Global Colour Cosmetics Market Growth Forecast

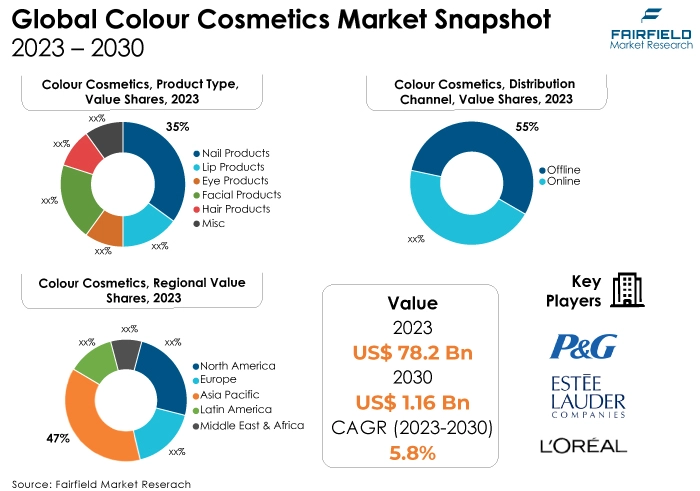

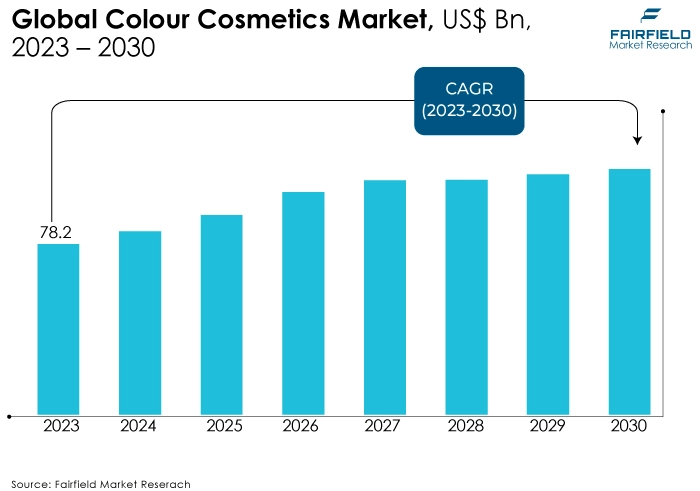

- The approximately US$78.2 Bn market for colour cosmetics 2023 poised to reach US$116 Bn by 2030

- Global colour cosmetics market revenue likely to demonstrate a CAGR of 5.8% over 2023 - 2030

Quick Report Digest

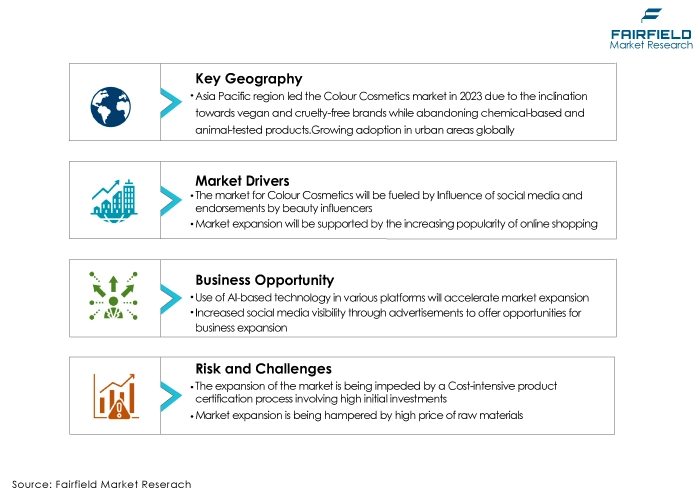

- The key trend anticipated to fuel the colour cosmetics market growth is increasing consumer awareness and expenditure on beauty products. As individuals place greater importance on personal appearance, there is a demand for innovative products addressing skincare concerns and enhancing overall appearance and well-being.

- Another major market trend expected to fuel the colour cosmetics market growth is the heightened awareness of fashion trends among women. Recent research indicates a growing desire among female consumers to enhance their attractiveness. Additionally, the influence of social media, particularly fashion bloggers and online education, plays a significant role in shaping consumer preferences and driving market growth.

- The expansion of digital marketing efforts contributes to enhancing brand visibility, thereby fostering growth in the global market

- Substantial investments in the marketing and advertising of colour cosmetics are anticipated to drive market growth significantly

- In 2022, the Facial Products category dominated the industry. The increasing demand from the working-class female demographic is a pivotal driver for segment growth.

- In terms of market share for colour cosmetics globally, the Offline segment is anticipated to dominate. Hypermarkets and specialty stores represent prominent offline distribution channels, offering a diverse range of brands across various price ranges.

- The Asia Pacific region is anticipated to account for the largest share of the global colour cosmetics market, owing to the expanding middle-class population in countries like India and China. The proliferation of online shopping platforms like Nykaa, Purplle, HokMake-up, and Amazon India has contributed to the rise in sales of colour cosmetics in India.

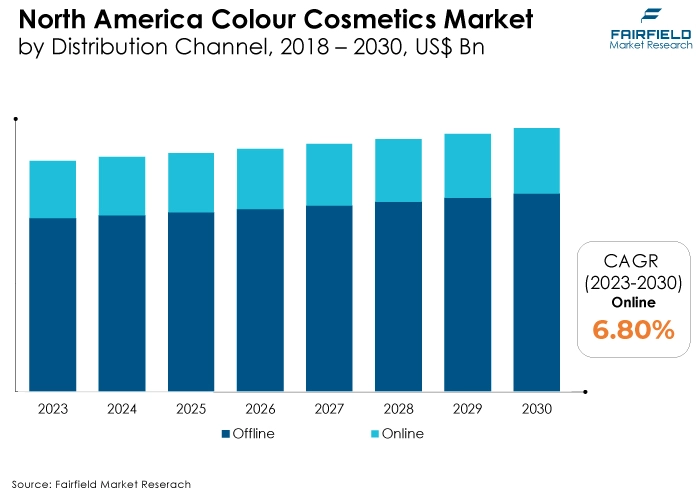

- The market for colour cosmetics is expanding in North America due to the increasing adoption of social media platforms and smartphone usage has impacted the purchasing behaviour of Millennials, and Generation Z, leading them to explore and contemplate the purchase of colour cosmetics.

A Look Back and a Look Forward - Comparative Analysis

The market for colour cosmetics has grown in popularity as a result of factors such as high investments in advertising and marketing strategies, including social media promotions and celebrity endorsements, which have bolstered brand recognition and consumer visibility. The expansion of digital marketing serves as a significant catalyst for industry growth.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as hair and eye Products. However, in some applications, the demand for colour cosmetics has increased, including nail, lip, and facial products.

The increasing adoption of make-up brands in emerging markets is a key factor driving the swift expansion of the global colour cosmetics market. With evolving consumer preferences and dynamic beauty trends, these emerging markets are experiencing a notable rise in demand for a diverse range of cosmetic products.

Key Growth Determinants

- Rising Disposable Incomes and Pacing Urbanisation

The primary catalyst for the global colour cosmetics market is the growth in disposable incomes and urbanisation. According to UNCTAD 2022, there has been a steady increase in the urban population worldwide, with projections indicating a rise from 52.5% in 2012 to 56.9% in 2022. This trend is more pronounced in developed regions, where urban populations comprise 79.7% of the total population, compared to 52.3% in developing regions and 35.8% in the least developed countries (LDCs).

According to the World Bank, approximately 56% of the global population resides in cities, with projections indicating a further increase, with nearly 70% expected to live in urban areas by 2050. As economies grow and urban migration persists, there is a concurrent increase in the demand for beauty products. Urban lifestyles often prioritise personal grooming and self-expression, resulting in heightened sales of colour cosmetics.

This trend is particularly evident in emerging markets like China, and India, where a burgeoning middle class has greater purchasing power. These consumers are willing to invest in high-quality cosmetics to enhance their appearance and self-confidence. Furthermore, urban environments provide access to a diverse range of products and beauty services, further driving the demand for colour cosmetics.

In developed markets such as North America and Europe, rising disposable incomes continue to stimulate market growth. Consumers in these regions are inclined to spend on premium and luxury cosmetics, contributing to the expansion of the industry. Brands catering to various income segments are thriving, offering products across different price points to cater to a diverse consumer base.

- Rising Social Media Influence and Beauty Trends

The growing impact of social media on beauty trends and consumer behaviour is undeniable. Platforms such as Instagram, YouTube, and TikTok have cultivated a global community of beauty enthusiasts, driving the adoption of colour cosmetics. In 2022, beauty companies allocated an estimated $7.7 billion towards advertising efforts (Bandt), with one-third of beauty product buyers engaging with brands on social media. Additionally, marketing emails have demonstrated success, boasting an impressive 11.5% open rate.

According to Harvard Business School, approximately 4 out of 5 beauty shoppers utilise Instagram daily, while around 2 out of 3 turn to influencers for product discovery. Prominent figures like Dutch beauty influencer Nikkie de Jager, boasting around 14 million YouTube subscribers, and make-up artist Huda Kattan, with over 50 million Instagram followers, endorse products and showcase their skills to millions of global followers. This digital influence has revolutionised the industry, making it more accessible and personalised.

Consumers now have easy access to tutorials, product reviews, and recommendations, empowering them to make informed purchase decisions. Brands leverage social media for marketing purposes, collaborating with influencers to promote their products and enhance visibility and sales.

Beauty trends disseminate rapidly through social media, spanning from natural and organic cosmetics to daring and avant-garde looks. Consumers are increasingly inclined to experiment with their make-up routines, leading to heightened product turnover and sales. Brands that remain adaptable and responsive to emerging trends stand to capitalise on these shifts in consumer preferences.

- Innovation in Product Formulations and Packaging

Continuous innovation in product formulations and packaging serves as a primary driver of the colour cosmetics market. Companies allocate significant resources to research and development initiatives aimed at creating products with enhanced performance, extended wear, and skin-friendly ingredients. For example, the clean beauty trend has spurred the development of cosmetics devoid of harmful chemicals, catering to health-conscious consumers.

Moreover, brands prioritise sustainability by utilising eco-friendly packaging materials and implementing waste reduction measures. Packaging plays a pivotal role in consumer attraction, with innovative and visually appealing packaging serving to differentiate products and spark consumer interest. Luxury brands, in particular, invest in premium and collectible packaging to elevate the overall consumer experience.

Major Growth Barriers

- Rising Awareness Regarding Environmental Conservation, and Animal Protection

The increasing awareness surrounding environmental and animal conservation has prompted manufacturers to transition towards plant-based cosmetic products, impacting the growth trajectory of this market segment. According to UNICEF 2022, a majority of citisens (73%) express concerns about climate change and its adverse effects on children's quality of life. The Asahi Glass Foundation reports that the perceived level of Sustainable Development Goal (SDG) achievement stands at 35.0% as of 2023, with younger demographics showing slightly higher levels of awareness, at 41.1% among 18-24-year-olds.

Concerns over the negative effects of chemical-based cosmetics on skin and overall health have also contributed to a decline in sales within the cosmetic products sector. Governments across various countries have implemented regulations to govern resource usage and promote environmental conservation efforts. Additionally, the COVID-19 pandemic, which significantly disrupted the cosmetics sector, has presented numerous challenges for market players.

- Increasing Availability of Counterfeit Products

The coloured cosmetics market is characterised by a significant presence of counterfeit products, which have adverse effects on the sales and brand value of reputable brands. Counterfeit goods often utilise low-quality materials to reduce production costs, compromising product quality and safety. Hazardous substances such as arsenic, cyanide, lead, and mercury are frequently found in counterfeit products, posing health risks to consumers.

Additionally, online sales channels serve as the primary distribution channels for counterfeit goods, posing a direct challenge to established brands. The competition from counterfeit products, which often offer lower prices and similar functionality, is expected to impede the growth of leading companies in the colour cosmetics market throughout the forecast period.

Key Trends and Opportunities to Look at

- Growing Consumer Inclination Toward Organic Cosmetic Products

The growing consumer preference for organic products has spurred an increased demand for sustainable and natural alternatives in the cosmetics industry. Europe stands out as one of the largest markets for natural and organic cosmetics, representing 38% of the global market value, as reported by CBI. The European market for natural and organic cosmetics witnessed substantial growth, reaching €3.89 billion in 2020 from €3.64 billion in 2018. This surge in demand for organic and vegan products is driven by beauty-conscious consumers who prioritise chemical-free cosmetics for skincare.

A survey conducted by YPulse in September 2021 revealed that 36% of Gen Z and Millennial females in Western Europe are keen on trying cleaner, greener beauty products. In response to these preferences, many manufacturers are transitioning towards producing more organic products with colours derived from natural sources, thus significantly impacting market growth.

Additionally, the rising customer preference for value-for-money cosmetic products featuring natural and beneficial ingredients further propels market expansion. Moreover, the increasing disposable income in developing and emerging markets, coupled with ongoing innovations, serves as a significant driving force in creating a more compelling and appealing market landscape.

- Evolving Beauty Standards and Inclusivity

The global colour cosmetics market is being propelled by evolving beauty standards and an increasing demand for inclusivity. Consumers are now seeking products that cater to a diverse range of skin tones, hair types, and gender identities. To meet these demands, the industry has expanded shade ranges to encompass a wider spectrum of skin tones. Additionally, inclusivity in advertising and marketing campaigns has become commonplace, as brands recognise the importance of representing all individuals in their promotional materials.

Moreover, there's a notable shift in the concept of beauty itself, moving away from rigid ideals to celebrating individuality and self-expression. This shift has sparked a surge in demand for products that enable consumers to experiment with their appearance, whether through bold eyeshadows, vibrant lip colours, or innovative make-up techniques. Brands that embrace inclusivity and diversity in both their product offerings and marketing endeavors are poised to resonate more strongly with consumers, thereby driving sales and fostering brand loyalty.

- Male Cosmetics Become Popular

The male cosmetics segment within the global colour cosmetics market has experienced notable growth. Traditional gender norms are shifting, leading to increased acceptance of men using make-up to enhance their appearance. Men's grooming products such as foundation, concealer, and eyebrow products have seen a surge in popularity as a result. This trend is propelled by changing perceptions of masculinity and a desire among men to achieve a polished and well-groomed look.

According to a survey conducted by Attest, a significant 35% of men aged 26-40 report shopping for make-up at least once a month, with nearly half of all Millennial men purchasing it occasionally. Similar patterns are observed among Gen X men, with 36% buying make-up and 21% doing so regularly. However, the older demographic, including Boomers aged 56-66, are considerably less likely to purchase cosmetics, with 78% indicating they never buy them. Cosmetic companies are adapting to this trend by developing and marketing products tailored specifically to men.

For instance, Vedix, an Indian-based ayurvedic beauty brand, announced its entry into the men's skincare market in October 2021 with a range of grooming products, including face cleanser, moisturiser, and nighttime serum. These products feature packaging, branding, and formulations designed to cater to male preferences and skin types. As the male cosmetics market continues to expand, it presents a significant opportunity for companies to diversify their product offerings and tap into new consumer segments.

How Does the Regulatory Scenario Shape this Industry?

The European Union (EU) has implemented track and trace regulations aimed at bolstering the safety and authenticity of various products, including cosmetics, across its member states. A key initiative in this realm is the EU's Falsified Medicines Directive (FMD), which includes provisions for verifying prescription medicines and incorporates measures applicable to cosmetic products.

Additionally, the EU Cosmetics Regulation (EC) No 1223/2009 delineates requirements for product information, labelling, and safety assessment. It underscores the obligation of manufacturers and importers to guarantee the traceability of cosmetic products within the EU market.

In the US, the Food and Drug Administration (FDA) regulates cosmetics under the Federal Food, Drug, and Cosmetic Act (FD&C Act) and imposes specific labelling and manufacturing standards to uphold product safety and provide consumer information. The regulatory landscape shapes the colour cosmetics industry by promoting product safety, authenticity, and transparency, while also ensuring consumer confidence and protection

Fairfield’s Ranking Board

Top Segments

- Facial Products Category Maintains Leadership Position

The facial product segment dominated the market in 2023. This product category encompasses items like foundations, concealers, blushes, and powders, which are essential for establishing a smooth base and enhancing facial features. Foundations come in diverse formulations tailored to various skin types and coverage preferences. With the growing emphasis on natural and clean beauty, many brands are prioritising foundations that offer skincare benefits alongside coverage. Concealers are also highly sought after, addressing concerns such as blemishes and under-eye circles.

Blushes and powders contribute to adding dimension and setting make-up, thereby enhancing the overall appearance. These products often integrate innovative ingredients, including hyaluronic acid and antioxidants, to deliver additional skincare benefits. The facial cosmetics segment is continuously evolving, driven by technological advancements and the quest for achieving a natural yet flawless complexion.

Furthermore, the nail products category is projected to experience the fastest market growth. Nail cosmetics have garnered significant popularity globally, particularly focusing on nail polishes, nail care products, and nail art. Nail polish, boasting an extensive array of colours and finishes, empowers consumers to express their creativity and individual style. Nail care products, including cuticle creams, nail strengtheners, and treatments, play a pivotal role in sustaining healthy nails. With an increasing emphasis on nail wellness and environmental sustainability, brands are introducing eco-friendly and non-toxic alternatives in the realm of nail care.

- Offline Distribution Channel Dominant

In 2023, the offline distribution category dominated the industry. The offline distribution channel for colour cosmetics predominantly includes physical retail outlets like department stores, specialty beauty retailers, drugstores, and supermarkets. Despite the growing prevalence of online shopping, offline channels remain integral to the industry.

Brick-and-mortar stores offer consumers the opportunity for hands-on interaction with products, enabling them to visually assess, feel, and test cosmetics before making a purchase decision. This tactile engagement is particularly significant for colour cosmetics, where factors like shade selection and texture are crucial considerations. Department stores such as Sephora and Ulta Beauty provide a diverse assortment of brands and premium cosmetics, appealing to consumers seeking luxury products and a personalised shopping experience. On the other hand, drugstores and supermarkets cater to budget-conscious consumers, offering convenient access to everyday make-up essentials.

The online distribution category category is anticipated to grow substantially throughout the projected period. E-commerce platforms, encompassing brand websites, online marketplaces like Amazon, and beauty-focused websites, have emerged as preferred destinations for cosmetics shopping. Online shopping offers convenience, a vast array of products, and the ability to compare prices and reviews. It has democratised access to cosmetics, enabling consumers in remote areas to purchase products that may not be readily available locally.

Virtual try-on tools and augmented reality applications enable consumers to visualise how products will appear on them, addressing some of the challenges associated with online cosmetics shopping. Moreover, direct-to-consumer (DTC) brands have thrived in the online realm, leveraging the opportunity to reach a global audience without the need for physical storefronts. Social media and influencer marketing have significantly contributed to driving online cosmetics sales, as consumers are influenced by product reviews and tutorials.

Regional Frontrunners

Asia Pacific Provides the Largest Consumer Base

The burgeoning middle-class population in countries like India, and China is poised to drive demand in the foreseeable future. Additionally, the increasing presence of women in the workforce is contributing to growth in the region, particularly evident in the popularity of BB (blemish balms), and CC (colour correcting) creams in countries such as China, and Japan.

The global and Indian markets have witnessed a surge in the cruelty-free and vegan beauty segment in recent years. In March 2023, Plum, a vegan beauty brand based in India, inaugurated its inaugural store in New Delhi, India. The brand boasts exclusive outlets across the nation, including in major cities like Mumbai, Bengaluru, Lucknow, Kolkata, and Chandigarh, with intentions to further extend its presence to additional cities in India in the future.

Cosmetic manufacturers are prioritising natural and environmentally friendly ingredients to align with the growing demand for 'green cosmetics' and clean beauty products. Both manufacturers and third-party e-retailers are capitalising on this trend by introducing or incorporating clean beauty offerings into their product portfolios.

For example, in June 2023, the eCommerce platform Purplle introduced the UK's clean beauty brand Dr. PAWPAW to the Indian market, offering multi-tasking lip and skin care products. Furthermore, the Ministry of Health and Family Welfare of India has implemented a ban on cosmetic testing, reinforcing the prohibition of cosmetic testing on animals under the existing Drugs and Cosmetics Rules with the addition of rule "148-C.

Europe Gears up for Exceptional Growth as Organic and Natural Take Centre Stage

Germany, France, the U.K., Italy, Poland, and Spain stand out as key markets in the region. The cosmetics sector plays a substantial role in the European economy, employing over 2.0 billion individuals throughout the region. In recent years, there has been a surge in the popularity of highlighter and colour-correcting products in the region.

Additionally, there is a growing preference for organic colour cosmetics, driven by concerns regarding the potential adverse effects of conventional cosmetics. Consumers are increasingly seeking products free from controversial synthetic chemicals and opting for multifunctional cosmetics.

According to the Soil Association, the organic health and beauty market in the U.K. has experienced consistent growth over the past 12 years, averaging a remarkable annual growth rate of 47%, from €37 million in 2012 to €171 million in 2022. However, despite the impressive growth in sales of organic-certified cosmetics, this segment only represents 1.7% of total cosmetic sales in the U.K. Furthermore, the U.K. organic beauty and wellbeing market saw a robust growth rate of 6.8% in retail sales in 2021-2022, surpassing €173.7 million.

Fairfield’s Competitive Landscape Analysis

The global colour cosmetics market is a consolidated market with fewer major players present across the globe. Significant investments are being made in research and development to produce cosmetics that are not only highly efficient but also sustainable and eco-friendly. This encompasses the innovation of clean beauty items devoid of harmful chemicals and the adoption of cruelty-free practices, which appeal to socially aware consumers. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Colour Cosmetics Space?

- L'Oréal S.A.

- The Estée Lauder Companies Inc.

- Procter & Gamble Co. (P&G)

- Coty Inc.

- Shiseido Company, Limited

- Revlon, Inc.

- Avon Products, Inc.

- Amorepacific Corporation

- Chanel S.A.

- Johnson & Johnson (J&J)

Significant Company Developments

New Product Launch

- January 2020: In January 2020, the L’Oréal Group launched its groundbreaking beauty tech innovation aimed at revolutionising the hair colouration sector: Coloursonic, a portable device that streamlines the hair colouring process with its mess-free mixing and application method, ensuring consistent results for consumers at home. Additionally, they introduced Colouright, an AI-integrated hair colour system tailored for salon professionals. This system incorporates virtual try-on capabilities to visualise desired shades and utilises an algorithm to create personalised hair colours from over 1,500 custom shade possibilities.

- January 2022: In January 2022, Chanel introduced a new range of beauty products featuring natural ingredients sourced sustainably, accompanied by eco-conscious packaging solutions.

- September 2022: In September 2022, BBIA launched its signature soft MLBB colours, marking a significant advancement in the industry. This development represents a contemporary shift towards offering refined and enhanced colour options, effectively diversifying the company's product portfolio.

Distribution Agreement

- April 2023: In April 2023, L'Oréal S.A. completed the acquisition of the esteemed Australian luxury label, Aesop, from Natura & Co. This strategic maneuver aims to strengthen L'Oréal's presence in the high-end cosmetics sector. With the incorporation of Aesop into its portfolio, L'Oréal gains access to a brand renowned for its premium skincare and beauty offerings, perfectly aligning with its dedication to excellence in the beauty industry.

- October 2021: In October 2021, Coty announced the expansion of the direct-to-consumer website for the Kylie Skin cosmetic brand, extending its reach to the U.K., Germany, Australia, and France. This expansion initiative is geared toward enhancing global outreach and enhancing consumer purchasing accessibility.

An Expert’s Eye

Demand and Future Growth

Colour cosmetic products serve to enhance the outward appearance of the human body, encompassing facial and eye products, lip care items, and nail care treatments. These products are commonly found in supermarkets and specialty stores, but the prevailing distribution channel for colour cosmetics is increasingly through online platforms. The surge in demand for colour cosmetics within the beauty industry is anticipated to propel market expansion.

Furthermore, the growth in disposable income in emerging economies like India, Brazil, the UAE, and Saudi Arabia has contributed to market growth. Additionally, the financial autonomy of women in the workforce stands as a pivotal factor driving market growth. However, the colour cosmetics market is expected to face considerable challenges because of skin issues arising from chemical ingredients in cosmetics.

Supply Side of the Market

According to our analysis, The reduction of toxic elements such as lead, phthalates, and parabens has led to the emergence of organic cosmetics, thereby fueling the expansion of the colour cosmetics market. Additionally, luxury cosmetic brands place significant emphasis on product packaging. For example, they prioritise manufacturing lipstick containers with push-up lids or magnetic closures, providing a robust and opulent feel. These aspects are anticipated to boost the demand for colour cosmetics.

Furthermore, manufacturers are introducing personalised colour cosmetic items. These products offer tailored blending options, featuring a mixing palette and a wide range of colour choices to create shades according to individual preferences. Specifically engineered to complement various skin tones, they have garnered significant consumer interest. Moreover, these products leverage technology to scan skin tones and formulate a product to perfection.

Global Colour Cosmetics Market is Segmented as Below:

By Product Type:

- Nail Products

- Lip Products

- Eye Products

- Facial Products

- Hair Products

- Misc

By Distribution Channel:

- Offline

- Online

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Colour Cosmetics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Colour Cosmetics Market Outlook, 2018 - 2030

3.1. Global Colour Cosmetics Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Nail Products

3.1.1.2. Lip Products

3.1.1.3. Eye Products

3.1.1.4. Facial Products

3.1.1.5. Hair Products

3.1.1.6. Misc

3.2. Global Colour Cosmetics Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Offline

3.2.1.2. Online

3.3. Global Colour Cosmetics Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Colour Cosmetics Market Outlook, 2018 - 2030

4.1. North America Colour Cosmetics Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Nail Products

4.1.1.2. Lip Products

4.1.1.3. Eye Products

4.1.1.4. Facial Products

4.1.1.5. Hair Products

4.1.1.6. Misc

4.2. North America Colour Cosmetics Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Offline

4.2.1.2. Online

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Colour Cosmetics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Colour Cosmetics Market Outlook, 2018 - 2030

5.1. Europe Colour Cosmetics Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Nail Products

5.1.1.2. Lip Products

5.1.1.3. Eye Products

5.1.1.4. Facial Products

5.1.1.5. Hair Products

5.1.1.6. Misc

5.2. Europe Colour Cosmetics Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Offline

5.2.1.2. Online

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Colour Cosmetics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Colour Cosmetics Market Outlook, 2018 - 2030

6.1. Asia Pacific Colour Cosmetics Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Nail Products

6.1.1.2. Lip Products

6.1.1.3. Eye Products

6.1.1.4. Facial Products

6.1.1.5. Hair Products

6.1.1.6. Misc

6.2. Asia Pacific Colour Cosmetics Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Offline

6.2.1.2. Online

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Colour Cosmetics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Colour Cosmetics Market Outlook, 2018 - 2030

7.1. Latin America Colour Cosmetics Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Nail Products

7.1.1.2. Lip Products

7.1.1.3. Eye Products

7.1.1.4. Facial Products

7.1.1.5. Hair Products

7.1.1.6. Misc

7.2. Latin America Colour Cosmetics Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Offline

7.2.1.2. Online

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Colour Cosmetics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Colour Cosmetics Market Outlook, 2018 - 2030

8.1. Middle East & Africa Colour Cosmetics Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Nail Products

8.1.1.2. Lip Products

8.1.1.3. Eye Products

8.1.1.4. Facial Products

8.1.1.5. Hair Products

8.1.1.6. Misc

8.2. Middle East & Africa Colour Cosmetics Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Offline

8.2.1.2. Online

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Colour Cosmetics Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Colour Cosmetics Market by Product Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Colour Cosmetics Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Distribution Channel Heatmap

9.2. Manufacturer vs Distribution Channel Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. L'Oréal S.A.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. The Estée Lauder Companies Inc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Procter & Gamble Co. (P&G)

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Coty Inc

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Shiseido Company, Limited

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Revlon, Inc

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Avon Products, Inc

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Amorepacific Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Chanel S.A.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. Johnson & Johnson (J&J)

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |