Global Solar Cullet Market Forecast

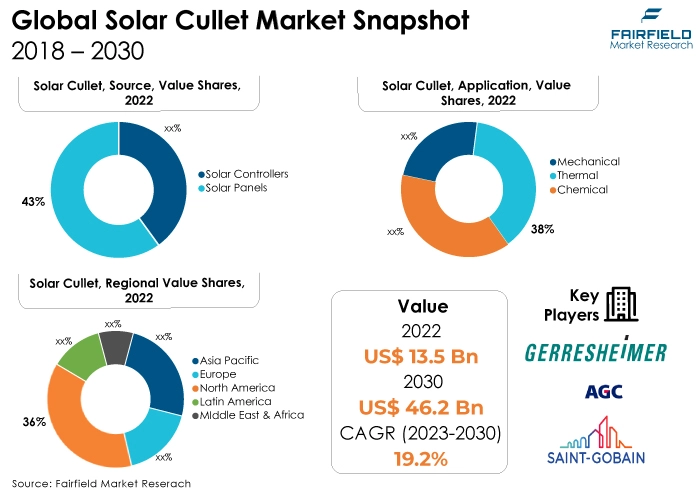

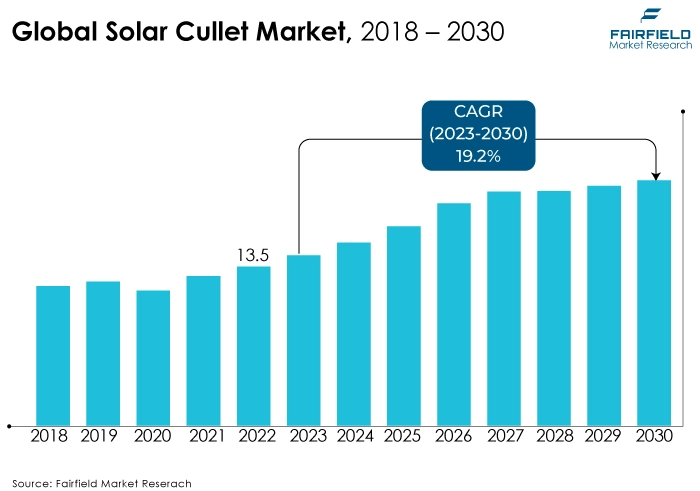

- Global solar cullet market size to jump from US$13.5 Bn in 2022 to US$46.2 Bn in 2030

- Market valuation projected for a CAGR of 19.2% between 2023 and 2030

Quick Report Digest

- Some of the most difficult problems are faced by the construction and architectural industries. Glass is now employed in building facades as a partition to physically and visually separate spaces while still meeting all safety and security criteria. Thus, the increased usage of glass in the construction industry helps to increase sales of solar cullets.

- Major major market trends expected to fuel the solar cullet market growth is the rising adoption of renewable energy, focus on sustainable growth, and major to decrease carbon emmissions.

- Solar cullet operates within the framework of the renewable energy sector and is impacted by elements such as governmental laws, technology improvements, and consumer preferences.

- In terms of market share for solar cullet globally, the aggregate replacement segment is anticipated to dominate. In a variety of construction applications, including the building of roads and the manufacture of concrete, solar cullet is utilised as an alternative to conventional aggregates.

- In 2022, the solar panels category controlled the market. The market for solar cullet is being driven by developments in solar panels that include improving efficiency, lowering costs, and improvements in production techniques.

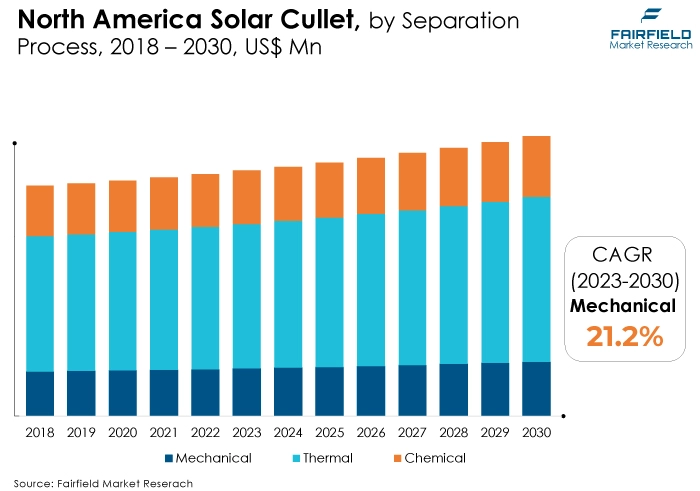

- The thermal separation process category is highly prevalent in the market for solar cullet. Improvements in heat recovery systems and energy-efficient heating technology are trends in thermal separation techniques.

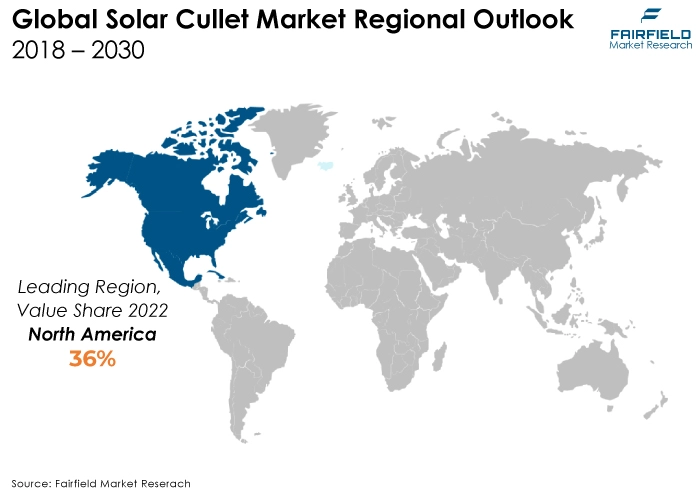

- The North American region is anticipated to account for the largest share of the global solar cullet market, owing to rise in adoption of solar energy systems. Furthermore, the growing focus toward sustainable development is driving the regional market growth.

- The market for solar cullet is expanding in Asia Pacific. This is because of the solar energy industry and rising government support.

A Look Back and a Look Forward - Comparative Analysis

Growing solar energy system usage, government renewable energy efforts, improvements in recycling technology, and a focus on sustainability and circular economy practices are key market drivers for solar cullet. Additionally, the market's expansion and growth are also significantly fueled by trends like declining solar energy system costs and technological breakthroughs in manufacturing techniques.

The market witnessed staggered growth during the historical period 2018 – 2022. The increasing usage of solar control glass in several infrastructure development projects is to blame for this. This is due to the increased demand for energy-efficient building materials in both residential and commercial construction applications. Accordingly, the demand for solar cullet in residential buildings to lower the amount of energy needed for HVAC appliances has been fueled by rapid urbanisation.

The market is being positively impacted by ongoing technological developments in the production of solar control glass, which have led to the development of more effective, visually pleasing, and cost-effective product variants. The market is further fueled by the rising demand for different green building certifications, which has led to more solar control glasses being installed in buildings. In addition, the increasing adoption of solar energy as a key aspect of the nation's strategy for energy security is encouraging market growth.

Key Growth Determinants

- Unwavering Growth of Automotive Industry

The automobile sector has experienced remarkable growth during the last ten years. The primary driver of the automobile industry's expansion is increased production from major automotive manufacturing nations like Germany. Glass is frequently utilised in the automobile sector.

In the upcoming years, rising vehicle production and consumption will fuel glass demand, which will fuel the need for solar cullet. Recycling solar cullet for use in the auto sector is possible. Strong demand has been generated for solar cullet in headlights, taillights, and windows due to the rise in commercial vehicle sales.

In the upcoming years, the automobile industry is projected to experience increasing demand for solar cullet due to growing consumer desire for electric vehicles.

- Consistent Increase in the Number of Solar Projects

Due to numerous advantages like low emissions, pollution-free energy, and reduced maintenance needs, the use of solar energy has grown over time. Since glass' optical properties make it ideal for use in solar panels for protection and reflection to ensure maximum use of the available resources, the expansion of the solar energy market has a positive effect on the market for solar cullet and the glass components used in the same.

The usage of solar cullet can significantly lower energy prices, lessen the negative effects of power generation on the environment, and increase a region's energy independence.

- Increasing Recycling Efforts, and Emphasis on Circular Economy

The market for solar cullet has a chance due to the focus on sustainability and circular economy principles. The market may help reduce waste and lessen the environmental effect of solar panel manufacture by encouraging the recycling and reuse of glass resources in the manufacturing process. This is consistent with the increased preference for eco-friendly solutions among consumers and businesses.

Major Growth Barriers

- Fluctuations in Raw Material Prices

Raw materials for solar cullet production, including recycled glass, might fluctuate in price and availability. The constant supply of solar cullet is threatened by variations in recycling rates, collecting infrastructure, and the quality of recyclable glass, which could have an impact on the market.

- Presence of Substitutes

Solar cullet has a cost and environmental advantages, but it could face competition from other materials used to make solar panels. Thin-film solar cells and other sophisticated semiconductor materials, for example, may endanger the need for conventional glass-based solar panels and, by extension, solar cullet.

Key Trends and Opportunities to Look at

- Technological Upgrades

The production of solar panels and recycling techniques have benefited from technological developments that have reduced costs and increased efficiency. Due to these developments, solar energy is now more affordable than traditional energy sources.

The solar cullet market benefits from greater affordability and wider usage of solar energy systems as technology advances and manufacturing prices fall.

- Rising Installation of Solar Energy Systems

The market for solar cullet has a sizable possibility because of the growing installation of solar energy systems around the world. The demand for solar cullet as a sustainable and affordable raw material for solar panel production will increase as more nations and companies adopt solar energy.

- Hastening Penetration Across Developing Nations

For the solar cullet market, emerging economies with rising energy consumption provide unexplored possibilities. Solar cullet suppliers have a chance to penetrate and take root in these markets as these nations concentrate on building their renewable energy infrastructure.

Companies may increase their reach and take advantage of the rising demand for solar energy solutions by collaborating with regional stakeholders and utilising government support.

How Does the Regulatory Scenario Shape this Industry?

Globally, governments have implemented stimulus plans and incentive schemes to boost their economies following the outbreak. Numerous of these programs encourage renewable energy initiatives, such as the installation of solar panels.

The demand for solar cullet is significantly increased by government incentives and subsidies, which also support the market's revival. For instance, the E-Waste (Management and Handling) Rules, 2011, in India, encourage recycling and/or reuse of valuable materials from e-waste, hence lowering the dumping of hazardous wastes.

With this, solar panel producers, dealers, refurbishers, and collectors have adopted a more structured approach to recycling solar panels, where solar cullet is sorted for subsequent uses. This aspect could be one of the major forces propelling the solar cullet market's expansion. Additionally, the recycling and reuse of solar cullet might be profitable.

Fairfield’s Ranking Board

Top Segments

- Solar Panels Remain the Source of Choice over Solat Collectors

The solar panels segment dominated the market in 2022. Numerous laws and incentives have been put in place by governments all over the world to encourage the use of solar power.

The government, for instance, has set a goal of adding 175 GW of renewable energy capacity by 2022, which is sinclusive of a sizable amount of solar energy. This could increase the supply of solar cullet made from broken or damaged solar panels.

Furthermore, the solar collectors category is projected to experience the fastest market growth. The total demand for solar cullet in the renewable energy industry is being driven by developments in solar collectors such as enhanced thermal efficiency, integration with energy storage systems, and growing usage in residential and commercial structures.

- Thermal Separation Process Wins Preference

In 2022, the thermal category dominated the industry. Solar panels that are no longer in use are frequently recycled thanks to the thermal process, which effectively and sustainably separates glass from solar panels. This element is the main market trend that is driving the solar cullet market's expansion for thermal processes.

The mechanical separation process category is anticipated to grow substantially throughout the projected period. The development of more effective crushing and grinding machinery, automation technologies, and enhanced screening procedures are all drivers in mechanical separation processes that aim to increase the quality and consistency of solar cullet.

- Aggregate Replacement Leads by Application

The aggregate replacement segment dominated the market in 2022. Using solar cullet as an alternative to aggregate can have several advantages, including lowering the need for natural aggregates, preventing trash from going to landfills, and offering a greener solution for used glass.

The abrasives category is expected to experience the fastest growth within the forecast time frame. Finely ground solar cullet is used as an efficient abrasive material in a variety of industries. Solar cullet's hardness, homogeneity, and recyclability make it a good choice for use as an abrasive.

Regional Frontrunners

North America Captures the Largest Revenue Share

Government incentives and the rising need for renewable energy sources are driving a surge in the use of solar energy systems in North America, according to the solar cullet industry.

Sustainable building methods are also emphasized, such as the use of solar cullet to replace aggregate and create energy-efficient building materials. The leading companies in the North American solar cullet market include Ardagh Group S.A., Vetropack Holding AG, and Owens-Illinois Inc.

Asia Pacific Awaits Notable Prospects

The increasing growth of the solar energy industry in the Asia Pacific region, notably in nations like China, Japan, and India, is what is driving the market for solar cullet. The development of sustainable manufacturing methods utilising solar cullet as well as increased government funding for renewable energy projects is a trend.

Investments in solar panel installations are also on the rise. China Glass Holdings Limited, Heinz-Glas Holding GmbH, and Nippon Electric Glass Co., Ltd. are some of the top market participants in the Asia Pacific solar cullet industry.

Fairfield’s Competitive Landscape Analysis

The global solar cullet market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Solar Cullet Space?

- Owens-Illinois Inc.

- Saint-Gobain S.A.

- AGC Inc.

- Ardagh Group S.A.

- Vetropack Holding AG

- Gerresheimer AG

- Vitro S.A.B. de C.V.

- Nihon Yamamura Glass Co. Ltd.

- Heinz-Glas Holding GmbH

- Asahi India Glass Ltd.

- Gold Plus Glass Industry Ltd.

- Sisecam

- Lingel Windows

- ROSI Solar

- Ambedkar Glass Cullet Enterprises

Significant Company Developments

Investment and Expansion

- July 2023: The US Department of Energy announced US$20 Mn in support for solar panels that are more durable, more recyclable, and of higher quality. The financing intends to hasten the adoption of solar power in the US as well as address panel and solar technology maintenance over the course of their lifetimes.

- October 2022: To secure a sustainable future, AGC Glass Europe is aiming to minimise the environmental impact of its production processes. The Group announced the manufacturing of a line of float glass with a drastically decreased carbon presence of less than 7 kg of CO2 per m2 for clear glass as part of its Roadmap to Carbon Neutrality.

Partnership

- June 2023: The School of Photovoltaic, and Renewable Energy Engineering at the University of New South Wales, and VRX SILICA LIMITED have announced their collaboration on a strategic research project to examine the viability of a local, low-carbon solar panel glass recycling program in Australia.

Merger and Acquisition

- October 2022: As it broadens its value chain to enhance capabilities in the production of solar panels and related materials, Reliance Industries Ltd. recently announced the acquisition of a 20 percent ownership in the US-based solar-tech company Caelux for US$12 Mn.

An Expert’s Eye

Demand and Future Growth

The high quality of the solar cullet will drive up demand from glass manufacturing companies, which will help the market expand. Solar cullet can be utilised as a cost-effective replacement for over 95% of the raw materials needed in glass manufacture.

Additionally, rising consumer awareness of sustainable development is anticipated to fuel market demand. In addition, the demand for new glass can be reduced by recovering the cullet from broken or damaged solar panels or solar collectors, which is anticipated to lower the overall production cost for companies that make solar products.

During the anticipated time, this aspect can help the solar cullet industry flourish. A thorough recycling framework for solar cullet is lacking in many developing nations, including India.

Supply Side of the Market

According to our analysis, the industry engaged in the production, supply, and usage of recycled or crushed glass components used in the fabrication of solar panels is referred to as the solar cullet market. The average glass container recycling rate, according to the Container Recycling Institute, is 63%.

Different laws and deposit minimums have been set up. A law was approved in the state of Oregon requiring consumers to pay a deposit of five cents per container for carbonated beverages, which was increased to 10 cents in April 2017, which would be repaid to anyone who returned the container for recycling.

In addition, in England, the government's deposit-return programme covers all drink containers, whether they are made of plastic, glass, or metal. The program's goal is to lessen the amount of trash that pollutes land and water by periodically paying consumers who return their bottles and cans a small financial reward.

Furthermore, The Circular Economy Package was introduced by the European Union to support effective waste management and ongoing initiatives that would expand the European market.

Global Solar cullet Market is Segmented as Below:

By Source:

- Solar Panels

- Solar Collectors

By Separation Process:

- Thermal

- Mechanical

- Chemical

By Application:

- Aggregate Replacement

- Abrasives

- Fiberglass Insulation

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & and Africa

1. Executive Summary

1.1. Global Solar Cullet Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Solar Cullet Market Outlook, 2018 - 2030

3.1. Global Solar Cullet Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Solar panels

3.1.1.2. Solar collectors

3.2. Global Solar Cullet Market Outlook, by Separation Process, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Thermal

3.2.1.2. Mechanical

3.2.1.3. Chemical

3.3. Global Solar Cullet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Aggregate Replacement

3.3.1.2. Abrasives

3.3.1.3. Fiberglass Insulation

3.3.1.4. Others

3.4. Global Solar Cullet Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Solar Cullet Market Outlook, 2018 - 2030

4.1. North America Solar Cullet Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Solar panels

4.1.1.2. Solar collectors

4.2. North America Solar Cullet Market Outlook, by Separation Process, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Thermal

4.2.1.2. Mechanical

4.2.1.3. Chemical

4.3. North America Solar Cullet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Aggregate Replacement

4.3.1.2. Abrasives

4.3.1.3. Fiberglass Insulation

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Solar Cullet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

4.4.1.3. Canada Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Solar Cullet Market Outlook, 2018 - 2030

5.1. Europe Solar Cullet Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Solar panels

5.1.1.2. Solar collectors

5.2. Europe Solar Cullet Market Outlook, by Separation Process, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Thermal

5.2.1.2. Mechanical

5.2.1.3. Chemical

5.3. Europe Solar Cullet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Aggregate Replacement

5.3.1.2. Abrasives

5.3.1.3. Fiberglass Insulation

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Solar Cullet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

5.4.1.3. U.K. Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

5.4.1.5. France Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.6. France Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

5.4.1.7. Italy Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.8. Italy Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

5.4.1.9. Turkey Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.10. Turkey Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

5.4.1.11. Russia Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.12. Russia Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

5.4.1.13. Rest of Europe Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

5.4.1.14. Rest of Europe Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Solar Cullet Market Outlook, 2018 - 2030

6.1. Asia Pacific Solar Cullet Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Solar panels

6.1.1.2. Solar collectors

6.2. Asia Pacific Solar Cullet Market Outlook, by Separation Process, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Thermal

6.2.1.2. Mechanical

6.2.1.3. Chemical

6.3. Asia Pacific Solar Cullet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Aggregate Replacement

6.3.1.2. Abrasives

6.3.1.3. Fiberglass Insulation

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Solar Cullet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

6.4.1.3. Japan Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

6.4.1.5. South Korea Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.6. South Korea Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

6.4.1.7. India Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.8. India Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

6.4.1.9. Southeast Asia Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.10. Southeast Asia Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

6.4.1.11. Rest of Asia Pacific Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

6.4.1.12. Rest of Asia Pacific Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Solar Cullet Market Outlook, 2018 - 2030

7.1. Latin America Solar Cullet Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Solar panels

7.1.1.2. Solar collectors

7.2. Latin America Solar Cullet Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Thermal

7.2.1.2. Mechanical

7.2.1.3. Chemical

7.3. Latin America Solar Cullet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Aggregate Replacement

7.3.1.2. Abrasives

7.3.1.3. Fiberglass Insulation

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Solar Cullet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

7.4.1.3. Mexico Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

7.4.1.5. Argentina Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

7.4.1.6. Argentina Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

7.4.1.7. Rest of Latin America Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

7.4.1.8. Rest of Latin America Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Solar Cullet Market Outlook, 2018 - 2030

8.1. Middle East & Africa Solar Cullet Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Solar panels

8.1.1.2. Solar collectors

8.2. Middle East & Africa Solar Cullet Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Thermal

8.2.1.2. Mechanical

8.2.1.3. Chemical

8.3. Middle East & Africa Solar Cullet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Aggregate Replacement

8.3.1.2. Abrasives

8.3.1.3. Fiberglass Insulation

8.3.2. Others BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Solar Cullet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

8.4.1.3. South Africa Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

8.4.1.5. Egypt Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.6. Egypt Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

8.4.1.7. Nigeria Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.8. Nigeria Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

8.4.1.9. Rest of Middle East & Africa Solar Cullet Market by Source, Value (US$ Mn), 2018 - 2030

8.4.1.10. Rest of Middle East & Africa Solar Cullet Market Source, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs. Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Owens-Illinois Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Saint-Gobain S.A

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. AGC Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Ardagh Group S.A.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Gerresheimer AG

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Vitro S.A.B. de C.V

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Nihon Yamamura Glass Co. Ltd.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Heinz-Glas Holding GmbH

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Asahi India Glass Ltd.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. Gold Plus Glass Industry Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Sisecam

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Lingel Windows.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. ROSI Solar

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Ambedkar Glass Cullet Enterprises

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Vetropack Holding AG.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Source Coverage |

|

|

Separation Process Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |