Yoga Clothing Market Growth and Industry Forecast

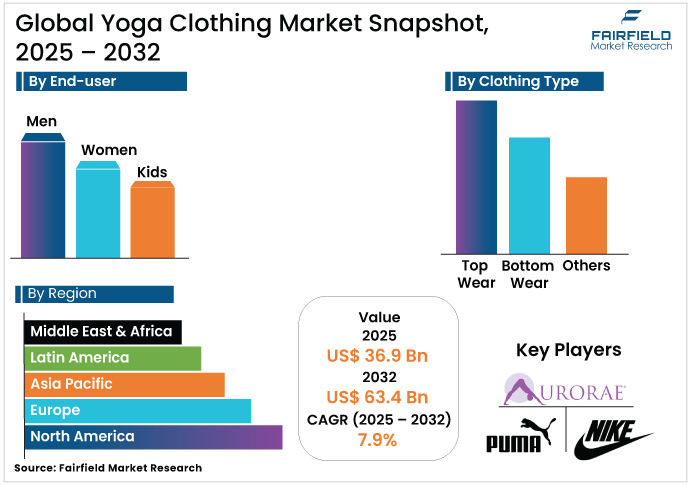

- Global Yoga Clothing Market size to reach US$ 63.4 Bn in 2032, up from US$ 36.9 Bn estimated in 2025.

- Market revenue projected to grow at a steady CAGR of 7.9% during 2025-2032.

Yoga Clothing Market Summary: Key Insights & Trends

- Bottom wear dominates the market with over 50% share in 2024, owing to its versatility and strong demand for leggings and yoga pants in athleisure.

- Women lead the market with a 58% share in 2025, while the men’s segment is growing at a CAGR of 10.1% due to increased male participation in yoga and fitness.

- Online stores are the fastest-growing distribution channel, registering an 11.3% CAGR, supported by digital convenience, wider product range, and customization.

- A key growth driver is the global rise in yoga participation, surpassing 300 million practitioners, spurring demand for functional and stylish yoga apparel.

- Sustainable and ethical fashion is a major trend, with over 60% of global consumers preferring eco-friendly clothing and boosting brands with green credentials.

- North America leads the global yoga clothing market with a 34% share in 2024, driven by a strong fitness culture, high disposable incomes, and premium brand presence.

A Look Back and a Look Forward - Comparative Analysis

The yoga clothing market grew steadily from 2019 to 2024, driven by increasing yoga participation and athleisure trends. The COVID-19 pandemic initially disrupted supply chains and offline retail, causing a temporary dip in sales in 2020. However, the shift to home-based fitness and virtual yoga classes spurred demand for comfortable, high-quality yoga apparel. E-commerce channels saw significant growth as consumers turned to online shopping, with brands such as Lululemon and Nike capitalizing on digital platforms. The industry rebounded strongly post-2021, supported by rising health awareness and premium brand presence, particularly in North America.

Yoga apparel is expected to witness steady growth over the forecast period, driven by rising interest in wellness and active lifestyles. This growth is driven by continued demand for athleisure, sustainable fabrics, and size-inclusive apparel. Emerging markets in Asia Pacific and Latin America offer significant opportunities due to rising disposable incomes and internet penetration. Innovations such as smart yoga clothing, incorporating performance feedback technology, are expected to gain traction. North America and Europe will maintain dominance, but Asia Pacific is forecasted to grow rapidly due to increasing yoga adoption and urbanization.

Key Growth Drivers

- Rising Popularity of Yoga and Fitness Activities Worldwide Fuels Apparel Demand

The global surge in yoga participation, with over 300 million practitioners worldwide, drives the yoga clothing market. Health consciousness, particularly post-COVID, has led to increased engagement in wellness activities, with yoga gaining traction for its mental and physical benefits. In the U.S., 36 million people practiced yoga in 2024, boosting demand for specialized apparel. Brands such as Lululemon and Adidas report strong sales growth due to consumer preference for high-performance, breathable fabrics. The athleisure trend further amplifies demand, as yoga clothing is worn beyond practice settings. Social media and influencer marketing also play a key role, promoting yoga lifestyles and branded apparel.

- E-commerce Growth Accelerates Yoga Clothing Sales Through Online Convenience and Reach

The expansion of e-commerce has significantly propelled, with online stores accounting for a growing share of sales. In 2024, e-commerce contributed to over 20% of market revenue in North America, driven by convenient shopping experiences and wider product availability. Platforms such as Amazon and brand-specific websites offer diverse yoga apparel, appealing to tech-savvy consumers. The rise of direct-to-consumer models by brands such as Alo Yoga has enhanced market reach, especially in emerging economies. Online customization options and virtual try-ons are increasing consumer engagement. The global e-commerce market’s growth supports expansion, particularly in Asia Pacific, where internet penetration is rising rapidly.

- Sustainable and Ethical Fashion Trends Drive Demand for Eco-Friendly Yoga Apparel

Sustainability is a major driver in the yoga clothing market, with consumers prioritizing eco-friendly materials such as organic cotton and bamboo fiber. In 2024, more than 60% of global consumers say they prefer or are willing to pay more for sustainable apparel, boosting brands such as Green Apple Active and Prana. Adidas’s collaboration with Parley for the Oceans, using recycled marine plastic, exemplifies this trend. The market for sustainable yoga clothing is expected to grow at a CAGR of 10.7% through 2032. Ethical manufacturing practices also attract conscious buyers, with companies such as Manduka emphasizing fair labor. This shift aligns with broader environmental awareness, particularly among millennials and Gen Z, who dominate yoga participation. Certifications such as Fair Trade further enhance brand appeal, driving market growth.

Key Growth Restraints

- High Apparel Costs Limit Access in Price-Sensitive and Emerging Markets

The high cost of premium yoga clothing poses a significant restraint on market growth, particularly in price-sensitive regions. Brands such as Lululemon and Alo Yoga price leggings above USD 100, limiting affordability for middle- and low-income consumers. In emerging markets such as India and Southeast Asia, where disposable incomes are lower, high pricing restricts market penetration. Despite the growth of a middle-class consumer base, many yoga practitioners in these regions prefer local or unbranded alternatives that offer more affordable options.

- Ongoing Supply Chain Issues Raise Costs and Disrupt Global Distribution

Supply chain disruptions continue to challenge the market, impacting production and distribution. In 2025, geopolitical tensions and rising raw material costs, particularly for sustainable fabrics, increased production expenses by 10% – 15%. These disruptions limit the ability of brands such as Nike and Under Armour to meet demand, especially during peak seasons. In Asia Pacific, where over 58% of yoga apparel is manufactured, labor shortages and port congestion further complicate supply chains. Such challenges raise retail prices, potentially alienating cost-conscious consumers and slowing market growth.

Yoga Clothing Market Trends and Opportunities

- Emerging Markets Drive Growth with Rising Incomes and Online Shopping Surge

Emerging economies in Asia Pacific and Latin America present significant opportunities for the yoga clothing market. Rising disposable incomes, with India’s middle class projected to reach 715 million by 2030-2031, drive demand for fitness apparel. Urbanization and growing yoga awareness, particularly in India and Brazil, where yoga festivals attract millions, fuel market potential. E-commerce penetration is high across Southeast Asia, with over 70% of internet users engaging in online shopping, enabling brands to target these regions with localized offerings. Companies such as Puma and Adidas are investing in culturally tailored designs to appeal to diverse preferences. Partnerships with local influencers and yoga studios can further enhance brand visibility.

- Smart Yoga Clothing Gains Traction with Tech-Driven Fitness Innovation

The development of smart yoga clothing offers a transformative opportunity for the yoga clothing market. Technologies such as embedded sensors in yoga pants, which provide real-time performance feedback, are gaining traction. In 2022, brands such as Asuno UK launched smart apparel, enhancing user experience and driving engagement. The global smart clothing market is projected to grow at a CAGR of 25% through 2032, with yoga apparel as a key segment. Innovations in moisture-wicking and temperature-regulating fabrics also appeal to consumers seeking performance-driven products. Companies such as Nike and Under Armour are investing in R&D to integrate wearable technology, aligning with the growing demand for personalized fitness solutions. These advancements attract tech-savvy Millennials and Gen Z, creating a lucrative niche for premium brands as these generations increasingly prioritize wellness, sustainability, and digital engagement.

Segment-wise Trends & Analysis

- Bottom Wear Leads While Top Wear Gains with Stylish Innovations

Bottom wear, including leggings and yoga pants, leads the yoga clothing market, holding over 50% of the share in 2024 due to its versatility and athleisure appeal. These items are favored for their functionality and style, suitable for both yoga and casual wear. Top wear is the fastest-growing segment, driven by demand for breathable, stylish tops for diverse fitness activities. Innovations in sustainable fabrics and designs, such as cropped tanks, boost this segment’s growth.

- Women Lead Sales as Men’s Yoga Apparel Demand Rises Quickly

Women dominate the yoga clothing market, accounting for 58% of sales in 2025, driven by high participation in yoga and fitness trends. The men’s segment is the fastest-growing, with a CAGR of 10.1%, as male yoga participation rises, particularly in urban areas. Brands such as Adidas and Outdoor Voices are expanding men’s lines, offering performance-driven and stylish options to meet this demand.

- Offline Sales Stay Strong while Online Channels Expand Rapidly Worldwide

Offline stores lead the yoga clothing market, capturing 62% of sales in 2025, due to consumer preference for in-store trials of fit and quality. Online stores are the fastest-growing channel, with a CAGR of 11.3%, fueled by e-commerce growth and convenience. Platforms such as Amazon and brand websites offer diverse options, with virtual try-ons and customization driving online sales, especially in North America and Europe.

Regional Trends & Analysis

- North America Leads with Strong Fitness Culture and Premium Brand Presence

North America, led by the U.S., holds the largest yoga clothing market share at 34% in 2024, driven by a strong fitness culture and premium brand presence such as Lululemon and Athleta. High disposable income and yoga’s popularity, with 36 million U.S. practitioners, fuel demand. The rise of e-commerce and growing consumer preference for sustainable and ethically produced apparel further accelerate market expansion, as brands align with health-conscious and environmentally aware lifestyles.

- Europe Witnesses a Growth through Health Focus and Sustainable Fashion trends

Germany and the UK are leading, and account for a significant market share due to high health consciousness and low unemployment rates, enabling strong purchasing power. The region’s yoga clothing industry is driven by active lifestyles and demand for eco-friendly apparel, with brands such as Puma focusing on sustainable lines. The market is expected to grow at a CAGR of 8.3% through 2032.

- Asia Pacific is a Fastest-Growing Market Followed with Rising Incomes and Surge in Yoga Adoption

Asia Pacific, led by India and China, is the fastest-growing region with a CAGR of 11.5%, driven by rising disposable incomes and yoga adoption. India’s yoga culture and China’s urbanization boost demand for affordable, stylish apparel. E-commerce platforms and local brands are also enhancing accessibility across the region.

Competitive Landscape

Key players in the yoga clothing market, including Lululemon, Nike, Adidas, Alo Yoga, and Athleta, focus on sustainable materials, innovative designs, and e-commerce expansion. They leverage influencer marketing and smart clothing technology to enhance brand appeal and capture diverse consumer segments.

Key Companies

- Aurorae Yoga LLC

- Puma SE

- Green Apple Active

- Hugger Mugger

- Nike Inc.

- Athleta (Gap Inc.)

- Manduka

- Adidas AG

- Prana

- Hanesbrands Inc.

- Lululemon Athletica

- Under Armour Inc.

- Outdoor Voices

- Alo Yoga

- Ralph Lauren Corp.

Recent Industry Developments:

- In July 2025, Lululemon Athletica announced its debut in India through a franchise partnership with Tata CLiQ, set to launch stores and online platforms in late 2026. This move targets India’s USD 100 billion sportswear market, capitalizing on growing yoga adoption and premium athleisure demand. It strengthens Lululemon’s global presence in emerging markets.

- In 2025, Alo Yoga began preparations for its first offline store in Shanghai, China, with a General Manager appointed to oversee operations. This expansion taps into China’s dynamic activewear market, driven by rising fitness consciousness among urban consumers. The move enhances Alo Yoga’s global footprint and brand visibility.

- In 2025, Adidas launched a new sustainable yoga clothing collection, incorporating recycled polyester and organic cotton in collaboration with Parley for the Oceans. This initiative aligns with consumer demand for eco-friendly apparel, boosting Adidas’s market share among environmentally conscious buyers. The line emphasizes performance and sustainability, targeting millennials and Gen Z.

- In July 2024, Under Armour announced its Autumn/Winter 2025 sportswear line, including yoga apparel targeting Gen Z with trendy, casual designs. Launched in 2025, this collection features moisture-wicking fabrics and inclusive sizing, enhancing Under Armour’s appeal in the athleisure-driven yoga clothing market. The move strengthens its competitive positioning.

Global Yoga Clothing Market Segmentation:

By Clothing Type

- Top Wear

- Bottom Wear

- Others

By End-user

- Men

- Women

- Kids

By Distribution Channel

- Online Stores

- Offline Stores

By Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

1. Executive Summary

1.1. Global Yoga Clothing Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Yoga Clothing Market Outlook, 2019 - 2032

3.1. Global Yoga Clothing Market Outlook, By Clothing Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.1.1. Top Wear

3.1.2. Bottom Wear

3.1.3. Others

3.2. Global Yoga Clothing Market Outlook, By End-user, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.2.1. Men

3.2.2. Women

3.2.3. Kids

3.3. Global Yoga Clothing Market Outlook, By Distribution Channel, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.3.1. Online Stores

3.3.2. Offline Stores

3.4. Global Yoga Clothing Market Outlook, by Region, Value (US$ Bn) & Volume (Units), 2019 - 2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Yoga Clothing Market Outlook, 2019 - 2032

4.1. North America Yoga Clothing Market Outlook, By Clothing Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.1.1. Top Wear

4.1.2. Bottom Wear

4.1.3. Others

4.2. North America Yoga Clothing Market Outlook, By End-user, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.2.1. Men

4.2.2. Women

4.2.3. Kids

4.3. North America Yoga Clothing Market Outlook, By Distribution Channel, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.3.1. Online Stores

4.3.2. Offline Stores

4.4. North America Yoga Clothing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

4.4.1. U.S. Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

4.4.2. U.S. Yoga Clothing Market Outlook, By End-user, 2019 - 2032

4.4.3. U.S. Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

4.4.4. Canada Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

4.4.5. Canada Yoga Clothing Market Outlook, By End-user, 2019 - 2032

4.4.6. Canada Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Yoga Clothing Market Outlook, 2019 - 2032

5.1. Europe Yoga Clothing Market Outlook, By Clothing Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.1.1. Top Wear

5.1.2. Bottom Wear

5.1.3. Others

5.2. Europe Yoga Clothing Market Outlook, By End-user, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.2.1. Men

5.2.2. Women

5.2.3. Kids

5.3. Europe Yoga Clothing Market Outlook, By Distribution Channel, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.3.1. Online Stores

5.3.2. Offline Stores

5.4. Europe Yoga Clothing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

5.4.1. Germany Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

5.4.2. Germany Yoga Clothing Market Outlook, By End-user, 2019 - 2032

5.4.3. Germany Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

5.4.4. Italy Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

5.4.5. Italy Yoga Clothing Market Outlook, By End-user, 2019 - 2032

5.4.6. Italy Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

5.4.7. France Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

5.4.8. France Yoga Clothing Market Outlook, By End-user, 2019 - 2032

5.4.9. France Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

5.4.10. U.K. Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

5.4.11. U.K. Yoga Clothing Market Outlook, By End-user, 2019 - 2032

5.4.12. U.K. Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

5.4.13. Spain Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

5.4.14. Spain Yoga Clothing Market Outlook, By End-user, 2019 - 2032

5.4.15. Spain Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

5.4.16. Russia Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

5.4.17. Russia Yoga Clothing Market Outlook, By End-user, 2019 - 2032

5.4.18. Russia Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

5.4.19. Rest of Europe Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

5.4.20. Rest of Europe Yoga Clothing Market Outlook, By End-user, 2019 - 2032

5.4.21. Rest of Europe Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Yoga Clothing Market Outlook, 2019 - 2032

6.1. Asia Pacific Yoga Clothing Market Outlook, By Clothing Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.1.1. Top Wear

6.1.2. Bottom Wear

6.1.3. Others

6.2. Asia Pacific Yoga Clothing Market Outlook, By End-user, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.2.1. Men

6.2.2. Women

6.2.3. Kids

6.3. Asia Pacific Yoga Clothing Market Outlook, By Distribution Channel, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.3.1. Online Stores

6.3.2. Offline Stores

6.4. Asia Pacific Yoga Clothing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

6.4.1. China Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

6.4.2. China Yoga Clothing Market Outlook, By End-user, 2019 - 2032

6.4.3. China Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

6.4.4. Japan Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

6.4.5. Japan Yoga Clothing Market Outlook, By End-user, 2019 - 2032

6.4.6. Japan Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

6.4.7. South Korea Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

6.4.8. South Korea Yoga Clothing Market Outlook, By End-user, 2019 - 2032

6.4.9. South Korea Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

6.4.10. India Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

6.4.11. India Yoga Clothing Market Outlook, By End-user, 2019 - 2032

6.4.12. India Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

6.4.13. Southeast Asia Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

6.4.14. Southeast Asia Yoga Clothing Market Outlook, By End-user, 2019 - 2032

6.4.15. Southeast Asia Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

6.4.16. Rest of SAO Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

6.4.17. Rest of SAO Yoga Clothing Market Outlook, By End-user, 2019 - 2032

6.4.18. Rest of SAO Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Yoga Clothing Market Outlook, 2019 - 2032

7.1. Latin America Yoga Clothing Market Outlook, By Clothing Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.1.1. Top Wear

7.1.2. Bottom Wear

7.1.3. Others

7.2. Latin America Yoga Clothing Market Outlook, By End-user, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.2.1. Men

7.2.2. Women

7.2.3. Kids

7.3. Latin America Yoga Clothing Market Outlook, By Distribution Channel, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.3.1. Online Stores

7.3.2. Offline Stores

7.4. Latin America Yoga Clothing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

7.4.1. Brazil Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

7.4.2. Brazil Yoga Clothing Market Outlook, By End-user, 2019 - 2032

7.4.3. Brazil Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

7.4.4. Mexico Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

7.4.5. Mexico Yoga Clothing Market Outlook, By End-user, 2019 - 2032

7.4.6. Mexico Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

7.4.7. Argentina Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

7.4.8. Argentina Yoga Clothing Market Outlook, By End-user, 2019 - 2032

7.4.9. Argentina Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

7.4.10. Rest of LATAM Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

7.4.11. Rest of LATAM Yoga Clothing Market Outlook, By End-user, 2019 - 2032

7.4.12. Rest of LATAM Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Yoga Clothing Market Outlook, 2019 - 2032

8.1. Middle East & Africa Yoga Clothing Market Outlook, By Clothing Type, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.1.1. Top Wear

8.1.2. Bottom Wear

8.1.3. Others

8.2. Middle East & Africa Yoga Clothing Market Outlook, By End-user, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.2.1. Men

8.2.2. Women

8.2.3. Kids

8.3. Middle East & Africa Yoga Clothing Market Outlook, By Distribution Channel, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.3.1. Online Stores

8.3.2. Offline Stores

8.4. Middle East & Africa Yoga Clothing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2032

8.4.1. GCC Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

8.4.2. GCC Yoga Clothing Market Outlook, By End-user, 2019 - 2032

8.4.3. GCC Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

8.4.4. South Africa Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

8.4.5. South Africa Yoga Clothing Market Outlook, By End-user, 2019 - 2032

8.4.6. South Africa Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

8.4.7. Egypt Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

8.4.8. Egypt Yoga Clothing Market Outlook, By End-user, 2019 - 2032

8.4.9. Egypt Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

8.4.10. Nigeria Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

8.4.11. Nigeria Yoga Clothing Market Outlook, By End-user, 2019 - 2032

8.4.12. Nigeria Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

8.4.13. Rest of Middle East Yoga Clothing Market Outlook, By Clothing Type, 2019 - 2032

8.4.14. Rest of Middle East Yoga Clothing Market Outlook, By End-user, 2019 - 2032

8.4.15. Rest of Middle East Yoga Clothing Market Outlook, By Distribution Channel, 2019 - 2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Aurorae Yoga LLC

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Puma SE

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Green Apple Active

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Hugger Mugger

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Nike Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Athleta (Gap Inc.)

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Manduka

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Adidas AG

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Prana

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Hanesbrands Inc.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Clothing Type Coverage |

|

|

End-user Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |