Global Silicone Tape Market Forecast

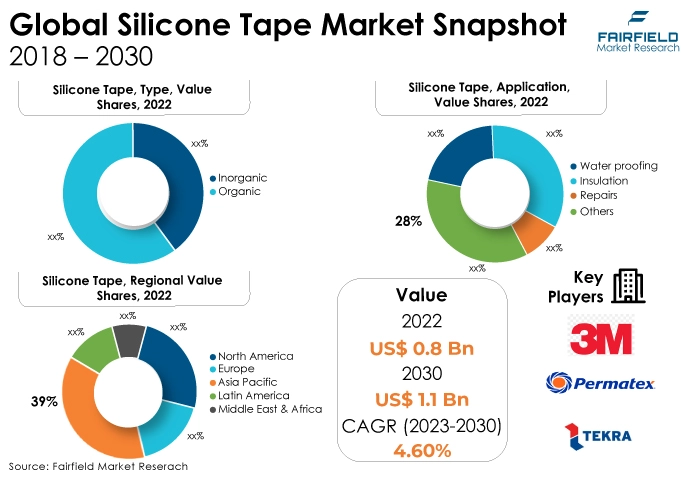

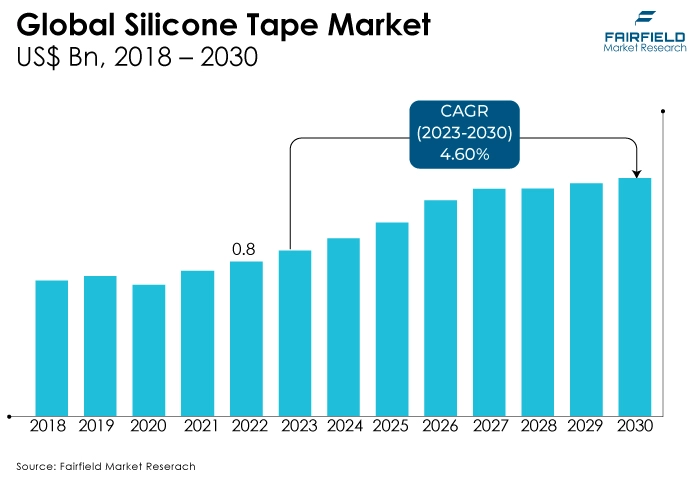

- Global market for silicone tape worth around US$0.8 Bn in 2022 to reach nearly US$1.096 Bn by 2030

- Market size likely to witness a value CAGR of 4.6% between 2023 and 2030

Quick Report Digest

- The main trend projected to drive the market expansion for silicone self-fusing tapes is the expected continuation of the rising demand for these tapes.

- The numerous new initiatives that the leading global market competitors have embraced are another significant market trend anticipated to propel the Silicone Tape market growth.

- The market for silicone tapes is likely to increase at a similar rate in the future due to the large number of consumers who are choosing more advanced technologies and superior silicone tapes.

- In terms of market share for silicone tape globally, the organic silicone tapes segment is anticipated to dominate. It has both organic and inorganic characteristics and can maintain its physical and chemical qualities over a wide temperature range because organic silicon tapes have the inorganic structural Si-O key.

- In 2022, the repairs category controlled the market. For hose, electrical, plumbing, and tool repairs, repair silicone tape forms an air- and water-tight seal.

- To increase the sales and demand for these silicone tapes, which are anticipated to reach new heights during the forecast period, the electrical sector has emerged as the dominant market player.

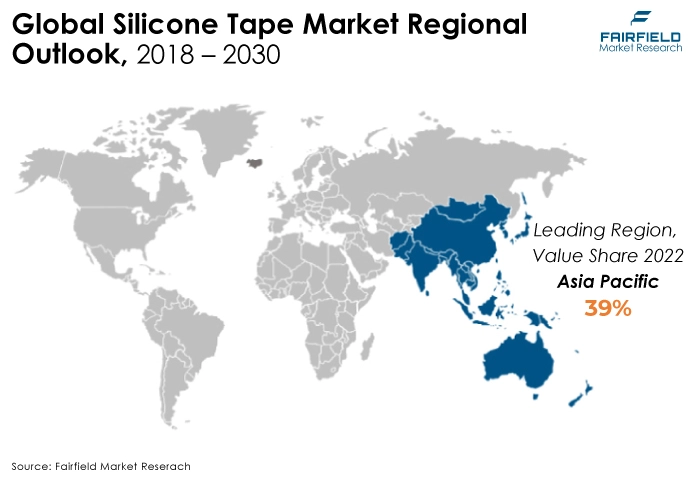

- Geographically, the Asia Pacific area has emerged as the largest market for silicone tapes, and this market is expanding quickly because of the region's growing industrial sector's demand for such materials.

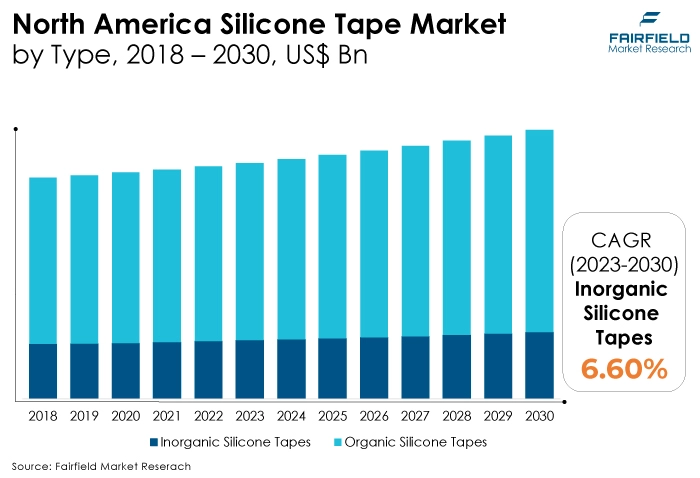

- North America registered the fastest growth. The industry for flexible packaging is most prevalent in North America. Additionally, the region consumes the most flexible packaging per person worldwide (US$71.58).

A Look back and a Look Forward - Comparative Analysis

The major players in the market have chosen specific materials that assist in delivering a premium experience to potential customers while raising the calibre of silicone elastomers, mostly with the use of silicone compounding technology that aids in refining the calibre of the material.

As a result, the large number of customers choosing these cutting-edge technologies and superior silicone tapes have turned out to be the main factors propelling the expansion of the silicone tapes market.

Due to the numerous rules and regulations put in place by the government, including the adoption of lockdowns and restricted movement, the pandemic epidemic significantly impacted the silicone tapes market's growth phase.

Because individuals could not leave their homes to work during this time, it severely affected the construction and electrical industries, which ultimately served as a major impediment to the market's expansion. A key selling point for potential customers globally is the silicone tapes' ability to be used by themselves, which contributes to enhanced performance over time.

The industry is anticipated to perform incredibly thanks to the fast demand and supply from the construction and electrical industries, which is helping the market to record a significant revenue over the period and is expected to perform similarly during the future as well, despite having multiple shortcomings caused by the lower tear resistance that is provided by silicone tapes.

Key Growth Factors

- Increasing Adoption of Self-fusing Tapes

The global market for silicone tape is anticipated to be driven by the expanding applications of self-fusing tapes in numerous sectors. Self-fusing silicone tape can be used in countless industries and offers a single solution for numerous issues.

To resist the roughest operational circumstances, the US Military initially adopted self-fusing silicone tapes as an efficient substitute for vinyl electrical tapes and plastic zip ties.

Self-fusing silicone tapes have been developed to meet the demands for long-lasting, high-temperature resistance, and simplicity. The F4 Fighter Jets' electrical parts and wiring harnesses made efficient use of the tapes.

- Rising Demand from Packaging Industry

The global silicone tapes market is expanding primarily owing to the increasing demand from across the packaging industry. The Association for Packaging and Processing Technologies, it is predicted that the packaging industry will grow by US$42.2 Bn by 2021, up from US$36.8 Bn dollars in 2016, because of rising population, growing sustainability concerns, more disposable income across developing regions, as well as the increasing demand for smart packaging. The market for silicone tapes is anticipated to be driven by this in the upcoming years.

- Rise in Use Across Vehicles

Increasing the use of silicone tapes in electric and hybrid vehicles is expected to support market expansion. Global plug-in vehicle deliveries in 2019 reached 2264,400 units, up 9% from 2018, according to the International Energy Agency's Global EV Outlook 2019.

The growth rates for the preceding six years ranged between 46% and 69%, thus this is a dramatic shift from those levels. The use of silicone tapes in the production of both the electric and hybrid vehicles is anticipated to rise because of this encouraging trend.

Major Growth Barriers

- Raw Material Price Fluctuations

Manufacturers of silicone tape must consider both the prices and the presence of raw materials to determine the cost structure of their goods. Medical adhesive tapes are made from a variety of basic materials, including rubber, silicone, paper, adhesives, and release liners.

Most of these basic materials are derivatives derived from petroleum, which are susceptible to diversities in commodity prices. Owing to the growing global demand for both oil and upheaval in the Middle East, oil prices have been highly unpredictable. The price and supply volatility of feedstock affect the market's expansion.

- Availability of Cheaper Substitutes

The silicone tape market's expansion during the forecast period is being constrained by the availability of substitutes. Similar uses for silicone tapes include sealing joints, splices, and connections in electrical cables for use at high voltages.

Similar tapes, such as PIB rubber self-tapes, are also employed for sealing and insulating cable applications that require lower-voltage electrical systems.

Key Trends and Opportunities to Look at

- Water-based Adhesive Technology

Due to their environmental friendliness, water-based adhesive technology is gaining popularity in the industry. It does not contain any volatile organic compounds (VOCs) and is thought to be safe for both people and the environment.

These adhesives offer excellent standards of tact and a flexible open schedule. They can also provide adherence to a variety of substrates and are quite versatile.

- Technical Upgrades

The market for silicone tapes is expanding significantly due to the demand for cutting-edge facilities and technology. The use of electrical and electronic devices is common in this industry, which necessitates a high-quality outer layer, which is provided by silicon tapes.

In addition, rapid advancements have been seen across both the aerospace and automotive sectors, they have reached as the major driving forces for the growth of the silicone tapes market.

- Growing Healthcare Industry

In addition to being great for chronic wounds and damaged skin, silicone tapes also provide a clean and comfortable wearing experience. Moreover, players in the silicone tapes market may expect to find considerable growth potential in emerging regions such as China, and India.

This is owing to the developed healthcare systems in these developing nations. The primary reason why patients move to these nations for elective procedures is the availability of high-quality surgical treatments at reduced costs.

How Does the Regulatory Scenario Shape this Industry?

Over the coming years, the industrial electronics sector is likewise anticipated to experience phenomenal growth. It is because more equipment, motors, wires, and meters are being sold. The expansion of energy generation and other industrial development initiatives being undertaken by governments of numerous countries are anticipated to increase demand for silicone tapes.

In addition, government efforts to provide a high-quality, reasonably priced manufacturing infrastructure are projected to support the expansion of the silicone tapes market in India for electrical and electronic applications.

The Indian electronics market is expected to be worth US$118 Bn in 2020, and India is the world's second-largest maker of mobile devices, according to Invest India, a National Investment and Facilitation Agency. Additionally, it says that by 2025, the Indian Electronics Manufacturing Service (EMS) Industry is anticipated to grow by 6.5 times the current market size.

Fairfield’s Ranking Board

Top Segments

- Organic Silicone Tapes Category Dominant

The organic silicone tapes segment dominated the market in 2022. Organic silicone tapes offer exceptional thermal durability, especially at high temperatures, hence they are always utilised as the high-temperature protective layer. Additionally, it has outstanding waterproof, weatherproof, corrosion-resistant, and electrical isolation properties.

Furthermore, the inorganic silicone tapes category is projected to experience the fastest market growth. Inorganic silicone tapes provide the best adhesion. It serves as an overwrap to prevent tracking of high-voltage cables. This highly conformable tape offers excellent ozone and arc resistance as well as superb weathering properties.

- Repairs Will Surge Ahead

In 2022, the repairs category dominated the industry. For repairing leaking hoses, broken pipes, and other repairs, use repair silicone tape, which is extremely elastic and highly conformable.

The insulation category is anticipated to grow substantially throughout the projected period. For electrical insulation purposes, silicone tape is utilised. This item fuses when stretched and wrapped around itself to create a sturdy, waterproof, and electrically insulating layer.

- Electrical Industry Leads

The electrical segment dominated the market. The silicone tape market is anticipated to be dominated by the electrical industry, which is expected to hold the biggest share of the market during the projected period. Since silicone tape provides superior insulation than other packaging tapes, it has been widely employed in the industry.

The packaging category is expected to experience the fastest growth within the forecast time frame. Perishables are often packaged with silicone tapes. Overall, it is anticipated that the demand for silicone tapes will be driven by the expanding packaging sector throughout the projected period.

Regional Frontrunners

Asia Pacific Remains the Largest Revenue Contributor

The silicone tape market is dominated by the Asia Pacific and is expected to maintain this position throughout the projected period. With an estimated US$250 Bn in revenue in 2021, China is the world's top exporter and producer of consumer electronics.

With more 21 million cars and 4.36 million commercial vehicles produced there in 2019, the nation is also the world's largest automaker. The plumbing sector in India has also been expanding quickly.

By 2020, the nation would need over 1.2 million qualified plumbers, according to a National Skill Development Council poll. In plumbing applications, silicone tape is highly dependable and has effective leak-sealing capabilities for water pipe hose leaks.

North America Likely to Witness Significant Growth

With its leading nations and rising industrial operations, the silicone tapes market is also dominated by the North American region. To improve their market positions, some businesses have been focusing on increasing their regional presence.

For instance, in 2021, Bond It, the adhesives and building chemical manufacturer in the UK with the quickest rate of growth, introduced its brand to the North American market. The corporation has also finished buying the Carolina-made silicone tape under the Rescue Tape name.

Fairfield’s Competitive Landscape Analysis

The global silicone tape market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in the Global Silicone Tape Space?

- Bostik

- Permatex

- Tekra

- Midsun Specialty Products

- Harbor Products, Inc.

- Cardinal Health

- Engineering Adhesives & Lubricants Pvt. Ltd.

- Freudenberg Simrit GmbH & Co.

- Specialty Tapes

- Solar Plus Company

- Custom Adhesive Products LLC

- 3M

- Sika AG

- DuPont

- HB Fuller Company

Significant Company Developments

New Product Launches

- April 2021: A new class of silicone adhesives created by 3M to be gentler to more delicate skin has been added. The new adhesive complies with ISO 10993 sections 5 and 10 and is ethylene oxide (EtO) sterilisation compatible.

- December 2020: The 3M Hi-Tack Silicone Adhesive Tapes are the company's new line of silicone adhesives. 2480 3M Single Coated Medical Nonwoven Tape with Hi-Tack Silicone Adhesive on Liner is the first product in its class and offers all the customary advantages of 3M's base silicone adhesive portfolio while having longer wear durations, supporting heavier devices, and delivering more solid adhesion.

- October 2019: With the launch of its Core Series Portfolio, Avery Dennison Performance Tapes now offers a wide range of tape constructions with a comprehensive range of adhesive technologies, from silicone to general-purpose rubber.

Merger/Acquisition

- June 2022: Intertape Polymer Group Inc. was fully acquired by Clearlake Capital Group, L.P. The outstanding shares of IPG common stock have been purchased by Clearlake. IPG is now a privately held firm because of the transaction, also now the shares of IPG common stock are not listed over the public market.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, growing investments in power generation, transportation, the electrical industry, and other infrastructural development are major factors that are anticipated to boost the growth of the silicone tape market in the forecast period.

Additionally, leading manufacturers are utilising cutting-edge techniques to expand the high-quality silicone tapes, including silicone compounding technology and premium quality silicone elastomers.

In addition, the worldwide medical industry is expected to develop, which will support the market's expansion, because of rising chronic disease prevalence and a growing population.

The silicone tapes market is expanding globally due to several factors, including quick economic development, government assistance, the availability of raw materials, and low-cost labour.

Supply Side of the Market

According to our analysis, in terms of the market for silicone tapes specifically, the demand for silicone tapes grew in late 2020 and has persisted through 2021. While silicone is still widely used in the automotive industry for applications under the hood, the aerospace and medical equipment industries rely on its adaptable qualities.

Silicone rubber is being more widely employed in the rising electric vehicle (battery) under-the-hood market thanks to the burgeoning automotive industry. Additionally, silicone tapes are being used increasingly frequently in household goods and kitchenware by the consumer products sector.

In addition, ongoing labour shortages and recent events in China have resulted in a lack of power, which is essential for silicone production, a process that consumes a lot of power. China produces over 70% of the silicon used in the world.

Global Silicone Tape Market is Segmented as Below:

By Type:

- Inorganic Silicone Tapes

- Organic Silicone Tapes

By Application:

- Waterproofing

- Repairs

- Insulation

- Others

By Industry Vertical:

- Electrical

- Automotive

- Packaging

- Textile

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & and Africa

1. Executive Summary

1.1. Global Silicone Tape Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Organic Silicone Tapes

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Silicone Tape Market Outlook, 2018 - 2030

3.1. Global Silicone Tape Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Inorganic Silicone Tapes

3.1.1.2. Organic Silicone Tapes

3.2. Global Silicone Tape Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Waterproofing

3.2.1.2. Repairs

3.2.1.3. Insulation

3.2.1.4. Others

3.3. Global Silicone Tape Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Electric

3.3.1.2. Automotive

3.3.1.3. Packaging

3.3.1.4. Textile

3.3.1.5. Others

3.4. Global Silicone Tape Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Silicone Tape Market Outlook, 2018 - 2030

4.1. North America Silicone Tape Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Inorganic Silicone Tapes

4.1.1.2. Organic Silicone Tapes

4.2. North America Silicone Tape Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Waterproofing

4.2.1.2. Repairs

4.2.1.3. Insulation

4.2.1.4. Others

4.3. North America Silicone Tape Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Electric

4.3.1.2. Automotive

4.3.1.3. Packaging

4.3.1.4. Textile

4.3.1.5. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Silicone Tape Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Silicone Tape Market Outlook, 2018 - 2030

5.1. Europe Silicone Tape Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Inorganic Silicone Tapes

5.1.1.2. Organic Silicone Tapes

5.2. Europe Silicone Tape Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Waterproofing

5.2.1.2. Repairs

5.2.1.3. Insulation

5.2.1.4. Others

5.3. Europe Silicone Tape Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Electric

5.3.1.2. Automotive

5.3.1.3. Packaging

5.3.1.4. Textile

5.3.1.5. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Silicone Tape Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Silicone Tape Market Outlook, 2018 - 2030

6.1. Asia Pacific Silicone Tape Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Inorganic Silicone Tapes

6.1.1.2. Organic Silicone Tapes

6.2. Asia Pacific Silicone Tape Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Waterproofing

6.2.1.2. Repairs

6.2.1.3. Insulation

6.2.1.4. Others

6.3. Asia Pacific Silicone Tape Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Electric

6.3.1.2. Automotive

6.3.1.3. Packaging

6.3.1.4. Textile

6.3.1.5. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Silicone Tape Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Silicone Tape Market Outlook, 2018 - 2030

7.1. Latin America Silicone Tape Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Inorganic Silicone Tapes

7.1.1.2. Organic Silicone Tapes

7.2. Latin America Silicone Tape Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Waterproofing

7.2.1.2. Repairs

7.2.1.3. Insulation

7.2.1.4. Others

7.3. Latin America Silicone Tape Market Outlook, by Industry, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Electric

7.3.1.2. Automotive

7.3.1.3. Packaging

7.3.1.4. Textile

7.3.1.5. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Silicone Tape Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Silicone Tape Market Outlook, 2018 - 2030

8.1. Middle East & Africa Silicone Tape Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Inorganic Silicone Tapes

8.1.1.2. Organic Silicone Tapes

8.2. Middle East & Africa Silicone Tape Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Waterproofing

8.2.1.2. Repairs

8.2.1.3. Insulation

8.2.1.4. Others

8.3. Middle East & Africa Silicone Tape Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Electric

8.3.1.2. Automotive

8.3.1.3. Packaging

8.3.1.4. Textile

8.3.1.5. Others

8.3.2. Others BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Silicone Tape Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Silicone Tape Market, by Industry, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Silicone Tape Market, by Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Market, by Industry, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Silicone Tape Market, by Application, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Type/Industry Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Permoseal

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Permatex

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Tekra

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Midsun Specialty Products.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Harbor Products, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Cardinal Health

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Engineering Adhesives & Lubricants Pvt. Ltd.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. HB Fuller Company

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Freudenberg Simrit GmbH & Co.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Business Strategies and Development

9.4.10. Specialty Tapes

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Solar Plus Company

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Custom Adhesive Products LLC.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. 3M

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Sika AG

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. DuPont

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Industry Vertical Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |