Global Lip Care Products Market Forecast

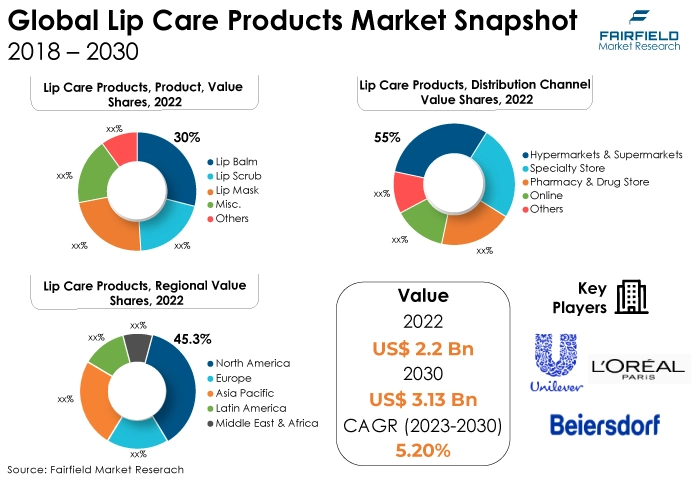

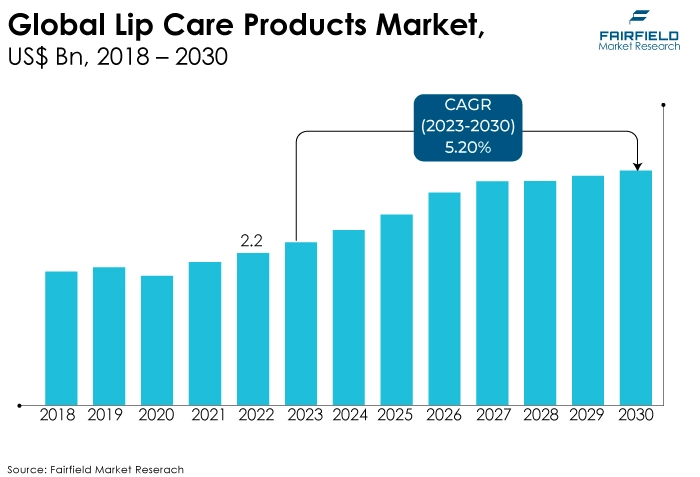

- Global market for lip care products to witness a healthy rise from US$2.2 Bn in 2022 to US$3.13 Bn in 2030

- Market size likely to expand at a CAGR of 5.2% during 2023 - 2030

Quick Report Digest

- The key trend anticipated to drive the lip care products market growth is an increasing demand for health and wellness focus. Furthermore, consumers who are concerned about their aesthetic look, demand lip care items with clear ingredient lists that are free of potentially dangerous or irritating ingredients. This market is drawn to companies with a focus on natural and clean components.

- Another major market trend expected to drive the lip care products market growth is the rapidly expanding seasonal variation. The demand for lip balms and other protective lip care products may rise because of seasonal changes, such as cold and dry winters.

- Some customers are wary about lip care items that might include artificial substances, preservatives, or possibly dangerous compounds. The demand for natural and organic substitutes is sparked by worries about the safety of some importance, which can reduce sales and slow market expansion.

- In 2022, the lip balm category dominated the industry. The flavours and smells of many lip balm products range from traditional alternatives like mint and cherry to more unusual possibilities like coconut or lavender. This gives the lip care experience a sensual component.

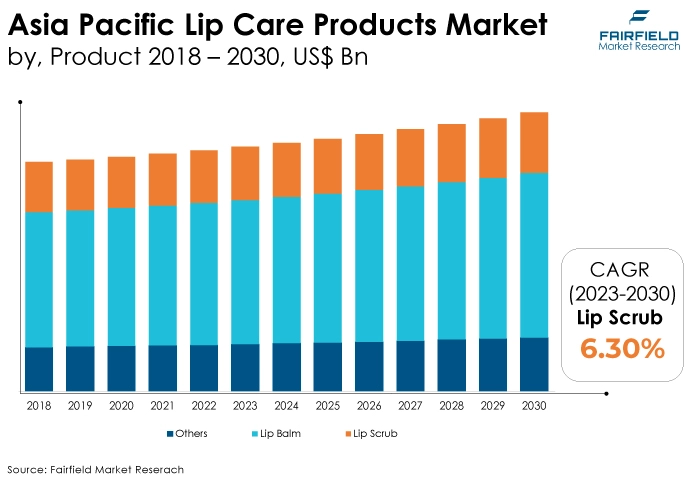

- The lip scrub segment is expected to be the fastest growing of the lip care products market during the forecast period. Various exfoliating ingredients, such as sugar, salt, coffee grounds, fruit seeds, or microbeads, can be found in lip scrubs. Exfoliation and texture may vary depending on the ingredient.

- In 2022, the hypermarkets & supermarkets category dominated the industry. Brands routinely plan promotional programs, offer discounts, and distribute product samples in supermarkets and hypermarkets to contact customers directly. These marketing strategies have the potential to affect consumer purchasing decisions.

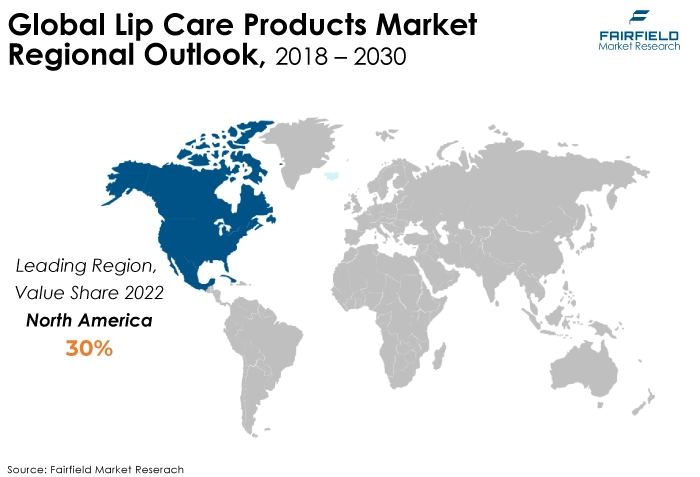

- North America is expected to dominate the lip care products market during the forecast period. In North America, lip care products with SPF (sunscreen) features are becoming more popular because of the increased awareness of the need to protect skin from the sun's damaging effects.

- Asia Pacific is expected to be the fastest-growing lip care products market region due to rising awareness about lip-care and cosmetic products.

A Look Back and a Look Forward - Comparative Analysis

Rising awareness regarding the risks associated with UV radiation, such as sunburn, early aging, and skin cancer. This has led to a higher need for sun-protective lip care products. To prevent sunburn and damage, countries with sunny, hot climates, particularly tropical and subtropical regions, have a higher requirement for lip care products containing SPF (sun protection factor).

Lip care products can protect you from the sun all year round. Because UV radiation can harm lips year-round, consumers are aware of the necessity for year-round protection.

The market witnessed staggered growth during the historical period 2018 - 2022. The brands in the lip care products market embraced customization by offering a wide range of goods.

Customers now had the choice to choose lip care products that suited their personal preferences, whether they were looking for tinted lip balms, SPF protection, natural ingredients, or medical treatments. Customized formulae were created to enable personalization.

Products were developed by brands to target issues, including dryness, chapping, fine lines, or sun protection. Customers who were looking for specialized solutions for their lip care needs reacted favourably to this strategy.

Collaborating with skin care specialists, makeup artists, and beauty influencers has become a strategic move. Influencers provided their audience with evaluations, tutorials, and suggestions based on their personal experiences with lip care products in the coming years.

Additionally, influencers had a global audience, enabling firms to reach consumers throughout the world and expand their market presence. Furthermore, through influencer relationships, brands gave their followers access to exclusive discounts and promotions that encouraged them to try lip care products for less during the next five years.

Key Growth Determinants

- Increasing Demand for Fashion and Cosmetics

The preferred lip colours and finishes among customers are greatly influenced by fashion and beauty trends. The demand for lip care products, such as matte lipsticks, glossy lip glosses, or strong lip colours, might increase when beauty trends change.

To keep up with current trends, cosmetic companies frequently produce new lip products, stimulating market growth.

Lip care products are commonly applied over other cosmetics like blush, foundation, and eye makeup. Customers are more inclined to seek additional lip care items to complete their look when they spend in their full makeup routine, driving up market sales.

- Rising Demand for Lip Balm

Many customers view lip balms as a daily requirement. They are an essential part of personal care routines because they provide a workable option for preserving the health and moisture of lips. This steady demand guarantees a stable market.

Lip balms frequently contain SPF protection and chemicals that protect the lips from damaging UV radiation, pollution, and adverse weather. The need for preventive lip balms rises as awareness of how various environmental factors affect lip health increases.

In dry and cold weather, when lips are more prone to chapping and drying out, lip balms are especially well-liked. To ease discomfort and keep soft, smooth lips, consumers frequently stock up on lip balms, which boosts seasonal sales.

- Increasing Disposable Income and Spending Power

Consumers are more likely to allocate a percentage of their budget to beauty and personal care items, such as lip care products when they have more disposable income. This greater purchasing power drives market expansion.

Consumers are more inclined to choose premium and luxury lip care products that offer distinctive formulations, cutting-edge ingredients, and exquisite packaging when they have more disposable cash. Brands that serve this market have better profit margins.

Higher-income consumers frequently give health and well-being a top priority. They are prepared to spend money on more expensive, often premium, lip care products manufactured with organic and natural components. This increases market demand for certain products.

Major Growth Barriers

- Price Sensitivity

Lip care items are sometimes regarded as luxury items rather than requirements, particularly when contrasted to basic personal care items like toothpaste or soap. As a result, consumers might be more cost-conscious while buying lip care products.

Price wars may result from fierce rivalry in the lip care market as brands compete to increase or preserve market share. This can reduce profit margins and make it difficult for businesses to charge more for luxury or cutting-edge lip care products.

Luxury and high-end lip care items frequently have steep price tags. Price-conscious consumers may be hesitant to purchase these products and opt to stick with more reasonably priced alternatives.

- Competition and Saturation

The lip care market is highly competitive, with numerous businesses and goods vying for consumers' attention. This intense rivalry may lead to price wars and aggressive marketing tactics, making it challenging for enterprises to maintain healthy profit margins.

Brands need help to stand out from the competition, given how many lip care products have identical fundamental advantages like protection and moisturization. This may lead to a crowded market where customers need help to discriminate between different products.

Key Trends and Opportunities to Look at

- Natural and Clean Ingredients

Modern customers are more concerned than ever about what people put on their skin, particularly their lips. They argue that the ingredients in their lip care products should be made public. Ingredient lists that are natural and healthful, which also reflect customer values, enable this openness.

Natural and clean components are excellent for people with sensitive skin or allergies because they frequently include fewer synthetic chemicals and potential allergens. The market appeal of lip care products has increased as a result.

- Environmentally Sustainable Packaging

The environmental impact of product packaging is a growing issue for consumers. Their goal to choose more sustainably and lower their carbon footprint is in line with the use of eco-friendly packaging.

Eco-friendly packaging helps brands stand out in a crowded market. Customers who care about the environment may be drawn to this differentiation and become devoted to the brand.

Eco-friendly packaging enhances a brand's reputation. Sustainability-focused firms are viewed favourably by consumers as being socially conscious, which can help them build their reputation and draw in ethical customers.

- Booming Men's Lip Care

The male grooming industry has recently seen a dramatic transformation as more men adopt skincare and grooming routines. Lip care is the natural progression in this trend. Men may have lip care requirements, such as those for irritated skin caused by shaving or extra protection for outdoor activities.

Brands can create specialized formulas. Brands can create packaging with a simple and manly aesthetic that appeals to males, improving the visual appeal and approachability of these products.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the lip care products market has been governed by regulations to ensure consumer protection and product safety, just like the larger cosmetics and personal care sector.

The Food and Drug Administration (FDA) regulates the regulation of cosmetics in the US, including lip care items. The US FDA establishes restrictions regarding ingredient limitations, safety testing, and labelling. For products to be able to access the American market, Food and Drug Administration (FDA) standards must be followed.

In the European Union (EU), cosmetics rules are supervised by the European Commission. The Cosmetic Products Regulation (CPR), implemented by the EU, establishes safety and labelling requirements for cosmetics, including lip care products. To sell their goods in the EU, businesses must abide by certain rules.

Regulatory agencies provide safety requirements to guarantee that lip care products don't hurt customers. This entails evaluating the contents, doing safety checks, and setting maximum permissible concentrations for compounds. The regulatory organizations from several nations, including the US, EU, Canada, Japan, and others, have joined forces to form the International Cooperation on Cosmetics Regulation (ICCR).

These entities collaborate to harmonize and standardize laws governing cosmetics while exchanging knowledge and best practices. Global regulation of lip care products is influenced by International Cooperation on Cosmetics Regulation (ICCR) standards.

Fairfield’s Ranking Board

Top Segments

- Lip Balm Bestseller

The lip balm segment dominated the market in 2022. The primary goal of lip balm is to hydrate the lips deeply. It has components like oils, waxes, and butter that assist the lips in keeping moisture and stop drying out.

Lip balm typically contains substances like shea butter or beeswax, which form a barrier of defense on the lips. This layer protects the lips from the elements, UV rays, and contaminants.

Furthermore, the lip scrub category is projected to experience the fastest market growth. A lip scrub's main goal is to exfoliate the lips. These solutions help exfoliate dry, flaky skin from the surface of the lips by using abrasive materials like sugar, salt, or exfoliating beads.

By buffing away the harsh texture, lip scrubs leave the lips feeling softer and smoother. This makes for the ideal surface on which to put lip balm, lipstick, or other lip cosmetics.

- Hypermarkets & Supermarkets Bring in Maximum Revenue

The hypermarkets & supermarkets segment dominated the market in 2022. Lip balms, lipsticks, lip glosses, and lip scrubs are frequently available in supermarkets and hypermarkets, together with other lip care items.

Customers are given the opportunity to select goods that meet their interests by having access to a variety of brands, formulas, and pricing points in one place.

Customers can easily get lip care products while shopping for groceries or other home items at these retail establishments, which are frequently found in urban and suburban regions.

The specialty store category is anticipated to grow substantially throughout the projected period. Customers can find specialty and boutique lip care lines that might be less extensively distributed in bigger retail stores. Innovative and unique products are frequently found in specialty shops.

Customers looking for premium or luxurious lip care products can find them in a variety of specialist retailers. These options consist of artisanal lip care companies, high-end lip balms, and designer lipsticks.

Regional Frontrunners

North America Gains from the Well-informed and Aware Consumer

Throughout the forecast period, North America is anticipated to dominate the market for lip care products. Customers in North America are well-informed about cosmetics and personal care items, especially lip care. They have a greater understanding of the value of protecting and maintaining healthy lips, which has increased the need for lip care products.

The climate in North America is varied, with cold winters and sunny summers. Due to the seasonal fluctuations in weather, consumers may seek protection from the sun in the summer and hard winters, respectively, which might affect the demand for lip care products.

Cultural diversity in North America results in a range of preferences for personal care and attractiveness. The lip care industry may satisfy a wide spectrum of consumer wants and needs, from those who use lip balm to those who want specialized lip products.

Asia Pacific Witnesses Growing Consumer Spending on Personal Care and Cosmetics

The region with the fastest-growing lip care products market is expected to be Asia Pacific as customers' awareness of their physical appearance grows. The need for different lip care products, such as lip balm, lip scrub, lip oil, and sleeping lip mask among others, is being fuelled by consumers' increased expenditure on personal care and cosmetics.

Innovation in the skin and personal care industry is also helping to enhance products like sleeping masks and washes. Major companies in the industry are all launching new products in collaboration with other companies, providing customers with a variety of choices.

Additionally, the expanding demand has attracted new competitors, increasing rivalry in the local market. To reach a larger consumer base, these new entrants are concentrating on celebrity endorsement and promotions through social media platforms.

Fairfield’s Competitive Landscape Analysis

The consolidated global market for lip care products, there are fewer well-known brands to choose from. In a drive to expand globally, the major firms are launching new products and modernizing their distribution systems. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Lip Care Products Space?

- L'Oreal S.A.

- Unilever

- Beiersdorf AG

- The Colgate-Palmolive Company

- The Estée Lauder Companies, Inc.

- Johnson and Johnson

- Avon Products, Inc.

- Shiseido Co., Ltd.

- Revlon, Inc.

- Burt's Bees

- Carmex

- EOS (Evolution of Smooth)

- Nivea

- Maybelline

- ChapStick

Significant Company Developments

New Product Launches

- August 2023: Model and Rhode Beauty founder Hailey Bieber announced a Krispy Kreme location in New York City about the launch of her new lip treatment, which uses natural ingredients to moisturize and plump lips. The item, which came in a pink tube with a donut-shaped applicator, was offered for sale via Rhode's website and some Krispy Kreme shops for US$ 16.

- February 2023: Deconstruct, an Indian company that sells science-based skincare products, just launched a new line of lip care items. Hyaluronic acid-infused lip balms with SPF 30 were introduced on the firm website as well as other e-commerce sites, including Myntra, Nykaa, Amazon, etc.

- January 2023: Two new lip balms from the renowned international personal care firm Himalaya Wellness firm have been launched. Cherry Shine and Berry Shine lip balms are manufactured completely from natural materials such as cranberry oils, and sweet cherry oils.

Distribution Agreement

- July 2023: A distribution agreement between L'Oréal and Alibaba enables L'Oréal to market its lip care items on Alibaba's Chinese e-commerce platforms. The deal includes provisions for online branding, product placement, and fulfillment.

- June 2023: Shiseido and Sephora signed a distribution agreement so that Shiseido's lip care products would be available in Sephora stores all over the world. The deal covers exclusive product releases and co-branded marketing campaigns.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, products for lip care that have several uses offer convenience by integrating several advantages into a single item. Consumers can handle multiple lip care issues with a single product.

Furthermore, hybrid formulations that mix lip balm, sunscreen, colour, and even anti-ageing effects can be found in lip care products. A diverse range of customers are drawn to this versatility.

Ingredients with extra skincare advantages, like as anti-aging effects or hydration for dry or sensitive skin, are sometimes found in multipurpose lip products. However, the lip care products market is expected to face considerable challenges because of price sensitivity.

Supply Side of the Market

According to our analysis, North America will have the largest market for lip care products in the world in 2022, accounting for more than 30% of the total market. The region is home to some of the top manufacturers of lip care products, such as Chapstick, Burt's Bees, and EOS Products.

The US has the largest market for lip care in North America, followed by Canada. Europe will rank as the second-largest market for lip care products in 2022, with more than 25% of the global market share.

The region is home to some of the main manufacturers of lip care products, such as Nivea, Labello, and Blistex. Germany, France, and the U.K. are the two biggest markets in Europe for lip care products.

Asia Pacific is the world's largest consumer of lip care products, accounting for over 40% of global usage. The three nations in the Asia Pacific region with the highest use of lip care products are China, Japan, and South Korea.

The second-largest consumer of lip care products in the world, Europe accounts for around 30% of the market. Germany, France, and the United Kingdom are the three nations in Europe that utilize lip care products the most.

Global Lip Care Products Market is Segmented as Below:

By Product:

- Lip Balm

- Lip Scrub

- Others

By Application:

- Medicated

- Cosmetic

By Distribution Channel:

- Hypermarkets & Supermarkets

- Pharmacy & Drug Store

- Specialty Store

- Online

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Lip Care Products Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Lip Care Products Market Outlook, 2018 - 2030

3.1. Global Lip Care Products Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Lip Balm

3.1.1.2. Lip Scrub

3.1.1.3. Lipstick and Lip Gloss

3.1.1.4. Lip Mask

3.1.1.5. Miscellaneous

3.2. Global Lip Care Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Medicated

3.2.1.2. Cosmetic

3.3. Global Lip Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hypermarkets & Supermarkets

3.3.1.2. Pharmacy & Drug Store

3.3.1.3. Specialty Store

3.3.1.4. Online

3.3.1.5. Miscellaneous

3.4. Global Lip Care Products Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Lip Care Products Market Outlook, 2018 - 2030

4.1. North America Lip Care Products Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Lip Balm

4.1.1.2. Lip Scrub

4.1.1.3. Lipstick and Lip Gloss

4.1.1.4. Lip Mask

4.1.1.5. Miscellaneous

4.2. North America Lip Care Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Medicated

4.2.1.2. Cosmetic

4.3. North America Lip Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hypermarkets & Supermarkets

4.3.1.2. Pharmacy & Drug Store

4.3.1.3. Specialty Store

4.3.1.4. Online

4.3.1.5. Miscellaneous

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Lip Care Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Lip Care Products Market Outlook, 2018 - 2030

5.1. Europe Lip Care Products Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Lip Balm

5.1.1.2. Lip Scrub

5.1.1.3. Lipstick and Lip Gloss

5.1.1.4. Lip Mask

5.1.1.5. Miscellaneous

5.2. Europe Lip Care Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Medicated

5.2.1.2. Cosmetic

5.3. Europe Lip Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hypermarkets & Supermarkets

5.3.1.2. Pharmacy & Drug Store

5.3.1.3. Specialty Store

5.3.1.4. Online

5.3.1.5. Miscellaneous

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Lip Care Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Lip Care Products Market Outlook, 2018 - 2030

6.1. Asia Pacific Lip Care Products Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Lip Balm

6.1.1.2. Lip Scrub

6.1.1.3. Lipstick and Lip Gloss

6.1.1.4. Lip Mask

6.1.1.5. Miscellaneous

6.2. Asia Pacific Lip Care Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Medicated

6.2.1.2. Cosmetic

6.3. Asia Pacific Lip Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hypermarkets & Supermarkets

6.3.1.2. Pharmacy & Drug Store

6.3.1.3. Specialty Store

6.3.1.4. Online

6.3.1.5. Miscellaneous

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Lip Care Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Lip Care Products Market Outlook, 2018 - 2030

7.1. Latin America Lip Care Products Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Lip Balm

7.1.1.2. Lip Scrub

7.1.1.3. Lipstick and Lip Gloss

7.1.1.4. Lip Mask

7.1.1.5. Miscellaneous

7.2. Latin America Lip Care Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Medicated

7.2.1.2. Cosmetic

7.3. Latin America Lip Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hypermarkets & Supermarkets

7.3.1.2. Pharmacy & Drug Store

7.3.1.3. Specialty Store

7.3.1.4. Online

7.3.1.5. Miscellaneous

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Lip Care Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Lip Care Products Market Outlook, 2018 - 2030

8.1. Middle East & Africa Lip Care Products Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Lip Balm

8.1.1.2. Lip Scrub

8.1.1.3. Lipstick and Lip Gloss

8.1.1.4. Lip Mask

8.1.1.5. Miscellaneous

8.2. Middle East & Africa Lip Care Products Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Medicated

8.2.1.2. Cosmetic

8.3. Middle East & Africa Lip Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hypermarkets & Supermarkets

8.3.1.2. Pharmacy & Drug Store

8.3.1.3. Specialty Store

8.3.1.4. Online

8.3.1.5. Miscellaneous

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Lip Care Products Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. Southeast Africa Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Lip Care Products Market by Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Lip Care Products Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Lip Care Products Market Distribution Channel, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Type Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. L'Oreal S.A.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Unilever

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Beiersdorf AG

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. The Colgate-Palmolive Company

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. The Estée Lauder Companies, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Johnson and Johnson

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Avon Products, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Shiseido Co., Ltd.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Revlon, Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Burt's Bees

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Carmex

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. EOS (Evolution of Smooth)

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Nivea

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. ChapStick

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Kao Corporation

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

9.4.16. The Clorox Company

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Development

9.4.17. Ethique Inc

9.4.17.1. Company Overview

9.4.17.2. Product Portfolio

9.4.17.3. Financial Overview

9.4.17.4. Business Strategies and Development

9.4.18. Blistex

9.4.18.1. Company Overview

9.4.18.2. Product Portfolio

9.4.18.3. Financial Overview

9.4.18.4. Business Strategies and Development

9.4.19. Forest Essentials

9.4.19.1. Company Overview

9.4.19.2. Product Portfolio

9.4.19.3. Financial Overview

9.4.19.4. Business Strategies and Development

9.4.20. The Body Shop

9.4.20.1. Company Overview

9.4.20.2. Product Portfolio

9.4.20.3. Financial Overview

9.4.20.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Capacity Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |