Tyre Derived Fuel (TDF) Market Outlook

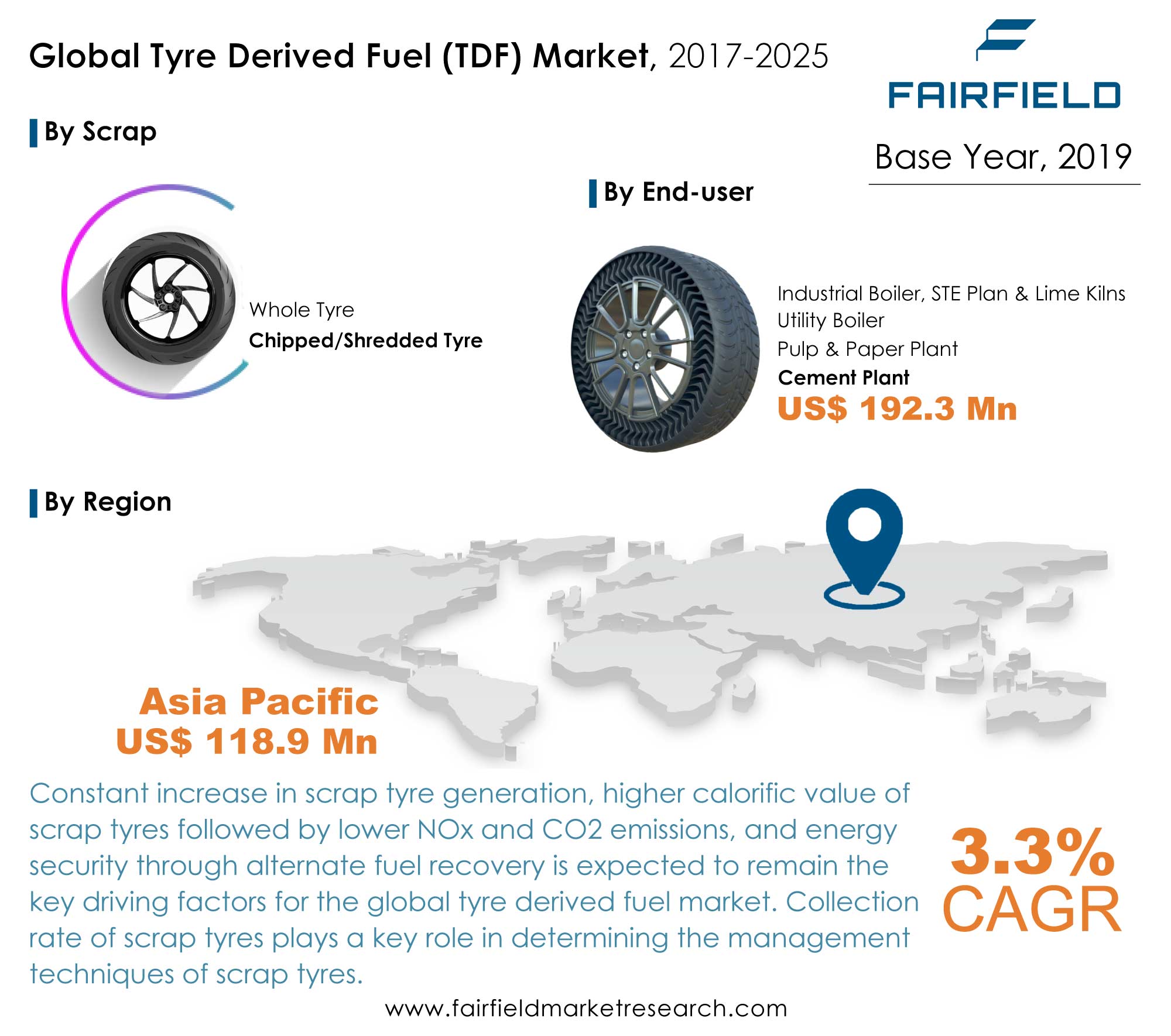

Exhibiting a modest rate of 3.3% of revenue growth between 2021 and 2025, tyre derived fuel market is slated to surpass revenue of US$430 Mn by the end of 2025.

Market Analysis in Brief

There has been a steady increase in the demand for adequate fuel sources in various end-use industries such as the cement, and paper & pulp sectors. A growing number of industry players and governments are now focused on investing higher sums to achieve improved processes to lower emissions and to increase productivity levels. As urbanization and industrialization increase, the need for products from various end-use industries is expected to increase as well. This is expected to have a profound influence on the expansion of the global tyre derived fuel market over the forecast timeline.

Key Report Findings

- The global tyre derived fuel market was valued at US$365.1 Mn in 2019

- Approximately 51% of tyres in the EU are recycled and 43% is used as fuel, including TDF

- Asia Pacific is expected to account for a majority of share in tyre derived fuel industry over the forecast period

- The TDF market is expected to expand at a CAGR of 3.3%

Growth Drivers

Increasing Effort on Scrap Tyre Management Through Alternative Solid Fuels

The demand for tyre derived fuel facilities is driven by governmental support, efficient waste management, and energy security through the use of alternate fuel. Several governments across the globe are using the concept of Reduce, Reuse, and Recover (3R) for scrap tyre management due to the various advantages it offers. Moreover, with fossil fuel price volatility, the demand for cheap alternatives is expected to lend the global tyre derived fuel market an excellent window to stir things up.

Growing concerns about the management of scrap tyres generated each year has paved ways for the development of facilities in the global tyre derived fuel market. Moreover, the diversion of tyres from landfills reserves capacity for other municipal waste and helps prevent scrap tyre piles. Scrap tyre piles pose risks, as they can catch fire, releasing copious amounts of toxic smoke and hazardous liquids that can contaminate air, water, and soil. The global tyre derived fuel industry is thus expected to present dual solutions to the world.

Growth Challenges

COVID-19 Impact

The COVID-19 pandemic has affected several industries including cement manufacturing, pulp & paper, and electrical utilities sectors. Most of the tyre derived fuel in whole form or shredded tyres is used in the cement industry as a supplemental alternative fuel. The temporary shut-down of cement, pulp & paper plants, etc., during the imposed lockdown phases in several nations, severely affected the tyre derived fuel market, particularly in Q1 2020. However, post the relaxing of these restrictions in several nations, the tyre derived fuel industry has continued to pick-up and is expected to regress at a fair pace.

Regulatory Restrictions, and Technological Limitations

TDF is subject to stringent regulations in various countries around the world, with some jurisdictions banning its use due to concerns related to emissions and environmental impacts. For example, in the EU, the tyre derived fuel market is strictly regulated under the Waste Framework Directive and the Industrial Emissions Directive.

Additionally, the technology for producing TDF still has limitations such as the need to remove steel and other contaminants from waste tyres before they can be used as a fuel source, which in turn increases the cost of production, and limits the availability of high-quality TDF. Factors such as these could hinder the market growth prospects for the TDS market in the coming years.

Overview of Key Segments

Cement Industry to Dominate TDF Consumption

Industrial facilities across the world including cement kilns, pulp and paper mills, and electric utilities use TDF as a supplemental fuel to increase boiler efficiency, decrease air emissions, and lower costs. Cement manufacturing is a major end-user segment of the tyre derived fuel industry. In 2020, the cement industry constituted a 52.7% share of the tyre derived fuel market. In terms of revenue, the cement manufacturing segment is expected to expand at a significant CAGR over the forecast period.

Fuel prices are continuously rising and there is no sign of relief in the future. Fossil fuel still makes up a major share of overall cement manufacturing costs. The cement industry depends heavily on coal, coke, and oil to fire kilns and can consume as much as 300,000 tons of coal per facility per year.

Currently, cement-manufacturing companies use tyre derived fuel to supplement their primary fuel for firing cement kilns. The heating value of an average-sized passenger tyre is approximately 13,000 to 15,000 British Thermal Units (BTUs) per pound, which is the same as that of coal. Analysts predict that global tyre derived fuel market is expected to have an incredible impact on savings related to fuel costs.

Growth Opportunities Across Regions

Asia Pacific Holds Staggering Growth Opportunity

The demand for shredded tyres is increasing in the US due to the presence of many cement plants. More than 49 million scrap tyres were used in cement plants in 2017. According to the World Business Council for Sustainable Development, every year the US, and the EU dump 14% and 16% of their scrap tyres into landfills respectively, while more than 50% of tyres go to landfills in Saudi Arabia, Russia, Ukraine, and Argentina. Additionally, the growing popularity of electric vehicles in North America and Europe is expected to boost vehicle sales. This is likely to result in increase in the flow of scrap tyres in the next few years which is expected drive the demand for TDF facilities in North America, and Europe, in turn fueling the growth of tyre derived fuel market.

Asia Pacific constituted 33% share of the global tyre derived fuel market in 2020. In Asia Pacific, end-of-life tyres are routinely disposed of in landfills or by using other methods such as burning, which have a harsh impact on the environment. This low recovery rate in developing countries of the Asia Pacific may hamper the market in the region over the forecast period. The Automotive Tyre Manufacturers’ Association (ATMA) together with the Technology, Environment, Safety and Standards (TESS) are working with India’s government to develop waste tyre legislation.

Key Market Players – Tyre Derived Fuel (TDF) Landscape

Some key companies in the global tyre derived fuel market include Liberty Tyre Recycling, ResourceCo Pty Ltd., Ragn-Sells Group, Tyre Disposal & Recycling, Reliable Tyre Disposal, Renelux Cyprus Ltd., L&S Tyre Company, Probio Energy International, Front Range Tyre Recycle Inc., ETR Group, Emanuel Tyre LLC, and Scandinavian Enviro Systems AB, to name a few. To gain a competitive edge, various established industry players are now more focused on new product launches, partnerships, collaborations, acquisitions, and alliances.

Recent Notable Developments

- In April 2022, Liberty Tire Recycling, a US-based company that produces over 140 million gallons of TDF per year, plans to expand its TDF production capacity by 50%

- In March 2022, the Mexican government banned the use of TDF in the cement industry due to emission concerns

- In February 2022, Michelin partnered with Enviro, a Swedish recycling company, to develop a new process for recycling end-of-life tyres

- In January 2022, The UK government awarded funding to Powerhouse Energy to construct a TDF plant in the West Midlands. This plant is expected to convert up to 300,000 tonnes of waste tyres per year

- In April 2020, Liberty Tire Recycling acquired Lakin Tire. Post-acquisition, the company now collects over 180 million tyres per year and recycle approximately 2.6 billion pounds of rubber into innovative, sustainable products

The Global Tyre Derived Fuel (TDF) Market is Segmented as Below:

By Scrap Tyre Type Coverage

- Chipped/Shredded Tyre

- Whole Tyre

By End-user Coverage

- Cement Plant

- Pulp & Paper Plant

- Utility Boiler

- Industrial Boiler, STE Plant, and Lime Kilns

By Geographical Coverage

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- Sweden

- Denmark

- Norway

- Rest of Europe

- Asia Pacific

- Japan

- India

- Indonesia

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- Mexico

- Others

Leading Companies

- Liberty Tyre Recycling

- ResourceCo Pty Ltd.

- Ragn-Sells Group

- L & S Tyre Company

- Reliable Tyre Disposal

- Emanuel Tyre, LLC

- Scandinavian Enviro Systems AB

- Renelux Group

- Tyre Disposal & Recycling

- FRONT RANGE TIRE RECYCLING

Inside This Report You Will Find:

1. Executive Summary

2. Market Overview

3. Price Trends Analysis and Future Projects, 2017 - 2025

4. Global Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

5. North America Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

6. Europe Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

7. Asia Pacific Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

8. Rest of the World (RoW) Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

9. Competitive Landscape

10. Appendix

Post Sale Support, Research Updates & Offerings:

We value the trust shown by our customers in Fairfield Market Research. We support our clients through our post sale support, research updates and offerings.

- The report will be prepared in a PPT format and will be delivered in a PDF format.

- Additionally, Market Estimation and Forecast numbers will be shared in Excel Workbook.

- If a report being sold was published over a year ago, we will offer a complimentary copy of the updated research report along with Market Estimation and Forecast numbers within 2-3 weeks’ time of the sale.

- If we update this research study within the next 2 quarters, post purchase of the report, we will offer a Complimentary copy of the updated Market Estimation and Forecast numbers in Excel Workbook.

- If there is a geopolitical conflict, pandemic, recession, and the like which can impact global economic scenario and business activity, which might entirely alter the market dynamics or future projections in the industry, we will create a Research Update upon your request at a nominal charge.

1. Executive Summary

1.1. Global Tyre Derived Fuel (TDF) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact and Recovery Analysis (U, V, W, and L Shaped Recover Scenario)

2.5.1. Supply Chain

2.5.2. Raw Materials Impact Analysis

2.6. Economic Overview

2.6.1. Microeconomic Trends

2.6.2. Macroeconomic Trends

3. Price Trends Analysis and Future Projects, 2017 - 2025

3.1. Key Highlights

3.2. by Type/by End-user

3.3. By Region

4. Global Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

4.1. Global Tyre Derived Fuel (TDF) Market Outlook, by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

4.1.1. Key Highlights

4.1.1.1. Chipped/Shredded Tyre

4.1.1.2. Whole Tyre

4.1.2. BPS Analysis/Market Attractiveness Analysis

4.2. Global Tyre Derived Fuel (TDF) Market Outlook, by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

4.2.1. Key Highlights

4.2.1.1. Cement Plant

4.2.1.2. Pulp & Paper Plant

4.2.1.3. Utility Boiler

4.2.1.4. Industrial Boiler, STF Plant, and Lime Kilns

4.3. Global Tyre Derived Fuel (TDF) Market Outlook, by Region, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Rest of the World (RoW)

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. North America Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

5.1. North America Tyre Derived Fuel (TDF) Market Outlook, by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

5.1.1. Key Highlights

5.1.1.1. Chipped/Shredded Tyre

5.1.1.2. Whole Tyre

5.2. North America Tyre Derived Fuel (TDF) Market Outlook, by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

5.2.1. Key Highlights

5.2.1.1. Cement Plant

5.2.1.2. Pulp & Paper Plant

5.2.1.3. Utility Boiler

5.2.1.4. Industrial Boiler, STF Plant, and Lime Kilns

5.3. North America Tyre Derived Fuel (TDF) Market Outlook, by Country, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

5.3.1. Key Highlights

5.3.1.1. U.S. Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

5.3.1.2. U.S. Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

5.3.1.3. Canada Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

5.3.1.4. Canada Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6. Europe Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

6.1. Europe Tyre Derived Fuel (TDF) Market Outlook, by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.1.1. Key Highlights

6.1.1.1. Chipped/Shredded Tyre

6.1.1.2. Whole Tyre

6.2. Europe Tyre Derived Fuel (TDF) Market Outlook, by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.2.1. Key Highlights

6.2.1.1. Cement Plant

6.2.1.2. Pulp & Paper Plant

6.2.1.3. Utility Boiler

6.2.1.4. Industrial Boiler, STF Plant, and Lime Kilns

6.3. Europe Tyre Derived Fuel (TDF) Market Outlook, by Country, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1. Key Highlights

6.3.1.1. U.K. Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.2. U.K. Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.3. Germany Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.4. Germany Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.5. Sweden Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.6. Sweden Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.7. Denmark Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.8. Denmark Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.9. Norway Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.10. Norway Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.21. Rest of Europe Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

6.3.1.22. Rest of Europe Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7. Asia Pacific Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

7.1. Asia Pacific Tyre Derived Fuel (TDF) Market Outlook, by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.1.1. Key Highlights

7.1.1.1. Chipped/Shredded Tyre

7.1.1.1. Whole Tyre

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Asia Pacific Tyre Derived Fuel (TDF) Market Outlook, by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.2.1. Key Highlights

7.2.1.1. Cement Plant

7.2.1.2. Pulp & Paper Plant

7.2.1.3. Utility Boiler

7.2.1.4. Industrial Boiler, STF Plant, and Lime Kilns

7.3. Asia Pacific Tyre Derived Fuel (TDF) Market Outlook, by Country, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1. Key Highlights

7.3.1.1. Japan Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.2. Japan Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.3. India Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.4. India Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025South Korea

7.3.1.5. Indonesia Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.6. Indonesia Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.7. South Korea Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.8. South Korea Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.13. Rest of Asia Pacific Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

7.3.1.14. Rest of Asia Pacific Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8. Rest of the World (RoW) Tyre Derived Fuel (TDF) Market Outlook, 2017 - 2025

8.1. Rest of the World (RoW) Tyre Derived Fuel (TDF) Market Outlook, by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8.1.1. Key Highlights

8.1.1.1. Chipped/Shredded Tyre

8.1.1.2. Whole Tyre

8.2. Rest of the World (RoW) Tyre Derived Fuel (TDF) Market Outlook, by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8.2.1. Key Highlights

8.2.1.1. Cement Plant

8.2.1.2. Pulp & Paper Plant

8.2.1.3. Utility Boiler

8.2.1.4. Industrial Boiler, STF Plant, and Lime Kilns

8.3. Rest of the World (RoW) Tyre Derived Fuel (TDF) Market Outlook, by Country, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8.3.1. Key Highlights

8.3.1.1. Brazil Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8.3.1.2. Brazil Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8.3.1.3. Mexico Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8.3.1.4. Mexico Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8.3.1.5. Others Tyre Derived Fuel (TDF) Market by Type, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

8.3.1.6. Others Tyre Derived Fuel (TDF) Market by End-user, Volume (Thousand Metric Tons) and Value (US$ Mn), 2017 - 2025

9. Competitive Landscape

9.1. Company Market Share Analysis, 2019

9.2. Type/End-user Heatmap

9.3. Strategic Collaborations

9.4. Company Profiles

9.4.1. Liberty Tyre Recycling

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. ResourceCo Pty Ltd.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Ragn-Sells Group

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. L & S Tyre Company

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Reliable Tyre Disposal

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Emanuel Tyre, LLC

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Scandinavian Enviro Systems AB

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Renelux Group

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Tyre Disposal & Recycling

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. FRONT RANGE TIRE RECYCLING

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. List of Other Key Players

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

|

2019 |

|

2017 - 2019 |

|

2020 - 2025 |

Value: US$ Million Volume: Thousand Metric Tons |

|

REPORT FEATURES |

DETAILS |

|

Scrap Tyre Type Coverage |

|

|

End-user Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2017-2019), Price Trend Analysis- 2019-2025, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |