Global Unified Workspaces Software Market Forecast

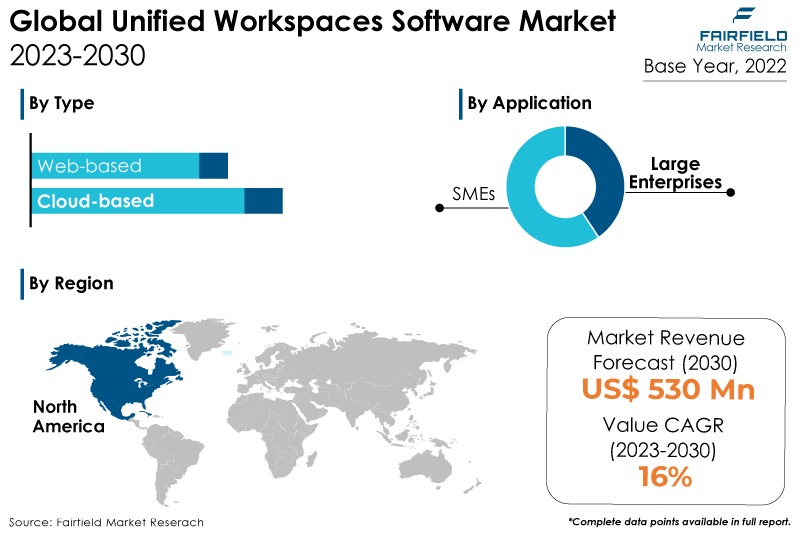

- Global unified workspaces software market valuation to expand at a CAGR of 16% between 2023 and 2030

- Market valuation to reach nearly US$530 Mn by the end of 2030

Market Analysis in Brief

Unified workspaces software is a comprehensive digital solution that unifies various productivity and collaboration tools onto a single platform. By providing a standardised interface via which individuals and organisations may access, manage, and engage in work-related activities, projects, and communication, it aims to streamline and centralise the digital workplace. Unified workspaces software has several common features, including team communication, access to files and retention, task and project administration, calendars and scheduling, video chatting, and interfaces with other frequently used business applications. It lets employees communicate, exchange information, and collaborate across different channels and devices without switching between several platforms or programs. The increased demand for seamless team interaction and communication is one of the crucial elements.

Due to the growth of remote work and scattered teams, businesses require a digital solution that enables real-time communication, file sharing, and collaboration across numerous locations and time zones. Software for unified workspaces provides a centralised setting for productive team communication, increasing productivity. The complicated nature of the modern workplace is another reason. Organisations utilise various productivity and communication tools, making managing and switching between them time- and effort-consuming. By merging many applications into a single platform, unified workspaces software streamlines the digital workplace while reducing the need for context switching and enhancing user experience.

Key Report Findings

- The market for unified workspaces software will demonstrate monumental expansion in revenue over the decade, i.e., between 2023 and 2030

- The widespread adoption of unified workspace software is driven by the need for seamless communication and collaboration, streamlined digital workstations, increased efficiency and productivity, improved information management and organisation, and combined capabilities with other business programs.

- Demand for cloud-based unified workspace software remains higher in the unified workspace software market.

- The large enterprise's category held the highest unified workspaces software market revenue share in 2022.

- North America will continue to lead its way, whereas Asia Pacific’s unified workspaces software market will experience significant growth till 2030.

Growth Drivers

Increased Demand for Flexibility, and Need to Create Better Employee Experience

A unified workplace will help recruitment, retention, employee engagement, and motivation. Under mature unified workplace rules, which also accommodate a variety of working ways, employees are free to choose their own gadgets. When employing persona-based models, end customers get a workspace bundle tailored to their needs rather than separate services.

Employee content and data are securely incorporated into collaboration tools, business drop boxes, and cloud storage so that staff members can view it from every device, at any moment, and from any place, regardless of if they are actually present in the office or working remotely. The accessibility of this data encourages organisational flexibility, boosts output, and improves efficiency.

Unified workplace solutions help employees foster stronger relationships, teamwork, and communication among themselves. When implemented successfully, these solutions enable organisations to reduce common risks, maintain regulatory compliance, and eventually realise increased economic value, providing employees with a better working environment.

Employee agility and flexibility will rise in organisations that provide the appropriate unified workplace tools. Employee productivity and happiness will increase due to simple-to-use unified workplace solutions within and beyond the firewall.

According to the survey, employees choose flexible work arrangements to reduce commute stress, spend more time with their families, and better work-life balance. Thus, these employee needs are anticipated to accelerate using unified workplace solutions.

Rise in Demand from SMEs

Through higher productivity, cost savings, a more mobile and agile staff, increased flexibility, and adaptation in the marketplace, SMEs who implement unified workplace solutions acquire a competitive edge in the sector. Small & medium-sized businesses (SMEs) must prioritise company operations and expansion while strengthening their position within their industry.

According to a Kissflow article, the percentage of SMEs familiar with digital transformation has increased over time, from just 33% in 2017 to 57% in 2019. According to the report, organisations have seen increases in revenue by 43%, employee engagement by 53%, and productivity by 67% after introducing a unified workplace.

SMEs are consistently under pressure to implement more reliable and effective IT infrastructures to reach the market as quickly as their larger competitors. But they frequently lack the internal capabilities to oversee the IT infrastructure. SMEs require affordable managed services that facilitate workplace transformation to overcome these obstacles. To survive and be competitive in the market, SMEs across all industries employ unified workplace services.

Overview of Key Segments

Cloud-based Deployments Preferred

Due to the significant advantages of cloud deployment, such as cheaper costs, no need for staff for hardware maintenance, faster and more effective outcomes, and complete flexibility and scalability, which result in lower OPEX and CAPEX, SMEs are heavily moving in this direction.

Customers may keep and easily retrieve useful insights at any time and from any location, thanks to seamless flexibility and scalability. Thanks to the cloud-based setup, users can perform real-time analytics on data coming from distant areas. The unified workplace and services offered by the cloud improve operational efficiency and lower business operating expenses.

The adoption of cloud-based unified workplace solutions and services across sectors is anticipated to be fueled by lower maintenance costs and a reduction in personnel. The web-based section is anticipated to grow moderately and hold its position throughout the forecast. It is in high demand due to its web-based simplicity, flexible cost, and ease of maintenance.

Demand for web-based services is increasing as a result of remote working. As a result, cooperative teams can now access previously consolidated data. It is projected that web-based goods will expand quickly since they will have an equivalent total cost of ownership (TCO) to on-premises solutions in the upcoming years.

Large Enterprises at the Forefront of Adoption

Large businesses have increasingly embraced the digitalisation trend. Due to the presence of a sizable workforce, large organisations might be viewed to be more impacted by the expanding interconnectedness of bandwidths and mobility trends. Large businesses have a broad corporate network and numerous sources of income. These organisations are eager to invest in the newest technologies to operate their businesses efficiently.

Due to the complexity of their IT infrastructure compared to SMEs, major businesses have a monopoly on the unified workplace market. Because employees increasingly want to access computing resources and apps from a mobile location at any time, businesses today find it difficult to manage their data centers, preserve their data properly, and focus on their core business operations.

Throughout the projected period, the small & medium enterprises (SMEs) segment is anticipated to expand at a rapid rate. Despite a weak organisational infrastructure, SMEs quickly implement unified workplace services. It provides SMEs with several benefits, including improved client experiences, a quicker time to market, lower costs, higher staff productivity and corporate efficiency.

Additionally, SMEs are rapidly adopting cloud enterprise scale because of the cheaper costs, lack of labor requirements for hardware maintenance, and scalability, which leads to lower operating and capital expenses. These elements will fuel the industry's expansion in SMEs during the forecast period for the unified workplace.

Growth Opportunities Across Regions

North America Leads

For important industries, including telecommunication and IT, business and financial services, and manufacturing, North America is predicted to be the most promising region. When it comes to the adoption of unified workplace solutions and services, North America is the most developed market. Because the area is home to so many businesses and has so much technological know-how, it adopts unified workplace solutions and services to assist businesses in having cutting-edge IT infrastructures.

The number of small businesses, startups, medium-sized businesses, and major businesses is concentrated in this area. The region's market is expected to grow as a result of efforts to secure Internet of Things (IoT) gateway communications, the adoption of technologies like Artificial Intelligence (AI), augmented reality (AR), and robotic process automation (RPA), and the rise of social collaboration outside of the enterprise.

The rising adoption of cutting-edge technologies, including bring-your-own-device (BYOD), artificial intelligence, and enterprise mobility management solutions, among others, is responsible for expanding the regional unified workspaces software market. Additionally, there is a considerable demand for software and robotics solutions because of the region's high levels of industrial, retail, and automotive activities. In the end, this propels the growth of the local market.

Asia Pacific Develops a Hub of Opportunities

The Asia Pacific region held a sizable portion of the market. Organisations in the Asia Pacific are searching for effective and integrated solutions for their unified workplaces due to the region's dynamic business environment and rapid increase in technology use.

Software for a single workspace makes collaboration easier, makes workers more productive, and allows for seamless communication, aligning with the region's emphasis on worker efficiency and digital transformation. The requirement highlights Asia Pacific's ambition for modern, integrated, unified workspaces.

Additionally, to maintain a dominant position in the market, industry participants in the area are implementing several methods, including product development, collaborations, and strategic partnerships, among others. Other factors that enhance market growth in the Asia Pacific region include rising retail sector propulsion and the province's IT businesses.

Growth Challenges

Lack of Training and Required Education Among Workforce

Organisations must train and educate employees to use the IT infrastructure to support workplace transformation and perform at their highest levels effectively. Therefore, employers must make sure that staff members are given access to instruction that will enable them to benefit from the solutions offered by the unified workplace fully.

In addition to technical training, employees require policy training on what kinds of information they should or should not share in the unified workplace. Organisations must share information about their rules for handling personal and business data and devices to minimise security and compliance issues. For instance, a team manager must receive all the instructions and training required to use the solution after acquiring a new resource performance tracker.

Organisations must create training programs as ongoing processes before implementing unified workplace solutions and services to advance and change with the workplace transformation plan. This, in turn, is a barrier to adopting initiatives to transform the unified workplace because they demand continuing organisational training efforts.

Unified Workspaces Software Market: Competitive Landscape

Some of the leading players at the forefront in the unified workspaces software market space include Microsoft Teams, Slack, Google Workspace, Monday.com, Asana, Trello, Notion, Jira, Basecamp, Airtable, Wrike, Evernote, Zoho Workplace, Cisco Webex Teams, and Workplace by Facebook.

Recent Notable Developments

In December 2020, Atos and Vodafone Spain, a leading European telecommunications operator, joined forces to change the workplace surroundings by modifying it to fresh methods of working and accessibility with the introduction of Vodafone Infinity Workplace, an innovative digital workplace designed for Vodafone business clients across Spain. All company profiles, including big companies, SMEs, and independent contractors, can subscribe to the service.

Similarly, in February 2020, Infosys collaborated with GE Appliances. As part of this partnership, Infosys will help GE Appliances accelerate their digital and workplace transformations by providing automation-driven managed IT services support across global command centers, service desks, end-user computing, IT infrastructure, and apps. Through this collaboration, Infosys will assist GE Appliances in modernising its IT infrastructure and running IT in a managed services fashion.

Global Unified Workspaces Software Market is Segmented as Below:

By Type

- Cloud-based

- Web-based

By Application

- Large Enterprises

- SMEs

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Unified Workspaces Software Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume/Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Unified Workspaces Software Market Outlook, 2018 - 2030

3.1. Global Unified Workspaces Software Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Cloud-based

3.1.1.2. Web Based

3.2. Global Unified Workspaces Software Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Large Enterprises

3.2.1.2. SMEs

3.3. Global Unified Workspaces Software Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Unified Workspaces Software Market Outlook, 2018 - 2030

4.1. North America Unified Workspaces Software Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Cloud-based

4.1.1.2. Web Based

4.2. North America Unified Workspaces Software Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Large Enterprises

4.2.1.2. SMEs

4.2.2. Market Attractiveness Analysis

4.3. North America Unified Workspaces Software Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Unified Workspaces Software Market Outlook, 2018 - 2030

5.1. Europe Unified Workspaces Software Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Cloud-based

5.1.1.2. Web Based

5.2. Europe Unified Workspaces Software Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Large Enterprises

5.2.1.2. SMEs

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Unified Workspaces Software Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Unified Workspaces Software Market Outlook, 2018 - 2030

6.1. Asia Pacific Unified Workspaces Software Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Cloud-based

6.1.1.2. Web Based

6.2. Asia Pacific Unified Workspaces Software Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Large Enterprises

6.2.1.2. SMEs

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Unified Workspaces Software Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Unified Workspaces Software Market Outlook, 2018 - 2030

7.1. Latin America Unified Workspaces Software Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Cloud-based

7.1.1.2. Web-based

7.2. Latin America Unified Workspaces Software Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Large Enterprises

7.2.1.2. SMEs

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Unified Workspaces Software Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Unified Workspaces Software Market Outlook, 2018 - 2030

8.1. Middle East & Africa Unified Workspaces Software Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Cloud-based

8.1.1.2. Web Based

8.2. Middle East & Africa Unified Workspaces Software Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Large Enterprises

8.2.1.2. SMEs

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Unified Workspaces Software Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Unified Workspaces Software Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Unified Workspaces Software Market by Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Microsoft Teams

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Google Workspace

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Monday.com

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Asana

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Trello

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Notion

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Airtable

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Wrike

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Evernote

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Zoho Workplace

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Cisco Webex Teams

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Workplace by Facebook

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |