Global Foldable Drones Market Forecast

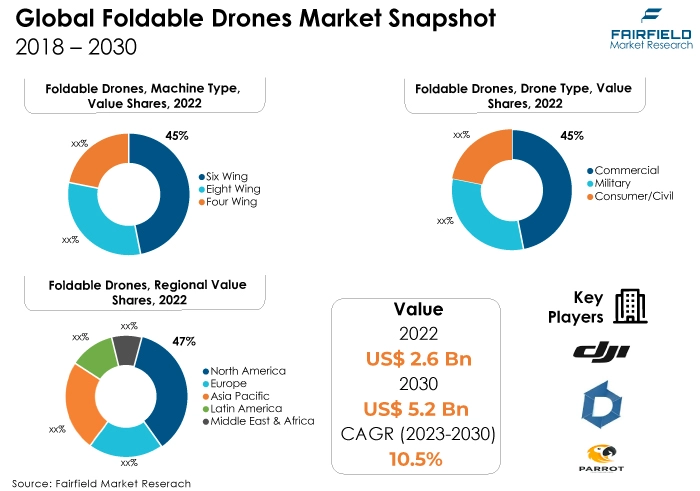

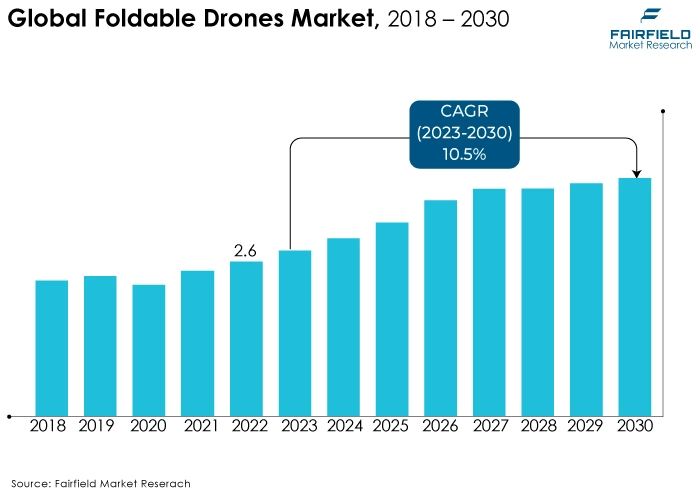

- Global foldable drones market size to be worth around US$5.2 Bn in 2030, up from US$2.6 Bn registered in 2022

- Market revenue projected to witness a CAGR of 10.5% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the foldable drones market growth is an increase in the rise of social media and content creation. Foldable drones offer a practical and efficient way to get breath-taking photos from unusual perspectives.

- Another major market trend expected to fuel the foldable drones market growth is the rapidly increasing global technology. Foldable drones with exceptional performance, including stable flight, high-resolution cameras, prolonged battery life, obstacle avoidance, and advanced flight modes, have been developed because of advancements in drone technology.

- In 2022, the four-wing (quadcopters) and six-wing (hexacopters) category dominated the industry. Due to its stability, maneuverability, and simplicity of usage, quadcopters have been widely used for several consumer purposes. As the demand for aerial photography and videography, as well as recreational drone use, continues to grow, this trend has likely persisted and possibly even extended.

- In terms of market share for foldable drones globally, the consumer/civil drone segment is anticipated to dominate. Consumer and civil drones have dominated the market, mostly in line with an increase in demand brought on by the incorporation of drones into everyday life. These adaptable devices are attracting more and more people to use them for recreational activities because they provide a distinctive viewpoint and exciting airborne experiences.

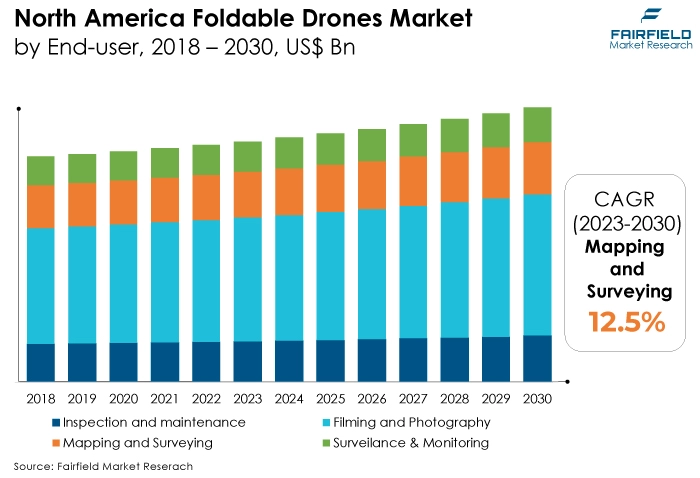

- In 2022, the filming and photography category controlled the market. Due to the public's insatiable need for visually compelling information, the cinematography and photography segment has established its supremacy in the drone business.

- With their unique angles and viewpoints, drones have completely changed how photographers, filmmakers, and content producers shoot imagery. Aerial footage may now be incorporated effortlessly into movies, documentaries, commercials, and social media posts, offering a unique and immersive watching experience.

- The media & entertainment category is highly prevalent in the market for foldable drones market. Foldable drones are being used more frequently by content producers, videographers, filmmakers, and social media influencers to record beautiful aerial footage and photos, improving the aesthetic appeal of their projects.

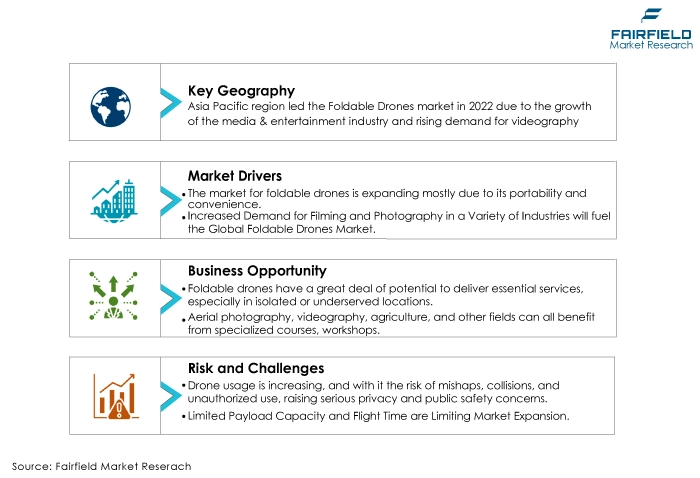

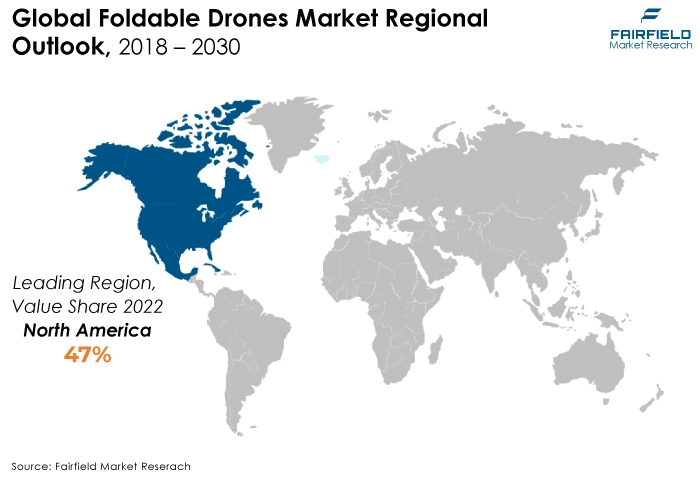

- The North America region is anticipated to account for the largest share of the global foldable drones market, owing to various technological factors such as economic conditions. The technologically advanced and innovative landscape of North America makes it a favourable environment for the development and uptake of cutting-edge technologies like foldable drones. A flourishing market ecology is supported by the presence of multiple well-known drone manufacturers and IT firms in the area.

- The market for foldable drones is expanding in Asia Pacific due to rapid economic growth and technological advancements. Asia Pacific has a people with significantly more disposable income and a rapidly expanding economy. Increased interest in consumer gadgets, such as recreational and commercial drones, is a result of this increased wealth.

A Look Back and a Look Forward - Comparative Analysis

The market for foldable drones has been experiencing significant growth, primarily driven by advancements in drone technology, increased consumer demand, and a broadening range of applications. The focus is on enhancing features like portability, camera capabilities, flight time, and obstacle avoidance. Major players are innovating to cater to both consumer and commercial markets, with a strong emphasis on ease of use and versatility.

The market witnessed staggered growth during the historical period 2018 – 2022. The larger consumer and commercial drone markets evolved into the foldable drone market. Drones were first heavier and less portable. Foldable designs were developed to satisfy the requirement for greater portability without sacrificing performance. With this change, a larger audience found drones to be more appealing and accessible. Foldable drones now have much more capabilities thanks to developments in materials, battery technology, and miniaturisation throughout time.

Drones will become incredibly clever thanks to technological developments, with features like autonomous flight, obstacle navigation, and improved AI-powered image and video processing. Their uses will go beyond the typical ones, with drone swarms used for massive activities like environmental monitoring or disaster relief. Their utility will be further increased by the Internet of Things (IoT) integration, which will enable smooth connection and coordination with other smart devices.

Sustainability will also be of utmost importance, inspiring the creation of eco-friendly materials and energy-efficient designs. The foldable drone market is poised to revolutionise industries, redefine daily tasks, and significantly contribute to a technologically advanced and interconnected future as regulatory frameworks mature and standardise, paving the way for beyond-visual-line-of-sight (BVLOS) operations.

Key Growth Determinants

- Increased Demand for Filming and Photography Purposes

Due to consumer demand for compelling visual content, the filmmaking and photography segment has established its dominance in the drone business. By providing dynamic angles and viewpoints that were previously inconceivable, drones have revolutionised the way filmmakers, photographers, and content creators shoot imagery.

Today, aerial footage can be smoothly incorporated into movies, documentaries, commercials, and social media posts, offering viewers a novel and immersive experience.

Drones are becoming essential tools for both professionals and enthusiasts, providing excellent image and video quality thanks to the high-grade cameras and cutting-edge stabilisation technology built into them.

- Growing Demand from Media & Entertainment Industry

The market for foldable drones has a large media and entertainment segment, which may be ascribed to the rise in demand for interesting and original content in the digital age. Foldable drones are the ideal solution for the needs of the media and entertainment sectors thanks to their mobility, simplicity of usage, and sophisticated camera capabilities.

Foldable drones are being used more frequently by content producers, videographers, filmmakers, and social media influencers to record beautiful aerial footage and photos, improving the aesthetic appeal of their projects.

Foldable drones offer a practical and effective means to acquire aerial images that can considerably improve the quality and impact of the finished product, whether it be for capturing stunning landscapes, action sequences, events, or vlogs.

- Portability, and Greater Convenience

The market for foldable drones is expanding mostly due to their portability and convenience. The need for portable and easily transportable technology is critical in a world that is becoming more mobile. Foldable drones excellently fill this need because of their small sizes and simple folding mechanics, which make it easy for users to take these gadgets with them wherever they go.

The ease with which these drones may be folded and unfolded greatly expands the range of uses for which they can be utilised, allowing for last-minute employment for aerial photography, videography, or leisurely flying. Foldable drones are a highly sought-after solution in the changing environment of technology and consumer preferences because of their versatility and ease of use, which appeal to both consumers and professionals.

Major Growth Barriers

- Limited Payload Capacity and Flight Time

Despite being helpful for portability, foldable drones' tiny designs frequently come at the expense of a reduced payload capacity, making it difficult for them to transport sophisticated cameras or additional specialised equipment. Their operational efficiency is further constrained by the smaller batteries' short flight times, which restricts the range of applications.

To meet the demands of industries that call for drones to carry larger payloads or operate for longer periods, these restrictions must be removed. To get over these limitations and unleash the market's full potential, technological advances emphasizing energy efficiency optimisation, lightweight materials, and cutting-edge battery technologies are crucial. These breakthroughs will enable diversified and long-lasting applications in a variety of industries.

- Safety and Security Concerns

Drone usage is increasing, and with it, the risk of mishaps, collisions, and unauthorised use is raising serious privacy and public safety concerns. These concerns have led to tougher rules and compliance standards that manufacturers and operators must follow, thus making drone usage more difficult and constrained.

In addition, incidences involving drones in prohibited regions or infractions of airspace have sparked concerns about potential abuse and called for strict enforcement measures. It is crucial to address these worries through strong safety features, improved geo-fencing capabilities, thorough pilot training, and community education on responsible drone use.

Key Trends and Opportunities to Look at

- Rural and Remote Area Accessibility

Foldable drones have a great deal of potential to deliver essential services, especially in isolated or underserved locations. By enabling quick and effective medical supply deliveries to remote locations where conventional transportation may encounter difficulties, these drones have the potential to revolutionise the accessibility of healthcare and necessities.

Governments, non-profit organisations, and companies can take advantage of this chance to close the gaps in access to healthcare and basic resources, particularly in times of crisis or under trying conditions like natural catastrophes.

- Education and Training Programs

Aerial photography, videography, mapping, agriculture, and other fields can all benefit from specialised courses, workshops, and certifications that can be found in education and training programs. These credentials can vastly improve employability and pave the way for a variety of job possibilities.

Entrepreneurship can be encouraged by educating people about the legal requirements, safety precautions, and commercial aspects of the drone sector. A new wave of entrepreneurial operations might be started by trained individuals offering drone services for airborne inspections, surveying, real estate, or agriculture.

- R&D Efforts, and Innovations

Investments in R&D can result in the adoption of cutting-edge features, including enhanced stabilisation technology, autonomous flight modes, advanced obstacle detection and avoidance systems, and gesture controls. These features broaden the audience of potential customers and improve the overall user experience.

R&D efforts might concentrate on creating effective battery technology, lightweight components, and aerodynamic designs to increase the flying time of foldable drones. Longer flight times boost the drones' usefulness and widen their scope of potential uses.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the regulatory environment has had a significant impact on how the foldable drones market develops. The regulatory environment significantly shapes the foldable drone industry. Government policies and regulations play a significant role in determining market accessibility, safety requirements, operational constraints, and privacy issues.

To ensure safe and responsible drone operation, stricter rules frequently call for registration, licensing, and adherence to airspace limits. The operational limits of foldable drones are also impacted by laws governing flight heights, no-fly zones, and privacy concerns. Both producers and consumers need to abide by these rules.

By building customer trust, stimulating investment, and fostering the development of standardised, safe, and dependable foldable drone solutions, regulatory clarity and harmonisation across regions can drive innovation and support market growth.

Fairfield’s Ranking Board

Top Segments

- Four-wing Drones More Preferred over Six-wing Counterparts

In the insurance market, the four-wing category still dominates the six-wing category. According to the consumer and commercial drone markets, the four-wing category (quadcopters) continues to outsell the six-wing categories (hexacopters).

On the other greater stability, flexibility, usability, and affordability, quadcopters are very common. They have been the go-to option for a variety of activities, such as leisure flying, aerial photography, videography, and different consumer usage.

Furthermore, the six-wing category is projected to experience the fastest market growth. Given its capabilities and prospective uses, it makes sense that the six-wing category (hexacopters) is predicted to have the fastest market growth in the foldable drone business.

Hexacopters, which have six rotors instead of quadcopters' four, offer better stability, maneuverability, and payload capacity. Because of these qualities, hexacopters are especially appealing for demanding and specialised applications across a range of sectors.

- Consumer/Civil Drones Surge Ahead Through 2030

In 2022, the consumer/civil category dominated the industry. Due to their adaptability, simplicity of usage, and steadily declining pricing, foldable drones have continually attracted a significant amount of customer interest. Consumers are drawn to foldable drones for leisure flights, aerial photography, videography, and the production of social media content.

Foldable designs are practical since they facilitate portability and simplicity of transportation and fit well with each user's demands and preferences. The capabilities of consumer-focused foldable drones have also improved thanks to technological advances, including high-quality cameras, longer flying periods, and user-friendly controls, further boosting their popularity.

The commercial category is anticipated to grow substantially throughout the projected period. Numerous industries, including agriculture, construction, real estate, infrastructure inspection, and public safety, have seen a rapid expansion in the commercial use of drones. Due to their mobility, simplicity of use, and ever-improving capabilities, foldable drones present an appealing choice for commercial users.

- Filming & Photography

The filming & photography segment dominated the market in 2022. Due to their outstanding portability, simplicity of operation, and capacity to take beautiful aerial photos, foldable drones are gradually turning into a necessary tool for professionals in the film and photography industries.

Filmmakers and photographers are using foldable drones to get exciting, fascinating aerial videos for their projects. Foldable drones with high-resolution cameras offer an unmatched perspective that improves storytelling and aesthetics, whether for films, documentaries, advertisements, or the creation of internet content.

The mapping & surveying category is expected to experience the fastest growth within the forecast time frame. Mapping and surveying professionals increasingly rely on drones to collect high-resolution aerial imagery, topographical data, and geospatial information for various projects. Foldable drones, with their ability to provide flexible and efficient aerial data acquisition, are particularly well-suited for mapping and surveying applications.

- Media & Entertainment Industry Represents the Leading Buyer Type Segment

In 2022, the media & entertainment category led the market growth. Foldable drones have become indispensable tools for professionals in the media and entertainment industry, including filmmakers, content creators, vloggers, and social media influencers.

Foldable drones offer filmmakers and content creators a convenient and cost-effective solution for capturing breathtaking aerial shots that enhance the visual appeal of their projects. The ability to easily transport and deploy foldable drones on-location, coupled with their advanced camera capabilities, enables the creation of compelling aerial sequences and stunning visuals.

Moreover, the security & law enforcement category is expected to grow fastest in the foldable drones market during the forecast period. Due to their portability, convenience of use during deployment, and sophisticated functions, foldable drones are being used more frequently in security and law enforcement applications.

Law enforcement agencies use foldable drones for a variety of purposes, such as surveillance, search and rescue missions, crowd control during public events, accident investigations, and crime scene analysis.

Regional Frontrunners

North America Provides the Largest Consumer Base to Foldable Drones

The dominant position of North America in the foldable drone market is due to several reasons. The area is home to a sizable number of well-known drone manufacturers, creative start-ups, and a broad network of drone industry stakeholders.

Additionally, North America has a sizable population of users that use foldable drones for a range of purposes, including photography, videography, surveying, agricultural, infrastructure inspection, and more. These users come from both the consumer and business sectors.

In addition, government programs and rules, like the Federal Aviation Administration (FAA) regulations in the US, have a significant impact on how the drone market is shaped and how responsible drone use is ensured, both of which contribute to market growth.

The market here is further fuelled by the presence of large technology companies investing in drone technologies and partnerships with different sectors.

Soaring Uptake for Filming & Photography Application Strengthens Market in Asia Pacific

The region of Asia Pacific is expected to experience tremendous growth in the filming & photography sectors during the projection period, and this expectation is well-founded. Several factors contribute to this expected growth. The region is witnessing a burgeoning media and entertainment industry fueled by increasing consumer demand for high-quality visual content.

Foldable drones, with their ability to capture stunning aerial shots and dynamic footage, cater to the burgeoning needs of filmmakers, content creators, and the entertainment industry at large.

Additionally, the rise of social media platforms and online streaming services has led to a growing need for visually appealing content. Content creators and influencers are utilizing foldable drones to capture captivating aerial shots for vlogs, travel videos, promotional content, and more.

Fairfield’s Competitive Landscape Analysis

The global foldable drones market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Foldable Drones Space?

- DJI

- RIEGL LMS

- Intellisystem Technologies

- Parrot

- Heliceo

- EMOTION

- Diodon

- ALPSdrone

- ONYXSTAR

- Autel Robotics

- Skydio

- PowerVision

- Hubsan

- Eachine

- Zero Zero Robotics

Key Company Developments

New Product Launches

- June 2022: Parrot, a renowned drone manufacturer, launched the "Parrot ANAFI USA." The ANAFI USA is a rugged and compact foldable drone designed to cater specifically to professional and government use cases, with a strong focus on the public safety sector. This drone was particularly engineered to meet the security and operational needs of various agencies and organisations.

- September 2021: With great success, Diodon, a company specializing in inflatable and foldable drones, had developed and launched a range of inflatable drones for various applications. The most notable product was the Diodon Drone, an inflatable and portable drone designed to be lightweight, compact, and easy to transport.

- November 2019: With the successful introduction of a new foldable Drones product, Parrot launched the ANAFI USA, a rugged and compact foldable drone designed for professional use, especially in the public safety sector. It offered features such as thermal imaging, 32x zoom, and a secure, encrypted communication system.

Distribution Agreements

- May 2021: For the markets in Australia, New Zealand, and the Pacific Islands, a collaboration between J.L. Lennard and Cama Group was established. J.L. Lennard is an exclusive distributor of tools, accessories, and life cycle services.

- February 2020: CT Pack grew its market share in Latin America. It has also developed solid client relationships and a potent sales team. Customers' ideal solutions have been its complete packaging systems for the food industry.

An Expert’s Eye

Demand and Future Growth

The market demand for foldable drones is expected to expand significantly. Drones are being used more often in a variety of industries for uses like aerial photography, surveillance, agricultural, and infrastructure inspection, which is one of the factors boosting demand. The desire for foldable drones is being fueled by the fact that they are convenient and portable and appeal to both professionals and consumers.

The effectiveness and adaptability of drones are increased by technological developments like longer battery lives, better camera capabilities, obstacle avoidance systems, and simplified folding procedures. The market is expanding on account of government policies that are supportive and raising public knowledge of the advantages of drone technology.

Supply Side of the Market

An extensive analysis of manufacturers, suppliers, and each of their manufacturing capacities, technological capabilities, and distribution networks is required to estimate the supply side of the foldable drone industry. It includes researching the business plans of major players, their product lines, and advancements in foldable drone designs and features.

To accurately predict market trends, one must have a thorough understanding of the production processes, material procurement, and production scalability. Additionally, researching industry partnerships, mergers, and collaborations might provide information about prospective changes in market dynamics.

The Global Foldable Drones Market is Segmented as Below:

By Type:

- Four Wing

- Six Wing

- Eight Wing

By Drone Type:

- Consumer / Civil

- Commercial

- Military

By End-use Industry:

- Filming & Photography

- Inspection & Maintenance

- Mapping & Surveying

- Precision Agriculture

- Surveillance & Monitoring

- Others

By Buyer Type:

- Agriculture & Forestry

- Delivery & Logistics

- Media & Entertainment

- Construction & Mining

- Oil & Gas

- Security & Law Enforcement

- Recreational Activity

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Foldable Drones Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Foldable Drones Market Outlook, 2018 - 2030

3.1. Global Foldable Drones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Four Wing

3.1.1.2. Six Wing

3.1.1.3. Eight Wing

3.2. Global Foldable Drones Market Outlook, by Drone Type, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Consumer / Civil

3.2.1.2. Commercial

3.2.1.3. Military

3.3. Global Foldable Drones Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Filming & Photography

3.3.1.2. Inspection & Maintenance

3.3.1.3. Mapping & Surveying

3.3.1.4. Precision Agriculture

3.3.1.5. Surveillance & Monitoring

3.3.1.6. Others

3.4. Global Foldable Drones Market Outlook, by Buyer Type, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Agriculture & Forestry

3.4.1.2. Delivery & Logistics

3.4.1.3. Media & Entertainment

3.4.1.4. Construction & Mining

3.4.1.5. Oil & Gas

3.4.1.6. Security & Law Enforcement

3.4.1.7. Recreational Activity

3.4.1.8. Others

3.5. Global Foldable Drones Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Foldable Drones Market Outlook, 2018 - 2030

4.1. North America Foldable Drones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Four Wing

4.1.1.2. Six Wing

4.1.1.3. Eight Wing

4.2. North America Foldable Drones Market Outlook, by Drone Type, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Consumer / Civil

4.2.1.2. Commercial

4.2.1.3. Military

4.3. North America Foldable Drones Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Filming & Photography

4.3.1.2. Inspection & Maintenance

4.3.1.3. Mapping & Surveying

4.3.1.4. Precision Agriculture

4.3.1.5. Surveillance & Monitoring

4.3.1.6. Others

4.4. North America Foldable Drones Market Outlook, by Buyer Type, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Agriculture & Forestry

4.4.1.2. Delivery & Logistics

4.4.1.3. Media & Entertainment

4.4.1.4. Construction & Mining

4.4.1.5. Oil & Gas

4.4.1.6. Security & Law Enforcement

4.4.1.7. Recreational Activity

4.4.1.8. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Foldable Drones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Foldable Drones Market Outlook, 2018 - 2030

5.1. Europe Foldable Drones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Four Wing

5.1.1.2. Six Wing

5.1.1.3. Eight Wing

5.2. Europe Foldable Drones Market Outlook, by Drone Type, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Consumer / Civil

5.2.1.2. Commercial

5.2.1.3. Military

5.3. Europe Foldable Drones Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Filming & Photography

5.3.1.2. Inspection & Maintenance

5.3.1.3. Mapping & Surveying

5.3.1.4. Precision Agriculture

5.3.1.5. Surveillance & Monitoring

5.3.1.6. Others

5.4. Europe Foldable Drones Market Outlook, by Buyer Type, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Agriculture & Forestry

5.4.1.2. Delivery & Logistics

5.4.1.3. Media & Entertainment

5.4.1.4. Construction & Mining

5.4.1.5. Oil & Gas

5.4.1.6. Security & Law Enforcement

5.4.1.7. Recreational Activity

5.4.1.8. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Foldable Drones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Foldable Drones Market Outlook, 2018 - 2030

6.1. Asia Pacific Foldable Drones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Four Wing

6.1.1.2. Six Wing

6.1.1.3. Eight Wing

6.2. Asia Pacific Foldable Drones Market Outlook, by Drone Type, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Consumer / Civil

6.2.1.2. Commercial

6.2.1.3. Military

6.3. Asia Pacific Foldable Drones Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Filming & Photography

6.3.1.2. Inspection & Maintenance

6.3.1.3. Mapping & Surveying

6.3.1.4. Precision Agriculture

6.3.1.5. Surveillance & Monitoring

6.3.1.6. Others

6.4. Asia Pacific Foldable Drones Market Outlook, by Buyer Type, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Agriculture & Forestry

6.4.1.2. Delivery & Logistics

6.4.1.3. Media & Entertainment

6.4.1.4. Construction & Mining

6.4.1.5. Oil & Gas

6.4.1.6. Security & Law Enforcement

6.4.1.7. Recreational Activity

6.4.1.8. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Foldable Drones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Foldable Drones Market Outlook, 2018 - 2030

7.1. Latin America Foldable Drones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Four Wing

7.1.1.2. Six Wing

7.1.1.3. Eight Wing

7.2. Latin America Foldable Drones Market Outlook, by Drone Type, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Consumer / Civil

7.2.1.2. Commercial

7.2.1.3. Military

7.3. Latin America Foldable Drones Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Filming & Photography

7.3.1.2. Inspection & Maintenance

7.3.1.3. Mapping & Surveying

7.3.1.4. Precision Agriculture

7.3.1.5. Surveillance & Monitoring

7.3.1.6. Others

7.4. Latin America Foldable Drones Market Outlook, by Buyer Type, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Agriculture & Forestry

7.4.1.2. Delivery & Logistics

7.4.1.3. Media & Entertainment

7.4.1.4. Construction & Mining

7.4.1.5. Oil & Gas

7.4.1.6. Security & Law Enforcement

7.4.1.7. Recreational Activity

7.4.1.8. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Foldable Drones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Foldable Drones Market Outlook, 2018 - 2030

8.1. Middle East & Africa Foldable Drones Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Four Wing

8.1.1.2. Six Wing

8.1.1.3. Eight Wing

8.2. Middle East & Africa Foldable Drones Market Outlook, by Drone Type, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Consumer / Civil

8.2.1.2. Commercial

8.2.1.3. Military

8.3. Middle East & Africa Foldable Drones Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Filming & Photography

8.3.1.2. Inspection & Maintenance

8.3.1.3. Mapping & Surveying

8.3.1.4. Precision Agriculture

8.3.1.5. Surveillance & Monitoring

8.3.1.6. Others

8.4. Middle East & Africa Foldable Drones Market Outlook, by Buyer Type, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Agriculture & Forestry

8.4.1.2. Delivery & Logistics

8.4.1.3. Media & Entertainment

8.4.1.4. Construction & Mining

8.4.1.5. Oil & Gas

8.4.1.6. Security & Law Enforcement

8.4.1.7. Recreational Activity

8.4.1.8. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Foldable Drones Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Foldable Drones Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Foldable Drones Market Drone Type, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Foldable Drones Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Foldable Drones Market Buyer Type, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-use Industry vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. DJI

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. RIEGL LMS

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Intellisystem Technologies

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Parrot

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Heliceo

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. EMBENTION

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Diodon

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. ALPSdrone

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. ONYXSTAR

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Autel Robotics

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Skydio

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. PowerVision

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Hubsan

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Eachine

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Zero Zero Robotics

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Drone Type Coverage |

|

|

End-use Industry Coverage |

|

|

Buyer Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |