Global Liquefied Natural Gas (LNG) Market Forecast

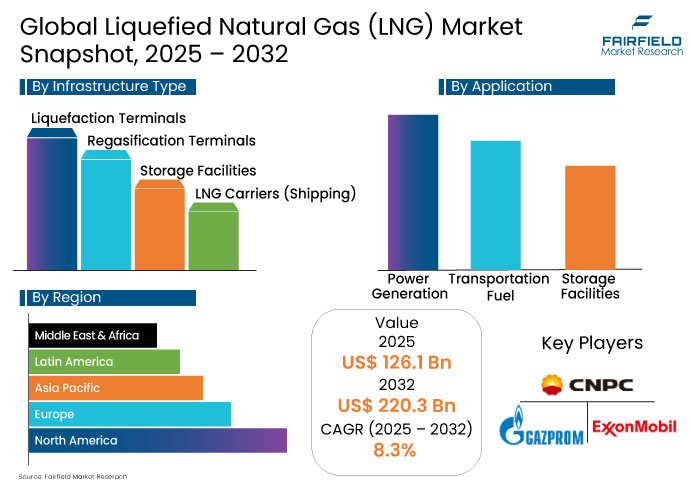

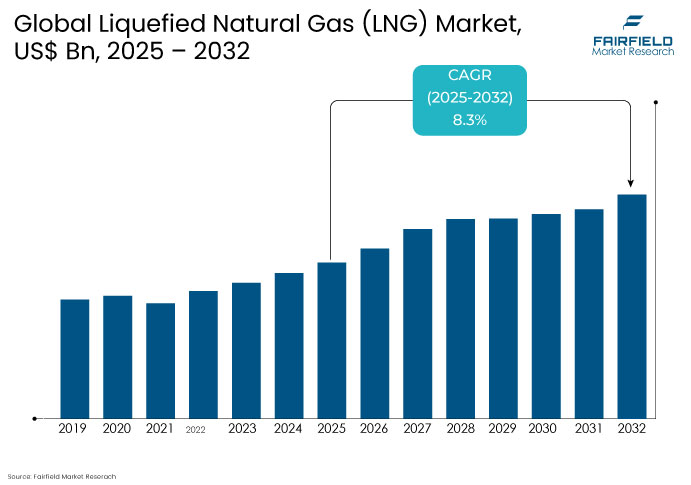

- The global Liquefied Natural Gas (LNG) market is projected to reach a valuation of US$ 126.1 Billion and is expected to expand at a CAGR of 8.3% from 2025 to 2032.

- This growth trajectory is anticipated to drive the market's valuation to US$ 220.3 Billion by 2032.

Liquefied Natural Gas (LNG) Market Insights

- The transition from coal to natural gas has contributed to a 14% emission reduction in the U.S. between 1995 and 2020, supporting decarbonization efforts.

- Global gas production rebounded by 0.7% in 2023, but geopolitical challenges caused significant declines in Russia (-5.5%) and Europe (-9.3%).

- Global electricity consumption is set to grow 3.4% annually by 2026, driving increased demand for natural gas in power generation.

- Volatile LNG prices and declining utilization of regasification terminals (41% in 2023) present challenges for sustained LNG growth.

- India's gas consumption is expected to grow 60% by 2030, positioning LNG as a critical component of its energy strategy.

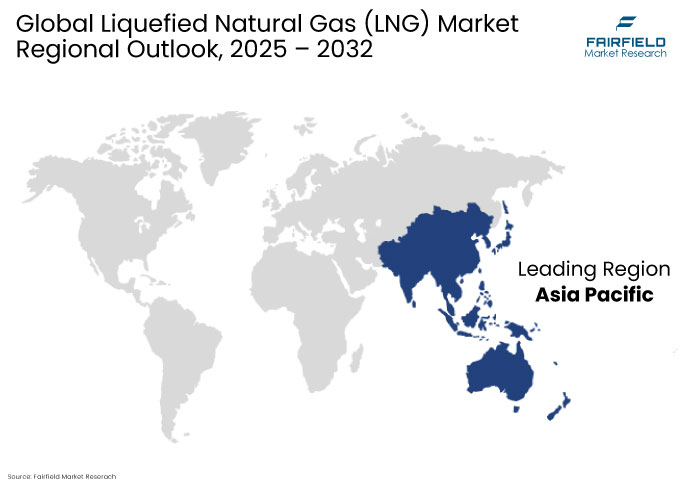

- Asia Pacific holds 55.6% of the LNG market in 2024, with strong demand from China, India, and Japan driving growth.

- Liquefied Natural Gas (LNG) adoption in the maritime sector surged by 33% in 2024, reflecting the growing reliance on LNG as an eco-friendly marine fuel.

- Major players like Gazprom, ExxonMobil, Chevron, and Eni drives market consolidation and innovation through strategic partnerships and technological advancements.

A Look Back and a Look Forward - Comparative Analysis

The global pivot toward cleaner energy fueled a major shift from coal, particularly in regions like the U.S., where this transition drove a 14% cut in emissions between 1995 and 2020. Natural gas emerged as a key solution, powering decarbonization while ensuring energy security in emerging markets. Infrastructure development and international alliances enabled broader access despite geopolitical headwinds. In 2022, global gas output dipped slightly by -0.1%, reflecting supply disruptions and market realignments.

In 2023, global gas production rebounded modestly by 0.7%, largely on the back of a 4.7% surge in U.S. output, maintaining its long-term growth pace. Declines of 5.5% in Russia and 9.3% in Europe, particularly a 34% plunge in the Netherlands, show the impact of geopolitical strains and field closures.

Growth in Asia and selective gains in Africa and Latin America offer optimism for balanced supply. Strategic investments in Liquefied Natural Gas (LNG) market's projects and regional partnerships continue to shape energy resilience and transition pathways.

Key Growth Determinants

- Rising Electricity Demand and Global Electrification Trends

Global electricity consumption is projected to increase at accelerated pace, contributing significantly to rising energy needs across both advanced and emerging economies. The continued electrification of residential and transport sectors, especially in countries like China and India, will drive up demand for power generation, which will largely rely on natural gas and renewables.

By 2026, global electricity consumption will grow by an average of 3.4% annually, bolstered by the rapid expansion of data centres, artificial intelligence, and electric vehicle sectors, all of which are significant energy consumers.

As electricity demand surges, the need for natural gas in power generation also rises, enhancing the role of Liquefied Natural Gas in meeting these energy requirements. While emerging economies, especially in Asia, will account for the majority of electricity demand growth, regions like the European Union and the United States will also see moderate increases driven by the adoption of energy-efficient technologies and electrification.

This growth trajectory in global energy demand is expected to create a favorable environment for the LNG market, positioning it as a key player in supporting the transition to cleaner, more sustainable power generation.

Key Growth Barriers

- Fluctuating Prices and Declining Utilization of Regasification Terminals

The severe fluctuations in global LNG prices in 2022 and 2023 have created challenges for market stability. Despite a significant decline in prices in 2023, the volatility in global pricing could hinder long-term investment in infrastructure and affect the economic viability of LNG for various applications.

While prices have become more favorable for Liquefied Natural Gas as a bunker fuel, the anticipated price increase in 2024 could dampen its competitiveness against other fuels, particularly when oil prices remain high. These price uncertainties remain a significant restraint for market participants who navigate a volatile energy landscape.

The growing global regasification capacity has not corresponded with a proportional increase in utilization, which declined from 43% in 2022 to 41% in 2023. A decrease in demand from key markets, including Europe and Asia Pacific, alongside the large number of new terminal start-ups, has pressured the efficiency of existing facilities.

This declining utilization highlights the mismatch between expanding infrastructure and actual market needs, presenting a restraint for continued LNG market growth as investments in new terminals may face diminishing returns.

Market Opportunity

- India's Expanding Energy Landscape Creates a Strategic Growth Avenue

India presents a compelling growth avenue as its gas consumption climbs steadily, rising over 10% in 2023 and 2024.

The nation’s demand is on track to grow nearly 60% by 2030, reaching 103 bcm annually, signaling an inflection point after years of stagnant growth. Rapid development of city gas networks and an expected 50% expansion in transmission pipelines bolster this momentum. Sectors such as refining, heavy industry, and urban transport increasingly turn to gas as a cleaner, competitive energy source.

Limited growth in domestic output means import dependence will intensify, requiring annual volumes to more than double by 2030. This surging need positions Liquefied Natural Gas as a critical enabler of India’s energy strategy, particularly as older long-term contracts near expiry. The transition opens doors for new supply agreements and infrastructure investments to ensure resilience and affordability. If India accelerates adoption through policy support, demand could even reach 120 bcm, surpassing current South American consumption levels.

Market Trend

- Natural Gas Emerges as a Key Bridge Fuel Amidst Global Surge in Electricity Consumption

Electricity consumption soared by 1,100 terawatt-hours in 2024, nearly double the previous decade’s annual average, pushing energy demand up by 2.2%. This sharp increase, driven by extreme heat, rising industrial use, and growing electrification of transport, reversed years of stagnation in advanced economies.

Emerging nations contributed over 80% to the global rise, while developed markets posted nearly 1% growth. The mounting demand have compelled the countries to turn to flexible, dispatchable sources to support grid reliability.

Among fossil fuels, natural gas registered the strongest absolute growth, adding 115 bcm in 2024, outpacing its average increase of 75 bcm over the past ten years. As renewables and nuclear dominated supply additions, natural gas-fired generation filled critical gaps in peak demand and system balancing. The trend reflects a broader realignment in energy portfolios as oil’s share fell below 30%, while electric vehicles captured one in five new car sales. This evolving mix underscores the timely role of Liquefied Natural Gas in enabling a smoother transition amidst global decarbonization efforts.

Segments Covered in the Report

- Rising Adoption of LNG as a Marine Fuel

Transportation fuel holds a market share of 18.2% in 2024, driven by the continued adoption of LNG in the maritime sector. The global fleet of LNG-fueled ships saw a 33% increase, reaching 638 vessels, demonstrating the growing reliance on LNG as an alternative marine fuel. This trend is primarily due to container ships and car carriers embracing LNG as a cost-effective, eco-friendly fuel option, particularly with its benefits in reducing emissions.

The number of LNG bunkering vessels has also expanded, with a 22% increase in 2024, totaling 60 ships. This growth in infrastructure supports the rising demand for LNG-powered vessels, reflecting an ongoing transition toward cleaner energy sources in the shipping industry. Shell’s delivery of 1.1 million tons of marine LNG further illustrates the expanding role of this fuel in global trade and the increasing importance of LNG in the energy transition, especially with global LNG consumption projected to surge by 60% by 2040.

- Growth and Expansion of Liquefaction Terminals in the Global LNG Market

Liquefaction terminals hold a market share of 33.7% in 2024, driven by the increasing demand for LNG across various industries, including power generation and transportation. The rapid growth in LNG export markets, particularly in regions such as North America and the Middle East, has fueled the need for more liquefaction capacity. The surge in global LNG demand and the expansion of LNG infrastructure are key drivers of this market segment.

The expansion of liquefaction terminals supports the growing role of LNG in global energy trade. Technological advancements and the rising focus on cleaner energy solutions contribute to the rising investment in liquefaction facilities. Increased export potential and operational efficiencies at these terminals further boost their market share in 2024.

Regional Analysis

- Asia Pacific Dominates Global Liquefied Natural Gas (LNG) Market Driven by Surging Demand, Strategic Imports, and Infrastructure Expansion

Asia Pacific holds the market share of 55.6% in 2024, driven by strong demand growth and strategic developments in major economies. China led global consumption, with natural gas use rising 7% in 2023 after a previous dip, fueled by economic recovery and a surge in residential, commercial, and power sector demand.

Imports met 42% of its needs, making China the world’s largest importer, sourcing mainly from Australia, Qatar, and Russia. Domestic output also surged 6%, supporting the country’s push toward its 2025 production targets.

India followed with a 20% jump in LNG imports in 2024, reaching a record 27 million tonnes as rising energy needs outpaced domestic supply. Projections show total gas demand climbing 60% by 2030, with LNG imports expected to more than double.

Japan, while seeing a gradual decline in LNG use, remains a key player, relying on its vast storage capacity and maintaining LNG in its energy mix amid nuclear restarts. Regional activity reflects a shift toward cleaner energy backed by infrastructure, policy support, and diversified supply sources.

- Europe's Liquefied Natural Gas (LNG) Market in 2024 Faces Demand Contraction Amid Renewable Surge and Infrastructure Overbuild

Europe holds a 15.6% market share in 2024, driven by aggressive energy transition policies and declining fossil fuel reliance. Imports dropped 19% as gas consumption reached its lowest point in over a decade, reflecting a shift toward renewables and efficiency gains.

Major importers like the UK, Belgium, and Spain saw respective declines of 47%, 29%, and 28%, dragging down regional demand. The dip follows efforts by EU nations to curb dependency on external gas sources while reshaping their energy mix.

Despite falling demand, Europe continues to build regasification terminals, with capacity expected to rise 60% between 2021 and 2030. Utilization, however, remains low-over half of the EU’s terminals operating below 40% capacity in 2024.

The U.S. maintained its position as the region’s top supplier, covering 46% of imports, although its shipments declined by 18%. Meanwhile, Russian gas deliveries rose unexpectedly, exposing strategic gaps and hinting at future demand volatility as the region adjusts to pipeline disruptions and fluctuating geopolitical dynamics.

Competitive Landscape

The global liquefied natural gas market operates in an oligopolistic structure, with major players like Gazprom, ExxonMobil, Chevron, and Eni dominating key markets. Gazprom has expanded its market presence by shifting focus to LNG supplies for marine transport, marking a significant milestone in response to geopolitical challenges. The company also emphasizes technological independence through its proprietary GMR technology, enhancing competitiveness in LNG production.

ExxonMobil's partnerships with Eagle LNG Partners and Crowley, alongside its joint ventures with QatarEnergy and significant investments in North Field East, highlight a strategic approach to expanding LNG production and market share.

Similarly, Chevron's acquisition of Noble Energy strengthens its position in the LNG space, particularly in offshore reserves, while Eni's focus on Floating LNG (FLNG) projects in Mozambique and Argentina further diversifies its portfolio. These developments demonstrate a competitive landscape were consolidation and technological advancements shape market dynamics.

Key Companies

- Gazprom

- ExxonMobil Corporation

- China National Petroleum Corporation (CNPC)

- Royal Dutch Shell PLC

- BP PLC

- Chevron Corporation

- Total S.A. (now TotalEnergies SE)

- Statoil ASA (now Equinor ASA)

- ConocoPhillips

- Eni S.p.A.

- EOG Resources

- Encana Corporation (now Ovintiv Inc.)

- Cimarex Energy (merged with Cabot Oil & Gas to form Coterra Energy)

- Exco Resources

- EQT Corporation

- Chesapeake Energy

- Hess Corporation

- SM Energy Company

- Anadarko Petroleum (acquired by Occidental Petroleum).

Recent Industry Developments

- In April 2025, Eni and YPF have signed a Memorandum of Understanding (MoU) to evaluate Eni’s involvement in the Argentina LNG project. The project, aimed at developing the Vaca Muerta gas field, plans to export up to 30 million tons per year (MTPA) of LNG by the decade’s end. The phase covered by the MoU focuses on upstream development, transportation, and liquefaction facilities using two Floating LNG units, each with a capacity of 6 MTPA. Eni’s expertise in FLNG projects in Congo and Mozambique positions it as a strategic partner in the development of the project.

- In June, 2023, ExxonMobil, Eagle LNG Partners, and Crowley signed an MoU to develop LNG as a marine fuel in North America, starting in Florida. ExxonMobil will provide technical expertise, Eagle LNG will supply and manage LNG production, and Crowley will oversee bunker logistics. The collaboration supports the IMO's global sulphur cap and promotes LNG adoption as a marine fuel.

Expert Opinion

- The Liquefied Natural Gas market is experiencing moderate growth, supported by rising electricity demand and increasing reliance on natural gas for cleaner energy, although challenges such as fluctuating prices and underutilized infrastructure persist.

- The future of the Liquefied Natural Gas market looks promising, with a key focus on expanding capacity in Asia Pacific, driven by increasing demand in China and India, while the maritime sector's shift to LNG as a fuel presents significant growth opportunities.

- LNG is expected to remain a key bridge fuel as global electrification and industrialization continue, especially in emerging markets, positioning LNG as essential for meeting power generation needs.

- Geopolitical tensions and supply chain disruptions could continue to pose risks, while the mismatch between infrastructure expansion and actual demand for LNG may hinder growth potential in certain regions.

Global Liquefied Natural Gas (LNG) Market is Segmented as-

By Infrastructure Type

- Liquefaction Terminals

- Regasification Terminals

- Storage Facilities

- LNG Carriers (Shipping)

By Application

- Power Generation

- Transportation Fuel

- Residential & Commercial

- Miscellaneous

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Liquefied Natural Gas (LNG) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Liquefied Natural Gas (LNG) Market Outlook, 2019 - 2032

3.1. Global Liquefied Natural Gas (LNG) Market Outlook, by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Liquefaction Terminals

3.1.1.2. Regasification Terminals

3.1.1.3. Storage Facilities

3.1.1.4. LNG Carriers (Shipping)

3.2. Global Liquefied Natural Gas (LNG) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Power Generation

3.2.1.2. Transportation Fuel

3.2.1.3. Residential & Commercial

3.2.1.4. Miscellaneous

3.3. Global Liquefied Natural Gas (LNG) Market Outlook, by Region, Value (US$ Bn) And Volume (Tons), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Liquefied Natural Gas (LNG) Market Outlook, 2019 - 2032

4.1. North America Liquefied Natural Gas (LNG) Market Outlook, by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Liquefaction Terminals

4.1.1.2. Regasification Terminals

4.1.1.3. Storage Facilities

4.1.1.4. LNG Carriers (Shipping)

4.2. North America Liquefied Natural Gas (LNG) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Power Generation

4.2.1.2. Transportation Fuel

4.2.1.3. Residential & Commercial

4.2.1.4. Miscellaneous

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Liquefied Natural Gas (LNG) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. U.S. Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

4.3.1.2. U.S. Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

4.3.1.3. Canada Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

4.3.1.4. Canada Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Liquefied Natural Gas (LNG) Market Outlook, 2019 - 2032

5.1. Europe Liquefied Natural Gas (LNG) Market Outlook, by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Liquefaction Terminals

5.1.1.2. Regasification Terminals

5.1.1.3. Storage Facilities

5.1.1.4. LNG Carriers (Shipping)

5.2. Europe Liquefied Natural Gas (LNG) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Power Generation

5.2.1.2. Transportation Fuel

5.2.1.3. Residential & Commercial

5.2.1.4. Miscellaneous

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Liquefied Natural Gas (LNG) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Germany Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.2. Germany Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.3. U.K. Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.4. U.K. Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.5. France Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.6. France Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.7. Italy Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.8. Italy Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.9. Spain Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.10. Spain Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.11. Turkiye Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.12. Turkiye Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.13. Russia Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.14. Russia Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.15. Rest of Europe Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.1.16. Rest of Europe Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Liquefied Natural Gas (LNG) Market Outlook, 2019 - 2032

6.1. Asia Pacific Liquefied Natural Gas (LNG) Market Outlook, by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Liquefaction Terminals

6.1.1.2. Regasification Terminals

6.1.1.3. Storage Facilities

6.1.1.4. LNG Carriers (Shipping)

6.2. Asia Pacific Liquefied Natural Gas (LNG) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Power Generation

6.2.1.2. Transportation Fuel

6.2.1.3. Residential & Commercial

6.2.1.4. Miscellaneous

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Liquefied Natural Gas (LNG) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. China Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.2. China Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.3. Japan Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.4. Japan Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.5. South Korea Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.6. South Korea Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.7. India Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.8. India Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.9. Southeast Asia Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.10. Southeast Asia Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.11. Rest of Asia Pacific Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.1.12. Rest of Asia Pacific Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Liquefied Natural Gas (LNG) Market Outlook, 2019 - 2032

7.1. Latin America Liquefied Natural Gas (LNG) Market Outlook, by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Liquefaction Terminals

7.1.1.2. Regasification Terminals

7.1.1.3. Storage Facilities

7.1.1.4. LNG Carriers (Shipping)

7.1.1.5. Misc (Ni-Si, etc,)

7.2. Latin America Liquefied Natural Gas (LNG) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Power Generation

7.2.1.2. Transportation Fuel

7.2.1.3. Residential & Commercial

7.2.1.4. Miscellaneous

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Liquefied Natural Gas (LNG) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Brazil Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.1.2. Brazil Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.1.3. Mexico Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.1.4. Mexico Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.1.5. Argentina Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.1.6. Argentina Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.1.7. Rest of Latin America Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.1.8. Rest of Latin America Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Liquefied Natural Gas (LNG) Market Outlook, 2019 - 2032

8.1. Middle East & Africa Liquefied Natural Gas (LNG) Market Outlook, by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Liquefaction Terminals

8.1.1.2. Regasification Terminals

8.1.1.3. Storage Facilities

8.1.1.4. LNG Carriers (Shipping)

8.2. Middle East & Africa Liquefied Natural Gas (LNG) Market Outlook, by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Power Generation

8.2.1.2. Transportation Fuel

8.2.1.3. Residential & Commercial

8.2.1.4. Miscellaneous

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Liquefied Natural Gas (LNG) Market Outlook, by Country, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. GCC Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.3.1.2. GCC Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.3.1.3. South Africa Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.3.1.4. South Africa Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.3.1.5. Rest of Middle East & Africa Liquefied Natural Gas (LNG) Market by Infrastructure Type, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.3.1.6. Rest of Middle East & Africa Liquefied Natural Gas (LNG) Market by Application, Value (US$ Bn) And Volume (Tons), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Application Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Gazprom

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. ExxonMobil Corporation

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. China National Petroleum Corporation (CNPC)

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Royal Dutch Shell PLC

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. BP PLC

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Chevron Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Total S.A. (now TotalEnergies SE)

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Statoil ASA (now Equinor ASA)

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. ConocoPhillips

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Eni S.p.A.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. EOG Resources

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Encana Corporation (now Ovintiv Inc.)

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Cimarex Energy (merged with Cabot Oil & Gas to form Coterra Energy)

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Exco Resources

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. EQT Corporation

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

9.4.16. Chesapeake Energy

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Development

9.4.17. Hess Corporation

9.4.17.1. Company Overview

9.4.17.2. Product Portfolio

9.4.17.3. Financial Overview

9.4.17.4. Business Strategies and Development

9.4.18. SM Energy Company

9.4.18.1. Company Overview

9.4.18.2. Product Portfolio

9.4.18.3. Financial Overview

9.4.18.4. Business Strategies and Development

9.4.19. Anadarko Petroleum (acquired by Occidental Petroleum).

9.4.19.1. Company Overview

9.4.19.2. Product Portfolio

9.4.19.3. Financial Overview

9.4.19.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Infrastructure Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |