Submarine Power Cables Market Outlook

"Estimated to exceed the revenue US$5.8 Bn by 2022 end, global submarine power cables market will possibly surpass the valuation of US$11 Bn through 2027 according to Fairfield Market Research. Although the market is poised for a strong growth outlook during the forecast period, the fact that the installation costs alone make up for 30-40% of the overall costs of these power cables will remain an impediment in short term."

Demand for Better Power Transmission Creates Opportunities in Submarine Power Cables Market

Year-on-year increase the deployment of power generators using variable renewable power sources such as wind and solar brings power balancing challenges in electricity systems. One means to achieve power balancing and to share balancing resources, is to interconnect electricity systems to geographically aggregate remotely located variable power sources. One of the best solutions available for bulk electric power transmission across large distances encompassing wide and deep-water bodies is using submarine power cables. This is expected to fuel the growth of global submarine power cables market.

Increased Investments in Offshore Projects Facilitate Expansion of Submarine Power Cables Market

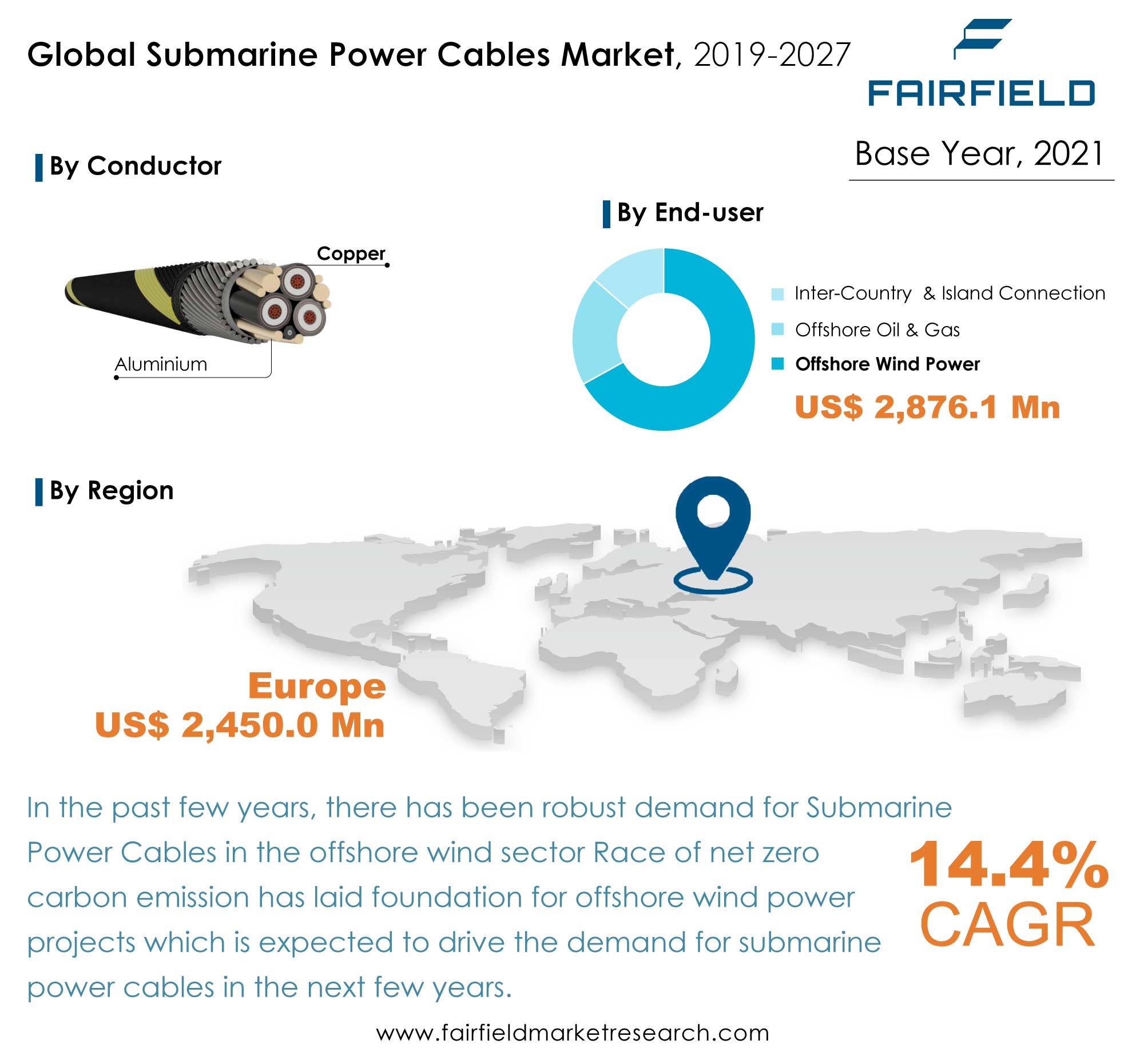

Global demand for energy is growing by more than a third over the period to 2035. This has great significance for the distribution of power through the development of greater subsea power cables. To lower CO2 emission, green energy has been developed fast, in Asia and Europe, offshore windmill has created huge demand and development of HV submarine cable, both HVAC, and HVDC. Race of net zero carbon emission has laid foundation for offshore wind power projects which is expected to drive the demand for submarine power cables in the next few years. Mounting investments in offshore wind power, and offshore oil and gas projects are expected to pave the further way for expansion of submarine power cables market.

The major challenges that can hinder the growth of submarine power cables market include high installation cost, technical challenges in installation, and damages caused due to human intervention. Submarine power cables are the infrastructural elements that require high financial investment to be built and installed. Building new power generation capacities also require high financial investments and longer pay-backs. Installing a submarine cable is a costly, and challenging activity. The lifetime of a submarine cable might be tens of years and the technical interventions for its repairing in case of faults are also costly and difficult. The cable route must thus be carefully surveyed and selected to minimise the environmental impact and maximise the cable protection.

Usage of Copper Conductor to Remain Dominant in Submarine Power Cables Market Through 2027

In terms of conductor, the market is divided into copper, and aluminium. In 2021, copper conductor-based submarine power cables dominated the market and constituted more than 70% share. The dominance of copper conductor in submarine power cables is attributed to high demand as well as advantages of copper conductor over aluminium conductor. However, the use of aluminium for submarine cables is less common. Some utilities see the economic opportunities of using aluminium while others exclude aluminium conductors already in the project specifications. Besides copper, aluminium is the only material used for power cable conductors in an industrial scale. Its low weight, and advantageous price have made it the conductor material of choice for underground cables in many countries.

Increased Investments in Offshore Wind Power to Benefit Demand

In terms of end-user, submarine power cables market is divided into Inter-country & island connection, offshore oil and gas and offshore wind power. In 2021, offshore wind power dominated the market and constituted more than 65% share. Governments and power suppliers are supporting renewable energy sources such as wind power and oil/gas companies are substituting less efficient and CO2 emitting gas-turbine generation on platforms with power supplies from the mainland. This has led to an increasing worldwide demand for submarine cable solutions with less environmental impact.

Inter-country, and island connection through submarine power cables are critical for energy security in rural areas as well as isolated islands across the global. Rural and island electrification through the usage of submarine power cables has been prime focus from several nations rather than developing grid networks for island areas. Submarine power cables have always played and now even more than before a substantial role in oil and gas projects. Submarine power cables protection is of critical importance to the successful outcome of the entire installation.

Single Core-based High Voltage (500KV and above) to Constitute Major Share

In terms of cable type, single core cables 79.3% share in the year 2021. In single core wire there is only a single core of metal is present, mostly copper, or aluminium. This is mainly attributed to technical ease and economical deployment as compared to multicore cables. The demands of single core cables are majorly derived from offshore wind sector, particularly in Europe, which is fuelling the demand of these cables in the region’s submarine power cables market. Moreover, single core cables are suitable for covering long distances, as they experience lower reverse current as compared to multicore cables. In terms of voltage, submarine power cables market is segmented into high (Above 500 KVA), and medium (Below 500 KVA). In the year 2021, high (Above 500 KVA) voltage submarine power cables constituted 67% share. High voltage or HVDC cables are used for cross border distribution/transmission of power and are highly reliable for bulk power distribution.

Submarine Power Cables Market in Asia Pacific Expects Strong Growth, News Installations Underway

Europe dominated global submarine power cables market in 2021. Inter-connector cables are being laid to move energy freely throughout Europe, thereby ensuring security of supply. On April 2022, Key contracts totalling more than US$1.95 Bn was awarded for a major interconnector project that will link Germany, and the UK. Asia Pacific, and North America follows behind Europe. In US, the importance of submarine power cables has increased steadily in recent decades. The advent of offshore renewable energy requires export cables from wind, wave and tidal installations are needed to bring the renewable energy ashore. In US, the demand for submarine power cables is expected to undergo sharp growth, with the goal of 30GW of new wind capacity to be installed by 2030 under the Biden Plan.

Growing investments in the deployment of high-voltage submarine cables for inter-country & island connection is the key region behind the dominance of Europe. In Europe, the major shift towards renewable energy is expected to drive demand for submarine power cables in the near future. Asia Pacific is estimated to be the most attractive region for the submarine power cables market. In Asia Pacific, Japan, and China together constituted more than 30% market share in 2021. India is emerging as a key strategic destination for global underwater cables, due to its geographic location and the fact cable systems connecting Europe, and Southeast Asia. In 2021, India joined global undersea cable race with Reliance Jio’s help.

Demand for submarine power cables in the Middle East and Africa, and Latin America is expected to grow at a fair pace. On January 2022, Prysmian has entered a Limited Notice to Proceed (LNTP) for the supply of power cables for what is said to be the first-of-its-kind high-voltage, direct current (HVDC-VSC) subsea power transmission system in the Middle East. Latin America has a huge potential for installing subsea power cables. The region is still short when it comes to installed base of subsea power cable connected between different nations.

Global Submarine Power Cables Market: Competitive Landscape

Key players operating in the submarine power cables market include Nexans S.A., Prysmian Group, NKT A/S, Furukawa Electric Co., LTD., Sumitomo Electric Industries, Ltd., ABB, LS Cable & System Ltd, ZTT, KEI Industries Limited, and Hengtong Marine Cable Systems.

In 2022, Prysmian Group, entered a Limited Notice to Proceed (LNTP) for the supply of power cables in the context of a landmark HVDC submarine cable project in the Middle East, worth around €220 million. The LNTP was awarded to Prysmian by Samsung C&T as part of its EPC consortium with Jan De Nul Group. The new link, part of the strategic HVDC transmission system for the Abu Dhabi National Oil Company (ADNOC) Abu Dhabi National Energy Company PJSC (TAQA) Lightning Project, will allow bulk-power energy transmission between the converter station in Al Mirfa, in Abu Dhabi mainland, and that on the Al Ghallan offshore island. In the same year, Prysmian Group secured 47 acres of land to develop a submarine power cable plant in Somerset, Massachusetts. The company plans to invest around $200m to develop the facility.

The Global Submarine Power Cables Market is Segmented as Below:

By Type Coverage

- Single Core

- Multi Core

By Conductor Coverage

- Aluminium

- Copper

By Voltage Coverage

- High (500KV and Above)

- Medium (Below 500 KV)

By End-user Coverage

- Inter-country & Island Connection

- Offshore Oil & Gas

- Offshore Wind Power

By Geographical Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- Denmark

- France

- Italy

- Netherlands

- Norway

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Malaysia

- Indonesia

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- Angola

- Rest of Middle East & Africa

Leading Companies

- Nexans

- Prysmian Group

- NKT

- ZTT

- KEI Industries Limited

- LS Cable & System Ltd

- The Furukawa Electric Co., Ltd.

- Hengtong Marine Cable Systems

- ABB

- Sumitomo Electric Industries

Inside This Report You Will Find:

1. Executive Summary

2. Market Overview

3. Global Submarine Power Cables: Micro/Macro Economic Factors

4. Global Submarine Power Cables Market Outlook,

5. North America Submarine Power Cables Market Outlook, 2019 - 2027

6. Europe Submarine Power Cables Market Outlook, 2019 - 2027

7. Asia Pacific Submarine Power Cables Market Outlook, 2019 - 2027

8. Latin America Submarine Power Cables Market Outlook, 2019 - 2027

9. Middle East & Africa Submarine Power Cables Market Outlook, 2019 - 2027

10. Competitive Landscape

11. Appendix

Post Sale Support, Research Updates & Offerings:

We value the trust shown by our customers in Fairfield Market Research. We support our clients through our post sale support, research updates and offerings.

- The report will be prepared in a PPT format and will be delivered in a PDF format.

- Additionally, Market Estimation and Forecast numbers will be shared in Excel Workbook.

- If a report being sold was published over a year ago, we will offer a complimentary copy of the updated research report along with Market Estimation and Forecast numbers within 2-3 weeks’ time of the sale.

- If we update this research study within the next 2 quarters, post purchase of the report, we will offer a Complimentary copy of the updated Market Estimation and Forecast numbers in Excel Workbook.

- If there is a geopolitical conflict, pandemic, recession, and the like which can impact global economic scenario and business activity, which might entirely alter the market dynamics or future projections in the industry, we will create a Research Update upon your request at a nominal charge.

1. Executive Summary

1.1. Global Submarine Power Cables Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst’s Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.2.4. Economic Trends

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis & PEST Analysis

2.5. COVID-19 Impact

2.5.1. Supply Chain

2.5.2. End-user Customer Impact Analysis

3. Global Submarine Power Cables: Micro/Macro Economic Factors

4. Global Submarine Power Cables Market Outlook,

4.1. Global Submarine Power Cables Market Outlook, by Type, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

4.1.1. Key Highlights

4.1.1.1. Single Core

4.1.1.2. Multi Core

4.1.2. BPS Analysis/Market Attractiveness Analysis, by Type

4.2. Global Submarine Power Cables Market Outlook, by Conductor, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

4.2.1. Key Highlights

4.2.1.1. Copper

4.2.1.2. Aluminium

4.2.2. BPS Analysis/Market Attractiveness Analysis, by Conductor

4.3. Global Submarine Power Cables Market Outlook, by Voltage, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

4.3.1. Key Highlights

4.3.1.1. High (Above 500 KVA)

4.3.1.2. Medium (Below 500 KVA)

4.3.2. BPS Analysis/Market Attractiveness Analysis, by Voltage

4.4. Global Submarine Power Cables Market Outlook, by End-user, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

4.3.1. Key Highlights

4.3.1.1. Inter-Country & Island Connection

4.3.1.2. Offshore Oil & Gas

4.3.1.3. Offshore Wind Power

4.3.2. BPS Analysis/Market Attractiveness Analysis, by End-user

4.4. Global Submarine Power Cables Market Outlook, by Region, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

4.4.2. BPS Analysis/Market Attractiveness Analysis, by Region

5. North America Submarine Power Cables Market Outlook, 2019 - 2027

5.1. North America Submarine Power Cables Market Outlook, by Type, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

5.1.1. Key Highlights

5.1.1.1. Single Core

5.1.1.2. Multi Core

5.2. North America Submarine Power Cables Market Outlook, by Conductor, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

5.2.1. Key Highlights

5.2.1.1. Copper

5.2.1.2. Aluminium

5.3. North America Submarine Power Cables Market Outlook, by Voltage, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

5.3.1. Key Highlights

5.3.1.1. High (Above 500 KVA)

5.3.1.2. Medium (Below 500 KVA)

5.4. North America Submarine Power Cables Market Outlook, by End-user, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

5.4.1. Key Highlights

5.4.1.1. Inter-Country & Island Connection

5.4.1.2. Offshore Oil & Gas

5.4.1.3. Offshore Wind Power

5.5. North America Submarine Power Cables Market Outlook, by Country, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

5.5.1. Key Highlights

5.5.1.1. U.S. Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

5.5.1.2. Canada Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

6. Europe Submarine Power Cables Market Outlook, 2019 - 2027

6.1. Europe Submarine Power Cables Market Outlook, by Type, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

6.1.1. Key Highlights

6.1.1.1. Single Core

6.1.1.2. Multi Core

6.2. Europe Submarine Power Cables Market Outlook, by Conductor, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

6.2.1. Key Highlights

6.2.1.1. Copper

6.2.1.2. Aluminium

6.3. Europe Submarine Power Cables Market Outlook, by Voltage, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

6.3.1. Key Highlights

6.3.1.1. High (Above 500 KVA)

6.3.1.2. Medium (Below 500 KVA)

6.4. Europe Submarine Power Cables Market Outlook, by End-user, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

6.4.1. Key Highlights

6.4.1.1. Inter-Country & Island Connection

6.4.1.2. Offshore Oil & Gas

6.4.1.3. Offshore Wind Power

6.5. Europe Submarine Power Cables Market Outlook, by Country, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

6.5.1. Key Highlights

6.5.1.1. U.S. Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

6.5.1.2. Canada Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

7. Asia Pacific Submarine Power Cables Market Outlook, 2019 - 2027

7.1. Asia Pacific Submarine Power Cables Market Outlook, by Type, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

7.1.1. Key Highlights

7.1.1.1. Single Core

7.1.1.2. Multi Core

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Asia Pacific Submarine Power Cables Market Outlook, by Conductor, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

7.2.1. Key Highlights

7.2.1.1. Copper

7.2.1.2. Aluminium

7.3. Asia Pacific Submarine Power Cables Market Outlook, by Voltage, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

7.3.1. Key Highlights

7.3.1.1. High (Above 500 KVA)

7.3.1.2. Medium (Below 500 KVA)

7.4. Asia Pacific Submarine Power Cables Market Outlook, by End-user, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

7.4.1. Key Highlights

7.4.1.1. Inter-Country & Island Connection

7.4.1.2. Offshore Oil & Gas

7.4.1.3. Offshore Wind Power

7.5. Asia Pacific Submarine Power Cables Market Outlook, by Country, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

7.5.1. Key Highlights

7.5.1.1. U.S. Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

7.5.1.2. Canada Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

8. Latin America Submarine Power Cables Market Outlook, 2019 - 2027

8.1. Latin America Submarine Power Cables Market Outlook, by Type, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

8.1.1. Key Highlights

8.1.1.1. Single Core

8.1.1.2. Multi Core

8.2. Latin America Submarine Power Cables Market Outlook, by Conductor, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

8.2.1. Key Highlights

8.2.1.1. Copper

8.2.1.2. Aluminium

8.3. Latin America Submarine Power Cables Market Outlook, by Voltage, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

8.3.1. Key Highlights

8.3.1.1. High (Above 500 KVA)

8.3.1.2. Medium (Below 500 KVA)

8.4. Latin America Submarine Power Cables Market Outlook, by End-user, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

8.4.1. Key Highlights

8.4.1.1. Inter-Country & Island Connection

8.4.1.2. Offshore Oil & Gas

8.4.1.3. Offshore Wind Power

8.5. Latin America Submarine Power Cables Market Outlook, by Country, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

8.5.1. Key Highlights

8.5.1.1. Brazil Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

8.5.1.2. Argentina Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

8.5.1.2. Rest of Latin America Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

9. Middle East & Africa Submarine Power Cables Market Outlook, 2019 - 2027

9.1. Middle East & Africa Submarine Power Cables Market Outlook, by Type, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

9.1.1. Key Highlights

9.1.1.1. Single Core

9.1.1.2. Multi Core

9.2. Middle East & Africa Submarine Power Cables Market Outlook, by Conductor, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

9.2.1. Key Highlights

9.2.1.1. Copper

9.2.1.2. Aluminium

9.3. Middle East & Africa Submarine Power Cables Market Outlook, by Voltage, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

9.3.1. Key Highlights

9.3.1.1. High (Above 500 KVA)

9.3.1.2. Medium (Below 500 KVA)

9.4. Middle East & Africa Submarine Power Cables Market Outlook, by End-user, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

9.4.1. Key Highlights

9.4.1.1. Inter-Country & Island Connection

9.4.1.2. Offshore Oil & Gas

9.4.1.3. Offshore Wind Power

9.5. Middle East & Africa Submarine Power Cables Market Outlook, by Country, Volume (“000” Km) and Value (US$ Mn), 2019 - 2027

9.5.1. Key Highlights

9.5.1.1. Brazil Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

9.5.1.2. Argentina Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

9.5.1.2. Rest of Latin America Submarine Power Cables Market, Volume (“000” Km) and Value (US$ Mn)

10. Competitive Landscape

10.1. Company Market Share Analysis, 2020

10.2. Strategic Collaborations

10.3. Company Profiles

10.3.1. Nexans

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Prysmian Group

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. NKT Cables

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. ZTT

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. LS Cable & System

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Furukawa Electric Co., Ltd.

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. KEI Industries

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. ABB Ltd

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Sumitomo Electric Industries, Ltd.

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. HENGTONG GROUP CO., LTD.

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2021 |

|

2019 - 2020 |

2022 - 2027 |

Value: US$ Million Volume: “000” KM |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Conductor Coverage |

|

|

Voltage Coverage |

|

|

End-user Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2027), Price Trend Analysis- 2019-2027, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |