Global Foamed Plastic Insulation Products Market Forecast

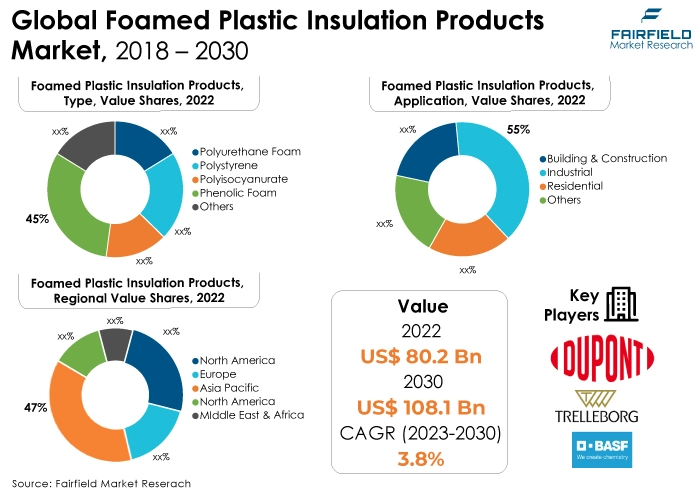

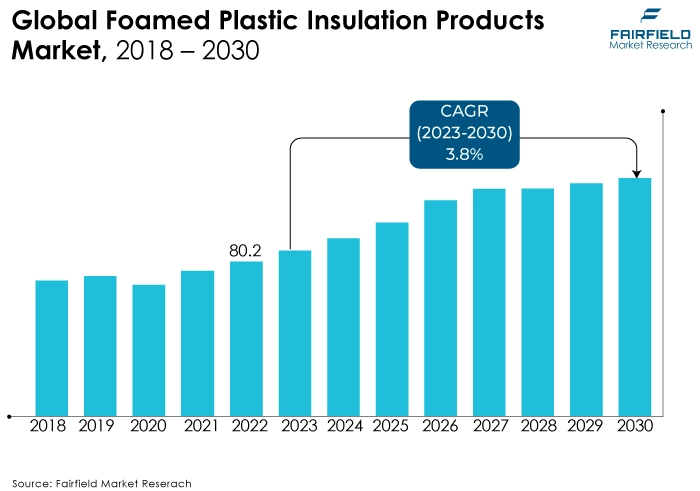

- Foamed plastic insulation products market size worth US$80.2 Bn in 2022 likely to reach US$108.1 Bn by 2030-end

- Market size poised to remain sluggish, witnessing a mere 3.8% CAGR between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the foamed plastic insulation products market growth is in the construction sector; energy efficiency continues to be a major trend. As builders and homeowners look for practical ways to cut energy use, foamed plastic insulation products—known for their high thermal resistance (R-values)-are in high demand. The need to reduce energy costs, adhere to strict building regulations, and address environmental issues are the driving forces behind this trend.

- Another major market trend expected to fuel the foamed plastic insulation product market growth is sustainable and environmentally friendly insulation. The market also predicted many consumers and contractors value eco-friendly building materials.

- In 2022, the phenolic foam category dominated the industry. Phenolic foam insulation exhibits excellent thermal conductivity properties, which results in high thermal performance. In order to lessen heat transfer, it offers a high level of thermal resistance (R-value) per unit thickness.

- In terms of market share for foamed plastic insulation products globally, the building and construction segment is anticipated to dominate. Both interior and exterior walls can be insulated with foamed plastic, such as rigid foam boards or spray foam. It improves energy efficiency, decreases heat loss or gain, and aids in maintaining a constant indoor temperature.

- In 2022, the building and construction category controlled the market. Roof assemblies or the underside of roofs are frequently coated with foamed plastic insulation. In order to maintain attic temperatures and stop heat from entering or escaping during the summer or winter, it offers thermal insulation.

- The global warming potential (GWP), certain foamed plastic insulation products, particularly those made with specific blowing agents, have high GWP. This adds to worries about their potential to worsen climate change and have an adverse effect on the environment.

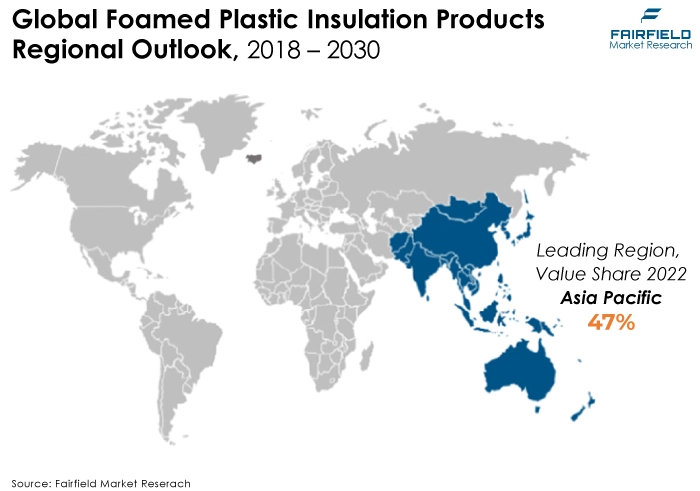

- The Asia Pacific region is anticipated to account for the largest share of the global foamed plastic insulation products market; an increasing number of people are moving to cities in Asia Pacific owing to this trend. As a result of this trend, there is a demand for insulation products to increase the energy efficiency of homes and businesses.

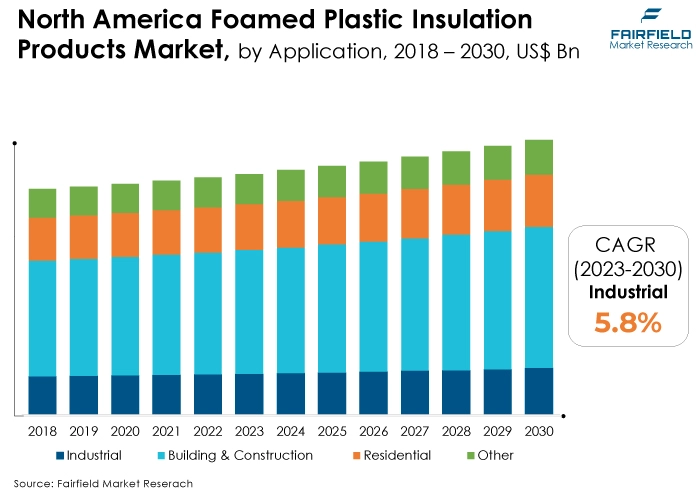

- The market for foamed plastic insulation products is expanding in North America due to Energy efficiency laws, and building codes like ASHRAE standards, and ENERGY STAR certification, which are very strict in North America. By offering high thermal resistance, foamed plastic insulation products assist homeowners and contractors in adhering to these regulations.

A Look Back and a Look Forward - Comparative Analysis

The market for Foamed Plastic Insulation Products has grown in popularity because of factors such as construction activity fueled by population growth, urbanisation, and infrastructure development. Foamed plastics offer advantages in terms of simplicity of installation and thermal performance as builders and contractors look for affordable and effective insulation solutions, with an increase in usage generally in line with the global economy.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to increased energy efficiency and lower greenhouse gas emissions; many governments around the world have implemented strict building codes and regulations. These regulations frequently demand the use of insulation materials with a predetermined thermal resistance (R-values). In order to meet these standards, foamed plastic insulation products with high R-values are crucial.

Better insulation is becoming more and more of a priority for owners of both residential and commercial properties due to rising energy costs and growing climate change concerns.

Products made of foamed plastic insulation help lower energy bills by reducing the need for heating and cooling, making them a desirable option for customers and businesses who care about the environment.

Key Growth Determinants

- Growing Prominence of Green Building Certifications

Green building certifications like Leadership in Energy and Environmental Design (LEED) are becoming more popular on account of the increased environmental awareness and demand for sustainable, eco-friendly building techniques. The energy-saving qualities of foamed plastic insulation products can help the achievement of these certifications.

The need for insulation materials is driven by the construction industry's expansion and rising housing demand. Rapid urbanisation and an expanding middle class in emerging markets support the building of homes, which further supports the need for foamed plastic insulation products.

- Rapid Technological Developments

Innovations in foamed plastic insulation with improved qualities, including increased fire resistance and reduced environmental impact, have been made possible by advances in materials science and manufacturing techniques. These developments draw industries seeking specialised insulation solutions.

Innovations in foamed plastic insulation with improved qualities, including increased fire resistance and reduced environmental impact, have been made possible by advances in materials science and manufacturing techniques. These developments draw industries seeking specialised insulation solutions.

- Concerns Around Climate Change, and Rocketing Energy Costs

Better insulation is becoming more and more of a priority for owners of both residential and commercial properties due to rising energy costs and growing climate change concerns. Products made of foamed plastic insulation help lower energy bills by reducing the need for heating and cooling, making them a desirable option for customers and businesses who care about the environment.

Products made of foamed plastic insulation are not just used in the construction industry. Additionally, they have uses in the manufacturing, aerospace, and automotive sectors. Insulation materials are essential in these industries for regulating temperature, minimizing noise, and increasing energy efficiency throughout various processes.

Major Growth Barriers

- Chemical Emissions

During installation and over time, some foamed plastic insulation products may release volatile organic compounds (VOCs), and other chemicals. These emissions could have an adverse effect on building occupants' health and well-being and raise questions about indoor air quality.

A few foamed plastic insulation products have a high flammability potential. It can be difficult to comply with fire safety regulations and ensure that adequate fire protection measures are in place, particularly in particular building applications.

- Fire Safety Regulations

A few foamed plastic insulation products have a high flammability potential. It can be difficult to comply with fire safety regulations and ensure that adequate fire protection measures are in place, particularly in particular building applications.

Key Trends and Opportunities to Look at

- Energy Efficiency Steals the Limelight

In the construction sector, energy efficiency continues to be a major trend. As builders and homeowners look for practical ways to cut energy use, foamed plastic insulation products—known for their high thermal resistance (R-values)-are in high demand. The need to reduce energy costs, adhere to strict building regulations, and address environmental issues are the driving forces behind this trend.

- Sustainable and Environmentally Friendly Insulation

In the field of construction, sustainability is a widely accepted trend. Foamed plastic insulation products have become more popular because many consumers and contractors value eco-friendly building materials. Products with smaller carbon footprints, like those made of recycled or bio-based materials, are being developed by manufacturers more frequently.

- Insulation Technology Advancements

Continuous technological advancements are taking place in the foamed plastic insulation market. Among these advancements are improved moisture resistance, increased fire resistance, and the creation of insulation materials with lower global warming potential (GWP). To improve effectiveness and performance, new installation techniques and systems are also being developed.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the markets for foamed plastic insulation products have been dominated by the US, and Canada. Energy efficiency laws, construction activity, and a growing interest in environmentally friendly building methods all contribute to the demand for insulation materials.

Due to rapid urbanisation, an increase in construction projects, and efforts to improve building energy efficiency, China, Japan, and South Korea are assuming a leading position in the market.

Expanded polystyrene (EPS), and extruded polystyrene (XPS) are two materials frequently used for foam board insulation. They are made from polystyrene resin. Polyurethane (PUR) and polyisocyanurate (PIR) foams are used to create these materials, which are well-known for their excellent insulating qualities.

Fairfield’s Ranking Board

Top Segments

- Phenolic Foam Category Maintains Dominance over Polyurethane Counterparts

The phenolic foam segment dominated the market in 2022. Phenolic foam is well-known for its fire-resistant qualities and has a low flame spread. It satisfies strict fire safety requirements and is frequently used in applications where fire safety is of utmost importance.

Phenolic foam produces little smoke and hazardous gases when it burns. For the purpose of preserving healthy indoor air and guaranteeing building occupants' safety, this quality is essential.

Furthermore, the Polyurethane form category is projected to experience the fastest market growth. The excellent thermal insulation properties of polyurethane foam are well known. It is very effective at reducing heat transfer because it has a high thermal resistance (R-value) per unit thickness. This feature lowers the amount of energy needed for heating and cooling while preserving a comfortable indoor climate.

- Building & Construction Sector Surges Ahead in Adoption

In 2022, the building and construction category dominated the industry. Foamed plastic insulation helps metal buildings like warehouses and industrial facilities control temperature extremes and save energy expenditure.

The industrial category is anticipated to grow substantially throughout the projected period. In commercial construction, foamed plastic insulation can be incorporated into the building facade to improve thermal performance while maintaining architectural aesthetics.

Regional Frontrunners

Asia Pacific Retains Leadership as Sales of High-performance Insulation Materials Climb up

In the packaging industries, foamed plastic insulation product adoption is anticipated to dominate in the Asia Pacific region. The Asia Pacific region experiences a wide range of climates, from incredibly hot and humid to cold and arid. In a variety of environments, foamed plastic insulation products are crucial for preserving cozy indoor temperatures and lowering energy costs.

Many Asian countries have been strongly enforcing building regulations recently, which is responsible for mandating greater levels of insulation in construction projects. High-performance insulation materials like foamed plastics are thus high in demand.

Strong Adherence to Green Building Standards Raise North America’s Market Attractiveness

North America has a wide variety of climates, from sweltering summers in the south to icy winters in the north. Foamed plastic insulation is essential for preserving cozy interior temperatures and lowering energy costs throughout the year.

To increase energy efficiency, existing buildings are being renovated and retrofitted heavily in the North American market. Older buildings can be upgraded to become cozier and energy-efficient using foamed plastic insulation.

In North America, there is a lot of emphasis on using sustainable construction methods. Foamed plastic insulation products help the achievement of LEED certification, and other green building standards.

Fairfield’s Competitive Landscape Analysis

The global foamed plastic insulation product market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Foamed Plastic Insulation Products Space?

- Trelleborg

- Dow

- Avery Dennison Corporation

- Owens Corning

- 3M Company

- Dupont

- Sika

- BASF

- Johns Manville

- Dunmore

- Knuaf Insulation

- Saint-Gobain

- ACH Foam Technologies

- American Excelsior

- INOAC Corporation

Significant Company Developments

New Product Launches

- July 2022: Elastospray, The BASF Plastics Journey's objective is to reduce product-related emissions, which is a critical step toward a circular economy. Every stage of product development takes sustainability into account. The ambitious sustainability goals are achieved by the new generation of spray foams that contain some recycled PET products.

- September 2021: Laptop or Construction materials with a core of PU rigid foam like Elastopor, and Elastopir, are perfect for the creation of facade and roof elements of buildings used for industrial purposes because they successfully combine outstanding mechanical and physical qualities with thermal insulation. The product carbon footprint (PCF) of buildings can now be reduced thanks to new rigid foam systems that BASF has created. These foams are partially made from plastic waste.

Distribution Agreement

- September 2021: Laser Shot, Inc. executed an Exclusive Distributor Agreement (the "Agreement"), a Texas-based business with headquarters at 12818 Century Drive in Stafford, Texas, 77477, and Lamperd Less Lethal, Inc. (the "Distributor") is a Canadian corporation with office at 1200 Michener Road in Sarnia, Ontario, Canada.

An Expert’s Eye

Demand and Future Growth

Products made of foamed plastic insulation used in the construction industry are driving the market. Insulation materials are essential in these industries for regulating temperature, minimising noise, and increasing energy efficiency throughout various processes, increasing the need for foamed plastic insulation products.

Furthermore, rigid building codes. However, the foamed plastic insulation products market is expected to face considerable challenges because of global warming potential (GWP).

Supply Side of the Market

According to our analysis, the market for foamed plastic insulation products is dominated by the North American nations of the US, and Canada. Because of the strict building codes and energy efficiency regulations, the North American market is benefited, which increases demand for premium insulation products. China, Japan, and South Korea are major nations in the Asia Pacific region.

Polyurethane (PU) is a material used to make both rigid and flexible foams. Polystyrene (PS), this substance is frequently used to make foam made of expanded polystyrene (EPS). Polyisocyanurate (PIR) is used in the production of high-performance insulation boards.

The demand for foamed plastic insulation products in these nations is being driven by rapid urbanisation, rising construction activity, and a focus on energy efficiency. Some of the vendors for polyurethane (PU), notable suppliers include BASF, Dow Chemical, Covestro, and Huntsman.

Global Foamed Plastic Insulation Products Market is Segmented as Below:

By Type:

- Polyurethane Foam

- Polystyrene

- Polyisocyanurate

- Phenolic Foam

- Others

By Application:

- Building & Construction

- Industrial

- Residential

- Other

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Foamed Plastic Insulation Products Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Foamed Plastic Insulation Products Market Outlook, 2018 - 2030

3.1. Global Foamed Plastic Insulation Products Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Polyurethane Foam

3.1.1.2. Polystyrene

3.1.1.3. Polyisocyanurate

3.1.1.4. Phenolic Foam

3.1.1.5. Others

3.2. Global Foamed Plastic Insulation Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Building & Construction

3.2.1.2. Industrial

3.2.1.3. Residential

3.2.1.4. Other

4. North America Foamed Plastic Insulation Products Market Outlook, 2018 - 2030

4.1. North America Foamed Plastic Insulation Products Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Polyurethane Foam

4.1.1.2. Polystyrene

4.1.1.3. Polyisocyanurate

4.1.1.4. Phenolic Foam

4.1.1.5. Others

4.2. North America Foamed Plastic Insulation Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Building & Construction

4.2.1.2. Industrial

4.2.1.3. Residential

4.2.1.4. Other

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Foamed Plastic Insulation Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Foamed Plastic Insulation Products Market Outlook, 2018 - 2030

5.1. Europe Foamed Plastic Insulation Products Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Polyurethane Foam

5.1.1.2. Polystyrene

5.1.1.3. Polyisocyanurate

5.1.1.4. Phenolic Foam

5.1.1.5. Others

5.2. Europe Foamed Plastic Insulation Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Building & Construction

5.2.1.2. Industrial

5.2.1.3. Residential

5.2.1.4. Other

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Foamed Plastic Insulation Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Foamed Plastic Insulation Products Market Outlook, 2018 - 2030

6.1. Asia Pacific Foamed Plastic Insulation Products Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Polyurethane Foam

6.1.1.2. Polystyrene

6.1.1.3. Polyisocyanurate

6.1.1.4. Phenolic Foam

6.1.1.5. Others

6.2. Asia Pacific Foamed Plastic Insulation Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Building & Construction

6.2.1.2. Industrial

6.2.1.3. Residential

6.2.1.4. Other

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Foamed Plastic Insulation Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Foamed Plastic Insulation Products Market Outlook, 2018 - 2030

7.1. Latin America Foamed Plastic Insulation Products Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Polyurethane Foam

7.1.1.2. Polystyrene

7.1.1.3. Polyisocyanurate

7.1.1.4. Phenolic Foam

7.1.1.5. Others

7.2. Latin America Foamed Plastic Insulation Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Building & Construction

7.2.1.2. Industrial

7.2.1.3. Residential

7.2.1.4. Other

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Foamed Plastic Insulation Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Foamed Plastic Insulation Products Market Outlook, 2018 - 2030

8.1. Middle East & Africa Foamed Plastic Insulation Products Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Polyurethane Foam

8.1.1.2. Polystyrene

8.1.1.3. Polyisocyanurate

8.1.1.4. Phenolic Foam

8.1.1.5. Others

8.2. Middle East & Africa Foamed Plastic Insulation Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Building & Construction

8.2.1.2. Industrial

8.2.1.3. Residential

8.2.1.4. Other

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Foamed Plastic Insulation Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Foamed Plastic Insulation Products Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Foamed Plastic Insulation Products Market Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Trelleborg

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Dow

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Avery Dennison Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Owens Corning

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. 3M Company

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Dupont

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Sika

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. BASF

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Johns Manville

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Dunmore

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Knuaf Insulation

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Saint-Gobain

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. ACH Foam Technologies

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. American Excelsior

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. INOAC Corporation

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |