Global Oil & Gas Cybersecurity Market Forecast

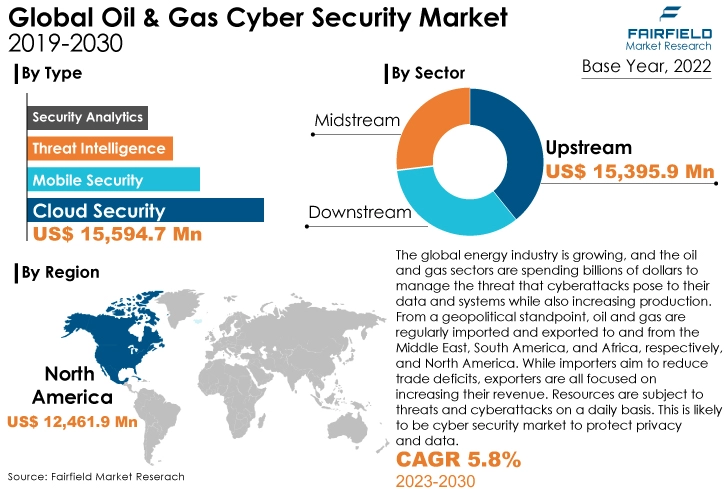

- Global demand for oil & gas cybersecurity services and solutions poised to witness a CAGR of 5.8% during 2023 - 2030

- Oil & gas cybersecurity market size likely to rise high through 2030, reaching US$44.2 Bn

Quick Report Digest

- As the industry continues to embrace digitalisation and faces evolving threats, the demand for robust cybersecurity solutions is expected to grow.

- OMV, ExxonMobil, and Equinor are leaders in cybersecurity adoption within the oil & gas industry.

- Siemens Energy, RigNet, Fortinet, Forescout, Mission Secure, Sectrio, Kognitiv Spark, XONA, Darktrace, and EY are some of the leading vendors of cybersecurity to the Oil & Gas industry.

- Oil and gas companies are channelling substantial investments into cybersecurity to shield themselves from cyber threats and attacks. As critical components of national infrastructure, they are prime objectives for cybercriminals, with potential attacks carrying significant disruption and extortion possibilities.

- The preservation of strong cybersecurity measures is imperative for ensuring the safe and dependable functioning of oil and gas firms. Furthermore, the expanding digitalisation in the industry presents a double-edged sword, offering both advantages and threats.

- The oil and gas cybersecurity market is witnessing trends such as IT/OT convergence, AI and ML-based threat detection, supply chain security, cloud security, threat intelligence sharing, workforce training, compliance-as-a-service, and threat hunting services.

- Demand for cloud security remains the highest, accounting for more than 55% market share.

- The upstream oil and gas sector will continue to be the major consumer of oil & gas cybersecurity solutions through 2030.

- Demand for services is higher than that for hardware or software.

- North America, and Europe hold a collective revenue share of more than 70%, in the global oil & gas cybersecurity industry.

Major Growth Drivers

Critical Need for Confidential Data Protection and Privacy

The global energy industry is growing, and the oil and gas sectors are spending billions of dollars to manage the threat that cyberattacks pose to their data and systems while also increasing production. From a geopolitical standpoint, oil and gas are regularly imported and exported to and from the Middle East, South America, and Africa, respectively, and North America. While importers aim to reduce trade deficits, exporters are all focused on increasing their revenue. Resources are regularly imported and exported, making them susceptible to danger and cyberattacks.

Cyberattacks in the oil and gas industry have escalated globally. This has sparked worries about the security of several private information, including bid data, privileged documents, and legal documents. Production sharing contracts (PSC), leasing block diagrams, project planning documents, and functional and operational data are only a few of the data that are still vulnerable to cyberattacks and can be used to win significant bids. This has led to the worldwide oil and gas industries' demand for a cybersecurity system.

Increased Digitalisation

The oil and gas industry is undergoing a digital transformation to enhance efficiency and reduce operational costs. This includes the widespread adoption of Internet of Things (IoT) devices, remote monitoring, automation, and data analytics.

However, the proliferation of these digital assets has expanded the attack surface for cyber threats. As a result, the demand for comprehensive cybersecurity solutions has grown significantly.

Companies are investing in securing their digital infrastructure, including supervisory control and data acquisition (SCADA) systems, to mitigate the risks associated with increased digitalisation.

Rising Cyber Threats

The oil and gas industry is increasingly vulnerable to cyber threats due to its critical infrastructure, making it a prime target for malicious actors. The frequency and sophistication of cyberattacks, including ransomware, supply chain attacks, and nation-state-sponsored threats, have escalated.

High-profile incidents, like the Colonial Pipeline ransomware attack, have underscored the industry's vulnerability and the potential for catastrophic consequences. Recognizing these risks, companies in the sector are prioritizing cybersecurity investments. They seek advanced threat detection and response solutions to proactively defend against evolving cyber threats and safeguard their critical operations.

Evolving Attack Vectors

Cyber threats are continuously evolving, and attackers are becoming more creative and persistent. The convergence of information technology (IT) and operational technology (OT) networks in the oil and gas sector has expanded the attack surface, as these interconnected systems control critical operations like drilling, refining, and distribution. This integration introduces new security challenges, prompting companies to seek innovative cybersecurity solutions.

Artificial intelligence (AI), and machine learning (ML) are being harnessed to enhance predictive and adaptive security measures. These technologies analyse vast datasets to identify anomalies and potential threats, improving the industry's ability to react swiftly to emerging attack vectors. The adaptability of AI and ML to evolving threats is driving market growth.

Key Growth Barriers

Legacy Systems

Many companies in the oil and gas industry rely on legacy infrastructure that was not originally designed with cybersecurity in mind. Retrofitting and securing these systems can be a complex and costly endeavour. Additionally, the process of upgrading and patching older technologies can be disruptive to ongoing operations.

The challenge lies in modernizing these legacy systems to meet modern cybersecurity standards while minimizing potential disruptions to production and distribution processes. Balancing the need for security with operational continuity is a significant challenge in this sector.

Resource Constraints

The oil and gas industry often faces resource constraints that impact its ability to invest in and maintain robust cybersecurity measures. Budget limitations can hinder efforts to procure and implement advanced security solutions, hire skilled cybersecurity professionals, and conduct ongoing security assessments and improvements. The shortage of qualified cybersecurity talent is also a challenge.

The high demand for experts in the field means that recruiting and retaining skilled cybersecurity professionals can be particularly challenging for energy companies. The shortage of cybersecurity talent compounds the difficulties of maintaining a strong security posture and responding effectively to emerging threats.

The oil and gas cybersecurity market is experiencing rapid growth due to increased digitalisation, regulatory pressures, the rising threat landscape, and the need to adapt to evolving attack vectors. However, the sector faces challenges related to legacy systems and resource constraints.

Addressing these challenges is essential to ensure that the industry's critical infrastructure remains secure in the face of persistent and evolving cyber threats. Energy companies need to strike a balance between modernizing their systems and optimizing their cybersecurity investments while continuing to deliver reliable energy services to consumers.

High Initial Costs Haunt Growth, Especially in Small-to-Mid-Sized Oil & Gas Firms

Globally, cyber-attacks continue to grow each year. Despite widespread alerts about the risks posed by cyberattacks, industry-specific responses and levels of cybersecurity awareness vary. Additionally, historically, the oil and gas business has not prioritised cybersecurity.

As the oil and gas sector develops, industrial control systems like SCADA are becoming more linked to the Internet and more vulnerable to cyberattacks. Growing cyberattacks, like the ones against Saudi Aramco, US Colonial Pipeline, European Oil Refining Ports and Storage Facilities, etc. have sparked worries about the need for greater protection.

Installing cybersecurity products and systems comes at a hefty cost. The creation, deployment, and upkeep of cybersecurity measures require significant financial outlays, and the entire arrangement is expensive. The licencing of the software, design and modification, implementation, maintenance, support, and upgrade are all included in the installation of these systems. The organisations that are investing in the installation of the system are bearing the brunt of its relatively high total deployment costs.

Because of this, multiple mid-sized oil and gas companies are hesitant to invest a significant sum of money in the installation of cybersecurity infrastructure. However, the need for cybersecurity systems is rising globally due to increased concerns about protecting data and corporate processes from cyber threats. The lack of adequate cybersecurity infrastructure continues to plague the oil and gas sectors.

Small and medium-sized businesses are still working to modify their operations without the use of cybersecurity systems, despite the worries expressed by large corporations regarding the cost of these systems. Globally, several power-related industries use more cybersecurity systems than the oil and gas sectors.

How is Regulatory Scenario Shaping this Industry?

The oil and gas sector operates in a highly regulated environment. Governments and industry bodies have introduced stringent cybersecurity regulations and standards to safeguard critical energy infrastructure. Compliance with frameworks like the North American Electric Reliability Corporation Critical Infrastructure Protection (NERC CIP), and the National Institute of Standards and Technology (NIST) guidelines is not only a legal requirement but also a competitive advantage.

Energy companies are compelled to invest in robust cybersecurity measures to meet these regulations and protect their assets from potential breaches and disruptions. This regulatory pressure is a key driver of market growth as companies strive to maintain compliance.

The General Data Protection Regulation (GDPR) has specific cybersecurity mandates for critical infrastructure operators. Companies in the oil and gas industry are required to adhere to these standards, necessitating significant investments in cybersecurity measures to achieve compliance.

Non-compliance with cybersecurity regulations can result in legal and financial penalties. Companies that fail to meet the mandated cybersecurity standards may face fines, lawsuits, and reputational damage. This creates a strong financial incentive for energy companies to invest in robust cybersecurity solutions to avoid regulatory violations and their associated consequences.

Regulations often require companies to conduct risk assessments and report on their cybersecurity posture regularly. This process encourages energy companies to evaluate their vulnerabilities, threat landscape, and incident response capabilities. By promoting a proactive approach to cybersecurity, these regulations drive investment in threat detection, incident response, and risk mitigation strategies.

Some regulations focus on supply chain cybersecurity, emphasizing the need to secure the entire ecosystem of vendors and partners. This has implications for energy companies, as they must ensure the security of not only their own operations but also those of their suppliers and collaborators. This approach has driven the demand for cybersecurity solutions that address supply chain vulnerabilities and promote a holistic security strategy.

Data privacy regulations, such as GDPR, have implications for the oil and gas industry, particularly when it comes to the handling of personal and sensitive data. Companies are required to implement cybersecurity measures to protect data from breaches and unauthorised access, which has led to increased investment in data encryption, access controls, and secure data management practices.

Key Trends and Opportunities to Look at

- Convergence of IT and OT Security

The integration of IT and operational technology (OT) networks is a key trend. Companies are recognizing the need for unified cybersecurity strategies that protect both IT and OT environments. Cybersecurity firms specializing in IT/OT convergence solutions are well-positioned to provide integrated security measures that bridge the gap between traditional IT and the unique challenges of OT networks.

- Advanced Threat Detection and Response

The adoption of Artificial Intelligence (AI), and machine learning (ML) for threat detection and response is increasing. These technologies enable proactive identification of anomalies and potential threats, improving the industry's ability to respond swiftly. Companies offering AI and ML-based cybersecurity solutions can capitalise on the demand for advanced threat detection and response capabilities that can adapt to evolving attack vectors.

- Supply Chain Security

Supply chain cybersecurity is gaining importance. Companies are focusing on securing the entire ecosystem of vendors and partners to mitigate risks associated with third-party vulnerabilities. Solutions that address supply chain security vulnerabilities, such as secure vendor assessments and continuous monitoring, present a growing market opportunity.

- Cloud Security for Remote Operations

The industry is embracing cloud technologies for remote operations and data storage. As cloud adoption grows, ensuring the security of cloud-based assets is essential. Companies providing cloud security solutions tailored to the unique needs of the oil and gas sector can tap into this growing market segment.

- Threat Intelligence Sharing

Collaborative threat intelligence sharing among industry stakeholders is increasing. Companies are recognizing the benefits of sharing information on emerging threats and vulnerabilities. Organisations facilitating threat intelligence sharing platforms and services are well-positioned to provide valuable cybersecurity insights and collaborative defense strategies.

- Workforce Training and Awareness

The human factor remains a significant cybersecurity challenge. Employee awareness and training programs are gaining importance to reduce insider threats and human errors. Providers offering customised cybersecurity training programs for oil and gas employees can help organisations build a security-conscious workforce.

- Compliance-as-a-Service

Meeting regulatory requirements is a top priority. Companies are looking for managed compliance services to streamline and ensure ongoing compliance. Firms offering compliance-as-a-service solutions can help energy companies efficiently manage their regulatory obligations and maintain cybersecurity standards.

- Threat-Hunting Services

Proactive threat hunting is becoming a critical practice to identify and mitigate threats before they escalate. Companies specializing in threat-hunting services and technologies can assist energy companies in staying one step ahead of cyber threats.

Fairfield’s Ranking Board

Top Segments

Demand for Process Control & Automation Higher in Upstream Sector

The global oil & gas cybersecurity has been segregated in terms of sector into upstream, midstream, and downstream. In 2022, upstream sector dominated the market and constituted more than 50% share.

Upstream also includes drilling, operating, and maintaining the exploratory wells which would bring the crude oil to the surface. Hence, increase in the process control and automation in upstream oil & gas sector requires awareness of the cybersecurity.

Oil & gas cybersecurity is required almost in the three areas, viz., upstream, midstream, and downstream. The storage, processing, transportation, and installation of pipelines to move oil from the production site to the appropriate refineries and distribute it to downstream distributors make up the midstream sector of the oil and gas sectors.

Hackers may be able to manipulate the distribution of refined goods and crude oil because of cyberattacks. Manufacturing, refining, marketing, and wholesaling are downstream activities that are easily targeted by unauthorised accounts.

Service Segment to Grow at a Higher Pace

In terms of component, the global oil & gas cybersecurity market has been fragmented into: hardware, software, and services. In 2022, services segment dominated and constituted 39.3% share by value.

Services are a package of hardware and software that are provided by various businesses. Lots of hardware and software packages are offered by cybersecurity vendors to the oil & gas industry which are customised as per need of upstream, midstream, and downstream sectors.

Cybersecurity Concerns to Lead the Demand for Cloud Security

In terms of type, the global oil & gas cybersecurity market has been segmented into security analytics, threat intelligence, cloud security, and mobile security. In 2022, cloud security dominated the global oil & gas cybersecurity market and constituted more than 50% share.

Although adopting a cloud-based system has many advantages, many of which revolve around reducing waste and hassle, oil and gas firms stand to gain more from it than others because of its operational features. Pay-as-you-go models are usually available with extremely modest entry costs, and fees are directly correlated with usage and specific requirements.

Oil and gas firms, particularly those that are smaller independents, can reap the advantages of an advanced and resilient IT infrastructure with minimal investment, clear monthly operating expenses, and less impact on their balance sheet.

Regional Frontrunners

The Collective Share of Developed Western Markets to Rise up to 75%

Because of the rise in cyberattacks in industries including manufacturing, energy, retail, and telecom, North America is the region with the largest investment in cybersecurity solutions. The government is also making a contributing and focusing on investing in effective cybersecurity systems to prevent critical data from being compromised and falling into the hands of unapproved parties.

The oil and gas sector in North America, and Europe is taking proactive measures to address cybersecurity concerns by collaborating on collaborative programmes and projects, recognising possible dangers. Numerous oil and gas firms from North America, and Europe are stepping up to defend against cyberattacks.

Asia Pacific to Witness Strong Growth

The need for cybersecurity systems in Asia Pacific, is primarily driven by the installation of systems to protect multiple assets and the understanding of safe practises. Since the Asia Pacific cybersecurity business is still in its infancy, government support, and laws are needed to fortify the ties between several foreign players.

Several Asia Pacific nations, including China, India, Australia, Japan, and Indonesia, have expressed interest in creating an effective anti-cybercrime network. These nations are aware of how cybercrime in the oil and gas sector can have severe consequences. Therefore, compared to other areas, it is projected that the oil and gas cybersecurity market in Asia Pacific will rise at a faster rate.

An Expert's Eye

The energy sector is a prime target for cyberattacks due to its critical infrastructure. The increasing frequency and sophistication of attacks, such as ransomware and nation-state-sponsored threats, have forced the industry to reevaluate its cybersecurity strategies. Governments worldwide are imposing stringent regulations on the energy sector to enhance cybersecurity. Compliance with standards like NIST, NERC CIP, and regional data protection laws is becoming mandatory. This regulatory environment is pushing oil and gas companies to invest significantly in cybersecurity measures.

The convergence of IT, and operational technology (OT) networks is a focal point in the industry. Protecting the interconnected systems that control critical operations like drilling, refining, and distribution is a unique challenge. Companies are adopting solutions that bridge the gap between IT and OT cybersecurity. The oil and gas industry relies on a vast global supply chain, which introduces cybersecurity risks. Companies are recognizing the need to secure not only their own operations but also the entire ecosystem of vendors and partners.

Artificial intelligence (AI), and machine learning (ML) are being leveraged for threat detection and response. These technologies analyse massive datasets to identify anomalies and potential threats, enhancing the industry's ability to react swiftly to emerging cyber risks. Employee awareness and training are considered vital elements of oil and gas cybersecurity. Insider threats and human error remain significant concerns, prompting investments in education and security culture development.

In conclusion, the oil and gas cybersecurity market is characterised by a complex threat landscape, stringent regulations, the integration of IT and OT, supply chain vulnerabilities, innovative technologies, and a growing emphasis on human factors. Companies in the sector are prioritizing these areas to build resilient defense against evolving cyber threats.

Fairfield’s Competitive Landscape Analysis

The competition landscape in the oil & gas cybersecurity market is highly dynamic, with constant technological advancements and evolving threats. It is essential for companies in this sector to stay updated on the latest cybersecurity trends and partner with the most suitable providers to safeguard their critical infrastructure and data. The competitive landscape is a mix of established cybersecurity companies, niche players, and industry-specific providers. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Key Players in Global Oil & Gas Cybersecurity Space?

- CISCO

- Symantec Corporation

- Honeywell Corporation

- Intel Corporation

- GE

- Microsoft Corporation

- Siemens AG

- Parson Corporation

- Rapid7

- ABB

- Schneider

The Global Oil & Gas Cybersecurity Market has been Segmented as Below-

By Technology

- Solvent-borne

- Water-borne

- UV-cured

- Powder

By End-use Industry

- Industrial Machinery

- Automotive

- Marine

- Consumer Electronics

- Aerospace

- Offshore Oil & Gas

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Oil & Gas Cybersecurity Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.2.4. Economic Trends

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact

2.5.1. Supply Chain

2.5.2. End-user Industry Customer Impact Analysis

3. Price Trends Analysis, 2019 - 2030

4. Global Oil & Gas Cybersecurity Market Outlook, 2019 - 2030

4.1. Global Oil & Gas Cybersecurity Market Outlook, by Type, Value (US$ Mn), 2019 - 2030

4.1.1. Key Highlights

4.1.1.1. Security Analytics

4.1.1.2. Threat Intelligence

4.1.1.3. Cloud Security

4.1.1.4. Mobile Security

4.1.2. BPS Analysis/Market Attractiveness Analysis, by Type

4.2. Global Oil & Gas Cybersecurity Market Outlook, by Sector, Value (US$ Mn), 2019 - 2030

4.2.1. Key Highlights

4.2.1.1. Upstream

4.2.1.2. Midstream

4.2.1.3. Downstream

4.2.2. BPS Analysis/Market Attractiveness Analysis, by Sector

4.3. Global Oil & Gas Cybersecurity Market Outlook, by Component, Value (US$ Mn), 2019 - 2030

4.3.1. Key Highlights

4.3.1.1. Hardware

4.3.1.2. Software

4.3.1.3. Services

4.3.2. BPS Analysis/Market Attractiveness Analysis, by Component

4.4. Global Oil & Gas Cybersecurity Market Outlook, by Region, Value (US$ Mn), 2019 - 2030

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Middle East & Africa

4.4.1.5. Latin America

4.4.2. BPS Analysis/Market Attractiveness Analysis, by Region

5. North America Oil & Gas Cybersecurity Market Outlook, 2019 - 2030

5.1. North America Oil & Gas Cybersecurity Market Outlook, by Type, Value (US$ Mn), 2019 - 2030

5.1.1. Key Highlights

5.1.1.1. Security Analytics

5.1.1.2. Threat Intelligence

5.1.1.3. Cloud Security

5.1.1.4. Mobile Security

5.2. North America Oil & Gas Cybersecurity Market Outlook, by Sector, Value (US$ Mn), 2019 - 2030

5.2.1. Key Highlights

5.2.1.1. Upstream

5.2.1.2. Midstream

5.2.1.3. Downstream

5.3. North America Oil & Gas Cybersecurity Market Outlook, by Component, Value (US$ Mn), 2019 - 2030

5.3.1. Key Highlights

5.3.1.1. Hardware

5.3.1.2. Software

5.3.1.3. Services

5.4. North America Oil & Gas Cybersecurity Market Outlook, by Country, Value (US$ Mn), 2019 - 2030

5.4.1. Key Highlights

5.4.1.1. U.S. Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

5.4.1.2. Canada Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

6. Europe Oil & Gas Cybersecurity Market Outlook, 2019 - 2030

6.1. Europe Oil & Gas Cybersecurity Market Outlook, by Type, Value (US$ Mn), 2019 - 2030

6.1.1. Key Highlights

6.1.1.1. Security Analytics

6.1.1.2. Threat Intelligence

6.1.1.3. Cloud Security

6.1.1.4. Mobile Security

6.2. Europe Oil & Gas Cybersecurity Market Outlook, by Sector, Value (US$ Mn), 2019 - 2030

6.2.1. Key Highlights

6.2.1.1. Upstream

6.2.1.2. Midstream

6.2.1.3. Downstream

6.3. Europe Oil & Gas Cybersecurity Market Outlook, by Component, Value (US$ Mn), 2019 - 2030

6.3.1. Key Highlights

6.3.1.1. Hardware

6.3.1.2. Software

6.3.1.3. Services

6.4. Europe Oil & Gas Cybersecurity Market Outlook, by Country, Value (US$ Mn), 2019 - 2030

6.4.1. Key Highlights

6.4.1.1. Germany Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

6.4.1.2. Netherland Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

6.4.1.3. U.K. Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

6.4.1.4. Italy Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

6.4.1.5. Russia & CIS Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

6.4.1.6. Rest of Europe Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

7. Asia Pacific Oil & Gas Cybersecurity Market Outlook, 2019 - 2030

7.1. Asia Pacific Oil & Gas Cybersecurity Market Outlook, by Type, Value (US$ Mn), 2019 - 2030

7.1.1. Key Highlights

7.1.1.1. Security Analytics

7.1.1.2. Threat Intelligence

7.1.1.3. Cloud Security

7.1.1.4. Mobile Security

7.2. Asia Pacific Oil & Gas Cybersecurity Market Outlook, by Sector, Value (US$ Mn), 2019 - 2030

7.2.1. Key Highlights

7.2.1.1. Upstream

7.2.1.2. Midstream

7.2.1.3. Downstream

7.3. Asia Pacific Oil & Gas Cybersecurity Market Outlook, by Component, Value (US$ Mn), 2019 - 2030

7.3.1. Key Highlights

7.3.1.1. Hardware

7.3.1.2. Software

7.3.1.3. Services

7.4. Asia Pacific Oil & Gas Cybersecurity Market Outlook, by Country, Value (US$ Mn), 2019 - 2030

7.4.1. Key Highlights

7.4.1.1. China Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

7.4.1.2. India Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

7.4.1.3. Japan Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

7.4.1.4. ASEAN Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

7.4.1.5. Rest of Asia Pacific Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

8. Middle East & Africa Oil & Gas Cybersecurity Market Outlook, 2019 - 2030

8.1. Middle East & Africa Oil & Gas Cybersecurity Market Outlook, by Type, Value (US$ Mn), 2019 - 2030

8.1.1. Key Highlights

8.1.1.1. Security Analytics

8.1.1.2. Threat Intelligence

8.1.1.3. Cloud Security

8.1.1.4. Mobile Security

8.2. Middle East & Africa Oil & Gas Cybersecurity Market Outlook, by Sector, Value (US$ Mn), 2019 - 2030

8.2.1. Key Highlights

8.2.1.1. Upstream

8.2.1.2. Midstream

8.2.1.3. Downstream

8.3. Middle East & Africa Oil & Gas Cybersecurity Market Outlook, by Component, Value (US$ Mn), 2019 - 2030

8.3.1. Key Highlights

8.3.1.1. Hardware

8.3.1.2. Software

8.3.1.3. Services

8.4. Middle East & Africa Oil & Gas Cybersecurity Market Outlook, by Country, Value (US$ Mn), 2019 - 2030

8.4.1. Key Highlights

8.4.1.1. Saudi Arabia Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

8.4.1.2. Iran Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

8.4.1.3. UAE Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

8.4.1.4. South Africa Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

8.4.1.5. Rest of Middle East & Africa Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

9. Latin America Oil & Gas Cybersecurity Market Outlook, 2019 - 2030

9.1. Latin America Oil & Gas Cybersecurity Market Outlook, by Type, Value (US$ Mn), 2019 - 2030

9.1.1. Key Highlights

9.1.1.1. Security Analytics

9.1.1.2. Threat Intelligence

9.1.1.3. Cloud Security

9.1.1.4. Mobile Security

9.2. Latin America Oil & Gas Cybersecurity Market Outlook, by Sector, Value (US$ Mn), 2019 - 2030

9.2.1. Key Highlights

9.2.1.1. Upstream

9.2.1.2. Midstream

9.2.1.3. Downstream

9.3. Latin America Oil & Gas Cybersecurity Market Outlook, by Component, Value (US$ Mn), 2019 - 2030

9.3.1. Key Highlights

9.3.1.1. Hardware

9.3.1.2. Software

9.3.1.3. Services

9.4. Latin America Oil & Gas Cybersecurity Market Outlook, by Country, Value (US$ Mn), 2019 - 2030

9.4.1. Key Highlights

9.4.1.1. Brazil Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Sector, Component, 2019 - 2030

9.4.1.2. Mexico Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Source, End-user Industry, 2019- 2030

9.4.1.3. Venezuela Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Source, End-user Industry, 2019 - 2030

9.4.1.4. Rest of Latin America Oil & Gas Cybersecurity Market, Value (US$ Mn), by Type, Source, End-user Industry, 2019 - 2030

10. Competitive Landscape

10.1. Company Market Share Analysis, 2022

10.2. Strategic Collaborations

10.3. Company Profiles

10.3.1. CISCO

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Symantec Corporation

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Honeywell Corporation

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Intel Corporation

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. GE

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Siemens AG

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Microsoft Corporation

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. Parson Corporation

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Rapid7

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. ABB

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

10.3.11. Schneider

10.3.11.1. Company Overview

10.3.11.2. Product Portfolio

10.3.11.3. Financial Overview

10.3.11.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Sector Coverage |

|

|

Component Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Price Trend Analysis, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |