Global Transformer Oil Market

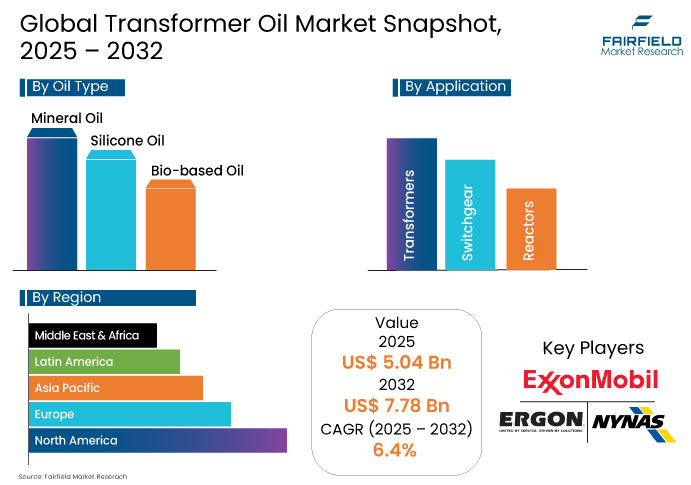

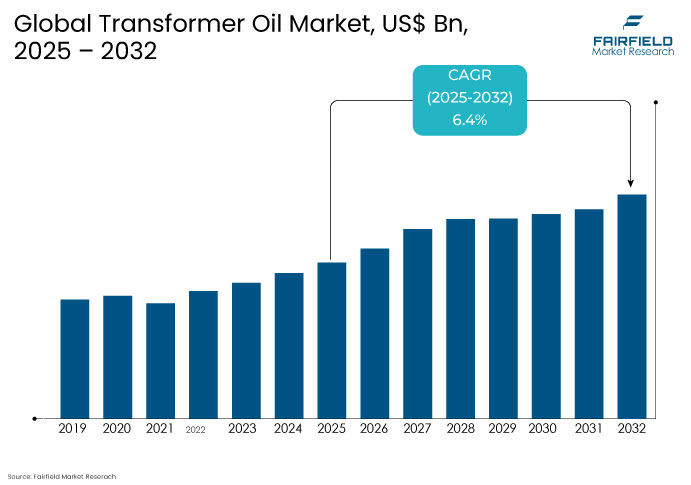

- The global Transformer Oil Market is projected to reach a valuation of US$ 5.04 billion and is expected to expand at a CAGR of 6.4% from 2025 to 2032.

- This growth trajectory is anticipated to drive the market's valuation to US$ 7.78 billion by 2032.

Transformer Oil Market Insights

- Companies such as Nynas, Shell, and Cargill are tapping into rising demand for sustainable, high-performance transformer fluids.

- Manufacturers are focusing on eco-friendly product innovations, such as NYTRO® BIO 300X and Shell’s MIDEL fluids, to align with global carbon neutrality goals.

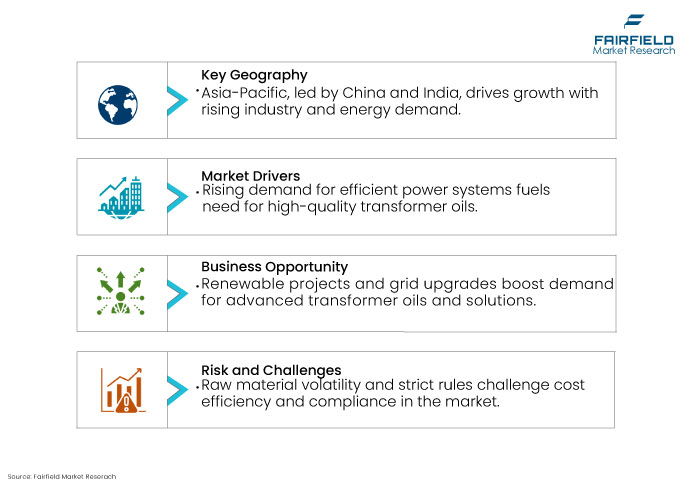

- With a 38.2% share in 2024, Asia Pacific dominates due to rapid industrialization, urbanization, and extensive energy infrastructure development.

- The T&D sector, accounting for 55.7% market share in 2025, continues to be the largest application area, fueled by global grid modernization efforts.

- Major players such as Nynas, ExxonMobil, and Ergon focus on strategic expansions, eco-friendly product development, and partnerships to maintain leadership.

- Increasing preference for biodegradable, eco-friendly fluids challenges the dominance of traditional mineral-based transformer oils.

- Growing electricity demand, especially in BRICS nations, is accelerating infrastructure development and transformer oil consumption.

A Look Back and a Look Forward- Comparative Analysis

The transformer oil market expanded steadily as rising electricity demand fueled large-scale transmission and distribution projects. Industries leaned toward mineral-based insulating fluids because of their cost efficiency and reliable performance, despite early concerns over environmental impact. Growth remained strong, driven by rapid industrialization across emerging economies and the urgent need to modernize aging grid infrastructure.

From 2025 to 2032, the market is poised for major changes with the rising shift toward renewable energy, tighter environmental regulations, and growing preference for organic and synthetic fluids. Companies focus more on developing eco-friendly, high-performance solutions that align with global carbon neutrality targets. Continuous innovation in biodegradable fluids and smart grid integration is expected to create new growth avenues while reshaping supply chain strategies.

Key Growth Determinants

- Surge in Renewable Energy Projects Drives Demand for Advanced Power Transmission Fluids

The global transformer oil market shift towards renewable energy is fueling the need for reliable and efficient power transmission systems. Significant infrastructure projects such as the Vineyard Wind Project in Massachusetts and the Gemini Solar Project in Nevada are leading the way in renewable energy generation. These projects, which contribute substantial power to regional grids, highlight the growing importance of advanced fluids to ensure safe and efficient transmission. As the global demand for cleaner energy sources rises, these initiatives emphasize the critical role of innovative materials to support the expanding energy landscape.

In India, the renewable energy sector is rapidly expanding, with a total capacity of 217.62 gigawatts as of January 2025. Large-scale solar and wind projects in states such as Rajasthan, Gujarat, and Tamil Nadu contribute significantly to the country’s energy grid. The Indian government’s ambitious goal to achieve 500 gigawatts of non-fossil fuel-based energy by 2030 further accelerates this growth. To ensure the smooth operation of these projects, the need for advanced fluids in power transmission systems is expected to rise, supporting the shift to sustainable energy and improving the overall efficiency and safety of energy infrastructure.

- Growing Power Consumption and Infrastructure Development Fuel Demand for Advanced Transmission Fluids

The rapid global rise in electricity consumption, particularly in developing nations, is driving the expansion of power transmission and distribution networks. According to the World Energy and Climate Statistics – Yearbook 2024, global energy consumption grew by 2.2% in 2023, with notable rise in BRICS nations such as China and India. As energy needs soar in these regions, there is a heightened focus on developing and modernizing infrastructure to meet the demand. This growth, especially in emerging markets, creates a need for efficient, reliable systems that can manage the increasing electricity load, ultimately boosting demand for advanced transmission fluids.

As global energy consumption continues to shift, countries are prioritizing the development of energy-efficient transmission systems to support rising electricity needs. For instance, China and India, which are responsible for a significant portion of the global consumption surge, are investing heavily in upgrading power grids. This expansion, particularly in Asia and Middle East, increases the pressure on transmission systems to operate efficiently and safely. The demand for advanced fluids to support these systems is expected to continue growing, as they play a critical role in ensuring stable operations amidst the rising energy consumption.

Key Growth Barriers

- Environmental Shift Towards Renewable Energy and Organic Insulating Fluids Challenges Traditional Mineral Oil Usage in the Market

The transition towards renewable energy sources is gaining momentum as countries strengthen efforts to adopt greener and more sustainable technologies.

Mineral oil, commonly used in transformers, is derived from non-renewable resources and offers poor biodegradability, raising environmental concerns. As clean energy projects expand globally, the demand for eco-friendly alternatives is expected to limit the growth of mineral oil-based products in the transformer oil market.

At the same time, stricter environmental regulations and rising preference for organic oils are shifting customer priorities. Developed and emerging economies alike are encouraging the use of biodegradable and sustainable insulating fluids. This shift could significantly reduce reliance on traditional petroleum-based oils and pose a long-term challenge for manufacturers heavily dependent on conventional products.

Market Opportunity

- Rising Demand for Bio-based Fluids Presents Sustainable Solutions for the Power Industry

The growing focus on sustainability is opening significant opportunities for transformer oil market players in the bio-based transformer fluid sector. Companies like Nynas, Shell, and Cargill are leading the charge with innovative, eco-friendly fluids that meet environmental and performance standards.

Nynas' NYTRO BIO 300X, for instance, provides enhanced cooling and is fully recyclable, aligning with the increasing demand for biodegradable and efficient solutions. This trend toward bio-based options is helping utilities and manufacturers reduce their carbon footprint while maintaining or improving operational performance.

Bio-based fluids offer several advantages, such as superior fire safety, environmental protection, and higher thermal stability compared to traditional mineral oils. Shell's MIDEL ester fluids and ISOVOLTINE BIO VE provide fire-safe, biodegradable alternatives that ensure both safety and compliance with stringent environmental regulations.

The increasing awareness and adoption of sustainable practices in the energy sector drive the growth of these bio-based fluids, offering a lucrative opportunity for manufacturers to innovate and expand their portfolios in line with the shift toward greener, more efficient energy solutions.

Market Trend

- Focus on Sustainability and Technological Innovation

The transformer oil market is experiencing a shift towards sustainability and technological innovation, driven by the increasing demand for cleaner and more efficient energy solutions. With the rise of renewable energy projects and global energy transition initiatives, there is a growing preference for bio-based and ester-based oils. Companies such as Nynas are responding by introducing eco-friendly solutions such as NYTRO® BIO 300X, which align with the industry's push for reducing environmental impact without compromising performance.

Advancements in technology are enhancing the efficiency and performance of oils used in power transmission systems. Innovations by companies such as Shell and Ergon focus on improving thermal stability, fire safety, and the ability to withstand extreme conditions.

These properties are crucial for modernizing power infrastructure, especially as renewable energy sources are integrated into the grid, requiring oils that can perform under demanding operational conditions.

To support these advancements, companies are expanding their production capacity and investing in research and development. ExxonMobil's investment in a new lubricant manufacturing plant in India and Savita Oil Technologies’ development of synthetic ester-based products are key examples of how the transformer oil market is evolving. These moves reflect the increasing importance of high-performance oils to maintain the reliability and safety of energy infrastructure, particularly in emerging economies and renewable energy sectors, positioning the market for continued growth.

Segments Covered in the Report

- Expanding Transmission and Distribution Networks Drive Continued Demand

The Transmission and Distribution (T&D) industry holds the largest share of 55.7% in the transformer oil market, driven by the increasing demand for reliable and efficient power distribution systems.

The industry's growth is fueled by expanding energy infrastructure, especially in emerging economies. Developments like Ergon’s HyVolt I dielectric fluids being used in Australia's EnergyConnect project, the largest transmission line project in the Southern Hemisphere highlights the rising demand for high-quality fluids.

As global energy consumption rises and new transmission networks are established, the T&D sector will continue to be a key driver, enhancing the efficiency and safety of power infrastructure.

- Mineral Oil Continues to Dominate the market

Mineral oil remains the most widely preferred and consumed type in the market, accounting for 66.2% of the share in 2024. Its cost-effectiveness, availability, and strong performance in power transmission and distribution drive its dominance. Developments such as APAR Industries Ltd.'s launch of ‘POWEROIL TO NE Premium’ in 2023, and ExxonMobil's investment in a lubricant manufacturing plant in India, highlight mineral oils' role in meeting the growing demand for power infrastructure solutions. These oils are crucial for ensuring reliable and efficient energy distribution across regions, cementing their position in the evolving energy landscape.

Regional Analysis

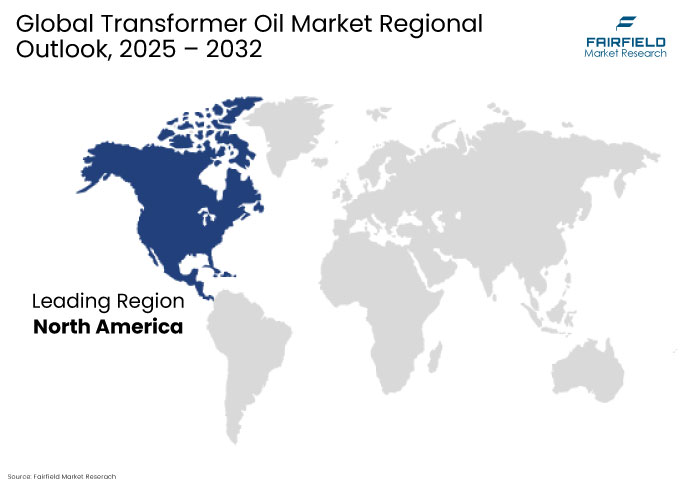

- North America Exhibits Significant Growth Potential

North America holds a 19.1% share of the transformer oil market in 2024, driven by advanced power infrastructure and a focus on renewable energy. The region’s energy transition initiatives, such as Chevron’s production expansion in the Gulf of Mexico, underscore the increasing reliance on high-quality oils for efficient power transmission.

As renewable energy projects expand, particularly in the U.S. and Canada, the demand for these fluids will continue to rise, especially in power generation and offshore wind parks. The region’s investments in clean energy solidify its role as a key player in the global market.

- Asia Pacific Dominates the Transformer Oil Market

Asia Pacific dominates the market with a 38.2% share in 2024, benefiting from rapid industrialization, increasing urbanization, and rising energy demands in countries like China and India.

ExxonMobil's investment in a lubricant plant in India highlights the region's expanding energy infrastructure. With numerous large-scale renewable energy projects and power distribution initiatives underway, demand for transformer oils in the region is set to grow steadily. Both government and private sector investments in energy infrastructure will drive this growth.

Competitive Landscape

The global transformer oil market is dominated by major players such as Nynas AB, ExxonMobil Corporation, Ergon Inc., Cargill Incorporated, Phillips 66, Valvoline, and Calumet Specialty Products, who collectively hold a significant share. These companies continue to drive innovation and market growth through strategic acquisitions and collaborations, enhancing their market presence. Nynas AB and ExxonMobil are particularly focused on developing bio-based oils and improving product performance, positioning themselves as leaders in the market.

Smaller and medium-sized manufacturers are gaining ground by offering cost-effective, value-driven solutions. Their competitive edge lies in their ability to quickly adapt to market demands and offer affordable alternatives, which allows them to carve out a niche, especially in emerging markets. This segment adds dynamism to the market, pushing larger companies to enhance their offerings while also driving price competition in the overall landscape.

Key Companies

- Nynas AB

- Exxonmobil Corporation

- Ergon Inc.

- Cargill Incorporated

- Phillips 66

- Valvoline

- Calumet Specialty Products

- PetroChina Lubricant Company

- Sinopec

- Apar Industries

- Savita Oil Technologies Limited

- Petro-Canada

- Gandhar Oil

- Repsol

Recent Industry Developments

- November 4, 2024, Shell announced the upcoming availability of its MIDEL synthetic and natural ester-based transformer fluids in the Middle East starting in summer 2025. The fluids offer enhanced fire safety, thermal stability, and operational efficiency compared to traditional mineral oils. This development, unveiled at ADIPEC 2024, addresses the increasing demand for advanced transformer oils in sectors such as power generation, transmission, and offshore wind parks, aiming to support operational safety and performance while contributing to the region's energy transition.

- On September 4, 2024, Nynas, in collaboration with Stena Recycling, announced that their fully circular transformer oil solution has received ISCC Plus certification. Using discarded transformer oil collected and pre-treated by Stena, Nynas produces re-refined transformer oil, enhancing resource efficiency in the electrical industry.

Expert Opinion

- Growing grid modernization initiatives globally are steadily boosting the demand for high-performance transformer oils.

- Sustainability trends are driving greater interest in bio-based and re-refined transformer oil solutions.

- Key manufacturers are prioritizing innovation to enhance oil efficiency, thermal stability, and environmental performance.

- Emerging economies in Asia Pacific and the Middle East are creating strong growth opportunities through power infrastructure expansion.

- Increasing renewable energy integration is prompting a need for advanced transformer cooling and insulation fluids.

Global Transformer Oil Market Segmentation

By Oil Type

- Mineral Oil

- Silicone Oil

- Bio-based Oil

By Application

- Transformers

- Switchgear

- Reactors

By End-use

- Transmission & Distribution

- Power Generation

- Railways & Metros

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Transformer Oil Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Transformer Oil Market Outlook, 2019 - 2032

3.1. Global Transformer Oil Market Outlook, by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Mineral Oil

3.1.1.2. Silicone Oil

3.1.1.3. Bio-based Oil

3.2. Global Transformer Oil Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Transformers

3.2.1.2. Switchgear

3.2.1.3. Reactors

3.2.1.4. Misc.

3.3. Global Transformer Oil Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Transmission & Distribution

3.3.1.2. Power Generation

3.3.1.3. Railways & Metros

3.3.1.4. Misc.

3.4. Global Transformer Oil Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Transformer Oil Market Outlook, 2019 - 2032

4.1. North America Transformer Oil Market Outlook, by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Mineral Oil

4.1.1.2. Silicone Oil

4.1.1.3. Bio-based Oil

4.2. North America Transformer Oil Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Transformers

4.2.1.2. Switchgear

4.2.1.3. Reactors

4.2.1.4. Misc.

4.3. North America Transformer Oil Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Transmission & Distribution

4.3.1.2. Power Generation

4.3.1.3. Railways & Metros

4.3.1.4. Misc.

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Transformer Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.2. U.S. Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.3. U.S. Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.4. Canada Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.5. Canada Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.6. Canada Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Transformer Oil Market Outlook, 2019 - 2032

5.1. Europe Transformer Oil Market Outlook, by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Mineral Oil

5.1.1.2. Silicone Oil

5.1.1.3. Bio-based Oil

5.2. Europe Transformer Oil Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Transformers

5.2.1.2. Switchgear

5.2.1.3. Reactors

5.2.1.4. Misc.

5.3. Europe Transformer Oil Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Transmission & Distribution

5.3.1.2. Power Generation

5.3.1.3. Railways & Metros

5.3.1.4. Misc.

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Transformer Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.2. Germany Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.3. Germany Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.4. U.K. Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.5. U.K. Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.6. U.K. Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.7. France Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.8. France Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.9. France Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.10. Italy Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.11. Italy Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.12. Italy Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.13. Spain Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.14. Spain Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.15. Spain Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.16. Russia Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.17. Russia Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.18. Russia Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.19. Rest of Europe Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.20. Rest of Europe Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.21. Rest of Europe Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Transformer Oil Market Outlook, 2019 - 2032

6.1. Asia Pacific Transformer Oil Market Outlook, by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Mineral Oil

6.1.1.2. Silicone Oil

6.1.1.3. Bio-based Oil

6.2. Asia Pacific Transformer Oil Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Transformers

6.2.1.2. Switchgear

6.2.1.3. Reactors

6.2.1.4. Misc.

6.3. Asia Pacific Transformer Oil Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Transmission & Distribution

6.3.1.2. Power Generation

6.3.1.3. Railways & Metros

6.3.1.4. Misc.

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Transformer Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.2. China Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.3. China Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.4. Japan Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.5. Japan Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.6. Japan Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.7. South Korea Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.8. South Korea Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.9. South Korea Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.10. India Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.11. India Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.12. India Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.13. Southeast Asia Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.14. Southeast Asia Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.15. Southeast Asia Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Transformer Oil Market Outlook, 2019 - 2032

7.1. Latin America Transformer Oil Market Outlook, by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Mineral Oil

7.1.1.2. Silicone Oil

7.1.1.3. Bio-based Oi

7.2. Latin America Transformer Oil Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Transformers

7.2.1.2. Switchgear

7.2.1.3. Reactors

7.2.1.4. Misc.

7.3. Latin America Transformer Oil Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Transmission & Distribution

7.3.1.2. Power Generation

7.3.1.3. Railways & Metros

7.3.1.4. Misc.

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Transformer Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.2. Brazil Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.3. Brazil Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.4. Mexico Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.5. Mexico Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.6. Mexico Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.7. Rest of Latin America Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.8. Rest of Latin America Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.9. Rest of Latin America Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Transformer Oil Market Outlook, 2019 - 2032

8.1. Middle East & Africa Transformer Oil Market Outlook, by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Mineral Oil

8.1.1.2. Silicone Oil

8.1.1.3. Bio-based Oil

8.2. Middle East & Africa Transformer Oil Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Transformers

8.2.1.2. Switchgear

8.2.1.3. Reactors

8.2.1.4. Misc.

8.3. Middle East & Africa Transformer Oil Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Transmission & Distribution

8.3.1.2. Power Generation

8.3.1.3. Railways & Metros

8.3.1.4. Misc.

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Transformer Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.2. GCC Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.3. GCC Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.4. South Africa Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.5. South Africa Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.6. South Africa Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.7. Rest of Middle East & Africa Transformer Oil Market by Product Type , Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.8. Rest of Middle East & Africa Transformer Oil Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.9. Rest of Middle East & Africa Transformer Oil Market by End Use , Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Product Type vs by Application Heat map

9.2. Manufacturer vs by Application Heat map

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Nynas AB

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Exxonmobil Corporation

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Ergon Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Cargill Incorporated

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Phillips 66

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Valvoline

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Calumet Specialty Products

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. PetroChina Lubricant Company

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Sinopec

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Apar Industries

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Savita Oil Technologies Limited

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Petro-Canada

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Gandhar Oil

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Repsol

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Oil Type Coverage |

|

|

Application Coverage |

|

|

End Use method |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |