Global Star Anise Market Forecast

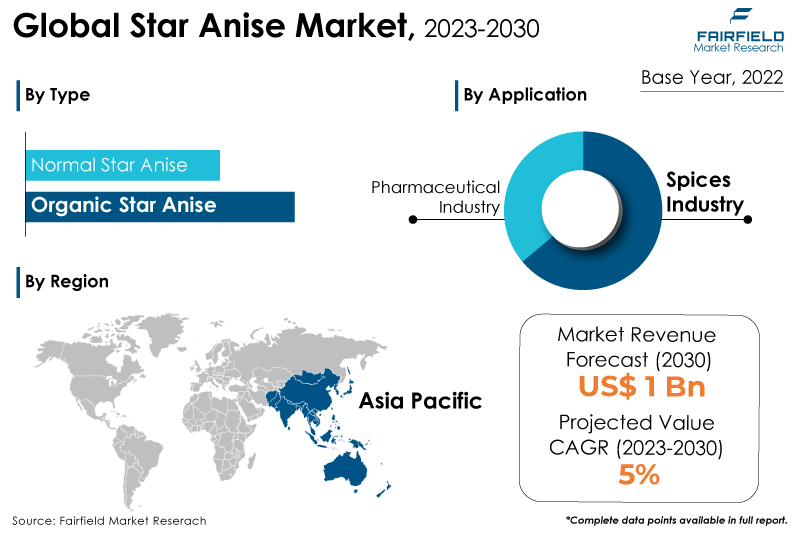

- Global star anise market set to witness a healthy CAGR of 5% during 2023 - 2030

- The star anise market size to hit the billion-dollar mark by the end of 2030

Market Analysis in Brief

A native of China and Vietnam, star anise (Illicium verum) is a spice derived from an evergreen tree's fruit. Its name refers to the seed's distinctive star-shaped pod, which gives the plant its outward appearance. The spice is used frequently in many different cuisines, especially in Asian and Indian cooking, and is distinguished by its potent, sweet, and licorice-like flavour. A key component of Chinese five-spice powder is star anise, which is also used to flavour various foods, including soups, stews, sauces, and marinades. It frequently appears in recipes for roasted meats and braised foods since it goes well, especially poultry. The growing popularity of star anise in the culinary world, especially in Asian cooking, is the main driver fueling the market's expansion owing to the rising demand for organic and herbal goods comprising herbal teas, health mixtures, dietary supplements, and herbal medicines.

Star anise is desirable for these goods due to its possible health advantages, such as its digestive and respiratory qualities. The extraction of star anise's bioactive components for prospective use in herbal supplements, and conventional medicines is one of the plant's contemporary pharmaceutical applications. Star anise is also a crucial component of cosmetic and fragrance goods in the cosmetics sector. Due to their high level of seasonal variation and scarcity, star anise has a wide range in price. Star anise is more expensive than other organic items due to labour-intensive spice farming and manufacturing.

Key Report Findings

- The star anise market size will nearly double over the forecast period, 2023 and 2030.

- The fact that star anise possesses therapeutic benefits makes its widespread use in pharmaceuticals as well as cosmetics industries.

- Demand for organic star anise remains higher in the star anise market.

- The spice industry held the highest star anise market revenue share in 2022.

- Asia Pacific will continue to lead its way, whereas North America's star anise market will experience the strongest growth by 2030.

Growth Drivers

Sustained Fondness for a Distinct Flavour

The market for star anise is expanding due to the rising preference for meals with distinctive flavours worldwide, particularly in the Americas and Asia-Pacific nations. Many different cuisines employ star anise as a flavouring agent. Due to its low demand in normal home-cooked cuisine, star anise is rarely utilised in household cooking.

Star anise popularity is rising, nevertheless, as more food businesses are adopting it as a source of novel flavours despite its peculiar flavour, and a growing number of consumers are becoming familiar with it. In addition to the aforementioned uses, star anise is also utilised in herbal medicine; as a result, the market for star anise in India and the surrounding regions is anticipated to grow due to the rising demand for herbal medicines in these areas.

Growing Use of Spices, and Herbs

The demand for star anise is anticipated to rise because of the constantly expanding food and beverage sector. Herbal tea makers have a higher demand for star anise since its taste goes well with the formulation. The star anise is also used to make numerous alcoholic beverages thus expanding its application coverage further.

The rise in usage of star anise amongst customers owing to the awareness and acceptance of the flavour, and health advantages of natural and plant-based products, and culinary and therapeutic uses of star anise are anticipated to increase demand for the star anise across the globe. The growing supply of star anise further drives the market for star anise due to the increasing demand for essential oils worldwide.

Inflammation Reducing Properties of Star Anise Gain Traction

The immune system occasionally views inflammation as a normal defense against injury and illness. Therefore, chronic inflammation at high levels is linked to conditions including diabetes, obesity, and heart failure. Star anise can lessen inflammation to support better health and ward off sickness, according to studies on animals and in test tubes.

Star anise, for instance, was found to reduce edema and pain in a mouse study. According to some studies, star anise is a good source of antioxidants, which may help to reduce inflammation and fend off disease-causing oxidative stress. A rise in positive clinical outcomes in numerous healthcare applications will further support the market growth.

Growth Challenges

Widespread Counterfeiting

The scarcity of star anise and the rising demand for spices are responsible for counterfeiting. Star anise is increasingly more vulnerable to intentional or unintentional adulteration because of the considerable expansion of the international spice trade. Intentional adulteration frequently occurs to boost profit margins. For instance, in December 2020, police in Uttar Pradesh, a state in northern India, raided a plant that produced fake spices using donkey dung, acid, and other questionable materials.

Other plants or artificial coluors can be substituted for star anise, and unlisted flavourings can be added. Additionally, the geographical origins may have been changed. In the star anise industry, food fraud is a significant issue that will likely impede market expansion in the years to come, if not regulated in time.

Overview of Key Segments

Consumption of Organic Star Anise Higher

The increase in nutritional benefits compared to other alternative products available on the market is a key factor driving the sector’s growth. The growing initiatives taken by different authorities and governments are promoting the adoption of organic farming and production practices. The growing preference of customers to consume higher quality products, ready-to-use food, the growth of R&D activities, and the modernisation of new products offered on the market are the main factors driving the sector of organic star anise.

Additionally, in the forecast period, the normal star anise segment will also showcase considerable growth due to the higher price associated with organic anise. Increased exposure to different flavours worldwide and increased knowledge of the nutritional advantages of star anise have boosted its demand in the global market. Due to their ease in producing various flavours, star anise is in high demand on the international market.

One of the most sought-after locations for the distribution of star anise is retail and e-commerce portals. Retailers like Walmart, Kroger, and Tesco offer self-labeled products to customers to establish their position in the market and maintain competition. Apart from these chains, eateries, pubs, and resorts emphasize giving customers a sample of various cuisines from particular countries as part of dipping into global trends.

The Spices Industry Leads Demand Generation

Rising acceptance of ethnic cuisines is driving the demand for spice blends, and novel spices. The majority of vegans frequently utilise spices to replace meat in their meals. They frequently opt for flavours imitating non-vegan food. It is generating several chances for the expansion of the market for star anise in the spice industry.

There are now significantly more vegans in the US, and the UK. Several star anise varieties previously employed in the meat processing industry are now found in vegetarian replacements. As a result of this tendency, star anise demand is rising.

The demand for spices in herbal use and healthcare applications will experience significant growth. This sector’s expansion can be attributed to consumers around the world becoming more aware of the illnesses and health issues brought on by foodborne pathogens, as well as to a rise in the demand for natural remedies for these problems, which has resulted in a rise in the demand for medicinal star anise as a preventive measure against illnesses.

An increase in demand for medicinal star anise is fueling the sector’s compound annual growth rate. Natural, plant-based components, particularly therapeutic spices, have drawn increased interest from the cosmetics sector. Conversely, unrealised potential in developing nations offers attractive prospects for market participants.

Growth Opportunities Across Regions

Asia Pacific Leads the Pack

Asia Pacific dominates the star anise market due to the rising global acclaim for Asian flavours and cuisines, increasing demand for star anise, and higher consumption in Asia. Asian cuisine has a long history of using star anise, especially in nations like China, Vietnam, Thailand, and India. China is the world's biggest star anise producer and consumer. Due to its distinctive and enjoyable flavour, star anise is growing in popularity among food manufacturers worldwide. The market for star anise here is thus predicted to maintain its lead over the projected time frame.

Consumer food preferences have changed due to market globalisation and the migration phenomena, providing new chances for food service establishments to add various spices, such as star anise, to their menus. With the advent of marketing and promotional efforts, rising consumer affluence, healthcare applications, and the expansion of local brands, consumption in the area is also increasing at a fast pace. The market includes well-known businesses, such as AJINOMOTO, Everest, Catch, Ariake Japan, and MDH.

Market Attractiveness of North America on the Rise

North America will experience the fastest growth rate, due to customer readiness to try new flavours and high demand from Asian immigrants living in the nation excited about the ethnic tastes, demonstrating significant growth in the US. The primary development factors for the star anise market in North America are the growing popularity of Indian and Asian cuisines and the increased consumption of cooked foods.

Additionally, the US population's strong desire for natural and organic culinary components and emerging new industries in the United States, and Canada employing spices such as star anise for purposes other than food flavouring is anticipated to fuel the star anise market in the future. The appeal of convenience and ready-to-eat foods in the region is expected to boost the consumption of star anise.

Star Anise Market: Competitive Landscape

Some of the leading players at the forefront in the star anise market space include BTL Herbs & Spices, VLC Spices, Kore International, Union Trading Company, The Counts, Shrih Trading Company Private Limited, Viet Delta Industrial Co, .Ltd., THANH HIEN PRIVATE ENTERPRISE, GMEX., JSC, and Organic Way LLC.

Recent Notable Developments

A press release article published in August 2023, featured healthy tea options that are naturally sweet. One of them was stra anise tea yielding a tea with a captivating natural sweetness. This tea is a sensory delight, with its aromatic allure and licorice-like. Its natural sweetness reduces the need for additional sugar, making it a distinct wholesome option for tea enthusiasts.

In July 2022, a news article highlighted the health benefits associated with star anise. The article focused on incorporating start anise in diet to boost overall well-being and yielding the benefits of promoting digestion, relieving respiratory issues, enhancing skin-related health, regulation of menstrual cycles, and many more.

In June 2021, Kerry, the world's top taste and nutrition firm, announced the launch of a new Latin American taste factory that will primarily service in Mexico, Central America, the Caribbean, and the Andean area. The new state-of-the-art facility in Irapuato, Mexico, will greatly boost Kerry's capacity in the region and further support customers in offering local and sustainable flavour solutions.

Global Star Anise Market is Segmented as Below:

By Type

- Organic Star Anise

- Normal Star Anise

By Application

- Spices Industry

- Pharmaceutical Industry

- Other

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Star Anise Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume/Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Star Anise Market Outlook, 2018 - 2030

3.1. Global Star Anise Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Organic Star Anise

3.1.1.2. Normal Star Anise

3.2. Global Star Anise Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Spices Industry

3.2.1.2. Pharmaceutical Industry

3.3. Global Star Anise Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Star Anise Market Outlook, 2018 - 2030

4.1. North America Star Anise Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Organic Star Anise

4.1.1.2. Normal Star Anise

4.2. North America Star Anise Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Spices Industry

4.2.1.2. Pharmaceutical Industry

4.2.2. Market Attractiveness Analysis

4.3. North America Star Anise Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Star Anise Market Outlook, 2018 - 2030

5.1. Europe Star Anise Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Organic Star Anise

5.1.1.2. Normal Star Anise

5.2. Europe Star Anise Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Spices Industry

5.2.1.2. Pharmaceutical Industry

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Star Anise Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Star Anise Market Outlook, 2018 - 2030

6.1. Asia Pacific Star Anise Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Organic Star Anise

6.1.1.2. Normal Star Anise

6.2. Asia Pacific Star Anise Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Spices Industry

6.2.1.2. Pharmaceutical Industry

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Star Anise Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Star Anise Market Outlook, 2018 - 2030

7.1. Latin America Star Anise Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Organic Star Anise

7.1.1.2. Normal Star Anise

7.2. Latin America Star Anise Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1.1. Spices Industry

7.2.1.2. Pharmaceutical Industry

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Star Anise Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Star Anise Market Outlook, 2018 - 2030

8.1. Middle East & Africa Star Anise Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Organic Star Anise

8.1.1.2. Normal Star Anise

8.2. Middle East & Africa Star Anise Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Spices Industry

8.2.1.2. Pharmaceutical Industry

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Star Anise Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Star Anise Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Star Anise Market by Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. BTL Herbs & Spices

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Union Trading Company

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Jagdish Masala Company

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Babji Marketing

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Mahaveer Marketing

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. VLC Spices

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. The Counts

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Business Strategies and Development

9.5.8. Shrih Trading Company Private Limited

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Kore International

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. BTL Herbs & Spices

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. VIET D.E.L.T.A INDUSTRIAL

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Thanh Hien Private Enterprise

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. GMEX.JSC

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Organicway

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |