Global Cosmetics ODM Market Forecast

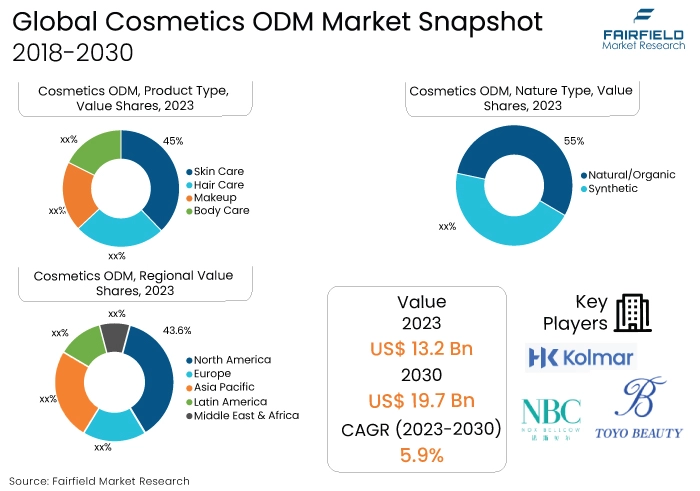

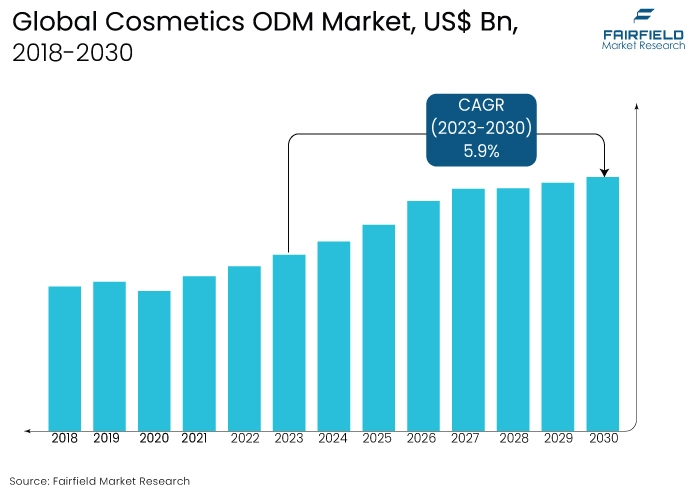

- The approximately US$13.2 Bn cosmetics ODM market (2023) poised to reach US$19.7 Bn by 2030

- Global market for cosmetics ODM likely to witness at a CAGR of 5.9% between 2023 and 2030

Quick Report Digest

- Inclusivity and diversity are the key trends anticipated to fuel the cosmetics ODM market growth. Furthermore, inclusion and diversity are becoming increasingly important in the cosmetics sector. ODMs collaborate with businesses to create products that suit a broad spectrum of skin types, tones, and cultural preferences, mirroring the varied beauty standards that consumers uphold.

- Another major market trend expected to fuel the cosmetics ODM market growth is the rapidly increasing transparent and ethical practices. To gain the trust of consumers and brands, ODMs must adhere to ethical and transparent processes. ODMs strongly emphasize openness in sourcing ingredients, the manufacturing processes, and the use of ethical labour practices to attract socially conscious customers.

- It can be difficult for ODMs to maintain constant quality throughout large-scale production. Brands are wary of possible differences in product quality because they could damage their standing with consumers and harm their confidence.

- In 2023, the skin care category dominated the industry. The two main components of skincare are hydration and moisturisation. ODM suppliers that create products that fulfill these necessities substantially contribute to the market, particularly in areas with diverse climates.

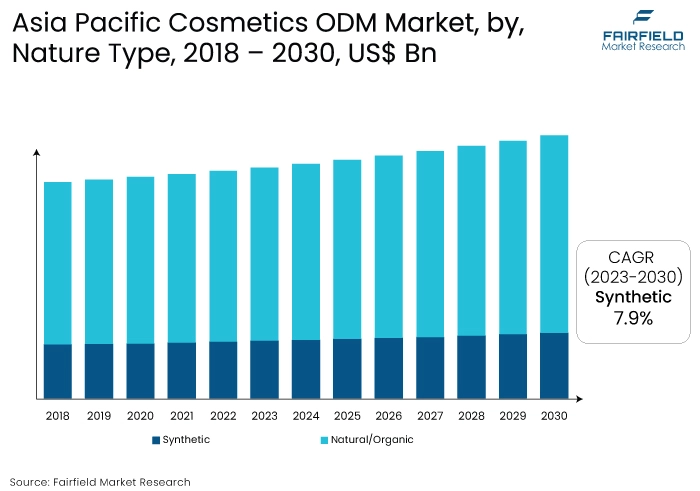

- Regarding market share for cosmetics ODM globally, the natural/organic segment is anticipated to dominate. Herbal and botanical-based ingredients are commonly found in natural and organic cosmetic products. ODM suppliers use botanical and herbal extracts in their recipes to satisfy consumers' desire for natural ingredients.

- In 2023, the prestige brands category controlled the market. High-end packaging and design are significant investments made by prestige businesses. Working closely with these companies, ODM services must design packaging that reflects their values and exudes exclusivity and elegance.

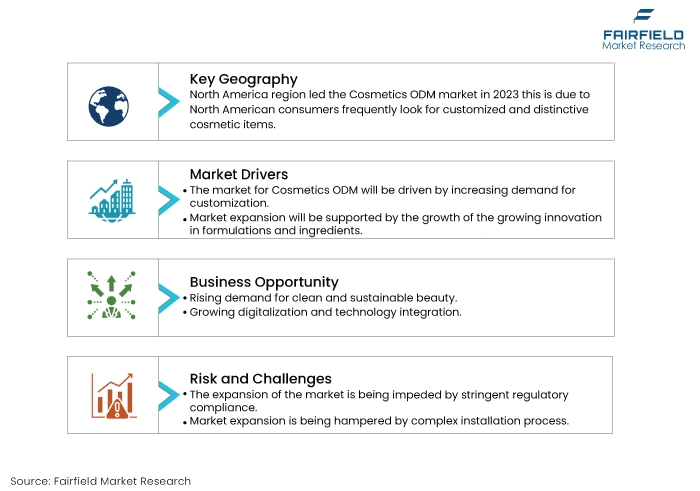

- The North American region is anticipated to account for the largest share of the global cosmetics ODM market, owing to the cosmetic manufacturers now having the chance to reach a larger audience due to the expansion of e-commerce in North America. By helping these companies create products appropriate for online retail, ODM suppliers may promote expanding the market.

- The market for cosmetics ODM is expanding in Asia Pacific due to Asia Pacific ODM suppliers being capable of producing a wide variety of cosmetic products, including skincare and color cosmetics. Because of the region's adaptability, ODM services can satisfy a wide range of demands from both local and foreign consumers.

A Look Back and a Look Forward - Comparative Analysis

Automated technologies for formulating and mixing cosmetic ingredients enhance precision and consistency in product creation. As a result, new formulations can reach the market more quickly and with higher efficacy and reduced errors. The rapid development of packaging designs and cosmetic product components is made possible by 3D printing technology. This speeds up iterations during product development and reduces the expenses and duration of more conventional prototype techniques.

The market witnessed staggered growth during the historical period 2018 - 2023. The cosmetics industry was governed by stringent regulations enforced by regulatory agencies and health authorities. By guaranteeing the safety and legality of their cosmetic formulas, OEM suppliers who prioritised adhering to these laws could gain a competitive advantage.

However, ODM suppliers integrated quality control procedures into their manufacturing processes. To guarantee the consistency and security of cosmetic products, stringent testing, quality control procedures, and adherence to Good Manufacturing Practices (GMP) were routine procedures.

Innovative cosmetic product formulations, textures, and delivery methods can be created by ODM suppliers who make R&D investments. Because of their ingenuity, they can stand out in a competitive market and draw in brands looking for unique and cutting-edge items in the coming years. Additionally, R&D expenditures allow ODM suppliers to approach product development from a customer-centric perspective.

To create products that resonate with the target audience and drive market success, it is necessary to understand consumer demands, preferences, and trends. Furthermore, strong R&D teams at ODM suppliers enable them to modify formulas to suit a variety of international markets. Serving clients with a global presence and adhering to various regulatory regulations necessitate this flexibility during the next five years.

Key Growth Determinants

- Increasing Demand for Customisation

Modern consumers seek beauty items that complement their unique tastes, skin tones, and cultural backgrounds. Customised beauty solutions are increasingly demanded to satisfy the varied demands of a multicultural and international customer base.

Brands can develop customised formulas that address particular skincare or cosmetic issues. ODMs and brands can collaborate closely to create customised solutions with ingredients that target specific problems like hydration, anti-ageing, or specific skincare needs.

Customisation allows brands an advantage over competitors in a competitive sector. Brands looking to launch new and distinctive goods can work with OEMs that provide creative and adaptable solutions as strategic partners, which promotes brand loyalty and market differentiation.

- Growing Innovation in Formulations and Ingredients

The sophisticated and discerning modern consumer seeks cosmetics beyond simple skincare or beauty routines. ODMs can address the demand for cutting-edge solutions, such as anti-ageing, skin health, and specialty skincare products, by prioritising innovation in formulations and ingredients.

Customers and brands are searching for cosmetics that provide noticeable effects. ODMs that invest in novel formulations with advanced ingredients can produce products renowned for their performance and efficacy, drawing in customers looking for obvious and long-lasting advantages.

Customers have a wide variety of skin types and issues, which has increased demand for specialised solutions. Innovative formulators at ODMs can create solutions that target particular skin types and address problems like moisture, uneven skin tone, and sensitivity.

- Rise of Indie Beauty Brands

Indie beauty brands are renowned for their creative and distinctive product lines. ODMs can benefit from this spirit of entrepreneurship by partnering with independent businesses to develop unique cosmetics in the marketplace. Indie brands frequently call for higher manufacturing flexibility and smaller production runs.

OEMs present themselves as desirable partners for independent beauty firms by providing flexible manufacturing capabilities and faster turnaround times in response to these demands. Indie businesses prosper when they serve niche markets and meet particular customer needs.

By altering product features and formulations, ODMs may take advantage of these specialised markets and enable independent businesses to produce goods specifically catered to their intended markets.

Major Growth Barriers

- Stringent Regulatory Compliance

ODMs need help complying with various regulations that are always changing in the cosmetics industry. Handling complex regulatory environments, which might differ between states and regions, requires significant time and knowledge.

Compliance criteria may need product formulation alterations due to stringent regulations. Adapting these adjustments without sacrificing the product's quality or going against the brand's initial intent may be difficult for ODMs.

- IP Concerns

Trade secrets are essential for OEMs and brands to stay competitive. Keeping these trade secrets safe while collaborating is the difficult part. One major limitation may be the possibility of unintentional disclosure or deliberate misappropriation.

Obtaining exclusive rights to the formulations that ODMs create may be difficult. Several brands may employ formulations that need to be adequately protected concurrently, which would restrict the ODM's capacity to provide exclusive or exclusive goods.

Key Trends and Opportunities to Look at

- Rising Demand for Clean and Sustainable Beauty

Consumers seek sustainable and environmentally friendly beauty products as their understanding and concern about environmental issues grow. ODMs emphasizing sustainable and clean formulations will be in an excellent position to satisfy this growing demand. Cosmetic brands are integrating sustainability into their brand identity as part of their commitment to sustainability.

ODMs that support this commitment by providing environmentally friendly options for product creation, packaging, and production help the brands they work with achieve their overall sustainability objectives.

- Growing Digitalisation, and Technology Integration

ODMs can analyse huge amounts of data to optimise formulations thanks to digital tools. More efficient and user-friendly cosmetic formulations result from identifying trends, preferences, and component interactions by machine learning algorithms and data analytics.

Digitalisation makes it easier to test and prototype cosmetic items virtually. Manufacturers may evaluate product performance, packaging designs, and formulas using virtual simulations, eliminating the need for physical prototypes and shortening the time required to produce new products.

- Rising E-commerce Integration

Manufacturers are prompted by e-commerce integration to create packaging that can be shipped online. Product unboxing experiences are improved, and good brand views are bolstered by visually appealing and protective packaging.

ODMs are enabled to participate part in innovative online campaigns through e-commerce integration. Brands might work together to craft limited-time offers, bundle packages, and unique discounts to increase online sales and draw in a larger customer base.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the US has regulated cosmetics by the FDA to guarantee product safety and accurate labeling. FDA rules impact ODM providers' formulation, labeling, and quality control operations in the U.S. market. Cosmetics are subject to a thorough regulatory system in the European Union to protect consumer safety. ODM suppliers to the EU market are bound by the EU Cosmetics Regulation, which includes safety evaluations and ingredient limitations.

In South Korea, the MFDS oversees cosmetics labeling and safety. To operate in the South Korean market, ODM services must follow the rules established by the MFDS. The role of China's cosmetics regulating body is to supervise product registration and guarantee product safety.

Exporting ODM goods to China requires adherence to CFDA rules, which include safety evaluations and product registration. ISO establishes guidelines for cosmetic products to guarantee their safety and quality. These guidelines impact the ODM market because ODM suppliers can use them to improve the quality of their products and ensure compliance.

Fairfield’s Ranking Board

Top Segments

- Skin Care Category Continues to Dominate Hare Care Segments

The skin care segment dominated the market in 2023 because of the growing tendency towards utilising cosmetics to protect the skin and the rising demand for skincare products. The skincare industry has grown due to escalating environmental effects on skin caused by atmospheric CO2 saturation and greater knowledge of the harmful effects of UV radiation on naked skin.

The need for anti-ageing skincare products has surged due to the global ageing population. This market is served by ODM services that concentrate on creating potent anti-ageing formulas. Furthermore, the hare care category is projected to experience the fastest market growth. The world of hair care is evolving due to increased hair damage, hair loss, and hair thinning.

Excessive hair loss is caused by air pollution because, as researchers have found, exposure to common pollutants lowers the amounts of four essential proteins for hair growth and retention. Hair tonics are often formulated with natural oils to protect the scalp, leave the hair lubricated and moisturised, reduce split ends, and minimise wrinkles.

- Natural/Organic Ingredients Surge Ahead

In 2023, the natural/organic category dominated the industry. Consumers are becoming more aware of environmental sustainability. The market for natural and organic cosmetics is partly fueled by ODM services that prioritise eco-friendly packaging, sustainable sourcing, and general environmental practices. The natural and organic cosmetics market aligns with more general trends in health and wellness. Customers' perception of the health benefits of natural components is fueling the need for ODM services that emphasize all-encompassing beauty solutions.

The synthetic category is anticipated to grow substantially throughout the projected period. Synthetic ingredients are often less expensive than their natural counterparts. ODM providers working with companies with tight budgets or searching for less expensive formulas may use synthetic components to reduce production costs.

Compared to some natural ingredients, synthetic ingredients are recognised for their stability and extended shelf-life. Cosmetics made with synthetic ingredients and formulated by ODM services have a longer shelf-life and are higher quality.

- Prestige Brands to Lead the Cosmetics ODM Space

The prestige brands segment dominated the market in 2023. Prestige brands emphasize the use of high-quality ingredients and formulas. Premium companies want their ODM suppliers to deliver high-end, sophisticated formulations that meet the brand's exacting requirements.

Prestige brands frequently set the standard for exclusivity and creativity. ODM services that work with luxury brands must create innovative and distinctive cosmetics that complement the brand's dedication to exclusivity and innovation.

The indie brands category is expected to experience the fastest growth within the forecast time frame. The budgets for indie brands are frequently tight. Independent companies who want to launch high-end products without incurring exorbitant production expenses are drawn to synthetic cosmetics due to their often lower prices than natural substitutes.

The image of independent brands depends on their ability to provide high-quality goods consistently. Assuring that every batch satisfies the required quality standards, synthetic ingredients help formulas remain stable and consistent.

Regional Frontrunners

North America Remains the Largest Revenue Contributor

North America is expected to dominate the market. North American consumers frequently look for customised and distinctive cosmetic items. ODM services can meet this demand and support market expansion by providing individualised solutions. The adoption of technology and innovation are concentrated in North America.

ODM suppliers in the area are likely to adopt cutting-edge technology for cosmetic formulation to satisfy the market's need for innovative, premium goods. Rapidly evolving trends define the North American cosmetics sector.

ODM services in the area can benefit from their swift shifts in response to market developments, giving companies flexible options to maintain their competitiveness. Numerous well-known cosmetic brands are based in North America. These brands might go with ODM services to develop products quickly and adaptably, impacting the market's general expansion.

Asia Pacific Attracts Investors

Asia Pacific is expected to be the fastest-growing region. Asia Pacific, particularly nations like China and South Korea, is a major hub for the production of cosmetics worldwide. ODM suppliers in this area profit from a well-established manufacturing infrastructure and knowledge. The area is renowned for its capacity for economical production.

International cosmetic brands looking for cost-effective and efficient production solutions are drawn to Asia Pacific's ODM services due to their affordable price. Innovation in cosmetic formulas and production techniques is highly prioritised in Asia Pacific nations. ODM suppliers use regional knowledge to deliver creative solutions that satisfy changing demands in the cosmetics industry.

Fairfield’s Competitive Landscape Analysis

A few global companies control most of the cosmetics ODM market. The leading businesses are creating new products and enhancing their distribution systems to expand their worldwide footprint. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in Global Cosmetics ODM Space?

- COSMAX Corporation

- Toyo Beauty Co. Ltd.

- Nox Bellcow Cosmetics Co. Ltd.

- Picaso Cosmetic Laboratory Group

- Kolmar Korea

- Ancorotti Cosmetics S.r.l.

- Cosmo Beauty Company Ltd.

- Cosmecca Korea

- The Fareva Group

- Kolormakeup & Skincare S.p.a.

- BioTruly Group

- ANC Corporation

- HCT Group

- Intercos Group

- Estée Lauder Companies

Significant Industry Developments

New Product Launch

- October 2022: Super Stay Vinyl Ink Liquid Lipcolor, a breakthrough in long-lasting lip color, was introduced by Maybelline, New York. With no smudging or transfer, this unique composition promises 16 hours of vinyl-like color retention.

- April 2022: Pat McGrath Labs launched Divine Skin, their first skincare product, to improve the efficacy of customers' skincare regimens. Fresh Beauty debuted a brand-new face mist at the same time as their rose-infused line.

- March 2019: KBL Cosmetics introduced the Foldable Triangle Eye Shadow, a new innovative design product. KBL is a top-tier manufacturing supply chain partner with large-volume sales. They specialise in turnkey full-service solutions. From brand ideation to the conclusion of high-quality manufacturing, our methodology is built to handle every facet of product operations.

Distribution Agreement

- January 2022: Vellvette Lifestyle Pvt Ltd acquired ENN Beauty and took a majority ownership position.

- August 2020: Estée Lauder partnered with Perfect Corp., a beauty tech startup, to create augmented reality technology for its line of products.

An Expert’s Eye

Demand and Future Growth

ODMs provide economies of scale that enable brands to produce high-quality cosmetics at a reasonable cost. This is why brands frequently turn to them. Original manufacturers can manufacture cosmetics at lower prices than independent companies could by utilising their resources and experience.

Furthermore, ODMs are essential to the globalisation of beauty trends and the growth of cosmetic businesses into new markets because they customise products to satisfy a wide range of cultural preferences, legal requirements, and customer demands. However, the cosmetics ODM market is expected to face considerable challenges because of stringent regulatory compliance.

Supply Side of the Market

According to our analysis, China, the undisputed leader in volume production, is home to many large-scale ODM manufacturers, including HCT Group, renowned for their effectiveness and affordability. They handle a sizable amount of the world's OEM production of cosmetics, especially for mainstream and mass-market goods.

Innovative and quick-thinking Korean ODM companies like Amorepacific, and Cosmax thrive in South Korea. They provide brands looking for agility and distinction and are well-known for their cutting-edge ingredient technology, trend-driven formulations, and quick turnaround times.

The US, which has the world's biggest cosmetics industry, uses many ODM products, especially mass-market and premium lines. There are chances for many ODM sectors due to the diversified population and high disposable money, resulting in various preferences.

In addition, China's local cosmetics sector is growing, with more people choosing to buy ODM products made there in addition to imports. This consumption is driven by the emergence of domestic brands and the rising need for customised beauty.

Global Cosmetics ODM Market is Segmented as Below:

By Product Type:

- Skin Care

- Hair Care

- Makeup

- Body Care

By Nature Type:

- Natural/Organic

- Synthetic

By End Use:

- Prestige Brands

- Private Labels

- Mass Brands

- Indie Brands

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Cosmetics ODM Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Cosmetics ODM Market Outlook, 2018 - 2030

3.1. Global Cosmetics ODM Market Outlook, by Product Type of Metal, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Skin Care

3.1.1.2. Hare Care

3.1.1.3. Makeup

3.1.1.4. Body Care

3.2. Global Cosmetics ODM Market Outlook, by Nature Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Natural/Organic

3.2.1.2. Synthetic

3.3. Global Cosmetics ODM Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Prestige Brands

3.3.1.2. Private Lables

3.3.1.3. Mass Brands

3.3.1.4. Indie Brands

3.4. Global Cosmetics ODM Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Cosmetics ODM Market Outlook, 2018 - 2030

4.1. North America Cosmetics ODM Market Outlook, by Product Type of Metal, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Skin Care

4.1.1.2. Hare Care

4.1.1.3. Makeup

4.1.1.4. Body Care

4.2. North America Cosmetics ODM Market Outlook, by Nature Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Natural/Organic

4.2.1.2. Synthetic

4.3. North America Cosmetics ODM Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Prestige Brands

4.3.1.2. Private Lables

4.3.1.3. Mass Brands

4.3.1.4. Indie Brands

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Cosmetics ODM Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Cosmetics ODM Market Outlook, 2018 - 2030

5.1. Europe Cosmetics ODM Market Outlook, by Product Type of Metal, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Skin Care

5.1.1.2. Hare Care

5.1.1.3. Makeup

5.1.1.4. Body Care

5.2. Europe Cosmetics ODM Market Outlook, by Nature Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Natural/Organic

5.2.1.2. Synthetic

5.3. Europe Cosmetics ODM Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Prestige Brands

5.3.1.2. Private Lables

5.3.1.3. Mass Brands

5.3.1.4. Indie Brands

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Cosmetics ODM Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cosmetics ODM Market Outlook, 2018 - 2030

6.1. Asia Pacific Cosmetics ODM Market Outlook, by Product Type of Metal, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Skin Care

6.1.1.2. Hare Care

6.1.1.3. Makeup

6.1.1.4. Body Care

6.2. Asia Pacific Cosmetics ODM Market Outlook, by Nature Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Natural/Organic

6.2.1.2. Synthetic

6.3. Asia Pacific Cosmetics ODM Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Prestige Brands

6.3.1.2. Private Lables

6.3.1.3. Mass Brands

6.3.1.4. Indie Brands

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Cosmetics ODM Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Cosmetics ODM Market Outlook, 2018 - 2030

7.1. Latin America Cosmetics ODM Market Outlook, by Product Type of Metal, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Skin Care

7.1.1.2. Hare Care

7.1.1.3. Makeup

7.1.1.4. Body Care

7.2. Latin America Cosmetics ODM Market Outlook, by Nature Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Natural/Organic

7.2.1.2. Synthetic

7.3. Latin America Cosmetics ODM Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Prestige Brands

7.3.1.2. Private Lables

7.3.1.3. Mass Brands

7.3.1.4. Indie Brands

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Cosmetics ODM Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Cosmetics ODM Market Outlook, 2018 - 2030

8.1. Middle East & Africa Cosmetics ODM Market Outlook, by Product Type of Metal, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Skin Care

8.1.1.2. Hare Care

8.1.1.3. Makeup

8.1.1.4. Body Care

8.2. Middle East & Africa Cosmetics ODM Market Outlook, by Nature Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Natural/Organic

8.2.1.2. Synthetic

8.3. Middle East & Africa Cosmetics ODM Market Outlook, by End Use, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Prestige Brands

8.3.1.2. Private Lables

8.3.1.3. Mass Brands

8.3.1.4. Indie Brands

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Cosmetics ODM Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Cosmetics ODM Market by Product Type of Metal, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Cosmetics ODM Market Nature Type, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Cosmetics ODM Market End Use, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End Use vs End Use Heatmap

9.2. Manufacturer vs End Use Heatmap

9.3. Company Market Share Analysis, 2023

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. COSMAX Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Toyo Beauty Co. Ltd.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Nox Bellcow Cosmetics Co. Ltd.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Picaso Cosmetic Laboratory Group

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Kolmar Korea

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Ancorotti Cosmetics S.r.l.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Cosmo Beauty Company Ltd.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Cosmecca Korea

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. The Fareva Group

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. B. Kolormakeup & Skincare S.p.a.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. BioTruly Group

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. ANC Corporation

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. HCT Group

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Intercos Group

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Estée Lauder Companies

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Nature Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |