Global MEMS Oscillator Market Forecast

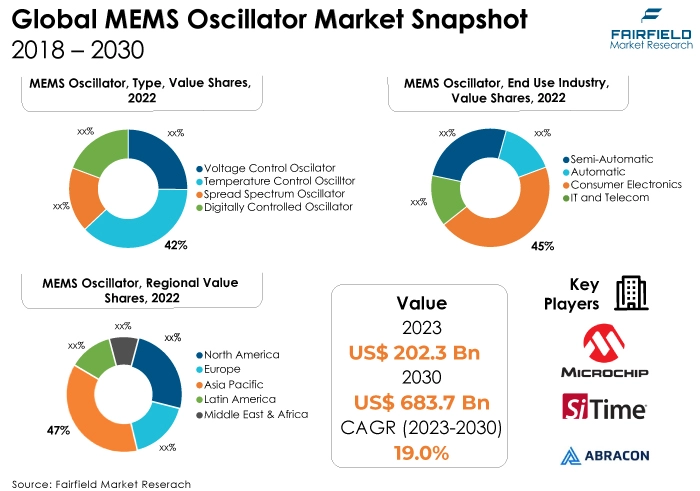

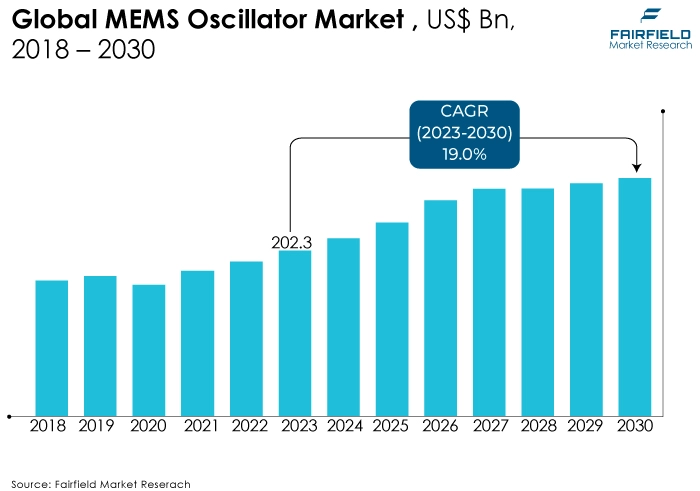

- The approximately US$202.3 Bn market for MEMS oscillators (2022) expects to reach US$683.7 Bn by 2030

- MEMS oscillator market size likely to expand at a CAGR 19% during 2023 - 2030

Quick Report Digest

- The global micro-electro-mechanical systems (MEMS) oscillator market is accelerating due to increased demand for products from end-use industries worldwide. One of the main reasons propelling the global MEMS oscillator market's expansion is the ongoing technological progress.

- The market is expanding more quickly due to the rapid development of mobile infrastructure, electronic wearables, and the Internet of Things, as well as the increased need for high-precision timing components that can be customised in different sizes for portable devices.

- In 2022, the temperature control oscillator category dominated the industry. Temperature-compensated crystal oscillators (TCXOs) are generally the better option when a precise frequency source at a reasonable cost is required in a limited space.

- In terms of market share for MEMS oscillators globally, the consumer electronics segment is anticipated to dominate. All electronic components, especially oscillators, need to reduce their energy consumption and environmental impact due to the growing popularity of wearable and portable electronics.

- MEMS-based oscillators are becoming increasingly common in clock circuits because they provide precise frequency production at a low power consumption.

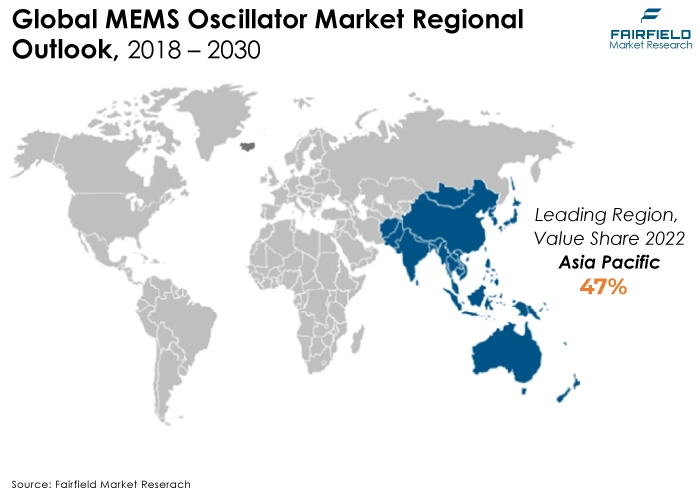

- The Asia Pacific region is anticipated to account for the largest global MEMS oscillator market share. Market participants here are majorly benefiting from the increasing demand for wearable technology, which includes fitness activities, smart watches, medical monitoring devices, etc.

- The market for MEMS oscillators is expanding in North America. In addition to having a sizable market share, North America is one of the world's leading inventors and pioneers in adopting new technologies.

A Look Back and a Look Forward - Comparative Analysis

The market for MEMS oscillators is expected to grow due to the increasing demand for electronic device miniaturization, enhanced functionality, and improved performance. These factors, along with the surge in adoption of these oscillators in various applications within the consumer electronics goods, networking industry, and consumer electronic gadgets like tablets, wearables, industrial GPS satellites, data cards, and mobile phones.

The market witnessed staggered growth during the historical period 2018 – 2022. The desire for greater features, smaller electronic devices, and increased performance are key factors anticipated to support the industry's growth in the upcoming years. Additionally, MEMS-based oscillators' high ruggedness, dependability, affordability, and miniaturization contribute to the market's growth.

The demand for more affordable, power-efficient, and compact solutions increased with the widespread use of smartphones, tablets, and wearable technology. Traditional quartz crystal oscillators have a strong competitor in MEMS oscillators. The needs of consumer and mobile electronics producers are aligned by reduced power consumption, increased dependability, and the demand for miniaturization.

The emergence of IoT led to an explosion of linked devices in several industries, including smart homes, transportation, healthcare, and industrial automation. These applications required tiny timing components that could function in various settings.

Key Growth Determinants

- Explosion of Smartphone Sales

The increasing number of people using smartphones for various applications is predicted to drive significant growth in the worldwide MEMS oscillator market in the upcoming years. MEMS oscillators are dependable, low-power, and high-performance timing devices that can be used in smartphones.

Additionally, MEMS oscillators may be manufactured and integrated more easily because they are compatible with regular semiconductor techniques. As a result, the need for MEMS oscillators will rise in the near future due to the growing use of smartphones.

- Progress in Silicon-Based Production and Packaging Methods

Much research and development has been done recently to find ways to mitigate the drawbacks of quartz oscillators. Micro-electromechanical system-based oscillators have gained traction as a possible substitute for quartz oscillators in recent years.

In recent years, advances in silicon-based manufacturing and packaging techniques have made it feasible to produce suitable alternatives to quartz crystal technology. Silicon MEMS is considered a superior process technology for resonator design.

- Global Growth in the Market for Goods from End-use Industries

A timing device known as a MEMS oscillator contributes to creating incredibly stable reference frequencies used in moment measurement. These comparative frequencies are widely used to manage information exchange, evaluate timing, characterise radio frequencies, and place orders for electronic goods.

In addition to having a wide frequency range of operation, MEMS and silicon-based technologies also exhibit low sensitivity to frequency jumps and great resistance to temperature fluctuations, vibration, and mechanical stress. Thus, this technique has been useful in creating programmable, robust, high-performing, small-sized timing solutions.

Major Growth Barriers

- Robust Designs Resulting in Exorbitant R&D Expenses

A crystal oscillator uses a short oscillator circuit and a quartz crystal reference. A MEMS oscillator is necessary for a PLL circuit, which uses a silicon resonator as its oscillation source and modifies its temperature coefficient and frequency to accommodate manufacturing faults. These simple structures demonstrate that the purpose of crystal oscillators is to function as precise clocks.

Compared to traditional crystal oscillators, MEMS oscillators are produced more efficiently. However, it depends on unconventional techniques for manufacturing semiconductor wafers, which are not frequently employed in the sector. As a result, there are fewer possibilities for production, and it isn't easy to plan for business continuity. These factors are driving up the R&D expenses associated with the development of MEMS oscillators.

Key Trends and Opportunities to Look at

- Developments in MEMS Oscillator Technology

MEMS oscillators use MEMS technology to produce precise and steady frequencies. Compared to conventional quartz crystal oscillators, they offer several benefits, including reduced size, lower power consumption, increased dependability, and improved performance in challenging conditions.

Recent developments in MEMS oscillator technology have opened up new industries and applications, including industrial automation, 5G connectivity, automotive electronics, and the Internet of Things (IoT).

Some of the major improvements include improved fabrication procedures, creative resonator designs, integrated phase noise reduction strategies, and improved temperature compensation techniques. As a result of these developments, MEMS oscillators are now more affordable, have a larger frequency range, have less jitter, and have improved frequency stability.

- Proliferation of Wearable and Portable Electronics

All electronic components, especially oscillators, need to reduce their energy consumption and environmental impact due to the growing popularity of wearable and portable electronics. MEMS-based oscillators are becoming increasingly common in clock circuits because they provide precise frequency production at a low power consumption.

- Growing Interest in New Automobile Applications

Modern cars require customized timing solutions for their driver assistance systems (ADAS). Some solutions include radar, LiDAR, in-car networks, onboard cameras, ultrasonic sensing systems, and more. Even though MEMS oscillators have been created and utilized extensively for automotive applications over the past ten years, the demand for time-synchronizing devices like MEMS oscillators in the automotive sector is increasing due to the growing use of ADAS systems for autonomous or self-driving cars.

How Does the Regulatory Scenario Shape this Industry?

Regulations governing MEMS oscillators vary based on the use and the area in which they are sold. Among the important rules are RoHS Regulation: This rule from the European Union limits the use of several dangerous materials in electronic devices. RoHS compliance is required for MEMS oscillators to be sold in the EU.

As per the EU’s REACH rule, manufacturers are required to register and monitor the use of certain chemicals. MEMS oscillators may include substances covered by REACH. The Federal Communications Commission of the US has established limits on the radio frequency emissions of electronic devices under FCC Part 15. MEMS oscillators sold in the US must adhere to Part 15.

Fairfield’s Ranking Board

Top Segments

- Temperature Control Oscillator Category Continues to Dominate over Spread Spectrum Oscillator Segment

The temperature control oscillator segment dominated the market in 2022. Temperature-compensated crystal oscillators (TCXOs) are generally the better option when a precise frequency source at a reasonable cost is required in a limited space.

In recent years, the market has experienced enormous growth and manufacturer investment. Because of this, many companies are available on the market, offering a large variety of TCXO in various packages and mounts. The optimal TCXO for an application is chosen based on a few essential criteria, such as output format and level, power dissipation, power needs, TCXO packaging, and stability performance.

Furthermore, the spread spectrum oscillator category is projected to experience the fastest market growth. The Spread Spectrum Oscillator (SSXO) modifies and synthesizes based on the input crystal frequency using Spread-Spectrum Clock Generator (SSCG) technology. Lowering the observed radiated energy at the fundamental and harmonic frequencies satisfies the Electro Magnetic Compliance (EMC) requirement.

The internal factory set-up function makes an adjustable selection of spread ratios, modulation rates, and output frequencies possible. Multifunction printers, media players, wired and wireless networking equipment, LCD panels, smart TVs, home appliances, industrial motors, and video surveillance are a few of the primary uses for SSXO.

- Consumption Maximum in Consumer Electronics, Demand Surge Expected in Automotive Industry

In 2022, the consumer electronics category dominated the industry. Oscillators are electronic circuits that use the mechanical resonance of a vibrating crystal (a piezoelectric material) to produce an electrical signal at a specific frequency. MEMS oscillators are programmable architecture-based timing systems in their entirety. It also experiences high demand, supported by the miniaturization of electronic devices, increased performance, and better usefulness.

An oscillator regulates oscillation, which is the periodic variation in two variables caused by changes in energy. MEMS oscillators are used in various technologies, including mobile systems, computers, smartwatches, etc.

The automotive category is anticipated to grow substantially throughout the projected period. Reliability is the most frequent and significant worry of automakers and the vendors of vehicle electronic systems. The market is expanding due to the increasing use of MEMS oscillators to achieve the proper frequency, withstand higher levels of vibration and shock, and maintain production cleanliness.

Because MEMS oscillators are produced using an IC fabrication method, they share the same high level of cleanliness as other ICs and offer 500 times better shock tolerance, 20 times higher dependability, and superior vibration resistance compared to standard crystal oscillator devices.

Furthermore, MEMS oscillators' ability to meet automotive requirements-such as the necessity for reduced packaging and the capacity to maintain frequency stability at extremely high temperatures-is eventually turning into another motivating factor in

Regional Frontrunners

Massive Growth of Consumer Electronics and Auto Industries Position Asia Pacific as the Epicentre of Activity

The main driving forces behind the market's expansion are nations like China, Japan, India, and South Korea. The growth is explained by the region's automobile industry's increasing use of MEMS oscillators. The market is expanding due to major automotive manufacturing nations like China, India, and Japan, as well as new uses for wearable technology.

North America Significant as the US Houses One of the Largest Wearables Markets

Maxim Integrated Products Inc., Microchip Technology Inc., and SiTime Corporation are local producers of MEMS-based solid oscillators that substantially impact the MEMS-based oscillator market. To counter the growing market competition, and erratic demand for these oscillators, vendors are utilising a variety of strategies, including introducing new products. The US is one of the largest wearable electronics marketplaces in the world and is renowned for being the epicenter of significant global technological advancements.

Fairfield’s Competitive Landscape Analysis

Large-scale suppliers with significant revenue-generating potential and the ability to integrate backward and forward are present in the MEMS-based oscillator industry. The market under investigation is extremely consolidated, and vendors invest more in R&D to advance their technological skills and obtain a competitive advantage over rival businesses. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in Global MEMS Oscillator Space?

- Microchip Technology Inc.

- HMI Frequency Technology

- Abracon LLC

- SiTime Corporation

- Daishinku Corporation

- Rakon Limited

- Maxim Integrated Products Inc.

- TXC Corporation

- Shenzhen Yangxing Technology Co. Ltd.

Significant Company Developments

New Product Launch

- November 2022: SiTime Corp. declared the SiT5503 Elite XTM to be available. The new device improves scheduling efficiency in 5G infrastructure and data centers by reducing latency.

- September 2022: SiTime Corporation showcased a novel range of automotive oscillators utilizing their advanced MEMS technology. The ADAS is reliable even in extreme driving conditions and temperatures because the revised differential oscillators are ten times more resilient. With the release of the AEC-Q100 SiT9396/7, the newest automotive oscillator, the SiTime serviced available market (SAM) has been expanded by USD 50 million.

Acquisition

- July 2022: Abracon LLC (Abracon) declared its acquisition by Genstar Capital. Genstar, a private equity business, specializes in investments in specific markets within the software, healthcare, financial services, and industrial sectors.

An Expert’s Eye

Demand and Future Growth

The global demand for the product from end-use industries is driving the market. Growing usage of smartphones, progress in silicon-based production and packaging methods, and global growth in the market for goods from end-use industries are increasing the need for MEMS oscillators.

Furthermore, developments in mems oscillator technology, the proliferation of wearable and portable electronics, and growing interest in new automobile applications. However, robust designs resulting in exorbitant R&D expenses are hindering market expansion.

Supply Side of the Market

According to our analysis, the frequent releases of new consumer electronics products are expected to drive the market for MEMS-based oscillators. With applications spanning smartphones and wearables, a significant increase in MEMS-based oscillators is predicted to produce smaller, lower-power Internet of Things devices.

The growing number of gadgets provided annually indicates that activity trackers are currently in higher demand in the consumer markets, followed by smartwatches, wearable cameras, and smart glasses. The enhanced MEMS technology in these devices simplifies timing and wireless communication options.

Advances in MEMS timing technology also significantly reduce power and physical area requirements in wearable applications while improving dependability. With the advent of 5G networks, there will likely be a greater need in consumer markets for smaller, higher frequency capable, and less timing slop-based MEMS oscillators for consumer electronics. Furthermore, it is projected that the growing prevalence of linked wearable technology will support market growth.

Global MEMS Oscillator Market is Segmented as Below:

By Type:

- Voltage Control Oscilator

- Temperature Control Oscillator

- Spread Spectrum Oscillator

- Digitally Controlled Oscillator

By End-use Industry:

- Automotive

- Aerospace & Defense

- Consumer Electronics

- IT and Telecom

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global MEMS Oscillator Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global MEMS Oscillator Market Outlook, 2018 - 2030

3.1. Global MEMS Oscillator Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Voltage Control Oscilator

3.1.1.2. Temperature Control Oscilltor

3.1.1.3. Spread Spectrum Oscillator

3.1.1.4. Digitally Controlled Oscillator

3.2. Global MEMS Oscillator Market Outlook, by End Use Industry, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Automotive

3.2.1.2. Aerospace & Defense

3.2.1.3. Consumer Electronics

3.2.1.4. IT and Telecom

3.3. Global MEMS Oscillator Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America MEMS Oscillator Market Outlook, 2018 - 2030

4.1. North America MEMS Oscillator Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Voltage Control Oscilator

4.1.1.2. Temperature Control Oscilltor

4.1.1.3. Spread Spectrum Oscillator

4.1.1.4. Digitally Controlled Oscillator

4.2. North America MEMS Oscillator Market Outlook, by End Use Industry, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Automotive

4.2.1.2. Aerospace & Defense

4.2.1.3. Consumer Electronics

4.2.1.4. IT and Telecom

4.3. North America MEMS Oscillator Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe MEMS Oscillator Market Outlook, 2018 - 2030

5.1. Europe MEMS Oscillator Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Voltage Control Oscilator

5.1.1.2. Temperature Control Oscilltor

5.1.1.3. Spread Spectrum Oscillator

5.1.1.4. Digitally Controlled Oscillator

5.2. Europe MEMS Oscillator Market Outlook, by End Use Industry, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Automotive

5.2.1.2. Aerospace & Defense

5.2.1.3. Consumer Electronics

5.2.1.4. IT and Telecom

5.3. Europe MEMS Oscillator Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

5.3.1.5. France MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific MEMS Oscillator Market Outlook, 2018 - 2030

6.1. Asia Pacific MEMS Oscillator Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Voltage Control Oscilator

6.1.1.2. Temperature Control Oscilltor

6.1.1.3. Spread Spectrum Oscillator

6.1.1.4. Digitally Controlled Oscillator

6.2. Asia Pacific MEMS Oscillator Market Outlook, by End Use Industry, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Automotive

6.2.1.2. Aerospace & Defense

6.2.1.3. Consumer Electronics

6.2.1.4. IT and Telecom

6.3. Asia Pacific MEMS Oscillator Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

6.3.1.7. India MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

6.3.2. Attractiveness Analysis

7. Latin America MEMS Oscillator Market Outlook, 2018 - 2030

7.1. Latin America MEMS Oscillator Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Voltage Control Oscilator

7.1.1.2. Temperature Control Oscilltor

7.1.1.3. Spread Spectrum Oscillator

7.1.1.4. Digitally Controlled Oscillator

7.2. Latin America MEMS Oscillator Market Outlook, by End Use Industry, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Automotive

7.2.1.2. Aerospace & Defense

7.2.1.3. Consumer Electronics

7.2.1.4. IT and Telecom

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America MEMS Oscillator Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa MEMS Oscillator Market Outlook, 2018 - 2030

8.1. Middle East & Africa MEMS Oscillator Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Voltage Control Oscilator

8.1.1.2. Temperature Control Oscilltor

8.1.1.3. Spread Spectrum Oscillator

8.1.1.4. Digitally Controlled Oscillator

8.2. Middle East & Africa MEMS Oscillator Market Outlook, by End Use Industry, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Automotive

8.2.1.2. Aerospace & Defense

8.2.1.3. Consumer Electronics

8.2.1.4. IT and Telecom

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa MEMS Oscillator Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa MEMS Oscillator Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa MEMS Oscillator Market End Use Industry, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Microchip Technology Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. HMI Frequency Technology

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Abracon LLC

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. SiTime Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Daishinku Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Rakon Limited

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Maxim Integrated Products Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. TXC Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Shenzhen Yangxing Technology Co. Ltd.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |