Global Renewable Energy Certificate Market Forecast

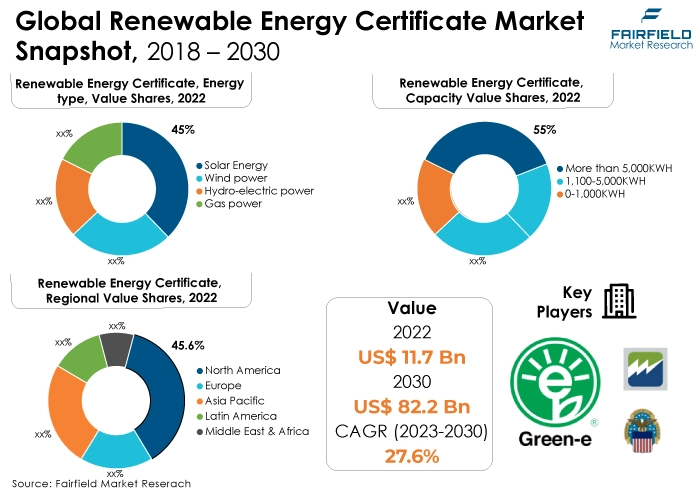

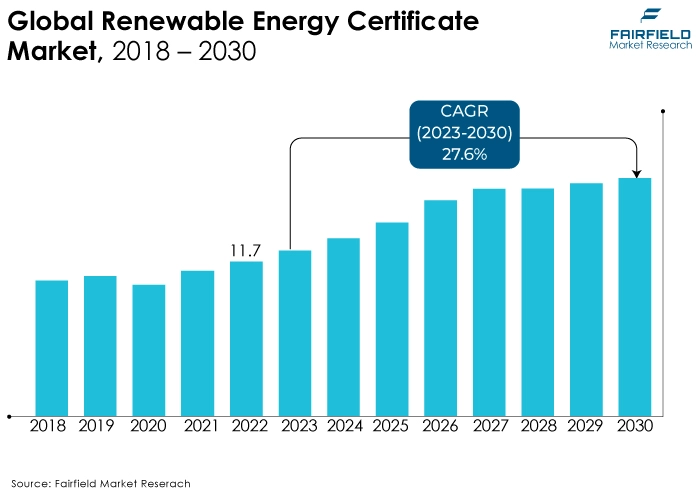

- Renewable energy certificate market size to take a leap from US$11.7 Bn in 2022 to US$82.2 Bn estimated in 2030

- Market valuation slated for a stupendous CAGR of 27.6% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to drive the renewable energy certificate market growth is an increasing demand for renewable natural gas (RNG) certificates. Furthermore, RNG creation benefits the environment, just like power generation from solar, wind, or other renewable sources. In order to address the growing demand for the procurement of sustainable energy, RNG certificates will be incorporated into the REC market, increasing the supply of renewable qualities.

- Another major market trend expected to drive the renewable energy certificate market growth is the rapidly expanding green data centers. The demand for RECs may rise significantly as a result of data centers switching to renewable energy. Data centers, especially large ones, use a lot of electricity, and because they are committed to using renewable energy, they may have a big requirement for REC purchases.

- The regulations, classifications, and verification procedures used in the REC market differ across areas and nations, indicating a need for global standardization. Because of the absence of consistency, market players may become confused and inefficient, which may discourage investment.

- In 2022, the solar energy category dominated the industry. Renewable energy markets allow for the purchase and sale of solar RECs. Without physically obtaining their electricity from solar installations, organizations who buy solar RECs can nevertheless claim the environmental advantages of using solar energy.

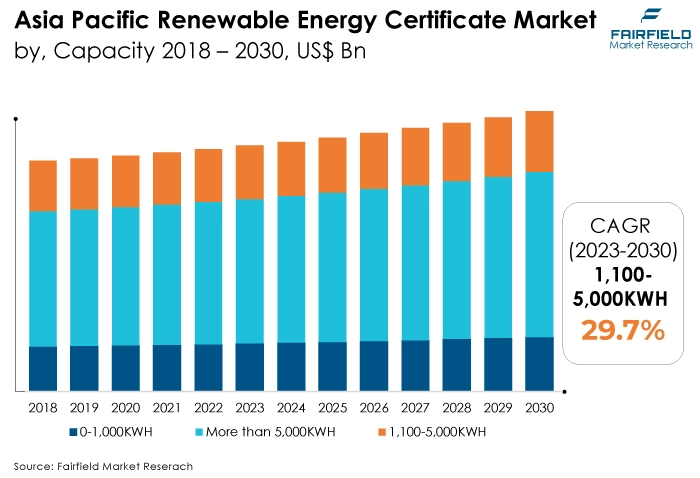

- In 2022, the more than 5,000KWH category dominated the industry. Install accurate metering and monitoring devices to keep tabs on your renewable energy system's electricity output. To determine how many RECs you can produce, you must have this information.

- During the forecast period, the compliance category is expected to grow significantly. Regulated organizations usually seek compliance RECs to satisfy their duties, which increases the demand for renewable energy sources and the growth of renewable energy projects.

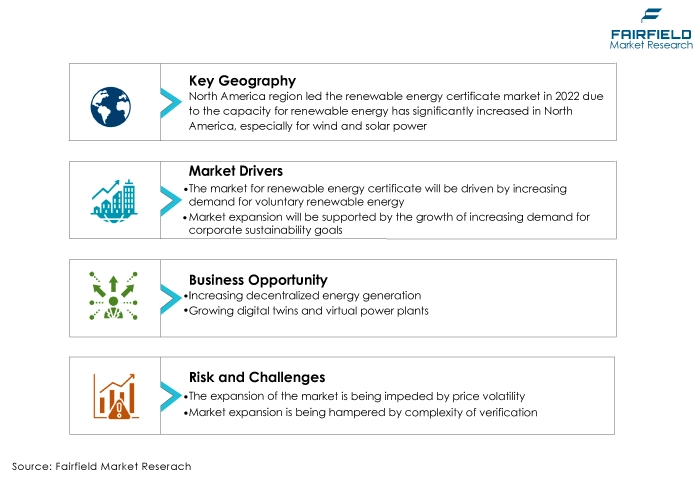

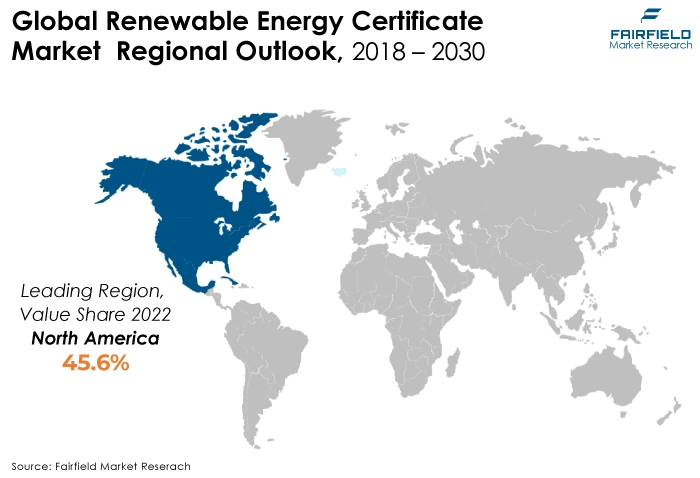

- The North America region is expected to dominate the renewable energy certificate market during the forecast period. The capacity for renewable energy has significantly increased in North America, especially for wind and solar power.

- Asia Pacific is expected to be the fastest-growing renewable energy certificate market region. Growing climate change awareness and environmental concerns have raised demand for clean and green energy sources, especially RECs.

A Look Back and a Look Forward - Comparative Analysis

Modern digital platforms and online markets give buyers and sellers a centralized and effective way to trade RECs. These platforms simplify the issue, monitoring, and trading of certificates while cutting expenses and administrative work. Market participants can analyze REC market dynamics, pricing, and demand due to advanced data analytics tools. Organizations can make informed choices about REC trading and procurement due to this data-driven strategy.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the climate agreements frequently containing clauses addressing the adoption of renewable energy, defining the percentage of fuel that must come from renewable sources. These objectives increased demand for RECs as a way to confirm adherence to renewable energy mandates.

Climate agreements established financial incentives and frameworks to stimulate the growth of renewable energy sources. Similar to carbon pricing or renewable energy subsidies, these incentives sparked investment in renewable projects and raised demand for RECs.

Electricity is needed to charge EVs, which raises the demand for electricity. Due to this increased demand, there is a chance for the production of clean electricity to power EVs to grow in the coming years. Additionally, Many companies are electrifying their fleets of vehicles and setting sustainability objectives. They might fuel their EV fleets with RECs and renewable energy, expanding the REC market.

Furthermore, The generation and storage of renewable energy can be combined with EV charging using smart grid technologies. This increases the use of clean energy by allowing EVs to set during periods of high renewable energy availability during the next five years.

Key Growth Determinants

- Increasing Voluntary Renewable Energy Buyers

Voluntary buyers actively look for RECs as a method to show their support for renewable energy, including eco-aware individuals and groups dedicated to sustainability. With a broader market and more chances to produce and sell certificates, there is a growth in the demand for RECs.

Voluntary purchasers come from a variety of industries, including businesses, charitable organizations, schools, and individual consumers. This variety of purchasers stabilizes the REC market because it is less dependent on laws and regulations from the government.

The market for these certificates grows outside of legally mandated criteria as more people and companies voluntarily buy RECs. This larger client base promotes the creation of additional renewable energy projects to satisfy increasing demand.

- Growing Global Emphasis on Corporate Environmental Responsibility and Sustainability Goals

Many corporations set ambitious sustainability goals, which frequently include targets for adopting renewable energy. Companies often buy RECs as a strategy to match their electricity demand with sustainable energy generation in order to achieve these aims. As a result, there is a significant and ongoing market demand for RECs.

Large organizations may sign power purchase agreements (PPAs) or actively invest in renewable energy projects if they have sustainability objectives. RECs enable businesses to support renewable energy generation elsewhere and uphold their commitment to clean energy in situations where on-site renewable energy generation is not practical.

- Exploding Penetration of IoT and Smart Meters

Smart meters connected to the Internet of Things offer real-time information on energy production and usage. It is possible to utilize this information to confirm the production of renewable energy and ensure that RECs appropriately reflect the environmental characteristics of the power.

Smart meters eliminate the need for manual meter readings and audits by automating data collection procedures. The issuance of RECs is streamlined by this automation, which increases its effectiveness and lowers its cost.

Transparent and impenetrable data from IoT-connected devices is essential for confirming the production of renewable energy. Between market players and authorities, this transparency helps foster confidence.

Major Growth Barriers

- Price Volatility

Developers and investors in renewable energy projects may experience uncertainty due to price volatility. Investments in renewable energy projects may be discouraged by fluctuations in REC prices that make it difficult to predict future revenue streams.

Businesses find it challenging to budget for REC purchases and renewable energy commitments due to price volatility. Unexpected cost fluctuations brought on by rapid price changes can affect financial planning and decision-making.

Due to price volatility, buyers of RECs, including businesses and utilities, are subject to market risk. It is more difficult to control the financial impact of renewable energy purchases when REC prices are extremely fluctuating.

- Complexity of Verification Processes

Verification can be labor- and resource-intensive, involving a lot of time, people, and money. Smaller renewable energy projects may encounter difficulties due to their complexity, which may also dissuade potential competitors from entering the market.

Accurate data collection on renewable energy production can be difficult, particularly for distributed energy resources like rooftop solar panels. Verifying the environmental characteristics of energy generation may become challenging as a result.

Key Trends and Opportunities to Look at

- Blockchain, and Transparency

Blockchain technology is used to maintain a transparent, unchangeable ledger of all REC transactions and renewable energy output. This transparency leads to greater confidence among market participants, which reduces the likelihood of fraud and ensures the accuracy of certificate data.

Blockchain can be used to safely check the legitimacy of the production of renewable energy and related environmental characteristics. Data validation can be done automatically using smart contracts, streamlining the verification process.

- Decentralized Energy Generation

A wide variety of renewable energy sources, such as solar, wind, hydro, and biomass, are included in decentralized energy generation. This diversification broadens the types of RECs that are available and appeals to a wider range of customers. The overall supply of RECs is increased through decentralized generation.

A greater pool of accessible certificates is produced when more people and small businesses invest in renewable energy projects and have RECs that may be sold on the market.

The continuous supply of renewable energy is made possible by combining decentralized generation with energy storage technology. By assuring reliable energy output, this integration can boost the supply of RECs.

- Digital Twins, and Virtual Power Plants

Solar farms, wind turbines, and hydroelectric facilities may all be digitally recreated because of the use of digital twins. In order to ensure correct data collection for REC issuance, these digital copies can continuously monitor the performance of these assets.

The operation of distributed energy resources, such as solar panels, battery storage, and wind turbines, is optimized by VPPs using cutting-edge algorithms and control systems. By improving the efficiency and accessibility of renewable energy, more chances for REC issuance may arise.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the market for renewable energy certificates (RECs) has been governed by a number of regulatory frameworks. It is affected by important regulatory organizations both domestically and abroad. The Environmental Protection Agency (EPA) is in charge of managing the REC program in the US. By means of its Green Power Partnership Program, it establishes the rules and requirements for the issuing, monitoring, and trading of RECs.

As a way to show their dedication to renewable energy and sustainability, organizations are encouraged to engage in the REC market by EPA laws and the Green Power Partnership. In order to maintain the legitimacy and integrity of RECs on the American market, the Environmental Protection Agency (EPA) role is essential. Federal Energy Regulatory Commission (FERC) governs the trading of RECs in various markets and controls interstate power markets in the United States. By ensuring that REC transactions adhere to federal energy policy and standards, Federal Energy Regulatory Commission (FERC) regulations assist in ensuring market transparency and consistency.

Directives and targets set by the European Union (EU) for renewable energy have an effect on the REC market in all member states. European Union (EU) directives establish targets for renewable energy and encourage the issue and trading of RECs to meet these requirements. A standardized framework for the case and trade of RECs inside the European Union (EU) is provided by the European Energy Certificate System (EECS).

Fairfield’s Ranking Board

Top Segments

- Dominance of Solar Energy Category Prevails

The solar energy segment dominated the market in 2022 by the type of energy. Photovoltaic (PV) panels or solar thermal systems convert sunlight into electricity or heat to produce solar energy. Solar RECs are created by separating the environmental attributes of the power produced by solar energy sources from the electricity itself. This procedure entails monitoring the quantity of power generated by the solar installation and confirming that it was created with the aid of solar technology.

Furthermore, the wind power category is projected to experience the fastest market growth. Wind energy is produced by using the wind's kinetic energy to turn wind turbine blades, which then power generators to create electricity. In places with abundant wind resources, wind turbines can be sited either onshore or offshore.

- Capacity of More than 5,000KWH Most Preferred

The more than 5,000KWH segment dominated the market in 2022. A renewable energy system's annual electricity production is often inversely correlated with the number of RECs it generates. Depending on the system's actual display, if it has a capacity of more than 5,000 KWh, it could produce a significant quantity of RECs.

REC programs must accurately track and report the generation of renewable energy. To ensure REC compliance, systems with huge capacities require more complex monitoring and reporting processes.

The 1,000-5,000KWH category is anticipated to grow substantially throughout the projected period. The quantity of RECs produced by the system will depend on how much electricity it really has annually.

Systems can make a substantial amount of RECs with an annual production of 1,100 to 5,000 KWh. Keep thorough records of the installation, operation, and electricity generation of the renewable energy system. These documents will be necessary for reporting and certification.

- Voluntary End Users Continue to Lead

The voluntary segment dominated the market in 2022. Voluntary RECs provide renewable energy producers with an additional revenue stream, and the proceeds from their sale can be used to finance the development of new renewable energy projects. This, therefore, helps the market for renewable energy to expand.

Third-party organizations frequently certify voluntary RECs to confirm their validity and guarantee that the related renewable energy output satisfies strict environmental and sustainability standards.

The compliance segment is anticipated to experience significant growth during the projection period. Compliance RECs are used to prove that a specific portion of a company's electricity supply is derived from renewable resources. Holding these RECs enables the entity to demonstrate that the required renewable energy targets have been reached or surpassed.

Regional Frontrunners

North America Remains the Top Performer

North America is expected to dominate the renewable energy certificate market throughout the projection period. RECs are non-tangible energy commodities that can be traded in the United States and serve as documentation that 1 MWh of electricity was produced from permissible renewable energy sources and fed into the nation's common network of power lines.

In the US, compliance markets and voluntary markets are the two main markets for renewable energy certificates. Depending on the state SREC market, SREC prices in 2021 range from US$10 to over US$400. For "green attributes energy" on long-term 20-year contracts, BC Hydro in Canada gives US$3/MWh.

The industry has expanded due to rising energy demand and the advancement of renewable energy sources. The market is increasing as a result of the establishment and existence of rules for the trade in renewable energy sales. The development of domestic renewable energy sources and governmental legislation have driven the market's growth.

A further reason driving the expansion of the renewable energy certificate market is the existence of very energy-intensive businesses in this region, which created a need for renewable energy certificates to offset their carbon footprint.

Asia Pacific All Set for Notable Growth

The region with the fastest-growing market for renewable energy certificates is expected to be Asia Pacific. Many countries in the Asia-Pacific region were rapidly increasing their capacity for renewable energy, especially in the fields of solar and wind power. By increasing the amount of renewable energy produced, RECs became more plentiful and appealing to buyers.

Governments in the Asia Pacific region adopted encouraging policies and rewards to encourage the use of renewable energy sources. Feed-in tariffs, renewable energy certificate programs, and renewable energy objectives were frequently incorporated into these schemes. The requirement to purchase RECs in order to comply with these laws increased market demand.

Fairfield’s Competitive Landscape Analysis

The consolidated global market for renewable energy certificates has a reduced number of well-known players participating. The major companies are introducing new products and enhancing their distribution networks in an effort to broaden their market reach. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Renewable Energy Certificate Space?

- Defense Logistics Agency Energy

- Environmental Tracking Network of North America

- Western Area Power Administration

- General Services Administration

- Green-e Energy

- Central Electricity Regulatory Commission

- S. Environment Protection Agency

- 3Degrees

- Schneider Electric

- Sterling Planet

- RECS International

- NextEra Energy Resources

- Community Energy

- EcoAct

- Engie North America

Key Company Developments

New Product Launches

- September 2022: An estimated 420 megawatts (MW) of sustainable energy will be produced by three solar farm projects Amazon India announced in Rajasthan. The company's utility-scale renewable energy projects in India included 210 MW, 100 MW, and 110 MW projects that will be developed by ReNew Power, Amp Energy India, and Brookfield Renewable, respectively.

- December 2022: The trading of renewable energy certificates has been halted for the ensuing six weeks, according to a statement from the high court of Delhi, the capital of India. This notice is valid for all RECs sold prior to October 31, 2022. The Indian Wind Power Association Northern Region Council petitioned against the Central Electricity Regulatory Commission's new 2022 regulations, which had an impact on the decision.

- December 2022: the Indian government hopes to have installed 100 GW of solar power systems nationwide. By the end of June, 48.71 GW was expected to be in the pipeline, but 57.71 GW had already been put into operation.

Distribution Agreements

- June 2022: Plug Power Inc., a top supplier of turnkey hydrogen solutions, intended to construct a 35-ton-per-day green hydrogen generation facility at the Port of Antwerp-Bridges in Europe for the global green hydrogen economy. Additionally, a 30-year contract was reached to build the second-largest power plant in Europe near the Belgian port.

- December 2022: Agreements for a USD 150 million International Bank for Reconstruction and Development (IBRD) loan, a USD 28 million Clean Technology Fund (CTF) loan, and a USD 22 million CTF grant were signed by the Indian government, Solar Energy Corporation of India Limited (SECI), and the World Bank to help India expand its power generation capacity.

An Expert’s Eye

Demand and Future Growth

Synergies in the market may result from the need for RECs as well as carbon offsets. The demand for both kinds of environmental instruments will likely expand as more businesses that buy RECs become interested in carbon offset initiatives.

Furthermore, A more thorough strategy for lowering carbon emissions can be achieved by integrating carbon offset initiatives with the production of renewable energy and RECs. This integrated approach enables businesses and individuals to manage both direct and indirect emissions, having a more positive effect on the environment.

However, the renewable energy certificate market is expected to face considerable challenges because of price volatility.

Supply Side of the Market

According to our analysis, the United States provides the majority of the renewable energy certificates (RECs) in North America, which is the region that supplies the most RECs globally. The demand for US RECs is driven by a variety of causes, such as state and federal renewable energy laws, voluntary corporate sustainability initiatives, and the expansion of renewable energy output.

Mexico, and Canada are other North American countries with significant REC markets. While Mexico has a national renewable energy goal, Canada has a number of provincial renewable energy mandates. The United States is the largest consumer of RECs in the world, with a consumption of over 80 TWh in 2023. This is driven by a number of factors, including state and federal renewable energy mandates, voluntary corporate sustainability goals, and the increasing availability of renewable energy generation.

Germany is the largest user in Europe in 2023, consuming more than 70 TWh of RECs. The main forces behind this are voluntary business sustainability goals, and the EU Renewable Energy Directive, which establishes required targets for EU member states to increase their share of renewable energy.

Global Renewable Energy Certificate Market is Segmented as Below:

By Energy type:

- Solar Energy

- Wind power

- Hydro-electric power

- Gas power

By Capacity:

- 0-1,000KWH

- 1,000-5,000KWH

- More than 5,000KWH

By End User:

- Voluntary

- Compliance

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Renewable Energy Certificate Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Renewable Energy Certificate Market Outlook, 2018 - 2030

3.1. Global Renewable Energy Certificate Market Outlook, by Energy type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Solar Energy

3.1.1.2. Wind power

3.1.1.3. Hydro-electric power

3.1.1.4. Gas power

3.2. Global Renewable Energy Certificate Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. 0-1,000KWH

3.2.1.2. 1,100-5,000KWH

3.2.1.3. More than 5,000KWH

3.3. Global Renewable Energy Certificate Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Voluntary

3.3.1.2. Compliance

3.4. Global Renewable Energy Certificate Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Renewable Energy Certificate Market Outlook, 2018 - 2030

4.1. North America Renewable Energy Certificate Market Outlook, by Energy type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Solar Energy

4.1.1.2. Wind power

4.1.1.3. Hydro-electric power

4.1.1.4. Gas power

4.2. North America Renewable Energy Certificate Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. 0-1,000KWH

4.2.1.2. 1,100-5,000KWH

4.2.1.3. More than 5,000KWH

4.3. North America Renewable Energy Certificate Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Voluntary

4.3.1.2. Compliance

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Renewable Energy Certificate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Renewable Energy Certificate Market Outlook, 2018 - 2030

5.1. Europe Renewable Energy Certificate Market Outlook, by Energy type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Solar Energy

5.1.1.2. Wind power

5.1.1.3. Hydro-electric power

5.1.1.4. Gas power

5.2. Europe Renewable Energy Certificate Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. 0-1,000KWH

5.2.1.2. 1,100-5,000KWH

5.2.1.3. More than 5,000KWH

5.3. Europe Renewable Energy Certificate Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Voluntary

5.3.1.2. Compliance

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Renewable Energy Certificate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Renewable Energy Certificate Market Outlook, 2018 - 2030

6.1. Asia Pacific Renewable Energy Certificate Market Outlook, by Energy type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Solar Energy

6.1.1.2. Wind power

6.1.1.3. Hydro-electric power

6.1.1.4. Gas power

6.2. Asia Pacific Renewable Energy Certificate Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. 0-1,000KWH

6.2.1.2. 1,100-5,000KWH

6.2.1.3. More than 5,000KWH

6.3. Asia Pacific Renewable Energy Certificate Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Voluntary

6.3.1.2. Compliance

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Renewable Energy Certificate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Renewable Energy Certificate Market Outlook, 2018 - 2030

7.1. Latin America Renewable Energy Certificate Market Outlook, by Energy type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Solar Energy

7.1.1.2. Wind power

7.1.1.3. Hydro-electric power

7.1.1.4. Gas power

7.2. Latin America Renewable Energy Certificate Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. 0-1,000KWH

7.2.1.2. 1,100-5,000KWH

7.2.1.3. More than 5,000KWH

7.3. Latin America Renewable Energy Certificate Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Voluntary

7.3.1.2. Compliance

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Renewable Energy Certificate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Renewable Energy Certificate Market Outlook, 2018 - 2030

8.1. Middle East & Africa Renewable Energy Certificate Market Outlook, by Energy type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Solar Energy

8.1.1.2. Wind power

8.1.1.3. Hydro-electric power

8.1.1.4. Gas power

8.2. Middle East & Africa Renewable Energy Certificate Market Outlook, by Capacity, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. 0-1,000KWH

8.2.1.2. 1,100-5,000KWH

8.2.1.3. More than 5,000KWH

8.3. Middle East & Africa Renewable Energy Certificate Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Voluntary

8.3.1.2. Compliance

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Renewable Energy Certificate Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Renewable Energy Certificate Market by Energy type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Renewable Energy Certificate Market Capacity, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Renewable Energy Certificate Market End Use, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End Use vs End Use Heatmap

9.2. Manufacturer vs End Use Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Defense Logistics Agency Energy

9.5.2. Environmental Tracking Network of North America

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Western Area Power Administration

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. General Services Administration

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Green-e Energy

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Central Electricity Regulatory Commission

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. U.S. Environment Protection Agency

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. 3Degrees

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Schneider Electric

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Sterling Planet

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. RECS International

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. NextEra Energy Resources

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Community Energy

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. EcoAct

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Engie North America

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Energy Type Coverage |

|

|

Capacity Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |