Global Gas Turbine Market Forecast

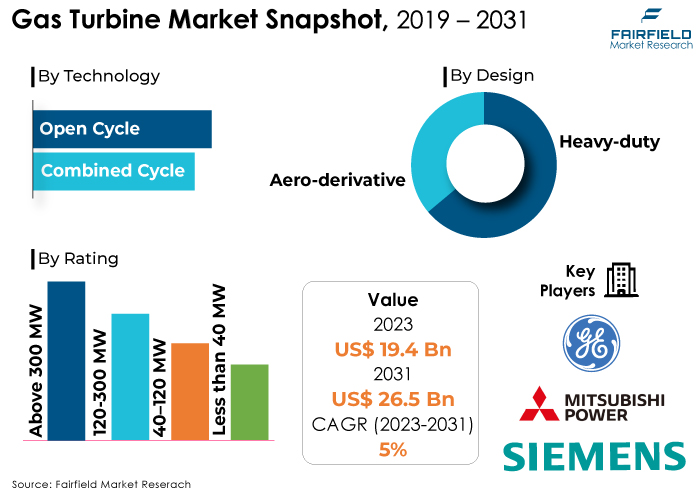

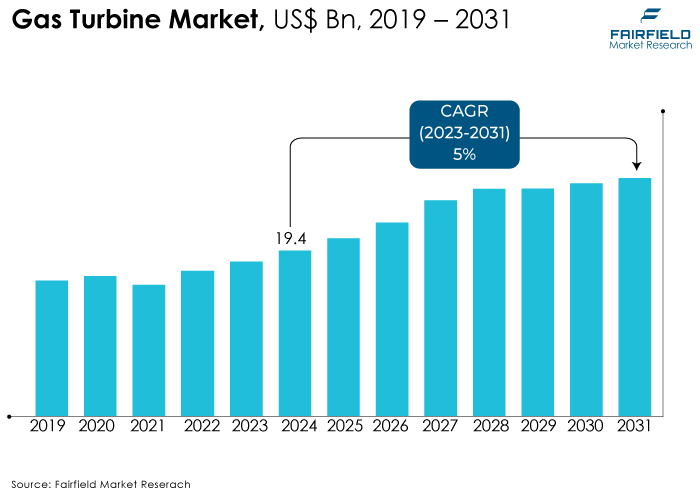

- The global gas turbine market to reach US$26.5 Bn by 2031, up from its 2024 size worth US$19.4 Bn

- Gas turbine market revenue projected to experience a CAGR of 5% between 2024 and 2031

Quick Report Digest

- Global gas turbine market anticipates more than 1.3x growth in revenue between the years of forecast, i.e., 2023 and 2030.

- Growth driven by increasing demand for electricity, transition toward cleaner energy sources, and technological advancements.

- Challenges include regulatory constraints, high initial investment and maintenance costs, and competition from renewables.

- Key trends include digital transformation, rising demand for power generation, and sustainability initiatives.

- Regulatory impact shapes industry dynamics, pushing for cleaner operations and technological advancements.

- Top segments include power generation, oil & gas, and aviation, each with unique opportunities and challenges.

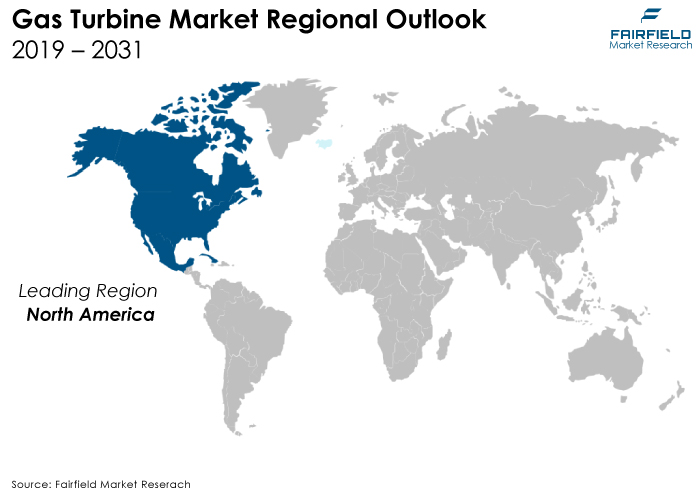

- Regional dynamics vary with North America, Asia Pacific, Europe, Middle East & Africa, and Latin America showing distinct growth patterns.

- Leading companies like General Electric (GE), Siemens, and Mitsubishi Hitachi Power Systems (MHPS) dominate the market.

- Recent developments focus on efficiency enhancements, IoT/AI integration, and combining gas turbines with renewables.

- Market segmentation includes technology, design type, rating capacity, application, and geographic coverage.

A Look Back and a Look Forward - Comparative Analysis

The global gas turbine market saw steady growth between 2018 and 2023, with estimates ranging from US$10.19 Bn to US$19.74 Bn by 2023. This growth was driven by factors like rising energy demand, particularly in developing economies, and a shift toward decentralised power generation using smaller, more efficient gas turbines.

Advancements in efficiency, emissions reduction, and digital integration further fuelled market expansion. However, fluctuating fuel prices, competition from renewable energy sources like solar and wind, and stricter environmental regulations posed challenges. The Asia Pacific region, led by China, and India's rapid industrialisation, dominated the market.

Analysts further predict continued but moderate growth at a CAGR of 3.6% to 4.1% until 2030. The market is expected to reach a valuation of US$25.98 Bn to US$27.57 Bn by then. Technological advancements in efficiency, lower emissions, and digitalisation will be key drivers. Manufacturers will likely prioritise cleaner burning technologies to comply with stricter environmental regulations.

While the Asia Pacific region is expected to maintain its lead, growth in developed regions might be slower. Overall, the gas turbine market seems poised for moderate expansion despite the rise of renewables. Its role in providing reliable power generation, coupled with continuous technological improvements, is likely to secure its place in the global energy landscape.

Key Growth Determinants

- Increasing Demand for Electricity

The growing global population coupled with industrialisation and urbanisation drives the demand for electricity. Gas turbines are widely used in power generation due to their efficiency, reliability, and flexibility. As countries aim to expand their power generation capacities, especially in emerging economies, the demand for gas turbines is expected to rise.

- Transition Toward Cleaner Energy Sources

Governments worldwide are implementing stricter environmental regulations to combat climate change and reduce air pollution. Gas turbines offer a more environmentally friendly option compared to coal-fired power plants, emitting fewer greenhouse gases and pollutants. There is thus a growing trend toward natural gas-based power generation, which boosts the demand for gas turbines.

- Technological Advancements and Efficiency Improvements

Ongoing advancements in gas turbine technology continue to enhance their efficiency, performance, and reliability. Innovations such as combined cycle power plants, advanced materials, digitalisation, and additive manufacturing are driving efficiency gains and reducing operational costs.

Major Growth Barriers

- Regulatory Constraints

Gas turbine technology often encounters regulatory challenges due to environmental concerns. Regulations regarding emissions, noise pollution, and energy efficiency standards can significantly impact the market. Compliance with these regulations may require costly modifications to existing turbines or the development of new, more environmentally friendly technologies.

- High Initial Investment and Maintenance Costs

Gas turbines are capital-intensive assets, with high upfront costs for installation and infrastructure development. Additionally, ongoing maintenance and operational expenses can be significant. The initial investment and maintenance costs can deter potential buyers or investors, especially in regions where access to capital is limited or where alternative energy sources present more cost-effective options.

- Growing Competition from Renewable Energy Sources

The growing popularity and competitiveness of renewable energy sources, such as wind and solar power, pose a challenge to the gas turbine market. Renewable energy technologies have become more affordable and environmentally preferable, leading to increased adoption and investment. As a result, gas turbines face competition not only in terms of cost-effectiveness but also in meeting sustainability goals.

Key Trends and Opportunities to Look at

- Digital Transformation

Many industries are undergoing digital transformations, integrating technologies such as IoT, AI, and data analytics into their operations to improve efficiency, reduce costs, and enhance decision-making processes.

- Increasing Demand for Power Generation

With the global population rising and industrialisation continuing in many regions, there is a consistent demand for power generation solutions. Gas turbines offer an efficient and reliable option for electricity generation, particularly in regions where natural gas is abundant.

- Sustainability and Renewable Energy

There is a growing emphasis on sustainability and renewable energy sources across different sectors. Companies are increasingly investing in renewable energy technologies like wind, solar, and hydroelectric power to reduce their carbon footprint and meet regulatory requirements.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly shapes the gas turbine industry, acting as both a driver and a hurdle. Stringent environmental regulations are a double-edged sword. On the one hand, they push manufacturers to develop cleaner burning technologies, a trend that benefits the industry in the long run.

This focus on cleaner operations aligns with the growing global emphasis on sustainability and helps the gas turbine industry maintain its relevance in a future increasingly dominated by renewable energy sources. Stringent regulations can also translate into significant upfront costs for manufacturers, as they invest in research and development of cleaner burning technologies like advanced combustion systems and carbon capture & storage solutions.

The regulatory scenario plays a complex role in shaping the gas turbine industry. While it pushes for cleaner operations and technological advancements, it can also impose significant costs and influence market trends.

Navigating this complex regulatory landscape effectively will be crucial for the gas turbine industry's long-term success. Manufacturers who can adapt their offerings to meet stricter environmental standards while maintaining cost-effectiveness are likely to thrive in this evolving regulatory environment.

Fairfield’s Ranking Board

Top Segments

Power Generation Segment Spearheads Riding the Efficiency Trend

Gas turbines are pivotal in the power generation sector owing to their exceptional efficiency and flexibility. They are prominently featured in combined cycle power plants, serving the electricity needs of both residential and industrial consumers. The demand for gas turbines in power generation stems from the imperative for dependable and cost-effective energy solutions. Their ability to swiftly respond to fluctuating electricity demands, coupled with relatively lower emissions compared to other fossil fuel-based alternatives, positions gas turbines as indispensable assets in the energy landscape.

Moreover, advancements such as advanced combustion technologies and digital control systems further enhance their efficiency and operational flexibility. As the global energy transition accelerates toward cleaner sources, gas turbines will continue to play a vital role in ensuring grid stability and meeting the ever-growing demand for electricity.

Adoption Significant Across Oil & Gas Industry

Gas turbines find extensive utilisation across the oil and gas sector for diverse applications, including power generation, mechanical drive, and offshore platforms. Renowned for their robustness and ability to withstand harsh environments, gas turbines provide reliable power for drilling, pumping, and processing operations in remote and challenging locations. Their modular design and quick-start capabilities make them ideal for supporting intermittent power needs in oil and gas facilities.

Furthermore, ongoing advancements in turbine technology, such as enhanced fuel flexibility and emissions control systems, align with the industry's goals of operational efficiency and environmental stewardship. Despite fluctuations in oil prices and market dynamics, the demand for gas turbines in the oil and gas sector remains resilient, driven by the perpetual need for efficient energy solutions to sustain operations and optimise resource extraction.

Gas Turbines Gain Momentum in Aviation Advancements

Gas turbines serve as the primary propulsion systems for both commercial and military aircraft, underpinning safe and economical flight operations worldwide. In the aviation sector, stringent requirements for performance, reliability, and fuel efficiency propel continuous innovation in gas turbine technology. Manufacturers strive to develop engines that deliver higher thrust with reduced fuel consumption and emissions, addressing the industry's sustainability goals and regulatory mandates.

Advancements such as advanced materials, aerodynamic designs, and digital engine control systems contribute to achieving these objectives while ensuring operational safety and passenger comfort. Moreover, ongoing research into alternative fuels and hybrid-electric propulsion systems underscores the aviation industry's commitment to reducing its carbon footprint. As air travel demand continues to soar, gas turbines remain indispensable for powering modern aircraft fleets, facilitating global connectivity, and driving economic growth.

Regional Frontrunners

North America Driven by Technological Advancements and Regulatory Measures

North America, Asia Pacific, and Europe have traditionally been significant players in the global gas turbine market. However, North America remains in the bandwagon. The US especially has been a key market for gas turbines, driven primarily by demand from the power generation sector, including utilities and independent power producers.

The shale gas revolution in the US has significantly impacted the market dynamics, leading to increased adoption of natural gas-fired power plants, which in turn drives demand for gas turbines. Technological advancements and increasing emphasis on cleaner energy sources have also influenced the market, with a growing interest in more efficient and environmentally friendly gas turbine solutions.

North America's gas turbine market is primarily fueled by technological advancements and strict emission regulations. The US leads the region due to substantial investments in shale gas exploration and the modernisation of ageing infrastructure with more efficient turbines.

Rapid Industrialisation, and Urbanisation Empower Asia Pacific

Asia Pacific is one of the fastest-growing regions in terms of gas turbine demand, largely due to rapid industrialisation, urbanisation, and increasing electricity demand. Key countries like China, India, Japan, South Korea, and Southeast Asian nations have been investing heavily in infrastructure development, including power generation capacity expansion, which boosts the demand for gas turbines.

Additionally, factors such as government initiatives to improve energy efficiency, modernise power infrastructure, and reduce emissions contribute to the growth of the gas turbine market in the region.

Asia Pacific's gas turbine market is propelled by rapid industrialisation and urbanisation, particularly in countries like China, and India. The region's escalating energy demands, coupled with governmental efforts to reduce carbon emissions, drive the adoption of gas turbines for power generation.

Europe’s Prominent Shift Toward Sustainable Energy Solutions Creates Opportunities

Europe is experiencing a shift toward gas turbines as a cleaner alternative to coal-fired power plants, driven by a growing emphasis on sustainable energy solutions. Additionally, the integration of renewable energy sources with gas turbines for grid stability further propels market growth in the region.

Europe has a mature gas turbine market, with established players in the power generation, oil & gas, and industrial sectors. The region has been focusing on energy transition and reducing greenhouse gas emissions, leading to a shift toward cleaner energy sources and greater adoption of renewable energy technologies.

However, gas turbines still play a crucial role in providing flexible and reliable power generation, particularly to support intermittent renewable energy sources like wind and solar. Furthermore, Europe has been investing in upgrading existing gas turbine fleets to improve efficiency, flexibility, and environmental performance.

Fairfield’s Competitive Landscape Analysis

The gas turbine market is fiercely competitive, characterised by leading players vying for market dominance through various strategic approaches. General Electric (GE) stands out as a major contender, renowned for its diverse range of gas turbine products tailored for power generation, industrial, and oil and gas applications.

GE's focus on innovation and technological advancement underscores its commitment to staying ahead in the market. Similarly, Siemens AG is a formidable force, emphasizing sustainability and efficiency in its gas turbine offerings, driving its growth trajectory.

Mitsubishi Hitachi Power Systems (MHPS) is another significant player, recognised for its advanced technology solutions geared toward enhancing efficiency and reliability in power generation and industrial sectors.

Ansaldo Energia, and Kawasaki Heavy Industries also command notable market shares, leveraging flexibility, customisation, and innovative approaches to meet customer demands. Moreover, Solar Turbines, a Caterpillar Company, maintains its stronghold in the oil and gas segment, prioritising product efficiency and reliability.

Who are the Leaders in the Global Gas Turbine Space?

- General Electric (GE)

- Siemens

- Mitsubishi Hitachi Power Systems (MHPS)

- Ansaldo Energia

- Kawasaki Heavy Industries

- BHEL (Bharat Heavy Electricals Limited)

- Solar Turbines (a Caterpillar company)

- MAN Energy Solutions

- Alstom Power

Significant Company Developments

New Product Launch

- July 2023: Gas turbine manufacturers prioritise efficiency enhancements through advanced materials and combustion technologies, reducing emissions and operational costs.

- May 2024: Mitsubishi Hitachi Power Systems (MHPS) enters into a distribution agreement with a major industrial conglomerate to expand its market presence in the oil & gas sector, providing reliable power solutions for offshore platforms and drilling operations.

Distribution Agreement

- April 2022: Integration of IoT, AI, and big data analytics enables real-time monitoring and predictive maintenance, enhancing reliability and reducing downtime.

- November 2024: Gas turbines are combined with renewables and energy storage like batteries, boosting grid stability and supporting the shift toward sustainable energy.

The Global Gas Turbine Market is Segmented as Below:

By Technology

- Open Cycle

- Combined Cycle

By Design Type

- Heavy-duty

- Aero-derivative

By Rating Capacity

- Less than 40 MW

- 40-120 MW

- 120-300 MW

- Above 300 MW

By Application

- Power Generation

- Oil & Gas

- Marine

- Aerospace

- Process Plants

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Lipid Nutrition Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output Analysis and Trade Statistics

3.1. Key Highlights

3.2. Production, by Region

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Latin America

3.2.5. Middle East & Africa

4. Price Trend Analysis

4.1. Key Highlights

4.2. Key Factors Affecting Prices

4.3. Prices by Product/Application/End-user

4.4. Prices by Region

5. Global Lipid Nutrition Market Outlook, 2019 - 2031

5.1. Global Lipid Nutrition Market Outlook, by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Lifetime Seals

5.1.1.2. Floating Seals

5.1.1.3. Duo Cone Seals

5.1.1.4. Toric Seals

5.1.1.5. Heavy Duty Seals

5.2. Global Lipid Nutrition Market Outlook, by Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Tracked Vehicles

5.2.1.2. Agriculture Machines

5.2.1.3. Conveyor Systems

5.2.1.4. Mining Machines

5.2.1.5. Heavy Trucks

5.2.1.6. Tunnel Boring Machines

5.2.1.7. Axles

5.2.1.8. Others

5.3. Global Lipid Nutrition Market Outlook, by Region, Volume (Tons) and Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Lipid Nutrition Market Outlook, 2019 - 2031

6.1. North America Lipid Nutrition Market Outlook, by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Lifetime Seals

6.1.1.2. Floating Seals

6.1.1.3. Duo Cone Seals

6.1.1.4. Toric Seals

6.1.1.5. Heavy Duty Seals

6.2. North America Lipid Nutrition Market Outlook, by Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Tracked Vehicles

6.2.1.2. Agriculture Machines

6.2.1.3. Conveyor Systems

6.2.1.4. Mining Machines

6.2.1.5. Heavy Trucks

6.2.1.6. Tunnel Boring Machines

6.2.1.7. Axles

6.2.1.8. Others

6.2.2. Market Attractiveness Analysis

6.3. North America Lipid Nutrition Market Outlook, by Country, Volume (Tons) and Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

6.3.1.2. U.S. Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

6.3.1.3. Canada Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

6.3.1.4. Canada Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Lipid Nutrition Market Outlook, 2019 - 2031

7.1. Europe Lipid Nutrition Market Outlook, by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Lifetime Seals

7.1.1.2. Floating Seals

7.1.1.3. Duo Cone Seals

7.1.1.4. Toric Seals

7.1.1.5. Heavy Duty Seals

7.2. Europe Lipid Nutrition Market Outlook, by Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Tracked Vehicles

7.2.1.2. Agriculture Machines

7.2.1.3. Conveyor Systems

7.2.1.4. Mining Machines

7.2.1.5. Heavy Trucks

7.2.1.6. Tunnel Boring Machines

7.2.1.7. Axles

7.2.1.8. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Lipid Nutrition Market Outlook, by Country, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.2. Germany Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.3. U.K. Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.4. U.K. Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.5. France Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.6. France Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.7. Italy Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.8. Italy Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.9. Turkey Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.10. Turkey Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.11. Russia Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.12. Russia Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.13. Rest of Europe Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.1.14. Rest of Europe Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Lipid Nutrition Market Outlook, 2019 - 2031

8.1. Asia Pacific Lipid Nutrition Market Outlook, by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Lifetime Seals

8.1.1.2. Floating Seals

8.1.1.3. Duo Cone Seals

8.1.1.4. Toric Seals

8.1.1.5. Heavy Duty Seals

8.2. Asia Pacific Lipid Nutrition Market Outlook, by Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Tracked Vehicles

8.2.1.2. Agriculture Machines

8.2.1.3. Conveyor Systems

8.2.1.4. Mining Machines

8.2.1.5. Heavy Trucks

8.2.1.6. Tunnel Boring Machines

8.2.1.7. Axles

8.2.1.8. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Lipid Nutrition Market Outlook, by Country, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.2. China Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.3. Japan Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.4. Japan Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.5. South Korea Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.6. South Korea Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.7. India Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.8. India Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.9. Southeast Asia Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.10. Southeast Asia Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.11. Rest of Asia Pacific Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.1.12. Rest of Asia Pacific Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Lipid Nutrition Market Outlook, 2019 - 2031

9.1. Latin America Lipid Nutrition Market Outlook, by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Lifetime Seals

9.1.1.2. Floating Seals

9.1.1.3. Duo Cone Seals

9.1.1.4. Toric Seals

9.1.1.5. Heavy Duty Seals

9.2. Latin America Lipid Nutrition Market Outlook, by Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.1.1. Key Highlights

9.2.1.1. Tracked Vehicles

9.2.1.2. Agriculture Machines

9.2.1.3. Conveyor Systems

9.2.1.4. Mining Machines

9.2.1.5. Heavy Trucks

9.2.1.6. Tunnel Boring Machines

9.2.1.7. Axles

9.2.1.8. Others

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Lipid Nutrition Market Outlook, by Country, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.1.2. Brazil Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.1.3. Mexico Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.1.4. Mexico Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.1.5. Argentina Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.1.6. Argentina Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.1.7. Rest of Latin America Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.1.8. Rest of Latin America Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Lipid Nutrition Market Outlook, 2019 - 2031

10.1. Middle East & Africa Lipid Nutrition Market Outlook, by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Lifetime Seals

10.1.1.2. Floating Seals

10.1.1.3. Duo Cone Seals

10.1.1.4. Toric Seals

10.1.1.5. Heavy Duty Seals

10.2. Middle East & Africa Lipid Nutrition Market Outlook, by Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Tracked Vehicles

10.2.1.2. Agriculture Machines

10.2.1.3. Conveyor Systems

10.2.1.4. Mining Machines

10.2.1.5. Heavy Trucks

10.2.1.6. Tunnel Boring Machines

10.2.1.7. Axles

10.2.1.8. Others

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Lipid Nutrition Market Outlook, by Country, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.2. GCC Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.3. South Africa Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.4. South Africa Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.5. Egypt Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.6. Egypt Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.7. Nigeria Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.8. Nigeria Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.9. Rest of Middle East & Africa Lipid Nutrition Market by Type, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.1.10. Rest of Middle East & Africa Lipid Nutrition Market Application, Volume (Tons) and Value (US$ Mn), 2019 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Caterpillar

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Enduro Bearings Industrial

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. FTL Technology

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Goetze

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. SKF

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Timken AB

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Trelleborg Group

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. ROC Carbon Company

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Morcor Limited

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Dover Corporation

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Tenneco Inc.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. SAP Parts

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Freudenberg SE

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Trostel

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Fenner Group Holdings Limited

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million Volume: MW |

||

|

REPORT FEATURES |

DETAILS |

|

Technology Coverage |

|

|

Design Type Coverage |

|

|

Rating Capacity Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |