Market Growth Forecast

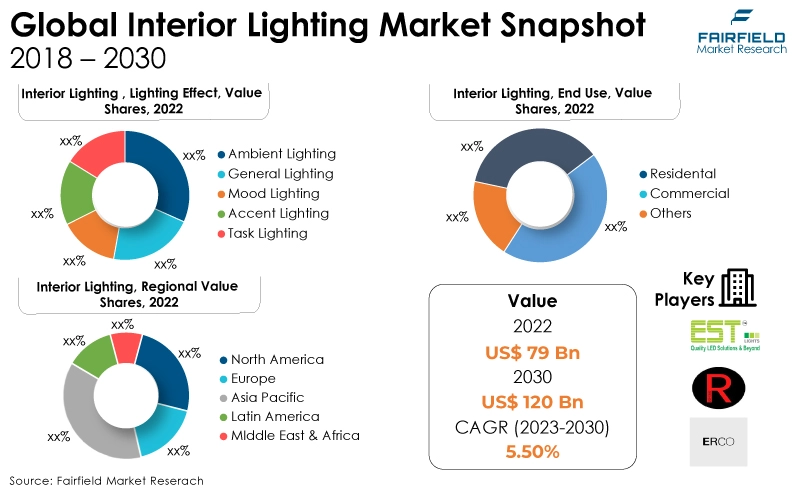

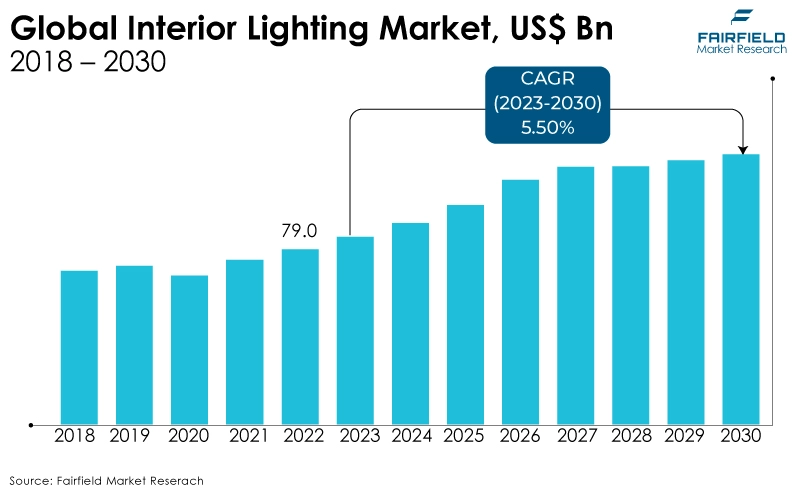

- Global market for interior lighting that was worth US$79 Bn in 2022 to reach US$120 Bn by 2030

- Interior lighting market valuation to expand at a CAGR of 5.5% during 2023 - 2030

Quick Report Digest

- The demand for aesthetic appearance, consumer focus on interior design, more energy-efficient lighting solutions and architecture, development of smart city projects, and government initiatives for energy savings are some factors driving the growth of the interior lighting market.

- Another major market trend expected to fuel the interior lighting market growth is the escalating demand for cozy and creative lighting solutions and the requirement for energy-efficient ones.

- In 2022, the perimeter lighting category dominated the industry. Increased demand for comfort and safety and advancements in LED lighting technology drive the global perimeter lighting systems sector.

- In terms of market share for interior lighting globally, the residential user is anticipated to dominate owing to the increasing number of international infrastructure projects.

- In 2022, the ambient lighting category controlled the market. Due to the growing demand for innovative lighting solutions that are both comfortable and effective, the ambient lighting sector may expand.

- The recessed lighting category is highly prevalent in the market for interior lighting. The sector growth can be attributed to these lights' ability to blend into surfaces and their expanding appeal in residential and commercial sectors.

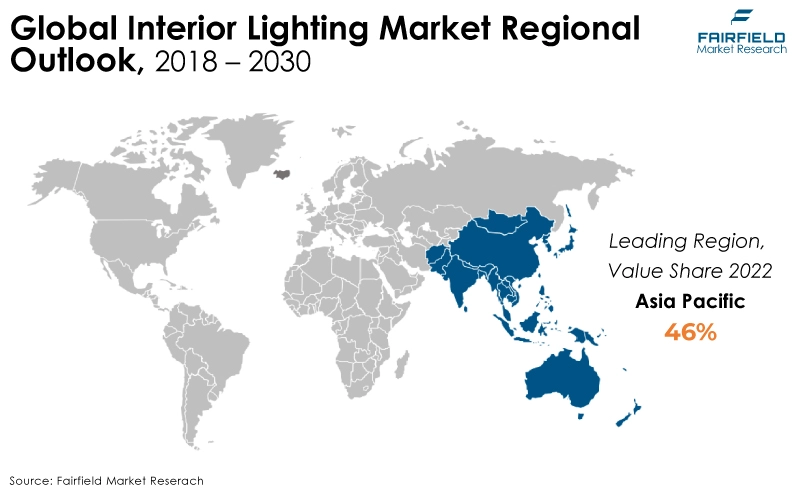

- The Asia Pacific region is assumed to account for the largest share of the global interior lighting market. The fastest increase is seen in the Asia Pacific area due to the frenzied infrastructure construction taking place in developing nations like China and India. The various regional governments are also putting a lot of effort into enacting strict laws and regulations on energy efficiency.

- The market for interior lighting is expanding in North America. Demand for ambient lighting is expected to continue to rise as more public-private collaborations for deploying energy-efficient lighting solutions in the region are anticipated.

A Look Back and a Look Forward - Comparative Analysis

The desire for linked and automated lighting systems and more energy-efficient lighting solutions was primarily causing the market's revenue rise. Other significant factors boosting demand for interior lighting in commercial and residential buildings were better lighting distribution, increased workplace productivity, increased illumination quality, and a reduced carbon impact.

The market witnessed staggered growth during the historical period 2018 - 2022. An important aspect supporting the further rise of market revenue is the increasing initiatives by governments of various nations that concentrate attentively on minimising energy usage. Increasing public-private collaborations focusing on adopting energy-efficient lighting solutions further accelerates market revenue growth.

During the projected period, the worldwide interior lighting market is anticipated to increase in terms of revenue due to technological developments in lighting systems and the increasing deployment of smart lighting systems in residential and commercial buildings. Future advancements in interior lighting technologies are anticipated to be boosted by the growing demand for automated, linked lighting systems integrated with motion sensors in commercial and residential buildings.

Key Growth Determinants

- Technological Advancements as Smart Lighting and Integration

The ability of lights to connect with IoT devices and produce a variety of ambient lighting using only smartphones or tablets has increased their appeal and demand in both commercial and residential environments.

Smart lights can link to other devices by Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee and can be muted with various color tones depending on the situation. They can also be controlled to turn on and off at specific times and measure their energy consumption. These numerous functions beyond illumination and the rising popularity of IoT devices and smart assistant platforms drive the market’s growth.

- Increase in Construction and Infrastructure Development

The worldwide construction industry is being driven by government spending on major infrastructure projects. Nearly 50% of the anticipated building spending is anticipated to come from nations like China, India, and the United States. The widespread success and potential benefits of the construction outsourcing model in the United States are a significant trend in the industry.

In addition, the advent of technology for the production of building construction materials is speeding up the construction process and giving the materials new strengths. As a result, the demand for interior lighting will increase with increased construction activity.

- Growing Demand for Automotive Interior Lighting

The use of interior lighting systems in the car sector has increased dramatically. Improved visibility inside automobiles, ambient lighting, and programmable lighting effects have emerged as major differentiators. The demand for cutting-edge lighting technology in car interiors is driven by interior lighting, improving the driving experience and adding a touch of luxury and beauty.

Additionally, improving driver pleasure, convenience, and safety is automotive interior illumination. Furthermore, it makes it easier for drivers to recognise the instrument cluster and dashboard when they are out at night. Moreover, it illuminates the passenger area to make it easier for people to read at night.

Major Growth Barriers

- Supply Chain Disruptions Leading to Demand-Supply Gap

As a result of a previous shutdown in China, the COVID-19 outbreak has had a substantial impact on the lighting industry's supply of electronic components. According to the lighting OEMs and integrators, most LED drivers, processors, and other electrical components are beginning to be in short supply.

As a result of this imbalance in supply and demand, lighting products are now more expensive. While there are immediate effects on the supply, the demand will experience severe effects for a longer period when forthcoming lighting projects are halted due to cost-cutting measures taken by businesses.

- Lack of Standardisation

The absence of universal standards is one of the interior lighting industry's biggest problems. There is a lack of clarity in the standards and regulations for LEDs and other light sources.

As a result, producers offer unique items that adhere to regulations specific to each region and nation. The absence of universal norms frequently makes the sector inefficient.

Key Trends and Opportunities to Look at

- Demand for Energy Efficiency

Strict laws and rising environmental concerns drive the demand for energy-efficient lighting solutions. Technology developments in lighting systems offer advantages like warm lighting, ambiance, and energy efficiency.

Manufacturers can take advantage of the opportunity by creating cutting-edge, environmentally friendly products that adhere to rules and satisfy the needs of customers who care about the environment.

- Technological Advancements

Lighting technologies like LED and OLED are advancing quickly, allowing manufacturers to offer more effective, long-lasting, personalised lighting options.

The advantages of OLED technology include higher contrast ratios, faster refresh rates, and sharper, more brilliant colors. These developments allow for the development of linked lighting, smart controls, and intelligent lighting systems, which enhance user experience and stimulate market expansion.

- Potential Opportunities for New Vendors

Lighting components are typically scarce because China's factories are overloaded, and the supply chain has been messed up. Since the entire value chain has collapsed, predicting when the supply will return to normal is difficult.

Given these elements, lighting manufacturers are considering importing parts from places like Hong Kong, Taiwan, and South Korea, creating enormous prospects for them.

How Does the Regulatory Scenario Shape this Industry?

Energy must be used sustainably and efficiently to reduce energy waste and carbon emissions, which are rising due to increased energy use. The production of electricity is responsible for roughly one-fourth of carbon emissions. Government efforts to reduce their carbon footprint have escalated in response to growing global warming and ozone depletion concerns. To reduce carbon emissions, governments all around the world are implementing strict rules.

The Energy Conservation (Amendment) Act 2022, which updates the 2001 Energy Conservation Act, was passed by both chambers of the Indian Parliament and went into effect on January 1, 2023. The amendment allows the federal government to designate a carbon emission-reduction trading system.

Governments are pushing citizens to save energy through several measures. For instance, the National Programme for LED-based Home and Street Lighting program of the Indian government aims to boost the use of LED lamps in homes and cities. The intention is to swap out existing lamps for these, which often consume more power.

Fairfield’s Ranking Board

Top Segments

- Perimeter Lighting Category Continues to Dominate

The perimeter lighting segment dominated the market in 2022. Increased demand for comfort and safety and advancements in LED lighting technology, integrated LED lighting with energy efficiency and low maintenance requirements all drive the global segment for perimeter lighting systems. The demand for perimeter lighting systems is significantly fueled by

Furthermore, the wall grazing category is projected to experience the fastest market growth. For stone homes, wall grazing is a wise option. Closely spaced ground-level lights throughout the night can accentuate the angular, rough edges and produce a dramatic image. Wall grazing can highlight a brick wall's intricacies inside and outside.

- Residential User Will Surge Ahead

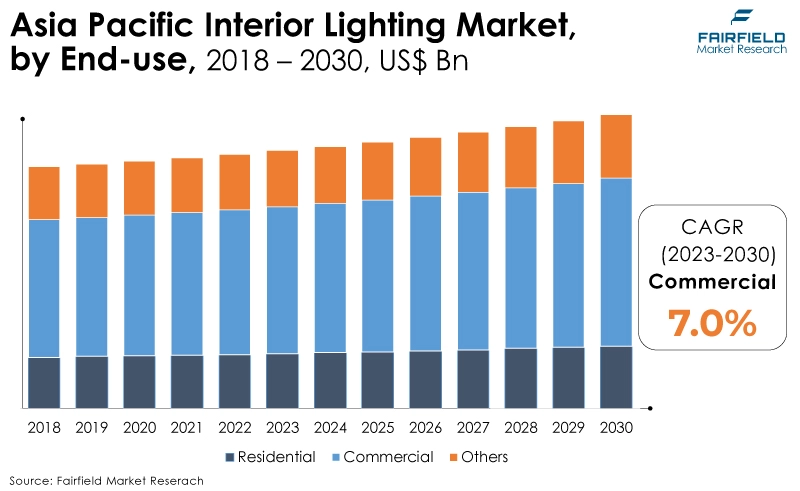

In 2022, the residential user dominated the industry, which is anticipated to continue for the entire forecast period. The residential sector is expanding due to the growing number of global infrastructure projects.

The commercial user is anticipated to grow substantially throughout the projected period. The sector’s revenue growth is anticipated to be fueled by the rising need for more energy-efficient lighting systems, rapid infrastructure developments, and ongoing and upcoming smart city projects in developing nations.

- Ambient Lighting Leads

The ambient lighting segment dominated the market in 2022. The sector for ambient lighting may see growth due to the increased need for creative lighting solutions that are both comfortable and efficient. These solutions are becoming increasingly popular as incandescent bulbs lose efficiency due to excessive heat emission, supporting the expansion of the interior lighting market.

The general lighting category is expected to experience the fastest growth within the forecast time frame. Urbanisation and an increase in households are the main trends propelling the general lighting sector’s expansion. The sector’s expansion is influenced by several variables, such as the falling cost of producing LEDs, the expanding use of energy-efficient lighting solutions, and the rising demand for LEDs from the automobile industry.

- The Recessed Lighting Category Spearheads

In 2022, the recessed lighting category led the market growth. The ability of these lights to fit into surfaces and their rising popularity in both the residential and commercial sectors can be credited with the market expansion. Residential buildings, hotels, retail showrooms, and businesses are driving the development of the need for recessed lighting.

Moreover, the track light category is expected to grow fastest in the interior lighting market during the forecast period. Since track lights are an excellent choice for evenly illuminating both indoor and outdoor environments, they are typically utilised in locations where the position of the light must be changed frequently and at various angles.

Regional Frontrunners

Asia Pacific Holds the Largest Revenue Share

Asia Pacific supplied the largest revenue share to the overall interior lighting market during the forecast period. The market for interior lighting in emerging nations is expanding due to increased residential and commercial buildings with improved energy-efficient solutions.

Another important element driving up demand for interior lighting is the increase in investment in the building sector to create modernised infrastructure and the rise of smart city initiatives in developing nations.

As living standards rise, consumer taste is steadily shifting towards more energy-efficient interior lighting and interior design. Interior lighting market expansion in the region is also being supported by strict GHG emission restrictions and attempts to reduce energy use.

North America Set for Significant Growth in Sales

The North American market is anticipated to register a much higher revenue share during the projected period than other regional markets. During the forecast period, significant players in the area, including Acuity Brands, Inc., Hubbell Incorporated, and General Electric Company, are anticipated to stimulate revenue growth in the interior lighting market.

Demand for interior lighting will continue to rise as more public-private collaborations are anticipated for deploying energy-efficient lighting solutions in the region. The market is growing as smart lighting systems are installed in more homes and businesses, and nations in the region emphasize lowering energy use and carbon emissions.

Fairfield’s Competitive Landscape Analysis

The interior lighting market is concentrated, with few significant companies present worldwide. The major firms are launching new items and enhancing their distribution networks to increase their global footprint. In addition, Fairfield Market Research anticipates that there will be further market consolidation during the next few years.

Who are the Leaders in Global Interior Lighting Space?

- Est Lights

- Russell Lighting

- ERCO GmbH

- Lena Lighting S.A.

- Kichler Lighting, LLC

- Trilux Gmbh

- Jaquar Group

- Wipro Lighting

- WLS Lighting Systems, Inc.

- Karice Lighting

- Signify

- Thorn Lighting Ltd.

- Hubbell Incorporated

- Osram Licht AG

- Acuity Brands, Inc.

Significant Company Developments

New Product Launches

- April 2022: ERCO announced the next generation of Parscan Spotlights. The latest generation consists of three products: the Parscan InTrack, the Parscan 48V, and the Parscan OnTrack. Parscan's broad technical platform makes this light quality available for various applications. For the market debut, spotlights in sizes XS, S, and M will be offered, with more sizes ranging from L to XXL for Parscan InTrack to follow later in the year.

- March 2022: Wipro Lighting unveiled Aqua, a sleek line of designer office lighting solutions. Aqua LED is designed primarily for indoor lighting solutions in workplaces. It is an ever-green LED that stretches horizontally to illuminate the ceilings evenly. This curved luminaire is also useful for communicating an architect's design purpose.

- January 2022: Signify, the global lighting leader, introduced a new line of Philips Hue smart lighting devices and features to help you create the right ambiance inside and outside your home. Additional outdoor wall and bollard lights, as well as additional effects in the Philips Hue app, can enhance any event, whether a social gathering on the patio or a romantic night on the sofa.

Partnership Agreements

- June 2021: Wipro Lighting, India's top provider of lighting and Internet of Lighting (IoL) solutions, collaborates with Enlighted, the leading supplier of Internet of Things (IoT) solutions for commercial buildings, to create smarter workspaces. Wipro Lighting and Enlighted combine their solutions and technologies to create smarter buildings for various customers.

- March 2021: TRILUX announced a relationship with Sonepar in Singapore. This collaboration builds on the TRILUX Group's and Sonepar's historically strong ties in Europe and will allow both parties to generate long-term, potential economic prospects in the ASEAN area. Expanding to Singapore is the first step in further strengthening TRILUX's business partnership in important Asia-Pacific markets.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the market is expected to develop due to continued technical advancements, such as smart lighting systems in office or residential buildings. The rising demand for ambient lighting may result in a growth in interior lighting, where recessed lighting is favoured in large quantities, increasing the need for interior lighting.

Furthermore, the growth and development of numerous interior lighting solutions have been considerably helped by technical advancements. However, because of the high initial cost due to supply chain disruption, the interior lighting industry is anticipated to encounter significant hurdles.

Supply Side of the Market

According to our analysis, the manufacturers active in the interior lighting industry are concentrating on improving lighting solutions by introducing new technologies in the LED and OLED sectors that will assist end users in working more effectively and efficiently.

For instance, in March 2022, Acuity Brands, Inc. introduced Verjure, a professional-grade horticulture LED lighting system that provides efficient and consistent performance for indoor horticulture applications. The Verjure Pro Series LED luminaires were developed utilising academic, plant-based research and are intended to promote all stages of plant growth, from veg to flower.

Manufacturers of interior lighting are developing technologically sophisticated models that incorporate IoT and AI to boost productivity, aesthetic appeal, and adaptability. As a result of growing environmental concerns, several businesses are also developing energy-efficient interior lighting solutions to support energy-saving measures. This can entail using eco-friendly materials, implementing energy-saving technologies, and optimising lighting designs.

Global Interior Lighting Market is Segmented as Below:

By Lighting Effect:

- Spotlighting

- Downlighting

- Uplighting

- Perimeter Lighting

- Others

By End Use:

- Residential

- Office Spaces

- Others

By Type:

- General Lighting

- Ambient Lighting

- Accent Lighting

- Others

By Product:

- Ceiling Lights

- Decorative Lamps

- Pendant Lights

- Wall Lights

- Track Lights

- Recessed and Surface-mounted Lights

- Chandeliers

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Interior Lighting Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Interior Lighting Market Outlook, 2018 - 2030

3.1. Global Interior Lighting Market Outlook, by Lighting Effect, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Spotlighting

3.1.1.2. Downlighting

3.1.1.3. Uplighting

3.1.1.4. Perimeter Lighting

3.1.1.5. Others

3.2. Global Interior Lighting Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Residential

3.2.1.2. Office Spaces

3.2.1.3. Others

3.3. Global Interior Lighting Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. General Lighting

3.3.1.2. Ambient Lighting

3.3.1.3. Accent Lighting

3.3.1.4. Others

3.4. Global Interior Lighting Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Ceiling Lights

3.4.1.2. Decorative Lamps

3.4.1.3. Pendant Lights

3.4.1.4. Wall Lights

3.4.1.5. Track Lights

3.4.1.6. Recessed and Surface-Mounted Lights

3.4.1.7. Chandeliers

3.4.1.8. Others

3.5. Global Interior Lighting Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Interior Lighting Market Outlook, 2018 - 2030

4.1. North America Interior Lighting Market Outlook, by Lighting Effect, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Spotlighting

4.1.1.2. Downlighting

4.1.1.3. Uplighting

4.1.1.4. Perimeter Lighting

4.1.1.5. Others

4.2. North America Interior Lighting Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Residential

4.2.1.2. Office Spaces

4.2.1.3. Others

4.3. North America Interior Lighting Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. General Lighting

4.3.1.2. Ambient Lighting

4.3.1.3. Accent Lighting

4.3.1.4. Others

4.4. North America Interior Lighting Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Ceiling Lights

4.4.1.2. Decorative Lamps

4.4.1.3. Pendant Lights

4.4.1.4. Wall Lights

4.4.1.5. Track Lights

4.4.1.6. Recessed and Surface-Mounted Lights

4.4.1.7. Chandeliers

4.4.1.8. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Interior Lighting Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Interior Lighting Market Outlook, 2018 - 2030

5.1. Europe Interior Lighting Market Outlook, by Lighting Effect, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Spotlighting

5.1.1.2. Downlighting

5.1.1.3. Uplighting

5.1.1.4. Perimeter Lighting

5.1.1.5. Others

5.2. Europe Interior Lighting Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Residential

5.2.1.2. Office Spaces

5.2.1.3. Others

5.3. Europe Interior Lighting Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. General Lighting

5.3.1.2. Ambient Lighting

5.3.1.3. Accent Lighting

5.3.1.4. Others

5.4. Europe Interior Lighting Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Ceiling Lights

5.4.1.2. Decorative Lamps

5.4.1.3. Pendant Lights

5.4.1.4. Wall Lights

5.4.1.5. Track Lights

5.4.1.6. Recessed and Surface-Mounted Lights

5.4.1.7. Chandeliers

5.4.1.8. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Interior Lighting Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Interior Lighting Market Outlook, 2018 - 2030

6.1. Asia Pacific Interior Lighting Market Outlook, by Lighting Effect, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Spotlighting

6.1.1.2. Downlighting

6.1.1.3. Uplighting

6.1.1.4. Perimeter Lighting

6.1.1.5. Others

6.2. Asia Pacific Interior Lighting Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Residential

6.2.1.2. Office Spaces

6.2.1.3. Others

6.3. Asia Pacific Interior Lighting Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. General Lighting

6.3.1.2. Ambient Lighting

6.3.1.3. Accent Lighting

6.3.1.4. Others

6.4. Asia Pacific Interior Lighting Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Ceiling Lights

6.4.1.2. Decorative Lamps

6.4.1.3. Pendant Lights

6.4.1.4. Wall Lights

6.4.1.5. Track Lights

6.4.1.6. Recessed and Surface-Mounted Lights

6.4.1.7. Chandeliers

6.4.1.8. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Interior Lighting Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Interior Lighting Market Outlook, 2018 - 2030

7.1. Latin America Interior Lighting Market Outlook, by Lighting Effect, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Spotlighting

7.1.1.2. Downlighting

7.1.1.3. Uplighting

7.1.1.4. Perimeter Lighting

7.1.1.5. Others

7.2. Latin America Interior Lighting Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Residential

7.2.1.2. Office Spaces

7.2.1.3. Others

7.3. Latin America Interior Lighting Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. General Lighting

7.3.1.2. Ambient Lighting

7.3.1.3. Accent Lighting

7.3.1.4. Others

7.4. Latin America Interior Lighting Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Ceiling Lights

7.4.1.2. Decorative Lamps

7.4.1.3. Pendant Lights

7.4.1.4. Wall Lights

7.4.1.5. Track Lights

7.4.1.6. Recessed and Surface-Mounted Lights

7.4.1.7. Chandeliers

7.4.1.8. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Interior Lighting Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Interior Lighting Market Outlook, 2018 - 2030

8.1. Middle East & Africa Interior Lighting Market Outlook, by Lighting Effect, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Spotlighting

8.1.1.2. Downlighting

8.1.1.3. Uplighting

8.1.1.4. Perimeter Lighting

8.1.1.5. Others

8.2. Middle East & Africa Interior Lighting Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Residential

8.2.1.2. Office Spaces

8.2.1.3. Others

8.3. Middle East & Africa Interior Lighting Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. General Lighting

8.3.1.2. Ambient Lighting

8.3.1.3. Accent Lighting

8.3.1.4. Others

8.4. Middle East & Africa Interior Lighting Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Ceiling Lights

8.4.1.2. Decorative Lamps

8.4.1.3. Pendant Lights

8.4.1.4. Wall Lights

8.4.1.5. Track Lights

8.4.1.6. Recessed and Surface-Mounted Lights

8.4.1.7. Chandeliers

8.4.1.8. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Interior Lighting Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Interior Lighting Market by Lighting Effect, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Interior Lighting Market by End Use, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Interior Lighting Market by Type, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Interior Lighting Market by Product, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Product Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Est Lights

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Russell Lighting

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. ERCO GmbH

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Lena Lighting S.A.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Kichler Lighting, LLC

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Trilux Gmbh

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Wipro Lighting

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. WLS Lighting Systems, Inc

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Karice Lighting

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Business Strategies and Development

9.4.10. Signify

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Thorn Lighting Ltd.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Hubbell Incorporated

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Osram Licht AG

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Clearpack

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Acuity Brands, Inc.

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Lighting Effect Coverage |

|

|

End Use Coverage |

|

|

Type Coverage |

|

|

Product Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |