Small Modular Reactor (SMR) Market Growth and Industry Forecast

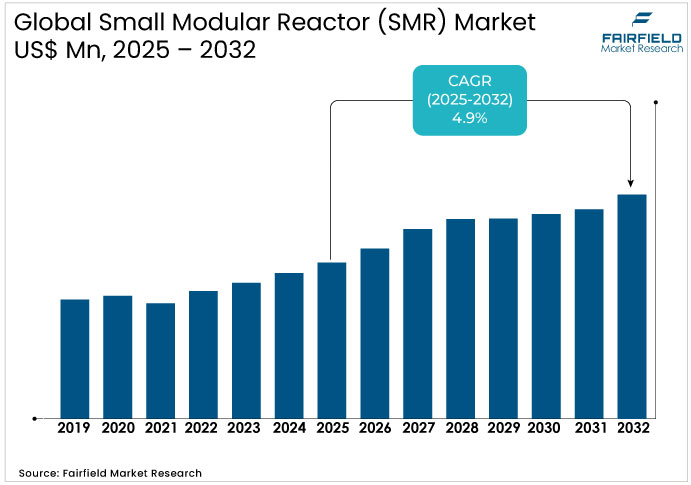

The Small Modular Reactor (SMR) Market is valued at CAPEX USD 6.6 billion in 2025 and is projected to reach CAPEX USD 9.2 billion by 2032, growing at a CAGR of 4.9%.

Small Modular Reactor (SMR) Market Summary: Key Insights & Trends

- The Pressurized Water Reactor (PWR) segment leads the global SMR market with about 60% share, supported by proven design safety, mature supply chains, and widespread regulatory acceptance.

- The Pressurized Heavy Water Reactor (PHWR) segment holds nearly 25% share, expanding through natural uranium utilization and indigenous development initiatives, particularly across Asia Pacific.

- Energy security and decarbonization remain primary growth drivers, as governments adopt SMRs for stable, low-carbon baseload power amid fossil fuel depletion and geopolitical uncertainties.

- Hybrid SMR-renewable integration offers a key opportunity, enhancing grid stability and enabling green hydrogen, desalination, and data center power solutions within ESG-aligned frameworks.

- Asia Pacific dominates the global landscape with approximately 80% share, propelled by rapid energy demand growth, strong government support for clean nuclear technologies, and large-scale deployment initiatives in China, Japan, and South Korea.

- Europe represents the fastest-expanding region, propelled by growing investments in clean energy transition, nuclear decarbonization strategies, and initiatives to replace aging conventional reactors with advanced modular systems.

- Emerging markets in Latin America and the Middle East & Africa show growing potential, leveraging SMRs for off-grid power, mining operations, and sustainable water desalination projects.

Key Growth Drivers

- Energy Security and Decarbonization Propel Global Adoption of Small Modular Reactors

The small modular reactor (SMR) market benefits from escalating global energy security concerns, as finite fossil fuels deplete and geopolitical tensions disrupt supplies. Governments prioritize baseload power sources that mitigate intermittency in renewables, with SMRs offering compact, factory-built units deployable in remote areas. Theoretically, this aligns with portfolio theory in energy planning, diversifying risk across fuel types to stabilize grids. In practice, the International Energy Agency notes that nuclear capacity must double by 2050 to meet net-zero goals, driving SMR investments. Justification lies in their inherent safety features, such as passive cooling, reducing accident risks compared to large reactors. This driver propels the market by enabling utilities to integrate low-carbon power without overhauling infrastructure, fostering long-term reliability. A 2024 Australian report by CSIRO estimates that for SMRs in Australia the LCOE in 2023 was about US $387-641/MWh, and could improve by 2030 to US $230-382/MWh.

- Modular Innovation and Digital Twin Technologies Accelerate Next-Gen SMR Deployment

Innovations in small modular reactor (SMR) market technologies, such as advanced fuels and digital twins for simulation, streamline licensing and construction timelines. Theoretical frameworks from systems engineering emphasize modularity's role in reducing complexity, allowing parallel manufacturing to slash build times from 10 years to under five. This driver is justified by real-world prototypes, where integral designs eliminate large piping, enhancing efficiency. The Nuclear Energy Agency highlights how SMRs support hybrid systems with renewables, balancing load variability. These advances lower barriers for emerging economies, with fuel cycles optimized for higher burnup extending refueling intervals. Justification includes cost savings: modular factories achieve economies of scale, potentially halving capital expenditures per megawatt. As AI integrates into reactor controls, predictive maintenance further bolsters uptime, aligning with Industry 4.0 principles.

Key Restraints

- Stringent Regulatory Frameworks and Licensing Delays Hinder SMR Commercialization Globally

The small modular reactor (SMR) industry faces hurdles from stringent regulatory frameworks that prolong approval processes, theoretically inflating project timelines and deterring investors. Harmonization challenges across jurisdictions create uncertainty, as varying standards for safety assessments demand extensive documentation, potentially delaying commercialization by years. This restraint theoretically undermines the modularity advantage, where rapid deployment is key, leading stakeholders to favor established renewables despite SMRs' long-term benefits.

- Component Bottlenecks and Talent Shortages Restrict Global SMR Deployment Capacity

Supply chain vulnerabilities constrain the SMR market, as specialized components such as high-assay low-enriched uranium (HALEU) depend on robust global networks that are prone to disruptions. This bottleneck exacerbates first-of-a-kind (FOAK) costs, while a shortage of nuclear-trained engineers persists. The industry requires about 3,000–5,000 new nuclear engineers globally each year, and large-scale expansion scenarios suggest that hundreds of thousands more nuclear-industry workers (including engineers, trades, and technicians) will be needed by 2030–2040. Mitigation demands strategic partnerships; however, persistent gaps are likely to slow market penetration in emerging regions.

Small Modular Reactor (SMR) Market Trends and Opportunities

- Hybrid SMR-Renewable Systems Enhance Grid Resilience and Attract ESG Investments

The small modular reactor (SMR) market is evolving toward hybrid integration with renewable energy sources, where SMRs provide firming capacity to balance variable solar and wind output. These systems offer flexible, dispatchable generation that enhances grid reliability without relying solely on large-scale storage. Studies estimate SMR-based hybrid systems to achieve levelized electricity costs of $48–$80 per MWh, depending on design and regulatory frameworks. According to the OECD Nuclear Energy Agency, global SMR capacity could reach about 21 GW by 2035, while the International Energy Agency projects 40 GW by 2050 under current policies and up to 120 GW under accelerated decarbonization scenarios. Co-location opportunities with data centers and hydrogen production provide diversified revenue streams. As global decarbonization efforts intensify, hybrid SMR–renewable systems are expected to bridge baseload gaps, strengthen grid resilience, and attract long-term sustainability-focused capital.

- SMRs Unlock Low-Carbon Industrial Heat Solutions for Sustainable Global Manufacturing

Beyond electricity, the opportunities lie in process heat for industries such as chemicals and mining, theoretically applying heat transfer principles to replace fossil fuels efficiently. This driver is justified by thermal efficiencies exceeding 30-40%, reducing emissions in hard-to-abate sectors. the IAEA projects that SMR deployment could significantly expand non-electric uses by 2040. Remote mining sites exemplify this, where barge-mounted units ensure uninterrupted operations. Theoretical modular upgrades enable retrofits, minimizing downtime and justifying premiums through lifecycle savings. As circular economy models gain traction, waste heat recovery further amplifies value, positioning the small modular reactor (SMR) market as a cornerstone for sustainable industrialization.

Segment-wise Trends & Analysis

- PWR Segment Leads SMR Market with Proven Safety and Modular Efficiency

The Pressurized Water Reactor (PWR) segment leads by capturing approximately 60% share in 2025, valued at CAPEX USD 3.96 billion. This dominance stems from PWR's proven thermal-hydraulic stability and dual-loop systems that isolate radioactive contaminants, reducing environmental risks. Established supply chains for light-water fuel further solidify its position, enabling cost predictability in volatile commodity markets.

Growth in the PWR segment accelerates at a robust CAGR through 2032, driven by the deployment of advanced and modular PWR designs that enhance construction efficiency and safety. Supportive government programs such as the U.S. Department of Energy’s initiatives to advance small modular PWR technology further bolster market prospects. Incumbents like GE Hitachi Nuclear Energy, Westinghouse Electric Company, and Framatome maintain a strong foothold through vertical integration and robust global partnerships, while emerging players focus on regulatory collaboration and modularization to accelerate certification and market entry.

The Pressurized Heavy Water Reactor (PHWR) emerges as the fast-growing segment in the Small Modular Reactor (SMR) Market, driven by natural uranium efficiency that circumvents enrichment dependencies. In 2025, it holds over 25% share, bolstered by deployments in resource-constrained regions such as India. Theoretical advantages in fuel flexibility align with diversification strategies amid geopolitical uranium supply risks.

Growth in PHWR deployment is driven by countries like India and Canada, where domestic uranium resources and indigenous reactor development programs strengthen adoption. The technology’s lower front-end fuel costs and suitability for cogeneration applications enhance its economic appeal in emerging markets. Although PHWRs are not expected to surpass PWRs in market share soon, their fuel flexibility and non-proliferation compliance position them as an important contributor to the diversification of the global SMR landscape, capturing a 35% share by 2032.

Regional Trends & Analysis

North America Strengthens SMR Leadership Through Regulatory Reforms and Strategic Investment

North America is establishing regional leadership through comprehensive regulatory frameworks and strategic government investments. The U.S. Nuclear Regulatory Commission has approved multiple SMR designs, including NuScale's 77 MWe configuration, demonstrating regulatory pathways that support commercial deployment. Federal funding programs and public-private partnerships provide crucial financial support for technology development and demonstration projects.

U.S. Small Modular Reactor Market – 2025 Snapshot & Outlook

The U.S. leads global SMR development through established regulatory frameworks and substantial private investment, with companies securing approximately billion in equity funding over the past eight years. Technology sector demand drives deployment acceleration, as companies including Amazon, Google, and Microsoft invest directly in SMR technology to power energy-intensive AI infrastructure. The Department of Energy provides crucial support through funding programs, streamlined licensing initiatives, and national laboratory partnerships that reduce development risks for private companies.

Asia Pacific - High-Growth Market Development

Asia Pacific region commands approximately 80% of the market, driven by rapid industrialization, urbanization, and aggressive decarbonization policies. China leads regional development with multiple SMR designs including the ACP100, supported by significant government investment and established nuclear manufacturing capabilities. The region's fast-growing economies generate substantial electricity demand that SMRs can address through scalable deployment strategies.

Japan Small Modular Reactor Market – 2025 Snapshot & Outlook

Japan's SMR strategy focuses on energy security enhancement following the Fukushima disaster, with nuclear power targeted to comprise 20% of the energy supply by 2040. The Japan Atomic Energy Agency's agreement with the U.K.'s National Nuclear Laboratory accelerates SMR deployment through collaborative advancement of high-temperature gas-cooled reactor technologies. Government policies support nuclear power expansion as part of comprehensive decarbonization strategies, creating favorable conditions for SMR adoption.

India Small Modular Reactor Market – 2025 Snapshot & Outlook

India's Nuclear Energy Mission allocates Rs. 20,000 crores for SMR research and development, positioning the country as a major regional market with indigenous technology development. The Bhabha Atomic Research Centre develops multiple SMR configurations including BSMR-200 for industrial applications and SMR-55 for remote locations, targeting diverse market segments through customized solutions. Holtec International's 10-year authorization to transfer SMR technology to Indian private entities marks the first direct U.S. technology transfer to Indian private firms, establishing public-private partnership models for market development.

Europe Advances SMR Innovation Through Strategic Partnerships and Energy Transition Goals

European market development emphasizes technology innovation and strategic partnerships, with countries including the U.K., France, and Russia pursuing distinct approaches to SMR deployment. Russia maintains operational SMR experience through floating nuclear power plants and icebreaker reactors, providing practical deployment knowledge that supports commercial applications. The U.K.'s investment decisions anticipated in 2025 could accelerate regional deployment efforts through substantial financial commitments.

Germany Small Modular Reactor Market – 2025 Snapshot & Outlook

Germany's energy transition priorities create complex dynamics for SMR adoption, as the country phases out traditional nuclear power while maintaining industrial competitiveness requirements. Energy-intensive manufacturing sectors including automotive and chemical industries face growing pressure to secure reliable, carbon-free energy sources that SMRs could provide. Industrial process heat applications represent the most viable market segment, where SMRs can support manufacturing operations without direct electricity grid integration.

France Small Modular Reactor Market – 2025 Snapshot & Outlook

France leverages established nuclear expertise and industrial capabilities to pursue SMR development as natural evolution of its nuclear energy leadership. The country's nuclear supply chain and manufacturing capabilities position it strategically for SMR component production and system integration, supporting both domestic deployment and export opportunities. Government support for nuclear technology development includes SMR initiatives as part of broader energy transition strategies.

Competitive Landscape Analysis

The players in the small modular reactor (SMR) market focus on strategic alliances to expedite regulatory approvals and scale manufacturing. This approach counters deployment delays, as evidenced by the OECD-NEA's 2025 dashboard logging 50+ global designs in advancement across 15 countries. Collaborations such as the U.S.–South Korea MOUs facilitate shared R&D and testing resources, improving efficiency and reducing overall development timelines through ecosystem-driven innovation.

Industry consolidation and capital inflows, including X-Energy’s USD 700 million Series C-1 round in 2025, are bolstering supply chains amid component constraints. The EU’s initiative to harmonize nuclear codes and standards is expected to simplify licensing processes and enhance project economics across member states. Early movers will benefit from entrenched footholds in high-demand regions, while latecomers may face escalated entry barriers.

Key Companies

- Bechtel Corporation

- China National Nuclear Corporation

- BWX Technologies Inc.

- GE

- Mitsubishi Heavy Industries, Ltd.

- Holtec International

- General Atomics

- Rolls Royce

- Nuclear Power Corporation of India Limited (NPCIL)

- NuScale Power, LLC.

- Korea Electric Power Corporation

Recent Developments:

- January 2025, Bechtel is leading a global nuclear resurgence, completing America’s first new reactors in 30 years and partnering with TerraPower and TVA on next-gen SMRs. Its projects in the U.S. and Poland highlight accelerating adoption of safer, modular, and efficient reactor technologies.

- April 2025, China achieved a major milestone in April 2024 as the first main pump of the Linglong One, the world’s first commercial land-based SMR, was installed in Hainan. Developed by CNNC, this modular pressurized water reactor marks a breakthrough in China’s independent nuclear innovation, offering safer, flexible, and location-adaptable clean energy solutions.

- September 2025, Holtec International and EDF UK will develop SMR-300 small modular reactors at the former Cottam coal plant in Nottinghamshire, transforming it into a clean energy and data hub. The U.S.–UK partnership aims to create thousands of jobs and deploy SMRs by the early 2030s, building on Holtec’s Palisades project experience.

Global Small Modular Reactor (SMR) Market Segmentation-

By Type

- Pressurized Water Reactor (PWR)

- Pressurized Heavy Water Reactor (PHWR)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Small Modular Reactor (SMR) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.2.4. Economic Trends

2.3. Value Chain Analysis

2.4. SWOT Analysis

2.5. Porter’s Five Forces Analysis

2.6. COVID-19 & Russia-Ukraine War Impacts

2.6.1. Supply Chain

2.6.2. End-user Customer Impact Analysis

3. Small Modular Reactor- Existing and Upcoming Project Details

4. Global Small Modular Reactor (SMR) Market Outlook, 2019 - 2032

4.1. Global Small Modular Reactor (SMR) Market Outlook, by Configuration, Value (US$ Mn) & Capacity (MW), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Pressurized Water Reactor (PWR)

4.1.1.2. Pressurized Heavy Water Reactor (PHWR)

4.1.1.3. Others

4.1.2. BPS Analysis/Market Attractiveness Analysis, by Configuration

4.2. Global Small Modular Reactor (SMR) Market Outlook, by Region, Value (US$ Mn) & Capacity (MW), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. North America

4.2.1.2. Europe

4.2.1.3. Asia Pacific

4.2.1.4. Rest of the World

4.2.2. BPS Analysis/Market Attractiveness Analysis, by Region

5. North America Small Modular Reactor (SMR) Market Outlook, 2019 - 2032

5.1. North America Small Modular Reactor (SMR) Market Outlook, by Configuration, Value (US$ Mn) & Capacity (MW), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Pressurized Water Reactor (PWR)

5.1.1.2. Pressurized Heavy Water Reactor (PHWR)

5.1.1.3. Others

5.2. North America Small Modular Reactor (SMR) Market Outlook, by Country, Value (US$ Mn) & Capacity (MW), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. U.S. Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

5.2.1.2. Canada Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

6. Europe Small Modular Reactor (SMR) Market Outlook, 2019 - 2032

6.1. Europe Small Modular Reactor (SMR) Market Outlook, by Configuration, Value (US$ Mn) & Capacity (MW), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Pressurized Water Reactor (PWR)

6.1.1.2. Pressurized Heavy Water Reactor (PHWR)

6.1.1.3. Others

6.2. Europe Small Modular Reactor (SMR) Market Outlook, by Country, Value (US$ Mn) & Capacity (MW), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Russia Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

6.2.1.2. Rest of Europe Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

7. Asia Pacific Small Modular Reactor (SMR) Market Outlook, 2019 - 2032

7.1. Asia Pacific Small Modular Reactor (SMR) Market Outlook, by Configuration, Value (US$ Mn) & Capacity (MW), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Pressurized Water Reactor (PWR)

7.1.1.2. Pressurized Heavy Water Reactor (PHWR)

7.1.1.3. Others

7.2. Asia Pacific Small Modular Reactor (SMR) Market Outlook, by Country, Value (US$ Mn) & Capacity (MW), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. China Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

7.2.1.2. India Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

7.2.1.3. Rest of Asia Pacific Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

8. Rest of the World (RoW) Small Modular Reactor (SMR) Market Outlook, 2019 - 2032

8.1. Rest of the World (RoW) Small Modular Reactor (SMR) Market Outlook, by Configuration, Value (US$ Mn) & Capacity (MW), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Pressurized Water Reactor (PWR)

8.1.1.2. Pressurized Heavy Water Reactor (PHWR)

8.1.1.3. Others

8.2. Rest of the World (RoW) Small Modular Reactor (SMR) Market Outlook, by Country, Value (US$ Mn) & Capacity (MW), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Saudi Arabia Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

8.2.1.2. Brazil Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

8.2.1.3. UAE Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

8.2.1.4. Kuwait Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

8.2.1.5. Others Small Modular Reactor (SMR) Market, Value (US$ Mn) & Capacity (MW), 2019 - 2032

9. Competitive Landscape

9.1. Company Market Share Analysis, 2022

9.2. Strategic Collaborations

9.3. Company Profiles

9.3.1. Bechtel Corporation

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. BWX Technologies Inc.

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. GE

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Mitsubishi Heavy Industries, Ltd

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Holtec International

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. General Atomics

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Rolls Royce

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Nuclear Power Corporation of India Limited (NPCIL)

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. NuScale Power, LLC.

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. Korea Electric Power Corporation

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. China National Nuclear Corporation

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Price Trend Analysis, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |