Global Industrial Explosives Market Forecast

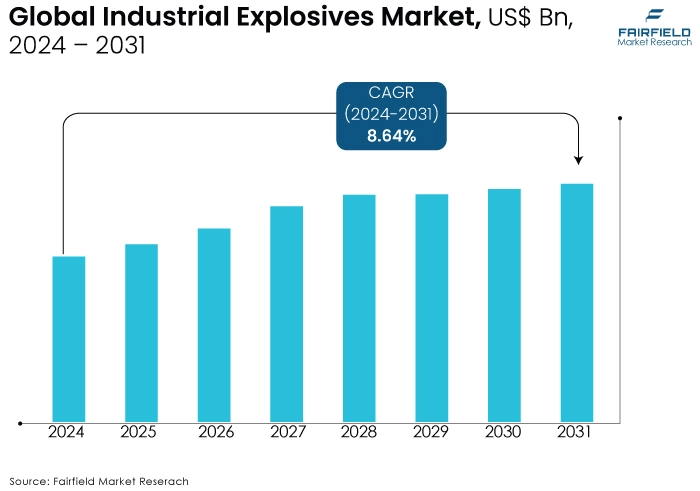

- The Industrial Explosives Market is valued at USD 13.4 Bn in 2026 and is projected to reach USD 21.2 Bn, growing at a CAGR of 7% by 2033.

Quick Report Digest

- Steady growth experienced from 2019-2023, driven by mining sector demand, expected to continue with a CAGR of 5.3%.

- Some of the factors driving historical growth include improved extraction methods, rising disposable incomes, and increased construction projects.

- Future growth of the market for industrial explosives to be fuelled by mining industry expansion, technological advancements, but hindered by regulatory and safety concerns.

- Key growth determinants include mining industry expansion, infrastructure development, and technological advancements.

- Major growth barriers include regulatory hurdles, raw material price volatility, and safety concerns.

- Trends include increasing demand for mining activities, focus on safety and efficiency, and expansion in construction and infrastructure development.

- Regulatory scenario shapes the industry through strict safety regulations and environmental standards.

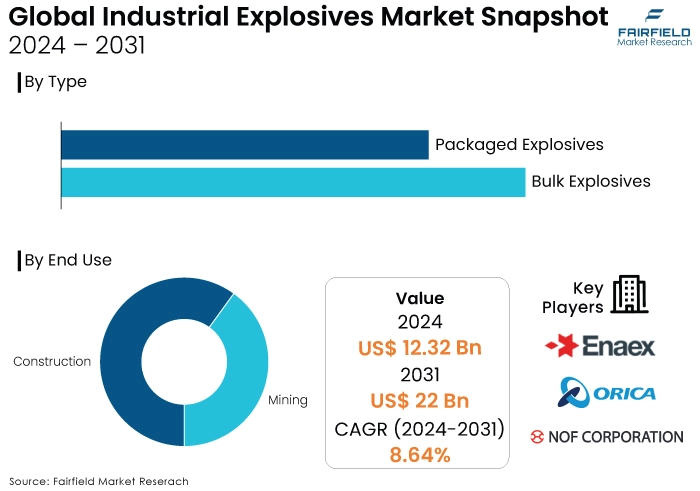

- Top segments include bulk explosives and packaged explosives, catering to mining, construction, defence, and commercial sectors.

- Asia Pacific drives explosives demand, North America shows dynamism in mining and construction, whereas Europe balances safety and innovation.

A Look Back and a Look Forward - Comparative Analysis

The industrial explosives market experienced steady growth between 2019 and 2023, driven primarily by the mining sector's increasing demand for explosives for efficient resource extraction. This growth is expected to continue over the forecast period of 2024-2031, with a projected CAGR of around 5.3%. Several factors contributed to the historical growth. Governments and mining companies are focusing on improved extraction methods, and rising disposable incomes are leading to more construction projects, both of which require controlled explosions. This trend is expected to hold strong in the coming years.

The expansion of the mining industry, particularly in developing economies, will likely be a key driver. Additionally, advancements in explosive technology, offering improved safety and efficiency, could further fuel market growth. However, stringent regulations regarding environmental impact and safety protocols might pose challenges. The increasing adoption of alternative excavation methods in certain sectors could also act as a restraining factor.

Overall, the industrial explosives market is poised for continued growth, fuelled by the mining industry's expansion and a rise in construction activities. Technological advancements and a focus on efficient resource extraction will likely create a positive outlook, although navigating environmental and safety regulations will be crucial for market participants.

Key Growth Determinants

- Mining Industry’s Stable Expansion

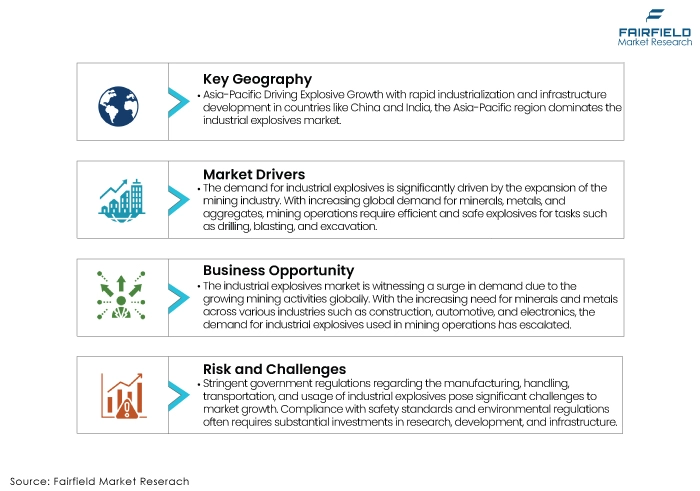

The demand for industrial explosives is significantly driven by the expansion of the mining industry. With increasing global demand for minerals, metals, and aggregates, mining operations require efficient and safe explosives for tasks such as drilling, blasting, and excavation.

- Infrastructural Developments

Industrial explosives play a crucial role in infrastructure development projects such as construction of roads, bridges, tunnels, and dams. As countries invest in upgrading their infrastructure to support economic growth, the demand for explosives for activities like rock excavation and demolition rises.

- Technological Advancements

Continuous innovation in explosive technologies, including development of safer and more efficient products, drives market growth. Advancements such as electronic detonators, bulk explosives, and eco-friendly formulations improve operational efficiency while minimising environmental impact and safety risks.

Major Growth Barriers

- Regulatory Complexities

Stringent government regulations regarding the manufacturing, handling, transportation, and usage of industrial explosives pose significant challenges to market growth. Compliance with safety standards and environmental regulations often requires substantial investments in research, development, and infrastructure.

- Volatility in Raw Material Prices

The industrial explosives market is sensitive to fluctuations in the prices of key raw materials such as ammonium nitrate, nitric acid, and sulphur. Price volatility can affect profit margins and hinder investment in new technologies or expansion initiatives.

- Safety Concerns, and Risk Perceptions

Despite advancements in safety protocols and technologies, the perception of risk associated with industrial explosives remains a significant restraint. Accidents, even rare ones, can have severe consequences for both human lives and the environment, leading to heightened scrutiny from regulators and the public, which may dampen market growth prospects.

Key Trends and Opportunities to Look at -

- Increasing Demand for Mining Activities

The industrial explosives market is witnessing a surge in demand due to the growing mining activities globally. With the increasing need for minerals and metals across various industries such as construction, automotive, and electronics, the demand for industrial explosives used in mining operations has escalated.

- Focus on Safety and Efficiency

Another significant trend in the industrial explosives market is the emphasis on safety and efficiency in blasting operations. Manufacturers are increasingly investing in research and development to develop safer and more efficient explosive products. This includes the development of innovative explosives with enhanced performance characteristics, such as reduced sensitivity to external factors and improved control over fragmentation.

- Growth of Construction Industry, and Pacing Infrastructure Development

One of the biggest opportunities for players in the industrial explosives market lies in the expansion of construction and infrastructure development activities worldwide. Rapid urbanisation, population growth, and increasing investments in infrastructure projects, particularly in developing regions, are driving the demand for construction materials, including aggregates obtained through mining operations.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly impacts the industrial explosives market. Every step, from production and storage to transportation and use, is governed by strict safety regulations set by various organisations. These regulations prioritise the safety of workers, communities, and the environment.

For companies in this industry, complying with these regulations is crucial. The processes can be lengthy and require obtaining licenses and permits. This can act as a barrier to entry, limiting competition and potentially influencing market dynamics. Strict licensing might deter some businesses, giving an edge to established players who've navigated the system.

Environmental regulations also play a part. Explosives handling and disposal are subject to standards that govern emissions, waste disposal, and environmental impact assessments. Companies must adhere to these to avoid hefty fines and legal repercussions.

While regulations might seem like an obstacle, they also create a safer and more controlled market. They ensure responsible practices throughout the explosives lifecycle, minimising risks and fostering trust with the public and authorities.

Fairfield’s Ranking Board

Top Segments

Bulk Explosives Retain the Leading Market Share

Bulk explosives represent a pivotal segment within the industrial explosives market, primarily utilised in large-scale mining operations and construction projects. These explosives are manufactured and transported in bulk quantities, offering cost-efficiency and convenience for high-volume applications.

One key factor driving the growth of bulk explosives is their effectiveness in large-scale excavation and blasting activities in mining, where they facilitate efficient fragmentation of rock formations and ore extraction. Moreover, the rising demand for minerals and metals worldwide amplifies the need for bulk explosives in mining operations, contributing to the segment's sustained growth.

Packaged Explosives Surge Ahead in Preference

Packaged explosives represent another significant segment in the industrial explosives market, catering to diverse applications across mining, construction, defence, and commercial sectors. Packaged explosives are pre-packaged in convenient forms such as cartridges, bags, or boxes, offering ease of handling, storage, and transportation for various blasting operations.

The segment benefits from the versatility and flexibility of packaged explosives, which can be tailored to specific blasting requirements based on factors like rock type, fragmentation needs, and environmental considerations. In the mining industry, packaged explosives find widespread usage in small to medium-scale operations, including quarrying, tunnelling, and surface mining, where precise and controlled blasting is essential.

Regional Frontrunners

- Asia Pacific in Charge, China to be the Largest Consumer Country

With rapid industrialisation and infrastructure development in countries like China and India, the Asia Pacific region dominates the industrial explosives market. The construction and mining sectors drive demand, with China being the largest consumer globally. Additionally, emerging economies like Indonesia and Vietnam are witnessing significant growth in infrastructure projects, further boosting demand for industrial explosives.

- North America Grows Stronger with Dynamism in Mining and Construction

The US, and Canada are major players in the industrial explosives market due to extensive mining activities, particularly in sectors like coal, metal, and quarrying. Technological advancements, and strict safety regulations characterise this market, with a focus on minimising environmental impact.

- Europe Balances Safety and Innovation

Europe's industrial explosives market is driven by sectors such as construction, mining, and defence. Countries like Germany, and Russia are key contributors due to their substantial mining operations and military requirements. Stringent regulations regarding safety and environmental concerns influence market dynamics, leading to a focus on sustainable practices and innovation.

Fairfield’s Competitive Landscape Analysis

The competition landscape in the Industrial Explosives market is characterised by intense rivalry among key players striving for market dominance. Leading companies such as Orica Ltd., Dyno Nobel, Incitec Pivot Limited, and Austin Powder Company command significant market share. These industry giants employ various growth strategies to maintain their competitive edge.

Expansion through mergers and acquisitions, strategic partnerships, and technological innovation are common tactics. Additionally, focusing on product development to enhance efficiency, safety, and environmental sustainability remains paramount.

Furthermore, geographical diversification and penetrating emerging markets are key strategies to capitalise on untapped opportunities. Overall, the market's dynamism necessitates continuous adaptation and innovation from industry players to navigate challenges and sustain growth in this competitive landscape.

Who are the Leaders in the Industrial Explosives Market Space?

- Orica Limited

- NOF Corporation

- Enaex S.A.

- African Mining Explosives

- Dyno Nobel

- Exsa S.A.

- Maxam corp Holdings

- Austin Powder Company

- Irish Industrial Explosives Ltd

- Ideal Industrial Explosives Limited

- Sichuan Yahua Industrial Group Co., Ltd

- BME Mining

- Solar Industries

- LSB INDUSTRIES

- Eurenco S.A.

Significant Company Developments

- In January 2024, Normet's Charmec Revo®, a remote-controlled machine, is the first commercially available robotic system for explosives charging in underground mining. This innovation aims to improve safety for workers by keeping them away from hazardous areas during the process. Explosives charging is one of the most dangerous tasks in mining, and Normet's technology positions them as a leader in safe mining practices.

- Recently in May 2024, Dyno Nobel, an explosives supplier, extended their contract with BHP Mitsubishi Alliance (BMA) for five years. The deal covers supplying explosives and related services to four of BMA's mines in Queensland, Australia. They will also continue supplying a mine recently sold by BMA to Whitehaven Coal. This agreement strengthens Dyno Nobel's position in the Bowen Basin region.

An Expert’s Eye

Increasing Demand from Mining and Construction

The market is poised for growth due to rising demand from the mining and construction industries. Industrial explosives are crucial for activities like quarrying, tunnelling, and demolition, which are integral to these sectors.

- Technological Advancements

Continuous innovation in explosive technologies, such as emulsion explosives and electronic detonators, enhances safety, efficiency, and precision, thereby driving market growth.

- Geopolitical Factors

Political stability in key mining regions and government investments in infrastructure projects can significantly impact market growth. Any geopolitical tensions or disruptions may affect the supply chain and market dynamics.

The Global Industrial Explosives Market is Segmented as Below:

By Type:

- Bulk Explosives

- Packaged Explosives

By End Use:

- Mining

- Metal mining

- Coal Mining

- Quarry & Non-Metal Mining

- Construction

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- Executive Summary

- Global Industrial Explosives Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Industrial Explosives Market Outlook, 2020 - 2033

- Global Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Bulk Explosives

- Packaged Explosives

- Global Industrial Explosives Market Outlook, by End Use, Value (US$ Bn), 2020-2033

- Mining

- Metal mining

- Coal Mining

- Quarry & Non-Metal Mining

- Construction

- Mining

- Global Industrial Explosives Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- North America Industrial Explosives Market Outlook, 2020 - 2033

- North America Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Bulk Explosives

- Packaged Explosives

- North America Industrial Explosives Market Outlook, by End Use, Value (US$ Bn), 2020-2033

- Mining

- Metal mining

- Coal Mining

- Quarry & Non-Metal Mining

- Construction

- Mining

- North America Industrial Explosives Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Industrial Explosives Market Outlook, by Type, 2020-2033

- S. Industrial Explosives Market Outlook, by End Use, 2020-2033

- Canada Industrial Explosives Market Outlook, by Type, 2020-2033

- Canada Industrial Explosives Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Europe Industrial Explosives Market Outlook, 2020 - 2033

- Europe Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Bulk Explosives

- Packaged Explosives

- Europe Industrial Explosives Market Outlook, by End Use, Value (US$ Bn), 2020-2033

- Mining

- Metal mining

- Coal Mining

- Quarry & Non-Metal Mining

- Construction

- Mining

- Europe Industrial Explosives Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Industrial Explosives Market Outlook, by Type, 2020-2033

- Germany Industrial Explosives Market Outlook, by End Use, 2020-2033

- Italy Industrial Explosives Market Outlook, by Type, 2020-2033

- Italy Industrial Explosives Market Outlook, by End Use, 2020-2033

- France Industrial Explosives Market Outlook, by Type, 2020-2033

- France Industrial Explosives Market Outlook, by End Use, 2020-2033

- K. Industrial Explosives Market Outlook, by Type, 2020-2033

- K. Industrial Explosives Market Outlook, by End Use, 2020-2033

- Spain Industrial Explosives Market Outlook, by Type, 2020-2033

- Spain Industrial Explosives Market Outlook, by End Use, 2020-2033

- Russia Industrial Explosives Market Outlook, by Type, 2020-2033

- Russia Industrial Explosives Market Outlook, by End Use, 2020-2033

- Rest of Europe Industrial Explosives Market Outlook, by Type, 2020-2033

- Rest of Europe Industrial Explosives Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Asia Pacific Industrial Explosives Market Outlook, 2020 - 2033

- Asia Pacific Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Bulk Explosives

- Packaged Explosives

- Asia Pacific Industrial Explosives Market Outlook, by End Use, Value (US$ Bn), 2020-2033

- Mining

- Metal mining

- Coal Mining

- Quarry & Non-Metal Mining

- Construction

- Mining

- Asia Pacific Industrial Explosives Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Industrial Explosives Market Outlook, by Type, 2020-2033

- China Industrial Explosives Market Outlook, by End Use, 2020-2033

- Japan Industrial Explosives Market Outlook, by Type, 2020-2033

- Japan Industrial Explosives Market Outlook, by End Use, 2020-2033

- South Korea Industrial Explosives Market Outlook, by Type, 2020-2033

- South Korea Industrial Explosives Market Outlook, by End Use, 2020-2033

- India Industrial Explosives Market Outlook, by Type, 2020-2033

- India Industrial Explosives Market Outlook, by End Use, 2020-2033

- Southeast Asia Industrial Explosives Market Outlook, by Type, 2020-2033

- Southeast Asia Industrial Explosives Market Outlook, by End Use, 2020-2033

- Rest of SAO Industrial Explosives Market Outlook, by Type, 2020-2033

- Rest of SAO Industrial Explosives Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Latin America Industrial Explosives Market Outlook, 2020 - 2033

- Latin America Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Bulk Explosives

- Packaged Explosives

- Latin America Industrial Explosives Market Outlook, by End Use, Value (US$ Bn), 2020-2033

- Mining

- Metal mining

- Coal Mining

- Quarry & Non-Metal Mining

- Construction

- Mining

- Latin America Industrial Explosives Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Industrial Explosives Market Outlook, by Type, 2020-2033

- Brazil Industrial Explosives Market Outlook, by End Use, 2020-2033

- Mexico Industrial Explosives Market Outlook, by Type, 2020-2033

- Mexico Industrial Explosives Market Outlook, by End Use, 2020-2033

- Argentina Industrial Explosives Market Outlook, by Type, 2020-2033

- Argentina Industrial Explosives Market Outlook, by End Use, 2020-2033

- Rest of LATAM Industrial Explosives Market Outlook, by Type, 2020-2033

- Rest of LATAM Industrial Explosives Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Middle East & Africa Industrial Explosives Market Outlook, 2020 - 2033

- Middle East & Africa Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Bulk Explosives

- Packaged Explosives

- Middle East & Africa Industrial Explosives Market Outlook, by End Use, Value (US$ Bn), 2020-2033

- Mining

- Metal mining

- Coal Mining

- Quarry & Non-Metal Mining

- Construction

- Mining

- Middle East & Africa Industrial Explosives Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Industrial Explosives Market Outlook, by Type, 2020-2033

- GCC Industrial Explosives Market Outlook, by End Use, 2020-2033

- South Africa Industrial Explosives Market Outlook, by Type, 2020-2033

- South Africa Industrial Explosives Market Outlook, by End Use, 2020-2033

- Egypt Industrial Explosives Market Outlook, by Type, 2020-2033

- Egypt Industrial Explosives Market Outlook, by End Use, 2020-2033

- Nigeria Industrial Explosives Market Outlook, by Type, 2020-2033

- Nigeria Industrial Explosives Market Outlook, by End Use, 2020-2033

- Rest of Middle East Industrial Explosives Market Outlook, by Type, 2020-2033

- Rest of Middle East Industrial Explosives Market Outlook, by End Use, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Industrial Explosives Market Outlook, by Type, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Orica Limited

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- NOF Corporation

- Enaex S.A.

- African Mining Explosives

- Dyno Nobel

- Exsa S.A.

- Maxam corp Holdings

- Austin Powder Company

- Irish Industrial Explosives Ltd

- Ideal Industrial Explosives Limited

- Orica Limited

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |