Global Lyotropic Liquid Crystal Polymer Market Forecast

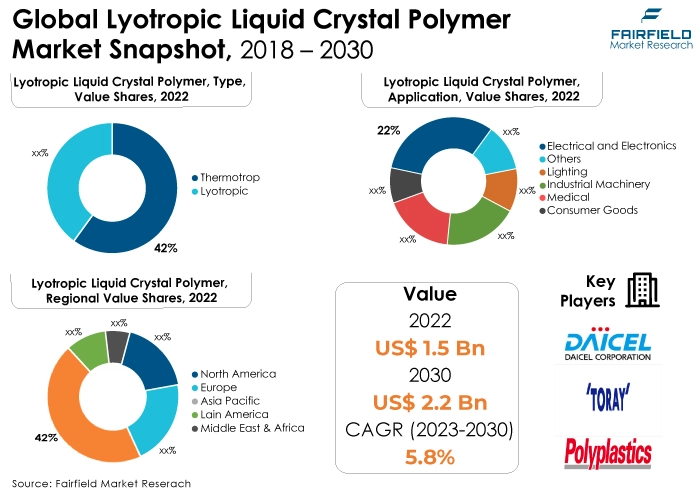

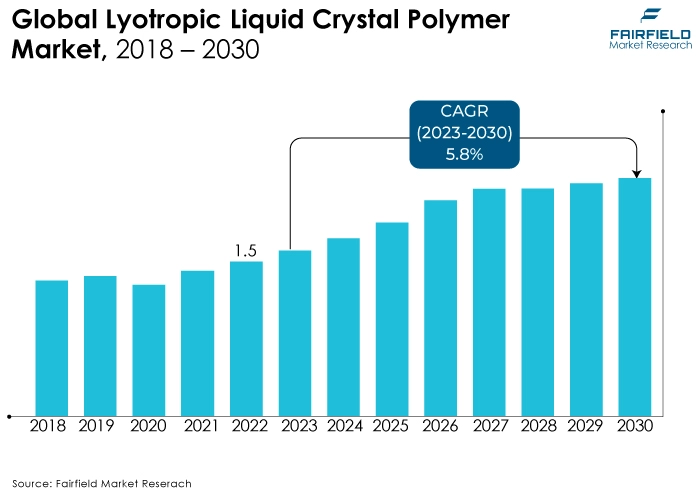

- The approximately US$1.5 Bn market for lyotropic liquid crystal polymers (2022) to reach US$2.2 Bn by 2030

- Lyotropic liquid crystal polymer market size poised to observe a CAGR of 5.8% over 2023 - 2030

Quick Report Digest

- One of the main trends in the market for lyotropic liquid crystal polymers is the advancement of technology, improvement of new product developments, and stimulation of auto components and OEM production.

- The lyotropic liquid crystal polymer market is likely to expand during the forecast period due to its numerous uses in automobile engineering, spatial light modulators, and other vehicle components.

- The development of intelligent polymers has also been aided by a rise in the output of OEM manufacturing equipment.

- The automotive components industry, for example, grew at a CAGR of 6% from FY16 to FY20, reaching US$49.3 Bn in FY20, and exports grew at a CAGR of 7.6% from FY16 to FY20, reaching US$14.5 Bn in FY20, as per a report introduced by the India Brand Equity Foundation in January 2021.

- The biggest revenue portion was accounted for the thermotropic type. Due to its great elastic behavior, low viscosity, and excellent thermal characteristics, it has these qualities.

- Owing to the increasing demand for electronic items, government approval for the introduction of electric vehicles, and the mature semiconductor manufacturing sector that has improved the performance of lyotropic liquid crystals, the electrical & electronics segment will account for the largest market share in 2022.

- The majority of the market is in Asia Pacific. The electrical and electronics industries are flourishing in nations like India, Japan, China, South Korea, and others, which will increase the need for lyotropic liquid crystal polymers in electronics for the production of fiber optic cables and PCB components.

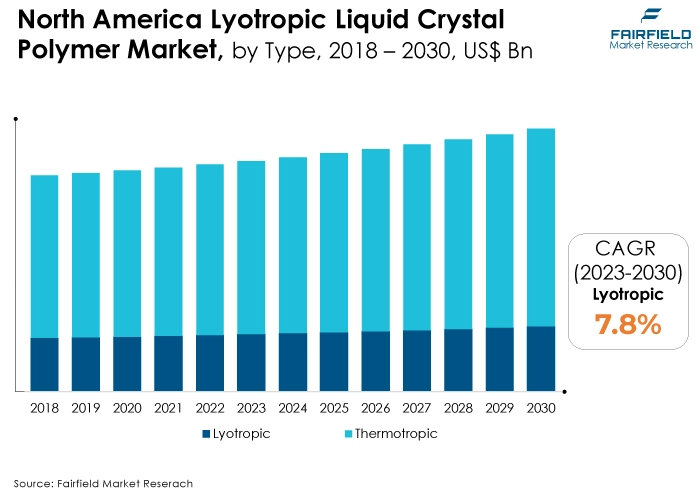

- Over the course of the predicted years, North America is anticipated to have a gradual expansion. The market is expected to grow as a result of the increasing initiatives for new goods and technologies.

A Look Back and a Look Forward - Comparative Analysis

The global industry for thermoplastic polymers is seeing significant growth potential. The primary thermoplastics for high-temperature applications in a variety of end-user sectors are LCPs. These are becoming more and more popular as an alternative to conventional materials because of their qualities, including high-temperature resistance and a higher weight-to-strength ratio, among others. As a result, the industry's growth prospects are being further improved by the new uses of LCPs.

Throughout the historical period of 2018 to 2022, the market had uneven growth. Smart polymers' biocompatibility and stability properties have grown in popularity in the biomedical industry, where they are employed in drug delivery systems, therapeutic agents, scaffolds for tissue engineering, bioseparation tools, sensors or actuator systems, and other applications. Sales of lyotropic liquid crystal polymers have risen as a result of these causes.

Additionally, several significant businesses are actively involved in producing cost-effective lyotropic liquid crystal polymers, where smart polymers based on biological and physical stimuli responses are used across variety of end-use industries. Together, these elements saw significant potential growth for smart polymers, providing lucrative market prospects.

Key Growth Determinants

- Increased Adoption of Microinjection Molding

The market for lyotropic liquid crystal polymers is expected to be driven by the rising global need for the miniaturisation of electronic and electrical components. Manufacturers are creating products with greater functions in a smaller compact thanks to the trend towards miniaturisation.

Because of LCP's advantages, including its superior stiffness, flow, mechanical strength, chemical resistance, dimensional stability, and temperature resistance, the electronics and electrical industry is increasingly moving towards miniaturisation.

LCPs are injection molded into custom electrical connectors, IC sockets, HF network switches, power modules for solar and wind converters & and inverters, and other precision devices for the same advantages. Therefore, it is projected that the growing popularity of microinjection molding will propel the growth of the lyotropic liquid crystal polymer business.

- Automobile Industry’s Rapid Expansion

The adoption of lyotropic liquid crystal polymers in the expanding automobile industry is what is driving the increase in demand for these materials. Both the manufacture and sales of cars have grown significantly in countries including the US, India, China, and Japan. The development of automobiles to meet the increasingly strict fuel economy regulations is the industry's global trend.

LCP has been employed in automotive parts like electrical, insulation, and combustion systems. It is resistant to chemicals, weathering, and radiation, and it can replace materials like ceramics, metals, and composites. By replacing heavy components in vehicle design with lightweight ones, these compounds help the automotive industry improve fuel economy and cut carbon emissions.

High-performance engineering polymers, and laminates are created by several businesses, including Celanese Corporation, and Toray Industries Inc., for use in automotive and aircraft parts. Consequently, it is anticipated that the growing number of cars will significantly increase the sales of LCPs used in car electronics.

- Increasing Demand for Biocompatible and Bioactive Polymers

Bioactive polymers are macromolecules with biological activity that can be used as drugs, pesticides, weed killers, and other things. Light-sensitive components used in the electronics sector can be made from economically viable biocompatible polymers.

By combining photosensitive materials with very viscous biocompatible fluids, the adhesion of these materials can be improved. This concoction is ideal for plastic exhibits. The dyes' biocompatible components are crucial to the surface's alignment.

Lyotropic liquid crystal polymer market share is therefore predicted to increase shortly due to the rise in demand for bioactive and biocompatible polymers.

Major Growth Barriers

- High Production Expenses

The key factor limiting the lyotropic liquid crystal polymers market expansion is the high cost of producing liquid crystal polymers. Lyotropic Liquid crystal polymers are more expensive than standard high-performance polymers.

Due to their lower cost, these polymers are less competitive than nylon, PPA, and ABS. Prices for generic nylon, and ABS are roughly one-fifth that of liquid crystal polymers, providing a cost advantage in electrical and electronic applications that need high-performance polymers to fill walls as thin as 0.25 mm at most. However, at the same time, these polymers can only be used in high-end applications, which limits market expansion.

- Inefficeint Raw Material Supply

However, a significant obstacle to the expansion of the lyotropic liquid crystal polymers market would be the deficiency in raw material supply brought on by the effects of lockdown and a lack of awareness in the developing nations.

The production technique' high costs and the widespread availability of replacements will slow the market's expansion for lyotropic liquid crystal polymers.

Key Trends and Opportunities to Look at

- Enhanced MRI Technology

MRI has been employed in the medical field for soft tissue visualisation for medical diagnosis and treatment. However, due to metal catheter components that are incompatible with MRI, procedures that call for catheterisation in MRI use X-ray to guide the catheter.

The strong tensile strength and autoclavability of LCPs, as well as their ability to replace metal catheter components, make them useful for reducing the radiation effect. Thus, the use of lyotropic liquid crystal polymers has been seen as a trend in the advancement of MRI technology.

- Advent of Technology

The increased demand for lyotropic liquid crystal polymers is being primarily driven by next-generation technologies like 5G, and 3D printing. With a wide range of applications, including electrical and electronics, automotive, consumer goods, sports, leisure, and medical equipment, the demand for lyotropic liquid crystal polymers is rising extremely quickly.

Additionally, the growing use of lyotropic liquid crystal polymer films in flexible solar cells is supporting market growth due to their superior heat resistance and minimal water absorption.

- Popularity of Thermoplastic Polymers

Thermoplastics are polymers with the ability to change from a solid state to a liquid one when heated and vice versa. Melting and freezing can happen repeatedly. This would make it possible to heat the plastic and reshape it.

The primary thermoplastics utilised for extreme temperature applications across a variety of end-use industries, including transportation, electrical & and electronics, medical, and others, are lyotropic liquid crystal polymers. They can be used for a variety of things, including packaging and storage materials, medical equipment, and machine parts for consumer items.

How Does the Regulatory Scenario Shape this Industry?

The performance of lyotropic liquid crystals has improved as a result of factors including the rising demand for electronic gadgets and government backing for the introduction of electric vehicles. For instance, from April 2000 to June 2022, computer software and hardware accounted for 88.94 billion dollars in FDI inflows into India. The market is anticipated to grow in the next years because of government assistance for the electronics sector.

In addition, on September 23, 2022, in Pittsburgh, during the 13th Clean Energy Ministerial, the EVI Zero Emission Government Fleet Declaration was made public. By increasing the introduction and use of zero-emission vehicles, in all vehicle classes, in their fleets, governments formally pledge to considerably decrease carbon and air pollutant emissions from vehicles and promote the clean transportation economy.

Furthermore, At the 12th Clean Energy Ministerial in June 2021, the EVI Call to Action was officially introduced. It is an appeal to close the gap between expected EV sales levels for 2030 based on current policies and the necessary global sales to comply with the standards of the Paris Agreement.

Fairfield’s Ranking Board

Top Segments

- Thermotropic Category Retains Dominant

The biggest revenue share is accounted for the thermotropic type. This is because it may be used across various electronic devices, including computers, tablets, and televisions. The process of converting anisotropic phases into thermotropic liquid crystal polymers (LCPs) produces liquid crystal phases. This has an impact on these molecules' shape and orientation.

In addition, this polymer has a high fiber content that results in good mechanical qualities as a result of self-reinforcing characteristics obtained from macromolecular orientation in the mesophase.

Furthermore, the Lyotropic category is projected to experience the fastest market growth. Lyotropic liquid crystal polymer has the potential to be used in a variety of end-use industries, including automotive, electronics, industrial, biotechnology, nuclear energy, and many more. It has features including resistance to heat, chemicals, and temperature. The usage of high-tech engineering applications is very widespread.

- Electrical and Electronics Sectors Represent the Prime End Users

In 2022, the electrical and electronics category dominated the industry. This is a result of the expanding worldwide electrical and electronics industry's increased demand for LCP. It is also projected that the growing demand for miniaturisation across the electronics industry will fuel the segment's expansion.

Among other advantages, LCP provides thin-wall flowability, exceptional processability, and great dimensional stability, which makes them appropriate for the current miniaturisation trend.

In the total lyotropic liquid crystal polymer sector, a rising CAGR is predicted for the medical market segment. The rising use of LCPs in the medical industry is responsible for the segment's rise.

LCP is a suitable replacement for conventional plastics and metals as producers experiment with novel materials for better medical equipment and gadgets. Typically, LCP takes the place of stainless steel in medical applications.

Regional Frontrunners

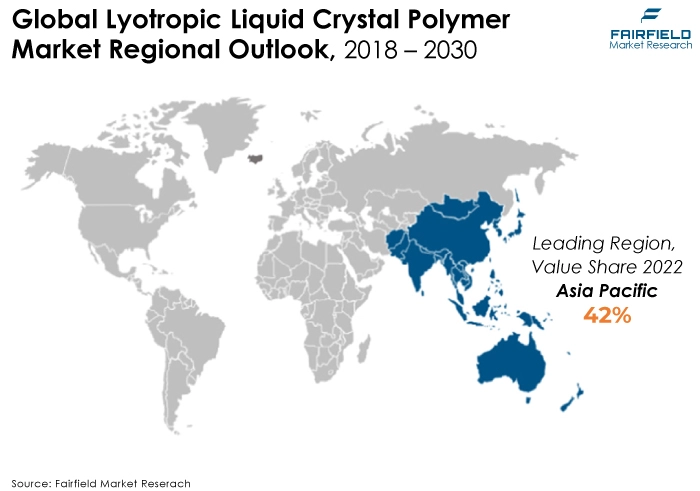

Asia Pacific Holds the Commanding Share

Geographically, Asia Pacific held the largest market shares in the lyotropic liquid crystal polymer market in 2022 and is anticipated to continue to do so during the anticipated period. The sizeable market share in the region can be ascribed to the escalating demand from end-use industries throughout developing countries, including, among others, India, China, and Japan.

One of the world's biggest makers of electronics, China puts up a fight against the established industry titans. Furthermore, the demand for electronic devices is reportedly rising as a result of expanding disposable incomes, which is predicted to further increase market demand. Therefore, it is projected that the regional market will be driven by rising local demand and reasonably priced manufacturing facilities.

North America’s Market Attractiveness on the Rise

Furthermore, over the course of the predicted years, North America is anticipated to have a gradual expansion. The market is expected to grow as a result of the increasing initiatives for new goods and technologies.

The area is a pioneer in the adoption of cutting-edge technology including 5G and 3D printing. It is predicted that the adoption of these cutting-edge technologies would offer fantastic chances for market expansion.

Furthermore, it is projected that the demand for lyotropic liquid crystal polymer in the region will be driven by the expansion of the automotive sector and the increased need for high-performance, lightweight materials in the sector.

Fairfield’s Competitive Landscape Analysis

The lyotropic liquid crystal polymer market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Lyotropic Liquid Crystal Polymer Space?

- Asia International Enterprise (HK) Limited

- Avaient

- BASF AG

- Chang Chun Plastics Co. Ltd.

- Celanese Corporation

- Daicel Corporation

- Kuraray Co. Ltd

- Polyplastics Co. Ltd.

- Rogers Corporation

- RTP Company

- Shanghai Pret Composites Co., Ltd.

- Solvay SA

- Sumitomo Chemicals Co. Ltd.

- Toray Industries, Inc.

- Ueno Fine Chemicals Industry Limited

Significant Company Developments

New Product Launches

- January 2021: To support the rapid expansion of its high-value Vectra and Zenite LCP product lines, Celanese Corporation announced its intention to construct a multi-phase, global Liquid Crystal Polymer (LCP) polymerisation plant in China.

- September 2021: A new product launch was announced by Polyplastics Co. Additionally, this corporation is constructing a new polymer facility in Taiwan. This will likely lead to a bigger increase in market production. More than 5,000 tonnes of polymer crystals will be produced by the company.

- July 2019: Three novel LCPs with the names SumikaSuper E6205L, SumikaSuper SR1205L, and SumikaSuper SZ6911EM were introduced by Sumitomo Chemical. These brand-new LCPs are specially made for high-speed connectors like backplanes and infotainment connectors for automobiles.

- May 2018: Crystallin technology from Light Polymers was announced for upcoming micro and mini LED display applications. Crystallin will hasten the adoption of micro and mini LEDs in laptops, automobiles, desktop displays, and industrial display applications thanks to its award-winning lyotropic liquid crystal technology.

An Expert’s Eye

Demand and Future Growth

The data on the global lyotropic liquid crystal polymers market are being driven by expansion in end-use sectors including the automobile, electronics, and industrial machines. minimal melt viscosity, strong solvent resistance, quick cycle times, and minimal flammability are just a few of the distinctive qualities that LCP offers.

Shortly, it is projected that the growing acceptance of miniaturised electronic components will support the expansion of the LCP market. However, during the anticipated term, market growth is predicted to be hampered by these materials' high production costs.

Supply Side of the Market

According to our analysis, The lyotropic liquid crystal polymer has good thermal properties together with strong flexibility and low viscosity. Thermotropic liquid crystal polymers are well-known polymers due to their wide use in electronic goods including tablets, flat-screen televisions, and laptop computers.

Additionally, the annual production capacity of lyotropic liquid crystal polymers is now around 78,000 tonnes worldwide. It is mainly found in China, Japan, and the US. About 80% of the world's total production capacity is held by corporations with headquarters in the US, and Japan, with China making up the remaining 20%.

The LCPs are also utilised in numerous optical fiber applications. The subsea cable that will be installed on the Arctic seabed and connect Europe to Japan via North America will get its first investment of US$1.15 Bn as of December 2022.

Global Lyotropic Liquid Crystal Polymer Market is Segmented as Below:

By Type:

- Thermotropic

- Lyotropic

By Application:

- Electrical and Electronics

- Industrial Machinery

- Consumer Goods

- Lighting

- Medical

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & and Africa

1. Executive Summary

1.1. Global Lyotropic Liquid Crystal Polymer Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Lyotropics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Lyotropic Liquid Crystal Polymer Market Outlook, 2018 - 2030

3.1. Global Lyotropic Liquid Crystal Polymer Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Thermotropic

3.1.1.2. Lyotropic

3.2. Global Lyotropic Liquid Crystal Polymer Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Electrical and Electronics

3.2.1.2. Industrial Machinery

3.2.1.3. Consumer goods

3.2.1.4. Lighting

3.2.1.5. Medical

3.2.1.6. Others

3.3. Global Lyotropic Liquid Crystal Polymer Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Lyotropic Liquid Crystal Polymer Market Outlook, 2018 - 2030

4.1. North America Lyotropic Liquid Crystal Polymer Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Thermotropic

4.1.1.2. Lyotropic

4.2. North America Lyotropic Liquid Crystal Polymer Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Electrical and Electronics

4.2.1.2. Industrial Machinery

4.2.1.3. Consumer goods

4.2.1.4. Lighting

4.2.1.5. Medical

4.2.1.6. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Lyotropic Liquid Crystal Polymer Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Lyotropic Liquid Crystal Polymer Market Outlook, 2018 - 2030

5.1. Europe Lyotropic Liquid Crystal Polymer Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Thermotropic

5.1.1.2. Lyotropic

5.2. Europe Lyotropic Liquid Crystal Polymer Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Electrical and Electronics

5.2.1.2. Industrial Machinery

5.2.1.3. Consumer goods

5.2.1.4. Lighting

5.2.1.5. Medical

5.2.1.6. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Lyotropic Liquid Crystal Polymer Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Lyotropic Liquid Crystal Polymer Market Outlook, 2018 - 2030

6.1. Asia Pacific Lyotropic Liquid Crystal Polymer Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Thermotropic

6.1.1.2. Lyotropic

6.2. Asia Pacific Lyotropic Liquid Crystal Polymer Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Electrical and Electronics

6.2.1.2. Industrial Machinery

6.2.1.3. Consumer goods

6.2.1.4. Lighting

6.2.1.5. Medical

6.2.1.6. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Lyotropic Liquid Crystal Polymer Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Lyotropic Liquid Crystal Polymer Market Outlook, 2018 - 2030

7.1. Latin America Lyotropic Liquid Crystal Polymer Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Thermotropic

7.1.1.2. Lyotropic

7.2. Latin America Lyotropic Liquid Crystal Polymer Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Electrical and Electronics

7.2.1.2. Industrial Machinery

7.2.1.3. Consumer goods

7.2.1.4. Lighting

7.2.1.5. Medical

7.2.1.6. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Lyotropic Liquid Crystal Polymer Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Lyotropic Liquid Crystal Polymer Market Outlook, 2018 - 2030

8.1. Middle East & Africa Lyotropic Liquid Crystal Polymer Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Thermotropic

8.1.1.2. Lyotropic

8.2. Middle East & Africa Lyotropic Liquid Crystal Polymer Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Electrical and Electronics

8.2.1.2. Industrial Machinery

8.2.1.3. Consumer goods

8.2.1.4. Lighting

8.2.1.5. Medical

8.2.1.6. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Lyotropic Liquid Crystal Polymer Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Lyotropic Liquid Crystal Polymer Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Lyotropic Liquid Crystal Polymer Market Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs. Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Asia International Enterprise (HK) Limited.

9.5.2. BASF AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Chang Chun Plastics Co. Ltd

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Celanese Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Daicel Corporation.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Kuraray Co. Ltd.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Avaient.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Polyplastics Co. Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Rogers Corporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. RTP Company.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Shanghai Pret Composites Co., Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Solvay SA.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Sumitomo Chemicals Co. Ltd.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Toray Industries, Inc.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Ueno Fine Chemicals Industry Limited

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |