Global Silver Sintering Paste Market Forecast

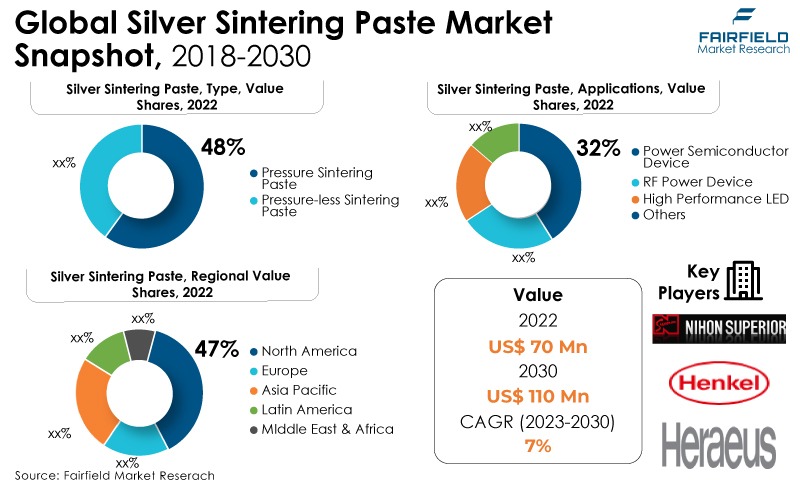

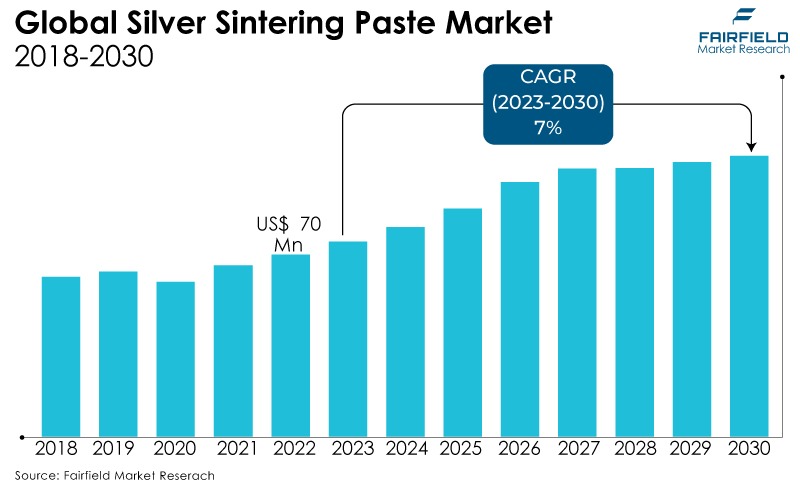

- The approximately US$70 Mn market for silver sintering paste to reach US$110 Mn by 2030

- Silver sintering paste market size to expand at a CAGR of 7% during 2023 - 2030

Quick Report Digest

- In the manufacture of power semiconductor devices, silver sintering paste is frequently employed to enhance thermal and electrical conductivity. Market expansion is facilitated by rising consumer electronics and electric vehicle (EV) demand.

- In order to increase the efficiency and durability of the power electronic components used in solar panels and wind turbines, silver sintering paste is essential for their development. As a result, this is fuelling market expansion.

- Silver is a precious metal, & silver sintering paste may be more expensive than conventional soldering materials, which may deter wider adoption, particularly in cost-sensitive businesses. This is restricting market growth for silver sintering paste.

- Opportunities exist in the end-use sector thanks to research and advancements made in improved sintering paste. Multi-level interconnections, electrical distribution, component joining, UPS translation, integrated modules, and storage are a few new applications, along with inverters, radars, servomotors, and sensors.

- The pressure sintered paste category dominated the market in 2023. The temperature needed for silver sintering is lowered to the same level as the ceramic melting point as the high pressure being applied increases the forced intensity for densification.

- Power semiconductor devices make up a sizable application category for silver sintering paste. Due to its high thermal and electrical conductivity qualities, silver sintering paste is frequently used to fabricate and assemble power semiconductor devices.

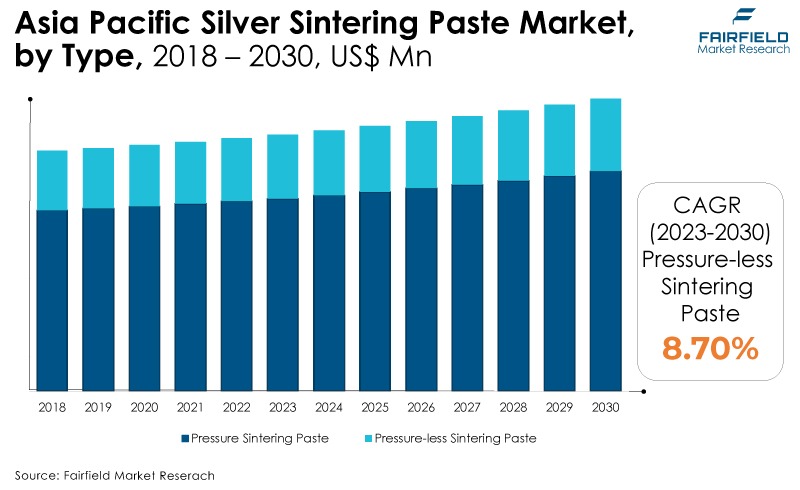

- The silver sintering paste market is expected to be dominated by Asia Pacific region, primarily due to the rising use of power semiconductor devices in the automotive and renewable energy sectors. Additionally, this market was developing due to continuous research and development initiatives in the area.

- The silver sintering paste market will rise substantially in the North America region during the anticipated period. Silver sintering paste was in high demand to produce various electronic components and power semiconductor devices in the region, which was at the forefront of the electronics manufacturing industry.

Current, Historical, and Futuristic Analysis

The market for sintering paste is expanding due to the preference for sintering over traditional production techniques. The material's structural integrity is strengthened and preserved by the thermal process of sintering. It links together particles to produce an orderly, largely solid structure. Given the current and prospective sintering measures, it provides a bright outlook for the global silver sintering paste market.

Throughout the historical period of 2018-2022, the market had staggered growth. The market for silver sintering paste demonstrates its development from a niche product with special features to a common option in various industries. Environmental legislation, technological advancements, and the rise of industries like renewable energy and automotive significantly influenced its adoption and commercial expansion.

In the upcoming years, the market for silver sintering paste will be driven by the increase in the production of semiconductor devices and components. The end user industry's demand for sintering paste is further boosted by people's increased conservatism concerning new products made with cutting-edge technology. Moreover, developing innovative silver sintering paste formulations with improved qualities is another result of continuous research and development efforts, contributing to the market's continued expansion.

Key Growth Determinants

- Rising EV Sales

The market for electric vehicles (EVs) is a significant market driver for silver sintering paste because of the critical function of silver sintering paste in power electronics and thermal management within EVs. Electric vehicles depend on inverters to transform the battery's direct current (DC) into the alternating current (AC) the electric motor needs.

Furthermore, the semiconductor chips in inverter modules are joined using silver sintering paste, ensuring effective electrical and thermal conductivity. This is essential for the inverter's effectiveness because it directly affects how efficiently and powerfully the car operates.

It is thus anticipated that as the global automotive sector electrifies, demand for EVs will increase, providing possibilities for suppliers in the silver sintering paste market.

- Growing Need for Energy-efficient Electronics

The need for energy-efficient electronics, including high-performance computing and renewable energy systems, drives the silver sintering paste market since it improves these components' efficiency and dependability.

Due to its outstanding electrical conductivity, silver is a perfect material for forming electrical connections in various electronic components. Silver sintering paste makes reduced resistive loss in power semiconductor devices and other electrical components possible.

Additionally, silver sintering paste has exceptional heat conductivity qualities. Effective heat dissipation is essential in power electronics, as components heat up while operating to avoid overheating and preserve peak performance.

- Increasing Adoption in Solar Cells and Panels

Solar cells and panels are necessary for the solar PV sector to convert sunlight into electricity. In order to establish electrical connections and improve conductivity between photovoltaic components, such as silicon wafers and busbars, silver sintering paste is used in the production of solar cells.

Additionally, the electrical conductivity of solar cells must be improved with silver sintering paste to raise the total efficiency of solar panels. Solar energy is more economical because it can produce more electricity with the same quantity of sunshine when it is more efficient.

The estimated operational lifetime of solar panels is long—often 25 years or more. The longevity of solar panels is increased by creating strong and dependable electrical connections by silver sintering paste, which also lowers maintenance costs and guarantees steady energy output.

Major Growth Barriers

- Lack of Accuracy in Procedure

Although silver sintering paste is well known for processing and strengthening a substance's characteristics, the technique has a significant disadvantage. Several micro- and nanostructures subjected to the silver sintering paste are typically destroyed.

Additionally, this drawback hurts the high performance LED industry because the latter's delicate and compact componentry calls for extremely high precision levels. The global market for silver sintering paste is hampered due to this drawback.

- Price Volatility, and Availability of Silver

The pricing and availability of silver sintering paste may vary depending on the quantity and price of silver. Supply chain interruptions may impact the market.

Although there are several sources of silver in the world, the supply may be constrained by things like production capacity, mining laws, and the geopolitical stability of important mining locations.

Additionally, silver's price may be impacted by the demand for the metal in industrial settings, such as the electronics sector, which uses silver sintering paste.

Key Trends and Opportunities to Look at

- Adoption of Electric Current-assisted Sintering

Electric current-assisted sintering is an improved method for sintering silver paste because it uses electricity to travel through sintering powders under vacuum.

Additionally, the primary motivation for this technology was to manufacture semiconductor devices on an industrial scale as well as RF power devices. As a result, the silver sintering paste market grows more due to electric current-aided sintering.

- Pressure-less Sintering Paste Varieties

The several methods of pressure-less sintering include rate-controlled sintering (RCS), constant-rate heating (CH), and two-step sintering (TSS). These techniques can differ according on the microstructure, grain size, required material, and process of the item.

Additionally, the different methods let the clients achieve efficient and productive sintering in accordance with their requirements and preferences for unique materials like ceramics and other components. increasing the worldwide market share of silver sintering paste.

- Growing Demand from Wind Energy Sector

Power electronics are essential for transforming wind-derived mechanical energy into electrical energy in wind turbines. Using silver sintering paste as a bonding agent, power semiconductor devices convert and control electrical power within the wind turbine system. The market growth is predicted to be boosted by this.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scope for silver sintering paste, like any other material used in electronics and manufacturing, may encompass several aspects, such as environmental, safety, and quality standards.

Many countries and regions have placed rules to manage the materials used in electronic devices and their effects on the environment. This includes restrictions on hazardous substances, such as the Restriction of Hazardous Substances (RoHS) directive in the European Union, which limits the use of specific substances like lead in electronic equipment.

Compliance with these laws and rules is necessary for market access. Furthermore, there are safety rules and laws that apply to electronic equipment in addition to environmental issues. It is vital to ensure that substances like silver sintering paste don't pose any electrical or thermal risks. It can be necessary to adhere to safety regulations set by US organizations like UL (Underwriters Laboratories).

Fairfield’s Ranking Board

Top Segments

- Pressure Sintering Paste Category Outweighs over Pressure-less Counterpart

The pressure sintering paste segment dominated the market in 2022. Due to its ability to withstand high pressure, the pressure sintering paste process is well-known. With the improved thermal and electrical conductivity qualities provided by pressure silver sintering, power electronics applications may operate at high temperatures.

Silver sintering's adoption would be substantially more accessible and compatible with the current supply chain if precious metal finishing on the substrate were eliminated. This market for silver sintering paste is anticipated to grow substantially.

The pressure-less sintering paste category is expected to grow significantly over the forecast period. The process of pressure-less sintering paste involves heating a crushed material to extremely high temperatures without applying any external pressure, depending on the density of the material.

The final product's density will thus not vary, which is something that several well-known hot compressing techniques do. Before the final procedure, the material can also be pre-sintered to produce the molded substance or ceramic and molded into the proper shape and size. Consumer demand for silver sintering is growing due to its effectiveness.

- Power Semiconductor Device Category Leads

In 2022, the power semiconductor device category dominated the market and is predicted to grow significantly throughout the forecast period. Silver-sintering paste is the substance that is currently utilized most commonly. A silver sintering paste acquires a melting point of 960 degrees Celsius.

The silver-sintered paste has a high epoxy resin adhesion, boosts process yield overall, and keeps the components stable for efficient management. It gains from having, among other things, the best thermal conductivity coefficient (>150 W/(mK)), the best electrical conductivity coefficient, and an elevated re-melting temperature (>400 C).

Furthermore, the high performance LED category is expected to expand significantly. The main players in the market are manufacturing a lot of things. Demand for LED devices has increased due to consumers' need to keep up with the latest developments in electronic devices like smartphones, tablets, and televisions.

In addition, silver sintering paste procedures are employed to sinter the high-performance LEDs used in these digital gadgets. Additionally, increased market production helps the big corporations keep a solid market share worth.

Regional Frontrunners

North America Leads the Pack

During that projected period, North America is expected to have the largest market share for silver sintering paste. Compared across countries, it has the highest semiconductor R&D spending as a percentage of revenue. American supremacy in the semiconductor sector impacts the silver sintering paste market.

Additionally, this section aims to significantly enhance comprehension of the sintering process in all market industry sectors. Demand ultimately increases in the sectors where the product is appropriate as consumers become more aware of its uses. As a result, this region is anticipated to perform well during the predicted period.

Asia Pacific Set for Substantial Expansion

The market for silver sintering paste is increasing at the quickest rate in Asia Pacific, presenting the industry with substantial potential. This region is seeing increased innovative technologies and government initiatives to help the semiconductor industry. As a result, the market for silver sintering paste will expand.

Furthermore, due to the popularity of this paste among customers, the demand for sintering paste in this region is likely to expand. Furthermore, as this area seeks to significantly increase awareness of the sintering process in every diversified industry sector in the market.

In addition, as consumers become more aware of the product's utility, demand in the appropriate industries rises. This region primarily established markets where the product is widely consumed. Overall, the Asia Pacific region is growing its market share in silver sintering paste.

Fairfield’s Competitive Landscape Analysis

As per the Fairfield’s analysis, leading market players compete in the silver sintering paste market based on price and product quality. Given the low level of startup capital requirements, small and medium-sized market players are anticipated to demonstrate significant advances in the years to come. These players also utilize new product launches, alliances, and other strategic activities to broaden their portfolio and market presence in the silver sintering paste market.

Who are the Leaders in Global Silver Sintering Paste Space?

- Heraeus

- Indium

- Alpha Assembly Solutions

- Henkel

- Kyocera

- Namics

- Saur Energy

- Nihon Superior Co., Ltd

- KAKEN TECH Co., Ltd

- Rogers Corporation

- Ferro Corporation

- DuPont

- Asahi Chemical Research Laboratory Co Ltd

- Fujikura Kasei Co Ltd

- Nippon Kokuen Group

Significant Company Developments

New Product Launches

- August 2023: Silver (Ag) nanoparticle paste for die-attach applications has been created by the Corporate R&D Division of Toyo Ink SC Holdings Co., Ltd., the parent company of the specialized chemicals firm Toyo Ink Group, which is situated in Japan. Sintering the freshly created lead-free material at low temperatures is possible using pressure-free and pressure-assisted techniques.

- May 2023: The German company Tresky GmbH, a DIE bonding specialist, introduced the dependable pre-sintering method using copper pastes. Tresky is extending this process area through the application and pre-sintering of thixotropic silver pastes from all top suppliers.

- April 2023: Argomax's technological offering has been increased by MacDermid Alpha. A brand-new silver sintering product called Argomax 2141 is intended for power inverters for electric vehicles. The creation of more compact, lighter, and dependable power train systems is made possible by the sintered joint. These silver sintering pastes provide convenience and adaptability while cutting down on production costs and time to market.

Distribution Agreement

- August 2019: A partnership agreement between GKN and Trackwise Designs Plc, a leading provider of specialty goods based on printed circuit technology, would enable the industrialization of the GKN Aerospace Type 8 Ice Protection System.

Investments

- March 2021: Sintercom India Ltd. received a 222 million INR investment from the promoter, Miba Sinter Holding Gmbh & CO KG. Miba AG, based in Austria, manufactures and sells coatings, specialist equipment, friction materials, engine bearings, and sintered components globally.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the demand for silver sintering paste, a high-performance material renowned for its superior thermal and electrical conductivity, is increasing due to several important considerations.

Furthermore, the development of consumer electronics and electric vehicles (EVs) has considerably raised the demand for effective heat management and dependable electrical connections, making silver sintering paste an excellent option for these applications.

Additionally, constant research and development activities keep improving and advancing the characteristics of silver sintering paste, guaranteeing that it stays at the forefront of materials technology.

Supply Side of the Market

According to our analysis, as the industry's application in the electronics sector grows, producers in the silver sintering paste market produce pressure sintering paste. A further development is the growing focus of major manufacturers on creating pressure-free sintering paste due to its effectiveness.

The leading market players also manufacture a huge volume of the market's items. To meet rising demand, consumers seek to stay up with the latest trends in LED gadgets such as mobile phones, tablets, and televisions.

Furthermore, these digital gadgets are made up of high-performance LEDs sintered using silver sintering paste processes. Moreover, higher market production aids key firms in maintaining a healthy market share value.

Global Silver Sintering Paste Market is Segmented as Below:

By Type

- Pressure Sintering Paste

- Pressure-less Sintering Paste

By Application

- Power Semiconductor Device

- RF Power Device

- High Performance LED

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Silver Sintering Paste Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Silver Sintering Paste Market Outlook, 2018 - 2030

3.1. Global Silver Sintering Paste Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Pressure Sintering Paste

3.1.1.2. Pressure-less Sintering Paste

3.2. Global Silver Sintering Paste Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Power Semiconductor Device

3.2.1.2. RF Power Device

3.2.1.3. High Performance LED

3.2.1.4. Misc.

3.3. Global Silver Sintering Paste Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Silver Sintering Paste Market Outlook, 2018 - 2030

4.1. North America Silver Sintering Paste Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Pressure Sintering Paste

4.1.1.2. Pressure-less Sintering Paste

4.2. North America Silver Sintering Paste Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Power Semiconductor Device

4.2.1.2. RF Power Device

4.2.1.3. High Performance LED

4.2.1.4. Misc.

4.2.2. Market Attractiveness Analysis

4.3. North America Silver Sintering Paste Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Silver Sintering Paste Market Outlook, 2018 - 2030

5.1. Europe Silver Sintering Paste Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Pressure Sintering Paste

5.1.1.2. Pressure-less Sintering Paste

5.2. Europe Silver Sintering Paste Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Power Semiconductor Device

5.2.1.2. RF Power Device

5.2.1.3. High Performance LED

5.2.1.4. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Silver Sintering Paste Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.9. Russia Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Russia Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.11. Rest of Europe Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Rest of Europe Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Silver Sintering Paste Market Outlook, 2018 - 2030

6.1. Asia Pacific Silver Sintering Paste Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Pressure Sintering Paste

6.1.1.2. Pressure-less Sintering Paste

6.2. Asia Pacific Silver Sintering Paste Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Power Semiconductor Device

6.2.1.2. RF Power Device

6.2.1.3. High Performance LED

6.2.1.4. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Silver Sintering Paste Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Silver Sintering Paste Market Outlook, 2018 - 2030

7.1. Latin America Silver Sintering Paste Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Pressure Sintering Paste

7.1.1.2. Pressure-less Sintering Paste

7.2. Latin America Silver Sintering Paste Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1.1. Power Semiconductor Device

7.2.1.2. RF Power Device

7.2.1.3. High Performance LED

7.2.1.4. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Silver Sintering Paste Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. Rest of Latin America Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Rest of Latin America Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Silver Sintering Paste Market Outlook, 2018 - 2030

8.1. Middle East & Africa Silver Sintering Paste Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Pressure Sintering Paste

8.1.1.2. Pressure-less Sintering Paste

8.2. Middle East & Africa Silver Sintering Paste Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Power Semiconductor Device

8.2.1.2. RF Power Device

8.2.1.3. High Performance LED

8.2.1.4. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Silver Sintering Paste Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. Rest of Middle East & Africa Silver Sintering Paste Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Rest of Middle East & Africa Silver Sintering Paste Market Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Heraeus

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Indium

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Alpha Assembly Solutions

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Henkel

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Kyocera

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Namics

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Saur Energy

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Nihon Superior Co., Ltd

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. KAKEN TECH Co., Ltd

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Rogers Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Ferro Corporation

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. DuPont

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Asahi Chemical Research Laboratory Co Ltd

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Fujikura Kasei Co Ltd

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Nippon Kokuen Group

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis,Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |