Hydrogen Tube Trailer Market Outlook

Promising Hydrogen Roadmap to Benefit Hydrogen Tube Trailers Demand in Near Future

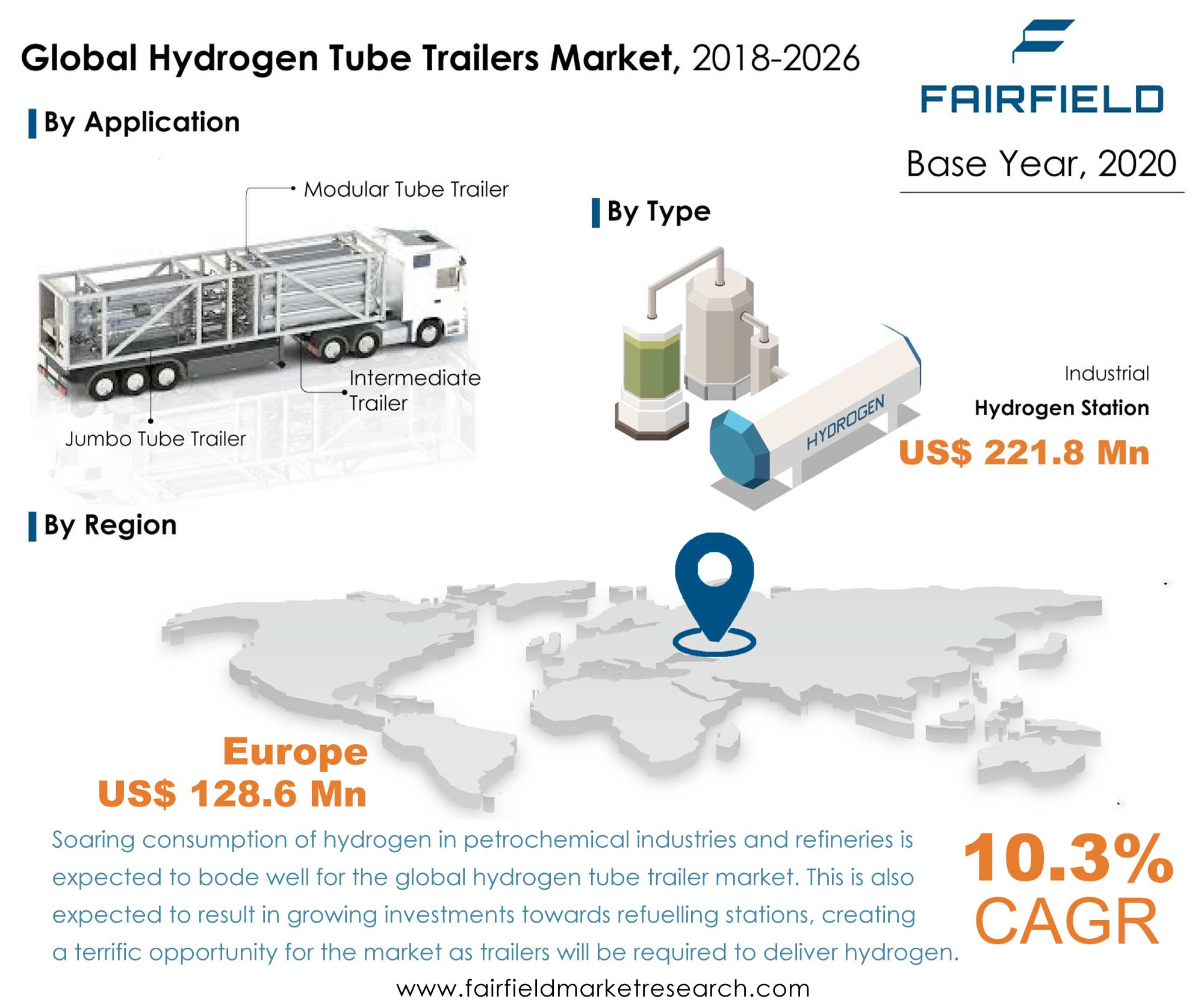

According to Fairfield Market Research, the global hydrogen tube trailer market was valued at US$ 276.3 Mn in 2020 and is anticipated to be worth US$498.6 Mn in 2026, registering a CAGR of 10.3% between 2021 and 2026.

Hydrogen, as a fuel, holds the drawn-out potential to tackle two basic issues-reliance on fossil fuel and outflow of greenhouse gas (GHG’s) emissions. Fruitful commercialization of hydrogen fuel cell EV’s will rely on the presence of a hydrogen conveyance framework that gives a similar degree of security and accommodation as the current gas networks.

Furthermore, the hydrogen conveyance framework should uphold the different creation pathways for hydrogen fuel. The potential hydrogen conveyance pathways depend on the different actual states wherein hydrogen can be conveyed. These pathways incorporate vaporous hydrogen, fluid hydrogen, and a range of conceivable strong or fluid hydrogen transporters. Blended pathways are additionally potential choices. Conveyance pathways contain various parts like blowers, pipelines, liquefiers, vaporous cylinder trailers, cryogenic fluid trucks, stockpiling vessels, terminals, and distributors.

The gaseous hydrogen delivery pathway includes compression, storage, and transport by pipeline and/or tube trailer. Hydrogen tube trailers are widely utilized to carry hydrogen from production-site to delivery point. Trucks that haul gaseous hydrogen are called tube trailers. Gaseous hydrogen is compressed to pressures of 180 bar (~2,600 psig) or higher into long cylinders that are stacked on a trailer that the truck hauls. This gives the appearance of long tubes, hence the name tube trailer.

Lower Transportation Costs Followed by the Russia-Ukraine War will Accelerate Investments in Hydrogen Tube Trailer Market

The hydrogen tube trailers demand is widely driven by consumption of hydrogen by industrial and automotive sectors. Hydrogen tube trailers are vital in compressed hydrogen transportation at efficient costs when contrasted with pipeline-based delivery options. Significant expenses related with pipeline-based hydrogen conveyance, combined with lacking pipeline framework, makes hydrogen tube trailers ideal for near term delivery of compressed gaseous hydrogen.

The ongoing war between Russia and Ukraine is expected to result in supply shortage of crude oil and natural gas to the rest of the world. Russia is the third largest exporter of crude oil and natural gas in the world. Russia exports more than 60% of its oil & gas to Europe. However, due to the several sanctions imposed on Russia by the U.S. and EU nations, the price of crude oil is likely to increase. Thus, the U.S. and Europe are expected to shift their interests towards other fuel options such as hydrogen or renewables in order to minimize the demand-supply gap. This is indirectly expected to boost the growth of the global hydrogen tube trailer market in the near future.

Jumbo Tube Trailers to Register Higher Growth by 2026 in Hydrogen Tube Trailer Market

In terms of type, modular tube trailers dominated and constituted 66.9% of the global hydrogen tube trailers market in 2020. Other categories include intermediate tube trailer and jumbo tube trailer.

Jumbo tube trailers consist of more tubes than a conventional modular or intermediate tube trailer setup. Usually, a jumbo tube trailer has 10 tubes and a 44-foot (13.41 m) chassis, operating with pressures in excess of 3,200 psi. Hydrogen carrying capacity of these tubes is higher compared to other types. Fairfield Market Research reports that this segment will register an 11.1% CAGR by 2026 owing to increasing demand for high capacity-based hydrogen tube trailers.

Ambitious Targets to Setup New Hydrogen Refuelling Stations to Poise Growth

In terms of application, hydrogen refuelling station constituted 79.8% of the global hydrogen tube trailers market in 2020. In the past five years, there has been a sharp increase in the number of public hydrogen stations owing to increase in sales for fuel cell-powered vehicles. Along with industrial demand from refineries and petrochemical plants for compressed hydrogen gas, planned projects for H2 fuelling station will augment the demand for hydrogen tube trailers over the forecast period.

Furthermore, ambitious H2 refuelling station targets by 2030 set by key nations such as the U.S., China, Europe, and Japan are expected to benefit sales and rental activities of hydrogen tube trailers. More than 12,000 hydrogen refuelling stations are expected to get operational by 2030.

Under industrial category, refineries and petrochemical plants are major end users of hydrogen tube trailers. However, majority of these industries procure hydrogen gas through pipeline network and pay a certain amount to the pipeline owner/operator. By 2026, industrial demand for hydrogen tube trailers is expected to moderately lose share owing to growing demand from hydrogen fuelling stations each year.

Europe and Asia Pacific Lead With Ability to Remain Dominant Throughout Forecast Period

Europe and Asia Pacific constituted more than 80% share of the global hydrogen tube trailer market in 2020. Europe is expected to add 3,700 hydrogen refuelling stations by 2030. In the year 2019, more than 80 hydrogen refuelling stations came online. In 2020, demand for pure hydrogen is around 90 Mt, mostly for oil refining and chemical production.

In Asia Pacific, China and Japan remains lucrative market for hydrogen tube trailers. Japan has more than 150 H2 fuel stations followed by China (more than 50) and South Korea (33). In terms of attractiveness, India and Australia remains the key market for hydrogen tube trailers post 2020. Hydrogen tube trailer market in Asia Pacific is still not matured like in Europe or North America. The market for hydrogen tube trailers in the region is purely driven by Japanese and German manufacturers of hydrogen tube trailers. Low market penetration of hydrogen tube trailers in the Asia market, especially in the most polluting nations such as China and India possess immense potential during the forecast period.

North America follows behind Europe and Asia Pacific. However, North America is expected to register higher CAGR of 10.3% from 2020-2026. In North America, U.S. is expected to add 7,100 H2 refuelling stations by 2030. This is likely to boost the demand for hydrogen tube trailers in the U.S.

Global Hydrogen Tube Trailer Market: Competitive Landscape

Key players competing in hydrogen tube trailer market are Air Liquide, Linde AG, Air Products and Chemicals, Inc., Roberts Oxygen Company, Inc., Calvera, Hexagon Composites ASA, Zhejiang Rein Gas Equipment Co., Ltd., FIBA Technologies, Inc, Matar Srl. Air Products and Chemicals, Inc. offers transportation service for both liquid and gaseous hydrogen. The company offers gaseous hydrogen tube trailers of up to 2,400 psig pressure and 142–300 kg/trailer capacity.

The Global Hydrogen Tube Trailer Market is Segmented as Below:

By Type Coverage

- Modular Tube Trailer

- Intermediate Trailer

- Jumbo Tube Trailer

By Application Type

- Hydrogen Fuel Station

- Industrial

By Geographical Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Leading Companies

- Air Liquide

- Linde AG

- Air Products and Chemicals, Inc.

- Roberts Oxygen Company, Inc.

- Calvera

- Hexagon Composites ASA

- Zhejiang Rein Gas Equipment Co., Ltd.

- FIBA Technologies, Inc

- Matar Srl.

- Weldship Corporation

- Composite Advanced Technologies, LLC.

Inside This Report You Will Find:

1. Executive Summary

2. Market Overview

3. Price Trends Analysis and Future Projects, 2018 - 2026

4. Global Hydrogen Tube Trailer Market Outlook, 2018 - 2026

5. North America Hydrogen Tube Trailer Market Outlook, 2018 - 2026

6. Europe Hydrogen Tube Trailer Market Outlook, 2018 - 2026

7. Asia Pacific Hydrogen Tube Trailer Market Outlook, 2018 - 2026

8. Middle East & Africa Hydrogen Tube Trailer Market Outlook, 2018 - 2026

9. Latin America Hydrogen Tube Trailer Market Outlook, 2018 - 2026

10. Competitive Landscape

11. Appendix

Post Sale Support, Research Updates & Offerings:

We value the trust shown by our customers in Fairfield Market Research. We support our clients through our post sale support, research updates and offerings.

- The report will be prepared in a PPT format and will be delivered in a PDF format.

- Additionally, Market Estimation and Forecast numbers will be shared in Excel Workbook.

- If a report being sold was published over a year ago, we will offer a complimentary copy of the updated research report along with Market Estimation and Forecast numbers within 2-3 weeks’ time of the sale.

- If we update this research study within the next 2 quarters, post purchase of the report, we will offer a Complimentary copy of the updated Market Estimation and Forecast numbers in Excel Workbook.

- If there is a geopolitical conflict, pandemic, recession, and the like which can impact global economic scenario and business activity, which might entirely alter the market dynamics or future projections in the industry, we will create a Research Update upon your request at a nominal charge.

1. Executive Summary

1.1.Global Hydrogen Tube Trailer Market Snapshot

1.2.Future Projections

1.3.Key Market Trends

1.4.Analyst Recommendations

2. Market Overview

2.1.Market Definitions and Segmentations

2.2.Market Dynamics

2.2.1.Drivers

2.2.2.Restraints

2.2.3.Market Opportunities

2.3.Value Chain Analysis

2.4.Porter’s Five Forces Analysis

2.5.Covid-19 Impact

2.5.1.Supply Chain

2.5.2.Raw Materials Impact Analysis

3. Price Trends Analysis and Future Projects, 2018 - 2026

3.1.Key Highlights

3.2.by Type/Application

3.3.By Region

4. Global Hydrogen Tube Trailer Market Outlook, 2018 - 2026

4.1.Global Hydrogen Tube Trailer Market Outlook, by Type, Volume (Units) and Value (US$ Mn), 2018 - 2026

4.1.1.Key Highlights

4.1.1.1.Modular Tube Trailer

4.1.1.2.Intermediate Tube Trailer

4.1.1.3. Jumbo Tube Trailer

4.1.2.BPS Analysis/Market Attractiveness Analysis, by Type

4.2.Global Hydrogen Tube Trailer Market Outlook, by Application, Volume (Units) and Value (US$ Mn), 2018 - 2026

4.2.1.Key Highlights

4.2.1.1.Hydrogen Fuel Station

4.2.1.2.Industrial

4.2.2.BPS Analysis/Market Attractiveness Analysis, by Application

4.3.Global Hydrogen Tube Trailer Market Outlook, by Region, Volume (Units) and Value (US$ Mn), 2018 - 2026

4.3.1.Key Highlights

4.3.1.1.North America

4.3.1.2.Europe

4.3.1.3.Asia Pacific

4.3.1.4.Middle East & Africa

4.3.2.BPS Analysis/Market Attractiveness Analysis, by Region

5. North America Hydrogen Tube Trailer Market Outlook, 2018 - 2026

5.1.North America Hydrogen Tube Trailer Market Outlook, by Type, Volume (Units) and Value (US$ Mn), 2018 - 2026

5.1.1.Key Highlights

5.1.1.1.Modular Tube Trailer

5.1.1.2.Intermediate Tube Trailer

5.1.1.3. Jumbo Tube Trailer

5.2.North America Hydrogen Tube Trailer Market Outlook, by Application, Volume (Units) and Value (US$ Mn), 2018 - 2026

5.2.1.Key Highlights

5.2.1.1.Hydrogen Fuel Station

5.2.1.2.Industrial

5.3.North America Hydrogen Tube Trailer Market Outlook, by Country, Volume (Units) and Value (US$ Mn), 2018 - 2026

5.3.1.Key Highlights

5.3.1.1.U.S. Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

5.3.1.2.Canada Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

6. Europe Hydrogen Tube Trailer Market Outlook, 2018 - 2026

6.1.Europe Hydrogen Tube Trailer Market Outlook, by Type, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.1.1.Key Highlights

6.1.1.1.Modular Tube Trailer

6.1.1.2.Intermediate Tube Trailer

6.1.1.3. Jumbo Tube Trailer

6.2.Europe Hydrogen Tube Trailer Market Outlook, by Application, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.2.1.Key Highlights

6.2.1.1.Hydrogen Fuel Station

6.2.1.2.Industrial

6.3.Europe Hydrogen Tube Trailer Market Outlook, by Country, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.3.1.Key Highlights

6.3.1.1.Germany Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.3.1.2.U.K. Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.3.1.3. France Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.3.1.4.Italy Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.3.1.5.Spain Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.3.1.6.Russia Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

6.3.1.7.Rest of Europe Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

7. Asia Pacific Hydrogen Tube Trailer Market Outlook, 2018 - 2026

7.1.Asia Pacific Hydrogen Tube Trailer Market Outlook, by Type, Volume (Units) and Value (US$ Mn), 2018 - 2026

7.1.1.Key Highlights

7.1.1.1.Modular Tube Trailer

7.1.1.2.Intermediate Tube Trailer

7.1.1.3. Jumbo Tube Trailer

7.1.2.BPS Analysis/Market Attractiveness Analysis

7.2.Asia Pacific Hydrogen Tube Trailer Market Outlook, by Application, Volume (Units) and Value (US$ Mn), 2018 - 2026

7.2.1.Key Highlights

7.2.1.1.Hydrogen Fuel Station

7.2.1.2.Industrial

7.3.Asia Pacific Hydrogen Tube Trailer Market Outlook, by Country, Volume (Units) and Value (US$ Mn), 2018 - 2026

7.3.1.Key Highlights

7.3.1.1.China Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

7.3.1.2.Japan Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

7.3.1.3.South Korea Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

7.3.1.4.Australia Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026South Korea

7.3.1.5.India Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

7.3.1.6.ASEAN Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

7.3.1.7.Rest of Asia Pacific Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

8. Middle East & Africa Hydrogen Tube Trailer Market Outlook, 2018 - 2026

8.1.Middle East & Africa Hydrogen Tube Trailer Market Outlook, by Type, Volume (Units) and Value (US$ Mn), 2018 - 2026

8.1.1.Key Highlights

8.1.1.1.Modular Tube Trailer

8.1.1.2.Intermediate Tube Trailer

8.1.1.3. Jumbo Tube Trailer

8.2.Middle East & Africa Hydrogen Tube Trailer Market Outlook, by Application, Volume (Units) and Value (US$ Mn), 2018 - 2026

8.2.1.Key Highlights

8.2.1.1.Hydrogen Fuel Station

8.2.1.2.Industrial

8.3.Middle East & Africa Hydrogen Tube Trailer Market Outlook, by Country, Volume (Units) and Value (US$ Mn), 2018 - 2026

8.3.1.Key Highlights

8.3.1.1.Saudi Arabia Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

8.3.1.2.UAE Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

8.3.1.3. Rest of Middle East & Africa Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

9. Latin America Hydrogen Tube Trailer Market Outlook, 2018 - 2026

9.1.Latin America Hydrogen Tube Trailer Market Outlook, by Type, Volume (Units) and Value (US$ Mn), 2018 - 2026

9.1.1.Key Highlights

9.1.1.1.Modular Tube Trailer

9.1.1.2.Intermediate Tube Trailer

9.1.1.3. Jumbo Tube Trailer

9.2.Latin America Hydrogen Tube Trailer Market Outlook, by Application, Volume (Units) and Value (US$ Mn), 2018 - 2026

9.2.1.Key Highlights

9.2.1.1.Hydrogen Fuel Station

9.2.1.2.Industrial

9.3.Latin America Hydrogen Tube Trailer Market Outlook, by Country, Volume (Units) and Value (US$ Mn), 2018 - 2026

9.3.1.Key Highlights

9.3.1.1.Brazil Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

9.3.1.2.Mexico Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

9.3.1.3.Rest of Latin America Hydrogen Tube Trailer Market, Volume (Units) and Value (US$ Mn), 2018 - 2026

10. Competitive Landscape

10.1.Company Market Share Analysis, 2020

10.2.Strategic Collaborations

10.3.Company Profiles

10.3.1.Linde AG

10.3.1.1.Company Overview

10.3.1.2.Product Portfolio

10.3.1.3.Financial Overview

10.3.1.4.Business Strategies and Development

10.3.2.Air Liquide

10.3.2.1.Company Overview

10.3.2.2.Product Portfolio

10.3.2.3.Financial Overview

10.3.2.4.Business Strategies and Development

10.3.3.Air Products and Chemicals, Inc

10.3.3.1.Company Overview

10.3.3.2.Product Portfolio

10.3.3.3.Financial Overview

10.3.3.4.Business Strategies and Development

10.3.4.Calvera

10.3.4.1.Company Overview

10.3.4.2.Product Portfolio

10.3.4.3.Financial Overview

10.3.4.4.Business Strategies and Development

10.3.5.Hexagon Composites ASA

10.3.5.1.Company Overview

10.3.5.2.Product Portfolio

10.3.5.3.Financial Overview

10.3.5.4.Business Strategies and Development

10.3.6.Zhejiang Rein Gas Equipment Co., Ltd.

10.3.6.1.Company Overview

10.3.6.2.Product Portfolio

10.3.6.3.Financial Overview

10.3.6.4.Business Strategies and Development

10.3.7.FIBA Technologies, Inc

10.3.7.1.Company Overview

10.3.7.2.Product Portfolio

10.3.7.3.Financial Overview

10.3.7.4.Business Strategies and Development

10.3.8.Matar Srl.

10.3.8.1.Company Overview

10.3.8.2.Product Portfolio

10.3.8.3.Financial Overview

10.3.8.4.Business Strategies and Development

10.3.9.Weldship Corporation

10.3.9.1.Company Overview

10.3.9.2.Product Portfolio

10.3.9.3.Financial Overview

10.3.9.3.Business Strategies and Development

10.3.10.Composite Advanced Technologies, LLC.

10.3.10.1.Company Overview

10.3.10.2.Product Portfolio

10.3.10.3.Financial Overview

10.3.10.4.Business Strategies and Development

10.3.11.Roberts Oxygen Company, Inc

10.3.11.1.Company Overview

10.3.11.2.Product Portfolio

10.3.11.3.Financial Overview

10.3.11.4.Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2020 |

|

2018 - 2019 |

2021 - 2026 |

Value: US$ Million Volume Units: |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Type |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, PEST Analysis, Historical Trend (2018-2019), Price Trend Analysis- 2018-2026, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |