Global Titanium Alloy Market Forecast

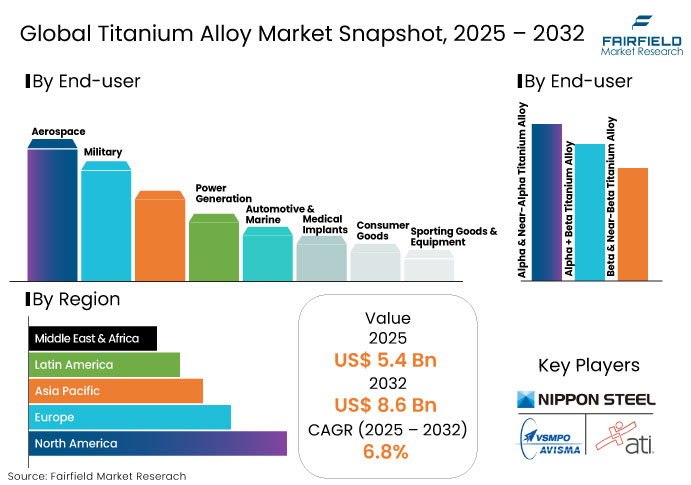

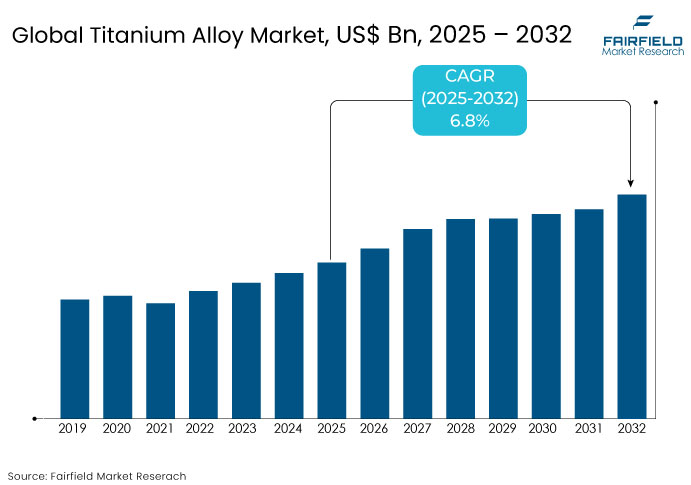

- The global titanium alloy market was valued at US$ 5.4 Bn in 2025 and is projected to reach US$ 8.6 Bn by the end of 2032, exhibiting a healthy CAGR of 6.8% between 2025 and 2032. By 2032, the global titanium alloy market is poised to expand by around 1.6x as compared to 2025.

Titanium Alloy Market Insights

- Titanium alloys are prized for their superior strength-to-weight ratio, corrosion resistance, and durability, making them essential for applications across various demanding industries such as aerospace, automotive, and medical engineering.

- The Alpha + Beta alloy group, known for its versatility and superior performance in high-temperature and high-strength applications, dominates the market, especially in aerospace, automotive, and industrial sectors.

- The aerospace and military sectors are the largest consumers of titanium alloys, utilizing their unique properties for aircraft structures, engines, and defense equipment, which are critical for both performance and safety.

- The United States remains a dominant player in the titanium alloy market due to its advanced aerospace industry, while China’s rapid industrialization and growing demand for high-performance materials offer significant market growth prospects.

A Look Back and a Look Forward - Comparative Analysis

From 2019 to 2024, the global titanium alloys market experienced steady growth, driven primarily by the aerospace and defense sectors, which continued to invest in lightweight, high-strength materials. Technological advancements, particularly in additive manufacturing, allowed for more complex and cost-effective production. However, challenges in raw material sourcing and volatility in titanium prices posed barriers to growth during this period.

Looking ahead to 2025-2032, the titanium alloys market is expected to expand significantly due to increased demand from emerging industries like medical implants and electric vehicles. The aerospace sector will maintain dominance, but growth will also be fueled by advancements in manufacturing technologies and rising environmental regulations promoting sustainable materials. Regional growth in Asia Pacific will contribute to overall market expansion.

Key Growth Determinants

- Surging demand from the automotive industry is accelerating titanium alloy adoption

Titanium alloys are increasingly being adopted in the automotive industry due to their exceptional strength-to-weight ratio, corrosion resistance, and ability to withstand high temperatures. Automakers are under immense pressure to meet stringent emission standards and fuel efficiency targets, pushing them to incorporate lightweight materials such as titanium alloys. According to the International Energy Agency (IEA), improving vehicle fuel economy by 1% can lead to a 2% reduction in CO₂ emissions, further underscoring the value of lightweight metals. High-performance and luxury carmakers such as BMW and Ferrari have already integrated titanium components into exhaust systems, suspension parts, and engine valves to enhance performance while reducing weight.

In recent years, major automotive OEMs and Tier 1 suppliers have shown growing interest in titanium alloy solutions. In 2023, a collaboration between Toyota and Osaka Titanium Technologies was announced to explore cost-effective titanium alloy applications for future electric vehicle (EV) models. Additionally, Ford has filed patents for titanium-based engine components to improve durability and reduce maintenance in performance vehicles. With electric vehicles projected to account for over 50% of new car sales by 2035, the demand for materials that enhance range and reduce weight is expected to rise, positioning titanium alloys as a strategic material in automotive design and engineering.

Key Growth Barriers

- High production costs remain a major restraint for the titanium alloy market expansion

Despite their superior properties, titanium alloys remain significantly more expensive than conventional metals like steel and aluminium. The Kroll process, which is the primary method for extracting titanium from its ore, is energy-intensive and costly, contributing to high raw material prices. According to the U.S. Geological Survey (USGS), the average price of titanium sponge was over US$ 8,000 per metric ton in 2023, far higher than aluminium or steel. These high costs limit adoption in cost-sensitive sectors such as mass-market automotive manufacturing or consumer electronics.

Moreover, complex machining requirements and high tool wear rates add to titanium alloy processing costs. According to a 2022 report by the National Center for Defense Manufacturing and Machining, the machining cost for titanium can be up to 10 times higher than aluminium alloys. While companies such as Norsk Titanium and ATI Inc. invest in additive manufacturing and near-net-shape forming to reduce waste and improve efficiency, these technologies are still in early adoption phases. Until cost-effective production methods become mainstream, the high overall lifecycle cost of titanium alloys will remain a major barrier to widespread commercial use.

Titanium Alloy Market Trends and Opportunities

- Growing medical implant and prosthetics applications offer lucrative market opportunities

Titanium alloys are increasingly favored in medical implants and prosthetics due to their exceptional biocompatibility, strength-to-weight ratio, and corrosion resistance. In 2023, titanium accounted for the largest revenue share in the medical alloys market, driven by its widespread use in orthopedic, dental, and cardiovascular applications. The aging global population and the rising prevalence of chronic conditions such as osteoporosis and cardiovascular diseases fuel the demand for durable, long-lasting implants, positioning titanium alloys as a material of choice in modern healthcare.

Advancements in manufacturing technologies, such as 3D printing, are further enhancing the appeal of titanium alloys in the medical field. Additive manufacturing enables the production of patient-specific implants with complex geometries, improving surgical outcomes and reducing recovery times. Companies such as Stryker Corporation have introduced new lines of titanium alloy implants for dental procedures, emphasizing the material's versatility and growing adoption across various medical disciplines. As the demand for personalized and minimally invasive medical solutions grows, titanium alloys are set to play a pivotal role in the evolution of implant and prosthetic technologies.

- Recycling of titanium alloys is gaining traction as a sustainable industry trend

Titanium alloy recycling is emerging as a pivotal trend in the global market, driven by the need for sustainability and resource efficiency. Recycling titanium can save up to 95% of the energy required for new titanium production, making it a highly efficient alternative. In 2023, IperionX partnered with Aperam to upcycle titanium scrap from consumer electronics, aiming to transform up to 12 metric tons of scrap into high-performance titanium products. Such initiatives not only conserve natural resources but also reduce the environmental footprint associated with titanium extraction and processing.

The aerospace and automotive industries are increasingly adopting recycled titanium alloys to meet their sustainability goals. For instance, in June 2023, Ford Motor Company agreed to a Scope of Work with IperionX for the delivery of titanium metal components made from 100% recycled, low-carbon titanium metal. Additionally, the U.S. Department of Defense awarded IperionX a contract to reclaim used or non-compliant titanium powder and create titanium metal powders from scrap sources. These developments underscore the growing importance of titanium recycling in reducing carbon emissions and enhancing supply chain resilience.

Leading Segment Overview

- Aerospace & Defense remains the dominant consumer of titanium alloys globally

The aerospace and defense sector continues to be the largest consumer of titanium alloys, accounting for over 50% of global demand in 2023. Titanium alloys are integral to modern aircraft due to their high strength-to-weight ratio, corrosion resistance, and ability to withstand extreme temperatures. For instance, the Boeing 787 Dreamliner utilizes approximately 15% titanium in its structure, contributing to a 20% improvement in fuel efficiency compared to older models. These properties make titanium alloys indispensable for manufacturing critical components such as turbine blades, airframes, and engine parts.

Major aerospace manufacturers such as Boeing and Airbus heavily rely on titanium alloys for their aircraft production. In 2021, Airbus received gross orders for 909 aircraft, while Boeing secured 771, indicating a strong demand for titanium components. However, the industry's dependence on specific suppliers poses challenges; for example, Europe's aerospace sector remains heavily reliant on Russian titanium supplied by VSMPO-AVISMA, which produces 90% of Russia's titanium and exports to 50 countries. This dependency underscores the strategic importance of titanium alloys in aerospace and defense applications.

Regional Analysis

- North America titanium alloy market remains strong with steady aerospace investment

North America's aerospace sector continues to drive substantial demand for titanium alloys, leveraging the material's strength-to-weight ratio and corrosion resistance. In 2022, the region's aerospace titanium market was valued at more than USD 1.5 billion, with the United States contributing more than 80% of this revenue. This dominance is fueled by major aircraft manufacturers such as Boeing and Lockheed Martin, who incorporate titanium alloys extensively in their aircraft structures and engines.

The U.S. government's commitment to enhancing military aircraft capabilities further bolsters titanium alloy demand. Initiatives to upgrade fleets with advanced models such as the F-22 Raptor and F/A-18, which utilize significant amounts of titanium, exemplify this trend. Additionally, the Department of Defense's 2024 budget includes over USD 1 billion aimed at advancing aerospace manufacturing, including titanium machining facilities. These investments underscore the strategic importance of titanium alloys in maintaining the region's aerospace superiority.

- European market to witness moderate growth amidst rising automotive and medical applications

Europe's titanium alloy market is experiencing steady growth, propelled by advancements in the automotive and medical sectors. In 2023, the automotive industry accounted for approximately 15% of global titanium alloy demand, with Europe contributing significantly due to its focus on lightweight materials for electric and high-performance vehicles. Countries like Germany and the UK are investing in titanium components to enhance fuel efficiency and meet stringent emission standards.

Simultaneously, the medical sector in Europe is expanding its use of titanium alloys, valued at around USD 900 million in 2023. This growth is driven by the material's biocompatibility and durability, making it ideal for implants and prosthetics. Germany, France, and the UK are leading in medical technology innovation, with government initiatives supporting healthcare infrastructure improvements and increased funding for medical research.

- Asia Pacific emerges as a titanium alloy hotspot with expanding aerospace and automotive applications

Asia Pacific's titanium alloy market is experiencing significant growth, driven by rapid industrialization and expanding aerospace sectors. China's aerospace sector is a significant driver of titanium alloy demand, with the C919 airliner program leading the charge. The country produced 33,000 tons of titanium for aerospace applications in 2022, accounting for 23% of its total titanium consumption. The C919 program has received over 1,400 orders, further boosting titanium demand.

The automotive industry in Asia Pacific is witnessing increased adoption of titanium alloys, especially in high-performance and electric vehicles. Titanium's lightweight and corrosion-resistant properties make it ideal for components such as engine valves and suspension springs. China, the world's largest automotive market, produced over 26 million vehicles in 2021, further boosting the demand for titanium alloys.

Competitive Landscape

The global titanium alloy market is characterized by a competitive landscape dominated by a few key players, including VSMPO-AVISMA, ATI, and Kobelco. These companies leverage strategic partnerships and long-term contracts with aerospace and automotive OEMs to secure market share.

For instance, VSMPO-AVISMA has maintained a strong presence across Asia, Europe, and the Americas through its extensive distribution network. Similarly, ATI has focused on expanding its product portfolio to cater to diverse industry needs. The market is also witnessing increased investments in recycling initiatives, with companies like IperionX and Aperam partnering to upcycle titanium scrap from consumer electronics, aiming to enhance sustainability and reduce reliance on virgin materials.

Technological advancements are playing a pivotal role in shaping the competitive dynamics of the titanium alloy market. The adoption of artificial intelligence (AI) is enabling manufacturers to optimize production processes, improve material properties, and enhance supply chain efficiency.

Additionally, innovations in 3D printing and precision forging are facilitating the production of complex titanium components with reduced material waste and improved performance characteristics. These technological developments are not only enhancing product offerings but also providing companies with a competitive edge in meeting the evolving demands of industries such as aerospace, automotive, and medical applications.

- In Arpil 2025: Hermith GmbH has enhanced titanium alloy wire production for additive manufacturing by optimizing Ti-6Al-4V wire quality. This advancement aims to improve feedstock reliability and performance in metal 3D printing applications. The development supports the growing demand for high-quality materials in aerospace, automotive, and medical industries.

- In April 2025: IperionX has secured an US$ 11 million loan to expand its titanium and additive manufacturing capabilities. This funding will support the development of its Titanium Production Facility in Virginia, aiming to produce high-performance titanium products using sustainable methods. The initiative aligns with the company's commitment to reshoring U.S. titanium production and enhancing supply chain resilience.

Key Companies

- VSMPO-AVISMA Corporation

- NIPPON STEEL CORPORATION

- ATI

- TIMET

- CRS Holdings, LLC.

- KOBE STEEL, LTD.

- AMG Advanced Metallurgical Group N.V.

- Hermith GmbH

- Toho Titanium Co., Ltd.

- Daido Steel Co. Ltd.

Expert Opinion

- Innovations such as additive manufacturing (3D printing) and improvements in casting and forging techniques will significantly reduce production costs, increase material efficiency, and enable more complex designs. These developments will drive broader adoption of titanium alloys across industries like aerospace, automotive, and medical sectors.

- The growing focus on reducing vehicle weight to enhance fuel efficiency, alongside the need for high-strength materials in modern aerospace applications, will continue to drive the demand for titanium alloys. The aerospace sector, in particular, remains a major consumer, with titanium alloys being integral to aircraft and spacecraft structures.

- Stringent environmental regulations, particularly in regions such as Europe and North America, will encourage the adoption of titanium alloys due to their durability, corrosion resistance, and lightweight properties. These qualities align with the rising demand for sustainable and energy-efficient products, making titanium alloys more attractive for manufacturers in industries such as automotive and construction.

- The availability of raw materials, specifically titanium sponge, remains a critical challenge. The ongoing volatility in the supply of titanium, coupled with high extraction and processing costs, could impact pricing stability and hinder growth in certain market segments. Ensuring a steady supply of titanium resources and mitigating supply chain disruptions will be essential for long-term market growth.

Global Titanium Alloy Market is Segmented as-

By Alloy Type

- Alpha & Near-Alpha Titanium Alloy

- Alpha + Beta Titanium Alloy

- Beta & Near-Beta Titanium Alloy

By End-user

- Aerospace

- Military

- Chemical

- Power Generation

- Automotive & Marine

- Medical Implants

- Consumer Goods

- Sporting Goods & Equipment

- Others (Jewellery, Construction)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Titanium Alloy Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024 - 2032

2.9.2. Price Impact Factors

3. Global Titanium Alloy Market Outlook, 2019 - 2032

3.1. Global Titanium Alloy Market Outlook, by Alloy Type, Value (US$ Mn) & Volume (Tons), 2019 - 2032

3.1.1. Alpha & Near-Alpha Titanium Alloy

3.1.2. Alpha + Beta Titanium Alloy

3.1.3. Beta & Near-Beta Titanium Alloy

3.2. Global Titanium Alloy Market Outlook, by End-user, Value (US$ Mn) & Volume (Tons), 2019 - 2032

3.2.1. Aerospace

3.2.2. Military

3.2.3. Chemical

3.2.4. Power Generation

3.2.5. Automotive & Marine

3.2.6. Medical Implants

3.2.7. Consumer Goods

3.2.8. Sporting Goods & Equipment

3.2.9. Misc. (Jewellery, Construction, etc.)

3.3. Global Titanium Alloy Market Outlook, by Region, Value (US$ Mn) & Volume (Tons), 2019 - 2032

3.3.1. North America

3.3.2. Europe

3.3.3. Asia Pacific

3.3.4. Latin America

3.3.5. Middle East & Africa

4. North America Titanium Alloy Market Outlook, 2019 - 2032

4.1. North America Titanium Alloy Market Outlook, by Alloy Type, Value (US$ Mn) & Volume (Tons), 2019 - 2032

4.1.1. Alpha & Near-Alpha Titanium Alloy

4.1.2. Alpha + Beta Titanium Alloy

4.1.3. Beta & Near-Beta Titanium Alloy

4.2. North America Titanium Alloy Market Outlook, by End-user, Value (US$ Mn) & Volume (Tons), 2019 - 2032

4.2.1. Aerospace

4.2.2. Military

4.2.3. Chemical

4.2.4. Power Generation

4.2.5. Automotive & Marine

4.2.6. Medical Implants

4.2.7. Consumer Goods

4.2.8. Sporting Goods & Equipment

4.2.9. Misc. (Jewellery, Construction, etc.)

4.3. North America Titanium Alloy Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2032

4.3.1. U.S. Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

4.3.2. U.S. Titanium Alloy Market Outlook, by End-user, 2019 - 2032

4.3.3. Canada Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

4.3.4. Canada Titanium Alloy Market Outlook, by End-user, 2019 - 2032

4.4. BPS Analysis/Market Attractiveness Analysis

5. Europe Titanium Alloy Market Outlook, 2019 - 2032

5.1. Europe Titanium Alloy Market Outlook, by Alloy Type, Value (US$ Mn) & Volume (Tons), 2019 - 2032

5.1.1. Alpha & Near-Alpha Titanium Alloy

5.1.2. Alpha + Beta Titanium Alloy

5.1.3. Beta & Near-Beta Titanium Alloy

5.2. Europe Titanium Alloy Market Outlook, by End-user, Value (US$ Mn) & Volume (Tons), 2019 - 2032

5.2.1. Aerospace

5.2.2. Military

5.2.3. Chemical

5.2.4. Power Generation

5.2.5. Automotive & Marine

5.2.6. Medical Implants

5.2.7. Consumer Goods

5.2.8. Sporting Goods & Equipment

5.2.9. Misc. (Jewellery, Construction, etc.)

5.3. Europe Titanium Alloy Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2032

5.3.1. Germany Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

5.3.2. Germany Titanium Alloy Market Outlook, by End-user, 2019 - 2032

5.3.3. Italy Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

5.3.4. Italy Titanium Alloy Market Outlook, by End-user, 2019 - 2032

5.3.5. France Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

5.3.6. France Titanium Alloy Market Outlook, by End-user, 2019 - 2032

5.3.7. U.K. Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

5.3.8. U.K. Titanium Alloy Market Outlook, by End-user, 2019 - 2032

5.3.9. Spain Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

5.3.10. Spain Titanium Alloy Market Outlook, by End-user, 2019 - 2032

5.3.11. Russia Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

5.3.12. Russia Titanium Alloy Market Outlook, by End-user, 2019 - 2032

5.3.13. Rest of Europe Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

5.3.14. Rest of Europe Titanium Alloy Market Outlook, by End-user, 2019 - 2032

5.4. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Titanium Alloy Market Outlook, 2019 - 2032

6.1. Asia Pacific Titanium Alloy Market Outlook, by Alloy Type, Value (US$ Mn) & Volume (Tons), 2019 - 2032

6.1.1. Alpha & Near-Alpha Titanium Alloy

6.1.2. Alpha + Beta Titanium Alloy

6.1.3. Beta & Near-Beta Titanium Alloy

6.2. Asia Pacific Titanium Alloy Market Outlook, by End-user, Value (US$ Mn) & Volume (Tons), 2019 - 2032

6.2.1. Aerospace

6.2.2. Military

6.2.3. Chemical

6.2.4. Power Generation

6.2.5. Automotive & Marine

6.2.6. Medical Implants

6.2.7. Consumer Goods

6.2.8. Sporting Goods & Equipment

6.2.9. Misc. (Jewellery, Construction, etc.)

6.3. Asia Pacific Titanium Alloy Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2032

6.3.1. China Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

6.3.2. China Titanium Alloy Market Outlook, by End-user, 2019 - 2032

6.3.3. Japan Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

6.3.4. Japan Titanium Alloy Market Outlook, by End-user, 2019 - 2032

6.3.5. South Korea Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

6.3.6. South Korea Titanium Alloy Market Outlook, by End-user, 2019 - 2032

6.3.7. India Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

6.3.8. India Titanium Alloy Market Outlook, by End-user, 2019 - 2032

6.3.9. Southeast Asia Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

6.3.10. Southeast Asia Titanium Alloy Market Outlook, by End-user, 2019 - 2032

6.3.11. Rest of SAO Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

6.3.12. Rest of SAO Titanium Alloy Market Outlook, by End-user, 2019 - 2032

6.4. BPS Analysis/Market Attractiveness Analysis

7. Latin America Titanium Alloy Market Outlook, 2019 - 2032

7.1. Latin America Titanium Alloy Market Outlook, by Alloy Type, Value (US$ Mn) & Volume (Tons), 2019 - 2032

7.1.1. Alpha & Near-Alpha Titanium Alloy

7.1.2. Alpha + Beta Titanium Alloy

7.1.3. Beta & Near-Beta Titanium Alloy

7.2. Latin America Titanium Alloy Market Outlook, by End-user, Value (US$ Mn) & Volume (Tons), 2019 - 2032

7.2.1. Aerospace

7.2.2. Military

7.2.3. Chemical

7.2.4. Power Generation

7.2.5. Automotive & Marine

7.2.6. Medical Implants

7.2.7. Consumer Goods

7.2.8. Sporting Goods & Equipment

7.2.9. Misc. (Jewellery, Construction, etc.)

7.3. Latin America Titanium Alloy Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2032

7.3.1. Brazil Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

7.3.2. Brazil Titanium Alloy Market Outlook, by End-user, 2019 - 2032

7.3.3. Mexico Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

7.3.4. Mexico Titanium Alloy Market Outlook, by End-user, 2019 - 2032

7.3.5. Argentina Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

7.3.6. Argentina Titanium Alloy Market Outlook, by End-user, 2019 - 2032

7.3.7. Rest of LATAM Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

7.3.8. Rest of LATAM Titanium Alloy Market Outlook, by End-user, 2019 - 2032

7.4. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Titanium Alloy Market Outlook, 2019 - 2032

8.1. Middle East & Africa Titanium Alloy Market Outlook, by Alloy Type, Value (US$ Mn) & Volume (Tons), 2019 - 2032

8.1.1. Alpha & Near-Alpha Titanium Alloy

8.1.2. Alpha + Beta Titanium Alloy

8.1.3. Beta & Near-Beta Titanium Alloy

8.2. Middle East & Africa Titanium Alloy Market Outlook, by End-user, Value (US$ Mn) & Volume (Tons), 2019 - 2032

8.2.1. Aerospace

8.2.2. Military

8.2.3. Chemical

8.2.4. Power Generation

8.2.5. Automotive & Marine

8.2.6. Medical Implants

8.2.7. Consumer Goods

8.2.8. Sporting Goods & Equipment

8.2.9. Misc. (Jewellery, Construction, etc.)

8.3. Middle East & Africa Titanium Alloy Market Outlook, by Country, Value (US$ Mn) & Volume (Tons), 2019 - 2032

8.3.1. GCC Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

8.3.2. GCC Titanium Alloy Market Outlook, by End-user, 2019 - 2032

8.3.3. South Africa Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

8.3.4. South Africa Titanium Alloy Market Outlook, by End-user, 2019 - 2032

8.3.5. Egypt Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

8.3.6. Egypt Titanium Alloy Market Outlook, by End-user, 2019 - 2032

8.3.7. Nigeria Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

8.3.8. Nigeria Titanium Alloy Market Outlook, by End-user, 2019 - 2032

8.3.9. Rest of Middle East Titanium Alloy Market Outlook, by Alloy Type, 2019 - 2032

8.3.10. Rest of Middle East Titanium Alloy Market Outlook, by End-user, 2019 - 2032

8.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Allegheny Technologies Incorporated (ATI)

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Baoji Titanium Co. Ltd.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Western Superconducting Technologies Co, Ltd. (WST)

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Kobe Steel, Ltd.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Western Metal Materials Co. Ltd. (WMM)

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Precision Castparts Corp. (PCC)

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. UKTMP JSC

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Toho Titanium Co., Ltd.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Hermith GmbH

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Howmet Aerospace Inc.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

9.4.11. Mishra Dhatu Nigam Limited (MIDHANI)

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Developments

9.4.12. ERAMET Group

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Developments

9.4.13. Xinjiang Xiangsheng New Material Technology Co., Ltd.

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Developments

9.4.14. Oric Italiana S.r.l.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Developments

9.4.15. C.M.A. S.A.

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Bn Volume: Tons |

||

|

REPORT FEATURES |

DETAILS |

|

Alloy Type Coverage |

|

|

End-user Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Production Output, Trade Statistics, Prices Trend Analysis, Competition Landscape, Alloy Type-, End-user-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply), Key Market Trends |