Global Cool Roof Coatings Market Forecast

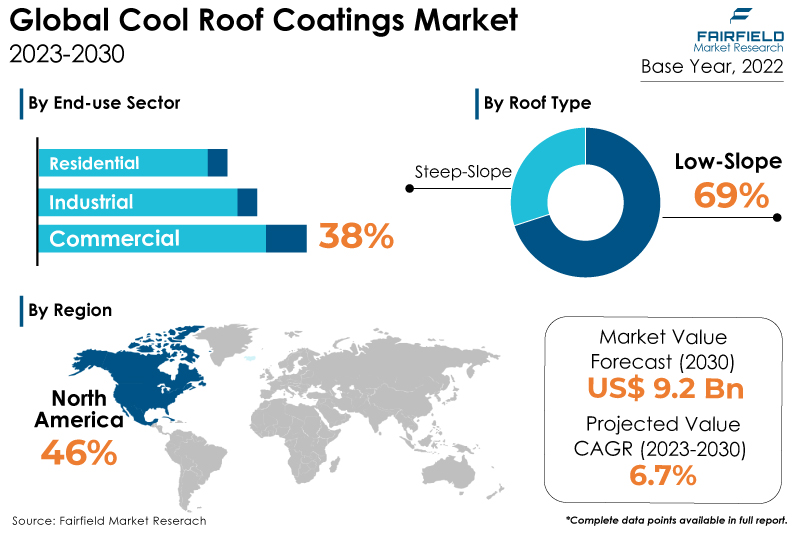

- Global cool roof coatings market size projected to reach nearly US$9.2 Bn by 2030-end, up from US$5.4 Bn recorded in 2022.

- Market value set to demonstrate a strong CAGR of 6.7% during 2023 - 2030.

Market Analysis in Brief

Cool roof coatings have gained significant traction in the global market in recent years due to their energy-saving and environmental benefits. As concerns about climate change and energy efficiency continue to grow, cool roof coatings have become a crucial element in the construction and renovation of buildings worldwide. The market for cool roof coatings is on a steady upward trajectory, driven by increasing awareness of energy efficiency, environmental concerns, and innovative product developments. As the construction industry continues to prioritise sustainability, the demand for cool roof coatings is expected to remain strong, providing both economic and environmental advantages to consumers and businesses alike.

The global market for cool roof coatings has witnessed consistent growth, with North America, and Europe leading the way in adoption due to stringent energy efficiency regulations and incentives. However, emerging economies in Asia Pacific, and Latin America are also recognising the benefits of cool roofs, creating new opportunities for market expansion. Additionally, advancements in coating technologies are enhancing product durability and performance, further boosting the market's growth potential.

Key Report Findings

- Unprecedented population growth, and rapid urbanisation across the major cities worldwide have led to the phenomenon heat urban island (UHI) effect. Cool roof coatings offer benefits to mitigate urban heat island effects as well as reduced air pollution and GHG emission.

- With more cities adopting policies and initiatives/programs for encouraging the installations of cool roof coatings, especially in the Europe and Asia Pacific, through voluntary green building programs, income-qualified programs, and financial incentives.

- Asia Pacific represents an important, high-potential market for cool roof coatings, and currently accounts for more than 26% share of the total market valuation.

- While North America leads, followed by European and Asian markets, the Middle East & Africa is expected to exhibit the fastest growth, displaying an estimated value CAGR of 9.5% between 2023 and 2030.

Growth Drivers

Increased Demand for Energy-efficient Building Materials

The sun is the most damaging element the roof experiences, and cool roof coating systems are light coloured roof coating systems designed to reflect the sun’s heat, aka ultraviolet (UV) rays, away from the roof. This not only protects the roof from the harsh sun, which causes blistering, splitting, embrittlement, and premature aging but it also lengthens the lifespan of the roof. Buildings with cool roof coatings remain cooler in temperature.

One key factor driving the adoption of cool roof coatings is their ability to reflect sunlight and heat, reducing the temperature of roofs and subsequently lowering indoor cooling costs. This translates into substantial energy savings for homeowners and businesses, making cool roofs an attractive investment.

Cool roof coating systems reduce energy consumption and cost. Moreover, lowered maintenance costs - add years onto the roof’s life by prolonging the inevitable and normal deterioration a roof experience. Roof coatings cut landfill waste - these cool roof coatings are installed in place, directly over the existing aged, leaking and/or failing roof. There is no need for a costly and timely roof replacement, eliminating any trips to a landfill site. This remains a robust factor supporting the growth of cool roof coatings market.

The Flourishing Energy-efficient Building Trend

The global need for energy-efficient building materials is increasing. These materials are used in commercial building renovations as well as new home construction. The product is thought to contribute to structural safety and enhancement while also cutting energy costs. These coatings have a high acceptance rate since they improve environmental and economic sustainability.

Furthermore, the development of cool metal roofs has the potential to save up to 40% on annual energy expenses. Titles or granular-coated metal roofing systems are recommended for homes in hotter climates because they reflect solar energy and re-emit most of the absorbed solar radiation. According to a study, net consumption of 11.47 billion square meters in 2020, Asia was by far the world's greatest consumer of ceramic tiles. in comparison, Oceania consumed 53 million square meters of ceramic tile that year.

Moreover, governments and environmental organisations are increasingly promoting cool roof technologies as a sustainable solution to mitigate urban heat island effects and reduce greenhouse gas emissions.

The Global Cooling Crunch

To save energy, metal roofs that are extremely reflective, and emissive are painted or granular coated. In addition, progress and continued research are likely to lead to the development of more energy-efficient rooftop coatings. According to the International Energy Agency (IEA), cities in the global south face a complicated issue like all cities, they must cut carbon emissions while still expanding energy access.

Currently, 1.1 billion people throughout the world do not have access to electric cooling despite the fact that they would benefit immediately from better thermal comfort, health, and productivity. As climate change increases, this challenge will only become more difficult. Increased hot days equal more air conditioner usage.

To fulfil the demands of this approaching "cooling crunch," the International Energy Agency believes that the globe will need to create the equivalent of the entire electrical infrastructure of the United States, Europe, and India combined by 2050.

Growth Drivers

Lower Initial Installation Costs of Low-sloped Roof

The cool roof coatings market is dominated by the low-sloped roof application segment, which is expected to grow during the projected period due to benefits such as reduced build-up material and lower initial installation costs compared to the steep-sloped procedure. Low-sloped roofs are common in industrial and commercial structures.

Increased penetration of low-sloped roofing systems has resulted from increased awareness of the necessity of green building construction, as well as strict rules regarding roofing materials for industrial and commercial structures. The demand for cool roof coatings is steadily increasing due to the widespread usage of low-sloped roofs in commercial and industrial buildings around the world.

The growing awareness about the necessity of green building development in both industrial and commercial regions is driving the increased penetration of low-sloped roofing systems. Low-sloped is becoming increasingly popular among businesses and property owners because of its low cost, low material and labour needs, and ease of installation and coating. In addition, if any repairs or replacements are necessary, the re-roofing process is quite simple and quick.

One of the most noticeable advantages of low-sloped is the increase in outdoor usable space. These roofs are also perfect for routine maintenance. Demand for this area is projected to be aided by the durability of low-sloped.

Overview of Key Segments

Based on material, the white elastomeric material will continue to be the preferred consumer choice for cool roof coatings.

When it comes to the type of roof, low-slope type has been winning consumer preference over its steep-slope counterpart.

Among residential, industrial, and commercial end users, the commercial end user segment will most likely maintain a dominating share of more than 38% in the market through the end of 2030.

Growth Opportunities Across Regions

North America Surges Ahead as Building Energy Use Gains Wider Recognised

The North America’s cool roof coatings market is projected to dominate the global industry, with over 46% revenue share throughout the period of forecast. This is majorly due to the early implementation of building codes and increased consumer awareness of building energy use. Homes, and other structures in the United States consume a lot of energy. Buildings also account for about 40% of total energy consumption in the United States, as well as a similar percentage of greenhouse gas emissions.

Cool roof coatings market in the United States is expected to be driven by rising awareness of building energy use and the implementation of the Leadership in Energy and Environmental Design (LEED) green building certification project.

Moreover, rising consumer awareness and government initiatives to minimise carbon emissions are credited in this region. Because these green buildings have unique design elements that ensure efficient water and energy efficiency, demand for roof coating has exploded in this region. As a result, ecologically friendly coatings such as silicone coating have been developed and used. Because they provide necessary building protection over the building's entire life cycle while lowering energy costs.

The construction industry of North America is expected to grow significantly in the coming years because of the high demand for residential, non-residential, and commercial construction projects, which will drive the growth of the cool roof coatings market in the region over the forecast period.

With the favourable outlook for commercial real estate and strong economic fundamentals, as well as increased federal and state financing for institutional buildings and public infrastructure, the construction industry in the United States has seen tremendous growth in recent years.

Over the forecast period, ongoing and planned projects such as new homeless services and health centres, modernisation of SFUSD sites, affordable housing developments, the SoFi Stadium project in Inglewood, and Treasure Island redevelopment are expected to boost demand for cool roof floor coatings applications.

Competitive Landscape: Cool Roof Coatings Market

A few of the players in the cool roof coatings market include Sika AG, Wacker, Nutech Paint; The Valspar Corporation; Dow Inc., PPG Industries, Inc., AkzoNobel, and Huntsman International LLC.

Notable Industry Developments

- In June 2020, Grupo Orbis, a Colombian paints and coatings manufacturer, agreed to be acquired by AkzoNobel. Completion is scheduled for 2022, subject to regulatory permissions. By creating a market presence in the Andean region and Central America, this acquisition will strengthen the company's long-term position in South America.

- In October 2021, WACKER, a chemical company located in Munich, acquired a 60 percent share in Jining-based specialised silane maker SICO Performance Material Co., Ltd. (China). WACKER and SICO have signed a similar agreement, and their new relationship with SICO is a logical next step in our global plan to increase the share of high-margin specialties in our silicone business.

The Global Cool Roof Coatings Market is Segmented into:

By Material

- White Elastomeric

- IR-based Coloured Coatings

By Roof Type

- Low-slope

- Steep-slope

By End-use Sector

- Residential

- Commercial

- Industrial

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Cool Roof Coatings Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.7.2. Construction Activity Worldwide

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Global Cool Roof Coatings, Production Output, by Region, 2018 - 2022

4. Price Trends Analysis and Future Projects, 2018 - 2030

4.1. Global Average Price Analysis, by Material, US$ per Kg

4.2. Prominent Factors Affecting Cool Roof Coatings Prices

4.3. Global Average Price Analysis, by Region, US$ per Kg

5. Global Cool Roof Coatings Market Outlook, 2018 - 2030

5.1. Global Cool Roof Coatings Market Outlook, by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. White Elastomeric

5.1.1.2. IR-based Coloured Coatings

5.2. Global Cool Roof Coatings Market Outlook, by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Low-slope

5.2.1.2. Steep-slope

5.3. Global Cool Roof Coatings Market Outlook, by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Residential

5.3.1.2. Commercial

5.3.1.3. Industrial

5.4. Global Cool Roof Coatings Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Cool Roof Coatings Market Outlook, 2018 - 2030

6.1. North America Cool Roof Coatings Market Outlook, by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. White Elastomeric

6.1.1.2. IR-based Coloured Coatings

6.2. North America Cool Roof Coatings Market Outlook, by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Low-slope

6.2.1.2. Steep-slope

6.3. North America Cool Roof Coatings Market Outlook, by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Residential

6.3.1.2. Commercial

6.3.1.3. Industrial

6.4. North America Cool Roof Coatings Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. U.S. Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.4.1.2. U.S. Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.4.1.3. U.S. Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.4.1.4. Canada Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.4.1.5. Canada Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.4.1.6. Canada Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Cool Roof Coatings Market Outlook, 2018 - 2030

7.1. Europe Cool Roof Coatings Market Outlook, by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. White Elastomeric

7.1.1.2. IR-based Coloured Coatings

7.2. Europe Cool Roof Coatings Market Outlook, by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Low-slope

7.2.1.2. Steep-slope

7.3. Europe Cool Roof Coatings Market Outlook, by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Residential

7.3.1.2. Commercial

7.3.1.3. Industrial

7.4. Europe Cool Roof Coatings Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Germany Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.2. Germany Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.3. Germany Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.4. France Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.5. France Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.6. France Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.7. U.K. Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.8. U.K. Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.9. U.K. Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.10. Italy Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.11. Italy Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.12. Italy Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.13. Spain Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.14. Spain Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.15. Spain Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.16. Russia Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.17. Russia Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.18. Russia Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.19. Rest of Europe Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.20. Rest of Europe Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.1.21. Rest of Europe Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Cool Roof Coatings Market Outlook, 2018 - 2030

8.1. Asia Pacific Cool Roof Coatings Market Outlook, by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. White Elastomeric

8.1.1.2. IR-based Coloured Coatings

8.2. Asia Pacific Cool Roof Coatings Market Outlook, by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Low-slope

8.2.1.2. Steep-slope

8.3. Asia Pacific Cool Roof Coatings Market Outlook, by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Residential

8.3.1.2. Commercial

8.3.1.3. Industrial

8.4. Asia Pacific Cool Roof Coatings Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. China Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.2. China Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.3. China Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.4. Japan Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.5. Japan Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.6. Japan Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.7. India Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.8. India Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.9. India Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.10. South Korea Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.11. South Korea Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.12. South Korea Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.13. Southeast Asia Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.14. Southeast Asia Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.15. Southeast Asia Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.16. Rest of Asia Pacific Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.17. Rest of Asia Pacific Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.1.18. Rest of Asia Pacific Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Cool Roof Coatings Market Outlook, 2018 - 2030

9.1. Latin America Cool Roof Coatings Market Outlook, by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.1.1. Key Highlights

9.1.1.1. White Elastomeric

9.1.1.2. IR-based Coloured Coatings

9.2. Latin America Cool Roof Coatings Market Outlook, by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.2.1. Key Highlights

9.2.1.1. Low-slope

9.2.1.2. Steep-slope

9.3. Latin America Cool Roof Coatings Market Outlook, by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.3.1. Key Highlights

9.3.1.1. Residential

9.3.1.2. Commercial

9.3.1.3. Industrial

9.4. Latin America Cool Roof Coatings Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1. Key Highlights

9.4.1.1. Brazil Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1.2. Brazil Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1.3. Brazil Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1.4. Mexico Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1.5. Mexico Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1.6. Mexico Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1.7. Rest of Latin America Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1.8. Rest of Latin America Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.1.9. Rest of Latin America Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Cool Roof Coatings Market Outlook, 2018 - 2030

10.1. Middle East & Africa Cool Roof Coatings Market Outlook, by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.1.1. Key Highlights

10.1.1.1. White Elastomeric

10.1.1.2. IR-based Coloured Coatings

10.2. Middle East & Africa Cool Roof Coatings Market Outlook, by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.2.1. Key Highlights

10.2.1.1. Low-slope

10.2.1.2. Steep-slope

10.3. Middle East & Africa Cool Roof Coatings Market Outlook, by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.3.1. Key Highlights

10.3.1.1. Residential

10.3.1.2. Commercial

10.3.1.3. Industrial

10.4. Middle East & Africa Cool Roof Coatings Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1. Key Highlights

10.4.1.1. GCC Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1.2. GCC Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1.3. GCC Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1.4. South Africa Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1.5. South Africa Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1.6. South Africa Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1.7. Rest of Middle East & Africa Cool Roof Coatings Market by Material, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1.8. Rest of Middle East & Africa Cool Roof Coatings Market by Roof Type, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.1.9. Rest of Middle East & Africa Cool Roof Coatings Market by End-use Sector, Volume (Kilo Tons) and Value (US$ Mn), 2018 - 2030

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Material vs Roof Type vs End-use Sector Heatmap

11.2. Company Market Share Analysis, 2022

11.3. Competitive Dashboard

11.4. Company Profiles

11.4.1. The Sherwin-Williams Company

11.4.1.1. Company Overview

11.4.1.2. Product Portfolio

11.4.1.3. Financial Overview

11.4.1.4. Business Strategies and Development

11.4.2. PPG Industries Inc.

11.4.2.1. Company Overview

11.4.2.2. Product Portfolio

11.4.2.3. Financial Overview

11.4.2.4. Business Strategies and Development

11.4.3. Akzo Nobel N.V.

11.4.3.1. Company Overview

11.4.3.2. Product Portfolio

11.4.3.3. Financial Overview

11.4.3.4. Business Strategies and Development

11.4.4. Sika AG

11.4.4.1. Company Overview

11.4.4.2. Product Portfolio

11.4.4.3. Financial Overview

11.4.4.4. Business Strategies and Development

11.4.5. RPM International Inc.

11.4.5.1. Company Overview

11.4.5.2. Product Portfolio

11.4.5.3. Financial Overview

11.4.5.4. Business Strategies and Development

11.4.6. Henry Company LLC

11.4.6.1. Company Overview

11.4.6.2. Product Portfolio

11.4.6.3. Financial Overview

11.4.6.4. Business Strategies and Development

11.4.7. Kansai Paints Co. Ltd.

11.4.7.1. Company Overview

11.4.7.2. Product Portfolio

11.4.7.3. Financial Overview

11.4.7.4. Business Strategies and Development

11.4.8. Nippon Paints Holdings Co. Ltd.

11.4.8.1. Company Overview

11.4.8.2. Product Portfolio

11.4.8.3. Financial Overview

11.4.8.4. Business Strategies and Development

11.4.9. Asian Paints

11.4.9.1. Company Overview

11.4.9.2. Product Portfolio

11.4.9.3. Financial Overview

11.4.9.4. Business Strategies and Development

11.4.10. GAF Materials

11.4.10.1. Company Overview

11.4.10.2. Product Portfolio

11.4.10.3. Financial Overview

11.4.10.4. Business Strategies and Development

11.4.11. Nutech Paints

11.4.11.1. Company Overview

11.4.11.2. Product Portfolio

11.4.11.3. Business Strategies and Development

11.4.12. Excel Coatings

11.4.12.1. Company Overview

11.4.12.2. Product Portfolio

11.4.12.3. Business Strategies and Development

11.4.13. Monarch Paints Private Limited

11.4.13.1. Company Overview

11.4.13.2. Product Portfolio

11.4.13.3. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Material Coverage |

|

|

Roof Type Coverage |

|

|

End-use Sector Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Production Output, Price Trend Analysis, Competition Landscape, Material-, Roof Type-, End-user-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply), Key Market Trends |