Global Triclosan Market Forecast

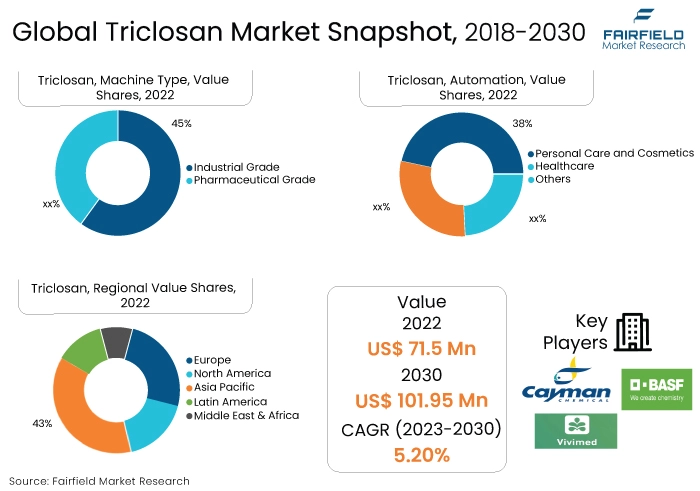

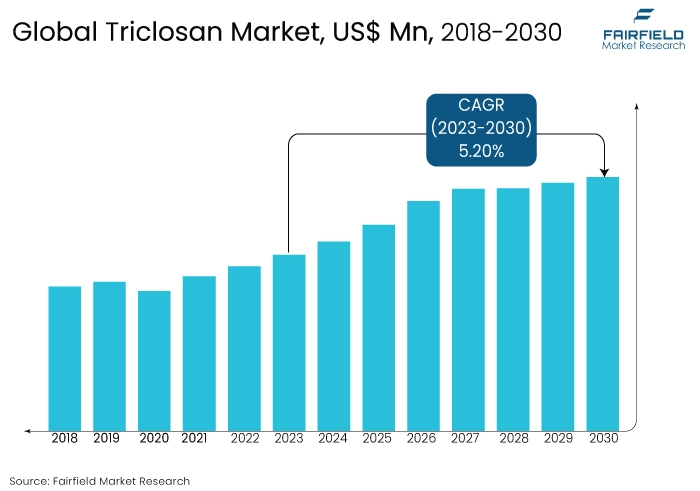

- The approximately US$71.5 Mn triclosan market (2022) is poised to reach US$101.95 Mn by 2030.

- Triclosan market size is anticipated to expand at a CAGR of 5.20% during 2023 - 2030.

Quick Report Digest

- Triclosan is a widely used substance in the cosmetics and personal care industries, one of the newer industries in the world. Consequently, a significant market trend is an increasing need in the cosmetics and personal care sector.

- Other significant market trends include an increase in the standard of living, a beneficial impact of personal care and beauty goods on self-esteem, and a swift shift in customer preference for opulent and premium cosmetic companies.

- The triclosan market is expanding as cities become more populous, while disposable income has increased, western culture has become more widely accepted, and people are becoming more aware of fashion. These factors have increased demand for textiles, which has fuelled the market for these products.

- Due to its antibacterial qualities, triclosan is becoming more and more popular in the textile industry. It is used as a finishing and bactericidal agent on cotton garments, extending their shelf lives and improving the quality of both cotton and other materials. This is anticipated to fuel the market for triclosan in the textile sector.

- The industrial grade generated the most revenue in 2022. It is frequently used as an antimicrobial pesticide to stop the growth of bacteria on HVAC coils and in ice-making equipment.

- The global cosmetics industry segment is anticipated to keep a strong position. Due to its antibacterial and antifungal qualities, consumers frequently use cosmetics containing triclosan, such as lotions, foundations, and many others.

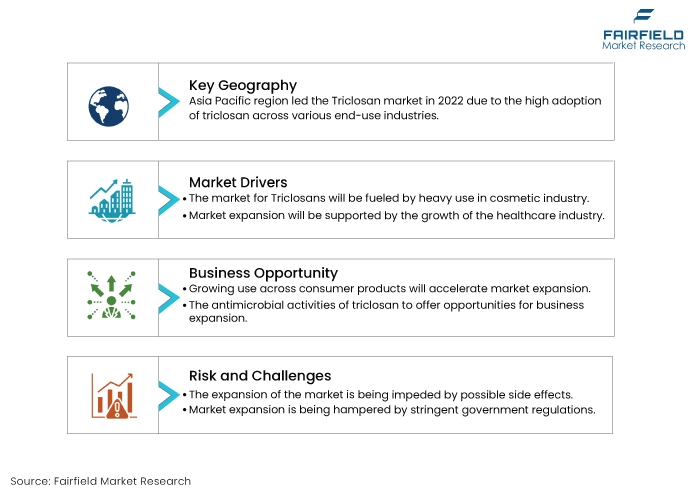

- The Asia Pacific region is expected to account for the largest share of the global triclosan market, due to reasons like rising consumer demand for high-end beauty goods and increased cosmetic product sales, China's cosmetic business has experienced enormous growth.

- The market for Triclosan is expanding in Europe due to the rising demand for triclosan across the healthcare industry.

A Look Back and a Look Forward - Comparative Analysis

Triclosan is a chlorinated aromatic chemical that is used in consumer items as an antibacterial, antifungal, disinfectant, and persevering agent to prevent bacterial and fungal contaminations. Triclosan offers many advantages over other antibacterial substances, and as a result, it has been broadly used across various end-use industries, including the medical, textile, pharmaceutical, cosmetic, paint and coatings, and agricultural sectors.

Throughout the historical period of 2018 to 2022, the market had uneven growth. Since the market has changed, businesses are putting more of an emphasis on bolstering and combining their R&D efforts. By doing this, they can produce more triclosan, which in turn fuels the market's expansion by meeting the demands of numerous end-use sectors.

The construction industry, where triclosan is utilised as a coating, preservative, and protective layer, is being driven by factors including the increase in global population, increased infrastructure activities, growing urbanisation, and others. Due to the rising need for paint and coatings in the construction industry, the triclosan market has experienced significant expansion. These elements will likely combine to produce lucrative chances for the growth of the triclosan industry.

Key Growth Determinants

- Robust Demand from Cosmetics Industry

Strong demand for triclosan in the personal care and cosmetics industries is what fuels the growth of the global triclosan market. For instance, a 2021 article from Cosmetics Europe stated that the retail sales price of the personal care business was €80 billion in 2021. Triclosan contains all the necessary components for the body and skin.

Triclosan has antiviral, antibacterial, cleaning, anti-inflammatory, and dispersant effects. It is mostly utilised in the production of lotions, face creams, deodorants, soaps, shower gels, and other goods because of these qualities. These elements work as one of the main forces boosting the global triclosan market throughout the predicted timeframe.

- Pharmaceutical Industry’s Expansion

The pharmaceutical industry is expanding quickly as a result of population growth, an increase in R&D activities, and government support for and investment in this industry. Due to its vast capabilities and use in numerous end-use industries, triclosan is also actively produced by several important firms.

For the pharmaceutical sector, triclosan is produced by companies like Jiangsu Huanxin High-tech Materials Co., Ltd. and Kumar Organic Products Limited. As a result, the pharmaceutical sector anticipates increased triclosan consumption.

- Rising Demand from Key End-Use Industries

The key driver for market expansion is the rising demand for coatings and paints as a result of the expansion of the construction sector's operations. In addition, the triclosan market is expected to be driven by the fact that it is used as a surface biocide in food contact materials and as a disinfectant in feed.

Additionally, triclosan is widely used in personal care products, which are also expected to dominate the global Triclosan market. Additionally, triclosan is used as a disinfectant in air fresheners, hygiene items, etc. Hence, the market's expansion is being driven by the increase in demand from various end-use industries.

Major Growth Barriers

- Potential Risks Associated with the Use of Triclosan

It is projected that risks related to triclosan use will restrain market expansion. Triclosan is absorbed mostly through the skin and mouth lining, which is how exposure occurs. Such exposure can have several negative effects, including dermatitis, skin irritability, and the potential for allergic reactions, particularly in young children.

For instance, triclosan interference in the body is anticipated to influence thyroid hormone metabolism and result in probable endocrine disruption, according to an article published by Beyond Pesticide. These elements taken together are expected to limit the market for triclosan's overall growth.

- Government Restrictions

A significant market barrier has been recognised as the adoption of environmental restrictions addressing triclosan in consumer items by governments in the US, and other nations. For example, the US Food and Drug Administration (USFDA) has indicated that producers must show that their goods are appealing and safe, which may hurt the expanding market for Triclosan in the coming years.

Key Trends and Opportunities to Look at

- Use of Triclosan as a Disinfectant

Triclosan is produced in large quantities all around the world. Recent estimates place the annual usage of Triclosan-containing goods at 1,500 tonnes and 132 million liters in the USA alone, respectively. Due to the strong demand for disinfection, production rates have surged since the outbreak of the new coronavirus illness 2019 (COVID-19).

However, the improper use of disinfectants, such as Triclosan, may encourage the emergence of antimicrobial resistance, which may prove to be the greatest significant threat to global health since the COVID-19 pandemic.

- Increasing Use in Consumer Products

Triclosan has mostly been utilised in personal care goods as an antibacterial. Cosmetics, personal care, and household cleaning products, which typically contain between 0.1 and 0.3% of Triclosan, account for about 80% of all Triclosan usage.

With a sales growth of 11.8% from 2015 to 2016, Colgate Total toothpaste, which contains 10 mM Triclosan, was the second most popular toothpaste in 2016. Triclosan has shown that toothpaste has a vital role in lowering plaque and gingivitis.

- Antimicrobial Activities

Triclosan has demonstrated a range of antibacterial properties. For use in medical textile applications, Triclosan has been shown to have strong biocidal and durable activity on polyester and cotton surfaces. To a lesser extent, triclosan is used in plastics and textiles to prevent the growth of bacteria that cause illness or odour.

Recently, it has been thought that using Triclosan in self-disinfecting paints is a potential way to create cleaner interior settings since it stops germs from growing on the surface of walls.

How Does the Regulatory Scenario Shape this Industry?

Triclosan is an antibiotic that is so widely used that 75% of people in the United States are probably exposed to it through consumer goods and personal care items. Triclosan was prohibited from being used in soap products in September 2016 as a result of the FDA's risk analysis. Triclosan is still present, albeit in high proportions, in other personal care items such as surgical soaps, mouthwash, toothpaste, and mouthwash.

Beginning in January 2017, the European Union (EU) outlawed Triclosan from all human hygiene biocidal products. However, in December 2016, Canada declared that it would keep allowing the antimicrobial agent triclosan to be used in consumer items, going against the recent FDA restriction in the US.

The Canadian authorities declared that triclosan is safe for use in consumer goods including toothpaste, soap, and hand sanitizer because it poses no risk to human health. The impact of Triclosan on human and environmental health is still being debated.

Fairfield’s Ranking Board

Top Segments

- Dominance of Industrial Grade Category Prevails

In 2022, the industrial grade category led the market, and growth is anticipated during the projection period. To prevent microbial development when transporting goods and materials, triclosan is included in a variety of products and machinery used for industrial applications. Examples of these include conveyor belts. The industrial sector's need for triclosan is expected to rise as a result.

Additionally, the market for pharmaceutical-grade triclosan is anticipated to develop significantly throughout the forecast period. It is an antibacterial and antifungal ingredient found in pharmaceutical items such as lotions, ointments, antiseptic gel, and surgical hand scrubs as well as hand wipes, gel, and surgical hand scrubs. This is expected to increase triclosan demand in the pharmaceutical sector, opening up lucrative market potential.

- Personal Care and Cosmetics Segment will Surge Ahead

In 2022, the personal care and cosmetics category dominated the industry. Due to its antibacterial and antifungal qualities, triclosan is an ingredient in numerous cosmetic products, including lotions, creams, foundations, and many more. As a result, the demand for triclosan will increase in the personal care and cosmetics sector throughout the course of the forecast.

Additionally, the end-use industry for triclosan that is predicted to be the most lucrative is the healthcare sector. Triclosan, which is utilised as an antibacterial, antifungal, and disinfection agent, is seeing substantial expansion due to reasons such as the expanding global population, the rise in diseases, and government initiatives and investments in the healthcare sector.

Regional Frontrunners

Asia Pacific Secures the Dominant Market Position

The market for triclosan is dominated by the Asia Pacific region. Throughout the predicted period, this region is also expected to continue to dominate. The expansion of the triclosan market in the region has been greatly aided by nations like China, Japan, and India. The demand for triclosan has increased due to important variables for creating pharmaceutical, cosmetic, and personal care goods, as well as factors related to the medical field, agriculture, and other end-use industries.

Additionally, one of India's fastest-growing industries is the pharmaceutical industry. For instance, the healthcare sector in India has expanded at a CAGR of almost 22% since 2016, according to a report released by NITI Aayog in March 2021. In 2022, this rate is anticipated to reach US$372 Bn. These elements work together to enhance the use of triclosan as an antibacterial, disinfectant, and preservative in various healthcare goods in the expanding healthcare sector.

Europe Likely to Demonstrate Lucrative Growth Potential

Due to the well-established cosmetics industry, where triclosan is used in the formulation of numerous skin care products, it is a great source of antibacterial, antifungal, and disinfectant agents, and it helps to maintain the shelf life of skin care products by inhibiting the growth of microorganisms, the Europe region has experienced significant growth.

Furthermore, consumer preferences for more natural and sustainable personal care products have changed because of growing consumer knowledge of the possible health and environmental risks linked with triclosan. The demand for triclosan-containing goods may be impacted by this change.

Fairfield’s Competitive Landscape Analysis

The global Triclosan market is a consolidated market with fewer major players present across the globe. The key players are introducing new products as well as working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research is expecting the market to witness more consolidation over the coming years.

Who are the Leaders in Global Triclosan Space?

- Salicylates and Chemicals Pvt. Ltd.

- Jiangsu Huanxin High-tech Materials Co. Ltd.

- Cayman Chemical

- A. DYESTUFFS INDIA P. LIMITED

- Spectrum Chemical

- Shandong Aoyou Biological Technology Co. Ltd.

- Kumar Organic Products Limited

- Merck KGaA

- DEV IMPEX

- BASF SE

- Xian Meheco

- Xiangyun Group

- Vivimed Labs

- Zhuzhou Fortune Chemical Industrial Co., Ltd.

- Hangzhou Motto Science & Technology Co., Ltd.

Significant Company Developments

Product Development

- January 2019: After removing the contentious chemical triclosan, Colgate Palmolive began a commercial campaign for the relaunched Colgate Total toothpaste.

Research News

- June 2017: More than 200 scientists and medical experts claim in a statement published in the journal Environmental Health Perspectives that antimicrobial or antibacterial soaps do not offer any additional health advantages and may even be harmful to both consumers and the environment.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, due to its powerful antibacterial capabilities, triclosan is frequently utilised in consumer goods and personal care items. The market for triclosan is expanding because of rising hygiene awareness and rising consumer demand for goods that prevent the growth of germs and fungi.

Additionally, it is projected that new possibilities will arise throughout the projection period due to the growing need for antimicrobial agents that are safer and more ecologically friendly.

To find and commercialise innovative antimicrobial chemicals that can replace triclosan, businesses are investing in research and development, creating new growth opportunities. On the other hand, long-term exposure to triclosan may pose health hazards, be persistent in the environment, and hurt aquatic ecosystems.

Supply Side of the Market

According to our analysis, the presence of triclosan at detectable levels in a variety of biological and environmental matrices sparked questions regarding its potential toxicity. However, it was calculated that 132 million litres of Triclosan-containing goods were utilised annually in the USA alone, out of a total annual production of 1,500 tonnes of Triclosan worldwide.

Due to the increasing demand for disinfection, production rates have likely changed after the coronavirus disease outbreak in 2019. In addition, Triclosan was classified as an endocrine-disrupting chemical by the US National Institute of Environmental Health Sciences and Environmental Protection Agency in 2020, but it is still being evaluated by the European Food Safety Authority and the European Chemical Agency.

The European Union has outlawed the use of Triclosan as a biocide and in items in contact with food, but the European Commission 2020 still permits its use in personal care products.

Global Triclosan Market is Segmented as Below:

By Type:

- Industrial Grade

- Pharmaceutical Grade

By End-Use Industry:

- Personal Care and Cosmetics

- Healthcare

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & and Africa

1. Executive Summary

1.1. Global Triclosan Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value/Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

4. Price Trend Analysis

5. Global Triclosan Market Outlook, 2018 - 2030

5.1. Global Triclosan Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Industrial Grade

5.1.1.2. Pharmaceutical Grade

5.2. Global Triclosan Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Personal Care and Cosmetics

5.2.1.2. Healthcare

5.2.1.3. Others

5.3. Global Triclosan Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Triclosan Market Outlook, 2018 - 2030

6.1. North America Triclosan Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Industrial Grade

6.1.1.2. Pharmaceutical Grade

6.2. North America Triclosan Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Personal Care and Cosmetics

6.2.1.2. Healthcare

6.2.1.3. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. North America Triclosan Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. U.S. Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. U.S. Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Canada Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Canada Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Triclosan Market Outlook, 2018 - 2030

7.1. Europe Triclosan Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Industrial Grade

7.1.1.2. Pharmaceutical Grade

7.2. Europe Triclosan Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Personal Care and Cosmetics

7.2.1.2. Healthcare

7.2.1.3. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Triclosan Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Germany Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Germany Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. U.K. Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. U.K. Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. France Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. France Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Italy Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Italy Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.9. Turkey Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.10. Turkey Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.11. Russia Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.12. Russia Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.13. Rest of Europe Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.14. Rest of Europe Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Triclosan Market Outlook, 2018 - 2030

8.1. Asia Pacific Triclosan Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Industrial Grade

8.1.1.2. Pharmaceutical Grade

8.2. Asia Pacific Triclosan Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Personal Care and Cosmetics

8.2.1.2. Healthcare

8.2.1.3. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Triclosan Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. China Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. China Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. Japan Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. Japan Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. South Korea Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. South Korea Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. India Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. India Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Southeast Asia Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Southeast Asia Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.11. Rest of Asia Pacific Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.12. Rest of Asia Pacific Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Triclosan Market Outlook, 2018 - 2030

9.1. Latin America Triclosan Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

9.1.1. Key Highlights

9.1.1.1. Industrial Grade

9.1.1.2. Pharmaceutical Grade

9.2. Latin America Triclosan Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

9.2.1. Key Highlights

9.2.1.1. Personal Care and Cosmetics

9.2.1.2. Healthcare

9.2.1.3. Others

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Triclosan Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

9.3.1. Key Highlights

9.3.1.1. Brazil Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

9.3.1.2. Brazil Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

9.3.1.3. Mexico Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

9.3.1.4. Mexico Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

9.3.1.5. Argentina Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

9.3.1.6. Argentina Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

9.3.1.7. Rest of Latin America Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

9.3.1.8. Rest of Latin America Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Triclosan Market Outlook, 2018 - 2030

10.1. Middle East & Africa Triclosan Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

10.1.1. Key Highlights

10.1.1.1. Industrial Grade

10.1.1.2. Pharmaceutical Grade

10.2. Middle East & Africa Triclosan Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

10.2.1. Key Highlights

10.2.1.1. Personal Care and Cosmetics

10.2.1.2. Healthcare

10.2.1.3. Others

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Triclosan Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

10.3.1. Key Highlights

10.3.1.1. GCC Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

10.3.1.2. GCC Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

10.3.1.3. South Africa Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

10.3.1.4. South Africa Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

10.3.1.5. Egypt Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

10.3.1.6. Egypt Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

10.3.1.7. Nigeria Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

10.3.1.8. Nigeria Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

10.3.1.9. Rest of Middle East & Africa Triclosan Market by Type, Value (US$ Bn), 2018 - 2030

10.3.1.10. Rest of Middle East & Africa Triclosan Market, by Application, Value (US$ Bn), 2018 - 2030

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Manufacturer vs Application Heatmap

11.2. Company Market Share Analysis, 2022

11.3. Competitive Dashboard

11.4. Company Profiles

11.4.1. Salicylates and Chemicals Pvt. Ltd.

11.4.1.1. Company Overview

11.4.1.2. Product Portfolio

11.4.1.3. Financial Overview

11.4.1.4. Business Strategies and Development

11.4.2. Jiangsu Huanxin High-tech Materials Co. Ltd.

11.4.2.1. Company Overview

11.4.2.2. Product Portfolio

11.4.2.3. Financial Overview

11.4.2.4. Business Strategies and Development

11.4.3. Cayman Chemical

11.4.3.1. Company Overview

11.4.3.2. Product Portfolio

11.4.3.3. Financial Overview

11.4.3.4. Business Strategies and Development

11.4.4. R. A. DYESTUFFS INDIA P. LIMITED

11.4.4.1. Company Overview

11.4.4.2. Product Portfolio

11.4.4.3. Financial Overview

11.4.4.4. Business Strategies and Development

11.4.5. Spectrum Chemical.

11.4.5.1. Company Overview

11.4.5.2. Product Portfolio

11.4.5.3. Financial Overview

11.4.5.4. Business Strategies and Development

11.4.6. Shandong Aoyou Biological Technology Co. Ltd.

11.4.6.1. Company Overview

11.4.6.2. Product Portfolio

11.4.6.3. Financial Overview

11.4.6.4. Business Strategies and Development

11.4.7. Kumar Organic Products Limited.

11.4.7.1. Company Overview

11.4.7.2. Product Portfolio

11.4.7.3. Financial Overview

11.4.7.4. Business Strategies and Development

11.4.8. Merck KGaA.

11.4.8.1. Company Overview

11.4.8.2. Product Portfolio

11.4.8.3. Financial Overview

11.4.8.4. Business Strategies and Development

11.4.9. DEV IMPEX

11.4.9.1. Company Overview

11.4.9.2. Product Portfolio

11.4.9.3. Business Strategies and Development

11.4.10. BASF SE.

11.4.10.1. Company Overview

11.4.10.2. Product Portfolio

11.4.10.3. Financial Overview

11.4.10.4. Business Strategies and Development

11.4.11. Xian Meheco.

11.4.11.1. Company Overview

11.4.11.2. Product Portfolio

11.4.11.3. Financial Overview

11.4.11.4. Business Strategies and Development

11.4.12. Xiangyun Group.

11.4.12.1. Company Overview

11.4.12.2. Product Portfolio

11.4.12.3. Financial Overview

11.4.12.4. Business Strategies and Development

11.4.13. Vivimed Labs.

11.4.13.1. Company Overview

11.4.13.2. Product Portfolio

11.4.13.3. Financial Overview

11.4.13.4. Business Strategies and Development

11.4.14. Zhuzhou Fortune Chemical Industrial Co., Ltd.

11.4.14.1. Company Overview

11.4.14.2. Product Portfolio

11.4.14.3. Financial Overview

11.4.14.4. Business Strategies and Development

11.4.15. Hangzhou Motto Science & Technology Co., Ltd.

11.4.15.1. Company Overview

11.4.15.2. Product Portfolio

11.4.15.3. Financial Overview

11.4.15.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End-Use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |