlights

3.1.1.1. Low Voltage

3.1.1.2. Medium Voltage

3.1.1.3. High Voltage

3.1.2. BPS Analysis/Market Attractiveness Analysis, by Voltage

3.2. Global Circuit Breaker Outlook, by Application, Value (US$ Mn), 2019 - 2030

3.2.1. Key Highlights

3.2.1.1. Residential

3.2.1.2. Commercial

3.2.1.3. Industrial

3.2.1.4. Utility

3.2.2. BPS Analysis/Market Attractiveness Analysis, by Application

3.3. Global Circuit Breaker Outlook, by Installation, Value (US$ Mn), 2019 - 2030

3.3.1. Key Highlights

3.3.1.1. Outdoor

3.3.1.2. Indoor

3.3.2. BPS Analysis/Market Attractiveness Analysis, by Installation

3.4. Global Circuit Breaker Outlook, by Region, Value (US$ Mn), 2019 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. ROW

3.4.2. BPS Analysis/Market Attractiveness Analysis, by Region

4. North America Circuit Breaker Outlook, 2019 - 2030

4.1. North America Circuit Breaker Outlook, by Voltage, Value (US$ Mn), 2019 - 2030

4.1.1. Key Highlights

4.1.1.1. Low Voltage

4.1.1.2. Medium Voltage

4.1.1.3. High Voltage

4.2. North America Circuit Breaker Outlook, by Application, Value (US$ Mn), 2019 - 2030

4.2.1. Key Highlights

4.2.1.1. Residential

4.2.1.2. Commercial

4.2.1.3. Industrial

4.2.1.4. Utility

4.3. North America Circuit Breaker Outlook, by Installation, Value (US$ Mn), 2019 - 2030

4.3.1. Key Highlights

4.3.1.1. Outdoor

4.3.1.2. Indoor

4.4. North America Circuit Breaker Outlook, by Country, Value (US$ Mn), 2019 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

4.4.1.2. U.S. Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

4.4.1.3. U.S. Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

4.4.1.4. Canada Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

4.4.1.5. Canada Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

4.4.1.6. Canada Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

5. Europe Circuit Breaker Outlook, 2019 - 2030

5.1. Europe Circuit Breaker Outlook, by Voltage, Value (US$ Mn), 2019 - 2030

5.1.1. Key Highlights

5.1.1.1. Low Voltage

5.1.1.2. Medium Voltage

5.1.1.3. High Voltage

5.2. Europe Circuit Breaker Outlook, by Application, Value (US$ Mn), 2019 - 2030

5.2.1. Key Highlights

5.2.1.1. Residential

5.2.1.2. Commercial

5.2.1.3. Industrial

5.2.1.4. Utility

5.3. Europe Circuit Breaker Outlook, by Installation, Value (US$ Mn), 2019 - 2030

5.3.1. Key Highlights

5.3.1.1. Outdoor

5.3.1.2. Indoor

5.4. Europe Circuit Breaker Outlook, by Country, Value (US$ Mn), 2019 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

5.4.1.2. Germany Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

5.4.1.3. Germany Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

5.4.1.4. UK Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

5.4.1.5. UK Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

5.4.1.6. UK Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

5.4.1.7. France Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

5.4.1.8. France Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

5.4.1.9. France Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

5.4.1.10. Italy Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

5.4.1.11. Italy Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

5.4.1.12. Italy Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

5.4.1.13. Spain Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

5.4.1.14. Spain Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

5.4.1.15. Spain Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

5.4.1.16. Rest of EU Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

5.4.1.17. Rest of EU Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

5.4.1.18. Rest of EU Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

6. Asia Pacific Circuit Breaker Outlook, 2019 - 2030

6.1. Asia Pacific Circuit Breaker Outlook, by Voltage, Value (US$ Mn), 2019 - 2030

6.1.1. Key Highlights

6.1.1.1. Low Voltage

6.1.1.2. Medium Voltage

6.1.1.3. High Voltage

6.2. Asia Pacific Circuit Breaker Outlook, by Application, Value (US$ Mn), 2019 - 2030

6.2.1. Key Highlights

6.2.1.1. Residential

6.2.1.2. Commercial

6.2.1.3. Industrial

6.2.1.4. Utility

6.3. Asia Pacific Circuit Breaker Outlook, by Installation, Value (US$ Mn), 2019 - 2030

6.3.1. Key Highlights

6.3.1.1. Outdoor

6.3.1.2. Indoor

6.4. Asia Pacific Circuit Breaker Outlook, by Country, Value (US$ Mn), 2019 - 2030

6.4.1. Key Highlights

6.4.1.1. China Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

6.4.1.2. China Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

6.4.1.3. China Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

6.4.1.4. Japan Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

6.4.1.5. Japan Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

6.4.1.6. Japan Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

6.4.1.7. India Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

6.4.1.8. India Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

6.4.1.9. India Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

6.4.1.10. South Korea Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

6.4.1.11. South Korea Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

6.4.1.12. South Korea Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

6.4.1.13. Rest of APAC Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

6.4.1.14. Rest of APAC Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

6.4.1.15. Rest of APAC Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

7. RoW Circuit Breaker Outlook, 2019 - 2030

7.1. RoW Circuit Breaker Outlook, by Voltage, Value (US$ Mn), 2019 - 2030

7.1.1. Key Highlights

7.1.1.1. Low Voltage

7.1.1.2. Medium Voltage

7.1.1.3. High Voltage

7.2. RoW Circuit Breaker Outlook, by Application, Value (US$ Mn), 2019 - 2030

7.2.1. Key Highlights

7.2.1.1. Residential

7.2.1.2. Commercial

7.2.1.3. Industrial

7.2.1.4. Utility

7.3. RoW Circuit Breaker Outlook, by Installation, Value (US$ Mn), 2019 - 2030

7.3.1. Key Highlights

7.3.1.1. Outdoor

7.3.1.2. Indoor

7.4. RoW Circuit Breaker Outlook, by Country, Value (US$ Mn), 2019 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

7.4.1.2. Brazil Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

7.4.1.3. Brazil Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

7.4.1.4. Mexico Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

7.4.1.5. Mexico Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

7.4.1.6. Mexico Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

7.4.1.7. GCC Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

7.4.1.8. GCC Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

7.4.1.9. GCC Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

7.4.1.10. Iran Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

7.4.1.11. Iran Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

7.4.1.12. Iran Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

7.4.1.13. Rest of Latin America, Middle East& Africa Circuit Breaker, Value (US$ Mn), by Voltage, 2019 - 2030

7.4.1.14. Rest of Latin America, Middle East& Africa Circuit Breaker, Value (US$ Mn), by Application, 2019 - 2030

7.4.1.15. Rest of Latin America, Middle East& Africa Circuit Breaker, Value (US$ Mn), by Installation, 2019 - 2030

8. Competitive landscape

8.1. Company Profile

8.1.1. ABB

8.1.2. Eaton

8.1.3. Siemens

8.1.4. Schneider Electric

8.1.5. Mitsubishi Electric

8.1.6. Toshiba

8.1.7. Powell industries

8.1.8. GE’s Alstom

8.1.9. Havells

8.1.10. Furukawa Electric

8.1.11. Kirloskar Electric

8.1.12. Hyundai Electric

8.1.13. Others

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Voltage Coverage |

|

|

Application Coverage |

|

|

Installation Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |