Global Impact Investing Market Forecast

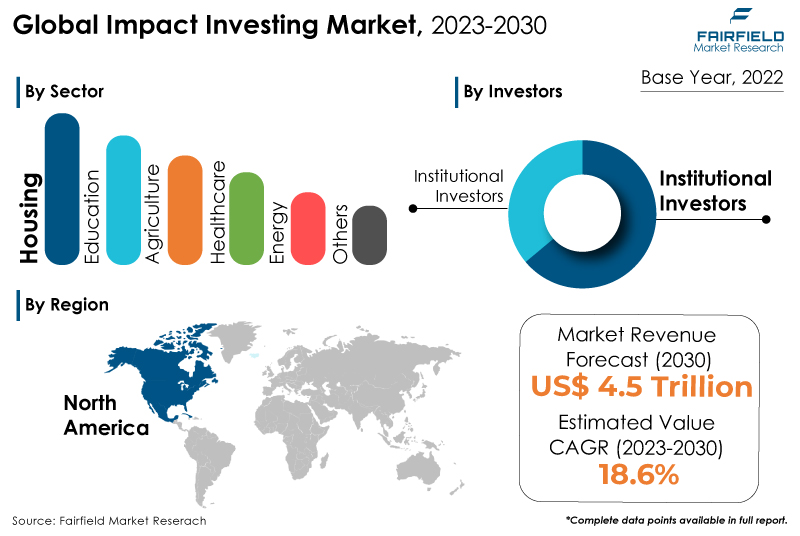

- Global impact investing market size to hit the US$4.5 trillion mark by the end of 2030

- Impact investing market revenue to witness significant growth at 18.6% CAGR during 2023 - 2030

Market Analysis in Brief

Impact investments are a type of investments made to generate positive and measurable environmental impact while also delivering financial returns. These investments can be made in various emerging and developed markets and offer returns. Typically, impact investors support businesses or non-profit organisations that work towards addressing social or environmental issues, such as carbon emission reduction, improved access to healthcare and education, sustainable agriculture, or aiding disadvantaged communities. The success of impact investments is measured not only by the financial returns but also by the positive social or environmental outcomes they contribute to.

The increasing demand from investors seeking financial returns and social or environmental impact has been a major driver for the growth of the impact investing market. Investing in renewable energy, for example, can help combat climate change by reducing greenhouse gas emissions while investing in affordable housing can address homelessness issues. Moreover, the rising awareness of the need to address social and environmental challenges, government support, and policies promoting impact investing has further boosted the market. However, achieving both financial returns and social or environmental impact presents challenges, as it requires balancing profitability with the desire for positive social or environmental outcomes. Additionally, a limited understanding of impact investing among investors and the general public hinders market growth.

Key Report Findings

- The market for impact investing will demonstrate substantial expansion in revenue over 2023 - 2030.

- Government support and policies have driven the demand for impact investing.

- Institutional investors captured the largest market share in the impact investing market due to their substantial capital, risk management expertise, and growing interest in aligning investments with positive social and environmental outcomes.

- The housing sector captured the largest market share in the impact investing market due to its critical social impact potential in providing safe and affordable housing while offering attractive financial returns.

- North America will continue to lead its way, whereas Asia Pacific's impact investing market will experience the strongest growth till 2030.

Growth Drivers

Investors Seeking Financial Returns, and Environmental Impact

In recent years, there has been a remarkable surge in demand from investors seeking financial returns and a positive environmental impact. This trend has been a driving force behind the increasing popularity of impact investing. As the global awareness of environmental challenges intensifies, more investors recognise the need to address pressing issues like climate change, resource depletion, and social inequality. They see impact investing as a powerful way to make a difference while achieving competitive financial returns.

The growing desire for environmental impact is also fueled by the preferences of younger generations, such as millennials, and Generation Z. These socially and environmentally conscious investors actively seek investment opportunities that align with their values. As they become a more significant portion of the investor base, their influence on financial markets reshapes the investment landscape.

Additionally, governments and policymakers worldwide recognise the importance of sustainable practices and create incentives to support impact investments. These supportive policies make impact investing even more appealing to investors looking to contribute to positive change.

The growing availability of impact-focused financial products and services has also bolstered the success of impact investing. Financial institutions respond to the increased demand by offering various impact investment options, including green bonds, social impact funds, and sustainable ETFs. These products provide investors with accessible and diverse avenues to invest in projects and companies making a tangible difference in various environmental and social areas.

As the impact investing sector continues to expand and innovate, more opportunities are being created for investors to align their financial goals with their values and contribute to a more sustainable and equitable future.

Supportive Governments, and Favourable Policy Frameworks

Government support and policies have driven the demand for impact investing. As governments worldwide recognise the urgent need to address environmental and social challenges, they have taken proactive steps to promote sustainable investments and incentivise businesses and individuals to embrace impact investing.

Governments have supported impact investing by offering tax incentives and regulatory frameworks that favour sustainable projects and businesses. These incentives can include tax breaks, grants, or subsidies for companies focusing on environmental and social initiatives. By creating a favourable environment for impact investing, governments encourage more investors to direct their capital toward projects with a positive impact.

Additionally, some governments have implemented mandatory reporting requirements for environmental, social, and governance (ESG) factors. This ensures that companies disclose their sustainability efforts and environmental and societal impacts. Such transparency helps investors make informed decisions, as they can assess potential investments' social and environmental performance.

Furthermore, governments have actively engaged in public-private partnerships to support impact investing initiatives. Governments can mobilise more significant resources toward sustainable projects by collaborating with private investors and impact-focused organisations, leading to increased demand for impact investments.

Overall, government support and policies are instrumental in creating an ecosystem that drives the growth of impact investing. By providing incentives, promoting transparency, and engaging in partnerships, governments catalyse the demand for impact investments and facilitate the transition toward a more sustainable and socially responsible financial system. As governments prioritise sustainability, impact investing will likely gain momentum as a viable and attractive investment strategy.

Growth Challenges

Practical Difficulties in Achieving Both Financial Returns, and Socio-environmental Impact

Achieving financial returns and meaningful social or environmental impact presents unique challenges in the impact investing market. One of the key challenges is the potential trade-off between financial returns and impact objectives. Impact investments often target projects in sectors with social or environmental missions, which may face higher risks or longer gestation periods. As a result, investors may need help meeting their desired financial return expectations.

Another challenge lies in the measurement and evaluation of impact. Unlike traditional financial metrics, measuring and quantifying social and environmental outcomes can be complex and context-specific. Standardised methodologies for assessing impact across diverse projects and sectors still need to be improved. This ambiguity can create difficulties in comparing and benchmarking different impact investments, leading to uncertainties for investors seeking to understand the real-world effectiveness of their investments. Without reliable impact data, it becomes challenging for investors to make data-driven decisions and build a robust impact investing portfolio.

Overcoming these challenges requires continuous efforts from various stakeholders in the impact investing ecosystem. Improved impact measurement practices, transparency, and data sharing are crucial for building investor confidence and promoting the integration of social and environmental considerations into investment strategies. Collaboration among investors, impact enterprises, policymakers, and researchers can drive innovation and foster a more effective impact investing market that delivers both financial returns and positive societal and environmental outcomes.

Overview of Key Segments

Housing Sector Witnesses the Highest Inflow

For several reasons, the housing sector held a significant share in the impact investing market. Firstly, access to safe and affordable housing is a fundamental need for individuals and families, making it a critical social issue. Impact investors recognise the potential for positive social impact in this sector, particularly in regions where housing affordability is challenging. By investing in affordable housing projects, impact investors aim to improve living conditions, reduce homelessness, and promote social stability.

Secondly, the housing sector offers attractive financial returns for impact investors. Real estate, including affordable housing developments, can provide steady income streams and potential capital appreciation over time. As impact investing gains traction and investors seek to align their financial aspirations with their values, the housing sector emerges as an appealing option that delivers both financial returns and positive social impact. Moreover, many impact investors see housing projects as a sustainable investment option with long-term benefits, given the continuous demand for housing in growing urban areas.

Furthermore, various governments and organisations have introduced policies and initiatives to support affordable housing and encourage impact investing in this sector. Tax incentives, grants, and public-private partnerships promote investment in affordable housing, making it an attractive proposition for impact investors looking to address social challenges while achieving financial objectives. The combination of significant social impact potential, financial returns, and government support has contributed to the housing sector's prominence in the impact investing market.

Institutional Investors at the Forefront

For several reasons, institutional investors held the largest market share in the impact investing market. Institutional investors, such as endowments,pension funds, and insurance companies, typically manage significant amounts of capital. As impact investing gained traction and demonstrated its potential for delivering both financial returns and positive social or environmental outcomes, these large investors sought to diversify their portfolios and incorporate impact investments to align with their stakeholders' values and preferences. Their substantial resources and long-term investment horizon allow them to make meaningful contributions to impact investing projects and funds.

Secondly, institutional investors can conduct rigorous due diligence and risk assessments, critical in impact investing. Many impact investments involve innovative and socially-focused projects that may carry higher risks than traditional investments. Institutional investors' expertise in risk management and financial analysis enables them to assess these opportunities thoroughly and make informed investment decisions. This capability reassures other investors and helps attract more capital into the impact investing space.

Lastly, regulatory requirements and fiduciary responsibilities increasingly push institutional investors towards impact investing. In some regions, regulatory mandates require institutional investors to consider environmental, social, and governance (ESG) parameters in their investment decisions. Additionally, as fiduciaries, institutional investors are bound to act in the best interest of their beneficiaries, and this now includes considering long-term risks and opportunities associated with environmental and social issues. Impact investing aligns well with these obligations, as it addresses sustainability concerns and reflects growing public sentiment towards socially responsible investing.

Overall, substantial capital, expertise in risk assessment, and regulatory and fiduciary responsibilities have led institutional investors to hold the largest market share in impact investing. As the impact investing space continues to evolve and expand, institutional investors are expected to play a vital role in driving further growth and making a meaningful positive impact on society and the environment.

Growth Opportunities Across Regions

North America Jumps in the Bandwagon

North America held the largest market share in the impact investing market in 2022. Firstly, the region has a robust and mature financial ecosystem in place, with well-established financial institutions, asset managers, and investment advisors. This strong financial infrastructure makes it easier for impact investment products and services to gain traction and reach a wider audience of investors.

Additionally, the region's history of socially responsible investing and corporate social responsibility initiatives has fostered a receptive environment for impact investing. Secondly, North America is home to many high-net-worth individuals and institutional investors increasingly interested in aligning their investments with their values and making a positive impact. This demand from investors has incentivised financial institutions and asset managers to develop a wide range of impact investment products to cater to this market segment.

Moreover, North American governments and policymakers have supported impact investing initiatives. They have introduced policies and regulations encouraging sustainable investing practices and offering tax incentives for impact investments. This support from the government creates a favourable environment for impact investing to flourish and attract more capital from institutional and retail investors.

Asia Pacific to Turn Lucrative

The Asia Pacific region was experiencing rapid growth in the impact investing market, with the fastest CAGR. Several factors contribute to this growth trajectory. Firstly, the region's significant population and emerging middle class present vast opportunities for impact investing. With rising awareness of environmental and social issues, there is increasing demand for sustainable and socially responsible investments among regional retail investors.

Secondly, many countries in the Asia Pacific region are witnessing robust economic growth and technological advancements. This economic expansion has increased social and environmental challenges, creating a pressing need for impact investments that address these issues. As a result, entrepreneurs and businesses are increasingly turning towards impact-driven solutions, attracting investments from both local and international investors.

Furthermore, governments in the Asia Pacific region have been actively supporting impact investing through policy initiatives and regulatory frameworks. They recognise the potential of impact investing to drive sustainable development and address societal challenges.

Governments have implemented measures to promote responsible investing and have created platforms to facilitate impact investing activities. These supportive policies and initiatives have contributed significantly to the region's rapid growth in the impact investing market, making it an attractive destination for impact-focused capital.

Impact Investing Market: Competitive Landscape

Some of the leading players at the forefront in the impact investing market space include Goldman Sachs, Morgan Stanley, Vital Capital, Bain Capital, Manulife Investment Management., Omidyar Network, Bridges fund management ltd., Reinvestment fund, Blueorchard finance Ltd, and Leapfrog Investments.

Recent Notable Developments

In May 2020, Alternative Investment Partners Private Markets (AIP Private Markets), a division of Morgan Stanley Investment Management, recently revealed the expansion of its impact investing platform, augmenting it with a new fund that emphasizes climate solutions. With a total value of US$110 million, this fund is dedicated to tackling pressing climate concerns such as global warming, pollution, resource depletion, and ecological diversity. The move aligns with the company's commitment to driving positive environmental impact while aligning with its broader financial objectives.

Global Impact Investing Market is Segmented as Below:

By Sector

- Education

- Agriculture

- Healthcare

- Energy

- Housing

- Others

By Investors

- Individual Investors

- Institutional Investors

- Others

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Impact Investing Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Impact Investing Market Outlook, 2018 - 2030

3.1. Global Impact Investing Market Outlook, by Sector, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Education

3.1.1.2. Agriculture

3.1.1.3. Healthcare

3.1.1.4. Energy

3.1.1.5. Housing

3.1.1.6. Others

3.2. Global Impact Investing Market Outlook, by Investor, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Individual Investors

3.2.1.2. Institutional Investors

3.2.1.3. Others

3.3. Global Impact Investing Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Impact Investing Market Outlook, 2018 - 2030

4.1. North America Impact Investing Market Outlook, by Sector, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Education

4.1.1.2. Agriculture

4.1.1.3. Healthcare

4.1.1.4. Energy

4.1.1.5. Housing

4.1.1.6. Others

4.2. North America Impact Investing Market Outlook, by Investor, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Individual Investors

4.2.1.2. Institutional Investors

4.2.1.3. Others

4.2.2. Market Attractiveness Analysis

4.3. North America Impact Investing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Impact Investing Market Outlook, 2018 - 2030

5.1. Europe Impact Investing Market Outlook, by Sector, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Education

5.1.1.2. Agriculture

5.1.1.3. Healthcare

5.1.1.4. Energy

5.1.1.5. Housing

5.1.1.6. Others

5.2. Europe Impact Investing Market Outlook, by Investor, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Individual Investors

5.2.1.2. Institutional Investors

5.2.1.3. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Impact Investing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Impact Investing Market By Sector, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Impact Investing Market By Investor, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Impact Investing Market By Sector, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Impact Investing Market By Investor, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Impact Investing Market By Sector, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Impact Investing Market By Investor, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Impact Investing Market By Sector, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Impact Investing Market By Investor, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest Of Europe Impact Investing Market By Sector, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest Of Europe Impact Investing Market By Investor, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Impact Investing Market Outlook, 2018 - 2030

6.1. Asia Pacific Impact Investing Market Outlook, by Sector, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Education

6.1.1.2. Agriculture

6.1.1.3. Healthcare

6.1.1.4. Energy

6.1.1.5. Housing

6.1.1.6. Others

6.2. Asia Pacific Impact Investing Market Outlook, by Investor, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Individual Investors

6.2.1.2. Institutional Investors

6.2.1.3. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Impact Investing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Impact Investing Market Outlook, 2018 - 2030

7.1. Latin America Impact Investing Market Outlook, by Sector, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Education

7.1.1.2. Agriculture

7.1.1.3. Healthcare

7.1.1.4. Energy

7.1.1.5. Housing

7.1.1.6. Others

7.2. Latin America Impact Investing Market Outlook, by Investor, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Individual Investors

7.2.1.2. Institutional Investors

7.2.1.3. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Impact Investing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Impact Investing Market Outlook, 2018 - 2030

8.1. Middle East & Africa Impact Investing Market Outlook, by Sector, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Education

8.1.1.2. Agriculture

8.1.1.3. Healthcare

8.1.1.4. Energy

8.1.1.5. Housing

8.1.1.6. Others

8.2. Middle East & Africa Impact Investing Market Outlook, by Investor, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Individual Investors

8.2.1.2. Institutional Investors

8.2.1.3. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Impact Investing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Impact Investing Market by Sector, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Impact Investing Market by Investor, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Sector vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Goldman Sachs

9.5.1.1. Company Overview

9.5.1.2. Sector Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Morgan Stanley

9.5.2.1. Company Overview

9.5.2.2. Sector Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Vital Capital

9.5.3.1. Company Overview

9.5.3.2. Sector Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Bain Capital

9.5.4.1. Company Overview

9.5.4.2. Sector Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Manulife Investment Management

9.5.5.1. Company Overview

9.5.5.2. Sector Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Omidyar Network

9.5.6.1. Company Overview

9.5.6.2. Sector Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Bridges Fund Management Ltd.

9.5.7.1. Company Overview

9.5.7.2. Sector Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Reinvestment Fund

9.5.8.1. Company Overview

9.5.8.2. Sector Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Blueorchard Finance Ltd.

9.5.9.1. Company Overview

9.5.9.2. Sector Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Leapfrog Investments

9.5.10.1. Company Overview

9.5.10.2. Sector Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Sector Coverage |

|

|

Investor Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |