Zero Waste Packaging Market Growth and Industry Forecast

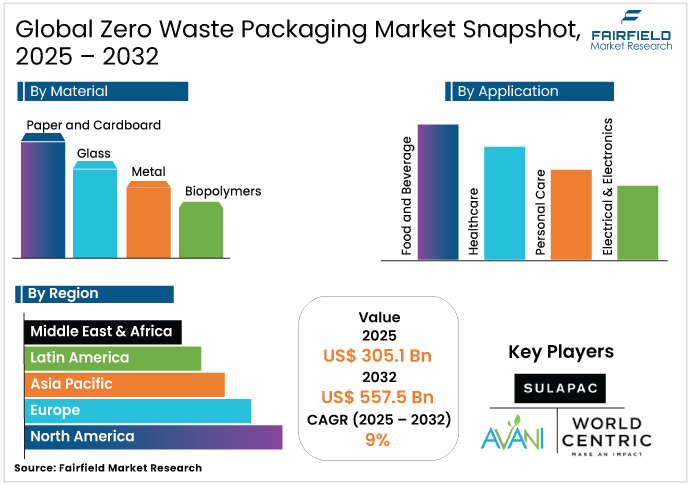

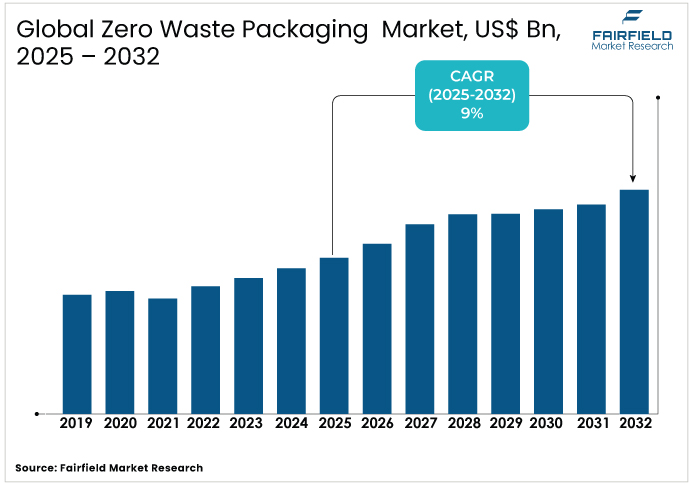

- Zero Waste Packaging Market size projected to reach US$ 557.5 Bn by 2032, showing significant growth from the US$ 305.1 Bn estimated in 2025.

- Market revenue projected to exhibit a strong growth trajectory, with an estimated CAGR of 9% during 2025–2032.

Zero Waste Packaging Market Summary: Key Insights & Trends

- Re-usable packaging leads the type segment, accounting for 48% share in 2025 due to durability, cost-efficiency, and sustainability mandates.

- Edible packaging is the fastest-growing type, expanding at a CAGR of 12% through 2032, supported by innovations from companies such as Loliware and Notpla.

- Paper and cardboard lead the material segment with a 50% market share in 2025, driven by recyclability and use across personal care and food sectors.

- Biopolymers are the fastest-growing material type, forecasted to grow at 14% CAGR due to advancements in PLA and PHA for sustainable packaging solutions.

- The food and beverage sector dominates applications with a 43% share in 2025, fueled by consumer demand for compostable and edible packaging.

- Personal care is the fastest-growing application segment, expanding at a CAGR of 10%, as brands shift toward reusable and biopolymer-based formats.

- The online retail channel is growing the fastest, with a 14% CAGR projected through 2032, driven by e-commerce demand for eco-friendly delivery packaging.

- Asia Pacific is the fastest-growing region, with a projected 12% CAGR, supported by policy reforms in China and India and a booming e-commerce market.

A Look Back and a Look Forward - Comparative Analysis

From 2019 to 2024, the Zero Waste Packaging Market grew steadily, fueled by rising environmental awareness and regulatory shifts toward sustainability. The COVID-19 pandemic disrupted supply chains, increasing reliance on single-use plastics for hygiene, which temporarily slowed progress. Post-pandemic, demand for compostable and reusable packaging surged, driven by e-commerce growth and innovations in biopolymers. Companies such as Unilever adopted sustainable packaging goals, boosting market momentum.

Growth is expected to continue at a CAGR of 9%, reaching US$ 557.5 billion by 2032. Key growth drivers include advancements in edible and biodegradable packaging technologies, along with stringent international regulations aimed at reducing plastic waste. Increasing consumer preference for environmentally responsible products, especially in food and beverage applications, will also play a crucial role. Additionally, the expansion of online retail is expected to enhance demand for sustainable delivery and shipping solutions.

Key Growth Drivers

- Environmental Awareness Spurs Demand for Sustainable and Zero-Waste Packaging Solutions

Growing consumer concern about plastic pollution, with over 8 million metric tons entering oceans annually, drives demand for sustainable packaging. Millennials and Gen Z prioritize eco-friendly products, pushing brands such as Nestlé to commit to 100% recyclable or compostable packaging by 2030. Social media campaigns amplify awareness, encouraging sustainable purchasing. Companies adopting zero-waste solutions gain consumer loyalty, enhancing market growth. The Zero Waste Packaging Market thrives as businesses align with these values to meet rising demand for eco-conscious products.

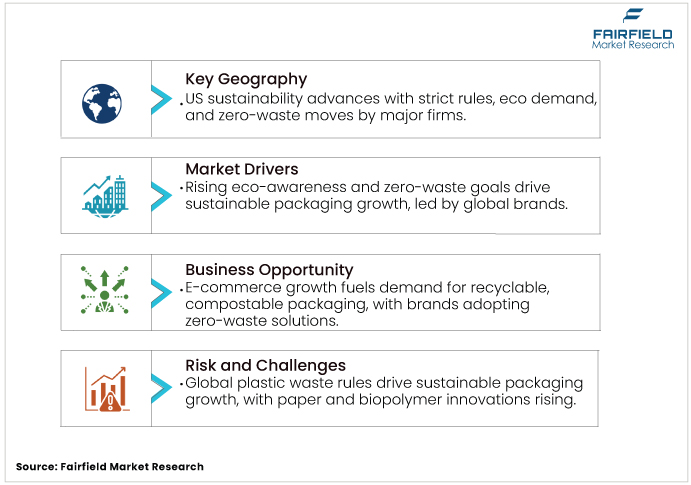

- Global Regulations Drive Shift Toward Recyclable and Compostable Packaging Materials

Governments globally are enforcing regulations to reduce plastic waste, boosting the adoption of sustainable packaging. The EU’s Single-Use Plastics Directive bans certain disposables, promoting reusable and compostable options. In the U.S., states such as California mandate recyclable packaging by 2030. These policies incentivize innovation in materials such as paper and biopolymers. Non-compliance penalties push companies to adopt eco-friendly solutions.

- Innovative Biopolymers and Edible Packaging Accelerate Eco-Friendly Market Expansion

Innovations in biopolymers and edible packaging propel market growth. Biopolymers such as PLA, with a projected production capacity, offer biodegradable alternatives. Edible packaging, made from seaweed or starch, gains traction in food applications. Companies such as Notpla develop compostable solutions, reducing landfill waste. These advancements improve material durability and scalability, meeting consumer demand.

Key Growth Restraints

- High Production Costs Limit Adoption of Sustainable Packaging Materials at Scale

Sustainable materials such as biopolymers and edible packaging are 20–30% more expensive to produce than conventional plastics, limiting adoption. Small-scale production and limited raw material availability, such as seaweed for edible packaging, increase costs. Small and medium enterprises struggle to afford these solutions, slowing market penetration. Scaling production and optimizing supply chains are critical to reducing costs.

- Low Awareness in Emerging Markets Hinders Zero-Waste Packaging Adoption

In emerging economies such as South Asia and Africa, low awareness of zero-waste benefits restricts market growth. Consumers often prioritize affordability over sustainability, reducing demand for eco-friendly packaging. For example, only 30% of plastic waste in India is recycled, reflecting limited engagement. Inadequate recycling infrastructure and lack of education further hinder adoption. The Zero Waste Packaging Market requires targeted campaigns to increase awareness and drive demand in these regions.

Zero Waste Packaging Market Trends and Opportunities

- E-Commerce Growth Fuels Demand for Eco-Friendly and Compostable Packaging Solutions

The rise of e-commerce, with global online retail sales projected to grow at 9% - 13% annually, creates opportunities for sustainable packaging. Consumers demand eco-friendly delivery options, prompting companies such as Amazon to adopt recyclable and compostable materials. Innovations such as paper-based mailers and biopolymer cushioning gain traction. Startups such as Hero Packaging offer compostable solutions for e-commerce. Partnerships between retailers and sustainable packaging providers can optimize supply chains. Developing scalable, cost-effective packaging tailored for online retail will drive expansion in the Zero Waste Packaging Market, meeting the needs of eco-conscious consumers.

- Emerging Economies Offer Strong Potential for Sustainable Packaging Market Expansion

Rapid urbanization and rising incomes in Asia Pacific countries such as India and China offer growth potential. India’s packaging market is expected to grow at a 24% CAGR through 2030, with zero-waste solutions gaining traction. Government initiatives, such as India’s Swachh Bharat Mission, promote waste reduction, encouraging compostable packaging. Local startups such as Avani Eco scale biodegradable solutions to meet regional demand. Investing in localized production and affordable materials can capture market share.

Segment-wise Trends & Analysis

- Re-usable Packaging Leads While Edible Formats See Rapid Market Growth

Re-usable packaging dominates, holding a 48% share in the zero waste packaging industry due to its durability, cost-effectiveness over multiple use cycles, and strong alignment with circular economy goals. Growing consumer awareness and regulatory push for sustainable alternatives further accelerate its adoption. Edible packaging, the fastest-growing segment, is projected to grow at a 12% CAGR, driven by innovations such as seaweed-based wrappers. Companies such as Loliware Inc. expand edible packaging applications, enhancing consumer appeal and market growth.

- Paper and Cardboard Dominate Biopolymers Experience Fastest Growth Rate

Paper and cardboard lead, accounting for 50% of share in 2025, due to their recyclability and widespread use in food and beverage packaging. Their cost-effectiveness and scalability drive adoption. Biopolymers, the fastest-growing material, are expected to grow at a 10% CAGR, fueled by advancements in PLA and PHA (polyhydroxyalkanoates). These biodegradable materials meet the rising demand for sustainable alternatives.

- Food and Beverage Sector Leads Personal Care Gains Growth Momentum

The food and beverage sector leads, comprising 43% of the Zero Waste Packaging Market, driven by demand for compostable and edible packaging. Consumer preference for sustainable food packaging fuels growth. Personal care is the fastest-growing application, with a 10% CAGR, as brands adopt reusable and biopolymer-based packaging to meet eco-conscious consumer demands, expanding market opportunities.

- Offline Retail Dominates While Online Channel Sees Strongest Market Surge

Offline retail dominates, holding over 60% of the market for zero-waste packaging, due to its established presence in supermarkets and specialty stores. Consumer access to sustainable products drives sales. Online retail is the fastest-growing channel, with a 14% CAGR, fueled by e-commerce growth and demand for eco-friendly delivery packaging, enhancing market reach.

Regional Trends & Analysis

- North America Leads with US Regulations and Zero Waste Brand Adoption

The United States leads sustainability efforts in North America, driven by strict regulations and rising consumer demand for eco-friendly solutions. California plays a key role with mandates on recyclable packaging and bans on single-use plastics, encouraging businesses to adopt compostable alternatives. Major companies such as Procter & Gamble have committed to zero-waste strategies, accelerating the shift toward environmentally responsible practices. Growing innovation in recyclable and biodegradable materials further supports this transition. With strong regulatory backing and increasing public awareness, the region is expected to continue its upward momentum, projected to expand at a CAGR of 8% through 2032.

- Europe Driven by Germany and UK Sustainability Policies and Demand

Germany and the U.K. are at the forefront of sustainability efforts in Europe, driven by the EU’s Single-Use Plastics Directive and robust recycling infrastructure. Germany’s emphasis on circular economy practices is accelerating the adoption of compostable and reusable packaging solutions. Meanwhile, growing consumer demand for environmentally friendly products in the U.K. is fostering innovation across industries. These combined efforts are pushing manufacturers to explore alternative materials and scalable green technologies.

- Asia Pacific Growth Fueled by China India Reforms and E Commerce

China and India dominate the Asia Pacific Zero Waste Packaging Market, driven by rapid urbanization and government initiatives. China’s plastic waste reduction policies and India’s Swachh Bharat Mission promote sustainable packaging. Rising consumer awareness and e-commerce growth fuel demand, with the region expected to grow at a 12% CAGR.

Competitive Landscape Analysis

Major players such as DS Smith plc, Sulapac Oy, and Notpla Limited lead the Zero Waste Packaging Market through innovation and sustainability. DS Smith focuses on recyclable paper-based solutions, while Sulapac Oy develops biopolymer packaging. Notpla pioneers edible and compostable materials, aligning with consumer and regulatory demands.

Key Market Companies

- Sulapac Oy

- Avani Eco

- World Centric

- Biome Bioplastics Limited

- Loliware Inc.

- Regeno

- DS Smith plc

- Ecovative LLC

- Hero Packaging

- Notpla Limited

- BIOPLA

- Evoware

- TIPA

Recent Development

- April 9, 2025:DS Smith Launched the GoChill Cooler, a 100% recyclable and reusable cooler made from wax-free corrugated board using GreenCoat® technology, offering food-grade cooling performance while reducing reliance on plastic and Styrofoam

- January 2025: Notpla supplied seaweed-coated, biodegradable boxes for Wimbledon’s strawberries and cream, partnering with Compass Group UK. The initiative showcases scalable, compostable packaging for foodservice. This development enhances Notpla’s influence in the Zero Waste Packaging Market, promoting eco-friendly alternatives.

Global Zero Waste Packaging Market Segmentation-

By Type

- Re-Usable Packaging

- Compostable Packaging

- Edible Packaging

By Material

- Paper and Cardboard

- Glass

- Metal

- Biopolymers

By Application

- Food and Beverage

- Healthcare

- Personal Care

- Electrical & Electronics

- Others

By Distribution Channel

- Offline Retail

- Online Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Zero Waste Packaging Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Zero Waste Packaging Market Outlook, 2019 - 2032

3.1. Global Zero Waste Packaging Market Outlook, By Type, Value (US$ Bn), 2019-2032

3.1.1. Re-Usable Packaging

3.1.2. Compostable Packaging

3.1.3. Edible Packaging

3.2. Global Zero Waste Packaging Market Outlook, By Material, Value (US$ Bn), 2019-2032

3.2.1. Paper and Cardboard

3.2.2. Glass

3.2.3. Metal

3.2.4. Biopolymers

3.3. Global Zero Waste Packaging Market Outlook, By Application, Value (US$ Bn), 2019-2032

3.3.1. Food and Beverage

3.3.2. Healthcare

3.3.3. Personal Care

3.3.4. Electrical & Electronics

3.3.5. Others

3.4. Global Zero Waste Packaging Market Outlook, By Distribution Channel, Value (US$ Bn), 2019-2032

3.4.1. Offline Retail

3.4.2. Online Retail

3.5. Global Zero Waste Packaging Market Outlook, by Region, Value (US$ Bn), 2019-2032

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Latin America

3.5.5. Middle East & Africa

4. North America Zero Waste Packaging Market Outlook, 2019 - 2032

4.1. North America Zero Waste Packaging Market Outlook, By Type, Value (US$ Bn), 2019-2032

4.1.1. Re-Usable Packaging

4.1.2. Compostable Packaging

4.1.3. Edible Packaging

4.2. North America Zero Waste Packaging Market Outlook, By Material, Value (US$ Bn), 2019-2032

4.2.1. Paper and Cardboard

4.2.2. Glass

4.2.3. Metal

4.2.4. Biopolymers

4.3. North America Zero Waste Packaging Market Outlook, By Application, Value (US$ Bn), 2019-2032

4.3.1. Food and Beverage

4.3.2. Healthcare

4.3.3. Personal Care

4.3.4. Electrical & Electronics

4.3.5. Others

4.4. North America Zero Waste Packaging Market Outlook, By Distribution Channel, Value (US$ Bn), 2019-2032

4.4.1. Offline Retail

4.4.2. Online Retail

4.5. North America Zero Waste Packaging Market Outlook, by Country, Value (US$ Bn), 2019-2032

4.5.1. U.S. Zero Waste Packaging Market Outlook, By Type, 2019-2032

4.5.2. U.S. Zero Waste Packaging Market Outlook, By Material, 2019-2032

4.5.3. U.S. Zero Waste Packaging Market Outlook, By Application, 2019-2032

4.5.4. U.S. Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

4.5.5. Canada Zero Waste Packaging Market Outlook, By Type, 2019-2032

4.5.6. Canada Zero Waste Packaging Market Outlook, By Material, 2019-2032

4.5.7. Canada Zero Waste Packaging Market Outlook, By Application, 2019-2032

4.5.8. Canada Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

4.6. BPS Analysis/Market Attractiveness Analysis

5. Europe Zero Waste Packaging Market Outlook, 2019 - 2032

5.1. Europe Zero Waste Packaging Market Outlook, By Type, Value (US$ Bn), 2019-2032

5.1.1. Re-Usable Packaging

5.1.2. Compostable Packaging

5.1.3. Edible Packaging

5.2. Europe Zero Waste Packaging Market Outlook, By Material, Value (US$ Bn), 2019-2032

5.2.1. Paper and Cardboard

5.2.2. Glass

5.2.3. Metal

5.2.4. Biopolymers

5.3. Europe Zero Waste Packaging Market Outlook, By Application, Value (US$ Bn), 2019-2032

5.3.1. Food and Beverage

5.3.2. Healthcare

5.3.3. Personal Care

5.3.4. Electrical & Electronics

5.3.5. Others

5.4. Europe Zero Waste Packaging Market Outlook, By Distribution Channel, Value (US$ Bn), 2019-2032

5.4.1. Offline Retail

5.4.2. Online Retail

5.5. Europe Zero Waste Packaging Market Outlook, by Country, Value (US$ Bn), 2019-2032

5.5.1. Germany Zero Waste Packaging Market Outlook, By Type, 2019-2032

5.5.2. Germany Zero Waste Packaging Market Outlook, By Material, 2019-2032

5.5.3. Germany Zero Waste Packaging Market Outlook, By Application, 2019-2032

5.5.4. Germany Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

5.5.5. Italy Zero Waste Packaging Market Outlook, By Type, 2019-2032

5.5.6. Italy Zero Waste Packaging Market Outlook, By Material, 2019-2032

5.5.7. Italy Zero Waste Packaging Market Outlook, By Application, 2019-2032

5.5.8. Italy Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

5.5.9. France Zero Waste Packaging Market Outlook, By Type, 2019-2032

5.5.10. France Zero Waste Packaging Market Outlook, By Material, 2019-2032

5.5.11. France Zero Waste Packaging Market Outlook, By Application, 2019-2032

5.5.12. France Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

5.5.13. U.K. Zero Waste Packaging Market Outlook, By Type, 2019-2032

5.5.14. U.K. Zero Waste Packaging Market Outlook, By Material, 2019-2032

5.5.15. U.K. Zero Waste Packaging Market Outlook, By Application, 2019-2032

5.5.16. U.K. Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

5.5.17. Spain Zero Waste Packaging Market Outlook, By Type, 2019-2032

5.5.18. Spain Zero Waste Packaging Market Outlook, By Material, 2019-2032

5.5.19. Spain Zero Waste Packaging Market Outlook, By Application, 2019-2032

5.5.20. Spain Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

5.5.21. Russia Zero Waste Packaging Market Outlook, By Type, 2019-2032

5.5.22. Russia Zero Waste Packaging Market Outlook, By Material, 2019-2032

5.5.23. Russia Zero Waste Packaging Market Outlook, By Application, 2019-2032

5.5.24. Russia Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

5.5.25. Rest of Europe Zero Waste Packaging Market Outlook, By Type, 2019-2032

5.5.26. Rest of Europe Zero Waste Packaging Market Outlook, By Material, 2019-2032

5.5.27. Rest of Europe Zero Waste Packaging Market Outlook, By Application, 2019-2032

5.5.28. Rest of Europe Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

5.6. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Zero Waste Packaging Market Outlook, 2019 - 2032

6.1. Asia Pacific Zero Waste Packaging Market Outlook, By Type, Value (US$ Bn), 2019-2032

6.1.1. Re-Usable Packaging

6.1.2. Compostable Packaging

6.1.3. Edible Packaging

6.2. Asia Pacific Zero Waste Packaging Market Outlook, By Material, Value (US$ Bn), 2019-2032

6.2.1. Paper and Cardboard

6.2.2. Glass

6.2.3. Metal

6.2.4. Biopolymers

6.3. Asia Pacific Zero Waste Packaging Market Outlook, By Application, Value (US$ Bn), 2019-2032

6.3.1. Food and Beverage

6.3.2. Healthcare

6.3.3. Personal Care

6.3.4. Electrical & Electronics

6.3.5. Others

6.4. Asia Pacific Zero Waste Packaging Market Outlook, By Distribution Channel, Value (US$ Bn), 2019-2032

6.4.1. Offline Retail

6.4.2. Online Retail

6.5. Asia Pacific Zero Waste Packaging Market Outlook, by Country, Value (US$ Bn), 2019-2032

6.5.1. China Zero Waste Packaging Market Outlook, By Type, 2019-2032

6.5.2. China Zero Waste Packaging Market Outlook, By Material, 2019-2032

6.5.3. China Zero Waste Packaging Market Outlook, By Application, 2019-2032

6.5.4. China Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

6.5.5. Japan Zero Waste Packaging Market Outlook, By Type, 2019-2032

6.5.6. Japan Zero Waste Packaging Market Outlook, By Material, 2019-2032

6.5.7. Japan Zero Waste Packaging Market Outlook, By Application, 2019-2032

6.5.8. Japan Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

6.5.9. South Korea Zero Waste Packaging Market Outlook, By Type, 2019-2032

6.5.10. South Korea Zero Waste Packaging Market Outlook, By Material, 2019-2032

6.5.11. South Korea Zero Waste Packaging Market Outlook, By Application, 2019-2032

6.5.12. South Korea Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

6.5.13. India Zero Waste Packaging Market Outlook, By Type, 2019-2032

6.5.14. India Zero Waste Packaging Market Outlook, By Material, 2019-2032

6.5.15. India Zero Waste Packaging Market Outlook, By Application, 2019-2032

6.5.16. India Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

6.5.17. Southeast Asia Zero Waste Packaging Market Outlook, By Type, 2019-2032

6.5.18. Southeast Asia Zero Waste Packaging Market Outlook, By Material, 2019-2032

6.5.19. Southeast Asia Zero Waste Packaging Market Outlook, By Application, 2019-2032

6.5.20. Southeast Asia Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

6.5.21. Rest of SAO Zero Waste Packaging Market Outlook, By Type, 2019-2032

6.5.22. Rest of SAO Zero Waste Packaging Market Outlook, By Material, 2019-2032

6.5.23. Rest of SAO Zero Waste Packaging Market Outlook, By Application, 2019-2032

6.5.24. Rest of SAO Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

6.6. BPS Analysis/Market Attractiveness Analysis

7. Latin America Zero Waste Packaging Market Outlook, 2019 - 2032

7.1. Latin America Zero Waste Packaging Market Outlook, By Type, Value (US$ Bn), 2019-2032

7.1.1. Re-Usable Packaging

7.1.2. Compostable Packaging

7.1.3. Edible Packaging

7.2. Latin America Zero Waste Packaging Market Outlook, By Material, Value (US$ Bn), 2019-2032

7.2.1. Paper and Cardboard

7.2.2. Glass

7.2.3. Metal

7.2.4. Biopolymers

7.3. Latin America Zero Waste Packaging Market Outlook, By Application, Value (US$ Bn), 2019-2032

7.3.1. Food and Beverage

7.3.2. Healthcare

7.3.3. Personal Care

7.3.4. Electrical & Electronics

7.3.5. Others

7.4. Latin America Zero Waste Packaging Market Outlook, By Distribution Channel, Value (US$ Bn), 2019-2032

7.4.1. Offline Retail

7.4.2. Online Retail

7.5. Latin America Zero Waste Packaging Market Outlook, by Country, Value (US$ Bn), 2019-2032

7.5.1. Brazil Zero Waste Packaging Market Outlook, By Type, 2019-2032

7.5.2. Brazil Zero Waste Packaging Market Outlook, By Material, 2019-2032

7.5.3. Brazil Zero Waste Packaging Market Outlook, By Application, 2019-2032

7.5.4. Brazil Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

7.5.5. Mexico Zero Waste Packaging Market Outlook, By Type, 2019-2032

7.5.6. Mexico Zero Waste Packaging Market Outlook, By Material, 2019-2032

7.5.7. Mexico Zero Waste Packaging Market Outlook, By Application, 2019-2032

7.5.8. Mexico Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

7.5.9. Argentina Zero Waste Packaging Market Outlook, By Type, 2019-2032

7.5.10. Argentina Zero Waste Packaging Market Outlook, By Material, 2019-2032

7.5.11. Argentina Zero Waste Packaging Market Outlook, By Application, 2019-2032

7.5.12. Argentina Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

7.5.13. Rest of LATAM Zero Waste Packaging Market Outlook, By Type, 2019-2032

7.5.14. Rest of LATAM Zero Waste Packaging Market Outlook, By Material, 2019-2032

7.5.15. Rest of LATAM Zero Waste Packaging Market Outlook, By Application, 2019-2032

7.5.16. Rest of LATAM Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

7.6. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Zero Waste Packaging Market Outlook, 2019 - 2032

8.1. Middle East & Africa Zero Waste Packaging Market Outlook, By Type, Value (US$ Bn), 2019-2032

8.1.1. Re-Usable Packaging

8.1.2. Compostable Packaging

8.1.3. Edible Packaging

8.2. Middle East & Africa Zero Waste Packaging Market Outlook, By Material, Value (US$ Bn), 2019-2032

8.2.1. Paper and Cardboard

8.2.2. Glass

8.2.3. Metal

8.2.4. Biopolymers

8.3. Middle East & Africa Zero Waste Packaging Market Outlook, By Application, Value (US$ Bn), 2019-2032

8.3.1. Food and Beverage

8.3.2. Healthcare

8.3.3. Personal Care

8.3.4. Electrical & Electronics

8.3.5. Others

8.4. Middle East & Africa Zero Waste Packaging Market Outlook, By Distribution Channel, Value (US$ Bn), 2019-2032

8.4.1. Offline Retail

8.4.2. Online Retail

8.5. Middle East & Africa Zero Waste Packaging Market Outlook, by Country, Value (US$ Bn), 2019-2032

8.5.1. GCC Zero Waste Packaging Market Outlook, By Type, 2019-2032

8.5.2. GCC Zero Waste Packaging Market Outlook, By Material, 2019-2032

8.5.3. GCC Zero Waste Packaging Market Outlook, By Application, 2019-2032

8.5.4. GCC Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

8.5.5. South Africa Zero Waste Packaging Market Outlook, By Type, 2019-2032

8.5.6. South Africa Zero Waste Packaging Market Outlook, By Material, 2019-2032

8.5.7. South Africa Zero Waste Packaging Market Outlook, By Application, 2019-2032

8.5.8. South Africa Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

8.5.9. Egypt Zero Waste Packaging Market Outlook, By Type, 2019-2032

8.5.10. Egypt Zero Waste Packaging Market Outlook, By Material, 2019-2032

8.5.11. Egypt Zero Waste Packaging Market Outlook, By Application, 2019-2032

8.5.12. Egypt Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

8.5.13. Nigeria Zero Waste Packaging Market Outlook, By Type, 2019-2032

8.5.14. Nigeria Zero Waste Packaging Market Outlook, By Material, 2019-2032

8.5.15. Nigeria Zero Waste Packaging Market Outlook, By Application, 2019-2032

8.5.16. Nigeria Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

8.5.17. Rest of Middle East Zero Waste Packaging Market Outlook, By Type, 2019-2032

8.5.18. Rest of Middle East Zero Waste Packaging Market Outlook, By Material, 2019-2032

8.5.19. Rest of Middle East Zero Waste Packaging Market Outlook, By Application, 2019-2032

8.5.20. Rest of Middle East Zero Waste Packaging Market Outlook, By Distribution Channel, 2019-2032

8.6. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Sulapac Oy

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Avani Eco

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. World Centric

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Biome Bioplastics Limited

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. Loliware Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Regeno

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. DS Smith plc

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Ecovative LLC

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Hero Packaging

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Notpla Limited

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Material Coverage |

|

|

Application Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |