Gas Insulated Substation (GIS) Market Outlook

Global Gas Insulated Substation (GIS) Market Shows Positive Outlook

A substation is a vital element of power system infrastructure. It transforms high electrical voltage to low or vice versa. It comprises the assembly of numerous power transmission and distribution systems. Presently there are two types of substations primarily being used: Air insulated substation (AIS) and gas insulated substation (GIS).

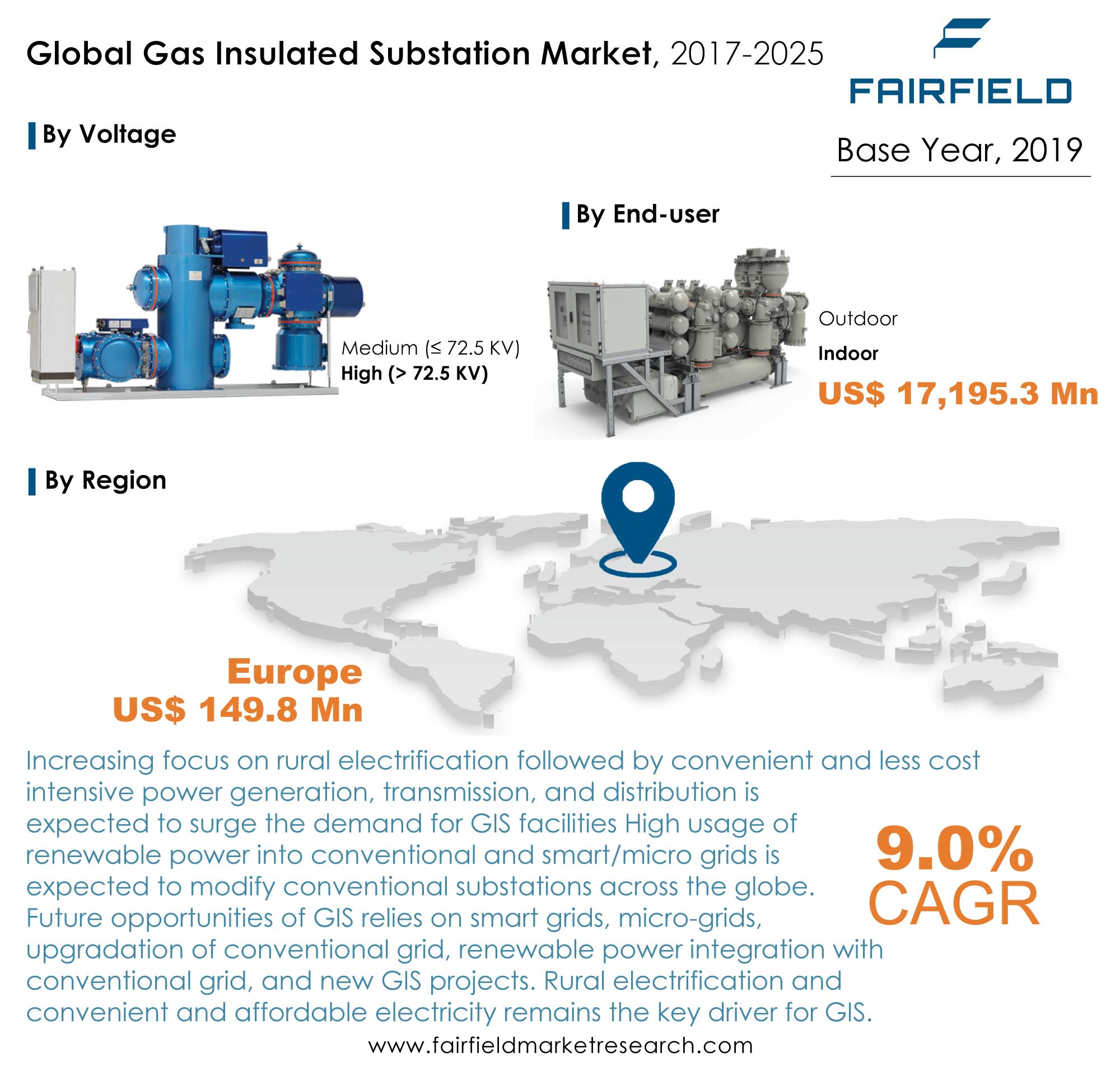

The gas insulated substation (GIS) is a compact assembly consisting of multiple components enclosed into a metallic covering with compressed sulphur hexafluoride (SF6) gas as an insulating medium. The substation is a combination of circuit breaker, spring mechanism, disconnector, earthing switch, current transformer, voltage transformer, busbar and load control cubicle used to control transmission and distribution of electric power. The global gas insulated substation market was worth US$23,751.9 Mn in 2020 and is expected to reach US$36,627.0 Mn by 2025. Analysts anticipate the market will register a CAGR of 9% between the forecast years of 2020 to 2025.

Gas Insulated Substation (GIS) Market Wins with Low Operational Costs and Compact Design

The key driver for the global gas insulated substation market is the environment-friendly nature of SF6 used in the transformer, which can be easily recycled. Also, GIS systems take up less space than air insulated substation (AIS). The compact design of gas insulated substation allows the best utilization of space and offers the most efficient and economical solutions to the customers. It can be easily installed in densely populated urban areas where land is limited and available at prohibitive costs. The physical footprint of a GIS is about 35% less than AIS. The compact design of GIS ensures easy and economical mobility of substations to the load centres thereby reducing transmission and distribution losses.

High capital costs related to GIS, when compared to AIS, are restraining the growth of GIS in developing countries. Also, cooling systems used for GIS are similar in principle to those used for oil insulated substation (OIS). The transformer used in gas insulated substations requires more elaborate cooling arrangements than oil filled substation transformers due to the lower thermal mass of SF6.

The power sector is the primary engine of the global economy, thus, generating, transmitting, and distributing electricity to all other sectors. A greater part of labour and products rely upon it. Coronavirus pandemic-based lockdown measures/conventions have altogether decreased power interest in the business and mechanical areas. The International Energy Agency (IEA) gauges that worldwide power requests diminished by 2.5% in Q1 2020. Many organizations across various areas universally have stopped or diminished capital consumptions, where conceivable, and the force area is no exemption. Non-basic ventures have been suspended all through the area-from age to transmission to circulation. This has hampered interest in GIS facilities.

Lower Capital Expenditure to Boost Demand for Indoor Gas Insulated Substation

The global gas insulated substation market can be segmented based on component, voltage, and end-user. In terms of component, the market has been bifurcated into: indoor and outdoor. In terms of voltage, the market has been segregated into: medium (≤ 72.5 KV) and high (> 72.5 KV). By end-user, the market has been divided into: utility and non-utility.

The indoor segment dominated the global gas insulated substation market in 2019. GIS is equally applicable for indoor and outdoor use for new and expansion of existing sub-stations. The GIS is manufactured over a wide range of voltages from 60 kV to 800 kV and capacity up to 4,000 amperes depending upon requirements in various designs suited to the particular requirements. In places where the cost of land or the cost of earthwork is high, indoor setup can greatly influence the overall investment needed in the global gas insulated substation market.

Asia Pacific to Remain the Most Promising Region for GIS Installations

Asia Pacific remains the most attractive region for the gas insulated substation (GIS) market. The growing need for safe and secure electricity generation, transmission, and distribution in India and China is expected to drive the market for GIS in the next few years. Toshiba is one of the key players in Asia Pacific. On 1st September 2020, India Grid Trust (“IndiGrid”) completed the acquired GPTL transmission project from Sterlite Power at US$ 150 Mn. GPTL consists of 3 GIS of 3,000 MVA capacity and ~270 ckms of 400 KV transmission lines spread across Uttar Pradesh, Haryana, and Rajasthan.

Next is Europe, followed closely by North America. North America is home to numerous suppliers/distributors/ manufacturers of key components used in of GIS network. Companies such as GE operating in the U.S., are rapidly expanding their product portfolio by offering different capacity-based GIS solutions for industrial and utility markets outside North America. Several companies headquartered in the U.S., including GE are targeting potential markets such as Asia Pacific, Middle East & Africa, and Latin America in order to acquire more market share.

Global Gas Insulated Substation (GIS) Market: Competitive Landscape

Key players involved in the global gas insulated substation (GIS) market are GE, ABB Ltd., Siemens AG, Toshiba Corporation, Nissin Electric Co., Mitsubishi Heavy Industries, Ltd., Hyundai Heavy Industries, Nissin Electric Co., Ltd., LARSEN & TOUBRO LIMITED, and Hitachi, Ltd.

In April 2021, Siemens Energy sealed the largest order to deliver 10 bays of SF6-free gas-insulated switchgear in Finland, Europe for Virkkala substation in Lohja. Commissioning is scheduled for summer 2022. In March 2021, GE won an order to upgrade gas insulated substations in Nepal. awarded to construct three 400 kilovolt (KV) Gas-Insulated Substations (GIS) by the state-owned Nepal Electricity Authority (NEA).

The Global Gas Insulated Substation (GIS) Market is Segmented as Below:

By Voltage Coverage

- Medium (≤ 72.5 KV)

- High (> 72.5 KV)

By Type Coverage

- Indoor

- Outdoor

By End-use Coverage

- Utility

- Non-utility

By Geographical Coverage

- North America

- U.S.

- Canada

- Europe

- Russia

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Rest of the World (RoW)

- Saudi Arabia

- Others

Leading Companies

- Siemens AG

- Toshiba Corporation

- Eaton Corporation

- ABB Ltd.

- GE

- Mitsubishi Heavy Industries, Ltd.

- Hyundai Heavy Industries

- Nissin Electric Co., Ltd.

- LARSEN & TOUBRO LIMITED

- Hitachi, Ltd.

Inside This Report You Will Find:

1. Executive Summary

2. Market Overview

3. Gas Insulated Substation- Cost Breakup Analysis

4. Global Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

5. North America Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

6. Europe Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

7. Asia Pacific Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

8. Rest of the World (RoW) Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

9. Competitive Landscape

10. Appendix

Post Sale Support, Research Updates & Offerings:

We value the trust shown by our customers in Fairfield Market Research. We support our clients through our post sale support, research updates and offerings.

- The report will be prepared in a PPT format and will be delivered in a PDF format.

- Additionally, Market Estimation and Forecast numbers will be shared in Excel Workbook.

- If a report being sold was published over a year ago, we will offer a complimentary copy of the updated research report along with Market Estimation and Forecast numbers within 2-3 weeks’ time of the sale.

- If we update this research study within the next 2 quarters, post purchase of the report, we will offer a Complimentary copy of the updated Market Estimation and Forecast numbers in Excel Workbook.

- If there is a geopolitical conflict, pandemic, recession, and the like which can impact global economic scenario and business activity, which might entirely alter the market dynamics or future projections in the industry, we will create a Research Update upon your request at a nominal charge.

1. Executive Summary

1.1. Global Gas Insulated Substation (GIS) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.2.4. Economic Trends

2.3. Value Chain Analysis

2.4. SWOT Analysis

2.5. Porter’s Five Forces Analysis

2.6. Covid-19 Impact

2.6.1. Supply Chain

2.6.2. End-user Customer Impact Analysis

3. Gas Insulated Substation- Cost Breakup Analysis

4. Global Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

4.1. Global Gas Insulated Substation (GIS) Market Outlook, by Source, Value (US$ Mn), 2017 - 2025

4.1.1. Key Highlights

4.1.1.1. Medium (≤ 72.5 KV)

4.1.1.2. High (> 72.5 KV)

4.1.2. BPS Analysis/Market Attractiveness Analysis, by Source

4.2. Global Gas Insulated Substation (GIS) Market Outlook, by Type, Value (US$ Mn), 2017 - 2025

4.2.1. Key Highlights

4.2.1.1. Indoor

4.2.1.2. Outdoor

4.2.2. BPS Analysis/Market Attractiveness Analysis, by Type

4.3. Global Gas Insulated Substation (GIS) Market Outlook, by End-use, Value (US$ Mn), 2017 - 2025

4.3.1. Key Highlights

4.3.1.1. Utility

4.3.1.2. Non-utility

4.2.2. BPS Analysis/Market Attractiveness Analysis, by End-use

4.4. Global Gas Insulated Substation (GIS) Market Outlook, by Region, Value (US$ Mn), 2017 - 2025

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Rest of the World

4.4.2. BPS Analysis/Market Attractiveness Analysis, by Region

5. North America Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

5.1. North America Gas Insulated Substation (GIS) Market Outlook, by Source, Value (US$ Mn), 2017 - 2025

5.1.1. Key Highlights

5.1.1.1. Medium (≤ 72.5 KV)

5.1.1.2. High (> 72.5 KV)

5.2. North America Gas Insulated Substation (GIS) Market Outlook, by Type, Value (US$ Mn), 2017 - 2025

5.2.1. Key Highlights

5.2.1.1. Indoor

5.2.1.2. Outdoor

5.3. North America Gas Insulated Substation (GIS) Market Outlook, by End-use, Value (US$ Mn), 2017 - 2025

5.3.1. Key Highlights

5.3.1.1. Utility

5.3.1.2. Non-utility

5.4. North America Gas Insulated Substation (GIS) Market Outlook, by Country, Value (US$ Mn), 2017 - 2025

5.4.1. Key Highlights

5.4.1.1. U.S. Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

5.4.1.2. Canada Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

6. Europe Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

6.1. Europe Gas Insulated Substation (GIS) Market Outlook, by Source, Value (US$ Mn), 2017 - 2025

6.1.1. Key Highlights

6.1.1.1. Medium (≤ 72.5 KV)

6.1.1.2. High (> 72.5 KV)

6.2. Europe Gas Insulated Substation (GIS) Market Outlook, by Type, Value (US$ Mn), 2017 - 2025

6.2.1. Key Highlights

6.2.1.1. Indoor

6.2.1.2. Outdoor

6.3. Europe Gas Insulated Substation (GIS) Market Outlook, by End-use, Value (US$ Mn), 2017 - 2025

6.3.1. Key Highlights

6.3.1.1. Utility

6.3.1.2. Non-utility

6.4. Europe Gas Insulated Substation (GIS) Market Outlook, by Country, Value (US$ Mn), 2017 - 2025

6.4.1. Key Highlights

6.4.1.1. Russia Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

6.4.1.2. Germany Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

6.4.1.3. France Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

6.4.1.4. Rest of Europe Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

7. Asia Pacific Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

7.1. Asia Pacific Gas Insulated Substation (GIS) Market Outlook, by Source, Value (US$ Mn), 2017 - 2025

7.1.1. Key Highlights

7.1.1.1. Medium (≤ 72.5 KV)

7.1.1.2. High (> 72.5 KV)

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Asia Pacific Gas Insulated Substation (GIS) Market Outlook, by Type, Value (US$ Mn), 2017 - 2025

7.2.1. Key Highlights

7.2.1.1. Indoor

7.2.1.2. Outdoor

7.3. Asia Pacific Gas Insulated Substation (GIS) Market Outlook, by End-use, Value (US$ Mn), 2017 - 2025

7.3.1. Key Highlights

7.3.1.1. Utility

7.3.1.2. Non-utility

7.4. Asia Pacific Gas Insulated Substation (GIS) Market Outlook, by Country, Value (US$ Mn), 2017 - 2025

7.4.1. Key Highlights

7.4.1.1. China Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

7.4.1.2. Japan Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

7.4.1.3. India Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

7.4.1.4. Rest of Asia Pacific Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

8. Rest of the World (RoW) Gas Insulated Substation (GIS) Market Outlook, 2017 - 2025

8.1. Rest of the World (RoW) Gas Insulated Substation (GIS) Market Outlook, by Source, Value (US$ Mn), 2017 - 2025

8.1.1. Key Highlights

8.1.1.1. Medium (≤ 72.5 KV)

8.1.1.2. High (> 72.5 KV)

8.2. Rest of the World (RoW) Gas Insulated Substation (GIS) Market Outlook, by Type, Value (US$ Mn), 2017 - 2025

8.2.1. Key Highlights

8.2.1.1. Indoor

8.2.1.2. Outdoor

8.3. Rest of the World (RoW) Gas Insulated Substation (GIS) Market Outlook, by End-use, Value (US$ Mn), 2017 - 2025

8.3.1. Key Highlights

8.3.1.1. Utility

8.3.1.2. Non-utility

8.4. Rest of the World (RoW) Gas Insulated Substation (GIS) Market Outlook, by Country, Value (US$ Mn), 2017 - 2025

8.4.1. Key Highlights

8.4.1.1. Saudi Arabia Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

8.4.1.2. Others Gas Insulated Substation (GIS) Market, Value (US$ Mn), 2017 - 2025

9. Competitive Landscape

9.1. Company Market Share Analysis, 2019

9.2. Strategic Collaborations

9.3. Company Profiles

9.3.1. Siemens AG

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Toshiba Corporation

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Eaton Corporation

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. ABB Ltd.

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. GE

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Mitsubishi Heavy Industries, Ltd.

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Hyundai Heavy Industries

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Nissin Electric Co., Ltd.

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. LARSEN & TOUBRO LIMITED

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. Hitachi, Ltd.

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

|

2019 |

|

2017 - 2019 |

|

2020 - 2025 |

Value: US$ Million |

|

REPORT FEATURES |

DETAILS |

|

Voltage Coverage |

|

|

Type Coverage |

|

|

End-use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2017-2019), Price Trend Analysis- 2019-2025, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |