Frozen Food Market Growth and Industry Forecast

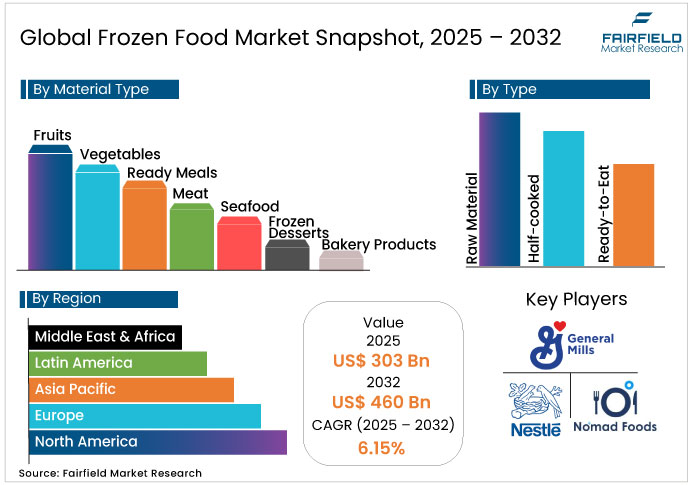

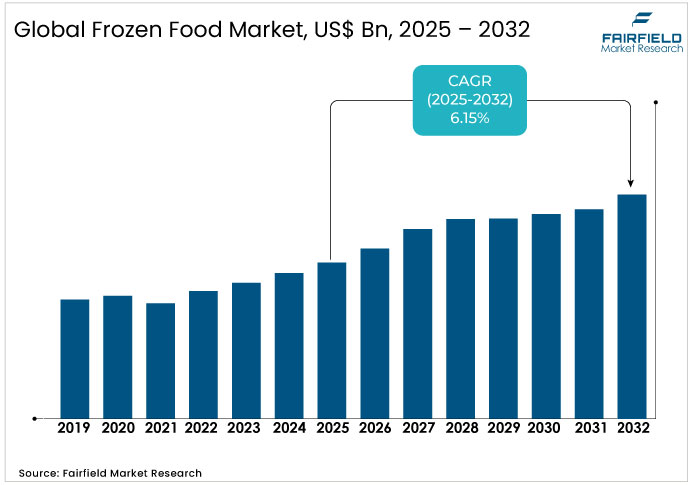

The Global Frozen Food Market is valued at USD 303 billion in 2025 and is projected to reach USD 460 billion, growing at a CAGR of 6.15% by 2032.

Frozen Food Market Summary: Key Insights & Trends

- Frozen desserts lead the product segment, with more than 30% share, driven by indulgent offerings and strong retail visibility.

- Ready-to-eat meals dominate by type, capturing over 45% share as urban consumers prioritize convenience and time efficiency.

- Half-cooked products are the fastest-growing segment, supported by millennial preferences for flexible and semi-prepared meal options.

- Offline retail channels maintain over 70% share, with supermarkets leading sales while online platforms expand rapidly through digital delivery.

- Retail end users account for over 55% share, reflecting widespread household adoption and rising stockpiling of frozen essentials.

- North America holds over 40% global share, leading through advanced cold chain systems and high consumer acceptance.

- Asia Pacific is the fastest-growing region, driven by urbanization, rising incomes, and localized flavor innovation.

- Sustainability and clean-label trends create new opportunities, as eco-friendly packaging and plant-based frozen meals gain momentum.

Key Growth Drivers

- Urban Lifestyles Drive Demand for Ready-to-Eat Frozen Food Solutions

Urbanization accelerates the frozen food market by compressing time for meal preparation. Currently, over 55% of the global population resides in urban areas, fuelling a 15% year-over-year increase in ready-to-eat frozen meals sales. Busy professionals and dual-income households prioritize quick solutions, reducing cooking time by up to 70% according to industry surveys. This driver stems from economic pressures and longer works hour, with e-commerce integration amplifying accessibility. Companies leverage this by diversifying portfolios, ensuring the frozen food industry captures 25% more household spending on groceries. Enhanced supply chains mitigate spoilage risks, sustaining momentum.

- Innovative Freezing Technologies Enhance Nutrition, Safety, and Shelf Life

Innovations such as individual quick freezing (IQF) bolster the industry by retaining 90% of nutrients compared to fresh produce. In 2025, IQF adoption rises 12%, driven by regulatory emphasis on safety post-pandemic. The U.S. FDA reports frozen items reduce contamination risks by 40%, appealing to health-conscious buyers. These technologies extend shelf life to 12 months, cutting waste and enabling global exports. Manufacturers invest 8% of revenues in R&D, yielding products with superior texture and flavor. This driver not only expands the frozen food market but also counters skepticism, with 68% of consumers trusting frozen over canned options per recent polls. Strategic alliances with tech firms accelerate deployment, fortifying market resilience.

Key Restraints

- Limited Cold Chain Infrastructure Challenges Growth of the Frozen Food Sector

Inadequate cold chain facilities in developing regions hinder the frozen food market, causing product waste and elevated costs. Theoretical logistics frameworks reveal that temperature fluctuations lead to 15-20% losses, eroding margins for producers. This restraint is particularly acute in tropical climates, where power unreliability exacerbates spoilage risks, deterring investment.

- Misconceptions About Nutrition Slow Adoption of Frozen Food Products

Misconceptions that frozen foods lack fresh equivalents' nutrition impede the market's penetration. Behavioral economics suggests anchoring biases favor "fresh" labels, despite evidence showing equivalent retention. This persists among 25% of consumers, slowing adoption in health-focused demographics.

Frozen Food Market Trends and Opportunities

- Emerging Economies Create New Growth Opportunities for Frozen Food Brands

Emerging economies present untapped potential driven by rapid urbanization and rising disposable incomes. Prospect theory posits that consumers in these regions weigh gains from convenience higher than losses from traditional cooking, accelerating adoption. Local trends such as middle-class expansion justify tailored product localization, such as spice-infused variants, to resonate culturally. This opportunity aligns with global value chain theories, enabling multinational scaling while nurturing domestic suppliers. Implications include diversified revenue streams, with strategic entry via partnerships enhancing the market's resilience against mature-market saturation. Long-term, it promises equitable growth, integrating underserved populations into modern consumption patterns.

- Sustainable Packaging and Nutrition Trends Drive Innovation in Frozen Foods

Advancements in sustainable packaging and functional nutrition open avenues in the frozen food market, catering to eco-aware demographics. Innovation diffusion theory highlights how eco-friendly attributes speed market acceptance, particularly among younger cohorts valuing ethical sourcing. Opportunities arise from regulatory pushes for reduced plastics, justifying investments in biodegradable materials that maintain cold efficacy. This fosters differentiation, as consumers reward brands aligning with planetary health goals. Theoretical sustainability models predict premium pricing for clean-label products, driving loyalty and margins. Businesses can leverage this for brand elevation, turning compliance into competitive advantage while contributing to broader environmental objectives.

Segment-wise Trends & Analysis

- Frozen Desserts Lead Global Frozen Food Segment with Flavor and Innovation

Frozen desserts command over 30% market share in 2025, valued at approximately USD 91 billion, establishing current leadership through indulgent yet accessible offerings such as ice creams and sorbets. This dominance stems from emotional appeal and seasonal versatility, positioning them as go-to treats in retail aisles.

The growth trajectory for frozen desserts in the Frozen Food Market projects a CAGR, propelled by flavor innovations and health adaptations such as low-sugar variants. Underlying drivers include rising at-home indulgence trends, with competitive positioning favoring agile players who integrate global flavors to outpace commoditized rivals.

- Ready-to-Eat Foods Dominate as Half-Cooked Options Gain Traction

Ready-to-eat products leads with over 45% share in 2025, equating to USD 136 billion, driven by seamless integration into fast-paced routines. Their leadership reflects superior convenience, outshining raw materials in urban consumer baskets.

Fast-growing half-cooked segments in the frozen food market anticipate robust expansion, fuelled by customization demands and hybrid cooking preferences. Drivers encompass skill-building trends among millennials, with competitors positioning via versatile recipes to capture share from pure ready-to-eat dominance.

- Offline Retail Leads Frozen Food Sales While E-Commerce Rapidly Expands

Offline channels dominate by holding over 70% share in 2025 at USD 212 billion, bolstered by tactile shopping experiences in supermarkets. This leadership persists due to established trust and immediate availability.

Emerging online distribution surges with e-commerce maturation, driven by delivery optimizations and personalized recommendations. Competitive dynamics favor integrated platforms that blend offline loyalty programs, enabling hybrid models to erode traditional strongholds.

- Retail Consumers Drive Demand as Foodservice Adoption Accelerates Globally

Retail end users spearhead the Frozen Food Market with over 55% share in 2025, reaching USD 167 billion, as household stockpiling underscores their primacy. Bulk accessibility cements this position amid economic uncertainties.

Food service providers emerge as fast-growing, propelled by operational efficiencies in hospitality. Trends such as menu diversification drive uptake, with competitors leveraging B2B contracts for volume gains against retail's consumer-facing edge.

Regional Trends & Analysis

North America Leads Frozen Food Industry Through Innovation and Premium Offerings

North America maintains over 40% global market share in 2025, establishing regional dominance through advanced cold chain infrastructure and sophisticated consumer preferences. The region demonstrates maturity in frozen food adoption with established distribution networks spanning comprehensive retail formats. Innovation leadership emerges through premium product development, plant-based alternatives, and functional food integration. Strong purchasing power enables premium pricing acceptance for value-added frozen products. Major players including General Mills, Conagra Brands, and Tyson Foods maintain significant market presence through extensive product portfolios.

U.S. Frozen Food Market - 2025 Snapshot & Outlook

The U.S. leads regional market performance with projected growth, representing a sustainable CAGR expansion. Dual-income household prevalence exceeding 60% drives ready-to-eat meal demand, while urban lifestyle changes support convenience-focused consumption patterns. Health-conscious trends manifest through increased organic and plant-based frozen food purchasing, with clean-label products demonstrating premium pricing acceptance. E-commerce penetration accelerates through major platforms including Amazon and Instacart, with over 138 million Americans purchasing groceries online as of September 2024. Government support for innovation through food safety regulations and technological advancement funding strengthens market foundation for sustained growth.

Asia Pacific Emerges as Fastest-Growing Region for Frozen Food Demand

Asia Pacific emerges as the fastest-growing region, expected to witness strong expansion and achieve significant growth momentum by 2030. Regional growth stems from rapid urbanization, rising disposable incomes, and changing dietary preferences influenced by Western lifestyle adoption. Cold chain infrastructure development through government initiatives and private investment enables expanded frozen food distribution. Cultural adaptation of international cuisines creates opportunities for diverse product offerings tailored to regional taste preferences.

Japan Frozen Food Market - 2025 Snapshot & Outlook

Japan demonstrates market maturity with established consumer acceptance of frozen foods across household and commercial sectors. The country's aging population and shrinking household sizes drive demand for portion-controlled, easy-preparation frozen products. Advanced cold chain infrastructure ensures minimal product degradation during distribution. Major food companies including Ajinomoto, Nichirei, and Maruha Nichiro continue innovation with premium frozen lines featuring organic and functional food options. Cultural emphasis on convenience and high-quality food standards supports premium pricing acceptance for innovative frozen products.

India Frozen Food Market - 2025 Snapshot & Outlook

India emerges as key growth engine due to rising disposable incomes, urbanization exceeding 30% urban population, and expanding retail infrastructure. Government investment in cold chain infrastructure through Pradhan Mantri Kisan Sampada Yojana (PMKSY) supports market development. Changing dietary habits in urban centers drive frozen food adoption among time-constrained dual-income households. Multinational brands including Nestlé and local players such as ITC and Godrej launch frozen meal lines adapted to Indian palates. Cultural adaptation remains crucial for market penetration, requiring products designed for traditional cooking methods and flavor preferences.

Europe Prioritizes Sustainability and Plant-Based Innovation in Frozen Foods

Europe demonstrates established market presence with emphasis on sustainability and premium product positioning. The region prioritizes eco-friendly packaging solutions and clean-label products aligning with environmental consciousness. Flexitarian dietary trends drive plant-based frozen meal demand across Western European markets. Advanced retail infrastructure supports comprehensive frozen food distribution through supermarket and hypermarket networks.

Germany Frozen Food Market - 2025 Snapshot & Outlook

Germany commands 23.87% share of European frozen food market with robust cold chain infrastructure supporting market leadership. Baked goods represent the largest product category at 27% sales volume, followed by vegetables and frozen meals in 2024. Frozen pizza demonstrates popularity with 425,000 tons sold annually, reflecting German consumer preferences for convenient home preparation options. Advanced logistics networks and consumer acceptance of frozen food quality support premium pricing for innovative products. The market benefits from strong purchasing power and willingness to invest in convenience-oriented food solutions.

U.K. Frozen Food Market - 2025 Snapshot & Outlook

The U.K. continues to hold a strong position in the European landscape, showcasing steady expansion and reinforcing its prominence through sustained consumer demand and robust industry performance. Consumer preferences favor convenience combined with quality, driving innovation in premium frozen meal offerings. Brexit implications influence supply chain dynamics, creating opportunities for domestic frozen food production. Retail concentration through major supermarket chains supports extensive frozen food distribution networks. Environmental consciousness drives demand for sustainable packaging solutions and locally sourced frozen products.

Competitive Landscape Analysis

The players in the frozen food market are focusing on acquisitions to expand capacity and portfolio diversity. This strategy counters fragmentation by integrating complementary brands, as seen in 2024 deals enhancing plant-based lines amid 5% annual volume growth. Rationales include scaling R&D for innovations such as flexible packaging, which extends shelf life by 20%, and securing raw material supplies against volatility. One notable event involved a major consolidator acquiring a vegan specialist, boosting market penetration in Asia by 15%.

Rising input costs from energy and logistics, coupled with stricter EU sustainability mandates, will pressure margins by 3-5% through 2027. Meanwhile, M&A waves enable shared cold chain investments, mitigating these via economies of scale. Early movers will benefit from first-mover advantages in premium niches, while latecomers may face premium pricing hurdles.

Key Companies

- Nestle SA

- Nomad Foods Ltd

- General Mills Inc

- Unilever Plc

- Tyson Foods Inc.

- Conagra Brands Inc

- Cargill Incorporated

- Kellogg Company

- The Kraft Heinz Company

- Associated British Foods Plc.

- Wawona Frozen Foods

- Bellisio Parent, LLC

- Others

Recent Developments:

- In September 2025, Tyson Foods introduced Tyson Chicken Cups, a new on-the-go frozen format offering 30g of protein per serving and ready in under two minutes. The range includes Grilled Boneless Bites, Lightly Breaded Bites, Mini Dino Nuggets, and Popcorn Chicken, marking Tyson’s latest innovation in convenient, high-protein meal solutions.

- In August 2025, Nomad Foods reported a modest revenue decline in Q2 2025, with sales down 0.8% to €747 million and adjusted EBITDA falling 7.2% amid volume drops and supply chain inflation. For H1 2025, revenue fell 1.9% to €1.51 billion, while adjusted profit slid 14% to €114 million despite lower operating expenses.

- In November 2024, Nestlé will invest $150 million to expand its frozen meal facility in Cherokee County, South Carolina, adding a new single-serve production line with advanced automation. The move strengthens its U.S. manufacturing presence and supports demand for brands such as Stouffer’s and Tombstone.

Global Frozen Food Market Segmentation

By Product

- Fruits

- Vegetables

- Ready Meals

- Meat

- Seafood

- Frozen Desserts

- Bakery Products

- Other

By Type

- Raw Material

- Half-cooked

- Ready-to-Eat

By Distribution

- Online

- Offline

By End-user

- Food Service Provider

- Retail

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Frozen Food Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions

2.2. Market Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.4. Value Chain Analysis

2.5. Porter’s Five Forces Analysis

2.6. COVID-19 Impact Analysis

2.7. Key Patents

3. Global Frozen Food Market Outlook, 2019 - 2032

3.1. Global Frozen Food Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Food Service Provider

3.1.1.2. Retail

3.1.2. BPS Analysis/Market Attractiveness Analysis

3.2. Global Frozen Food Market Outlook, by Distribution Channel, Value (US$ ‘000), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Online

3.2.1.2. Offline

3.2.2. BPS Analysis/Market Attractiveness Analysis

3.3. Global Frozen Food Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Ready meals

3.3.1.2. Frozen seafood

3.3.1.3. Frozen meat & poultry

3.3.1.4. Frozen fruit & vegetables

3.3.1.5. Frozen potatoes

3.3.1.6. Frozen soups

3.3.2. BPS Analysis/Market Attractiveness Analysis

3.4. Global Frozen Food Market Outlook, by Region, Value (US$ ‘000), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

3.4.2. BPS Analysis/Market Attractiveness Analysis

4. North America Frozen Food Market Outlook, 2019 - 2032

4.1. North America Frozen Food Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Food Service Provider

4.1.1.2. Retail

4.1.2. BPS Analysis/Market Attractiveness Analysis

4.2. North America Frozen Food Market Outlook, by Distribution Channel, Value (US$ ‘000), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Online

4.2.1.2. Offline

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Frozen Food Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Ready meals

4.3.1.2. Frozen seafood

4.3.1.3. Frozen meat & poultry

4.3.1.4. Frozen fruit & vegetables

4.3.1.5. Frozen potatoes

4.3.1.6. Frozen soups

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Frozen Food Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Frozen Food Market by Value (US$ ‘000), 2019 - 2032

4.4.1.2. Canada Frozen Food Market by Value (US$ ‘000), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Frozen Food Market Outlook, 2019 - 2032

5.1. Europe Frozen Food Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Food Service Provider

5.1.1.2. Retail

5.1.2. BPS Analysis/Market Attractiveness Analysis

5.2. Europe Frozen Food Market Outlook, by Distribution Channel, Value (US$ ‘000), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Online

5.2.1.2. Offline

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Frozen Food Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Ready meals

5.3.1.2. Frozen seafood

5.3.1.3. Frozen meat & poultry

5.3.1.4. Frozen fruit & vegetables

5.3.1.5. Frozen potatoes

5.3.1.6. Frozen soups

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Frozen Food Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Frozen Food Market by Value (US$ ‘000), 2019 - 2032

5.4.1.2. France Frozen Food Market by Product, Value (US$ ‘000), 2019 - 2032

5.4.1.3. U.K. Frozen Food Market by Value (US$ ‘000), 2019 - 2032

5.4.1.4. Italy Frozen Food Market by Value (US$ ‘000), 2019 - 2032

5.4.1.5. Spain Frozen Food Market by Product, Value (US$ ‘000), 2019 - 2032

5.4.1.6. Rest of Europe Frozen Food Market Value (US$ ‘000), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Frozen Food Market Outlook, 2019 - 2032

6.1. Asia Pacific Frozen Food Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Food Service Provider

6.1.1.2. Retail

6.1.2. BPS Analysis/Market Attractiveness Analysis

6.2. Asia Pacific Frozen Food Market Outlook, by Distribution Channel, Value (US$ ‘000), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Online

6.2.1.2. Offline

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Frozen Food Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Ready meals

6.3.1.2. Frozen seafood

6.3.1.3. Frozen meat & poultry

6.3.1.4. Frozen fruit & vegetables

6.3.1.5. Frozen potatoes

6.3.1.6. Frozen soups

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Frozen Food Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. India Frozen Food Market by Value (US$ ‘000), 2019 - 2032

6.4.1.2. China Frozen Food Market by Value (US$ ‘000), 2019 - 2032

6.4.1.3. Japan Frozen Food Market by Value (US$ ‘000), 2019 - 2032

6.4.1.4. Australia & New Zealand Frozen Food Market Value (US$ ‘000), 2019 - 2032

6.4.1.5. Rest of Asia Pacific Market by Value (US$ ‘000), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Frozen Food Market Outlook, 2019 - 2032

7.1. Latin America Frozen Food Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Food Service Provider

7.1.1.2. Retail

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Latin America Frozen Food Market Outlook, by Distribution Channel, Value (US$ ‘000), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Online

7.2.1.2. Offline

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Frozen Food Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Ready meals

7.3.1.2. Frozen seafood

7.3.1.3. Frozen meat & poultry

7.3.1.4. Frozen fruit & vegetables

7.3.1.5. Frozen potatoes

7.3.1.6. Frozen soups

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Frozen Food Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Frozen Food Market by Value (US$ ‘000), 2019 - 2032

7.4.1.2. Mexico Frozen Food Market by Value (US$ ‘000), 2019 - 2032

7.4.1.3. Rest of Latin America Frozen Food Market by Value (US$ ‘000), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Frozen Food Market Outlook, 2019 - 2032

8.1. Middle East & Africa Frozen Food Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Food Service Provider

8.1.1.2. Retail

8.1.2. BPS Analysis/Market Attractiveness Analysis

8.2. Middle East & Africa Frozen Food Market Outlook, by Distribution Channel, Value (US$ ‘000), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Online

8.2.1.2. Offline

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Frozen Food Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Ready meals

8.3.1.2. Frozen seafood

8.3.1.3. Frozen meat & poultry

8.3.1.4. Frozen fruit & vegetables

8.3.1.5. Frozen potatoes

8.3.1.6. Frozen soups

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Frozen Food Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Frozen Food Market by Value (US$ ‘000), 2019 - 2032

8.4.1.2. South Africa Frozen Food Market by Value (US$ ‘000), 2019 - 2032

8.4.1.3. Rest of Middle East & Africa Frozen Food Market by Value (US$ ‘000), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2021

9.2. Company Profiles

9.2.1. Cargill

9.2.1.1. Company Overview

9.2.1.2. Key Retailing Partners

9.2.1.3. Business Segment Revenue

9.2.1.4. Ingredient Overview

9.2.1.5. Product Offering & its Presence

9.2.1.6. Certifications & Claims

9.2.2. Nestle SA

9.2.3. Nomad Foods Ltd

9.2.4. General Mills Inc

9.2.5. Unilever Plc

9.2.6. Tyson Foods Inc

9.2.7. Conagra Brands Inc

9.2.8. Kellogg Company

9.2.9. The Kraft Heinz Company

9.2.10. Associated British Foods Plc

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

End User Coverage |

|

|

Type Coverage |

|

|

Distribution Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Product-, Application-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis, Key Trends |