Global Cryostat Market Forecast

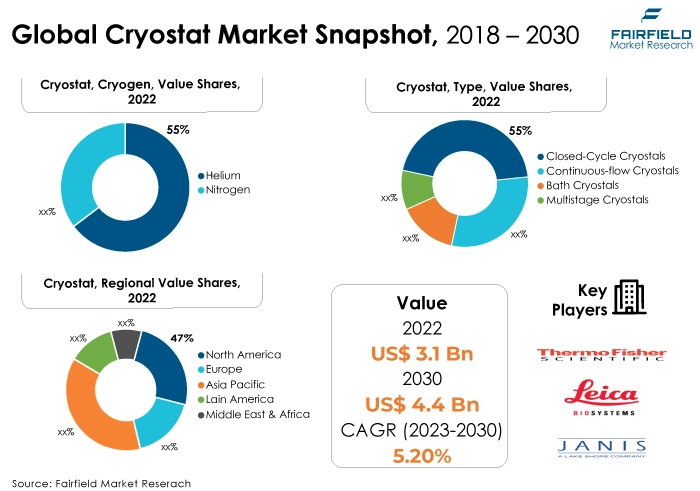

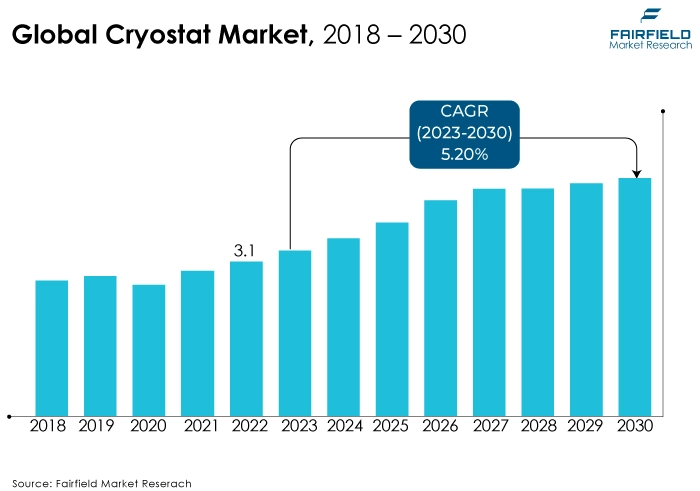

- The approximately US$3.1 Bn cryostat market (2022) poised to reach US$4.4 Bn in 2030

- Cryostat market size likely to see a CAGR of 5.2% during 2023 - 2030

A Quick Report Digest

- The cryostat market is growing due to its vital role in enabling low-temperature research and applications across diverse fields, including healthcare, materials science, and quantum computing. Advancements in research and emerging technologies drive the demand for precise temperature control and cryogenic capabilities, fueling market growth.

- Closed-cycle cryostats have secured the largest market share in the cryostat market due to their efficiency, versatility, and cost-effectiveness. They eliminate the need for cryogenic liquids, reduce operational costs, and are suitable for a wide range of applications, making them the preferred choice for many industries.

- Dewar's system components have captured the largest market share in the cryostat market due to their fundamental role in cryogenic temperature management and storage. Dewars are essential for storing and transporting cryogenic fluids and samples in various applications, from medical diagnostics to scientific research, contributing to their dominant market position.

- Helium cryogens have captured the largest market share in the cryostat market due to their widespread availability, non-reactive properties, and efficiency in achieving and maintaining extremely low temperatures. These characteristics make helium the preferred choice for various applications, particularly in scientific research and medical diagnostics.

- The healthcare application has captured the largest market share in the cryostat market due to its critical role in histology and pathology laboratories for medical diagnostics. Cryostats are essential for preparing thin tissue sections, contributing to their dominant market position in healthcare.

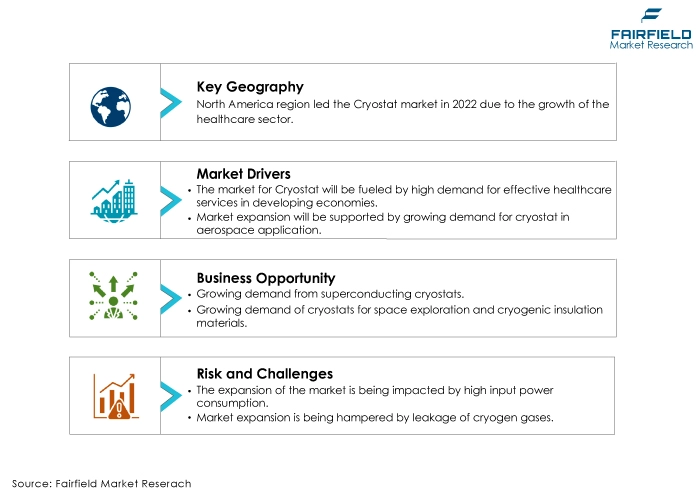

- North America has captured the largest market share in the cryostat market due to its advanced healthcare and research infrastructure, prominent semiconductor industry, robust scientific research initiatives, and stringent quality standards, contributing to a significant presence of cryostat technologies in the region.

- Asia Pacific is experiencing the highest CAGR in the cryostat market due to its expanding healthcare sector, burgeoning semiconductor industry, and rising research and development activities. Increasing investments in cutting-edge technologies and research infrastructure contribute to the region's rapid market growth.

- Input power consumption is challenging the cryostat market as there is a growing emphasis on energy efficiency and sustainability. High power consumption not only increases operational costs but also impacts the environmental footprint, which prompts the industry to develop more energy-efficient cryostat solutions.

A Look Back and a Look Forward - Comparative Analysis

The cryostat market is growing due to its indispensable role in enabling low-temperature research and applications across diverse fields such as medical diagnostics, materials science, and quantum computing. Advancements in scientific research, increased demand for precise temperature control, and expanding applications in emerging technologies drive the market's growth. Cryostats play a vital role in enabling breakthroughs in multiple industries, leading to their sustained expansion.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of the major end-use application sectors, such as Healthcare, Energy, and power. The Energy and power application in the cryostat market is growing due to its crucial role in superconducting power systems and grid infrastructure. Cryostats are employed to maintain the low temperatures required for superconducting materials, enabling energy-efficient power transmission and storage, driving their adoption in this sector.

The future of the cryostat market looks promising, with continued growth anticipated. Advancements in materials and design will lead to more efficient and versatile cryostat systems. Emerging applications in quantum computing and biobanking, along with ongoing research in fundamental sciences, will drive demand. Additionally, the market is likely to witness innovation in energy-efficient cryogenic technologies, expanding its reach into diverse industries and research disciplines.

Key Growth Determinants

- High Demand for Effective Healthcare Services in Developing Economies

The high demand for effective healthcare services in developing economies is driving the cryostat market for several reasons. As these countries invest in upgrading their healthcare infrastructure, there is a growing need for advanced diagnostic and research equipment, including cryostats, which are essential for preserving tissue samples and facilitating accurate pathology studies.

Rising healthcare awareness and increasing research activities in developing regions are boosting the demand for cryostats, particularly in fields like cancer research, drug discovery, and biotechnology.

The surge in chronic diseases and infectious illnesses in these regions necessitates precise diagnostics and therapies, fueling the adoption of cryostats for tissue sectioning and analysis. As a result, the cryostat market in developing economies is expanding rapidly to meet these evolving healthcare demands and research needs.

- Growing Demand for Aerospace Application

The growing demand for cryostats in aerospace applications is propelling the cryostat market due to several factors. Cryostats are crucial for testing and cooling aerospace components, especially those used in space exploration and satellite technology. The need for reliable and precise cooling systems in extreme conditions is driving increased adoption.

Moreover, advancements in aerospace technology and the expansion of commercial space endeavors are further boosting the demand for cryostats, making them a critical component in the aerospace industry's pursuit of innovation and exploration.

- Increase in Production of LNG

The increase in (liquefied natural gas (LNG) production is driving the cryostat market due to its pivotal role in the LNG value chain. Cryostats are essential for maintaining the extremely low temperatures required to liquefy natural gas for storage and transportation.

As global demand for cleaner energy sources continues to rise, there's a corresponding surge in LNG production and infrastructure development. Consequently, the cryostat market is witnessing growth as it becomes integral to supporting the expanding LNG industry's storage, transportation, and distribution needs.

Major Growth Barriers

- High Input Power Consumption

Cryostats demand substantial power to maintain ultra-low temperatures, which can be costly and environmentally unsustainable. Increasing awareness of energy conservation and environmental regulations is pressuring the industry to develop more power-efficient cryostats.

Meeting these demands while maintaining optimal performance poses a challenge for cryostat manufacturers. Addressing input power consumption is essential for sustainability and cost-effectiveness, driving innovation and competition within the cryostat market.

- Leakage of Cryogen Gases

The leakage of cryogenic gases presents a significant challenge to the cryostat market. Cryostats are designed to maintain extremely low temperatures, and any leakage of cryogenic gases not only leads to performance issues but also poses safety hazards. Ensuring the integrity of seals and insulation materials is crucial.

Additionally, environmental concerns related to the release of cryogenic gases further emphasize the need for leak prevention. Addressing these challenges through improved sealing technologies and rigorous safety measures is essential for maintaining the reliability and safety of cryostats.

Key Trends and Opportunities to Look at

- Superconducting Cryostats

Superconducting cryostats are innovative devices in the cryostat market, maintaining ultra-low temperatures for applications like quantum computing and particle physics. They employ superconducting materials and advanced cooling techniques, enabling the creation of stable, energy-efficient environments critical for research and technology development at the forefront of scientific discovery.

- Cryostats for Space Exploration

Cryostats for space exploration are vital in the cryostat market, supporting missions by cooling sensitive instruments like infrared and X-ray detectors to extremely low temperatures. These cryostats employ cutting-edge thermal insulation and refrigeration technologies, enabling precise space observations and furthering our understanding of the cosmos.

- Cryogenic Insulation Materials

Cryogenic insulation materials are key innovations in the cryostat market. These materials, such as aerogels and multilayer insulation, significantly improve cryostat efficiency by reducing heat transfer and thermal losses, allowing for the maintenance of ultra-low temperatures essential for various scientific and industrial applications, including space exploration and scientific research.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario significantly shapes the cryostat Market by influencing safety standards, quality control, and compliance requirements. Cryostats are used in various applications, including medical diagnostics, materials research, and semiconductor manufacturing, where precision and safety are paramount.

Regulations, such as those related to the use of cryogenic materials, electromagnetic compatibility, and workplace safety, guide the design, production, and use of cryostats. Adherence to these regulations ensures product quality, user safety, and environmental compliance.

Moreover, regulatory changes and updates can affect product development, certification, and market access. Cryostat manufacturers must stay informed about evolving regulations and standards to meet compliance requirements and maintain market competitiveness.

Fairfield’s Ranking Board

Top Segments

- Closed-cycle Crystals Lead the Way

Closed-cycle cryostats have captured the largest market share in the cryostat market due to their versatility, efficiency, and cost-effectiveness. These cryostats utilse closed-cycle refrigeration systems, eliminating the need for cryogenic liquids and minimising maintenance.

This type of cryostats is well-suited for a wide range of applications, including materials research, medical diagnostics, and superconducting technology. Their ease of operation and reduced operational costs make them a preferred choice for many industries, contributing to their dominant market position.

Multistage cryostats, on the other hand, are expected to due to their ability to achieve extremely low temperatures and precise thermal control. These cryostats are in demand for cutting-edge research in quantum computing, material science, and condensed matter physics.

The capacity of these cryostats to maintain stable cryogenic conditions for extended periods and accommodate diverse experimental set-ups positions them as a preferred choice for advanced research applications, resulting in the highest CAGR in the market.

- Dewars System Component at the Forefront

Dewars system components have captured the largest market share in the cryostat market because of their fundamental role in cryogenic temperature management and storage. Dewars are essential for storing and transporting cryogenic fluids and samples in various applications, from medical diagnostics to scientific research. Their reliability, safety, and efficiency in maintaining ultra-low temperatures make them a cornerstone component.

Additionally, advancements in dewar technology, including the development of specialised dewars for different applications, have further solidified their dominant position in the market.

High vacuum pump system controllers play a vital role in achieving and maintaining the required vacuum conditions in cryostat systems. They play a crucial part in ensuring the proper functioning of cryostats, especially in advanced applications like quantum computing and materials research.

The growing demand for precise control and automation in cryogenic experiments and processes is driving the adoption of advanced high vacuum pump system controllers, leading to the highest CAGR in the market.

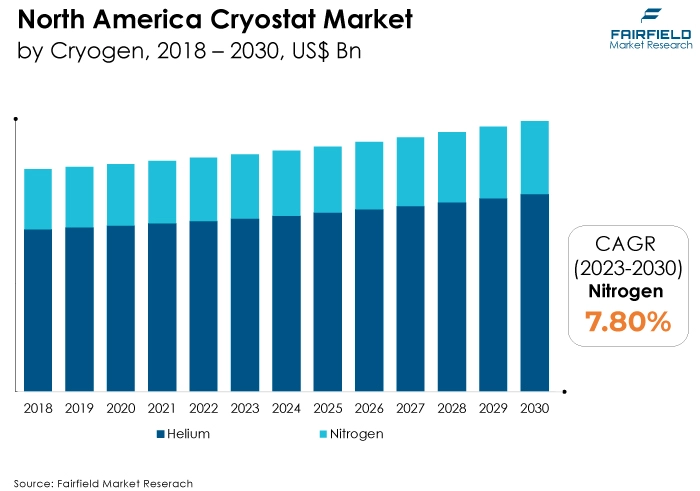

- Helium Cryogen Takes the Lead

Helium cryogens have captured the largest market share in the cryostat market due to their unique properties that make them ideal for achieving and maintaining extremely low temperatures.

Helium is abundant, non-reactive, and exhibits efficient heat transfer characteristics, making it the cryogen of choice for various applications. It is crucial in fields such as medical imaging, quantum computing, and scientific research. Its widespread availability, reliability, and cost-effectiveness have solidified helium's dominant position in the market.

On the other hand, nitrogen cryogens witness increasing adoption in various applications, including biological sample preservation, medical diagnostics, and semiconductor manufacturing. Nitrogen's non-reactive nature and affordability make it an attractive alternative to helium for achieving cryogenic temperatures.

Moreover, as sustainability becomes a focus, the use of nitrogen cryogens aligns with environmental considerations, driving their growth in the market, especially in applications where extremely low temperatures are not required.

- Healthcare Industry Leads Adoption Trail

The healthcare application has captured the largest market share in the cryostat market due to its critical role in medical diagnostics, particularly in histology and pathology laboratories. Cryostats are essential for preparing thin tissue sections for accurate disease diagnosis.

The growing prevalence of chronic diseases and increasing demand for early and precise diagnostics drive their adoption. Additionally, advancements in cryostat technology, such as improved temperature control and automation, enhance their efficiency in healthcare applications, solidifying their dominant market position.

The aerospace sector is likely to be experiencing the highest CAGR in the cryostat market due to its increasing use of cryostats in research, testing, and development of aerospace technologies.

Cryostats are crucial for simulating extreme cold conditions that aircraft and spacecraft encounter, aiding in the development and testing of materials, components, and propulsion systems. As aerospace innovation continues to expand, the demand for cryostats in this sector grows, contributing to the highest CAGR in the market.

Regional Frontunners

North America Holds a Commanding Share

North America has captured the largest market share in the cryostat market due to several key factors. The region boasts advanced healthcare and research infrastructure, including medical diagnostics and life sciences laboratories, which drive substantial demand for cryostats in applications like histology and tissue analysis.

North America is home to major players in the semiconductor and electronics industries, where cryostats are used for materials research and testing. Robust investments in research and development, coupled with government funding for scientific projects, fuel the adoption of advanced cryostat technologies. Stringent quality standards and regulatory requirements in the region ensure the reliability and safety of cryostat systems, bolstering their market presence in North America.

Demand will be the Fastest Across Asia Pacific

Asia Pacific's expanding healthcare sector, including medical research and diagnostics, drives demand for cryostats. The semiconductor and electronics industries are flourishing, leading to increased utilisation of cryostats for materials testing and research.

Additionally, growing investments in scientific research, coupled with a burgeoning biotechnology sector, contribute to the rising demand. Furthermore, initiatives promoting research and development in countries like China, and India are propelling the adoption of advanced cryostat technologies, resulting in the highest CAGR in the Asia Pacific region.

Fairfield’s Competitive Landscape

The global cryostat market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Cryostat Space?

- Thermo Fisher Scientific Inc.

- Leica Biosystems Nussloch GmbH

- Cryomech Inc.

- Janis Research Company, LLC

- Advanced Research Systems, Inc.

- Advanced Technology Inc.

- Bluefors Oy

- HICO Group

- Riber Group

- Iwatani Corporation

- JPK Instruments AG

- Oxford Instruments plc

- Scientifica Ltd.

- CryoConcepts LP

- Quorum Technologies Ltd.

Key Company Developments

New Product Launch

- September 2021: sureCore has created a CMOS IP library optimised for use in extremely low-temperature environments, necessary for quantum computing applications. This development allows for the design of cryo-CMOS control chips that can be situated alongside qubits in a cryostat.

Distribution Agreement

- June 2022: The Cryostat was inaugurated by the Director of the Regional Institute of Medical Sciences (RIMS), Manipur, marking a significant milestone in cancer treatment.

An Expert’s Eye

Demand and Future Growth

An increase in demand for aerospace products is driving the market. The cryostat market is experiencing robust demand driven by its critical role in applications like medical diagnostics, materials research, and semiconductor manufacturing.

Growing investments in healthcare, scientific research, and the semiconductor industry are fueling this demand. As technologies advance, cryostats are expected to become more versatile and efficient.

The future growth of the cryostat market is promising, with an emphasis on enhancing precision, reducing energy consumption, and expanding applications in emerging fields like quantum computing and biobanking.

Supply Side of the Market

The major countries in the cryostat market include the US, Canada, Germany, the UK, France, China, Japan, South Korea, India, and Brazil. These countries have well-established healthcare and research sectors where cryostats are extensively used for various applications. They are hubs for semiconductor manufacturing and materials research, driving significant demand for cryostats in these regions.

Fast-developing economies like India, and Brazil are also witnessing growing adoption of cryostat technologies in research and healthcare, contributing to their prominence in the market.

The cryostat market relies on various critical raw materials and components, including stainless steel for construction, insulation materials such as foam or glass wool for thermal management, compressors for cooling, cryogenic fluids like helium or nitrogen for temperature control, cryogenic valves, vacuum pumps, instrumentation and control systems, cryogenic temperature sensors, cryogenic dewars for storage, and cryocoolers.

Leading manufacturers of these raw materials and components include companies like Outokumpu, Owens Corning, Emerson Electric, Linde Group, Parker Hannifin, Leybold, Honeywell, Lake Shore Cryotronics, Chart Industries, and Sunpower Inc. contributing to the functionality and performance of cryostat systems in various applications.

Global Cryostat Market is Segmented as Below:

By Type:

- Closed-Cycle Crystals

- Continuous-flow Crystals

- Bath Crystals

- Multistage Crystals

By System Component:

- Dewars

- Transfer Tubes

- Gas Flow Pumps

- Temperature Controllers

- High Vacuum Pumps

- Microtome Blades

By Cryogen:

- Helium

- Nitrogen

By Application:

- Healthcare

- Energy & Power

- Aerospace

- Metallurgy

- Biotechnology

- Forensic Science

- Marine Biology

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Cryostat Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Cryostat Market Outlook, 2018 - 2030

3.1. Global Cryostat Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Closed-Cycle Cryostats

3.1.1.2. Continuous-flow Cryostats

3.1.1.3. Bath Cryostats

3.1.1.4. Multistage Cryostats

3.2. Global Cryostat Market Outlook, by System Component, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Dewars

3.2.1.2. Transfer Tubes

3.2.1.3. Gas Flow Pumps

3.2.1.4. Temperature Controllers

3.2.1.5. High Vacuum Pumps

3.2.1.6. Microtome Blades

3.3. Global Cryostat Market Outlook, by Cryogen, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Helium

3.3.1.2. Nitrogen

3.4. Global Cryostat Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Healthcare

3.4.1.2. Energy & Power

3.4.1.3. Aerospace

3.4.1.4. Metallurgy

3.4.1.5. Biotechnology

3.4.1.6. Forensic Science

3.4.1.7. Marine Biology

3.5. Global Cryostat Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Cryostat Market Outlook, 2018 - 2030

4.1. North America Cryostat Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Closed-Cycle Cryostats

4.1.1.2. Continuous-flow Cryostats

4.1.1.3. Bath Cryostats

4.1.1.4. Multistage Cryostats

4.2. North America Cryostat Market Outlook, by System Component, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Dewars

4.2.1.2. Transfer Tubes

4.2.1.3. Gas Flow Pumps

4.2.1.4. Temperature Controllers

4.2.1.5. High Vacuum Pumps

4.2.1.6. Microtome Blades

4.3. North America Cryostat Market Outlook, by Cryogen, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Helium

4.3.1.2. Nitrogen

4.4. North America Cryostat Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Healthcare

4.4.1.2. Energy & Power

4.4.1.3. Aerospace

4.4.1.4. Metallurgy

4.4.1.5. Biotechnology

4.4.1.6. Forensic Science

4.4.1.7. Marine Biology

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Cryostat Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Cryostat Market Outlook, 2018 - 2030

5.1. Europe Cryostat Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Closed-Cycle Cryostats

5.1.1.2. Continuous-flow Cryostats

5.1.1.3. Bath Cryostats

5.1.1.4. Multistage Cryostats

5.2. Europe Cryostat Market Outlook, by System Component, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Dewars

5.2.1.2. Transfer Tubes

5.2.1.3. Gas Flow Pumps

5.2.1.4. Temperature Controllers

5.2.1.5. High Vacuum Pumps

5.2.1.6. Microtome Blades

5.3. Europe Cryostat Market Outlook, by Cryogen, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Helium

5.3.1.2. Nitrogen

5.4. Europe Cryostat Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Healthcare

5.4.1.2. Energy & Power

5.4.1.3. Aerospace

5.4.1.4. Metallurgy

5.4.1.5. Biotechnology

5.4.1.6. Forensic Science

5.4.1.7. Marine Biology

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Cryostat Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cryostat Market Outlook, 2018 - 2030

6.1. Asia Pacific Cryostat Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Closed-Cycle Cryostats

6.1.1.2. Continuous-flow Cryostats

6.1.1.3. Bath Cryostats

6.1.1.4. Multistage Cryostats

6.2. Asia Pacific Cryostat Market Outlook, by System Component, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Dewars

6.2.1.2. Transfer Tubes

6.2.1.3. Gas Flow Pumps

6.2.1.4. Temperature Controllers

6.2.1.5. High Vacuum Pumps

6.2.1.6. Microtome Blades

6.3. Asia Pacific Cryostat Market Outlook, by Cryogen, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Helium

6.3.1.2. Nitrogen

6.4. Asia Pacific Cryostat Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Healthcare

6.4.1.2. Energy & Power

6.4.1.3. Aerospace

6.4.1.4. Metallurgy

6.4.1.5. Biotechnology

6.4.1.6. Forensic Science

6.4.1.7. Marine Biology

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Cryostat Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Cryostat Market Outlook, 2018 - 2030

7.1. Latin America Cryostat Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Closed-Cycle Cryostats

7.1.1.2. Continuous-flow Cryostats

7.1.1.3. Bath Cryostats

7.1.1.4. Multistage Cryostats

7.2. Latin America Cryostat Market Outlook, by System Component, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Dewars

7.2.1.2. Transfer Tubes

7.2.1.3. Gas Flow Pumps

7.2.1.4. Temperature Controllers

7.2.1.5. High Vacuum Pumps

7.2.1.6. Microtome Blades

7.3. Latin America Cryostat Market Outlook, by Cryogen, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Helium

7.3.1.2. Nitrogen

7.4. Latin America Cryostat Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Healthcare

7.4.1.2. Energy & Power

7.4.1.3. Aerospace

7.4.1.4. Metallurgy

7.4.1.5. Biotechnology

7.4.1.6. Forensic Science

7.4.1.7. Marine Biology

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Cryostat Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Cryostat Market Outlook, 2018 - 2030

8.1. Middle East & Africa Cryostat Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Closed-Cycle Cryostats

8.1.1.2. Continuous-flow Cryostats

8.1.1.3. Bath Cryostats

8.1.1.4. Multistage Cryostats

8.2. Middle East & Africa Cryostat Market Outlook, by System Component, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Dewars

8.2.1.2. Transfer Tubes

8.2.1.3. Gas Flow Pumps

8.2.1.4. Temperature Controllers

8.2.1.5. High Vacuum Pumps

8.2.1.6. Microtome Blades

8.3. Middle East & Africa Cryostat Market Outlook, by Cryogen, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Helium

8.3.1.2. Nitrogen

8.4. Middle East & Africa Cryostat Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Healthcare

8.4.1.2. Energy & Power

8.4.1.3. Aerospace

8.4.1.4. Metallurgy

8.4.1.5. Biotechnology

8.4.1.6. Forensic Science

8.4.1.7. Marine Biology

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Cryostat Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Cryostat Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Cryostat Market, by System Component, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Cryostat Market, by Cryogen, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Cryostat Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Type/System Component Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Thermo Fisher Scientific Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Leica Biosystems Nussloch GmbH

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Cryomech Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Janis Research Company, LLC

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Advanced Research Systems, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Advanced Technology Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Bluefors Oy

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. HICO Group

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Riber Group

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Iwatani Corporation

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. JPK Instruments AG

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Oxford Instruments plc

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Janis Research Company, LLC

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Scientifica Ltd.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. CryoConcepts LP

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

System Components Coverage |

|

|

Cryogen Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |