Global Ophthalmic Packaging Market Forecast

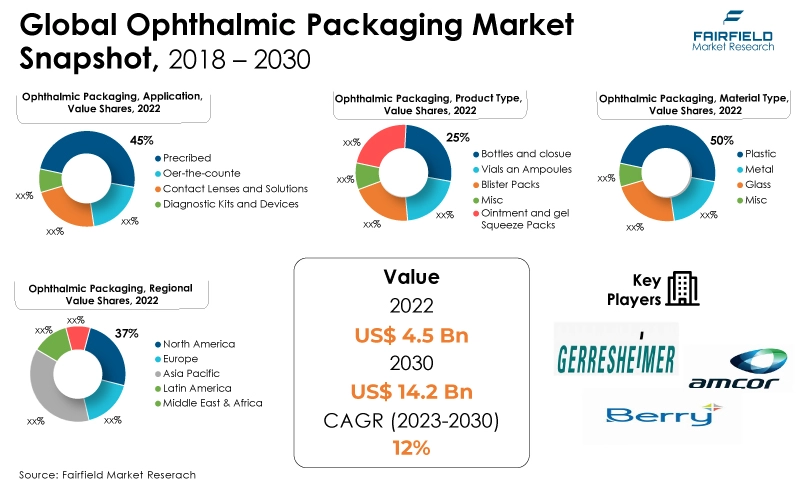

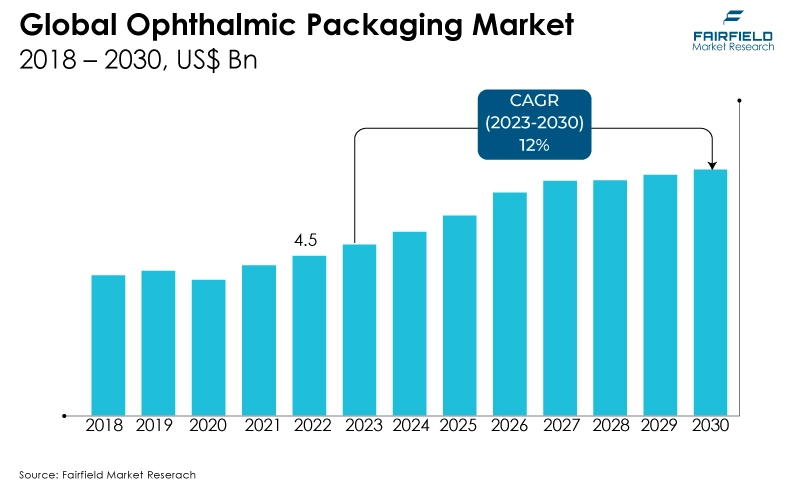

- Global ophthalmic packaging market size of US$4.5 Bn in 2022 to reach approximately US$14.3 Bn in 2030

- Market revenue poised to exhibit a strong CAGR of 12% over 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the ophthalmic packaging market growth is an increase in the demand for sustainable and Eco-friendly packaging, an increase in the geriatric population, and an increase in the prevalence of ocular infections.

- Another major market trend expected to fuel the ophthalmic packaging market growth is the rise in healthcare awareness and access. The market is also predicted to profit from the expanding worldwide pharmaceutical industries.

- In 2022, the plastic category dominated the material type segment as the focus on sustainability becomes a driving force, innovations in eco-friendly plastics are expected to sustain the dominance of this segment in the ophthalmic packaging market.

- In terms of market share for the ophthalmic packaging market globally, the multi-dose segment is anticipated to dominate. Multi-dose packaging formats offer convenience, extended shelf life, precise dosing, and reduced waste, making them increasingly popular for ophthalmic solutions, eye drops, and medications.

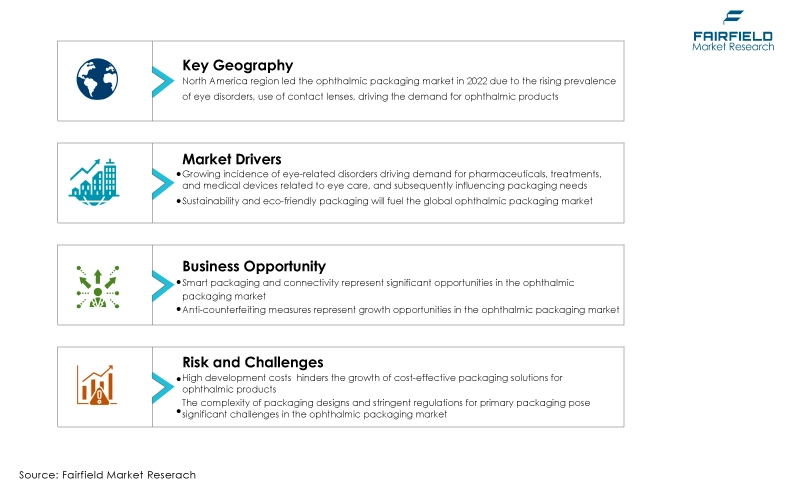

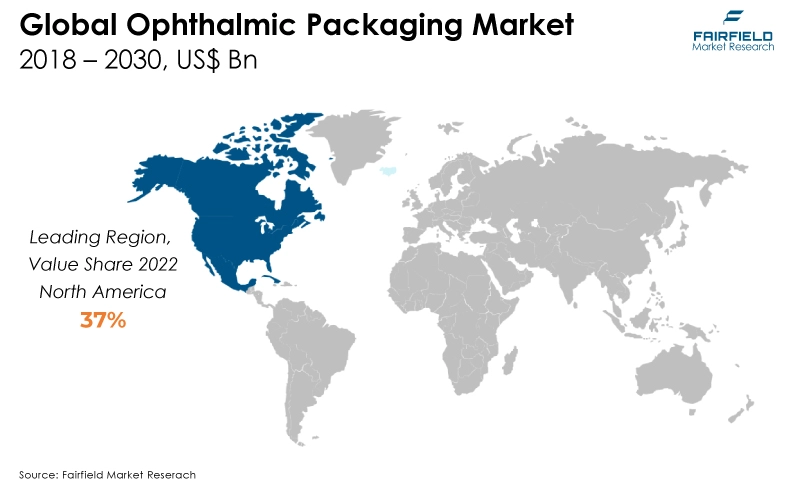

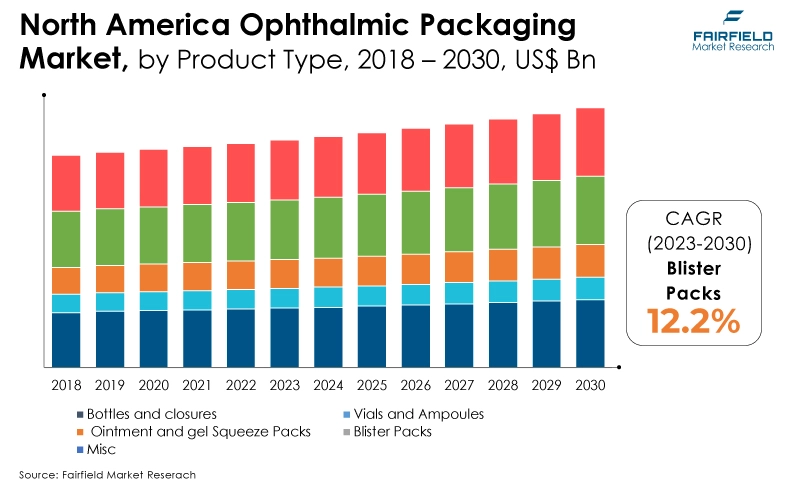

- The North America region is anticipated to account for the largest share of the global ophthalmic packaging market, owing to various factors such as an increase in the elderly population, government initiatives to encourage environmentally sustainable packaging use, and consistent packaging technology advancements by industry leaders.

- The ophthalmic packaging market is expanding in the Asia Pacific region due to the rising prevalence of eye diseases and the increased screen time experienced by individuals across the region.

A Look Back and a Look Forward - Comparative Analysis

The current state of the ophthalmic packaging market is marked by steady growth and significant trends. Globally, it has expanded due to factors such as the rising prevalence of eye diseases, expanding use of contact lenses and increasing awareness of eye health. The market varies in size and dynamics across regions, with North America, Europe, and Asia Pacific being notable contributors.

Within the ophthalmic packaging sector, various products, including blister packs for contact lenses, vials for eye drops, and cartons for prescription eyeglasses, require specific packaging solutions.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of the major application sectors such as prescription medications and over-the-counter (OTC) medications for ophthalmic purposes, contact lenses and solutions, and diagnostic kits and devices. Technological innovations are continually reshaping the industry, with a focus on materials that offer enhanced barrier properties, smart packaging, and eco-friendly options in response to sustainability concerns.

Additionally, stringent regulatory standards govern the ophthalmic sector, leading to a growing demand for compliant packaging solutions. The rise of eCommerce has transformed distribution channels, emphasizing the need for packaging that ensures product integrity during shipping and delivery.

A historical analysis of the ophthalmic packaging market reveals a shift toward specialisation and advancements in materials to better protect eye care products from light, moisture, and contamination. Companies have increasingly recognised packaging as a branding and marketing tool, leading to unique and appealing packaging designs. Sustainability initiatives have gained prominence, promoting the adoption of eco-friendly and recyclable materials.

Looking to the future, the ophthalmic packaging market is poised for continued growth and evolution. Technology integration, such as smart packaging with monitoring and reminder features, is expected to become more prevalent. Sustainability practices will remain central, focusing on reducing packaging waste and adopting biodegradable materials.

Customisation and personalisation efforts will enhance the consumer experience and brand loyalty. Furthermore, as online sales channels continue to expand, packaging innovations will be required to meet the specific needs of eCommerce.

Key Growth Determinants

- Expanding Ageing Population, and Rising Eye Disorder Rates

The expansion of the ophthalmic packaging market is propelled by a common drive rooted in the aging population and the surging incidence of eye disorders. As the global demographic shifts towards an increasingly aging population, the prevalence of age-related eye conditions rises significantly.

Eye disorders, including cataracts, glaucoma, and macular degeneration, require specialised eye care products such as prescription eyeglasses, contact lenses, and medications, all of which rely on effective packaging to maintain product integrity.

Simultaneously, the growing incidence of eye disorders, attributed to factors like lifestyle changes and prolonged screen time, amplifies the demand for innovative ophthalmic packaging solutions. Thus, these twin drivers, the ageing population, and the rising incidence of eye disorders, synergize to fuel the growth of the ophthalmic packaging market, as packaging becomes pivotal in preserving eye health and ensuring product safety for a broader and more diverse consumer base.

- Sustainability and Eco-friendly Packaging

Sustainability and the adoption of eco-friendly packaging have become powerful drivers in the ophthalmic packaging market. With growing environmental awareness among consumers and increased regulatory pressure for eco-conscious solutions, manufacturers are turning to sustainable materials and practices.

Embracing sustainability not only enhances brand reputation but also appeals to consumers seeking eco-friendly options. It can also lead to cost savings and drive innovation in packaging materials and design.

As a result, sustainability and eco-friendly packaging are transforming the ophthalmic packaging market, aligning it with the values and preferences of a more environmentally conscious consumer base.

Major Growth Barriers

- The Impact of Intricate Packaging

The complexity of packaging designs can pose significant challenges in the ophthalmic packaging market. While innovative packaging can enhance brand recognition and consumer appeal, it also introduces several practical and regulatory considerations. Ensuring compliance with stringent regulations governing ophthalmic products can be a demanding and resource-intensive process when intricate packaging is involved.

Furthermore, complex designs may lead to consumer confusion, impacting product usability and potentially raising concerns about product safety. The manufacturing of such intricate packaging often requires specialised processes and materials, resulting in higher production costs and potential supply chain complexities.

Environmental sustainability is also a concern, as complex designs may generate more waste and be less eco-friendly. Additionally, retailers may face difficulties in displaying and storing products with intricate packaging. Striking the right balance between attractive, informative packaging and practicality while adhering to regulatory standards is essential in navigating the challenges posed by packaging complexity in the ophthalmic industry.

- High Development Costs

High development costs are a notable restraint in the ophthalmic packaging market. Meeting stringent regulatory requirements, developing innovative packaging materials and designs, customisation efforts, sustainability initiatives, and ongoing quality assurance all contribute to substantial expenses. These costs, while essential for ensuring product safety and efficacy, can strain budgets and hinder the development of cost-effective packaging solutions for ophthalmic products. Businesses must carefully manage their resources to navigate this challenge effectively and remain competitive in the market.

Key Trends and Opportunities to Look at

- Transformative Opportunities in Smart Packaging and Connectivity

Smart packaging and connectivity represent significant opportunities within the ophthalmic packaging market. Connectivity through QR codes or RFID tags can provide consumers with valuable information and enable them to access product details, usage instructions, and even reorder options, fostering customer engagement and loyalty.

These technological advancements not only differentiate products in a competitive market but also align with the increasing demand for convenient and user-friendly packaging solutions, presenting a promising avenue for innovation and growth.

- Anti-counterfeiting, and Enhanced Product Security

Anti-counterfeiting measures and enhanced product security offer significant opportunities in the ophthalmic packaging market.

As the demand for authenticity and product safety grows, integrating features like holograms, serial numbers, or RFID tags can help verify the legitimacy of eye care products, ensuring that consumers receive genuine and safe items. These security measures not only protect consumers from counterfeit products but also safeguard brand reputation.

Moreover, they can be a valuable marketing tool, as consumers increasingly prioritise product security. Embracing anti-counterfeiting solutions not only fosters trust but also unlocks new avenues for brand differentiation and market growth in the ophthalmic packaging industry.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape plays a pivotal role in shaping the ophthalmic packaging industry, dictating stringent standards for product safety, efficacy, and consumer protection. Compliance with these regulations is essential for ensuring that eye care products, including prescription eyeglasses, contact lenses, and medications, maintain their integrity and sterility.

Manufacturers must incorporate features such as tamper-evident packaging, adhere to quality control and validation processes, and provide clear labelling with essential information. Key regulatory compliances involve adhering to Good Manufacturing Practices (GMP), ISO standards for quality management and packaging, FDA regulations (in the United States), European Union Medical Device Regulation (MDR), and compliance with pharmacopoeial standards.

Serialisation and traceability measures, environmental regulations, customs and import rules, and stringent labeling requirements are also integral parts of the regulatory landscape. Companies operating in this market must navigate these complex regulations diligently to meet safety standards, gain market access, and maintain consumer confidence.

Environmental regulations and sustainability concerns are also gaining prominence, pushing the industry toward eco-friendly packaging materials. Navigating this regulatory framework is crucial for market access and consumer trust, making compliance a top priority for packaging manufacturers and eye care product companies.

Fairfield’s Ranking Board

Top Segments

Plastic’s Dominance Prevails

The plastic segment remains a dominant force within the material type segment of the ophthalmic packaging market. Plastic materials, such as polyethylene, polypropylene, and PVC, continue to be favoured for their versatility, cost-effectiveness, and excellent barrier properties that protect eye care products from light, moisture, and contamination.

Additionally, plastics offer flexibility in design and customisation, enabling the creation of user-friendly and tamper-evident packaging, essential for eye care products. With sustainability concerns driving innovations in biodegradable plastics, this segment is poised to maintain its dominance while addressing environmental considerations, further solidifying its position in the ophthalmic packaging market.

OTC Medications to Lead

OTC medications are anticipated to take the lead as the leading application segment in the ophthalmic packaging market. This growth is attributed to several factors, including increased self-care and awareness of eye health, making OTC eye drops, lubricants, and treatments more accessible and popular.

OTC medications offer consumers convenience in managing common eye conditions, such as dry eyes and allergies, without the need for a prescription. Consequently, packaging for these products plays a pivotal role in ensuring product safety, proper dosing, and sterility, thereby boosting its significance in the ophthalmic packaging market.

As consumers continue to seek self-administered eye care solutions, the demand for secure and user-friendly packaging for OTC medications is expected to drive this segment's growth in the industry.

Regional Frontrunners

North America Spearheads with Rising Prevalence of Eye Diseases

In the packaging industries, Ophthalmic Packaging adoption is anticipated to dominate in the North America region. North America is undergoing a demographic shift with an increasingly aging population, making individuals more susceptible to age-related eye conditions.

Consequently, there is a growing need for ophthalmic products such as prescription eyeglasses, contact lenses, and eye medications, all of which necessitate specialised packaging to ensure their integrity and sterility. The rise in prevalence of the eye diseases helped drive market expansion in the area.

Additionally, heightened awareness of eye health and improved access to healthcare services encourage individuals in North America to seek eye care treatments and correction options more proactively. This increased engagement with eyecare professionals has led to higher prescription rates for eyeglasses and contact lenses, subsequently driving the need for specialised packaging.

Technological advancements in the field of eye care have given rise to innovative treatments, ocular medications, and surgical procedures. These advanced products often require specialised packaging to maintain their efficacy, sterility, and safety.

Asia Pacific Set to Gain from Specialised Ophthalmic Products

The Asia Pacific region is anticipated to witness significant sales expansion in the ophthalmic packaging market, fuelled by a confluence of factors, including the rising prevalence of eye diseases and the increased screen time experienced by individuals across the region. These intertwined factors are contributing to a growing demand for specialised ophthalmic products and their corresponding packaging solutions.

The escalation in screen time, driven by the proliferation of digital devices and the adoption of online activities, has led to a surge in digital eye strain and other vision-related issues.

Prolonged screen exposure is associated with discomfort and fatigue, prompting individuals to seek relief through eye care products such as lubricating eye drops, artificial tears, and specialised eyeglasses. This surge in demand for eye care products directly translates into a need for ophthalmic packaging that ensures product integrity and sterility.

Fairfield’s Competitive Landscape Analysis

The global ophthalmic packaging market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Ophthalmic Packaging Market Space?

- Amcor Ltd.

- Gerresheimer AG

- West Pharmaceutical Service Inc.

- Becton, Dickinson and Company

- Nolato AB

- Bormioli Pharma S.p.a

- AptarGroup

- Advance Packaging

- Berry Global Inc.

- Miller packaging

- MWV (MeadWestvaco Corporation)

- Nemera

- Datwyler Group

Significant Company Developments

Partnerships, Acquisitions, and Joint Ventures

- August 2023: Amcor announced an agreement to acquire Phoenix Flexibles, expanding Amcor’s capacity in the high-growth Indian market. Amcor currently has four flexible packaging plants in India. The business has delivered double-digit organic sales growth per annum over the last three years, significantly outpacing growth in the underlying market, and is also investing to double its local footprint in the Pharmaceutical and Medical packaging categories.

- February 2023: Gerresheimer AG, announced a joint venture with Corning Incorporated a leading innovator in materials science and manufacturing, to increase global access to the Velocity® Vial technology platform, addressing the need for a high-quality and cost-effective injectable drug-filling process. The partnership will combine Gerresheimer’s extensive glass-converting expertise with Corning’s innovative Velocity® Vial technology.

- November 2021: Gerresheimer acquired the IP of a new-generation cartridge-based autoinjector from Midas Pharma. This is the start of a strategic partnership. The joint project comprises the development and marketing of the new generation autoinjector. The go-to-market approach for the autoinjector combines the complementary strengths of both companies - Gerresheimer as a solution provider for medical devices and primary packaging solutions and Midas Pharma as an experienced facilitator for global pharma projects and provider of products and services along the pharmaceutical value chain.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the global ophthalmic packaging market has witnessed a growing demand for child-resistant packaging solutions, driven by a confluence of factors. Regulatory mandates in various countries underscore the need for secure packaging to prevent accidental ingestion of eye care products by children. This imperative aligns with the pharmaceutical industry's overarching commitment to consumer safety, fostering brand reputation and trust.

Increased consumption of eye care products, expanding use of contact lenses, and importance of child-resistant packaging is expected to escalate the market growth. Technological advancements in packaging design and materials hold the potential to refine and enhance child-resistant solutions, contributing to market growth.

Supply Side of the Market

According to our analysis, the supply side of the global ophthalmic packaging market encompasses a range of manufacturers, suppliers, and stakeholders involved in providing packaging solutions for various eye care products. These stakeholders contribute to shaping the market's dynamics and growth trajectory.

Packaging manufacturers are at the forefront, creating innovative and functional packaging solutions that cater to the specific needs of ophthalmic products such as eye drops, contact lens solutions, and ointments. They are tasked with developing packaging that ensures product integrity, prevents contamination, and maintains the efficacy of the enclosed products.

Material suppliers play a critical role by providing the raw materials necessary for producing ophthalmic packaging, including plastic resins, glass, aluminium, and other specialised materials. Their offerings impact the safety, durability, and sustainability of the packaging solutions.

Furthermore, technology providers offer advancements in packaging design, printing, and labelling that enhance the visual appeal and informational content of ophthalmic packaging. This includes features such as tamper-evident seals, dosage indicators, and ergonomic designs that enhance user experience.

Global Ophthalmic Packaging Market is Segmented as Below:

Product Type:

- Bottles and closures

- Eye dropper

- Lens solution

- Dispensers

- Vials and Ampoules

- Ointment and gel Squeeze Packs

- Blister Packs

- Miscellaneous

Material Type:

- Plastic

- Glass

- Metal

- Miscellaneous

Application:

- Prescribed Medicines

- Over-the-counter (OTC)

- Contact Lenses and Solutions

- Diagnostic Kits and Devices

- Miscellaneous

By Geographic Coverage:

- North America

- United States

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Ophthalmic Packaging Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Ophthalmic Packaging Market Outlook, 2018 - 2030

3.1. Global Ophthalmic Packaging Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Bottles and closures

3.1.1.2. Vials and Ampoules

3.1.1.3. Ointment and gel Squeeze Packs

3.1.1.4. Blister Packs

3.1.1.5. Misc.

3.2. Global Ophthalmic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Plastic

3.2.1.2. Glass

3.2.1.3. Metal

3.2.1.4. Misc.

3.3. Global Ophthalmic Packaging Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Prescribed

3.3.1.2. Over-the-counter (OTC)

3.3.1.3. Contact Lenses and Solutions

3.3.1.4. Diagnostic Kits and Devices

3.3.1.5. Misc.

3.4. Global Ophthalmic Packaging Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Ophthalmic Packaging Market Outlook, 2018 - 2030

4.1. North America Ophthalmic Packaging Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Bottles and closures

4.1.1.2. Vials and Ampoules

4.1.1.3. Ointment and gel Squeeze Packs

4.1.1.4. Blister Packs

4.1.1.5. Misc.

4.2. North America Ophthalmic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Plastic

4.2.1.2. Glass

4.2.1.3. Metal

4.2.1.4. Misc.

4.3. North America Ophthalmic Packaging Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Prescribed

4.3.1.2. Over-the-counter (OTC)

4.3.1.3. Contact Lenses and Solutions

4.3.1.4. Diagnostic Kits and Devices

4.3.1.5. Misc.

4.4. North America Ophthalmic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

5. Europe Ophthalmic Packaging Market Outlook, 2018 - 2030

5.1. Europe Ophthalmic Packaging Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Bottles and closures

5.1.1.2. Vials and Ampoules

5.1.1.3. Ointment and gel Squeeze Packs

5.1.1.4. Blister Packs

5.1.1.5. Misc.

5.2. Europe Ophthalmic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Plastic

5.2.1.2. Glass

5.2.1.3. Metal

5.2.1.4. Misc.

5.3. Europe Ophthalmic Packaging Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Prescribed

5.3.1.2. Over-the-counter (OTC)

5.3.1.3. Contact Lenses and Solutions

5.3.1.4. Diagnostic Kits and Devices

5.3.1.5. Misc.

5.4. Europe Ophthalmic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

6. Asia Pacific Ophthalmic Packaging Market Outlook, 2018 - 2030

6.1. Asia Pacific Ophthalmic Packaging Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Bottles and closures

6.1.1.2. Vials and Ampoules

6.1.1.3. Ointment and gel Squeeze Packs

6.1.1.4. Blister Packs

6.1.1.5. Misc.

6.2. Asia Pacific Ophthalmic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Plastic

6.2.1.2. Glass

6.2.1.3. Metal

6.2.1.4. Misc.

6.3. Asia Pacific Ophthalmic Packaging Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Prescribed

6.3.1.2. Over-the-counter (OTC)

6.3.1.3. Contact Lenses and Solutions

6.3.1.4. Diagnostic Kits and Devices

6.3.1.5. Misc.

6.4. Asia Pacific Ophthalmic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

7. Latin America Ophthalmic Packaging Market Outlook, 2018 - 2030

7.1. Latin America Ophthalmic Packaging Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Bottles and closures

7.1.1.2. Vials and Ampoules

7.1.1.3. Ointment and gel Squeeze Packs

7.1.1.4. Blister Packs

7.1.1.5. Misc.

7.2. Latin America Ophthalmic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Plastic

7.2.1.2. Glass

7.2.1.3. Metal

7.2.1.4. Misc.

7.3. Latin America Ophthalmic Packaging Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Prescribed

7.3.1.2. Over-the-counter (OTC)

7.3.1.3. Contact Lenses and Solutions

7.3.1.4. Diagnostic Kits and Devices

7.3.1.5. Misc.

7.4. Latin America Ophthalmic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

8. Middle East & Africa Ophthalmic Packaging Market Outlook, 2018 - 2030

8.1. Middle East & Africa Ophthalmic Packaging Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Bottles and closures

8.1.1.2. Vials and Ampoules

8.1.1.3. Ointment and gel Squeeze Packs

8.1.1.4. Blister Packs

8.1.1.5. Misc.

8.2. Middle East & Africa Ophthalmic Packaging Market Outlook, by Material Type, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Plastic

8.2.1.2. Glass

8.2.1.3. Metal

8.2.1.4. Misc.

8.3. Middle East & Africa Ophthalmic Packaging Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Prescribed

8.3.1.2. Over-the-counter (OTC)

8.3.1.3. Contact Lenses and Solutions

8.3.1.4. Diagnostic Kits and Devices

8.3.1.5. Misc.

8.4. Middle East & Africa Ophthalmic Packaging Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Ophthalmic Packaging Market by Product Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Ophthalmic Packaging Market by Material Type, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Ophthalmic Packaging Market by Application, Value (US$ Bn), 2018 - 2030

9. Competitive Landscape

9.1. Type vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Amcor Ltd.

9.5.1.1. Company Overview

9.5.1.2. Type Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Gerresheimer AG

9.5.2.1. Company Overview

9.5.2.2. Type Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. West Pharmaceutical Service Inc.

9.5.3.1. Company Overview

9.5.3.2. Type Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Becton, Dickinson and Company

9.5.4.1. Company Overview

9.5.4.2. Type Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Nolato AB

9.5.5.1. Company Overview

9.5.5.2. Type Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Bormioli Pharma S.p.a

9.5.6.1. Company Overview

9.5.6.2. Type Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Aptar Group

9.5.7.1. Company Overview

9.5.7.2. Type Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Advance Packaging

9.5.8.1. Company Overview

9.5.8.2. Type Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Berry Global Inc.

9.5.9.1. Company Overview

9.5.9.2. Type Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Miller Packaging

9.5.10.1. Company Overview

9.5.10.2. Type Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. MWV (MeadWestvaco Corporation)

9.5.11.1. Company Overview

9.5.11.2. Type Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Nemera

9.5.12.1. Company Overview

9.5.12.2. Type Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Datwayler Group

9.5.13.1. Company Overview

9.5.13.2. Type Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Material Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |