Global PUR Adhesive in Electronics Market Forecast

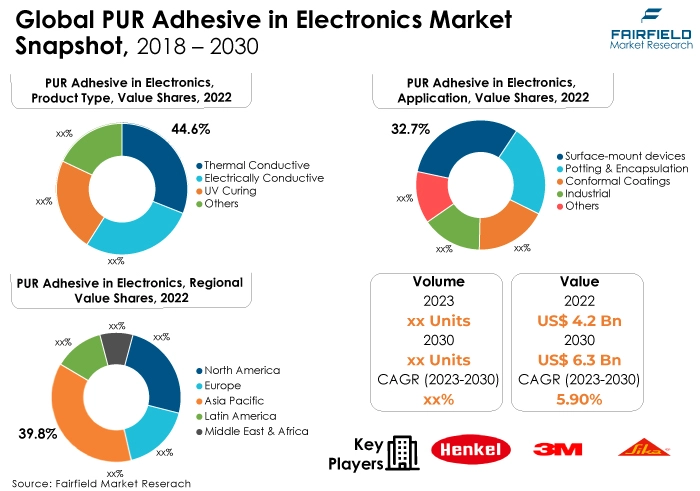

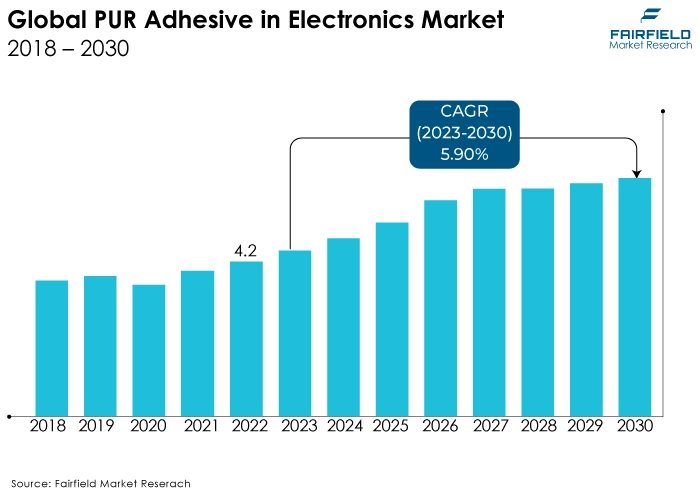

- The approximately US$4.2 Bn market for PUR adhesive in electronics (2022) poised to reach US$6.3 Bn in 2030

- Market expects a healthy growth in revenue at a CAGR of 5.9% during 2023 - 2030

Quick Report Digest

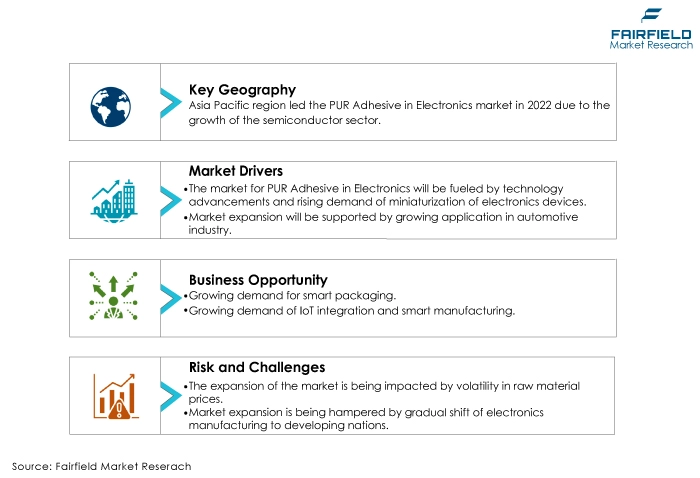

- The key trend anticipated to fuel the growth of polyurethane reactive (PUR) adhesive in electronics is the increasing demand from the electronics industry.

- Another major market trend expected to fuel the growth of PUR adhesive in electronics market is, a rapidly expanding global automotive industry. The global automotive industry's growth is expected to contribute to the market's profitability.

- Raw material availability and price fluctuations are challenges in the PUR adhesive in electronics market, impacting cost predictability and supply chain stability, hindering market growth and profitability.

- Thermal conductive PUR adhesives dominate the electronics market due to their crucial role in dissipating heat efficiently, enhancing device performance, and ensuring reliability. As electronics become more powerful and compact, the demand for effective thermal management solutions drives the popularity of these adhesives.

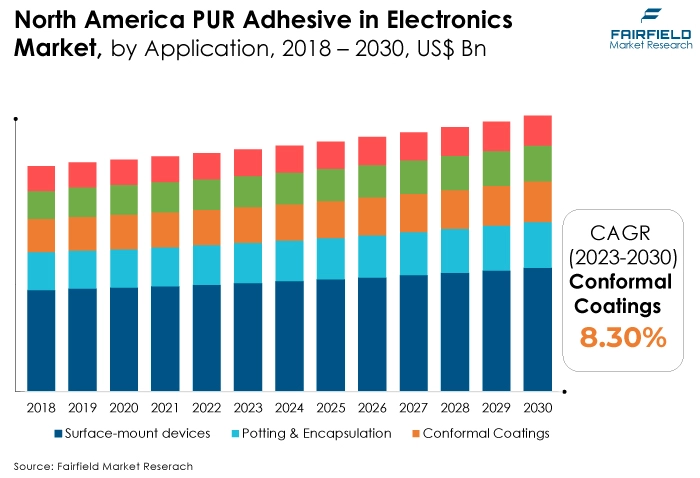

- Surface-mount devices (SMDs) leads the PUR adhesive market in electronics because of their widespread use in modern electronics manufacturing. The trend toward miniaturisation and high-density PCBs necessitates reliable adhesion, making SMDs the preferred choice for many electronic applications.

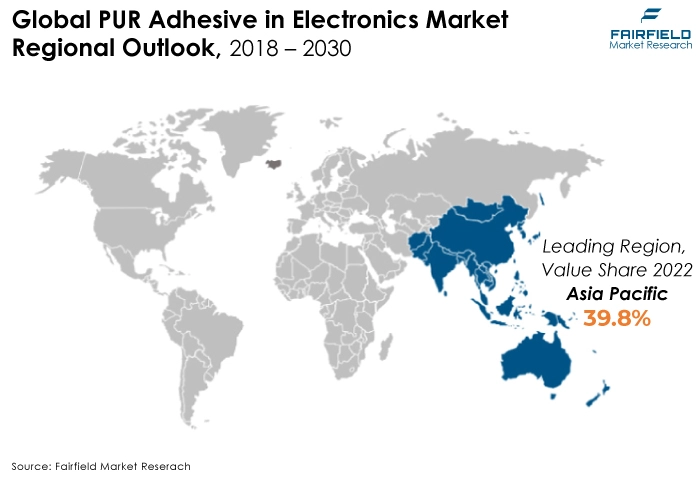

- The Asia Pacific region secured the dominant market share in PUR adhesive for electronics due to robust electronics manufacturing, technological advancements, cost-effective production, and a growing demand for high-performance adhesive solutions in the region's thriving electronics industry.

- Europe is the fastest-growing region in the PUR adhesive in electronics market due to stringent environmental regulations promoting eco-friendly adhesives, a surge in electronics innovation, increased automation, and a growing emphasis on sustainability driving the adoption of PUR adhesive in the European electronics sector.

- Volatility in raw material prices poses a significant challenge in the PUR adhesive electronics market by impacting production costs and product pricing. This instability can affect profit margins, hindering market growth and making it challenging for manufacturers to maintain competitiveness and stability.

A Look Back and a Look Forward - Comparative Analysis

The PUR adhesive market in the electronics sector is witnessing growth due to increased demand for miniaturised and high-performance electronic devices. PUR adhesives are favoured for their robust bonding capabilities and resistance to environmental factors. However, the market may have evolved with advancements in electronics and sustainability concerns.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as pharmaceuticals. The pharmaceutical application of the PUR adhesive in the electronics market is growing due to the critical need for safe and efficient drug packaging.

Glass ampoules offer excellent compatibility with a wide range of pharmaceutical compounds, ensuring drug stability and minimising the risk of contamination. With the pharmaceutical industry's expansion and its increasing focus on product quality, the demand for glass ampoules as a dependable packaging solution is on the rise.

The future of PUR adhesive in the electronics market appears promising. As electronics continue to evolve with trends like miniaturisation and increasing connectivity, demand for reliable, high-performance adhesives will grow. PUR adhesives are likely to play a pivotal role due to their durability and versatility.

Sustainability concerns may also drive the development of eco-friendly PUR adhesive solutions, aligning with industry shifts toward greener practices.

Key Growth Determinants

- Rising Trend of Miniaturisation of Electronic Devices

The increasing demand for the miniaturisation of electronic devices is a significant driver for the growth of the PUR adhesive market in the electronics industry. As consumers and enterprises seek smaller, lighter, and more compact electronic products, manufacturers face the challenge of assembling and bonding intricate components within limited spaces. PUR adhesives play a crucial role in addressing this challenge. Their ability to provide strong, reliable bonding in tight spaces allows for the assembly of miniaturised electronic components and ensures the structural integrity of these devices.

Furthermore, PUR adhesives offer excellent thermal stability and resistance to environmental factors, making them ideal for compact electronics that may be exposed to temperature variations, moisture, and harsh conditions. As the trend toward miniaturisation continues across various sectors, including consumer electronics, automotive electronics, and medical devices, the demand for PUR adhesives is expected to rise, driving growth in the electronics adhesive market.

Manufacturers rely on these adhesives to enable the production of smaller yet high-performance electronic products that meet the demands of today's technology-driven world.

- Technological Advancements

Technology advancements are propelling the PUR adhesive market in the electronics sector. As electronics continually evolve with innovations like flexible displays, advanced sensors, and complex circuitry, adhesive solutions must keep pace. PUR adhesives are adaptable to cutting-edge materials and designs, providing superior bonding for next-gen electronic components.

Moreover, as electronic devices become more sophisticated and compact, PUR adhesives offer improved thermal management, durability, and reliability. These qualities are essential in ensuring the performance and longevity of modern electronics, driving the adoption of PUR adhesives as a critical component in the industry.

- Broadening Range of Application in Automotive Industry

The expanding applications of electronics in the automotive industry are a key driver for the PUR adhesive market. As vehicles incorporate advanced electronic systems for safety, connectivity, and automation, there's a growing need for durable, high-performance adhesives.

PUR adhesives provide strong, reliable bonding in automotive electronics, ensuring component stability in demanding environments. With the rise of electric vehicles (EVs), and autonomous driving technology, the demand for PUR adhesives is poised to increase further, making them integral to the automotive electronics market's continued growth and innovation.

Major Growth Barriers

- Volatility in Raw Material Prices

Volatility in raw material prices presents a significant challenge for the PUR adhesive market in electronics. The production of PUR adhesives relies on various raw materials, including isocyanates and polyols, which are susceptible to price fluctuations due to factors like supply chain disruptions and market forces. The price uncertainties can impact manufacturing costs and pricing for electronics manufacturers, potentially limiting their adoption of PUR adhesives.

To mitigate this challenge, adhesive producers often seek alternative formulations and supply chain strategies to ensure stable pricing and availability, maintaining competitiveness in the electronics market.

- Gradual Shift of Electronics Manufacturing Bases to Developing Nations

The gradual shift of electronics manufacturing to developing countries presents challenges for the PUR adhesive market. While cost-effective production is a key driver for this shift, it may result in variations in regulatory standards and product quality.

Adhesive manufacturers must adapt to different regulatory landscapes and ensure consistent product performance, posing challenges in maintaining quality control and compliance.

Additionally, the demand for adhesives in these regions can be influenced by economic fluctuations and market dynamics, requiring companies to navigate a complex landscape for sustained growth.

Key Trends and Opportunities to Look at

- Smart Packaging

Smart packaging technology in the PUR adhesive electronics market involves incorporating electronic components, sensors, or indicators into adhesive-sealed packaging. This enables real-time monitoring of product conditions, such as temperature, humidity, or tampering.

PUR adhesives play a critical role in sealing and bonding these smart packaging solutions, ensuring the integrity of electronic components and enhancing consumer engagement through data-driven insights.

- IoT technology integration

In the PUR adhesive electronics market, IoT is being increasingly leveraged for real-time monitoring of adhesive applications and curing processes.

Sensors and connectivity enable data collection, helping manufacturers maintain quality control, track performance, and optimise production. This integration of IoT enhances efficiency and ensures consistent adhesive performance, contributing to the overall advancement of electronics manufacturing processes.

- Smart Manufacturing

Smart manufacturing technology in the PUR adhesive electronics market involves the integration of automation, data analytics, and AI to optimise adhesive application processes. It enhances quality control, reduces waste, and ensures precise adhesive application, leading to improved product reliability, and cost efficiency.

Smart manufacturing solutions are instrumental in meeting the evolving demands of the electronics industry for high-quality, miniaturised electronic devices.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario significantly influences the PUR (Polyurethane Reactive) adhesive market in the electronics industry. The usage of certain chemicals in adhesives is subject to strict requirements imposed by regulatory organisations like the Environmental Protection Agency (EPA), and the European Chemicals Agency (ECHA), which have an impact on formulation and component selection.

Manufacturers of adhesives are required to adhere to regulations like Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), and Restriction of Hazardous Substances (RoHS). Additionally, as electronics are subject to various international safety standards and certifications, adhesives used in electronic components must meet these requirements to ensure product safety and reliability.

Changes in regulations can impact adhesive formulations, production processes, and product labeling, making it crucial for manufacturers to stay updated and adapt to evolving regulatory landscapes to remain competitive and meet environmental and safety objectives.

Fairfield’s Ranking Borad

Top Segments

- Thermal Conductive Adhesives Retain a Dominant Position

Thermal conductive PUR adhesive products have captured the largest market share in the electronics industry due to their critical role in dissipating heat generated by electronic components. As electronics become more compact and powerful, effective thermal management is essential to prevent overheating and ensure device reliability.

Thermal conductive PUR adhesives offer superior heat transfer properties while providing strong bonding, making them ideal for applications like LED lighting, power electronics, and microprocessors. Their ability to enhance thermal efficiency while maintaining structural integrity has driven their widespread adoption, establishing them as a dominant product type in the PUR adhesive electronics market.

The electrically conductive product type in the PUR adhesive electronics market is expected to exhibit the fastest CAGR due to the increasing demand for reliable bonding solutions that also provide electrical conductivity. As electronics advance, there is a growing need for adhesives that can both securely bond components and maintain electrical connections.

Electrically conductive PUR adhesives fulfill this dual purpose, making them indispensable in applications like printed circuit boards (PCBs), sensors, and electromagnetic shielding, thus driving their rapid growth in the market.

- Prominence of Surface-mount Devices Prevails

SMD application has captured the largest market share in the PUR adhesive electronics market due to their widespread use in modern electronics manufacturing. SMDs offer advantages like compactness, improved circuit density, and automated assembly, requiring adhesives that provide strong and reliable bonding.

PUR adhesives offer excellent adhesion properties, environmental resistance, and durability, making them well-suited for SMD applications. With the continued trend toward miniaturisation and high-performance electronics, SMDs are integral to various electronic devices, solidifying their dominance in the market for PUR adhesives.

The conformal coatings application is expected to grow at the fastest CAGR in the PUR adhesive electronics market due to the increasing demand for protective coatings in electronic assemblies. Conformal coatings provide vital protection against moisture, chemicals, dust, and other environmental factors, extending the lifespan and reliability of electronic components.

PUR adhesives are chosen for their compatibility with conformal coatings, ensuring strong bonding and long-term performance. As electronics continue to expand into harsh and demanding environments, the need for effective conformal coatings is driving rapid growth in this segment of the PUR adhesive market.

Regional Frontrunners

Asia Pacific Presents the Largest Playing Ground to Industry Players

Asia Pacific has captured the largest market share in the PUR adhesive electronics market due to several key factors. First, the region is a manufacturing hub for electronics, with countries like China, Japan, South Korea, and Taiwan hosting numerous electronics production facilities. This extensive manufacturing activity drives the demand for adhesives used in electronic assembly.

Additionally, Asia Pacific benefits from robust investments in technology and infrastructure, facilitating research and development in advanced electronic devices that rely on PUR adhesives. The region's rapid industrialisation, growing consumer electronics market, and expanding automotive sector further contribute to the substantial market share.

Moreover, favourable government policies, cost-effective labour, and proximity to raw material suppliers enhance the region's competitiveness in electronics manufacturing, propelling Asia Pacific to the forefront of the PUR adhesive electronics market.

European Markets Set to Thrive with Strong Backing of Environmental Regulation

Europe is expected to grow at the fastest value CAGR in the PUR adhesive electronics market due to several factors. The region places a strong emphasis on sustainability and environmental regulations, which aligns with the development of eco-friendly and low-VOC PUR adhesives. Europe has a thriving automotive and industrial electronics sector, where the demand for high-performance and reliable bonds is growing rapidly.

Moreover, ongoing innovation in electronics manufacturing technologies and a focus on R&D contribute to the region's projected rapid growth in the PUR adhesive electronics market.

Fairfield’s Competitive Landscape Analysis

The global PUR adhesive in the electronics market is consolidated, with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global PUR Adhesive in Electronics space?

- Henkel AG & Co. KGaA

- 3M

- B Fuller

- Dow Chemical Company

- Sika AG

- Avery Dennison

- Master Bond Inc.

- Lord Corporation

- Huntsman Corporation

- Permabond

- DELO Industries Adhesives

- Panacol

- ITW Polymers Adhesives

- Dynamax Corporation

- Electrolube

Significant Company Developments

New Product Launches

- January 2022: The biggest independent producer of liquid adhesives, coatings, and primers for the UK's construction, industrial, and roofing industries, Apollo was recently bought by H.B. Fuller Company. Apollo will become a part of H.B. Fuller's construction and engineering adhesives units, strengthening the company's presence in lucrative U.K. and European markets with substantial value and margins.

- July 2021:B. Fuller, a prominent player in the global adhesive industry, unveiled a strategic collaboration with Covestro, a major polymer supplier worldwide, to introduce an environmentally friendly sticky solution for applications in woodworking, composites, textiles, and the automotive sector, aimed at minimising its carbon footprint.

Distribution Agreement

- May 2022: Henkel has launched innovative products like Loctite Liofol LA 7818 RE / 6231 RE and Loctite Liofol LA 7102 RE / 6902 RE, designed to encourage recyclability within the packaging sector, demonstrating their commitment to sustainable packaging solutions.

An Expert’s Eye

Demand and Future Growth

The growth of metal industry is driving the market. The PUR adhesive in electronics market is poised for robust future growth due to increasing market demand.

Factors such as a rising global pharmaceutical industry, growing demand for biologics and specialty drugs, stringent quality and regulatory standards, and an emphasis on patient safety are driving the need for high-quality glass ampoules.

Additionally, innovations in packaging and serialisation technologies to combat counterfeiting and ensure supply chain transparency are expected to boost the market's growth in the coming years.

Supply Side of the Market

With countries like China, Japan, South Korea, and Taiwan hosting extensive electronics manufacturing operations, Asia Pacific remains the dominant region for PUR adhesive demand in the electronics sector.

The US, and Canada have substantial electronics manufacturing activities, particularly in industries like consumer electronics, automotive electronics, and aerospace. European countries such as Germany, are significant players due to their strong automotive and industrial electronics industries.

Raw materials for PUR adhesive in the electronics market typically include polyols, isocyanates (e.g., MDI or TDI), catalysts, additives, and solvents. These materials are used to formulate the adhesive according to specific requirements such as bonding strength, curing time, and flexibility.

Major suppliers of raw materials for PUR adhesive in electronics market include Covestro, BASF SE, Dow Chemical Company, Huntsman Corporation, Wanhua Chemical Group, and Evonik Industries. These companies provide key components used by adhesive manufacturers to produce high-quality PUR adhesives for electronics applications.

Global PUR Adhesive in Electronics Market is Segmented as Below:

By Product Type:

- Thermal Conductive

- Electrically Conductive

- UV Curing

- Others

By Application:

- Surface-mount devices

- Potting & Encapsulation

- Conformal Coatings

- Others

- Industrial

By Geographic Coverage:

- North America

- The U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global PUR Adhesive in Electronics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global PUR Adhesive in Electronics Market Outlook, 2018 - 2030

3.1. Global PUR Adhesive in Electronics Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Thermal Conductive

3.1.1.2. Electrically Conductive

3.1.1.3. UV Curing

3.1.1.4. Others

3.2. Global PUR Adhesive in Electronics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Surface-mount devices

3.2.1.2. Potting & Encapsulation

3.2.1.3. Conformal Coatings

3.2.1.4. Others

3.2.1.5. Industrial

3.3. Global PUR Adhesive in Electronics Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America PUR Adhesive in Electronics Market Outlook, 2018 - 2030

4.1. North America PUR Adhesive in Electronics Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Thermal Conductive

4.1.1.2. Electrically Conductive

4.1.1.3. UV Curing

4.1.1.4. Others

4.2. North America PUR Adhesive in Electronics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Surface-mount devices

4.2.1.2. Potting & Encapsulation

4.2.1.3. Conformal Coatings

4.2.1.4. Others

4.2.1.5. Industrial

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America PUR Adhesive in Electronics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe PUR Adhesive in Electronics Market Outlook, 2018 - 2030

5.1. Europe PUR Adhesive in Electronics Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Thermal Conductive

5.1.1.2. Electrically Conductive

5.1.1.3. UV Curing

5.1.1.4. Others

5.2. Europe PUR Adhesive in Electronics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Surface-mount devices

5.2.1.2. Potting & Encapsulation

5.2.1.3. Conformal Coatings

5.2.1.4. Others

5.2.1.5. Industrial

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe PUR Adhesive in Electronics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific PUR Adhesive in Electronics Market Outlook, 2018 - 2030

6.1. Asia Pacific PUR Adhesive in Electronics Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Thermal Conductive

6.1.1.2. Electrically Conductive

6.1.1.3. UV Curing

6.1.1.4. Others

6.2. Asia Pacific PUR Adhesive in Electronics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Surface-mount devices

6.2.1.2. Potting & Encapsulation

6.2.1.3. Conformal Coatings

6.2.1.4. Others

6.2.1.5. Industrial

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific PUR Adhesive in Electronics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China PUR Adhesive in Electronics Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America PUR Adhesive in Electronics Market Outlook, 2018 - 2030

7.1. Latin America PUR Adhesive in Electronics Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Thermal Conductive

7.1.1.2. Electrically Conductive

7.1.1.3. UV Curing

7.1.1.4. Others

7.2. Latin America PUR Adhesive in Electronics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Surface-mount devices

7.2.1.2. Potting & Encapsulation

7.2.1.3. Conformal Coatings

7.2.1.4. Others

7.2.1.5. Industrial

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America PUR Adhesive in Electronics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa PUR Adhesive in Electronics Market Outlook, 2018 - 2030

8.1. Middle East & Africa PUR Adhesive in Electronics Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Thermal Conductive

8.1.1.2. Electrically Conductive

8.1.1.3. UV Curing

8.1.1.4. Others

8.2. Middle East & Africa PUR Adhesive in Electronics Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Surface-mount devices

8.2.1.2. Potting & Encapsulation

8.2.1.3. Conformal Coatings

8.2.1.4. Others

8.2.1.5. Industrial

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa PUR Adhesive in Electronics Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa PUR Adhesive in Electronics Market Product Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa PUR Adhesive in Electronics Market Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Henkel AG & Co. KGaA

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. 3M

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. H.B. Fuller

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Dow Chemical Company

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Sika AG

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Avery Dennison

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Master Bond Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. LORD Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Huntsman Corporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Permabond

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. DELO Industrial Adhesives

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Panacol

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. ITW Polymers Adhesives

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Dymax Corporation

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Electrolube

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country- wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |