Zero Liquid Discharge (ZLD) Market Outlook

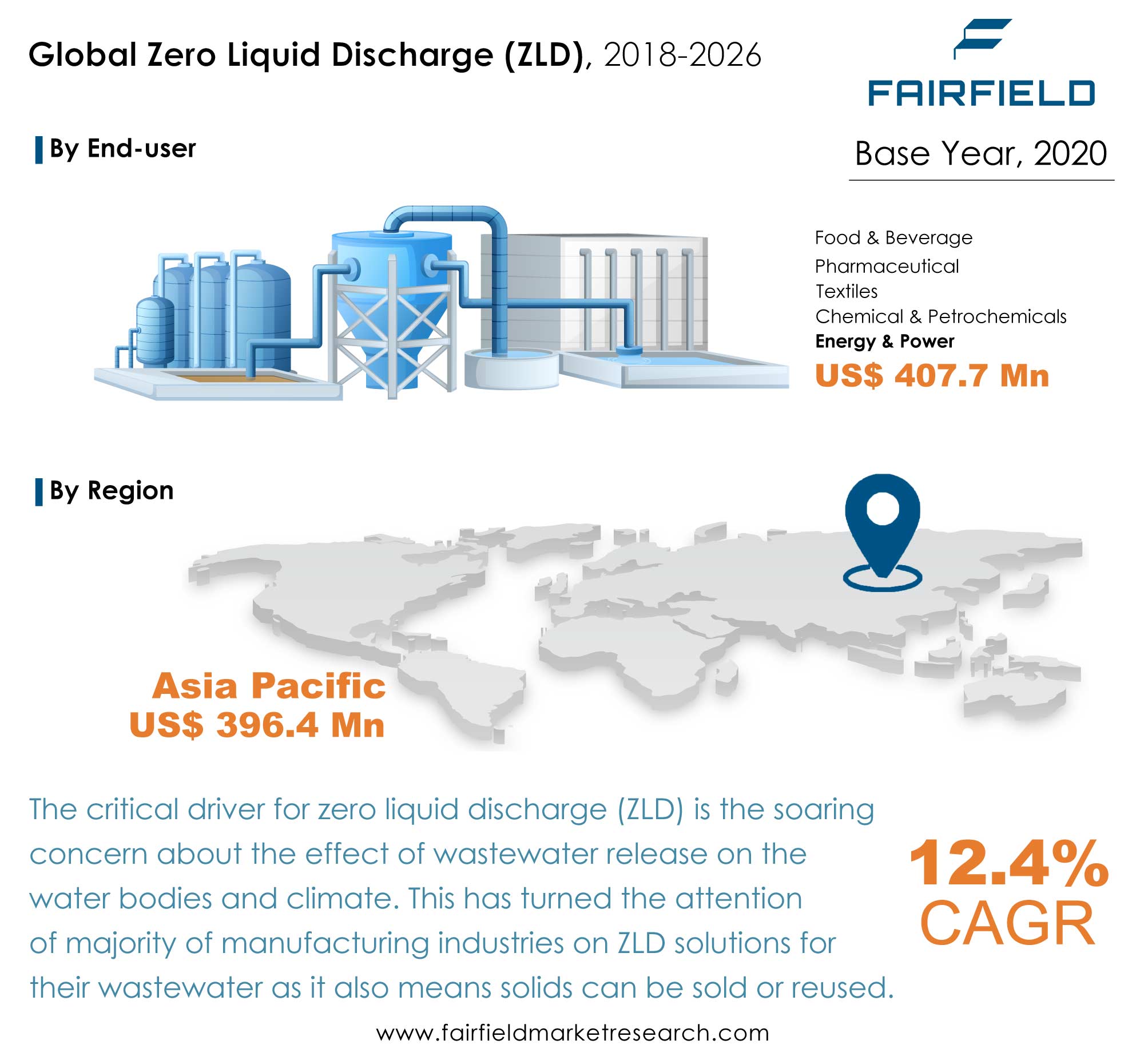

Up from the valuation of US$841.4 Mn attained in 2020, the global zero liquid discharge market revenue shows strong indications of surpassing the billion-dollar-mark by 2026-end.

Market Analysis in Brief

Water has become a scant asset with unwavering globalisation, and urbanisation. While major industries like oil and gas, energy and power, chemicals and petrochemicals, pharmaceuticals, and others produce a huge wastewater volume that contains strong waste, and natural waste in addition to harmful, and non-toxic chemicals. As these have been released into the natural water bodies, the resultant toxic wastewater has over the years led to certain disastrous impact on the natural flora and fauna, leading to some undesirable dramatic climate changes.

The scenario itself opens opportunities for the penetration of environmentally sustainable methods like the zero liquid discharge (ZLD). According to Fairfield Market Research, the global zero liquid discharge market is expected to demonstrate a CAGR of 12.4% from 2021 till 2026-end.

Key Report Findings

- By the end of 2026, the worldwide zero liquid discharge market size is all set to reach past US$1,639 Mn

- Critically rising need for groundwater conservation will primarily drive adoption of ZLD

- Supportive take of governments, and favourable regulatory guidelines are majorly responsible for market expansion

- Demand from energy and power industry will be the highest

- The market for zero liquid discharge will experience the most significant growth in Asia Pacific

Growth Drivers

Higher Preference for ZLD

Besides recycling, wastewater treatment eases the burden on key freshwater sources to some extent and promotes the use of treated wastewater for non-potable applications. The wastewater treatment industry consists of several treatment solutions such as sewage treatment plants (STP), effluent treatment plants (ETP), zero liquid discharge (ZLD), and wastewater treatment plants (WTP).

Zero liquid discharge is one of the most sought-after wastewater treatment methods as it includes reverse osmosis, ultrafiltration, crystallisation/evaporation, and fractional electrode ionisation, leaving zero discharge of water at the end of the treatment cycle. Greater preference will drive the growth of the zero liquid discharge market.

Critical Need for Freshwater Conservation

The pressing need for effective freshwater conservation predominantly drives the adoption of zero liquid discharge method across the wastewater treatment sector. According to the United Nations (UN) water report, out of the total water available on the earth’s surface, only 3% is freshwater. Out of this, 69% resides in glaciers, 30% underground, and mere 1% is in lakes, rivers, and swamps.

Given the significantly diminishing availability of freshwater and unprecedentedly rising water pollution further worsening the issue, the need for effective water conservation is repeatedly getting the spotlight over the past few decades. Several environmental agencies and government authorities have imposed regulations to reduce water pollution and promote water conservation. The zero liquid discharge market will benefit largely from this.

Stringent Regulations Set for Wastewater Treatment and Disposal

The global industrial wastewater treatment industry is expanding at a rapid pace and a large amount of wastewater is generated from industrialisation and municipal sewages. Alarming rate of industrial pollution compel environmental regulatory boards to set certain norms and regulations for wastewater treatment and standards for effluent discharge.

It has thus become imperative for companies to have operating treatment plants to meet stringent environmental standards. With regulatory screws tightening, zero liquid discharge is highly likely to remain in demand within the wastewater treatment industry during the forecast period.

Growing Awareness About Wastewater Effluent Treatment

The awareness regarding proper and effective treatment and disposal of wastewater effluents has been notably increased over the recent past. Regulatory bodies governing wastewater discharge limits in various countries across the globe have been setting and implementing stringent policies and guidelines for industrial plants to meet zero liquid discharge norms to attenuate water quality issues in their countries. This has been strongly driving the growth of zero liquid discharge market as manufacturing sites and municipal bodies also strive to meet the obligatory norms and legislations. For instance, ZLD mandates set by the EU Water Framework Directive, and the Effluent Limitation Guidelines (ELGs) set by the Environment Protection Agency in the US (EPA).

Growth Challenges

Cost and Space Constraints Continue to Restrict Application Potential of ZLD

A majority of zero liquid discharge processes are based on thermal processing that consists of the energy-intensive evaporation process. The process is used to recover reusable water from wastewater streams. The usage of custom-designed zero liquid discharge plants built according to end-use requirements entails substantial operating and capital costs.

The cost and efforts linked with the management and handling of solid waste generated at the end of the treatment are still playing out as an impediment to broader adoption of these units across industries. Space constraint is another major factor posing a limitation to installation of zero liquid discharge plants. The recovery cost of zero liquid discharge plants is significantly high, which currently makes it a feasible alternative for only a limited chunk of industrial players.

Overview of Key Segments

Energy and Power Industry Remains the Leading Demand Generating Category

As suggested by the end-use industry-wise analysis of the zero liquid discharge market, the energy and power industry sectors hold prominent shares in terms of consumption. The category currently leads with a share of more than 50% in the overall market value pie. The other end-use segments include chemicals and petrochemicals, pharmaceuticals, food and beverages, and textile.

While the dominance of energy and power industry is owing to the high ZLD adoption in line with the implementation of rigid environmental regulations on wastewater discharge, the energy and power industry, along with chemical and petrochemical industries, holds more than 65% share in global ZLD market valuation. The latter reportedly held a major share in the zero liquid discharge market till 2019.

Growth Opportunities Across Regions

Asia Pacific Holds the Lion’s Share till 2025

Till 2019, Asia Pacific has been a significant regional market for players in global zero liquid discharge landscape, which is clearly attributable to scarcity of freshwater sources in the region and growing implementation of strict environmental policies regarding wastewater. Market share of the region is projected to increase significantly due to the growth in chemical and energy and power industries in fast-developing countries such as China, and India.

Governments of these countries are increasingly particular about industries setting up ZLD systems for wastewater treatment, which is a strong factor driving zero liquid discharge market growth in Asia Pacific. From demand side, both North America, and Europe are matured markets as they have had an established framework of strict environmental laws and regulations towards curbing water pollution.

In the US, the Clean Water Act prohibits any entity from discharging pollutants through a point source without the National Pollutant Discharge Elimination System (NPDES) permit. In these regions, Environmental authorities in the region have enacted strict laws and regulations to curb pollution. Thus, it is mandatory for the energy and power industry to treat wastewater and establish in-house wastewater treatment plants.

In the US, the NPDES permit programme controls water pollution by regulating point sources that discharge pollutants into water bodies. This permit mandates industries to implement ZLD system installation, which provides an impetus to zero liquid discharge market. The Middle East and Africa and Latin America are also expected to develop lucrative markets for ZLD during the forecast period.

Zero Liquid Discharge Market: Competitive Landscape

Some of the key players involved in zero liquid discharge market include Veolia, ALFA LAVAL, GEA Group Aktiengesellschaft, SUEZ, Thermax Limited, Praj Industries, Aquatech International LLC, and Oasys Water.

Notable Developments

- Earlier in July 2018, GEA Group Aktiengesellschaft supplied a ZLD plant to Mexico-based Abengoa. The ZLD plant is used to convert salt-laden wastewater into pure water for internal recycling and dry solids for disposal. The company had offered thermal and non-thermal technologies for ZLD applications such as centrifugal separators, membrane concentrators, evaporators, crystallizers, and dryers

- In April 2021, Praj Industries has bagged an order from Godavari Biorefineries Ltd (GBL, Karnataka, India) to set up a syrup-based ethanol plant with the largest capacity in India. As a part of this project, the former will expand its existing ethanol manufacturing capacity of GBL to 600 kilo litres per day, using sugarcane syrup. The expansion capacity at GBL will continue to be a zero liquid discharge facility

The Global Zero Liquid Discharge (ZLD) Market is Segmented as Below:

By End-user Industry Coverage

- Energy & Power

- Food & Beverage

- Chemical & Petrochemicals

- Textiles

- Pharmaceutical

- Others

By Geographical Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Rest of the World (RoW)

- GCC

- South Africa

- Mexico

- Others

Leading Companies

- Veolia

- GEA Group Aktiengesellschaft

- SEUZ

- Thermax Global

- ALFA LAVAL

- Praj Industries

- Aquatech International LLC

- ENCON Evaporators

- AQUARION AG.

- 3V Green Eagle S.p.A.

- Oasys Water

- Kelvin Water Technologies Pvt. Ltd.

Inside This Report You Will Find:

1. Executive Summary

2. Market Overview

3. Global Zero Liquid Discharge (ZLD):Micro/Macro Economic Factors

4. Global Zero Liquid Discharge (ZLD) Market Outlook, 2018 - 2026

5. North America Zero Liquid Discharge (ZLD) Market Outlook, 2018 - 2026

6. Europe Zero Liquid Discharge (ZLD) Market Outlook, 2018 - 2026

7. Asia Pacific Zero Liquid Discharge (ZLD) Market Outlook, 2018 - 2026

8. Rest of the World (RoW) Zero Liquid Discharge (ZLD) Market Outlook, 2018 - 2026

9. Competitive Landscape

10. Appendix

Post Sale Support, Research Updates & Offerings:

We value the trust shown by our customers in Fairfield Market Research. We support our clients through our post sale support, research updates and offerings.

- The report will be prepared in a PPT format and will be delivered in a PDF format.

- Additionally, Market Estimation and Forecast numbers will be shared in Excel Workbook.

- If a report being sold was published over a year ago, we will offer a complimentary copy of the updated research report along with Market Estimation and Forecast numbers within 2-3 weeks’ time of the sale.

- If we update this research study within the next 2 quarters, post purchase of the report, we will offer a Complimentary copy of the updated Market Estimation and Forecast numbers in Excel Workbook.

- If there is a geopolitical conflict, pandemic, recession, and the like which can impact global economic scenario and business activity, which might entirely alter the market dynamics or future projections in the industry, we will create a Research Update upon your request at a nominal charge.

1. Executive Summary

1.1. Global Zero Liquid Discharge (ZLD) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.2.4. Economic Trends

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis & PEST Analysis

2.5. Covid-19 Impact

2.5.1. Supply Chain

2.5.2. End-user Customer Impact Analysis

3. Global Zero Liquid Discharge (ZLD):Micro/Macro Economic Factors

4. Global Zero Liquid Discharge (ZLD) Market Outlook, 2018-2026

4.1. Global Zero Liquid Discharge (ZLD) Market Outlook, by End-user Industry, Value (US$ Mn) 2018-2026

4.1.1. Key Highlights

4.1.1.1. Energy & Power

4.1.1.2. Food & Beverage

4.1.1.3. Chemical & Petrochemicals

4.1.1.4. Textiles

4.1.1.5. Pharmaceutical

4.1.1.6. Others

4.1.2. BPS Analysis/Market Attractiveness Analysis, by End-user Industry

4.2. Global Zero Liquid Discharge (ZLD) Market Outlook, by Region, Value (US$ Mn) 2018-2026

4.2.1. Key Highlights

4.2.1.1. North America

4.2.1.2. Europe

4.2.1.3. Asia Pacific

4.2.1.4. Rest of the World (RoW)

4.2.2. BPS Analysis/Market Attractiveness Analysis, by Region

5. North America Zero Liquid Discharge (ZLD) Market Outlook, 2018-2026

5.1. North America Zero Liquid Discharge (ZLD) Market Outlook, by End-user Industry, Value (US$ Mn) 2018-2026

5.1.1. Key Highlights

5.1.1.1. Energy & Power

5.1.1.2. Food & Beverage

5.1.1.3. Chemical & Petrochemicals

5.1.1.4. Textiles

5.1.1.5. Pharmaceutical

5.1.1.6. Others

5.2. North America Zero Liquid Discharge (ZLD) Market Outlook, by Country, Value (US$ Mn) 2018-2026

5.2.1. Key Highlights

5.2.1.1. U.S. Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

5.2.1.2. Canada Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

6. Europe Zero Liquid Discharge (ZLD) Market Outlook, 2018-2026

6.1. Europe Zero Liquid Discharge (ZLD) Market Outlook, by End-user Industry, Value (US$ Mn) 2018-2026

6.1.1. Key Highlights

6.1.1.1. Energy & Power

6.1.1.2. Food & Beverage

6.1.1.3. Chemical & Petrochemicals

6.1.1.4. Textiles

6.1.1.5. Pharmaceutical

6.1.1.6. Others

6.2. Europe Zero Liquid Discharge (ZLD) Market Outlook, by Country, Value (US$ Mn) 2018-2026

6.2.1. Key Highlights

6.2.1.1. Germany Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

6.2.1.2. France Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

6.2.1.3. U.K. Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

6.2.1.4. Rest of Europe Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

7. Asia Pacific Zero Liquid Discharge (ZLD) Market Outlook, 2018-2026

7.1. Asia Pacific Zero Liquid Discharge (ZLD) Market Outlook, by End-user Industry, Value (US$ Mn) 2018-2026

7.1.1. Key Highlights

7.1.1.1. Energy & Power

7.1.1.2. Food & Beverage

7.1.1.3. Chemical & Petrochemicals

7.1.1.4. Textiles

7.1.1.5. Pharmaceutical

7.1.1.6. Others

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Asia Pacific Zero Liquid Discharge (ZLD) Market Outlook, by Country, Value (US$ Mn) 2018-2026

7.2.1. Key Highlights

7.2.1.1. China Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

7.2.1.2. India Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

7.2.1.3. Japan Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

7.2.1.4. Rest of Asia Pacific Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

8. Rest of the World (RoW) Zero Liquid Discharge (ZLD) Market Outlook, 2018-2026

8.1. Rest of the World (RoW) Zero Liquid Discharge (ZLD) Market Outlook, by End-user Industry, Value (US$ Mn) 2018-2026

8.1.1. Key Highlights

8.1.1.1. Energy & Power

8.1.1.2. Food & Beverage

8.1.1.3. Chemical & Petrochemicals

8.1.1.4. Textiles

8.1.1.5. Pharmaceutical

8.1.1.6. Others

8.1.2. BPS Analysis/Market Attractiveness Analysis

8.2. Rest of the World (RoW) Zero Liquid Discharge (ZLD) Market Outlook, by Country, Value (US$ Mn) 2018-2026

8.2.1. Key Highlights

8.2.1.1. GCC Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

8.2.1.2. South Africa Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

8.2.1.3. Mexico Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

8.2.1.4. Others Zero Liquid Discharge (ZLD) Market, Value (US$ Mn) by End-user Industry, by End-user Industry - 2018-2026

9. Competitive Landscape

9.1. Company Market Share Analysis, 2020

9.2. Strategic Collaborations

9.3. Company Profiles

9.3.1. Veolia

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. GEA Group Aktiengesellschaft

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. SEUZ

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Thermax Global

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. ALFA LAVAL

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Praj Industries

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Aquatech International LLC

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. ENCON Evaporators

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. AQUARION AG.

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. 3V Green Eagle S.p.A.

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Oasys Water

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Kelvin Water Technologies Pvt. Ltd.

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

|

2020 |

|

2018 - 2019 |

|

2021 - 2026 |

Value: US$ Million |

|

REPORT FEATURES |

DETAILS |

|

End-user Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, PEST Analysis, Historical Trend (2018-2019), Price Trend Analysis- 2018-2026, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |