Agriculture Tires Market Growth and Industry Forecast

Agriculture Tires Market Summary: Key Insights & Trends

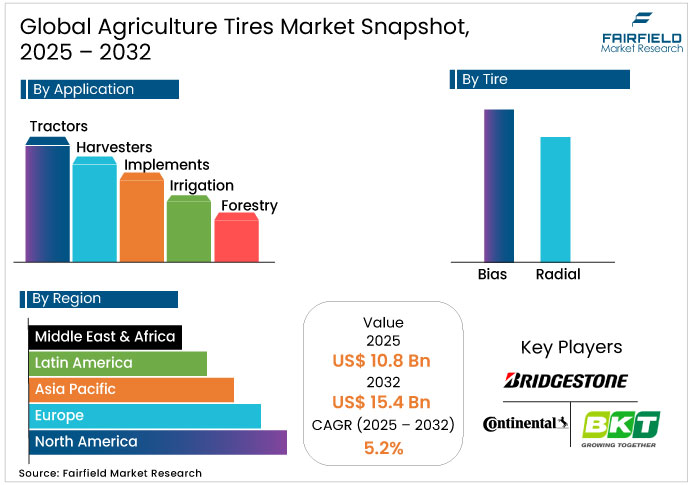

- Tractors dominate the agriculture tires market with around 50% share, reflecting their core role in plowing, tilling, and hauling applications.

- Harvesters represent the fastest-growing application segment, supported by the adoption of low-compaction tires for high-efficiency crop harvesting.

- Radial tires lead with over 50% share, driven by superior performance, durability, and traction in heavy-duty farm operations.

- Low-horsepower (0–80 HP) equipment holds more than 60% share, driven by widespread use across small and mid-sized farms globally.

- The aftermarket channel commands roughly 65% share, owing to frequent tire replacements and farmers’ preference for customized solutions.

- Smart tire integration emerges as a key opportunity, linking IoT-driven precision farming with performance optimization and sustainability.

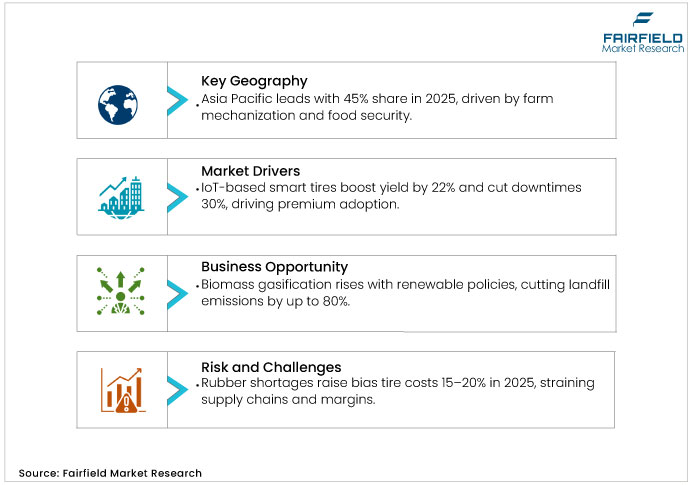

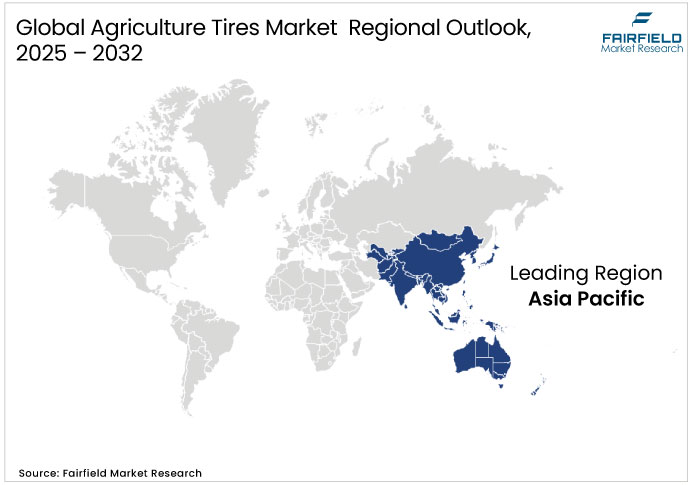

- Asia Pacific leads the global market with over 45% share, backed by large-scale mechanization programs in China and India.

- Europe stands out as the innovation hub, leading in VF and IF tire technologies under strict sustainability norms.

Key Growth Drivers

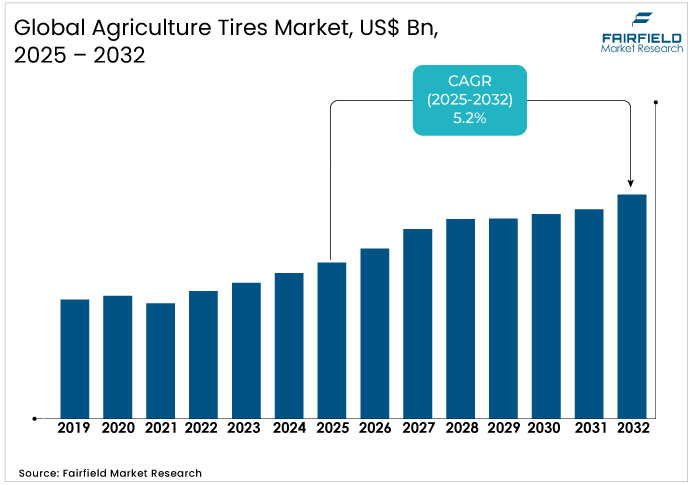

- Mechanization Surge Drives Global Demand for Advanced Agriculture Tires

Farmers worldwide increasingly adopt mechanized equipment to boost efficiency and yields, directly fueling demand. This shift reduces labor dependency, with global tractor registrations rising by 3.5% annually as per industry association data from 2022-2024. In theory, radial tires enhance soil protection and fuel savings by up to 10%, justifying investments in premium options. Emerging markets contribute significantly, where smallholder farmers transition to powered implements, amplifying tire replacement cycles. Overall, this driver sustains a robust ecosystem, linking equipment upgrades to tire innovation for long-term productivity gains.

- Smart and Sustainable Tire Innovations Revolutionize Modern Agricultural Practices

Innovations such as low-pressure and smart tires integrate sensors for real-time soil compaction monitoring, transforming the agriculture tires market. These developments cut operational costs by 15-20% through optimized traction, as evidenced by field trials from agricultural engineering bodies. Theoretically, nanotechnology in treads improves durability against harsh terrains, extending lifespan by 25%. Adoption accelerates in precision farming, where data-driven decisions minimize environmental impact. This driver not only elevates performance but also aligns with sustainability goals, positioning advanced tires as essential for modern agronomy.

Key Restraints

- Raw Material Instability Disrupts Rubber Supply and Increases Tire Production Costs

Fluctuations in natural rubber availability constrain bias tire production, elevating costs amid global shortages. Asia's dominance in rubber sourcing faces disruptions from weather events, pushing prices up 15-20% in 2025. Theoretically, this exposes supply chain vulnerabilities under just-in-time models, forcing diversification to synthetics. Manufacturers grapple with margin erosion, as aftermarket segments—holding 65% share—demand affordable options, yet delays hinder scalability.

- Environmental Regulations Intensify Challenges for Sustainable Agriculture Tire Development

Stringent emissions and sustainability challenges tire formulations in the agriculture tires market, increasing compliance burdens. EU directives on low-rolling-resistance designs add 5-8% to development costs, slowing innovation cycles. In practice, this restraint amplifies theoretical trade-offs in the Porter hypothesis, where regulations spur green tech but initially stifle short-term growth. The aftermarket's 65% dominance offers resilience, yet OEM integrations face delays, curbing overall momentum.

Agriculture Tires Market Trends and Opportunities

- Smart Tire Technologies Accelerate Precision Farming and Data-Driven Agricultural Efficiency

The surge in IoT-enabled farming opens avenues for smart tires with embedded sensors. USDA pilots demonstrate that sensor-equipped tires improve yield monitoring by 22%, based on 2024 field tests. Theoretically, real-time data analytics enable predictive maintenance, slashing unplanned downtimes by 30%. This convergence of agritech and tire engineering fosters premium pricing, with aftermarket upgrades projected to capture 20% more share by 2030. Regional policies, such as Brazil's digital ag initiatives, accelerate adoption, creating ecosystems where tire performance directly correlates with farm ROI.

- Rising Farm Mechanization in Emerging Economies Unlocks New Tire Opportunities

Developing economies' push for farm modernization presents untapped potential in the agriculture tires market. The FAO estimates a 25% mechanization uplift in Latin America by 2030, spurred by export-oriented crops. In theoretical terms, this leverages comparative advantages in land abundance, where affordable radial tires enhance productivity without excessive soil damage. Government subsidies in India, covering 50% of equipment costs, have driven a 14% tire import surge in 2024. Such dynamics not only bridge urban-rural divides but also integrate sustainable practices, such as low-compaction treads to combat erosion.

Segment-wise Trends & Analysis

- Tractors Dominate Agricultural Tire Demand as Harvesters Emerge as Fast-Growing Segment

Tractors command approximately 50% market share in the agriculture tires market in 2025, valued at US$ 5.4 billion, underscoring their pivotal role in core farming tasks. This leadership stems from tractors' ubiquity in plowing, tilling, and hauling, where deep-tread tires ensure traction across diverse soils.

Harvesters emerge as the fast-growing segment, with a projected CAGR of 6%, driven by seasonal intensification and crop diversification. Underlying factors include rising global food demand, prompting investments in efficient harvesting fleets that require low-compaction tires to protect yields. Competitionally, leaders such as Michelin position via radial-compatible designs, outpacing bias-focused rivals in durability, while aftermarket customization enhances farmer loyalty.

- Radial Tires Lead Market While Bias Variants Gain Emerging Momentum

Radial tires lead the market with over 50% share in 2025, equating to US$ 5.4 billion, due to their steel-belted construction offering superior flex and heat dissipation for heavy-duty use. This dominance reflects a theoretical shift toward performance optimization in mechanized operations.

Bias tires represent the emerging segment, gaining traction, fueled by cost sensitivity in developing regions where affordability trumps longevity. Drivers include raw material stabilization and eco-labeling for natural rubber variants. Positioning-wise, BKT excels in bias innovation for rough terrains, challenging radial incumbents through pricing strategies that capture 30% of low-HP equipment sales.

- Low-to-Mid Horsepower Equipment Drives Global Agricultural Tire Utilization Trends

The 0-80 HP category holds over 60% share in 2025, valued at US$ 6.5 billion within the agriculture tires market, as it caters to small-to-medium farms prevalent in 70% of global operations. Leadership arises from accessibility and versatility in mixed-crop settings.

The 80-200 HP segment emerges as fast-growing, propelled by mid-scale consolidation and precision tech integration demanding robust, low-resistance tires. Key drivers encompass subsidy programs boosting mid-HP acquisitions by 15%. Competitors such as Continental differentiate via OEM partnerships, securing 25% positioning in high-traction variants against aftermarket generalists.

- Aftermarket Retains Leadership as OEM Tire Sales Gain Rapid Traction

Aftermarket channels dominate with ~65% share in 2025, reaching US$ 7.0 billion in the agriculture tires industry, driven by frequent replacements and customization needs. This edge theoretically stems from farmers' preference for tailored fits over standardized OEM units.

OEM emerges rapidly, supported by rising new equipment sales amid farm upgrades. Growth factors include bundled warranties that reduce total ownership costs by 12%. Strategically, Titan International leads OEM through vertical integration, gaining 20% edge via just-in-time supply, while aftermarket players counter with digital inventory tools.

Regional Trends & Analysis

Asia Pacific Leads Global Agriculture Tire Demand with Expanding Mechanization Efforts

Asia Pacific dominates the global market with over 45% market share in 2025, driven by extensive mechanization programs across China, India, and Southeast Asian countries. The region benefits from government initiatives promoting agricultural modernization, substantial farmland areas requiring mechanized operations, and growing food security priorities driving equipment investment.

China Agriculture Tires Market - 2025 Snapshot & Outlook

China leads Asia Pacific with over 500,000 annual tractor sales requiring specialized tire solutions, supported by government policies promoting agricultural efficiency and food security. The market benefits from domestic tire manufacturing capacity expansion and increasing adoption of high-horsepower equipment requiring advanced tire technologies. Growing emphasis on sustainable farming practices drives demand for radial tires and low-pressure solutions that minimize soil compaction while supporting productivity objectives.

India Agriculture Tires Market - 2025 Snapshot & Outlook

India demonstrates the world's largest tractor market with over 900,000 units sold annually, creating substantial tire replacement and original equipment opportunities. The market is characterized by strong government subsidy programs supporting mechanization, increasing farmer adoption of advanced equipment, and growing preference for radial tire technology. Rural infrastructure development and improving farmer income levels support the transition toward premium tire solutions offering enhanced operational efficiency and extended service life.

North America Advances Agricultural Efficiency with Premium and Precision Tire Adoption

North America represents a high-value market characterized by advanced farming practices, large-scale operations, and preference for premium tire technologies supporting productivity optimization. The region demonstrates strong adoption of precision farming techniques requiring specialized tire solutions capable of supporting sophisticated agricultural equipment across diverse terrain conditions.

U.S. Agriculture Tires Market - 2025 Snapshot & Outlook

The U.S. market benefits from extensive mechanization, with over 217,000 annual tractor sales supporting robust tire demand across diverse agricultural regions. Government infrastructure investments and agricultural support programs create favorable conditions for equipment modernization, requiring advanced tire technologies. The market emphasizes performance characteristics, including fuel efficiency, soil protection, and extended operational life, driving preference for radial and specialty tire solutions.

Europe Leads Agricultural Tire Innovation Through Sustainable and Precision Technologies

Europe maintains leadership in agricultural tire innovation, with Germany and France accounting for nearly 30% of European agricultural equipment registrations requiring specialized tire solutions. The region prioritizes sustainable farming practices and environmental protection, creating demand for eco-friendly tire technologies that minimize soil impact while maximizing operational efficiency.

Germany Agriculture Tires Market - 2025 Snapshot & Outlook

Germany demonstrates a strong preference for Very High Flexion (VF) tire technologies supporting sustainable farming practices and soil conservation objectives. The market benefits from advanced agricultural research, government support for environmental protection, and farmer investment in precision farming equipment requiring specialized tire solutions.

U.K. Agriculture Tires Market - 2025 Snapshot & Outlook

The U.K. market shows growing adoption of Increased Flexion (IF) tire technologies as farmers modernize equipment to improve operational efficiency and environmental compliance. Post-Brexit agricultural policies supporting domestic food production create opportunities for equipment investment, requiring advanced tire solutions capable of supporting diverse farming applications

Competitive Landscape Analysis

The players in the Agriculture Tires Market are focusing on R&D investments to enhance durability and sustainability. This strategy counters raw material volatility, with 2024 spend rising 12% industry-wide per association filings, enabling 15% traction improvements. One event: Titan's Carlstar acquisition expanded capacity 20%, consolidating supply chains. Another: Bridgestone's bias portfolio launches targeted cost-sensitive segments, capturing 8% more aftermarket share.

M&A activity and emission regulations will impact costs, with 2024 deals such as Titan-Carlstar hiking integration expenses 5% short-term but promising 18% synergies. New EU rules mandate 10% recycled content by 2026, pressuring margins 3-5% until scale-up. Early movers will benefit from premium pricing in green niches, while latecomers may face compliance fines averaging 7% of revenues.

Key Companies

- Bridgestone Corp.

- Continental AG

- Balakrishna Industries Ltd. (BKT)

- Yokohama Rubber

- Michelin

- Titan International Inc.

- Sumitomo Rubber Industries, Ltd.

- Apollo tyres

- Pirelli & C SpA

- Trellborg AB

Recent Developments:

- September 2025, Bridgestone has launched its first agro-industrial tyre, the VH-IND, designed for both field and hard-surface use, offering 12% more pulling force and 500 kg higher load capacity than competitors. Featuring ENLITEN Technology for enhanced durability and sustainability

- September 2024, Michelin, in partnership with New Holland, has launched two new CEREXBIB 2 tires—VF900/65R46 CFO and VF800/70R46 CFO—specifically for the CR11 combine harvester. Featuring ULTRAFLEX Technology, the tires offer higher load capacity, reduced soil compaction, and improved fuel efficiency, marking a major advancement in agricultural tire innovation.

Global Agriculture Tires Market Segmentation-

By Application

- Tractors

- Harvesters

- Implements

- Irrigation

- Forestry

- Others

By Tire Type

- Bias

- Radial

By Equipment Horsepower

- 0-80 HP

- 80-200 HP

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Agriculture Tires Market: Snapshot

1.2. Future Projections, 2020 - 2033, (US$ Bn)

1.3. Key Segment Analysis and Competitive Insights

1.4. Premium Insights

2. Agriculture Tires Market Outlook

2.1. Market Definitions and Segmentation

2.2. Market Indicators

2.3. Market Dynamics & Key Trends

2.2.1. Driver

2.2.2. Restraint

2.2.3. Industry Challenges & Opportunities

2.4. Regulatory Scenario

2.5. Market Forces Analysis

2.4.1. Value Chain Analysis

2.4.2. Porters Five Forces Analysis

2.4.3. SWOT Analysis

2.6. Technology Roadmap

2.7. Impact Analysis

2.6.1. Covid-19 Analysis

2.6.2. BREXIT

3. Global Agriculture Tires Market Outlook, 2020 - 2033

3.1. Global Agriculture Tires Market Value Forecast, By Application, 2020 - 2033, (US$ Bn)

3.1.1. Base Point Share Analysis, By Application, 2020 & 2033

3.1.2. Tractors

3.1.3. Harvesters

3.1.4. Implements

3.1.5. Irrigation

3.1.6. Forestry

3.1.7. Others

3.1.8. Market Attractiveness Analysis, By Application

3.2. Global Agriculture Tires Market Value Forecast, By Tire Type, 2020 - 2033, (US$ Bn)

3.2.1. Base Point Share Analysis, By Tire Type, 2020 & 2033

3.2.2. Bias

3.2.3. Radial

3.2.4. Market Attractiveness Analysis, By Tire Type

3.3. Global Agriculture Tires Market Value Forecast, by Sales Channel, 2020 - 2033, (US$ Bn)

3.3.1. Base Point Share Analysis, By Sales Channel, 2020 & 2033

3.3.2. OEM

3.3.3. Aftermarket

3.3.4. Market Attractiveness Analysis, By Sales Channel

3.4. Global Agriculture Tires Market Value Forecast, Equipment Horsepower, 2020 - 2033, (US$ Bn)

3.4.1. Base Point Share Analysis, By Equipment Horsepower, 2020 & 2033

3.4.2. 0-80 HP

3.4.3. 80-200 HP

3.4.4. Market Attractiveness Analysis, By Equipment Horsepower

3.5. Global Agriculture Tires Market Outlook, by Region , 2020-2027, (US$ Bn)

3.5.1. Base Point Share Analysis, By Region, 2020 & 2033

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

3.5.2. Global Market Attractiveness Analysis, by Region

4. North America Agriculture Tires Market Outlook, 2020 - 2033

4.1. North America Market Snapshot

4.1.1. Agriculture Tires Market Value Forecast, By Application, 2020 - 2033, (US$ Bn)

4.1.1.1. Tractors

4.1.1.2. Harvesters

4.1.1.3. Implements

4.1.1.4. Irrigation

4.1.1.5. Forestry

4.1.1.6. Others

4.1.2. Agriculture Tires Market Value Forecast, By Tire Type, 2020 - 2033, (US$ Bn)

4.1.2.1. Bias

4.1.2.2. Radial

4.1.3. Agriculture Tires Market Value Forecast, By Sales Channel, 2020 - 2033, (US$ Bn)

4.1.3.1. OEM

4.1.3.2. Aftermarket

4.1.4. Agriculture Tires Market Value Forecast, By Equipment Horsepower, 2020 - 2033, (US$ Bn)

4.1.4.1. 0-80 HP

4.1.4.2. 80-200 HP

4.2. United States

4.3. Canada

5. Europe Agriculture Tires Market Outlook, 2020 - 2033

5.1. European Market Snapshot

5.1.1. Agriculture Tires Market Value Forecast, By Application, 2020 - 2033, (US$ Bn)

5.1.1.1. Tractors

5.1.1.2. Harvesters

5.1.1.3. Implements

5.1.1.4. Irrigation

5.1.1.5. Forestry

5.1.1.6. Others

5.1.2. Agriculture Tires Market Value Forecast, By Tire Type, 2020 - 2033, (US$ Bn)

5.1.2.1. Bias

5.1.2.2. Radial

5.1.3. Agriculture Tires Market Value Forecast, By Sales Channel, 2020 - 2033, (US$ Bn)

5.1.3.1. OEM

5.1.3.2. Aftermarket

5.1.4. Agriculture Tires Market Value Forecast, By Equipment Horsepower, 2020 - 2033, (US$ Bn)

5.1.4.1. 0-80 HP

5.1.4.2. 80-200 HP

5.2. Germany

5.3. U.K

5.4. France

5.5. Italy

5.6. Spain

5.7. Turkey

5.8. Russia

5.9. Rest of Europe

6. Asia Pacific Agriculture Tires Market Outlook, 2020 - 2033

6.1. Asia Pacific Market Snapshot

6.1.1. Agriculture Tires Market Value Forecast, By Application, 2020 - 2033, (US$ Bn)

6.1.1.1. Tractors

6.1.1.2. Harvesters

6.1.1.3. Implements

6.1.1.4. Irrigation

6.1.1.5. Forestry

6.1.1.6. Others

6.1.2. Agriculture Tires Market Value Forecast, By Tire Type, 2020 - 2033, (US$ Bn)

6.1.2.1. Bias

6.1.2.2. Radial

6.1.3. Agriculture Tires Market Value Forecast, By Sales Channel, 2020 - 2033, (US$ Bn)

6.1.3.1. OEM

6.1.3.2. Aftermarket

6.1.4. Agriculture Tires Market Value Forecast, By Equipment Horsepower, 2020 - 2033, (US$ Bn)

6.1.4.1. 0-80 HP

6.1.4.2. 80-200 HP

6.2. China

6.3. Japan

6.4. India

6.5. ASEAN

6.6. ANZ

6.7. Rest of Asia Pacific

7. Latin America Agriculture Tires Market Outlook, 2020-2027

7.1. Latin America Market Snapshot

7.1.1. Agriculture Tires Market Value Forecast, By Application, 2020 - 2033, (US$ Bn)

7.1.1.1. Tractors

7.1.1.2. Harvesters

7.1.1.3. Implements

7.1.1.4. Irrigation

7.1.1.5. Forestry

7.1.1.6. Others

7.1.2. Agriculture Tires Market Value Forecast, By Tire Type, 2020 - 2033, (US$ Bn)

7.1.2.1. Bias

7.1.2.2. Radial

7.1.3. Agriculture Tires Market Value Forecast, By Sales Channel, 2020 - 2033, (US$ Bn)

7.1.3.1. OEM

7.1.3.2. Aftermarket

7.1.4. Agriculture Tires Market Value Forecast, By Equipment Horsepower, 2020 - 2033, (US$ Bn)

7.1.4.1. 0-80 HP

7.1.4.2. 80-200 HP

7.2. Brazil

7.3. Mexico

7.4. Argentina

7.5. Rest of Latin America

8. Middle East & Africa Agriculture Tires Market Outlook, 2020 - 2033

8.1. Middle East & Africa Market Snapshot

8.1.1. Agriculture Tires Market Value Forecast, By Application, 2020 - 2033, (US$ Bn)

8.1.1.1. Tractors

8.1.1.2. Harvesters

8.1.1.3. Implements

8.1.1.4. Irrigation

8.1.1.5. Forestry

8.1.1.6. Others

8.1.2. Agriculture Tires Market Value Forecast, By Tire Type, 2020 - 2033, (US$ Bn)

8.1.2.1. Bias

8.1.2.2. Radial

8.1.3. Agriculture Tires Market Value Forecast, By Sales Channel, 2020 - 2033, (US$ Bn)

8.1.3.1. OEM

8.1.3.2. Aftermarket

8.1.4. Agriculture Tires Market Value Forecast, By Equipment Horsepower, 2020 - 2033, (US$ Bn)

8.1.4.1. 0-80 HP

8.1.4.2. 80-200 HP

8.2. GCC

8.3. South Africa

8.4. Rest of Middle East & Africa

9. Competitive Landscape

9.1. Company Market Share Analysis, 2021

9.2. Company Profiles

9.2.1. Continental AG

9.2.1.1. Company Overview

9.2.1.2. Financial Performance

9.2.1.3. Manufacturing Footprint

9.2.1.4. Strategic Overview

9.2.1.5. Key Developments

(*Note: Above details would be available for below list of companies on the basis of availability)

9.2.2. Balkrishna Industries Limited (BKT)

9.2.3. Bridgestone Corporation

9.2.4. Michelin

9.2.5. The Yokohama Rubber Co., LTD.

9.2.6. Titan International Inc.

9.2.7. Sumitomo Rubber Industries, Ltd.

10. Appendix

10.1. Acronyms and Abbreviations

10.2. Research Scope & Assumptions

10.3. Research Methodology and Information Sources

10.4. List of Figures

10.5. List of Tables

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

|

2024 |

|

2019 - 2024 |

|

2025 - 2032 |

Value: US$ Billion |

|

REPORT FEATURES |

DETAILS |

|

Application Coverage |

|

|

Tire Type Coverage |

|

|

Equipment Horsepower Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, BREXIT Impact Analysis, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |