Global Sustainable Finance Market Forecast

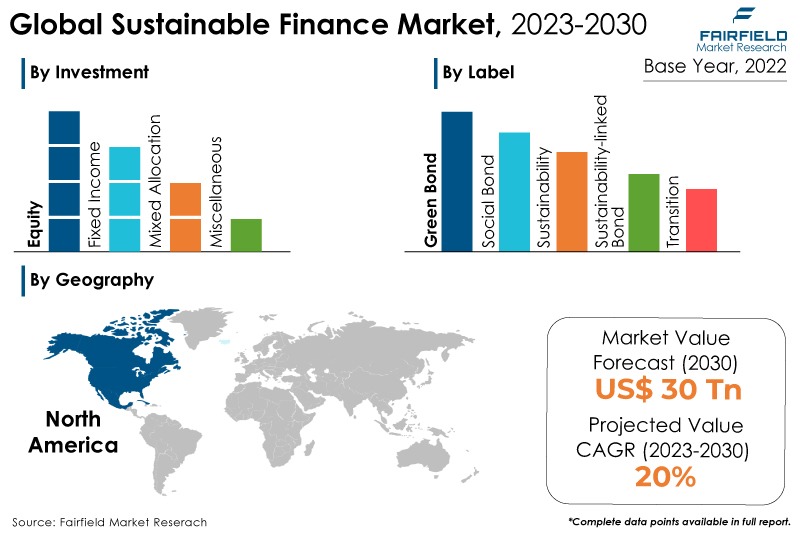

- Global sustainable finance market size to demonstrate a robust CAGR of 20% over 2023 - 2030

- Market valuation poised to reach approximately US$30 Tn by the end of 2030

Market Analysis in Brief

Sustainable finance encompasses a variety of activities, ranging from investing in green energy projects to supporting companies that exhibit strong social values and governance, like promoting diversity on their boards. It plays a crucial role in driving the world's transition to a net-zero future by directing private funds to carbon-neutral initiatives. The demand for professionals well-versed in sustainable finance is rapidly increasing as investments in businesses with sustainable practices are rising. Sustainable finance offers benefits such as cost-cutting, risk mitigation, improved returns, and reduced exposure to sustainability-related risks. These factors contribute to the growth of the sustainable finance market.

Nevertheless, diversification issues and high operating costs challenge the sustainable finance market's expansion. However, the growing awareness of sustainability across various sectors create lucrative opportunities for the sustainable finance market in the coming years. As more businesses and investors recognise the importance of sustainability, the demand for sustainable finance products and expertise is expected to increase, fueling further growth in the market.

Key Report Findings

- The sustainable finance market will demonstrate more than 5x expansion in revenue over the years of projection, i.e., between 2023 and 2030.

- Green bonds captured the largest market share in 2022 due to their clear focus on financing environmentally beneficial projects, and alignment with investors' growing demand for socially responsible and climate-friendly investments.

- Equity investment continues to hold the lion’s share of the sustainable finance industry on the back of its direct ownership stake in sustainable companies and potential for active engagement in shaping their sustainable practices.

- North America will continue to lead its way, whereas Asia Pacific's Sustainable finance market will experience the strongest growth till 2030.

Growth Drivers

Growing Investments in Businesses with Sustainable Practices

The rise in investment in businesses with sustainable practices is a driving force behind the growth of the sustainable finance market. Investors increasingly recognise the importance of addressing environmental and social challenges and seek investment opportunities that promote sustainable development.

Companies with sustainable practices prioritise environmental stewardship, social responsibility, and good governance, thereby reducing their negative impact on the planet and society while striving for long-term profitability.

As more investors direct their capital towards sustainable businesses, the demand for sustainable finance products has surged. Financial institutions have responded by offering a range of sustainable investment options, such as green bonds, social impact funds, and sustainability-focused exchange-traded funds (ETFs). These financial products enable investors to channel their funds into projects and companies that adhere to sustainable practices, creating a positive feedback loop that further stimulates sustainable investment.

Moreover, regulatory changes and policies have played a significant role in driving the sustainable finance market. Many governments worldwide have introduced regulations encouraging sustainable practices, such as carbon pricing, ESG reporting requirements, and tax incentives for green investments. These policy measures create a supportive environment for businesses with sustainable practices and motivate investors to engage in sustainable finance to comply with regulations or capitalise on available incentives.

The increasing investment in businesses with sustainable practices and supportive regulatory measures propels the sustainable finance market forward. As the awareness of environmental and social challenges continues to grow, sustainable finance is expected to become an even more integral part of the global financial system, driving positive impact and fostering a more sustainable future.

Growing Awareness About Sustainable Finance

The growing awareness of sustainable finance among various sectors has emerged as a pivotal driver for the expansion of the sustainable finance market. As awareness of environmental and social challenges intensifies, individuals, businesses, and governments increasingly recognise the significance of incorporating sustainability into financial decision-making. This heightened awareness has permeated various sectors, including finance, corporate entities, non-profit organisations, and academia.

Banks, asset managers, and institutional investors take the lead in the financial sector by incorporating Environmental, Social, and Governance (ESG) factors into their investing strategies. These actors are looking for investment possibilities that support good change since they are becoming more aware of the dangers connected to environmental and social challenges, such as climate change and labour practises.

Due to the increase in demand for sustainable finance products like green bonds and funds with a sustainability theme, financial institutions have been forced to respond by providing a variety of sustainable investment choices. Businesses from a variety of sectors are also going through a paradigm shift as they realise the benefits of sustainable practises for the environment, society, and business.

A growing number of businesses are committing to decreasing their carbon footprint, implementing sustainable business strategies, and establishing ethical supply chains. Such businesses are not only attracting conscious consumers but also receiving support from investors who value sustainable practices. The rise in investment in these companies, backed by their commitment to sustainability, is contributing to the growth of the sustainable finance market.

Non-profit organisations and academic institutions are also vital in driving awareness of sustainable finance. NGOs and sustainability-focused organisations actively advocate for sustainable practices, urging investors and businesses to consider their environmental and social impact.

Additionally, academic research and educational programs are shedding light on the importance of sustainability in finance, training the next generation of finance professionals to incorporate sustainability principles into their decision-making processes.

Growth Challenges

Potential Divergence Issues

Diversification issues in sustainable finance present a significant challenge for the market. Firstly, the range of available sustainable finance products and investment opportunities can be limited compared to traditional financial products. While green bonds and sustainable funds have gained popularity, the market may need more diversity in sectors and regions. This limited diversification can make it challenging for investors to build well-rounded sustainable portfolios that align with their risk appetite and financial goals.

Secondly, measuring and comparing the impact of different sustainable investments can be complex and subjective. Unlike traditional financial metrics, impact metrics are diverse and context-specific, making evaluating the actual social and environmental outcomes of different investments difficult. This lack of standardisation and transparency in impact measurement can hinder investors' ability to assess the effectiveness of their sustainable finance strategies and identify the most impactful opportunities.

Furthermore, the sustainable finance market may need to help attract more investors. Some traditional investors may still perceive sustainable finance as niche or unproven and may be hesitant to shift their investment strategies accordingly. This reluctance could limit the capital inflow into the sustainable finance market and impede its growth potential.

Additionally, smaller investors or those with limited resources might find the minimum investment thresholds for some sustainable finance products prohibitive, further limiting the market's accessibility and diversification. Addressing these diversification issues requires concerted efforts from various stakeholders.

Standardisation of impact measurement methodologies, greater transparency in sustainable finance products, and education initiatives to raise awareness among investors are critical steps to overcome these challenges. By fostering a more diverse and inclusive sustainable finance market, the financial industry can substantially address global environmental and social challenges and drive positive change in the long run.

Overview of Key Segments

Green Bond Category Dominant

For several reasons, green bond transactions have captured the largest market share in the sustainable finance market. Firstly, the growing awareness and urgency surrounding environmental issues, such as climate change and sustainability, have led investors and institutions to seek investment opportunities that align with their environmental objectives.

Green bonds offer a clear and straightforward way for issuers to raise capital for projects with positive environmental impacts. These projects typically focus on renewable energy, energy efficiency, clean transportation, and other initiatives that reduce greenhouse gas emissions and promote sustainable development. As investors increasingly prioritise sustainable investments, the demand for green bonds has surged, driving the market's growth.

Secondly, regulatory support and policy measures have played a crucial role in boosting the adoption of green bonds. Governments worldwide have introduced incentives and guidelines for green finance and sustainable investments. For instance, some countries offer tax benefits or subsidies to issuers of green bonds, while others have implemented ESG reporting requirements for corporations.

Such regulatory backing and policy frameworks create a favourable environment for issuers and investors, fostering the development of the green bond market. Moreover, the transparency and accountability associated with green bonds, as issuers must disclose how the proceeds will be used for environmentally beneficial projects, provide additional confidence for investors in the integrity and impact of their investments.

Overall, the combination of increased environmental awareness among investors and supportive regulatory measures has propelled green bond transactions to capture the largest market share in the sustainable finance market. As the focus on sustainable investments grows, green bonds are expected to remain a prominent and effective instrument for financing environmentally responsible projects and driving positive change in the global fight against climate change and other pressing environmental challenges.

Equity Investment Type Most Preferred

For several compelling reasons, the equity investment type has captured the largest market share in the sustainable finance market. Firstly, equity investments give investors a direct ownership stake in companies or projects prioritising sustainable practices. Investors can align their capital with businesses that demonstrate strong Environmental, Social, and Governance (ESG) principles, thereby promoting positive social and environmental outcomes.

As sustainable investing gains prominence, more investors seek to actively shape companies' sustainable strategies through equity ownership, thus driving the demand for sustainable equity investments.

Secondly, the long-term nature of equity investments makes them well-suited for supporting sustainable businesses and projects requiring continuous growth and expansion funding. Sustainable initiatives often involve projects with longer gestation periods, such as renewable energy infrastructure, clean technology research, or sustainable agriculture practices. Equity investors' patient capital can provide the financial stability and flexibility sustainable projects need to develop and thrive over time. Furthermore, equity investments allow investors to share in the success of sustainable ventures, potentially realising higher returns as these businesses grow and succeed in delivering on their sustainability goals.

Moreover, institutional investors, in particular, have played a significant role in driving the popularity of sustainable equity investments. Large asset managers, pension funds, and other institutional players are increasingly integrating ESG considerations into their investment strategies, and they wield considerable influence in the market. By channeling substantial capital into sustainable equity investments, these institutional investors have contributed to the market's growth and encouraged businesses to adopt sustainable practices to attract responsible capital.

In conclusion, the appeal of equity investments in the sustainable finance market stems from their ability to provide direct ownership in sustainable businesses and projects, their suitability for long-term sustainable initiatives, and the active role they allow investors to play in shaping sustainable strategies. As the demand for sustainable investment options continues to rise, equity investments are expected to remain dominant in driving positive social and environmental change through responsible finance.

Growth Opportunities Across Regions

North America Maintains a Dominant Position

North America has captured the largest market share in the sustainable finance market for several compelling reasons. Firstly, the region has a large and mature financial ecosystem, including well-established financial institutions, asset managers, and investment firms. This robust financial infrastructure has enabled North America to lead in developing and offering a wide range of sustainable finance products, such as green bonds, sustainable funds, and impact investing platforms.

Many investors who want to connect their financial aims with their environmental and social principles have been drawn to the availability of these diversified, sustainable investing alternatives. Moreover, North America has witnessed a significant rise in demand for sustainable investments from various stakeholders, including institutional investors, asset owners, and individual investors.

Institutional investors, in particular, have been actively integrating Environmental, Social, and Governance (ESG) considerations into their investment strategies, and they play a crucial role in shaping the sustainable finance landscape.

Additionally, corporations in North America are increasingly incorporating sustainable practices into their business models, driven by consumer demand, regulatory pressures, and a growing awareness of their social and environmental responsibilities. This commitment to sustainability from investors and businesses has driven the rapid growth of the sustainable finance market in the region.

Moreover, North America has seen strong support from governments and regulatory bodies for sustainable finance initiatives. Several states and provinces have implemented policies and incentives to promote green finance and sustainable investments.

Furthermore, North American financial regulators have encouraged transparency and accountability in ESG reporting, further bolstering the credibility and attractiveness of sustainable finance products.

Asia Pacific Promises a Lucrative Market

Due to several key factors, Asia Pacific emerged as the fastest-growing region in the sustainable finance market. Firstly, the region's increasing awareness of environmental and social challenges has prompted businesses and investors to embrace sustainability.

Countries in the Asia Pacific face significant environmental issues, such as pollution, deforestation, and climate change impacts, which have led to a growing recognition of the need for sustainable practices. As a result, businesses are incorporating sustainability into their operations and seeking sustainable finance options to support their environmental and social goals.

Secondly, the Asia Pacific region is experiencing rapid economic growth and urbanisation, creating a demand for sustainable infrastructure and development projects. This surge in economic activity has driven the need for investments in renewable energy, green transportation, and sustainable urban planning.

As governments and corporations in the region prioritise sustainable development, sustainable finance products, including green bonds and sustainable funds, have gained traction to support these projects. Moreover, the region has witnessed strong support from governments and financial regulators in promoting sustainable finance.

Governments in the Asia Pacific have introduced policies and incentives to encourage green finance and sustainable investments. For instance, countries like China, and India have set ambitious renewable energy targets, fostering the growth of green bond issuance in the region.

The commitment from both the public and private sectors to sustainability has accelerated the growth of the sustainable finance market in the Asia Pacific, positioning it as a leading force in driving positive environmental and social change through responsible finance.

Sustainable Finance Market: Competitive Landscape

Some of the leading players at the forefront in the sustainable finance market space include Triodos Bank, KPMG International, Aspiration Partners, Inc., BNP Paribas, Acuity Knowledge Partners, PwC, Goldman Sachs, Treecard, NOMURA HOLDINGS, INC., Starling Bank, Deutsche Bank AG, Refinitiv, HSBC Group, and South Pole.

Recent Notable Developments

In June 2022, Ortec Finance partnered with ESG Book to improve investor access to sustainability data and insights. This collaboration seeks to enhance the accessibility and usability of ESG (Environmental, Social, and Governance) data, empowering investors to make better-informed decisions in sustainable finance.

In November 2021, GoldenSource and Arabesque joined forces in a partnership to improve access to ESG (Environmental, Social, and Governance) data for both buy-side and sell-side participants. Through this collaboration, GoldenSource clients can utilise Arabesque's innovative solution, designed to help investors meet the requirements of the Sustainable Finance Disclosure Regulation (SFDR).

Global Sustainable Finance Market is Segmented as Below:

By Investment

- Equity

- Fixed Income

- Mixed Allocation

- Miscellaneous

By Label

- Green Bond

- Social Bond

- Sustainability

- Sustainability-linked Bond

- Transition

By Investor Type

- Institutional Investors

- Retail Investors

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Sustainable Finance Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Sustainable Finance Market Outlook, 2018 - 2030

3.1. Global Sustainable Finance Market Outlook, by Investment, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Equity

3.1.1.2. Fixed Income

3.1.1.3. Mixed Allocation

3.1.1.4. Misc.

3.2. Global Sustainable Finance Market Outlook, by Label, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Green Bond

3.2.1.2. Social Bond

3.2.1.3. Sustainability

3.2.1.4. Sustainability-linked Bond

3.2.1.5. Transition

3.3. Global Sustainable Finance Market Outlook, by Investor Type, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Institutional Investors

3.3.1.2. Retail Investors

3.4. Global Sustainable Finance Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Sustainable Finance Market Outlook, 2018 - 2030

4.1. North America Sustainable Finance Market Outlook, by Investment, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Equity

4.1.1.2. Fixed Income

4.1.1.3. Mixed Allocation

4.1.1.4. Misc.

4.2. North America Sustainable Finance Market Outlook, by Label, Value (US$ Bn), 2018 - 2030

4.2.1.1. Green Bond

4.2.1.2. Social Bond

4.2.1.3. Sustainability

4.2.1.4. Sustainability-linked Bond

4.2.1.5. Transition

4.2.2. Market Attractiveness Analysis

4.3. North America Sustainable Finance Market Outlook, by Investor Type, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Institutional Investors

4.3.1.2. Retail Investors

4.4. North America Sustainable Finance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Sustainable Finance Market Outlook, 2018 - 2030

5.1. Europe Sustainable Finance Market Outlook, by Investment, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Equity

5.1.1.2. Fixed Income

5.1.1.3. Mixed Allocation

5.1.1.4. Misc.

5.2. Europe Sustainable Finance Market Outlook, by Label, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Green Bond

5.2.1.2. Social Bond

5.2.1.3. Sustainability

5.2.1.4. Sustainability-linked Bond

5.2.1.5. Transition

5.3. Europe Sustainable Finance Market Outlook, by Investor Type, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Institutional Investors

5.3.1.2. Retail Investors

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Sustainable Finance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Sustainable Finance Market By Investment, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Sustainable Finance Market By Label, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Sustainable Finance Market By Investor Type, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Sustainable Finance Market By Investment, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Sustainable Finance Market By Label, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Sustainable Finance Market By Investor Type, Value (US$ Bn), 2018 - 2030

5.4.1.13. Russia Sustainable Finance Market By Investment, Value (US$ Bn), 2018 - 2030

5.4.1.14. Russia Sustainable Finance Market By Label, Value (US$ Bn), 2018 - 2030

5.4.1.15. Russia Sustainable Finance Market By Investor Type, Value (US$ Bn), 2018 - 2030

5.4.1.16. Rest Of Europe Sustainable Finance Market By Investment, Value (US$ Bn), 2018 - 2030

5.4.1.17. Rest Of Europe Sustainable Finance Market By Label, Value (US$ Bn), 2018 - 2030

5.4.1.18. Rest Of Europe Sustainable Finance Market By Investor Type, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Sustainable Finance Market Outlook, 2018 - 2030

6.1. Asia Pacific Sustainable Finance Market Outlook, by Investment, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Equity

6.1.1.2. Fixed Income

6.1.1.3. Mixed Allocation

6.1.1.4. Misc.

6.2. Asia Pacific Sustainable Finance Market Outlook, by Label, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Green Bond

6.2.1.2. Social Bond

6.2.1.3. Sustainability

6.2.1.4. Sustainability-linked Bond

6.2.1.5. Transition

6.3. Asia Pacific Sustainable Finance Market Outlook, by Investor Type, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Institutional Investors

6.3.1.2. Retail Investors

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Sustainable Finance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Sustainable Finance Market Outlook, 2018 - 2030

7.1. Latin America Sustainable Finance Market Outlook, by Investment, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Equity

7.1.1.2. Fixed Income

7.1.1.3. Mixed Allocation

7.1.1.4. Misc.

7.2. Latin America Sustainable Finance Market Outlook, by Label, Value (US$ Bn), 2018 - 2030

7.2.1.1. Green Bond

7.2.1.2. Social Bond

7.2.1.3. Sustainability

7.2.1.4. Sustainability-linked Bond

7.2.1.5. Transition

9.3. Company Profiles

7.3. Latin America Sustainable Finance Market Outlook, by Investor Type, Value (US$ Bn), 2018 - 2030

7.3.1.1. Institutional Investors

7.3.1.2. Retail Investors

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Sustainable Finance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

7.4.1.8. Rest of Latin America Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

7.4.1.9. Rest of Latin America Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Sustainable Finance Market Outlook, 2018 - 2030

8.1. Middle East & Africa Sustainable Finance Market Outlook, by Investment, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Equity

8.1.1.2. Fixed Income

8.1.1.3. Mixed Allocation

8.1.1.4. Misc.

8.2. Middle East & Africa Sustainable Finance Market Outlook, by Label, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Green Bond

8.2.1.2. Social Bond

8.2.1.3. Sustainability

8.2.1.4. Sustainability-linked Bond

8.2.1.5. Transition

8.3. Middle East & Africa Sustainable Finance Market Outlook, by Investor Type, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Institutional Investors

8.3.1.2. Retail Investors

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Sustainable Finance Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

8.4.1.7. Rest of Middle East & Africa Sustainable Finance Market by Investment, Value (US$ Bn), 2018 - 2030

8.4.1.8. Rest of Middle East & Africa Sustainable Finance Market by Label, Value (US$ Bn), 2018 - 2030

8.4.1.9. Rest of Middle East & Africa Sustainable Finance Market by Investor Type, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2022

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Goldman Sachs

9.3.1.1. Company Overview

9.3.1.2. Investment Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Aspiration Partners, Inc.

9.3.2.1. Company Overview

9.3.2.2. Investment Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. BNP Paribas

9.3.3.1. Company Overview

9.3.3.2. Investment Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Acuity Knowledge Partners

9.3.4.1. Company Overview

9.3.4.2. Investment Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. BlackRock Inc.

9.3.5.1. Company Overview

9.3.5.2. Investment Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Morgan Stanley

9.3.6.1. Company Overview

9.3.6.2. Investment Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Clarity AI

9.3.7.1. Company Overview

9.3.7.2. Investment Portfolio

9.3.7.3. Business Strategies and Development

9.3.8. PwC

9.3.8.1. Company Overview

9.3.8.2. Investment Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. HSBC Group

9.3.9.1. Company Overview

9.3.9.2. Investment Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. UBS

9.3.10.1. Company Overview

9.3.10.2. Investment Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Franklin Templeton Investment

9.3.11.1. Company Overview

9.3.11.2. Investment Portfolio

9.3.11.3. Business Strategies and Development

9.3.12. NOMURA HOLDINGS, INC.

9.3.12.1. Company Overview

9.3.12.2. Investment Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. Starling Bank

9.3.13.1. Company Overview

9.3.13.2. Investment Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

9.3.14. Deutsche Bank AG

9.3.14.1. Company Overview

9.3.14.2. Investment Portfolio

9.3.14.3. Financial Overview

9.3.14.4. Business Strategies and Development

9.3.15. Refinitiv

9.3.15.1. Company Overview

9.3.15.2. Investment Portfolio

9.3.15.3. Financial Overview

9.3.15.4. Business Strategies and Development

9.3.16. Triodos Bank

9.3.16.1. Company Overview

9.3.16.2. Investment Portfolio

9.3.16.3. Financial Overview

9.3.16.4. Business Strategies and Development

9.3.17. KPMG International

9.3.17.1. Company Overview

9.3.17.2. Investment Portfolio

9.3.17.3. Financial Overview

9.3.17.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Investment Coverage |

|

|

Label Coverage |

|

|

Investor Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |