Global Pet Milk Replacer Market Forecast

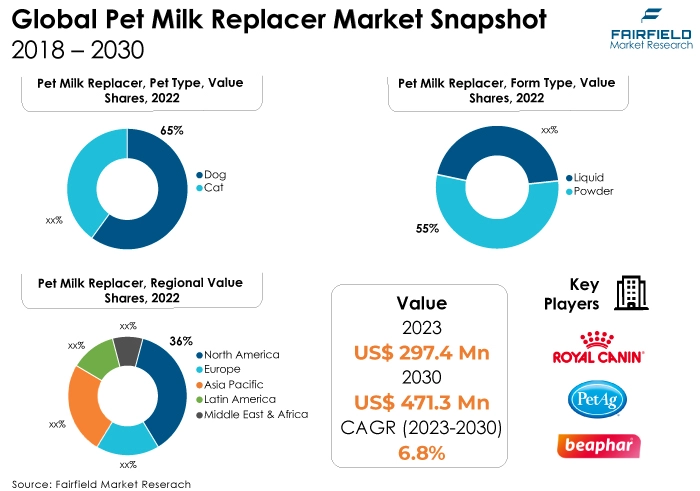

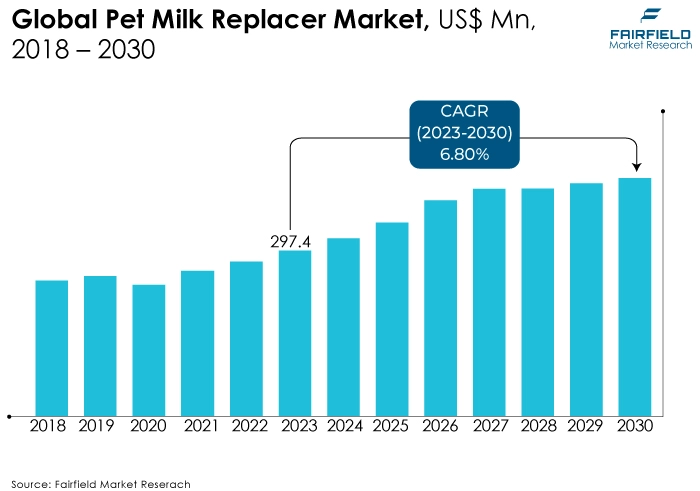

- Pet milk replacers market revenue poised to reach US$471.3 Bn in 2030, up from US$297.4 Bn recorded in 2022

- Global market for pet milk replacers likely to see expansion at a CAGR of 6.8% over 2023 - 2030

Quick Report Digest

- The growing number of household pets among customers is the key trend anticipated to fuel the pet milk replacer market growth due to increasing demand for a complete, nutrient-dense diet for dogs.

- Another major market trend expected to fuel the pet milk replacer market growth is consumer demand for milk substitutes rising across the board due to rising milk prices.

- In 2023, the dog category dominated the industry due to the widespread adoption of puppies among customers worldwide.

- In terms of market share for pet milk replacers globally, the powder segment is anticipated to dominate. Consumers prefer the powder form of the product due to its extended shelf life, ease of transportation, storage, and handling.

- In 2023, the pet specialty stores category controlled the market. The specialised shop market is growing due to the easy availability of desired brands and kinds of pet milk.

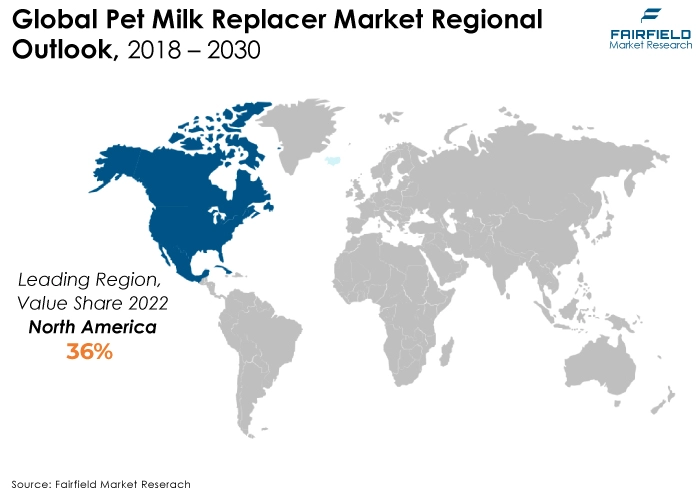

- The North American region is anticipated to account for the largest global pet milk replacement market share over the projected period. The rising trend of pet adoption among US consumers is expected to increase demand for pet milk replacements.

- The market for pet milk replacers is expanding in the Asia Pacific due to the humanisation of pets. Increased disposable income in nations such as China, Japan, India, and South Korea have emerged as major factors driving consumer expenditure on pet care.

A Look Back and a Look Forward - Comparative Analysis

The market for pet milk replacers has grown in popularity due to factors such as the trend of keeping companion animals such as dogs and cats becoming much more common than previously due to improved social standing and physical and mental health advantages. Pet ownership can reduce stress, boost confidence, protect the heart, and help control blood pressure and cholesterol levels, all scientifically proven benefits encouraging people to keep pets. As a result, increased pet adoption is an important factor driving the pet milk market forward.

The market witnessed staggered growth during the historical period 2018 – 2022. Higher production costs are caused by using high-quality components and nutrients, acting as a bottleneck in total market expansion. As a result of the competitively priced goods, market participants are finding it difficult to achieve appropriate profit margins. However, the new entrance of players with an improved and cost-friendly variety can cope with the market growth.

Moreover, mother dogs or cats may not be able to produce enough milk if they are ill. To provide the vital nutrients and proteins that the newborn pups and kittens require to survive and grow, they are fed pet milk or pet milk substitutes in these situations. Pet milk usage has increased as cow's milk cannot be given to lactose-intolerant animals, such as dogs and cats. This is also another significant factor driving the demand for pet milk worldwide.

Key Growth Determinants

- Insufficient Colostrum Milk Volumes

Adoption of little pups and kittens is rising, particularly among young people living in cities. The majority of homes often only acquire one pet. Newborns are denied access to colostrum milk are those who adopt pets or purchase them from pet stores. Moreover, a high litter rate frequently prevents the mother from producing enough milk. Because of this, pet owners frequently choose to offer their animals pet milk or substitutes to meet their young animals' fundamental nutritional demands.

Prebiotics, probiotics, vitamins, minerals, proteins, carbs, and lipids are all included in pet milk and are crucial for young animals' healthy development and growth. This commercial pet milk properly replaces the necessity for colostrum and is easily digested. As a result, the worldwide pet milk business is growing due to a lack of mother's milk and colostrum.

- Inclination Toward Urbanised Lifestyles

People in emerging economies are growing aware of pet ownership's significant benefits to human health. Most developing countries exhibit swift urbanisation, a transition to monogamous households, and increased disposable income.

The increase in pet adoption can be attributed to several factors. Furthermore, convenience makes older adults living in cities more likely to adopt a small pet. A pet improves mental health and lowers blood pressure, stress, and anxiety.

Furthermore, young couples frequently own a pet. The criteria above are in favour of higher expenditures on pet care items. The pet population is indirectly increased by increasing household numbers and rapid urbanisation.

- Perceived Health Advantages

Milk replacers' numerous health advantages to newborn animals are anticipated to boost the product's demand. For example, using milk replacers can enhance the long-term growth rate of newborn animals and their overall health and milk supply.

Ready-made, highly nutritious dry feed combinations known as milk replacers help guarantee the healthy growth and development of rare animal breeds. Further investigation into creating more natural and chemical-free items is anticipated to favour market expansion.

Major Growth Barriers

- Growing Production Costs

The high cost of pet milk replacement products is anticipated throughout the forecast period to limit market expansion. The components utilised in the formulation of the finished product determine how much pet milk replacement products cost. For example, the cost of pet milk replacement solutions increases when additional supplements like vitamins and prebiotics are added to the product to boost its nutritional content in addition to milk solids.

Furthermore, ongoing quality control is needed to create products free of contamination. The cost of producing pet milk substitute products goes up overall since this necessitates using advanced analytical tools to test the quality of the finished product and in-process ingredients. The high cost of pet replacement goods is anticipated to impede market expansion.

- Strong Government Regulations on Pet Milk Production

The content and production procedure of milk is subject to stringent regulatory standards, which pet milk providers must adhere to. Because every breed and type of pet has unique nutritional needs to thrive in the neonatal stage, pet milk manufacturers must carefully consider these factors when producing their products. Milk replacers are also stored in packaging, which is very important.

Pet milk replacers that are powdered or liquid require careful packing, which is another critical task for manufacturers. Only the production of pet milk is permitted to utilise ingredients and additives that government authorities have approved. Furthermore, manufacturers risk harsh penalties and government measures if they do not follow the criteria. As a result, strict government regulations prevent the pet milk market from expanding.

Key Trends and Opportunities to Look at

- Growing Adoption of Pet Cafés

Pet cafés, sometimes known as animal cafes, are distinctive pet locations where patrons enjoy seeing and engaging with various animals. Pets include dogs, cats, raccoons, bunnies, reptiles, and birds, which can be found in various pet cafes. In a pet café, patrons may watch animals eating and drinking. In recent years, these cafes have gradually become more and more well-known.

The idea of pet cafes is becoming increasingly popular due to the increase in population and pet adoption. The growing number of pet cafés may considerably impact the income of the pet sector and the market. In addition, dog and cat cafés are among the most well-liked cafes. Therefore, during the forecast period, these aspects are anticipated to present profitable prospects for market expansion.

- Investments in Innovative Nutritional Solutions

The quest to better understand how to maximise an animal's genetic potential is a big trend in the world's dairy and beef production. Businesses are examining the early stages of life because they believe this is the critical time when major productivity increases may be gained.

The world population is predicted to rise at a high rate, leading to a huge increase in demand for dairy and meat. It would be difficult for the agriculture sector to meet this demand. To address both the nutritional demands of animals and the global food demand, businesses seek to improve their capacity for innovation and invest in novel nutritional solutions.

- Extensive Availability of Multiple Milk Substitute Variants

For times when the mother isn't available, pet owners and livestock owners who are expecting have milk replacers on hand. The proper ratio of proteins, lipids, and carbohydrates-nutrients required for developing animals-can be found in milk substitutes. Calves, foals, goatlings, puppies, and piglets can all benefit from multi-species milk replacers already on the market.

The feeding schedule must be modified to suit the demands of the species when using a multi-species milk substitute, though. Noteworthy, colostrum is not provided by milk replacers. Within two hours of birth, newborn animals without moms must receive a colostrum supplement.

How Does the Regulatory Scenario Shape this Industry?

The FDA requires pet milk replacer makers to include all components and any potential allergies or additions on the box label. The FDA also mandates labeling requirements for pet milk replacers, such as reporting nutrient content per serving size and forbidding false or misleading representations about the product's health benefits or production safety precautions. Pet milk replacers in Europe must meet European Union nutritional adequacy standards and some labelling regulations covering nutrient declarations and warning statements.

Pet milk replacers are classified as pharmaceutical items in Canada and must fulfil the same safety criteria as human food products. To assure the quality and safety of pet milk replacers, the Canadian Veterinary Medical Association (CVMA) has produced guidelines for their safe usage. These rules include product storage, handling, preparation, and reconstitution suggestions. Furthermore, before they can be promoted or sold to customers, all pet milk replacers sold in Canada must be approved by Health Canada.

Fairfield’s Ranking Board

Top Segments

- Dogs to be the Leading Category

The dogs segment dominated the market in 2023. Puppies primarily eat pet milk. However, because pet milk is highly nutritional, pet owners also occasionally feed it to adult dogs. The primary drivers of expanding the global pet milk market include the growing trend of adopting pets, expansion of an urban lifestyle, and the rising dog population.

Furthermore, the cats category is projected to experience the fastest market growth. Cats are thought to be less expensive, use less room, prefer to spend their time indoors and produce less noise. Consequently, owning a cat or kitten as a pet is more convenient than owning a dog or puppy. Global market growth is anticipated to be attributed to the number of cats.

The health advantages of owning a companion cat, such as reduced stress and anxiety, a decreased chance of heart disease, and a decreased risk of allergies, have also come to the attention of more individuals. All these elements are anticipated throughout the forecast period to fuel the global market's expansion.

- Powder Milk Most Favoured Form, Preference for Liquid to Grow Substantially

In 2023, the powder category dominated the industry. Pet milk in powdered form has some benefits that boost producers' profitability. First, powder pet milk production costs are minimised since dry storage doesn't need refrigeration. Additionally, powdered pet milk is excellent for industrial packing and can be stored for long periods. These advantages of powdered pet milk are anticipated to fuel the market's expansion on a worldwide scale in the years to come.

The liquid category is anticipated to grow substantially throughout the projected period. The healthier, safer, and more dependable option is liquid pet milk. It is especially useful when traveling, and finding hot water to dispense powdered pet milk is difficult. Ready-to-drink pet milk in liquid form eliminates hassles. When feeding their pets, it provides various conveniences. In the next years, these advantages of liquid pet milk are anticipated to fuel the market's expansion on a worldwide scale.

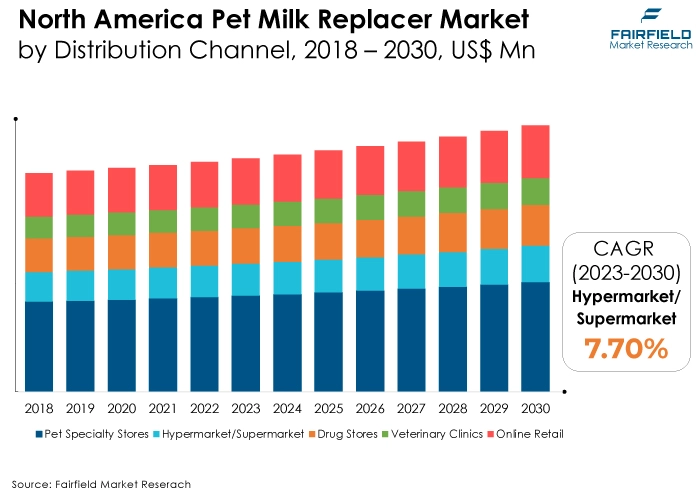

- Pet Specialty Stores Continue to Extend a Leading Share of Total Sales

The pet specialty stores segment dominated the market in 2023. Manufacturers are primarily targeting specialty retailers since they are always trying to increase the visibility of their products on store shelves. Consequently, specialty retailers carry every type of pet milk. Additionally, pet specialty stores offer advantages like instant pleasure and discounts, contributing to the market's expansion.

The hypermarket/supermarket category is expected to experience the fastest growth within the forecast time frame. Supermarkets provide a wide range of products from different food and beverage categories, which makes them conveniently accessible to consumers. Supermarkets. Products from both domestic and foreign platforms are arranged in these stores. These shops give customers access to specialised items that are available for purchase.

Opening of mass retail outlets in strategic areas thus offers profitable prospects for expanding the pet milk business worldwide. Manufacturers provide exclusive discounts through these mass retail outlets to get mass retailers to carry their goods. Manufacturers are working to make products more visible on the shelf to implement these methods, which draw customers and support market expansion.

Regional Frontrunners

North America Spearheads, the US Houses Most of Leading Brands

Most pet milk producers are American, including Royal Canin, Pet Ag, The Hartz Mountain Corporation, Milk Products, Inc., and Manna Pro Products, L.L.C. The biggest supplier to the North American market is the US. Additionally, it is the world's top exporter of pet milk. Regarding pet milk revenue, the US is followed by Canada, and Mexico.

North America is known for its large pet population, high disposable income, nuclear households, growing pet adoption rates, and growing knowledge of the health advantages of pet ownership. All these variables are anticipated to propel market expansion during the projected period. North America is anticipated to continue to hold a dominant position in generating revenue.

Sparsity of Significant Pet Milk Producers Uplifts Prospects of Asia Pacific

Most of the countries in the Asia Pacific region are still in the developing stages, and this region has the largest population. Because of the region's rapid expansion and growth, pet milk manufacturers should find lucrative growth opportunities in Asia Pacific. This region does not have a significant pet milk producer.

On the other hand, pet adoption is becoming more and more common, and the Asia Pacific industry is expanding rapidly. Growing consumer awareness of the health benefits of owning a pet, increased disposable income, fast urbanisation, the trend to nuclear families, and an increasing pet population are the factors propelling the market growth in Asia Pacific.

Fairfield’s Competitive Landscape Analysis

The global pet milk replacer market is a consolidated market with fewer major players present across the globe. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Pet Milk Replacer Space?

- Pet Ag, Inc.

- Beaphar, B.V.

- Manna Pro Products, LLC

- Royal Canin

- Venkys

- Liprovit BV

- Hartz

- Breeders' Edge

- Nutreco N.V.

- Drools

- Tu Meke Friend

Significant Company Developments

New Product Launch

- In 2021: Nestle Purina PetCare: Purina Pro Plan Veterinary Diets FortiFlora Probiotic Puppy Formula is a new range of puppy milk replacers introduced by Nestle Purina PetCare in 2021. With additional probiotics to ensure a healthy gut flora, this product is intended to assist the digestive health of young puppies.

- In May 2021, Goat's Milk Esbilac, a novel liquid milk substitute, was introduced by Pet-Ag, Inc. through its distributor and retailer channel partners. To satisfy the increasing needs of pet parents and experts, this new, ready-to-use liquid offers more options and convenience over the existing GME powder, which is meant to be reconstituted.

- In March 2021: To address the growing demand for its premium pet nutrition, Royal Canin North America, a division of Mars, Inc. and a major participant in the pet health nutrition industry, announced that it will invest US$ 390 million to construct a new factory in Lewisburg, Ohio. This expansion will generate 224 new jobs. Manufacturing product lines for dogs and cats is another aspect of this expansion.

Distribution Agreement

- November 2021: Through an agreement with Dairy Crop Solutions, a distributor located in British Columbia, 1,200 bags of Grober Excel premium milk replacer will be supplied to impacted dairy producers.

- In 2020, Agren, a provider of precision conservation planning software, was purchased by Land O'Lakes. With the development of pet milk replacers, this acquisition was intended to strengthen Land O'Lakes' agricultural sustainability initiatives.

An Expert’s Eye

Demand and Future Growth

Fairfield’s analysis shows growing demand for dairy products, increasing concerns about animal nutrition and health, and heightened spending by major industry participants on R&D to create affordable and effective milk replacers.

In addition, one of the main factors propelling the market's expansion is the need for pet food that is high in nutrients. When newborns lack access, the market argument is sometimes strengthened by the cost-effectiveness of pet milk replacers.

Supply Side of the Market

Milk replacers' varied health benefits to newborn animals are predicted to drive demand for the product. Consumption of milk replacers, for example, can aid in raising long-term growth rates in newborn animals and improve milk production and overall health.

Milk replacers are ready-made, high-nutritious dry feed combinations that can help rare animals grow and develop properly. Ongoing research to generate more natural and chemical-free products will favour product growth. Sprayfo, for example, altered the formulation of its existing milk replacement products in the above product category in January 2017 to utilise as few chemicals as possible.

Global Pet Milk Replacer Market is Segmented as Below:

By Pet Type:

- Dog

- Cat

By Form:

- Powder

- Liquid

By Distribution Channel:

- Pet Specialty Stores

- Hypermarket/Supermarket

- Drug Stores

- Veterinary Clinics

- Online Retail

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Pet Milk Replacer Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Pet Milk Replacer Market Outlook, 2018 - 2030

3.1. Global Pet Milk Replacer Market Outlook, by Pet Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Cat

3.1.1.2. Dog

3.2. Global Pet Milk Replacer Market Outlook, by Form Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Powder

3.2.1.2. Liquid

3.3. Global Pet Milk Replacer Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Pet Specialty Stores

3.3.1.2. Hypermarket/Supermarket

3.3.1.3. Drug Stores

3.3.1.4. Veterinary Clinics

3.3.1.5. Online Retail

3.4. Global Pet Milk Replacer Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Pet Milk Replacer Market Outlook, 2018 - 2030

4.1. North America Pet Milk Replacer Market Outlook, by Pet Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Cat

4.1.1.2. Dog

4.2. North America Pet Milk Replacer Market Outlook, by Form Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Powder

4.2.1.2. Liquid

4.3. North America Pet Milk Replacer Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Pet Specialty Stores

4.3.1.2. Hypermarket/Supermarket

4.3.1.3. Drug Stores

4.3.1.4. Veterinary Clinics

4.3.1.5. Online Retail

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Pet Milk Replacer Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Pet Milk Replacer Market Outlook, 2018 - 2030

5.1. Europe Pet Milk Replacer Market Outlook, by Pet Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Cat

5.1.1.2. Dog

5.2. Europe Pet Milk Replacer Market Outlook, by Form Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Powder

5.2.1.2. Liquid

5.3. Europe Pet Milk Replacer Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Pet Specialty Stores

5.3.1.2. Hypermarket/Supermarket

5.3.1.3. Drug Stores

5.3.1.4. Veterinary Clinics

5.3.1.5. Online Retail

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Pet Milk Replacer Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Pet Milk Replacer Market Outlook, 2018 - 2030

6.1. Asia Pacific Pet Milk Replacer Market Outlook, by Pet Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Cat

6.1.1.2. Dog

6.2. Asia Pacific Pet Milk Replacer Market Outlook, by Form Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Powder

6.2.1.2. Liquid

6.3. Asia Pacific Pet Milk Replacer Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Pet Specialty Stores

6.3.1.2. Hypermarket/Supermarket

6.3.1.3. Drug Stores

6.3.1.4. Veterinary Clinics

6.3.1.5. Online Retail

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Pet Milk Replacer Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Pet Milk Replacer Market Outlook, 2018 - 2030

7.1. Latin America Pet Milk Replacer Market Outlook, by Pet Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Cat

7.1.1.2. Dog

7.2. Latin America Pet Milk Replacer Market Outlook, by Form Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Powder

7.2.1.2. Liquid

7.3. Latin America Pet Milk Replacer Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Pet Specialty Stores

7.3.1.2. Hypermarket/Supermarket

7.3.1.3. Drug Stores

7.3.1.4. Veterinary Clinics

7.3.1.5. Online Retail

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Pet Milk Replacer Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Pet Milk Replacer Market Outlook, 2018 - 2030

8.1. Middle East & Africa Pet Milk Replacer Market Outlook, by Pet Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Cat

8.1.1.2. Dog

8.2. Middle East & Africa Pet Milk Replacer Market Outlook, by Form Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Powder

8.2.1.2. Liquid

8.3. Middle East & Africa Pet Milk Replacer Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Pet Specialty Stores

8.3.1.2. Hypermarket/Supermarket

8.3.1.3. Drug Stores

8.3.1.4. Veterinary Clinics

8.3.1.5. Online Retail

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Pet Milk Replacer Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Pet Milk Replacer Market by Pet Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Pet Milk Replacer Market Form Type, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Pet Milk Replacer Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Distribution Channel vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Pet Ag, Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Beaphar, B.V.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Manna Pro Products, LLC

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Royal Canin

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Venky,s

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Liprovit BV

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Hartz

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Breeders' Edge

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Nutreco N.V.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Drools

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Tu Meke Friend

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Pet Type Coverage |

|

|

Form Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |